Cheapest Nebraska Car Insurance Rates in 2025 (Unlock Big Savings From These 10 Companies!)

USAA, State Farm, and Geico offer the cheapest Nebraska car insurance rates, starting at just $15 a month. Discover why these providers lead in affordability and value, ensuring you get the best coverage at the lowest cost. Compare their benefits to find your ideal Nebraska car insurance solution.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

UPDATED: Aug 3, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Aug 3, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

6,589 reviews

6,589 reviewsCompany Facts

Min. Coverage for Nebraska

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 18,155 reviews

18,155 reviewsCompany Facts

Min. Coverage for Nebraska

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage for Nebraska

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews

The top pick providers for the cheapest Nebraska car insurance rates are USAA, State Farm, and Geico.

These companies lead the market by blending affordable rates with reliable coverage, making them ideal choices for Nebraska drivers. Learn more in our guide titled “Cheap Car Insurance.”

Our Top 10 Company Picks: Cheapest Nebraska Car Insurance Rates

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $15 A++ Military Members USAA

#2 $18 B Teen Discounts State Farm

#3 $24 A++ Online Convenience Geico

#4 $25 A+ Customer Service Progressive

#5 $27 A++ Safe Drivers Travelers

#6 $33 A+ Customized Policies Allstate

#7 $35 A Safe Drivers Farmers

#8 $43 A+ Organization Discount The Hartford

#9 $48 A Coverage Options Liberty Mutual

#10 $54 A High-Risk Coverage The General

In exploring these options, this article delves into the nuances of their insurance offerings, highlights key features, and provides insights into how you can choose the right policy for your circumstances. Understanding these factors will assist you in navigating Nebraska’s insurance landscape effectively.

- USAA is the top pick for the cheapest car insurance in Nebraska

- Affordable rates meet diverse driver needs across the state

- Comprehensive coverage options tailored to Nebraska drivers

- Compare Nebraska Car Insurance Rates

#1 – USAA: Top Overall Pick

Pros

- Competitive Rates: USAA offers some of the lowest rates starting at $15 a month. Unlock details in our guide titled “USAA Car Insurance Review.”

- Exceptional Customer Service: Known for its customer support, tailored specifically for military members and their families.

- Comprehensive Coverage: Provides a wide range of insurance products and services that meet the unique needs of military personnel.

Cons

- Eligibility Restrictions: Only available to military members, veterans, and their families.

- Limited Physical Locations: Fewer in-person offices compared to other major insurers.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#2 – State Farm: Best for Teen Discounts

Pros

- Bundling Policies: Significant discounts for bundling multiple insurance policies. Unlock details in our State Farm car insurance review.

- High Low-Mileage Discount: Substantial savings for drivers with low annual mileage.

- Wide Coverage: Offers a variety of coverage options tailored to different needs, including teens learning to drive.

Cons

- Limited Multi-Policy Discount: The multi-policy discount is not as competitive as some others.

- Premium Costs: Higher premiums for certain coverage levels despite discounts.

#3 – Geico: Best for Online Convenience

Pros

- User-Friendly Online Tools: Excellent online services for quote comparison, policy management, and claims handling.

- Affordable Premiums: Competitive rates with additional discounts for various customer profiles. Discover more about offerings in our Geico car insurance review.

- Extensive Coverage Options: Wide range of coverage choices that cater to different driving habits and vehicle types.

Cons

- Customer Service Variability: While generally good, service quality can vary depending on the region and specific circumstances.

- Claims Process Issues: Some users report delays and complications during the claims process.

#4 – Progressive: Best for Customer Service

Pros

- Personalized Service: Known for excellent customer relations and support.

- Dynamic Pricing: Offers the ‘Name Your Price’ tool, allowing customers to tailor policies to their budget.

- Loyalty Rewards: Provides discounts and benefits to long-term customers. Delve into our evaluation of Progressive car insurance review.

Cons

- Higher Rates for New Customers: New customers might face higher initial rates.

- Inconsistent Agent Experiences: Experiences can vary significantly depending on the agent or representative.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#5 – Travelers: Best for Safe Drivers

Pros

- Safe Driver Discounts: Attractive discounts for drivers with a clean driving record. See more details on our Travelers car insurance review.

- IntelliDrive Program: Usage-based program that can result in significant discounts for safe driving behavior.

- Customizable Packages: Offers a range of options and riders that enhance policy coverage.

Cons

- Higher Pricing: Tends to be more expensive for those without a perfect driving record.

- Complexity in Policy Options: Some customers find the variety of options confusing.

#6 – Allstate: Best for Customized Policies

Pros

- Flexible Coverage Options: Allows extensive customization of policies. Discover more about offerings in our Allstate car insurance review.

- Rewards for Safe Driving: Offers bonuses and discounts for safe driving through programs like Drivewise.

- Multiple Policy Discounts: Significant savings are available when combining different types of insurance.

Cons

- Higher Premiums: Generally higher costs compared to some competitors.

- Customer Service Complaints: Some dissatisfaction regarding claims processing and service responsiveness.

#7 – Farmers: Best for Safe Drivers

Pros

- Customized Insurance Packages: Tailored insurance solutions ideal for various driver profiles, including safe drivers.

- Potential Discounts: Offers competitive discounts for multiple policies and safe driving. Learn more in our Farmers car insurance review.

- Coverage Options: A wide array of additional coverages and endorsements are available.

Cons

- Costly Premiums: Higher premiums particularly for those with less-than-perfect driving histories.

- Inconsistent Customer Experience: Customer satisfaction can vary widely depending on the location and agent.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#8 – The Hartford: Best for Organization Discounts

Pros

- Specialized Discounts: Offers discounts for members of partner organizations. See more details in our guide titled, “The Hartford Car Insurance Discounts.”

- Retiree Benefits: Tailored services and benefits for retirees, including disappearing deductibles.

- Extensive Coverage: Wide range of coverage options catering to mature drivers.

Cons

- Eligibility Requirements: Best rates and benefits are often limited to members of specific organizations.

- Rate Increases: Some customers report rate increases upon policy renewal.

#9 – Liberty Mutual: Best for Coverage Options

Pros

- Diverse Coverage Offerings: Extensive range of policy options and additional coverage features.

- Discounts and Savings: Multiple opportunities for discounts, including safe driver and good student reductions.

- Customizable Policies: Allows customers to tailor their coverage to specific needs. Read up on the Liberty Mutual car insurance review for more information.

Cons

- Higher Price Point: Generally higher rates compared to other insurers.

- Variable Customer Satisfaction: Mixed reviews on customer service and claims handling.

#10 – The General: Best for High-Risk Coverage

Pros

- Specializes in High-Risk Insurance: Accessible coverage for drivers who may not qualify with other insurers.

- Flexible Payment Options: Offers various payment plans to accommodate different budgets. Discover insights in our guide titled “The General Car Insurance Review.”

- Quick Coverage: Fast and easy process to obtain coverage, even for those with poor driving records.

Cons

- Higher Premiums: Typically higher premiums due to the nature of covering high-risk drivers.

- Customer Service Concerns: Some reports of less satisfactory customer service experiences.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Nebraska Car Insurance Rates

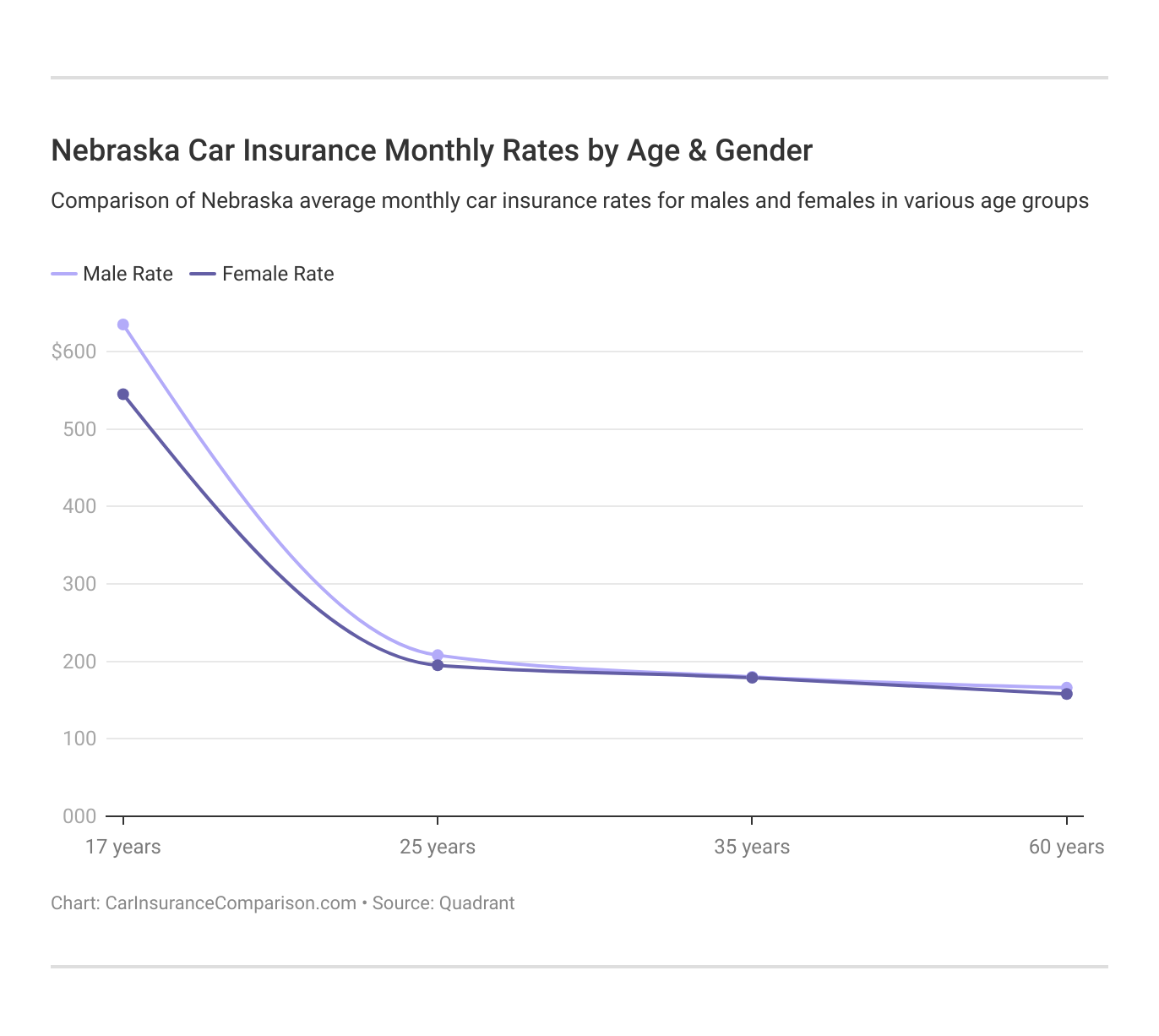

Understanding the cost of car insurance in Nebraska based on coverage level is crucial for making an informed decision. The table below provides a detailed comparison of monthly rates for minimum and full coverage across various providers. Nebraska Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $33 $125

Farmers $35 $130

Geico $24 $92

Liberty Mutual $48 $179

Progressive $25 $95

State Farm $18 $69

The General $54 $232

The Hartford $43 $113

Travelers $27 $102

USAA $15 $56

The table presents a snapshot of how monthly insurance premiums differ between minimum and full coverage in Nebraska. For those seeking basic, legally required coverage, USAA offers the most affordable rate at $15, while The General presents the highest at $54.

