Best Warren, MI Car Insurance in 2025

The cheapest Warren, MI car insurance is offered by Progressive, but rates will vary by driver. Auto insurance in Warren must meet the state minimum requirements of 50/100/10 in liability, 50/250 in PIP, and $1 million in PPI coverages. Michigan car insurance rates are the highest in the U.S. so compare Warren, MI auto insurance rates online to find the best deal for you.

Read moreFree Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

UPDATED: Oct 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- Progressive offers the cheapest Warren, MI car insurance to all drivers

- Michigan has the most expensive car insurance rates in the U.S.

- Warren is a suburb of Detroit, MI and shares high traffic volume with the larger city

Warren, MI car insurance is among the most expensive in the U.S. This isn’t shocking, considering that Michigan car insurance is the most expensive in the country on average.

It’s critical to find affordable Warren, MI car insurance. To find the cheap car insurance that suits your needs, shop around and compare offers from different providers.

Monthly Warren, MI Car Insurance Rates by ZIP Code

Find more info about the monthly Warren, MI auto insurance rates by ZIP Code below:

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

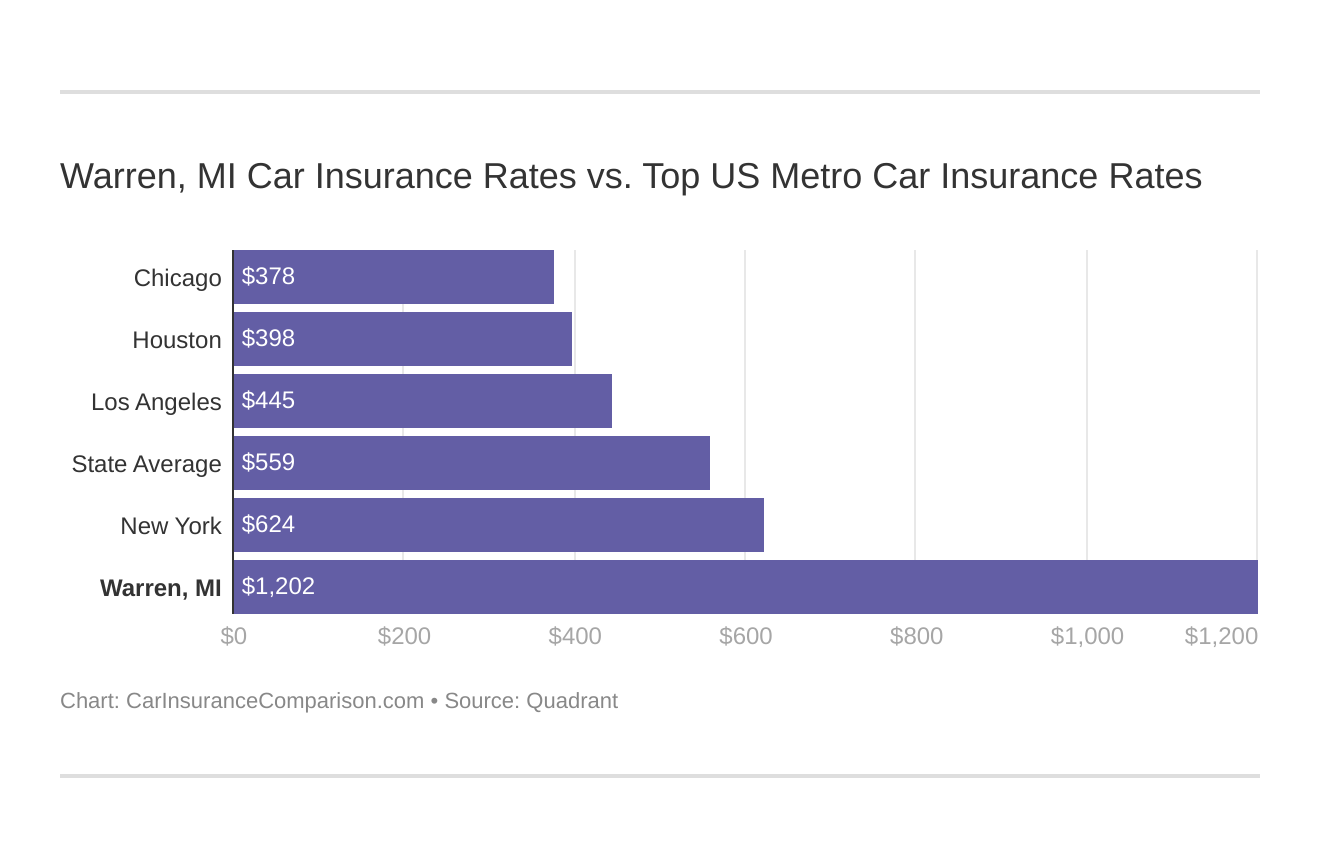

Warren, MI Car Insurance Rates vs. Top US Metro Car Insurance Rates

Which city you live in will have a major affect on car insurance. That’s why it’s vital to compare Warren, MI against other top US metro areas’ auto insurance rates.

Enter your ZIP code now to compare Warren, MI car insurance quotes from multiple companies for free.

What is the cheapest car insurance company in Warren, MI?

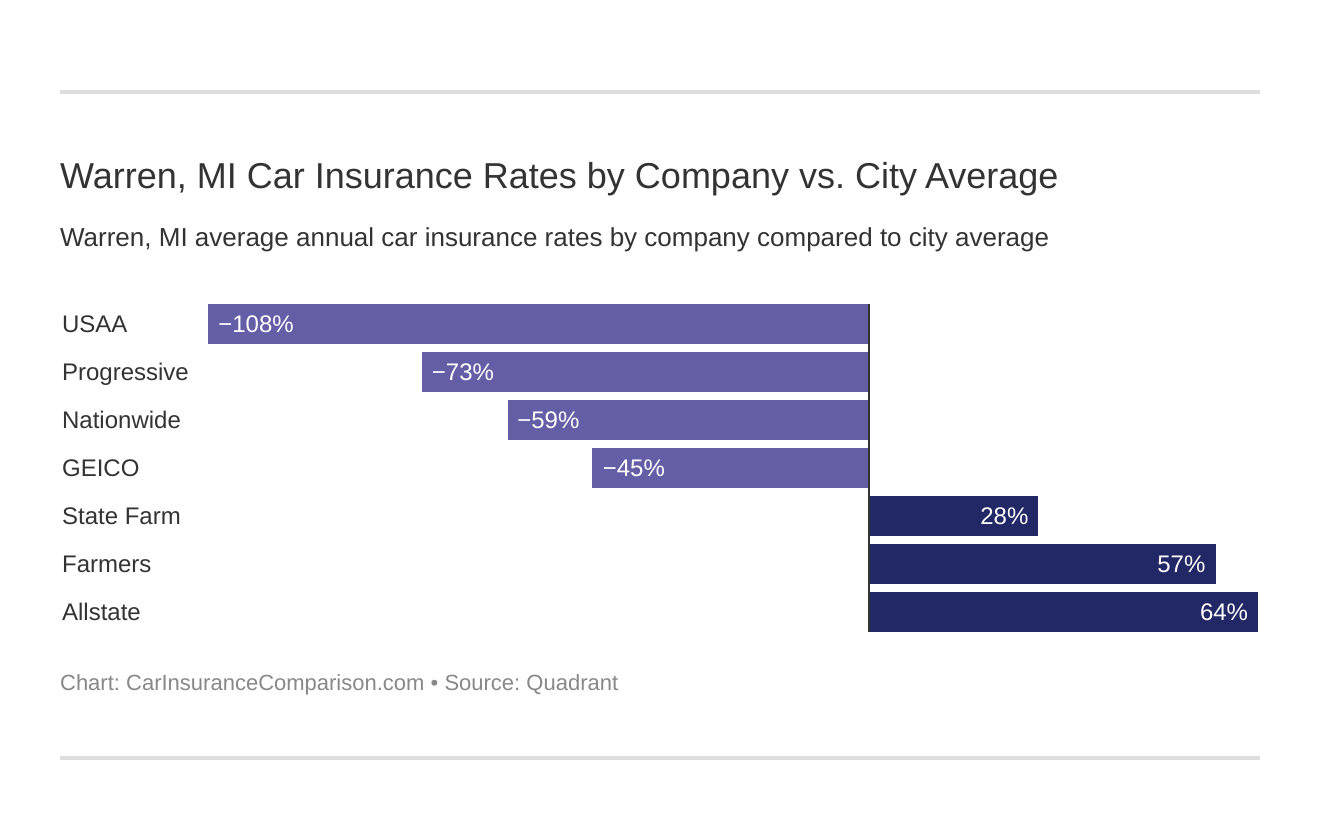

The company with the cheapest average car insurance rates that offers coverage to all Warren drivers is Progressive. Although USAA actually has cheaper rates, it only offers coverage to the military, veterans, and their families.

