Best Toyota Car Insurance Rates in 2025 (Find the Top 10 Companies Here!)

Geico, Allstate, and Liberty Mutual have the best Toyota car insurance rates. Geico's average rates for minimum Toyota coverage are $30/mo. However, Toyota insurance rates will vary depending on what Toyota model you own, as a Toyota Land Cruiser will cost much more to insure than a Toyota Yaris.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

UPDATED: Jul 19, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jul 19, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for Toyota

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage for Toyota

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews 3,792 reviews

3,792 reviewsCompany Facts

Full Coverage for Toyota

A.M. Best Rating

Complaint Level

Pros & Cons

3,792 reviews

3,792 reviewsGeico, Allstate, and Liberty Mutual have some of the best Toyota car insurance rates.

You should always compare Toyota car insurance rates since there are various factors that affect car insurance rates.

Some of the most typical factors insurers consider when setting Toyota insurance costs include demographics, coverage options, driving profile, and model year.

Our Top 10 Company Picks: Best Toyota Car Insurance Rates

| Company | Rank | Multi-Vehicle Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 22% | A++ | Cheap Rates | Geico | |

| #2 | 24% | A+ | Customized Policies | Allstate | |

| #3 | 20% | A | 24/7 Support | Liberty Mutual |

| #4 | 20% | A+ | Usage-Based Coverage | Nationwide |

| #5 | 12% | A+ | Competitive Rates | Progressive | |

| #6 | 20% | A | Discount Selection | Farmers | |

| #7 | 15% | A++ | Military Savings | USAA | |

| #8 | 18% | B | Safe Drivers | State Farm | |

| #9 | 20% | A | Roadside Assistance | AAA |

| #10 | 19% | A++ | Safety Features | Travelers |

Read on to learn more about the best Toyota auto insurance companies, Toyota coverage options, and more.

When you’re ready to compare Toyota insurance rates, you can enter your ZIP into our free quote tool above.

- Geico has some of the best Toyota insurance rates for drivers

- Toyota drivers can choose between several types of coverage

- A Toyota Yaris is one of the cheapest Toyotas to insure

#1 – Geico: Top Pick Overall

- Compare Toyota Car Insurance Rates

- Best Toyota RAV4 Prime Car Insurance in 2025 (Check Out the Top 10 Companies)

- Best Toyota RAV4 Hybrid Car Insurance in 2025 (Compare the Top 10 Companies)

- Best Toyota Prius Prime Car Insurance in 2025 (Check Out the Top 10 Companies)

- Best Toyota Corolla Hybrid Car Insurance in 2025 (Find the Top 10 Companies Here)

- Best Toyota Avalon Hybrid Car Insurance in 2025 (Find the Top 10 Companies Here!)

- Best Toyota Tundra Car Insurance in 2025 (Check Out the Top 10 Companies)

- Compare Toyota vs. Chevrolet Car Insurance Rates [2025]

- Best Toyota Venza Car Insurance in 2025 (Your Guide to the Top 10 Companies)

- Best Toyota 4Runner Car Insurance 2025 (Your Guide to the Top 10 Companies)

- Best Toyota Tacoma Car Insurance in 2025 (Top 10 Companies Ranked)

- Best Toyota RAV4 Car Insurance in 2025 (Find the Top 10 Companies Here)

- Best Toyota Highlander Car Insurance 2025 (Top 10 Companies Ranked)

- Best Toyota Camry Car Insurance in 2025 (Compare the Top 10 Companies)

- Best Toyota Sienna Car Insurance in 2025 (Find the Top 10 Companies Here)

- Best Toyota Prius Car Insurance in 2025 (Compare the Top 10 Companies)

Pros

- Cheap Rates: Geico has some of the most affordable Toyota car insurance rates.

- Strong Digital Presence: Geico makes online policy management changes easy.

- Financial Stability: A.M. Best gave Geico a good rating.

Cons

- Limited Personal Interaction: Geico offers mostly online services, so local agents are few.