On the other end, full coverage, which offers comprehensive protection, sees its lowest rate with USAA again at $56, suggesting a strong value proposition for comprehensive security at a lower cost. In contrast, The General’s rate jumps significantly to $232, indicating a higher premium for expanded coverage. This variation highlights the importance of comparing rates based on individual coverage needs to find the most cost-effective option for both basic and extensive insurance needs. See more details in our guide titled “Compare Comprehensive Car Insurance: Rates, Discounts, & Requirements.”

Minimum Car Insurance Requirements in Nebraska

Nebraska mandates specific minimum car insurance requirements to ensure that all drivers carry adequate coverage to protect against potential losses. The state enforces liability and uninsured/underinsured motorist coverages with set minimum limits. Nebraska Car Insurance Minimum Coverage Requirements

| Coverages | Limits |

|---|---|

| Bodily Injury Liability Coverage | $25,000 per one person $50,000 per accident |

| Property Damage Liability Coverage | $25,000 minimum |

| Uninsured/Underinsured Motorist | $25,000 per person $50,000 per accident |

Liability insurance pays all individuals — drivers, passengers, pedestrians, bicyclists, etc — who are owed compensation for property damage and/or injuries resulting from a car accident that you or anyone under your policy causes.

Nebraska is an “at-fault” accident state. This means, if you are the at-fault driver during an accident, you will be held liable for any personal injury or property claims.

As such, liability car insurance coverage is required in the state of Nebraska at these minimum coverage amounts:

- $25,000: To cover Injury or death per person in an accident you caused

- $50,000: To cover the total injuries or deaths per accident you caused

- $25,000: To cover property damage per accident you caused

Nebraska also requires all motorists to carry uninsured and underinsured coverage at least equal to the minimum amounts for bodily injury and property damage. Agents are required by law to offer more coverage than the minimum, which is highly recommended.

- $25,000: To cover your injury per person caused by an uninsured/underinsured driver

- $50,000: To cover total injuries or death per accident caused by an uninsured/underinsured driver

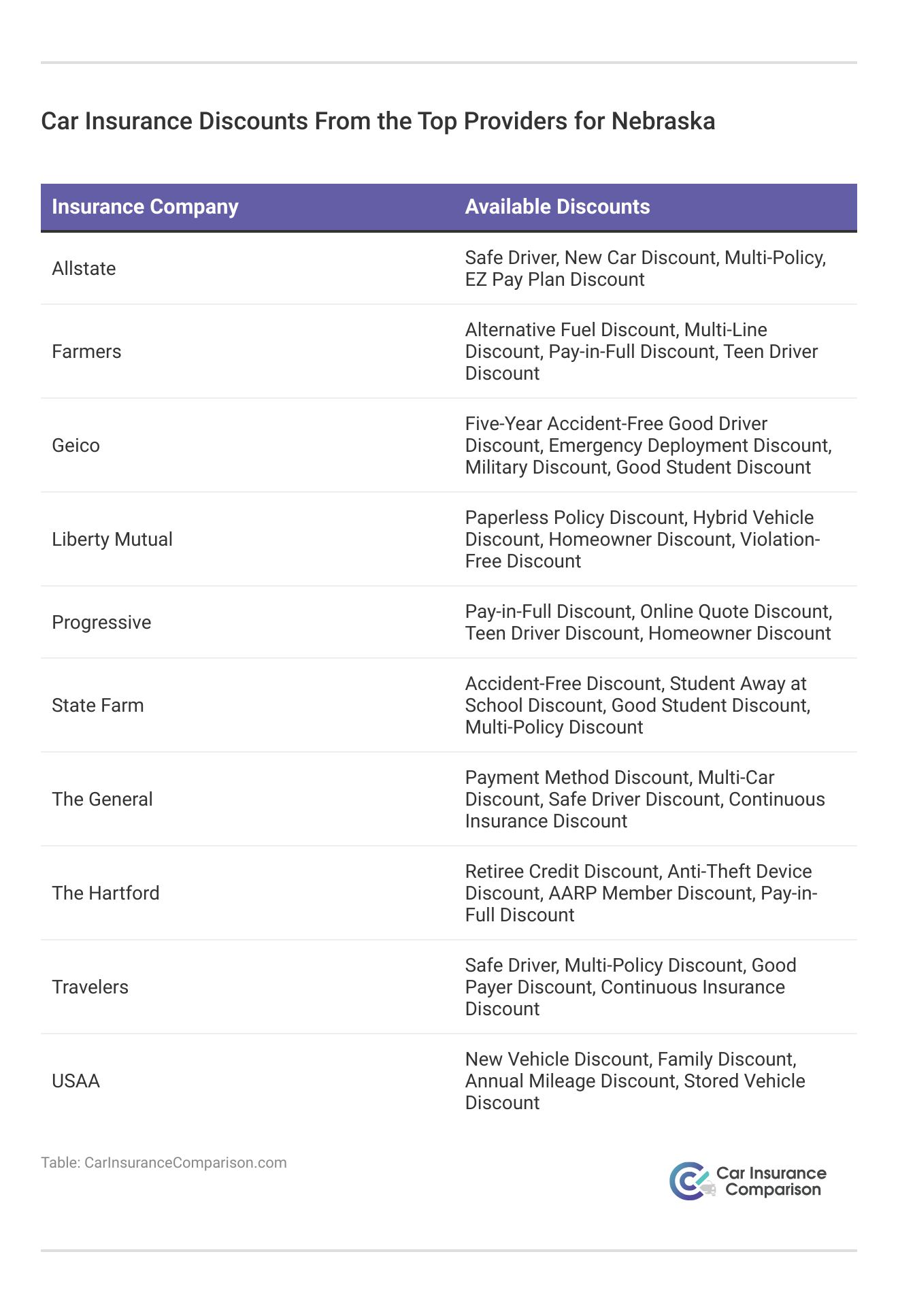

Maybe you’re curious about what the minimum car insurance costs are for the neighboring states. Take a look here:

This illustration reflects the significant diversity in car insurance rates across different U.S. cities, which can be influenced by local regulations, the rate of accidents, and other regional factors. Understanding these variations can help consumers make more informed decisions when purchasing car insurance.Required Forms of Financial Responsibility in Nebraska

There is a zero-tolerance policy for motorists driving without proof of car insurance in Nebraska.

Your driving license and driving privileges will be automatically suspended when you have been found guilty of a citation for No Proof of Insurance.

Nebraska reminds residents that it is the responsibility of the vehicle owner to carry insurance on the vehicle; therefore, if you were driving someone else’s vehicle without coverage, DO NOT pay/plead guilty to the ticket.

Premiums as Percentage of Income in Nebraska

In 2014, the annual per capita disposable personal income in Nebraska was $43,277. That’s not bad considering that almost half of the states have a DPI lower than $40K.Disposable personal income (DPI) is the total amount of money available for an individual to spend (or save) after their taxes have been paid.

On top of the stellar DPI, the average monthly cost of car insurance in Nebraska is only about $67, which is nearly $12 less than the national average.

Nebraska residents pay only 1.86 percent of their average disposable personal income on their car insurance premiums. The average Nebraska resident has $3,607 each month to buy food, pay bills, etc. The car insurance bill will deduct about $67 from that. Despite the higher income, Nebraska residents pay very reasonable rates for car insurance coming in at over $10 lower than the average monthly payment nationwide.

Average Monthly Car Insurance Rates in NE (Liability, Collision, Comprehensive)

The average monthly car insurance rates in Nebraska encompass liability, collision, and comprehensive coverages, reflecting a comprehensive picture of what drivers can expect to pay annually.

Nebraska Core Car Insurance Coverage

| Coverage Type | Monthly Cost |

|---|---|

| Collision | $20 |

| Combined | $69 |

| Comprehensive | $19 |

| Liability | $30 |

In Nebraska, the average monthly car insurance rates vary by coverage type, with liability insurance costing $30, collision insurance at $20, and comprehensive coverage slightly lower at $19. Collectively, these costs combine to an average total of $69 per month for a full spectrum of core car insurance coverages, providing a broad overview of what drivers typically pay for protection on the road.

Additional Liability Coverage in Nebraska

A loss ratio shows how much a company spends on claims to how much money they take in on premiums. For example, a loss ratio of 60 percent indicates that companies are spending $60 on claims out of every $100 earned in premiums. A loss ratio of over 100 percent means the company is losing money. If the loss ratio is too low, the company isn’t paying claims.

Nebraska Additional Liability Coverage

| Loss Ratio | 2012 | 2013 | 2014 |

|---|---|---|---|

| Medical Payments (Med Pay) | 78.34% | 81.17% | 80.34% |

| Uninsured/Underinsured Motorist (6.8% and ranked 46th in the nation) | 65.48% | 66.40% | 74.06% |

Loss ratios are increasing, and no doubt in response to the decreased percentage of uninsured motorists. Placing harsh consequences on those who drive without insurance has paid off for Nebraska residents who are taking advantage of higher coverage levels.

After all, it doesn’t take much to expire the minimum coverage of $25,000 with a two-day hospital stay. However, sometimes insurance companies can be very selective in what they will cover when you file a claim against your uninsured/underinsured motorist coverage. Before you file a claim after being hit by an uninsured motorist, be sure to:

- Follow all procedural and policy requirements outlined by your insurance provider

- Be truthful regarding any injuries sustained as a result of the accident

- Obtain only reasonable and necessary medical treatment

- And obtain documentation that the other party did not have coverage or your medical costs have already exceeded the negligent driver’s insurance limits

Based on the most recent loss ratios, insurance companies in Nebraska are likely not being too selective but taking extra precautions as outlined above will keep the loss ratios steady.

USAA sets the gold standard in auto insurance with unmatched service and customer satisfaction.

Brad Larson Licensed Insurance Agent

Add-ons, Endorsements, and Riders

We know getting the complete coverage you need for an affordable price is your goal. The good news: there are lots of powerful but cheap extras you can add to your policy. Here’s a list of other useful coverage available to you in Nebraska:

- Gap insurance

- Personal Umbrella Policy (PUP)

- Rental Car Reimbursement

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-as-You-Drive or Usage-Based Insurance

By considering these additional insurance options, you can customize your policy to match your driving habits and the specific risks you face. Opting for such endorsements ensures that you are well-prepared for a variety of scenarios, making your insurance experience more responsive to your lifestyle.