The cheapest Warren, MI car insurance company can be discovered below. You then might be asking, “How do those rates compare against the average Michigan car insurance company rates?” We cover that as well.

The top car insurance companies in Warren, MI listed from cheapest to most expensive are:

- USAA car insurance – $4,326.02

- Progressive car insurance – $6,741.57

- Nationwide car insurance – $7,815.97

- Geico car insurance – $9,155.83

- Travelers car insurance – $11,156.30

- State Farm car insurance – $19,074.48

- Liberty Mutual car insurance – $23,640.58

- Farmers car insurance – $25,975.42

- Allstate car insurance – $27,839.65

There are many factors that affect car insurance rates. Your rates can be calculated based on your age, driving record, and credit history. Even the Warren, MI weather can have an effect on your prices, as icy roads lead to more accidents.

Your rates can also be affected by the size of your city. Car insurance rates are higher in bigger cities with more traffic and crime. For example, despite their proximity, Detriot car insurance rates are significantly higher than those in Warren.

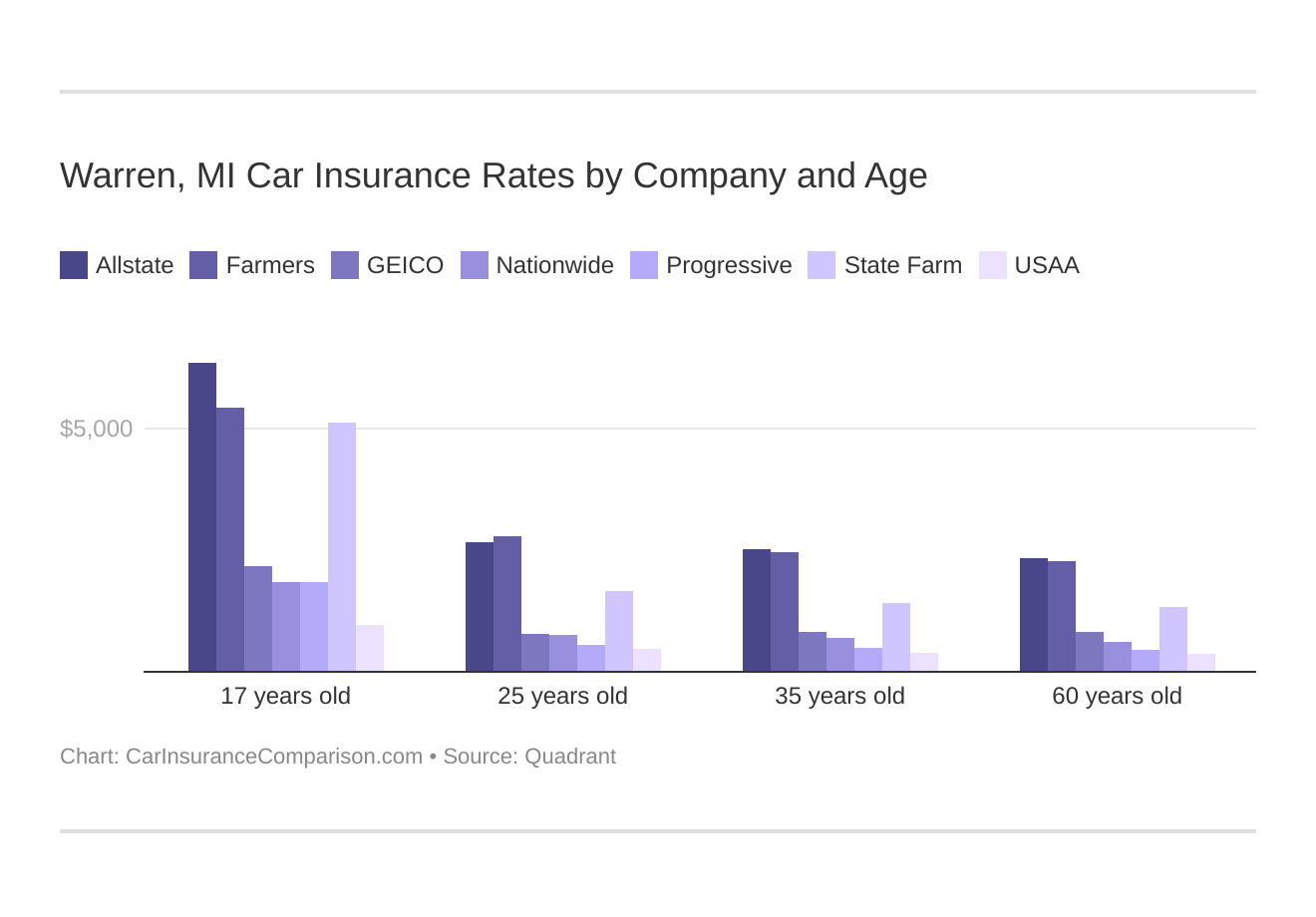

Comparing Warren, Michigan car insurance rates by age is an essential comparison because the top car insurance company for one age group may not be the best company for another age group.