- DUI Rates: Multiple DUI drivers will have expensive rates. Read more in our Geico review.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#2 – Allstate: Best for Customized Policies

Pros

- Customized Policies: Allstate’s policies are easy to customize. See what Allstate sells in our Allstate review.

- Pay-Per-Mile Coverage: Ideal for low-mileage Toyota drivers.

- Discount Options: Allstate has everything from student discounts to usage-based discounts.

Cons

- Claim Satisfaction: The number of claim complaints is high.

- Young Driver Rates: Rates are higher than average unless teens join a parent’s policy.

#3 – Liberty Mutual: Best for 24/7 Support

Pros

- 24/7 Support: Liberty Mutual offers support 24/7 to Toyota owners.

- Add-On Coverages: Liberty Mutual’s add-ons make it simple to personalize Toyota policies.

- Claim Filing: The claims filing process is simple at Liberty Mutual (learn more: How do you file a car insurance claim?).

Cons

- Customer Ratings: There are a few negative reviews left by Liberty Mutual customers.

- Discount Availability: Discounts may be limited in some states.

#4 – Nationwide: Best for Usage-Based Coverage

Pros

- Usage-Based Coverage: Nationwide sells usage-based insurance through SmartMiles, which charges Toyota drivers by the mile.

- Bundling Discounts: Toyota drivers who also buy home insurance will get a discount (read more: Nationwide car insurance discounts).

- Add-On Options: Toyota customers can add as many optional coverages to their policy as they want.

Cons

- Limited Agent Interaction: Local agents aren’t usually available.

- Customer Ratings: While not terrible, ratings could be improved.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#5 – Progressive: Best for Competitive Rates

Pros

- Competitive Rates: Progressive has competitive rates for higher-risk drivers. Learn more in our review of Progressive.

- Snapshot Program: Progressive’s UBI program offers a large discount to good drivers.

- Coverage Options: Personalize Toyota policies easily with Progressives’ choices.

Cons

- Snapshot Rate Changes: Scoring poorly in Snapshot may result in rate increases for some Toyota customers.

- Customer Loyalty: The number of customers who stick with Progressive could be higher.

#6 – Farmers: Best for Discount Selection

Pros

- Discount Selection: Farmers has one of the larger discount selections among car insurance companies.

- Local Agents: Most Toyota customers should have access to local agents. Learn more in our Farmers review.

- Accident Forgiveness: Claims-free customers may be forgiven an at-fault accident.

Cons

- Online Functions: Customers may find online capabilities more limited than at other companies.

- Customer Satisfaction: Customers have left negative reviews about their car insurance claims.

#7 – USAA: Best for Military Savings

Pros

- Military Savings: USAA’s low rates will help most military drivers save on Toyota insurance.

- Discount Variety: There are discounts for bundling insurance policies, driving safely, and many more.

- Add-On Coverages: USAA has a good selection for Toyota customers. Learn more in our USAA car insurance review.

Cons

- Eligibility: Only active service members and veterans can buy coverage.

- Local Agent Availability: USAA doesn’t have local agents in most locations.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#8 – State Farm: Best for Safe Drivers

Pros

- Safe Drivers: Toyota customers with clean driving records will have low rates and additional discounts. Read our State Farm review for more information.

- Adjustable Deductibles: Adjusting deductibles can help Toyota customers save on insurance.

- Local Agents: Local agents are easy to locate in most states.

Cons

- Financial Rating: State Farm has a lower rating than its competition.

- Agent Purchases: Toyota customers won’t be able to purchase policies online.

#9 – AAA: Best for Roadside Assistance

Pros

- Roadside Assistance: AAA has several different plans for roadside assistance. Learn more in our AAA review.

- Member Benefits: AAA members can get discounts on some purchases.

- Coverage Options: AAA has a full list of add-ons for Toyota car insurance policies.

Cons

- Fee for Membership: Toyota customers must purchase a membership before buying insurance.

- Customer Service May Vary: Various clubs sell AAA insurance, so ratings may be lower in some states.

#10 – Travelers: Best for Safety Features

Pros

- Safety Features: Customers who have certain safety features on their cars will have discounted rates.