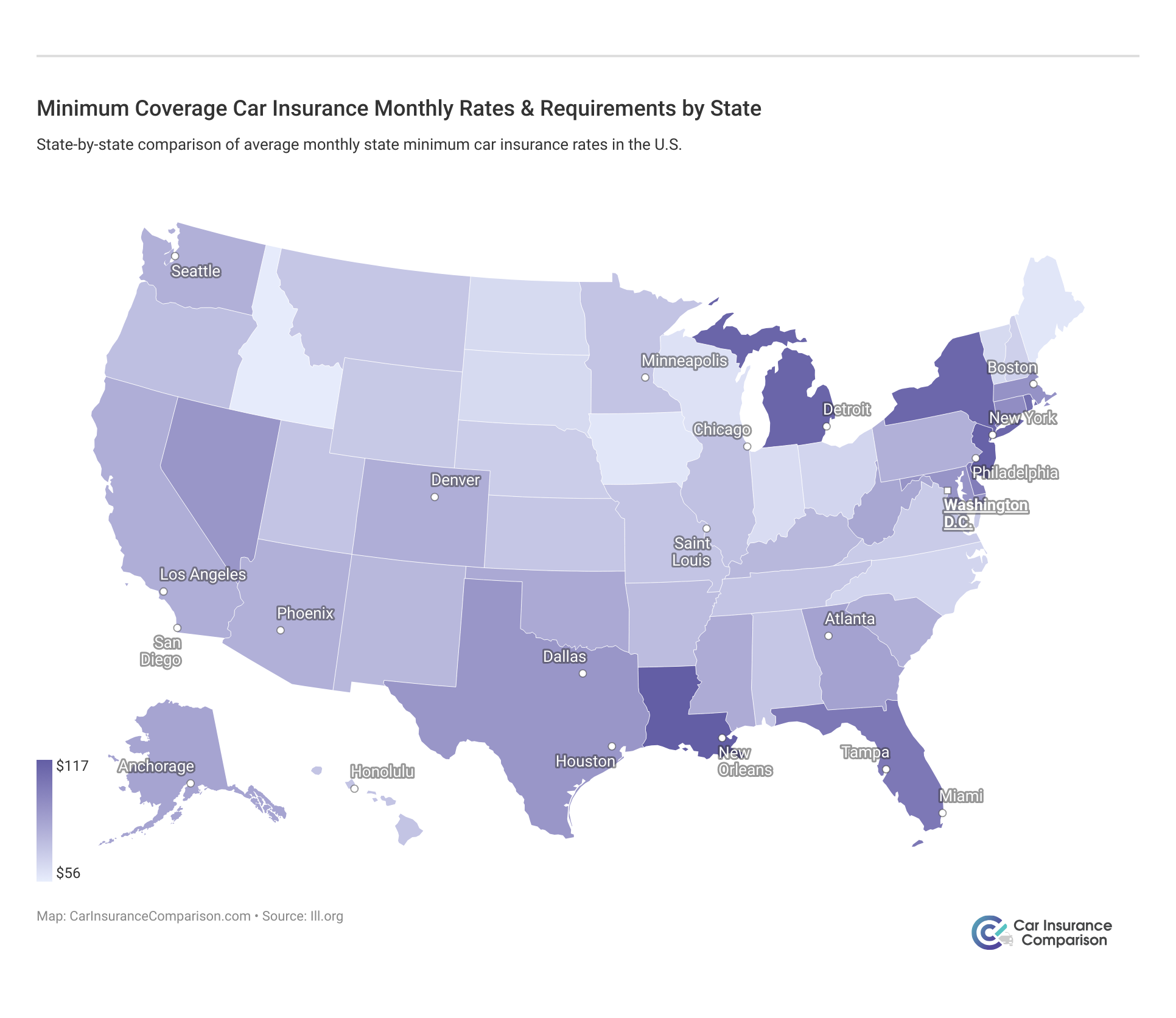

Average Monthly Car Insurance Rates by Age & Gender in NE

Most people are under the impression that men pay higher car insurance rates than women; in some states, this is true. However, six states have outlawed charging different insurance rates based on gender and/or marital status. Nebraska may not be too far behind.

Our researchers learned that age and the actual insurance carrier seem to be the most significant contributing factors in cost variance.Demographic and Insurance Carrier

The table below displays average rates by age, gender, and carrier. Click on the arrows for each column to sort rates. Nebraska Car Insurance Monthly Rates by Age, Gender, & Provider

| Insurance Company | Age: 17 Male | Age: 17 Female | Age: 25 Male | Age: 25 Female | Age: 35 Male | Age: 35 Female | Age: 60 Male | Age: 60 Female |

|---|---|---|---|---|---|---|---|---|

| Allied | $434 | $348 | $188 | $174 | $156 | $151 | $145 | $135 |

| Allstate | $533 | $507 | $209 | $205 | $173 | $182 | $163 | $162 |

| American Family | $364 | $247 | $156 | $144 | $148 | $148 | $134 | $134 |

| Geico | $664 | $507 | $215 | $222 | $241 | $246 | $232 | $241 |

| Mid-Century | $754 | $731 | $226 | $216 | $190 | $191 | $181 | $171 |

| Progressive | $756 | $670 | $225 | $210 | $170 | $176 | $150 | $144 |

| Safeco | $1,322 | $1,176 | $318 | $287 | $297 | $274 | $263 | $216 |

| State Farm | $456 | $357 | $166 | $147 | $133 | $133 | $116 | $116 |

| USAA | $433 | $361 | $167 | $150 | $115 | $116 | $108 | $105 |

Interestingly, Safeco charges 17-year-olds over $11,600 more than their average yearly premium of $3,312 for insureds over the age of 18. American Family Mutual, however, charges only about a $1,900 difference in annual premiums based on age.

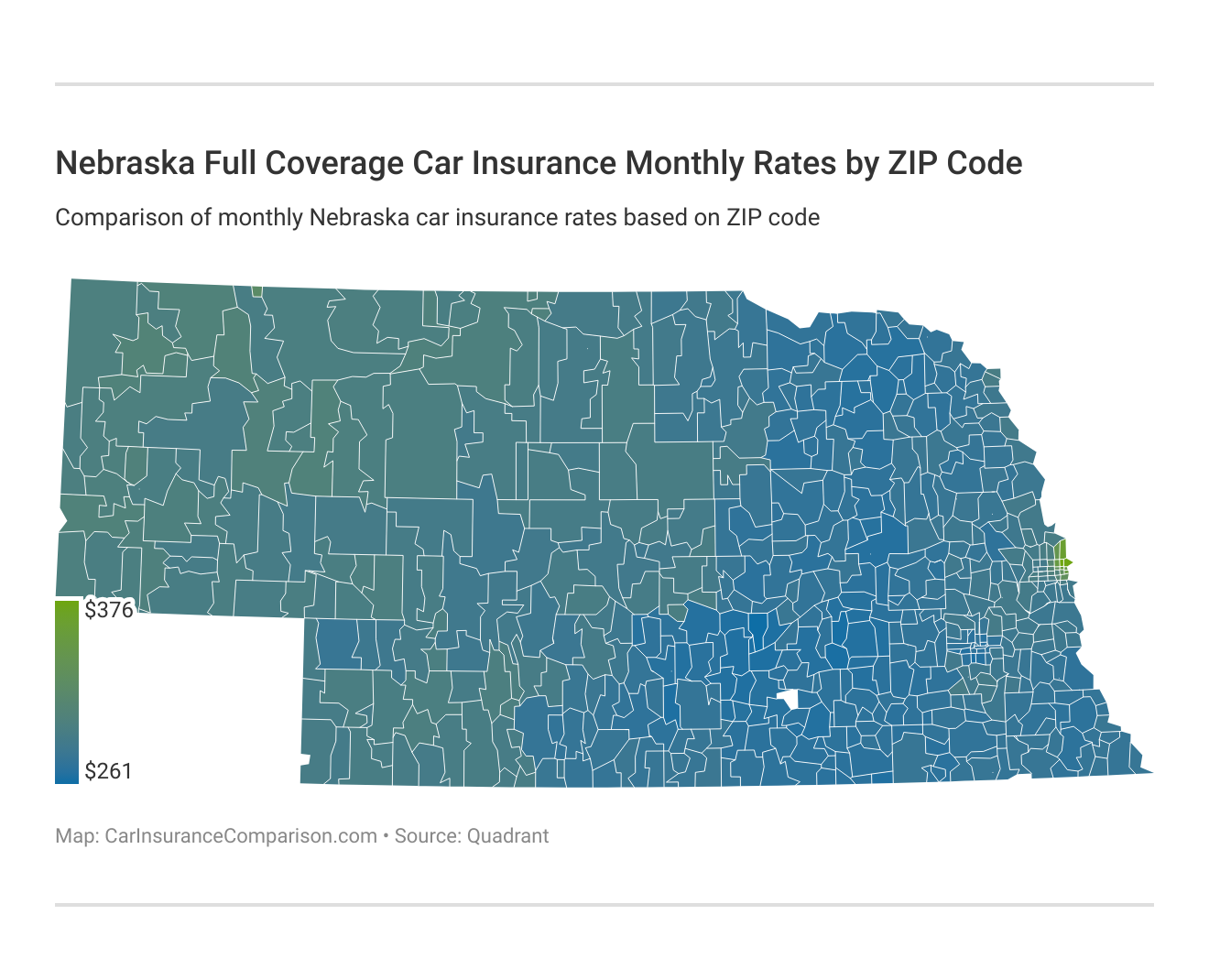

Highest and Lowest Rates by ZIP Code

Car insurance rates in Nebraska can vary significantly depending on your ZIP code. This comparison highlights the monthly average rates across different regions, showing how location impacts insurance costs.

The variability in car insurance rates by ZIP code underscores the importance of location in determining insurance premiums. Understanding these geographical price differences can help Nebraskans make informed decisions about their car insurance purchases. Search the table below which lists the highest and lowest rates according to the ZIP code.

Top 10 Most & Least Expensive Nebraska Car Insurance Monthly Rates by ZIP Code

| Least Expensive ZIP | City | Rates | Most Expensive ZIP | City | Rates |

|---|---|---|---|---|---|

| 68512 | Lincoln | $127 | 68111 | Omaha | $376 |

| 68506 | Lincoln | $129 | 68110 | Omaha | $375 |

| 68516 | Lincoln | $130 | 68132 | Omaha | $333 |

| 68502 | Lincoln | $131 | 68104 | Omaha | $351 |

| 68510 | Lincoln | $132 | 68108 | Omaha | $350 |

| 68505 | Lincoln | $132 | 68117 | Omaha | $342 |

| 68507 | Lincoln | $133 | 68102 | Omaha | $349 |

| 68520 | Lincoln | $134 | 68112 | Omaha | $345 |

| 68508 | Lincoln | $135 | 68105 | Omaha | $329 |

| 68503 | Lincoln | $135 | 68131 | Omaha | $355 |

Understanding the geographic distribution of insurance rates in Nebraska helps consumers make informed decisions about their car insurance. By comparing rates across different zip codes, drivers can better assess their potential insurance expenses and choose a provider that offers the best value for their specific needs and location.