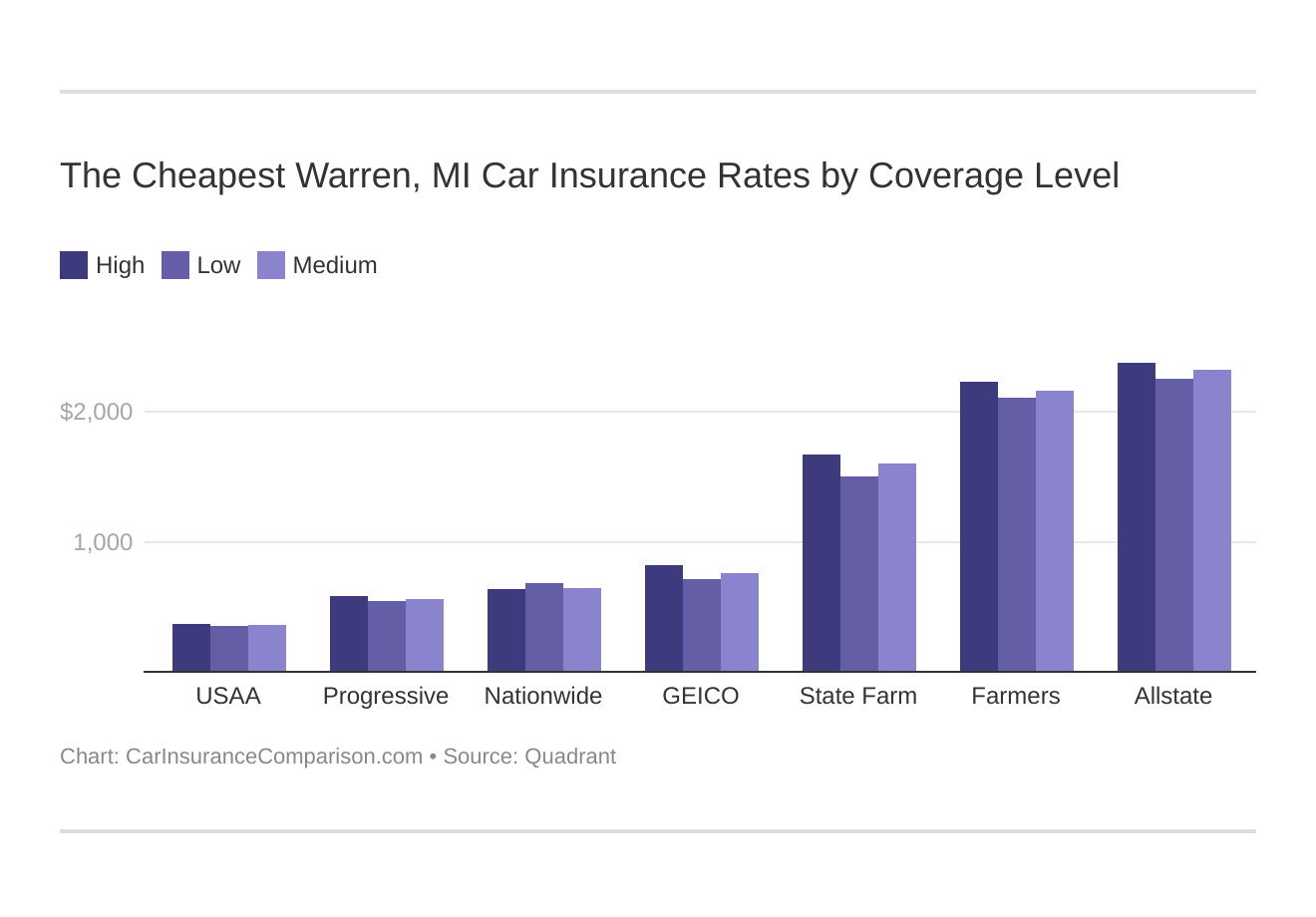

Your coverage level will play a major role in your Warren, MI car insurance rates. Find the cheapest Warren, Michigan car insurance rates by coverage level below:

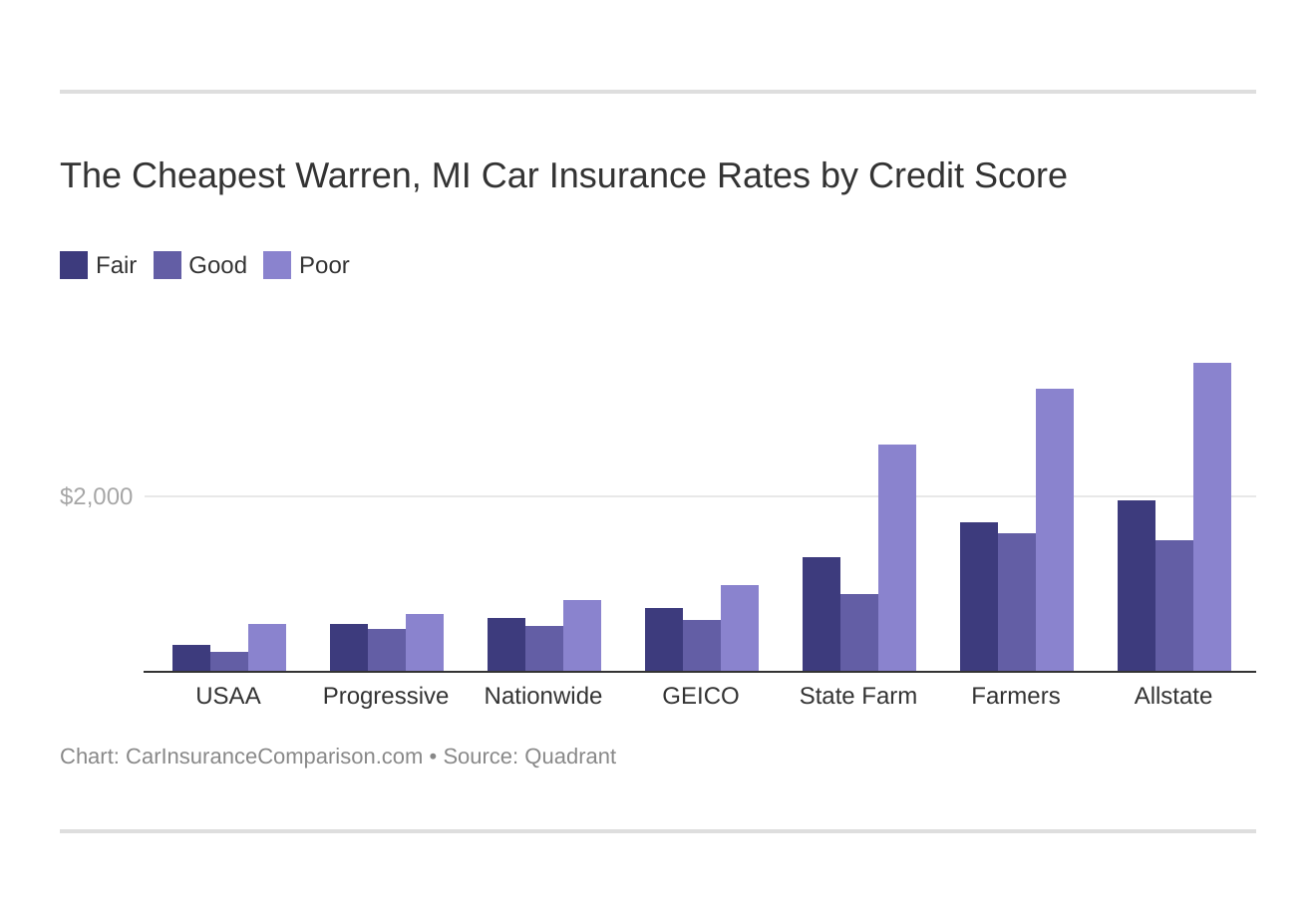

Your credit score will play a major role in your Warren, MI car insurance rates unless you live in these states where discrimination based on credit is not allowed: California, Hawaii, and Massachusetts. You may be able to get a good credit discount. Find the cheapest Warren, MI car insurance rates by credit score below.