- Coverage Options: Travelers sells numerous coverages for Toyota policies. Learn more in our Travelers review.

- Online Convenience: Customers can make changes directly from the Travelers’ app.

Cons

- UBI Rate Changes: Travelers’ discount program raises rates if drivers score poorly.

- Customer Reviews: Customer service may be improved based on reviews.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Comparing Toyota Car Insurance Rates

Comparing Toyota car insurance rates is vital to finding the best price for you since various factors affect your auto insurance costs.

The following is a list of factors insurance companies consider when setting your rates:

- Age

- Gender

- Marital status

- Vehicle age, make, and model

- Credit score

- Annual mileage

- Driving record

- Coverage amount

- Occupation

- Discounts

As you can see, some factors are outside of your control, but there are things you can control to get the best Toyota car insurance rate.

For example, you can compare car insurance rates by vehicle make and model to find a Toyota model with lower rates. You can also compare car insurance rates by age and gender to find a company with the best quote.

Check out the table below to compare Toyota car insurance rates by Toyota model:

Toyota Car Insurance Monthly Rates by Model & Coverage Type

| Toyota Model | Comprehensive | Collision | Liability | Full Coverage |

|---|---|---|---|---|

| Toyota Yaris | $25 | $47 | $42 | $129 |

| Toyota Tundra | $34 | $53 | $42 | $147 |

| Toyota Tacoma | $31 | $50 | $37 | $134 |

| Toyota Sienna | $29 | $53 | $37 | $136 |

| Toyota Sequoia | $32 | $55 | $42 | $145 |

| Toyota RAV4 | $29 | $50 | $37 | $132 |

| Toyota Prius | $32 | $53 | $32 | $131 |

| Toyota Land Cruiser | $41 | $76 | $42 | $174 |

| Toyota Highlander | $35 | $53 | $37 | $141 |

| Toyota Corolla | $31 | $56 | $37 | $140 |

| Toyota Camry | $31 | $59 | $37 | $143 |

| Toyota Avalon | $31 | $52 | $35 | $132 |

| Toyota 4Runner | $35 | $53 | $32 | $133 |

If you’re looking for the cheapest insurance for Toyota cars, the average monthly rates for the Toyota Yaris are $129 per month. However, 2023 Toyota Corolla insurance costs $143, so compare Toyota insurance quotes to get the best deal.

Unveiling Toyota Vehicle Comparison Insights

Explore the dynamic realm of car insurance rates as we analyze Toyota and Chevrolet vehicles head-to-head.

Toyota Vehicle Comparison

Discover the factors influencing insurance premiums for these two automotive giants.

Unlock Savings: Compare Toyota Car Insurance Rates by Model for Maximum Value

Explore and compare Toyota car insurance rates based on different models.

Compare Toyota Car Insurance Rates by Model

Whether you own a Toyota 4Runner, Prius, Sienna, Avalon Hybrid, Prius Prime, Tacoma, Camry, RAV4, Tundra, Corolla Hybrid, RAV4 Hybrid, or Venza, this concise table provides a quick overview of insurance rates to help you make an informed decision.

Toyota Car Insurance Coverage Options

Car insurance companies offer Toyota drivers several types of car insurance coverage. Liability, uninsured motorist, personal injury protection, comprehensive, collision, and gap insurance are the most common types of coverage purchased, and each offers drivers a specific type of protection.

View this post on Instagram

Find out how much car insurance you need.

Liability Car Insurance

Liability car insurance covers bodily injury and property damage expenses for other drivers and passengers involved in an accident you caused up to a certain limit. Almost all states require this type of insurance and dictate the required coverage limit.

Liability insurance often gets expressed as three numbers, each indicating the coverage limit of that state. For example, with 20/50/25, your liability insurance covers $20,000 bodily injury liability per person, $50,000 bodily injury liability per accident, and $25,000 property damage liability.

Uninsured Motorist Insurance

Uninsured/underinsured motorist insurance covers bodily injury and property damage expenses after an accident with an uninsured or underinsured motorist. While not all states require it, the coverage can protect drivers from suffering the negative financial consequences of being hit by some with little to no insurance coverage.