Most Expensive/Least Expensive Average Rates by City

Take a look at the table below listing the most/least expensive carrier rates according to the city. Use the search box to look for various cities. As you can see, your location is a significant factor in the rates you can expect to pay. Nebraska Full Coverage Car Insurance Monthly Rates by City

| City | Rates |

|---|---|

| Abie | $279 |

| Adams | $283 |

| Ainsworth | $290 |

| Albion | $274 |

| Alda | $264 |

| Alexandria | $273 |

| Allen | $275 |

| Alliance | $292 |

| Alma | $277 |

| Alvo | $283 |

| Amelia | $283 |

| Ames | $282 |

| Amherst | $273 |

| Angora | $293 |

| Anselmo | $291 |

| Ansley | $286 |

| Arapahoe | $277 |

| Arcadia | $286 |

| Archer | $280 |

| Arlington | $284 |

| Arnold | $286 |

| Arthur | $290 |

| Ashby | $304 |

| Ashland | $288 |

| Ashton | $288 |

| Atkinson | $284 |

| Atlanta | $274 |

| Auburn | $272 |

| Aurora | $268 |

| Avoca | $282 |

| Axtell | $265 |

| Ayr | $269 |

| Bancroft | $277 |

| Barneston | $277 |

| Bartlett | $292 |

| Bartley | $293 |

| Bassett | $295 |

| Battle Creek | $280 |

| Bayard | $295 |

| Beatrice | $274 |

| Beaver City | $277 |

| Beaver Crossing | $274 |

| Bee | $276 |

| Beemer | $274 |

| Belden | $272 |

| Belgrade | $279 |

| Bellevue | $288 |

| Bellwood | $274 |

| Belvidere | $275 |

| Benedict | $267 |

| Benkelman | $294 |

| Bennet | $283 |

| Bennington | $289 |

| Bertrand | $277 |

| Big Springs | $296 |

| Bingham | $298 |

| Bladen | $271 |

| Blair | $288 |

| Bloomfield | $270 |

| Bloomington | $279 |

| Blue Hill | $271 |

| Blue Springs | $275 |

| Boelus | $278 |

| Boys Town | $287 |

| Bradshaw | $263 |

| Brady | $287 |

| Brainard | $279 |

| Brewster | $289 |

| Bridgeport | $300 |

| Bristow | $283 |

| Broadwater | $298 |

| Brock | $274 |

| Broken Bow | $287 |

| Brownville | $276 |

| Brule | $292 |

| Bruning | $273 |

| Bruno | $272 |

| Brunswick | $273 |

| Burchard | $278 |

| Burr | $278 |

| Burwell | $294 |

| Bushnell | $299 |

| Butte | $286 |

| Byron | $270 |

| Cairo | $266 |

| Callaway | $291 |

| Cambridge | $277 |

| Campbell | $278 |

| Carleton | $270 |

| Carroll | $276 |

| Cedar Bluffs | $277 |

| Cedar Creek | $311 |

| Cedar Rapids | $275 |

| Center | $274 |

| Central City | $275 |

| Ceresco | $284 |

| Chadron | $304 |

| Chambers | $282 |

| Champion | $291 |

| Chapman | $280 |

| Chappell | $293 |

| Chester | $271 |

| Clarks | $276 |

| Clarkson | $277 |

| Clatonia | $280 |

| Clay Center | $270 |

| Clearwater | $275 |

| Cody | $297 |

| Coleridge | $271 |

| Colon | $282 |

| Columbus | $268 |

| Comstock | $292 |

| Concord | $277 |

| Cook | $276 |

| Cordova | $274 |

| Cortland | $279 |

| Cozad | $281 |

| Crab Orchard | $277 |

| Craig | $277 |

| Crawford | $306 |

| Creighton | $279 |

| Creston | $270 |

| Crete | $273 |

| Crofton | $274 |

| Crookston | $297 |

| Culbertson | $293 |

| Curtis | $298 |

| Dakota City | $292 |

| Dalton | $291 |

| Danbury | $292 |

| Dannebrog | $277 |

| Davenport | $272 |

| Davey | $280 |

| David City | $276 |

| Dawson | $277 |

| Daykin | $271 |

| De Witt | $276 |

| Decatur | $285 |

| Denton | $286 |

| Deshler | $271 |

| Deweese | $268 |

| Dickens | $297 |

| Diller | $270 |

| Dix | $297 |

| Dixon | $274 |

| Dodge | $279 |

| Doniphan | $265 |

| Dorchester | $271 |

| Douglas | $286 |

| Du Bois | $274 |

| Dunbar | $276 |

| Duncan | $305 |

| Dunning | $293 |

| Dwight | $276 |

| Eagle | $282 |

| Eddyville | $288 |

| Edgar | $267 |

| Edison | $278 |

| Elba | $279 |

| Elgin | $271 |

| Elk Creek | $277 |

| Elkhorn | $289 |

| Ellsworth | $297 |

| Elm Creek | $276 |

| Elmwood | $285 |

| Elsie | $284 |

| Elsmere | $292 |

| Elwood | $280 |

| Elyria | $288 |

| Emerson | $276 |

| Emmet | $280 |

| Enders | $290 |

| Endicott | $272 |

| Ericson | $283 |

| Eustis | $291 |

| Ewing | $287 |

| Exeter | $271 |

| Fairbury | $278 |

| Fairfield | $271 |

| Fairmont | $268 |

| Falls City | $277 |

| Farnam | $292 |

| Farwell | $278 |

| Filley | $277 |

| Firth | $288 |

| Fordyce | $273 |

| Fort Calhoun | $293 |

| Franklin | $278 |

| Fremont | $273 |

| Friend | $271 |

| Fullerton | $271 |

| Funk | $277 |

| Garland | $275 |

| Geneva | $272 |

| Genoa | $276 |

| Gering | $300 |

| Gibbon | $270 |

| Gilead | $266 |

| Giltner | $271 |

| Glenvil | $269 |

| Goehner | $303 |

| Gordon | $297 |

| Gothenburg | $283 |

| Grafton | $272 |

| Grand Island | $263 |

| Grant | $279 |

| Greeley | $273 |

| Greenwood | $287 |

| Gresham | $271 |

| Gretna | $289 |

| Guide Rock | $272 |

| Gurley | $291 |

| Hadar | $305 |

| Haigler | $292 |

| Hallam | $292 |

| Halsey | $291 |

| Hampton | $273 |

| Hardy | $270 |

| Harrisburg | $304 |

| Harrison | $299 |

| Hartington | $269 |

| Harvard | $273 |

| Hastings | $269 |

| Hay Springs | $305 |

| Hayes Center | $297 |

| Hazard | $296 |

| Heartwell | $276 |

| Hebron | $271 |

| Hemingford | $299 |

| Henderson | $264 |

| Hendley | $283 |

| Herman | $288 |

| Hershey | $293 |

| Hickman | $290 |

| Hildreth | $277 |

| Holbrook | $275 |

| Holdrege | $273 |

| Holstein | $268 |

| Homer | $284 |

| Hooper | $280 |

| Hordville | $273 |

| Hoskins | $281 |

| Howells | $276 |

| Hubbard | $280 |

| Hubbell | $266 |

| Humboldt | $272 |

| Humphrey | $271 |

| Hyannis | $299 |

| Imperial | $296 |

| Inavale | $276 |

| Indianola | $292 |

| Inland | $271 |

| Inman | $284 |

| Ithaca | $286 |

| Jackson | $277 |

| Jansen | $270 |

| Johnson | $272 |

| Johnstown | $291 |

| Julian | $278 |

| Juniata | $266 |

| Kearney | $268 |

| Kenesaw | $267 |

| Kennard | $290 |

| Keystone | $298 |

| Kilgore | $295 |

| Kimball | $296 |

| La Vista | $283 |

| Lakeside | $303 |

| Laurel | $270 |

| Lawrence | $272 |

| Lebanon | $293 |

| Leigh | $278 |

| Lemoyne | $296 |

| Lewellen | $289 |

| Lewiston | $273 |

| Lexington | $290 |

| Liberty | $276 |

| Lincoln | $272 |

| Lindsay | $275 |

| Linwood | $274 |

| Lisco | $293 |

| Litchfield | $292 |

| Lodgepole | $296 |

| Long Pine | $292 |

| Loomis | $275 |

| Lorton | $278 |

| Louisville | $282 |

| Loup City | $291 |

| Lyman | $298 |

| Lynch | $278 |

| Lyons | $278 |

| Macy | $289 |

| Madison | $273 |

| Madrid | $283 |

| Magnet | $271 |

| Malcolm | $282 |

| Malmo | $281 |

| Manley | $313 |

| Marquette | $274 |

| Marsland | $304 |

| Martell | $286 |

| Maskell | $277 |

| Mason City | $291 |

| Max | $293 |

| Maxwell | $286 |

| Maywood | $291 |

| Mc Cook | $294 |

| Mc Cool Junction | $268 |

| Mcgrew | $321 |

| Mclean | $272 |

| Mead | $280 |

| Meadow Grove | $278 |

| Melbeta | $324 |

| Memphis | $283 |

| Merna | $285 |

| Merriman | $298 |

| Milford | $275 |

| Miller | $269 |

| Milligan | $274 |

| Mills | $290 |

| Minatare | $303 |

| Minden | $276 |

| Mitchell | $298 |

| Monroe | $270 |

| Moorefield | $298 |

| Morrill | $296 |

| Morse Bluff | $280 |

| Mullen | $297 |

| Murdock | $285 |

| Murray | $284 |

| Naper | $283 |

| Naponee | $279 |

| Nebraska City | $273 |

| Nehawka | $284 |

| Neligh | $274 |

| Nelson | $271 |