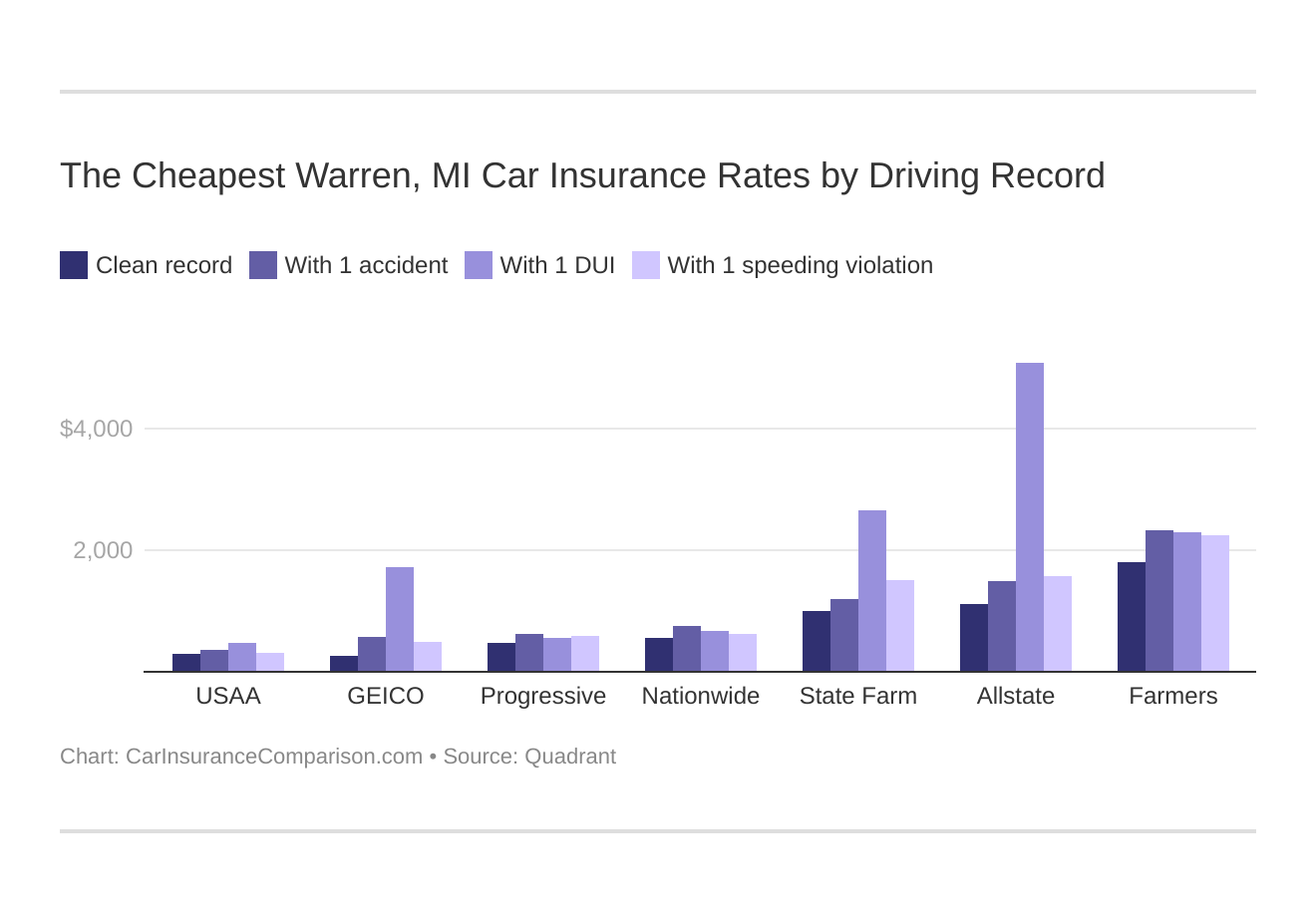

Your driving record will affect your Warren car insurance rates. For example, a Warren, Michigan DUI may increase your car insurance rates 40 to 50 percent. Find the cheapest Warren, Michigan car insurance with a bad driving record.