Personal Injury Protection Insurance

Personal injury protection insurance, or no-fault insurance, covers the driver’s and passengers’ medical expenses regardless of fault. This coverage can also pay for lost wages, replacement services, and funeral expenses. Like liability and uninsured motorist coverage, states may require a minimum amount of personal injury protection.

Collision Car Insurance

Collision car insurance covers property damage resulting from a collision with another vehicle or object, such as a telephone, guardrail, or building. It’s an optional coverage, meaning states don’t mandate it, but lenders and dealerships may require it for leased or financed vehicles.

When adding this coverage to your policy, you agree to pay a deductible before your car insurance covers the remaining cost of repair or replacement.

For example, if your deductible is $500 and your property damage expenses total $2,500, your insurance company will pay the remaining $2,000 for the repairs. If the vehicle gets totaled, the insurance company pays out the vehicle’s value minus the deductible.

Comprehensive Car Insurance

Comprehensive car insurance covers property damage from non-collision events, including fire, theft, vandalism, natural disasters, and animal damage. Like collision insurance, states don’t require comprehensive insurance, but Toyota comprehensive car insurance may be required if you leased or financed your Toyota. Additionally, drivers must pay a deductible before their Toyota comprehensive insurance covers the cost of repairs or pays out the vehicle’s value if it gets totaled.

Both comprehensive and collision are great coverages for Toyota drivers because it means drivers can avoid the out-of-pocket expense of repairing or replacing their vehicles after it gets damaged.

Gap Insurance

In some cases, when a vehicle gets totaled, the amount remaining on the lease or loan is more than the vehicle’s value. Since car insurance companies only pay out up to the vehicle’s value, gap insurance covers the difference between the remaining loan or lease balance and vehicle value.

If your Toyota is worth $5,000, but your remaining loan balance is $7,000 — gap insurance covers the $2,000 difference. So, you can purchase a new vehicle with peace of mind instead of worrying about paying for the loan on the totaled Toyota.

Brandon Frady Licensed Insurance Agent

When choosing the best car insurance coverage for you, consider the state minimum car insurance requirements and build on top of that. For example, while your state will require a minimum amount of liability car insurance, consider comprehensive and collision coverage if you have a newer vehicle that would be expensive to repair or replace. Learn more about gap insurance pricing and coverage.

How to Compare Toyota Car Insurance Rates and Coverage Options

Car insurance companies calculate insurance premiums using several different factors that affect car insurance rates, including the vehicle make, model, and year. As a result, you’ll rarely see two car insurance companies offering the same rates for insurance when you get quotes from companies like Geico or Allstate.

Of course, this leaves you with the task of comparing rates and finding the best car insurance for your Toyota. We recommend starting with the companies listed below.

Toyota Car Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| AAA | $32 | $84 |

| Allstate | $60 | $157 |

| Farmers | $52 | $136 |

| Geico | $30 | $78 |

| Liberty Mutual | $66 | $170 |

| Nationwide | $43 | $112 |

| Progressive | $38 | $103 |

| State Farm | $33 | $84 |

| Travelers | $37 | $97 |

| USAA | $22 | $57 |

Here are a few tips to help you find the best Toyota car insurance rates:

- Review Car Insurance Policy Costs: Factors like age, gender, driving record, location, vehicle type, and credit score impact your rates. If you have a budget in mind, compare Toyota insurance quotes to see which companies offer the best rates for that budget.

- Review Available Coverage Options: Compare car insurance by coverage type to find affordable Toyota insurance options. If a car insurance company you’re considering doesn’t offer the coverage you need, you should look elsewhere. Here’s how to find out the required auto insurance in your state.

- Review Available Discounts: Many companies offer car insurance discounts to help lower your insurance premium. There are a few common discounts that car insurance companies offer and discounts unique to the company, offering an additional chance to save.