| Nemaha | $280 |

| Nenzel | $302 |

| Newcastle | $275 |

| Newman Grove | $274 |

| Newport | $289 |

| Nickerson | $283 |

| Niobrara | $275 |

| Norfolk | $271 |

| North Bend | $283 |

| North Loup | $294 |

| North Platte | $285 |

| Oak | $270 |

| Oakdale | $273 |

| Oakland | $281 |

| Oconto | $294 |

| Odell | $277 |

| Odessa | $270 |

| Offutt A F B | $285 |

| Ogallala | $295 |

| Ohiowa | $273 |

| Omaha | $317 |

| Oneill | $282 |

| Ong | $271 |

| Orchard | $274 |

| Ord | $289 |

| Orleans | $281 |

| Osceola | $271 |

| Oshkosh | $292 |

| Osmond | $269 |

| Otoe | $280 |

| Overton | $283 |

| Oxford | $278 |

| Page | $280 |

| Palisade | $298 |

| Palmer | $275 |

| Palmyra | $281 |

| Panama | $312 |

| Papillion | $283 |

| Parks | $289 |

| Pawnee City | $278 |

| Paxton | $298 |

| Pender | $280 |

| Peru | $276 |

| Petersburg | $278 |

| Phillips | $276 |

| Pickrell | $273 |

| Pierce | $271 |

| Pilger | $281 |

| Plainview | $272 |

| Platte Center | $269 |

| Plattsmouth | $282 |

| Pleasant Dale | $275 |

| Pleasanton | $272 |

| Plymouth | $274 |

| Polk | $268 |

| Ponca | $279 |

| Potter | $301 |

| Prague | $285 |

| Primrose | $273 |

| Purdum | $293 |

| Ragan | $274 |

| Randolph | $269 |

| Ravenna | $268 |

| Raymond | $286 |

| Red Cloud | $274 |

| Republican City | $278 |

| Reynolds | $274 |

| Rising City | $274 |

| Riverdale | $273 |

| Riverton | $281 |

| Roca | $284 |

| Rockville | $294 |

| Rogers | $281 |

| Rosalie | $278 |

| Roseland | $269 |

| Royal | $277 |

| Rulo | $278 |

| Rushville | $294 |

| Ruskin | $272 |

| Saint Edward | $275 |

| Saint Helena | $278 |

| Saint Libory | $275 |

| Saint Paul | $271 |

| Salem | $278 |

| Sargent | $292 |

| Saronville | $274 |

| Schuyler | $281 |

| Scotia | $277 |

| Scottsbluff | $300 |

| Scribner | $281 |

| Seneca | $288 |

| Seward | $275 |

| Shelby | $270 |

| Shelton | $270 |

| Shickley | $272 |

| Shubert | $277 |

| Sidney | $294 |

| Silver Creek | $278 |

| Smithfield | $281 |

| Snyder | $311 |

| South Sioux City | $294 |

| Spalding | $279 |

| Sparks | $302 |

| Spencer | $287 |

| Sprague | $309 |

| Springfield | $284 |

| Springview | $290 |

| St Columbans | $303 |

| Stamford | $277 |

| Stanton | $279 |

| Staplehurst | $274 |

| Stapleton | $284 |

| Steele City | $272 |

| Steinauer | $278 |

| Stella | $276 |

| Sterling | $277 |

| Stockville | $298 |

| Strang | $272 |

| Stratton | $292 |

| Stromsburg | $269 |

| Stuart | $287 |

| Sumner | $283 |

| Superior | $272 |

| Surprise | $271 |

| Sutherland | $291 |

| Sutton | $272 |

| Swanton | $271 |

| Syracuse | $277 |

| Table Rock | $278 |

| Talmage | $279 |

| Taylor | $293 |

| Tecumseh | $274 |

| Tekamah | $282 |

| Thedford | $293 |

| Thurston | $279 |

| Tilden | $273 |

| Tobias | $271 |

| Trenton | $290 |

| Trumbull | $271 |

| Tryon | $289 |

| Uehling | $311 |

| Ulysses | $275 |

| Unadilla | $279 |

| Union | $283 |

| Upland | $278 |

| Utica | $274 |

| Valentine | $300 |

| Valley | $289 |

| Valparaiso | $282 |

| Venango | $291 |

| Verdigre | $273 |

| Verdon | $278 |

| Virginia | $277 |

| Waco | $267 |

| Wahoo | $285 |

| Wakefield | $273 |

| Wallace | $290 |

| Walthill | $281 |

| Walton | $283 |

| Washington | $285 |

| Waterbury | $274 |

| Waterloo | $284 |

| Wauneta | $295 |

| Wausa | $269 |

| Waverly | $290 |

| Wayne | $274 |

| Weeping Water | $286 |

| Wellfleet | $284 |

| West Point | $276 |

| Western | $273 |

| Westerville | $284 |

| Weston | $280 |

| Whiteclay | $322 |

| Whitman | $297 |

| Whitney | $298 |

| Wilber | $274 |

| Wilcox | $272 |

| Willow Island | $285 |

| Wilsonville | $280 |

| Winnebago | $284 |

| Winnetoon | $278 |

| Winside | $279 |

| Winslow | $311 |

| Wisner | $282 |

| Wolbach | $277 |

| Wood Lake | $296 |

| Wood River | $266 |

| Wymore | $278 |

| Wynot | $277 |

| York | $267 |

| Yutan | $282 |

This overview of car insurance rates in various Nebraska cities provides essential insights for residents and potential movers. By understanding the average costs in different areas, drivers can better budget for their automotive expenses and seek out the most cost-effective insurance options available.

Nebraska Car Insurance Companies

There are so many car insurance carriers vying for your business these days, that it’s hard to know which ones come through on their promises. Don’t worry, we’ve got you covered. Keep scrolling to find out who the best car insurance companies are in Nebraska. Ready to go? Let’s get this show on the road.

The 10 Largest Nebraska Car Insurance Companies’ Financial Rating

AM Best gives insurance companies financial ratings. A good score means they are highly likely to stay solvent and have the ability to pay customer claims. Top 10 Largest Nebraska Car Insurance Companies by Market Share

| Rank | Insurance Company | Market Share | A.M. Best |

|---|---|---|---|

| #1 | State Farm | 23.00% | B |

| #2 | Progressive | 16.70% | A+ |

| #3 | Geico | 14.50% | A++ |

| #4 | Allstate | 10.00% | A+ |

| #5 | USAA | 6.00% | A++ |

| #6 | Farmers | 4.80% | A |

| #7 | Nationwide | 2.10% | A+ |

| #8 | American Family | 2.10% | A |

| #9 | Erie | 1.50% | A |

| #10 | Iowa Farm Bureau | 1.30% | A- |

Besides premiums, one of the other components that should factor into your decision when picking an insurance carrier is customer ratings.

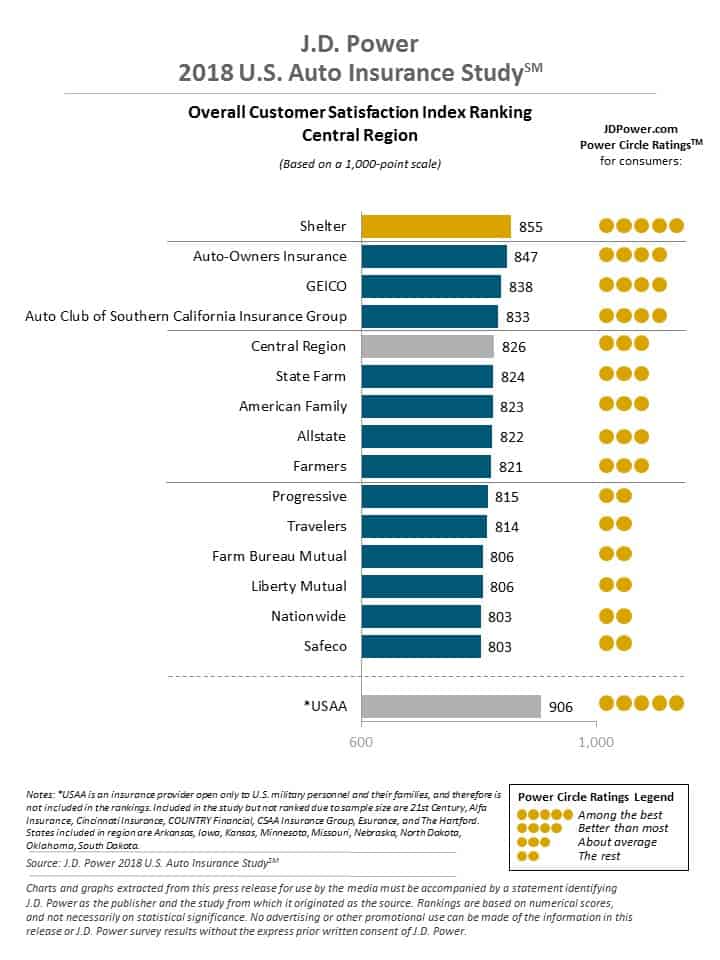

Companies With Best Ratings

Nebraska falls into the Central Region for the 2018 J.D. Power auto insurance study. The top insurance companies of Nebraska are sprinkled throughout the customer satisfaction ratings provided by this trusted source.

Car Insurance Company Complaints

The State of Nebraska’s Commission on Insurance does not track state-level complaints. In the table below is the complaint index of the largest Nebraska auto insurance company on a national level. The complaint index calculates how much larger a company’s share of complaints is compared to its share of profits across the state.

Companies that have a complaint index higher than one are worse than the average insurer, and those with an index below one are better than average. NAIC Customer Complaint Ratio From the Top Nebraska Car Insurance Companies

| Company | Complaint Ratio | Higher/Lower Than Average (1.00) |

|---|---|---|

| Allstate | 1.88 | Higher |

| American Family | 0.79 | Lower |

| Farmers | 0 | Lower |

| Farmers Mutual | 0.59 | Lower |

| Geico | 2.04 | Higher |

| Iowa Farm Bureau | 0.77 | Lower |

| Nationwide | 0.66 | Lower |

| Progressive | 1.33 | Higher |

| State Farm | 0.52 | Lower |

| USAA | 0.74 | Lower |

Bear in mind, that some complaints are based on general car insurance company customer satisfaction ratings, so factor that into your final decision.

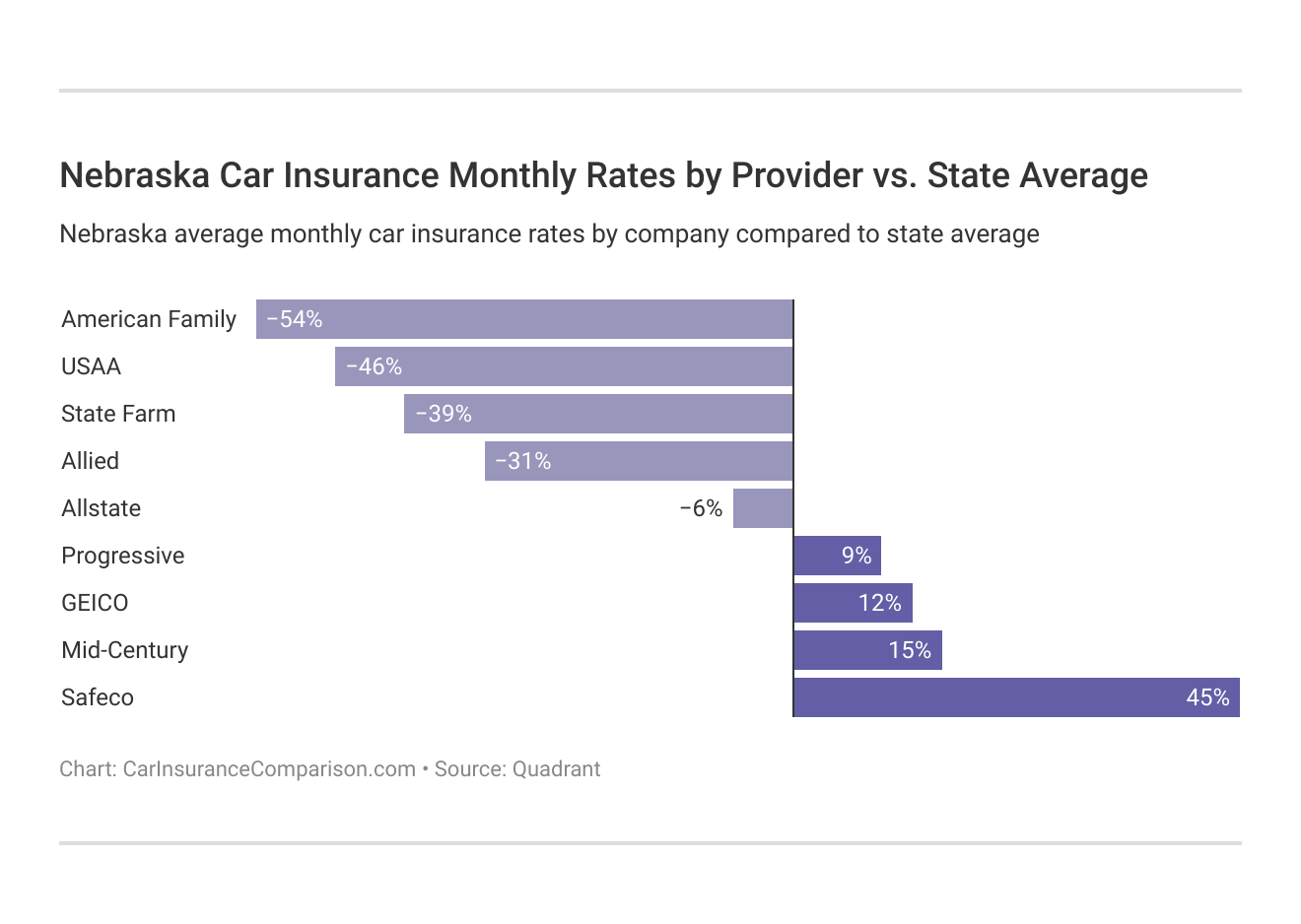

Car Insurance Rates by Company in Nebraska

We know that rates are one of the biggest factors that impact your choices in Nebraska car insurance. The below chart shows ten of the top carriers in the state, along with their average rates compared to the overall state average.

This comparative overview of insurance rates by company in Nebraska serves as a vital tool for drivers seeking the most cost-effective coverage. It helps ensure that consumers can make informed decisions based on how each carrier’s rates stack up against the state average.Commute Rates

The table below compares the rates of top carriers in the state against average commute times. Interestingly enough, Allstate comes out with the highest premium for annual mileage while Liberty Mutual and USAA compete for the lowest premium for car insurance mileage. Nebraska Car Insurance Monthly Rates by Annual Mileage

| Insurance Company | 6,000 Annual Miles | 12,000 Annual Miles |

|---|---|---|

| Allstate | $267 | $278 |

| American Family | $183 | $186 |

| Farmers | $333 | $367 |

| Geico | $316 | $326 |

| Liberty Mutual | $519 | $612 |

| Nationwide | $216 | $292 |

| Progressive | $313 | $274 |

| State Farm | $198 | $208 |

| USAA | $192 | $197 |

If you have a particularly short commute to work, consider one of the companies that doesn’t charge extra for a longer commute

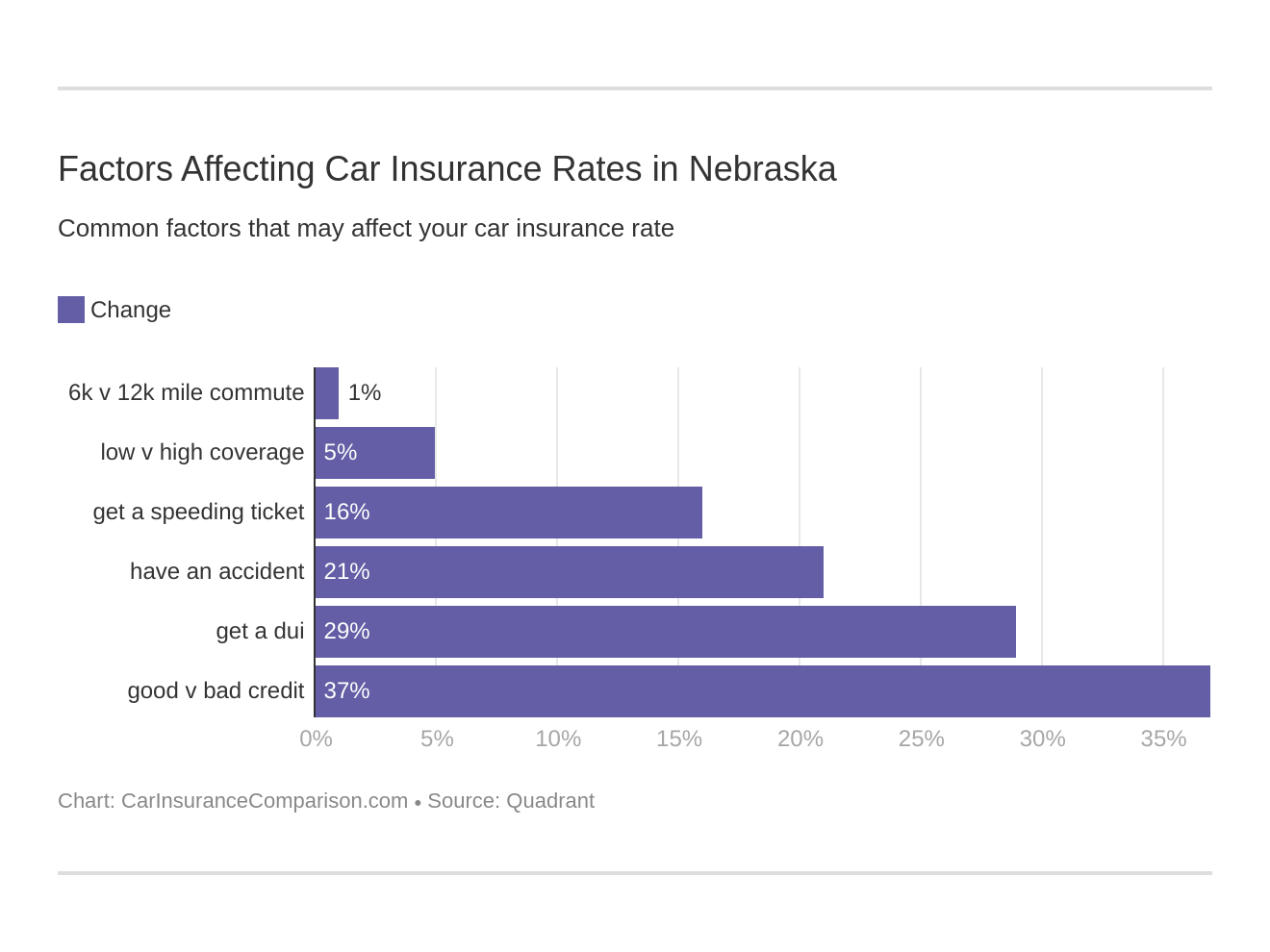

Understanding these factors is essential for managing your car insurance costs in Nebraska. Being aware of how each element affects your premiums can help you make informed decisions to potentially lower your rates.Credit History Rates

According to a study conducted by Experian, the average resident of Nebraska has a credit card VantageScore of 695 and around 2.83 credit cards in their name.

Nebraska falls in the top ten states for the highest VantageScore. You Nebraskans are smart shoppers.

The average Nebraska consumer has a credit card balance of $5,630. VantageScore considers a score over 700 to be good or excellent, between 650 and 699 to be fair, and 649 or lower to be poor. Nebraska Car Insurance Monthly Rates by Credit History & Provider

| Insurance Company | Good Credit | Fair Credit | Poor Credit |

|---|---|---|---|

| Allstate | $217 | $252 | $750 |

| American Family | $137 | $169 | $381 |

| Farmers | $301 | $316 | $367 |

| Geico | $277 | $318 | $359 |

| Liberty Mutual | $356 | $452 | $331 |

| Nationwide | $182 | $207 | $295 |

| Progressive | $278 | $301 | $260 |

| State Farm | $137 | $177 | $259 |

| USAA | $149 | $175 | $247 |

Keep your credit history manageable because insurance carriers run credit checks on their customers from time to time to recalculate the chance they may file a claim. If you see a change in your rates, this could be why.

Driving Record Rates

As you’ll note in the table below, your driving history has a direct effect on the annual rates you can expect to pay. Nebraska Full Coverage Car Insurance Monthly Rates by Driving Record

| Insurance Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| Allstate | $232 | $261 | $315 | $259 |

| American Family | $181 | $196 | $181 | $181 |

| Farmers | $282 | $361 | $352 | $336 |

| Geico | $206 | $296 | $446 | $335 |

| Liberty Mutual | $445 | $525 | $569 | $538 |

| Nationwide | $153 | $222 | $316 | $174 |

| Progressive | $266 | $390 | $297 | $298 |

| State Farm | $189 | $217 | $203 | $203 |

| USAA | $147 | $186 | $277 | $167 |

If you look at the rates listed for Geico, for example, you’ll notice that the rate difference for a clean record versus one DUI is nearly a $2,900 premium jump, while American Family and State Farm keep their rates on the lower end for customers that have a less-than-stellar driving record. These rates, however, may not apply to new customers. If you have a shady driving record, you may want to investigate high-risk auto insurance.

How Much Auto Insurance Costs in Nebraska

Discover the intricacies of auto insurance rates in Nebraska’s Plattsmouth and Scottsbluff with our city-specific analysis. Gain concise insights into the factors influencing premiums in your locale, helping you make informed decisions about coverage. Compare and analyze car insurance rates to understand the key factors shaping costs in these Nebraska cities. Nebraska Car Insurance Cost by City

Comparing car insurance rates in Plattsmouth and Scottsbluff can help residents of Nebraska find the most cost-effective coverage options tailored to their specific local conditions. This localized approach ensures that drivers secure the best possible rates and coverage suited to their unique needs.

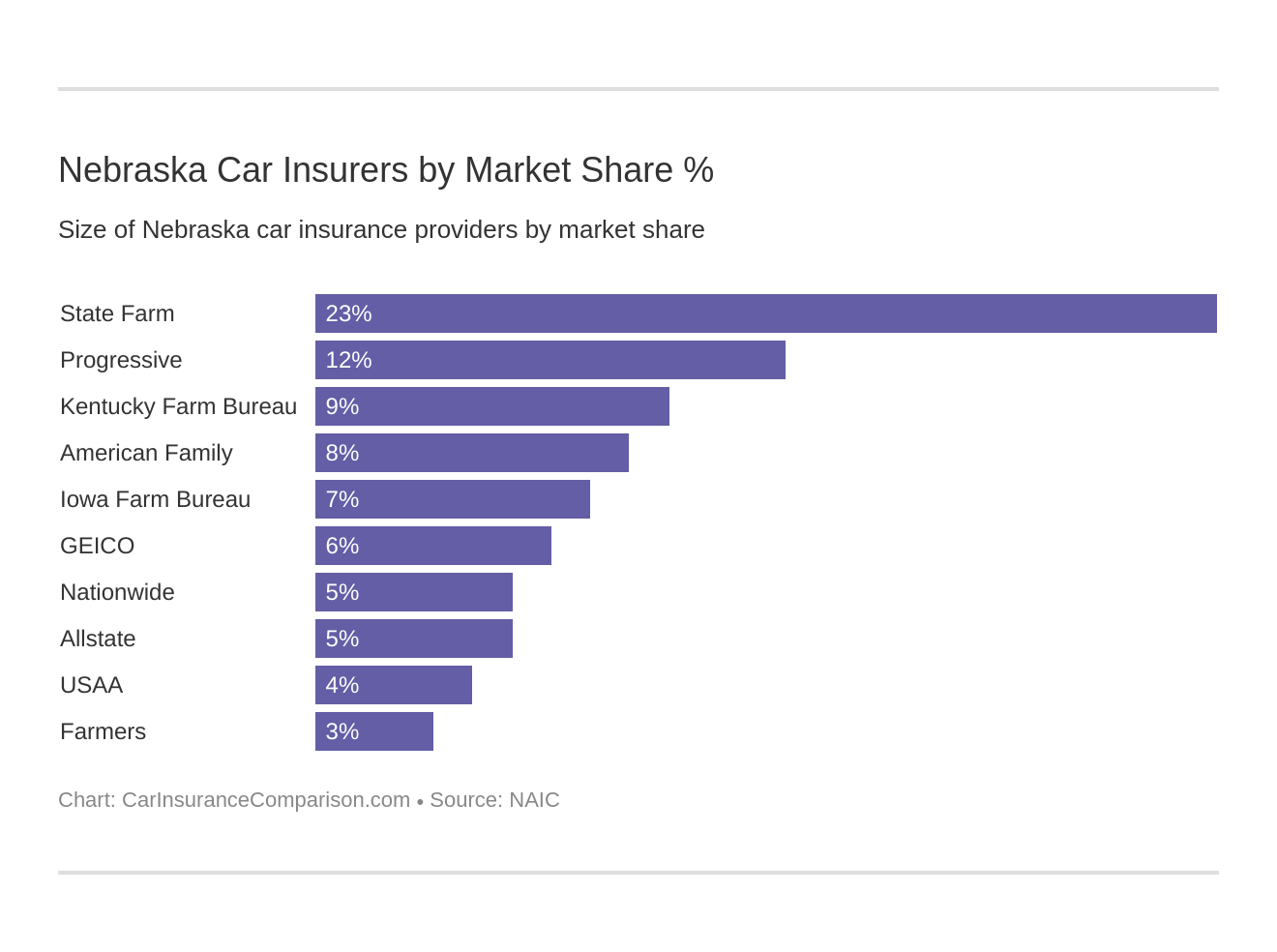

The 10 Largest Car Insurance Companies in Nebraska

In the table and chart below are the 10 insurance companies in Nebraska that are at the top of the market share. A loss ratio shows how much a company spends on claims to how much money they take in on premiums.