Ideally, the insurance company you choose will fit your coverage needs and your budget. It may be tempting to go with the company offering the cheapest premium, but it could cost you more in the long run if you don’t have the coverage you need.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

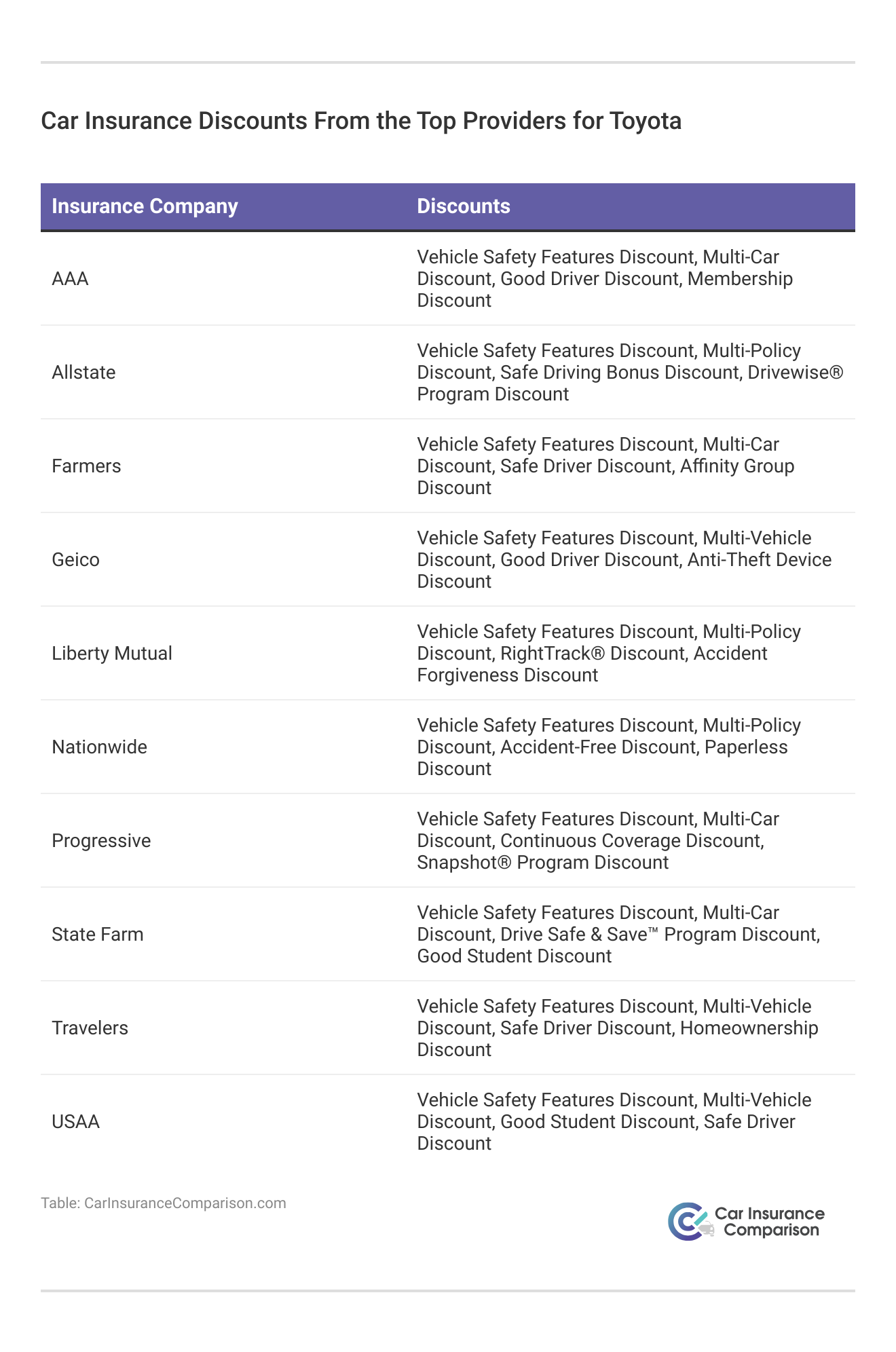

Toyota Car Insurance Discounts

Various insurance companies offer car insurance discounts to help give drivers the best Toyota car insurance rates.