The distribution of market share among Nebraska car insurers highlights the competitive nature of the insurance industry within the state. Consumers benefit from this competition, which often leads to better service and more tailored coverage options.

Number of Car Insurance Providers in Nebraska

Nebraska hosts a diverse range of car insurance providers, including both domestic and foreign companies. This variety offers residents numerous options to find coverage that best suits their needs.

Nebraska Property Casualty Insurance

| Property & Casualty Insurance | Number |

|---|---|

| Domestic | 34 |

| Foreign | 867 |

| Total | 901 |

With 901 different insurers to choose from in Nebraska, selecting the right provider can seem daunting. Utilizing tools to compare rates can streamline the process, ensuring you find the best insurance solution efficiently.

Nebraska Car Insurance Laws to Know About

To keep your car insurance rates low, you have to know the laws in your state so you’re not blindsided by a fine. Don’t worry. We’re here to help. Keep reading to learn about the laws specific to the state of Nebraska. Car insurance regulations vary widely across the United States, and Nebraska is known for its stringent enforcement of these laws.

Drivers in Nebraska must navigate a set of specific rules that emphasize compliance and safety. Navigating the car insurance laws in Nebraska requires a clear understanding of its strict requirements. Ensuring compliance not only helps avoid legal penalties but also enhances road safety for everyone.

High-Risk Insurance

The state of Nebraska has a points system. In most cases, excessive points on your driving record will affect your car insurance rates. Various violations result in several points, but if you reach 12 points in two years, there are serious repercussions.

For example, one speeding violation of 35 mph over the speed limit will result in a ticket and four points on your driving record. Have three violations of this particular kind in two years, your driving privileges will be automatically revoked. In addition, points from convictions remain on your driving record for five years.

Nebraska even tracks violations of the driving laws in other states. If you obtain a violation in all states except for three, points will be assessed in Nebraska.

There is an additional penalty for not addressing tickets in other states. If you fail to comply, your driving privileges will be suspended. But, there is a small sliver of hope. Nebraska offers a driver improvement course that can be completed once every five years. The course must be completed before the date of violation would assess the 12th point on the driving record, and completion of the course results in two points being removed from your record.

For top-tier auto insurance, USAA is the clear winner thanks to its comprehensive coverage and superior customer care.

Tracey L. Wells Licensed Insurance Agent & Agency Owner

Nebraska also has a medical hardship permit program for those who have lost their driving privileges. This permit must be renewed every 90 days. Though the name of the permit may indicate usage for medical needs only, it is permissible to travel between home and work but not for shopping, probationary meetings, or school.

For drivers with a history of accidents or traffic violations, they may find themselves unable to purchase coverage from an auto insurance carrier. This is where a type of insurance known as high-risk insurance comes into play.

If you are having trouble finding a car insurance carrier, you may apply for insurance through the Nebraska Automobile Insurance Plan (NEAIP). You must verify that you have tried and failed to get reasonable rates within 60 days of serving the consequences for your conviction.

Low-Cost Insurance

The state of Nebraska currently does not provide any auto insurance for welfare recipients.

Windshield Coverage

At this time, in Nebraska, there are no laws that specify windshield coverage. However, individual insurance companies may offer coverage and/or a zero-dollar deductible. In any case, Nebraska residents are permitted to choose any windshield repair vendor desired.

If windshield coverage is something you desire, you will need to have comprehensive coverage and you will have to carefully examine how the different insurance providers handle windshield claims.

Be aware that filing a claim may increase your premiums. Consider paying out of pocket if the cost of the repair is less than what you have on hand. Preserve your low premium for cases in which damages exceed what you can reasonably pay out of pocket.

Automobile Insurance Fraud in Nebraska

Insurance fraud is a criminal offense in the state of Nebraska. the Nebraska Department of Insurance defines insurance fraud as “any deliberate deception committed against, or by, an insurance company, insurance agent, or consumer for the purpose of unjustified financial gain.” In Nebraska, there are seven situations in which insurance fraud is committed:

- Fake Insurance Policies

- Arson-for-Profit

- Fraudulent Claims

- Exaggerated Claims

- Medical Fraud

- Slip and Fall Personal Injury Schemes

Committing insurance fraud in Nebraska is classified as a crime and will result in fines for each consecutive violation:

- First Violation: Fine of up to $5,000.

- Second Violation: Fine of up to $10,000.

- Each Subsequent Violation: Fine of up to $15,000.

The state of Nebraska has a fraud bureau that handles all instances of insurance fraud. In 2018, there were 43 cases of Auto Bodily Injury accounting for $122,684.00 and 272 cases of Auto Property accounting for a total of $383,754.09 of reported losses. The total amount of reported losses (actual/potential) was $14,865,363; therefore, auto-related cases of fraud made up 3.4 percent of all cases handled by the Nebraska Fraud Bureau.

However, auto-related fraud cases totaled 315, making up 44 percent of the total number of fraud cases during 2018 which were primarily life and health insurance fraud cases. The statistics tell you that auto insurance fraud is more common but makes up a small percentage of the money that the Nebraska Fraud Bureau handles. Don’t jump on the bandwagon of auto insurance fraud – it’s just not worth the money or the time.

Statute of Limitations

A statute of limitations is the limit on the amount of time you have to bring a lawsuit to court. Different states have different statutes of limitations for personal injury and property damage matters.

If you are ever in an auto accident involving extensive injuries and damages, you need to know your rights in the matter. Nebraska Revised Statute 25-207 explains that you have to get your personal injury lawsuit filed within four years and your property damage lawsuit filed within four years of the date of the car accident.

Penalties for Driving Without Nebraska Insurance

As mentioned earlier, Nebraska has a zero-tolerance policy for motorists driving without proof of car insurance.

Your driving license and driving privileges will be automatically suspended when you have been found guilty of a citation for No Proof of Insurance.

This stringent approach serves as a deterrent to prevent driving without insurance, thereby helping to ensure that all motorists are adequately protected. It underscores the importance of carrying proof of insurance at all times while driving.

Teen Driver Laws

Nebraska’s young driver licensing laws are structured to gradually introduce teenagers to full driving privileges through a series of stages. These regulations aim to enhance road safety by limiting exposure to high-risk driving situations during the early stages of their driving careers.

Nebraska Teen Driver Laws

| Young Driver Licensing Laws | Age Restrictions | Passenger Restrictions | Time Restrictions |

|---|---|---|---|

| Learner's Permit | 15 in metropolitan areas, and 14 and 2 mos. in rural areas | no more than 1 passenger younger than 19 secondary enforcement (family members excepted) | midnight-6 a.m. secondary enforcement |

| Provisional License | 16 with holding period of 6 months and 50 hours, 10 of which must be at night (none with driver education) | no more than 1 passenger younger than 19 secondary enforcement (family members excepted) | midnight-6 a.m. secondary enforcement |

| Full License | 16 | Passenger restrictions lifted: 6 months or age 18, whichever occurs first (min. age: 16, 6 mos.) | Time restrictions lifted: 12 months or at age 18, whichever occurs first (min. age: 17) |

Because Nebraska is mostly rural, the law makes an exception for teens living in rural areas. Students who are at least 14 years and two months of age may be issued a learner’s permit (called an “LPE permit”) and a limited license (called a “school permit”).

Both require adult supervision when in use. Case in point, Douglas County (home to Omaha) has a population density of 1,674 people per square mile. Cherry County, the largest county by land use in Nebraska, has a population density of 1 person per square mile.

Differentiation between laws in rural and urban areas is quite reasonable; nearly 86 percent of the counties in Nebraska have a population density of fewer than 15 people per square mile.

Rural or not, however, the same point system is in effect for teens and those under 21, but only harsher. If a driver under the age of 21 accumulates six or more points within 12 months, the only way to prevent suspension is to complete a Defensive Driving Course within three months of notification by the DMV. Drivers can get defensive driver car insurance discounts if they have taken a course.

Older Driver and General Population License Renewal Procedure

In Nebraska, the procedures for renewing a driver’s license are tailored to accommodate the general and older populations differently, emphasizing safety and convenience.

Nebraska Older Driver & General Population Renewal Procedures

| Renewal Procedures | General Population | Older Population |

|---|---|---|

| License renewal cycle | 5 years | 5 years |

| Mail or online renewal permitted | online, every other renewal | not permitted 72 and older |

| Proof of adequate vision required at renewal | when renewing in person | 72 and older, every renewal |

These renewal procedures ensure that all drivers, especially older adults, meet the requirements to maintain their driving privileges in Nebraska. Residents need to be aware of these regulations to ensure compliance and safety on the roads.

New Residents

New residents of Nebraska have specific documentation requirements that must be met within 30 days of establishing residency. This ensures that all legal and address verifications are up-to-date and compliant with state regulations. Here is a list of items that must be provided by new residents of Nebraska within 30 days of establishing residency:

- Proof of U.S. Citizenship or Lawful Status, containing name, date of birth, and identity

- Two documents showing proof of address

- Applicants must disclose their valid social security number which can be verified through the Social Security Administration

For those moving to Nebraska, promptly submitting the necessary documents is essential to establish legal residency and ensure access to state services. This process helps maintain accurate records and supports efficient government operations.

Comparative Negligence

In Nebraska, courts use a rule known as comparative negligence in the case that one driver is primarily at fault but the other driver is found to bear partial responsibility. Typically, blame is divided between the responsible parties based on the percentage of responsibility each has. The percentage of responsibility is then applied to the total cost of personal injury and property damage.

If the blame assigned to the person claiming damages is less than that assigned to the other parties, the plaintiff is entitled to damages — reduced by the percentage for which the plaintiff is responsible. However, if the blame assigned to the plaintiff is greater than that assigned to the other party or parties, the plaintiff is not entitled to damages.

Rules of the Road in Nebraska

Understanding Nebraska’s driving regulations is crucial as adherence can significantly reduce your insurance premiums. Violations or infractions can lead to higher rates, underscoring the importance of being well-versed in local traffic laws.

Fault vs. No-Fault

The first thing to know is that Nebraska follows a traditional fault-based system when it comes to financial responsibility for losses stemming from a crash: that includes car accident injuries, lost income, vehicle damage, and so on.

Keep Right and Move Over Laws

Nebraska law states that you should keep right if driving slower than the average speed of traffic around you with three exceptions. When it comes to moving over, the law states that when a driver comes upon an emergency vehicle parked on any multi-lane road, they must move over.

This law has been in effect for over 10 years. The first offense of violating the move-over law will result in a fine of $100 for the first offense and up to seven days in jail and a fine of $500 for the second offense.

Speed Limits

In Nebraska, the maximum posted speed limits are 75 mph on rural interstates, 70 mph on urban interstates, 70 mph on limited access roads, and 65 mph on all other roads.