Common Toyota car insurance discounts include:

- Good Student: Awarded to high school and college drivers with good grades.

- Multiple-Line Car Insurance Discount: Available to customers with more than one insurance policy.

- Multi-Car: Available to customers with more than one vehicle listed on the car insurance policy.

- Auto Pay: Available to policyholders who have their premium payments automatically deducted from their payment account.

- Paid-In-Full: Available to policyholders who pay their premium in one payment rather than monthly installments.

- Paperless: Available to policyholders who receive car insurance documents online.

As you can see, drivers have various options to reduce rates for their already affordable Toyota insurance options. Speak with insurance companies you’re considering to ask about eligible discount options.

How to Compare Car Insurance Rates for Toyota Cars

While most states require drivers to carry car insurance, a driver’s Toyota car insurance coverage needs may differ from the minimum car insurance required by state. Since you have so many coverage options, knowing how each coverage can protect you is important. As you search for the best car insurance for your Toyota, keep your needs and budget in mind to help you narrow your choices as you go through Toyota insurance reviews and rates.

If you are ready to start shopping for Toyota quotes, enter your ZIP code into our free tool to find cheap Toyota car insurance.

Frequently Asked Questions

Are Toyotas more expensive to insure?

Toyota car insurance rates are $140 monthly, which is lower than average compared to other vehicle brands. However, the most expensive Toyota to insure is a 2023 Toyota Land Cruiser, which costs $174/mofor full coverage auto insurance.

Which Toyota is the cheapest to insure?

A Toyota Yaris is the cheapest Toyota to insure, costing an average of $129/mo for liability, collision, and comprehensive. Liability costs $42/mo, collision costs $47/mo, and comprehensive costs $25/mo. Remember that you must pay a car insurance deductible for collision and comprehensive claims, so this out-of-pocket cost may be more than just the monthly premium.

How much is car insurance on a Toyota Corolla?

Toyota Corolla car insurance costs $140 monthly for full coverage. Further, liability costs $37/mo, comprehensive costs $31/mo, and collision costs $56/mo.

How much is insurance for a Toyota Camry?

Camry car insurance rates average $143 per month for most drivers.

Which insurance is best for a Toyota?

The best car insurance for Toyotas is full coverage. Liability, uninsured motorist, personal injury protection, comprehensive, and collision coverage will provide the highest level of protection for your Toyota.

How can I compare car insurance rates for a Toyota vehicle?

To compare car insurance rates for a Toyota vehicle, you can use online comparison platforms like the one below that allow you to compare quotes from multiple insurers, making it easier to find the best rate for your Toyota (learn more: Best Car Insurance Comparison Websites).

What factors affect Toyota car insurance rates?

Car insurance rates for a Toyota vehicle are influenced by various factors. Common factors include the model and year of your Toyota, your driving record, your age, gender, and marital status, your location, the coverage options you choose, and your deductible amount. For example, a Toyota Yaris costs $129 monthly for full coverage car insurance, making it the cheapest insurance for Toyota cars. On the other hand, 2023 Toyota Camry insurance costs $143 per month.

Additionally, factors such as the frequency of thefts or accidents involving Toyota vehicles can impact the cost of auto insurance for Toyotas. Fortunately, drivers have various affordable Toyota car insurance policy options, like liability, collision, comprehensive, uninsured motorist, personal injury protection, and gap insurance, depending on the company.

Are car insurance rates higher for Toyota vehicles compared to other car brands?

While Toyota vehicles generally have a reputation for being reliable and safe, Toyota car insurance costs can still vary based on factors such as the specific model, the cost of repairs, and the likelihood of theft or accidents. It’s recommended to compare Toyota car insurance quotes from multiple insurers to get a better understanding of how Toyota car insurance rates compare to other car brands.

Who is cheaper, Geico or Allstate?

Toyota auto insurance quotes tend to be cheaper at Gieco than at Allstate (learn more: Geico vs. Allstate Car Insurance Comparison).

Who is better, Geico or Progressive?

Geico is a little better than Progressive for car insurance for Toyotas.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.