Seat Belt, Car Seat, and Cargo Area Laws

Seat belt use in Nebraska is secondarily enforced and requires anyone in the front seat to be 8 years old or older with a fine of $25 if violated. Children 7 years and younger are required to be in a child safety seat. Children younger than 2 years old are required to be in a rear-facing child restraint or until the child outgrows the maximum allowable height or weight as prescribed by the manufacturer.

An adult belt is permissible for children 8-17 years with a preference for the rear seat for children under the age of 7. Nebraska’s law is secondary for those children who may be in safety belts and primary for those who must be in a child restraint device. Currently, Nebraska state law regulates that transporting people in the cargo areas of pick-up trucks is reserved for those 18 and older except for parades.

Ridesharing

Rideshare services like Uber and Lyft mandate that all their drivers carry personal car insurance policies that align with or exceed the minimum coverages dictated by state law. Drivers rarely carry their commercial car insurance coverage; however, Farmers, Geico, State Farm, and USAA provide rideshare insurance in Nebraska. Learn more: Compare Commercial Car Insurance: Rates, Discounts, & Requirements

Automation on the Road

As of June 2018, Nebraska has deployed autonomous vehicles. According to the Insurance Institute for Highway Safety (IIHS), automation is the use of a machine or technology to perform a task or function that was previously carried out by a human.

In driving, automation involves using radar, camera, and other sensors to gather information about a vehicle’s surroundings, which is then used by computer programs to perform parts or all of the driving tasks on a sustained basis.

Choosing USAA means opting for the best in auto insurance, with proven reliability and customer-first service

Scott W. Johnson Licensed Insurance Agent

Nebraska permits two types of autonomous vehicles: automated-driving-system-equipped vehicles and driverless-capable vehicles. These two types of vehicles must be able to achieve “a minimal risk condition” in the event of a failure. An automated-driving-system-equipped vehicle contains a licensed human; however, a driverless-capable vehicle can be operated remotely.

So why even have a human? Minimal risk condition, or fallback, ensures that the vehicle will be able to notify the human driver or remote operator of events in a way that enables the driver to regain proper control of the vehicle and manually bring the vehicle to a safe speed or a complete stop out of normal traffic lanes.

In the event of a crash or collision, the operator and/or vehicle is required to stay at the scene of the accident and comply with existing laws for conventional vehicles. While all of this is exciting and cool, state laws across the U.S. run the gamut when it comes to insurance requirements. Some states:

- Do not require liability insurance

- Require owners to carry liability insurance but do not specify any regulations beyond that

- Require 250 percent of the minimum coverage as defined by state law

- Require vehicle owners to carry five million dollars in liability insurance

- Require 1.5 million in coverage for rideshare companies

The real question is, can a machine be held liable? Well, based on Nebraska laws, it can be liable because a human is supposed to be present in the vehicle or present while operating it remotely. To remain consistent with Nebraska’s strict points system, points will be assessed for:

- Careless Driving (Inattentive, Forgetful, Inconsiderate): 4 points

- Negligent Driving (Indifferent, Offhand, Neglectful): 3 points

We assume these two categories can be applied to autonomous vehicles, whether a human is present or not.

Safety Laws in Nebraska

Nebraska’s safety laws are designed to enhance protection for all road users, ensuring a safer driving environment. It’s essential to familiarize yourself with these regulations to navigate the roads responsibly and securely.

DUI Laws

Nebraska’s DUI laws set the Blood Alcohol Content (BAC) limit at 0.08, with increased penalties for a BAC of 0.15 or higher. Repeat offenses within a 15-year look-back period escalate from misdemeanors for the first three instances to felonies for the fourth offense and beyond, with specific classifications based on the number of prior offenses and the presence of injuries caused by the DUI.

For a first offense, penalties can include a minimum two-month license revocation, up to $500 in fines, and additional requirements like installing an ignition interlock device (IID) or filing an SR-22 form for three years. To find out more, explore our guide titled “What are the DUI insurance laws in Nebraska?”

Marijuana-Impaired Driving Laws

Nebraska doesn’t currently have a marijuana-specific impaired driving law that restricts blood toxicity levels.

Distracted Driving Laws

The state of Nebraska has somewhat lenient laws regarding hand-held device usage, cellphone usage, and texting as compared to other states.

Nebraska has an all-driver texting ban, drivers age 18 and under have a cell phone ban, there is no handheld ban, all three are secondarily enforced.

Secondary enforcement means that you must be pulled over for another offense to receive a citation.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Nebraska Fascinating Facts You Need to Know

Exploring Nebraska’s road safety can reveal some intriguing insights. Discover key facts that shed light on what drivers in this state experience.

Vehicle Theft in Nebraska

In 2016, there were just over 4,200 motor vehicle thefts in the state of Nebraska. Seventy-four percent of these thefts were in Omaha alone. Lincoln falls in second with only 342 thefts. If you plan to drive to the big city, be extra careful. Hide your belongings, and don’t forget to lock them up. Here are the top 10 stolen cars in Nebraska.

Nebraska Make and Model Theft in 2023

| Make/Model | Number of Thefts |

|---|---|

| Chevrolet Pickup (Full Size) | 196 |

| Ford Pickup (Full Size) | 168 |

| Honda Civic | 165 |

| Honda Accord | 157 |

| Dodge Pickup (Full Size) | 102 |

| Jeep Cherokee/Grand Cherokee | 70 |

| Chevrolet Impala | 68 |

| GMC Pickup (Full Size) | 61 |

| Toyota Camry | 49 |

| Chevrolet Pickup (Small Size) | 43 |

This data underlines the importance of implementing robust security measures, especially for owners of these high-risk models. Awareness and preventive actions can significantly reduce the chances of falling victim to vehicle theft.

Risky/Harmful Driving Behavior

The best way to stay safe while driving is to always keep your eyes on the road and stay aware of common risky driving issues in your state. In 2017, there were 43 traffic incident-related fatalities in Douglas County, comprising a 7.66 fatality rate per 100,000 of the population.

Transportation

If you live in Nebraska, chances are you live in a household with one to three cars, drive alone to work, and spend anywhere from 5-24 minutes of your day commuting.

Commute Time

With an average commute time of only 17.8 minutes, and with 35 percent of the population driving fewer than 14 minutes to work, you’ve got it good, Nebraska. However, some residents of Nebraska (1.16 percent to be exact) suffer through a “super commute” — spending more than 90 minutes in the car. Maybe it’s time to move to the city.

Traffic Congestion

A great deal of Nebraska is rural with fewer than 10 people per square mile in the majority of the counties. There are two metropolitan cities which are Lincoln, Nebraska, and Omaha, Nebraska. The traffic in these two cities may be overwhelming to a Nebraskan coming from a rural county, but Omaha is the 58th most congested city in the United States.

In 2018, each driver in Omaha spent 35 hours sitting in congestion which is $494 per driver. To put this in comparison, consider the traffic in Chicago, Illinois (the 3rd most congested city in the US). In the same year, Chicago drivers spent 138 hours sitting in congestion which is $1,920 per driver.

So, even though Omaha traffic may be a pain in the rear, there is 75 percent less congestion than in Chicago. Discover insights in our guide titled “Traffic Tickets that Raise Car Insurance Rates.”

Comparing Nebraska Car Insurance Rates

Once you know what coverages you want to carry on your car, you can start shopping around for car insurance in Nebraska. Taking the time to compare car insurance rates in Nebraska will help you find the best possible deal. To find out more, explore our guide titled “Finding Free Car Insurance Quotes Online.”

If you want to get started on finding cheap Nebraska car insurance, check out our free quote comparison tool. It will help you compare Nebraska car insurance companies to find the best deal possible.

Frequently Asked Questions

Does my age affect car insurance rates in Nebraska?

Yes, age can affect car insurance rates in Nebraska. Younger drivers, particularly those under 25, usually face higher premiums due to their higher risk profile. As drivers gain more experience and reach middle age, their rates tend to decrease. However, other factors such as driving record and type of vehicle also play a role in determining the final premium.

For additional details, explore our comprehensive resource titled “Does the age of a car affect car insurance rates?“

Does my driving record affect car insurance rates in Nebraska?

Yes, your driving record has a significant impact on car insurance rates in Nebraska. Drivers with a history of accidents, traffic violations, or DUI convictions are considered higher risk and may face higher premiums. Maintaining a clean driving record with no incidents can help lower insurance rates.

Are there any specific requirements for uninsured/underinsured motorist coverage in Nebraska?

Yes, Nebraska law requires drivers to have uninsured/underinsured motorist (UM/UIM) coverage. This coverage helps protect you if you’re involved in an accident with a driver who doesn’t have insurance or has insufficient coverage. The minimum UM/UIM coverage limits in Nebraska are typically the same as the liability coverage limits. Finding cheap car insurance quotes is easy. Just enter your ZIP code into our free comparison tool below to instantly compare quotes near you.

Can I get discounts for being a safe driver in Nebraska?

Yes, many insurance companies offer safe driver discounts in Nebraska. If you have a clean driving record without any accidents or violations, you may be eligible for a safe driver discount. Some insurance providers also offer usage-based insurance programs that monitor your driving habits and reward safe driving behaviors with lower rates.

What are the Nebraska state minimum car insurance requirements?

Nebraska drivers must carry 25/50/25 of liability insurance.

To find out more, explore our guide titled “Minimum Car Insurance Requirements by State.”

How much does car insurance cost each month in Nebraska?

In Nebraska, car insurance typically costs $35 a month for the most basic coverage and $88 a month for more comprehensive coverage. Both types of coverage have budget-friendly options available.

Who usually offers the lowest-priced car insurance?

State Farm provides the least expensive nationwide car insurance, charging about $50 a month for basic liability coverage. American Family and Geico also offer low rates, with an average cost of around $61 a month.

At what age does car insurance cost the least?

Older drivers who are less likely to file claims generally pay less for car insurance. At Progressive, insurance rates usually drop significantly from ages 19 to 34 and then remain stable or decrease slightly from ages 34 to 75.

What kind of car insurance is the most affordable?

Generally, the most comprehensive insurance is often the cheapest, although the actual cost can vary depending on personal circumstances. See more details on our “How do you get competitive quotes for car insurance?“

Which companies offer the cheapest full coverage car insurance?

The most affordable full coverage car insurance is typically offered by American National, Country Financial, Nationwide, Erie, and USAA.

At what age is car insurance usually the most expensive?

Car insurance is most costly for young drivers between the ages of 16 and 24, as they are more likely to be involved in accidents and file claims.

What is the simplest form of car insurance?

The most basic car insurance usually includes liability protection, which is required by most states. States may also require uninsured/underinsured motorist coverage and comprehensive coverage.

What is the minimum required level of car insurance?

The least amount of car insurance you generally need is liability coverage required by your state. This helps cover some or all of the costs for injuries and damages you are responsible for in an accident.

To learn more, explore our comprehensive resource on “When should I switch to liability only car insurance?“

Which type of car insurance offers the most protection?

Comprehensive car insurance provides the highest level of coverage available.

Is it against the law to drive without car insurance in Nebraska?

In Nebraska, it’s illegal to drive without proof of valid car insurance or some other form of financial responsibility. This offense is considered a class II misdemeanor.

In Nebraska, does insurance cover the car or the driver?

In Nebraska, car insurance usually covers the car. Types of insurance that cover the car include liability for bodily injury and personal injury, uninsured motorist protection, collision, and comprehensive coverage. Explore your car insurance options by entering your ZIP code below and finding which companies have the lowest rates.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.