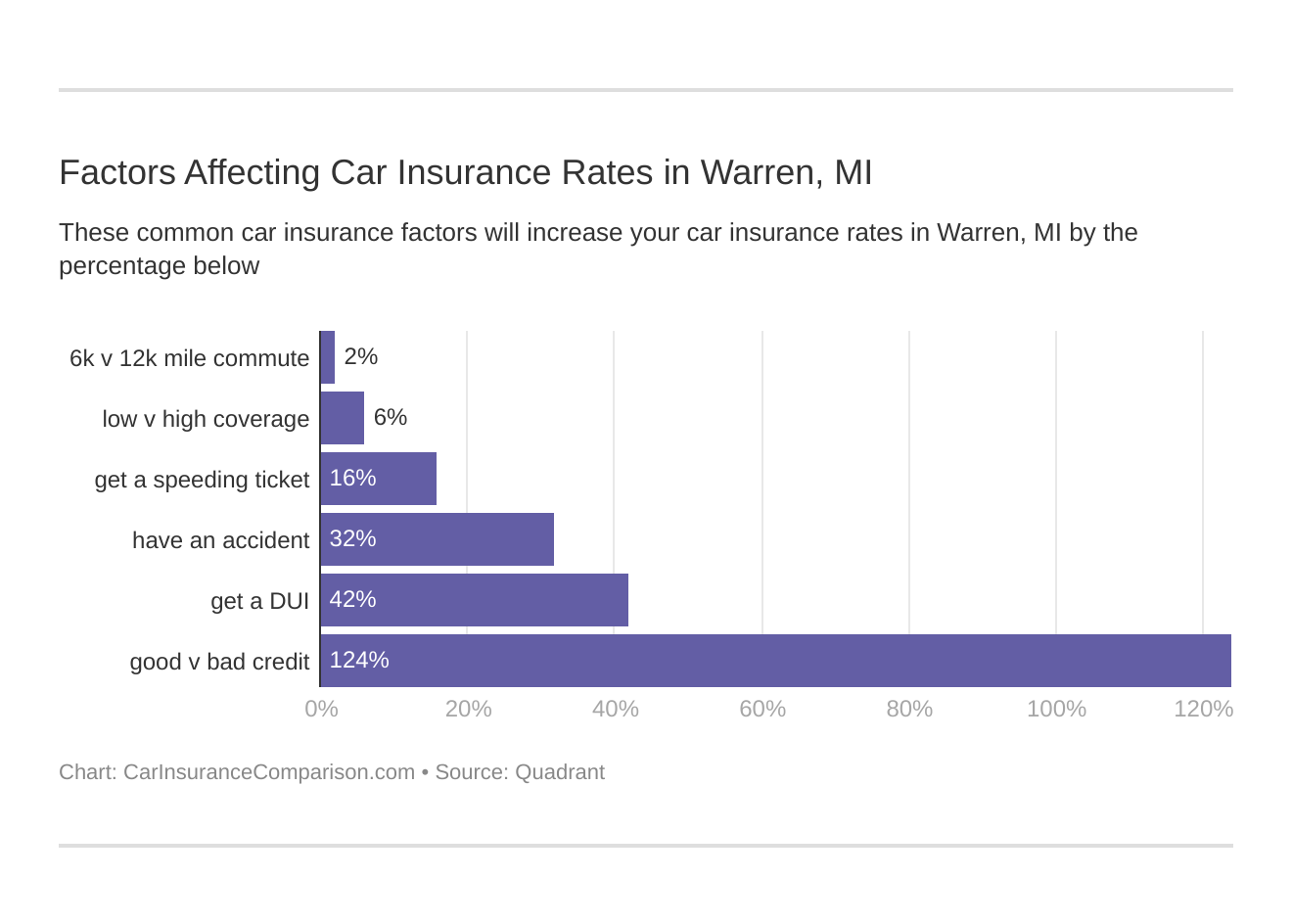

Factors affecting car insurance rates in Warren, MI may include your commute, coverage level, tickets, DUIs, and credit. Controlling these risk factors will ensure you have the cheapest Warren, Michigan car insurance.

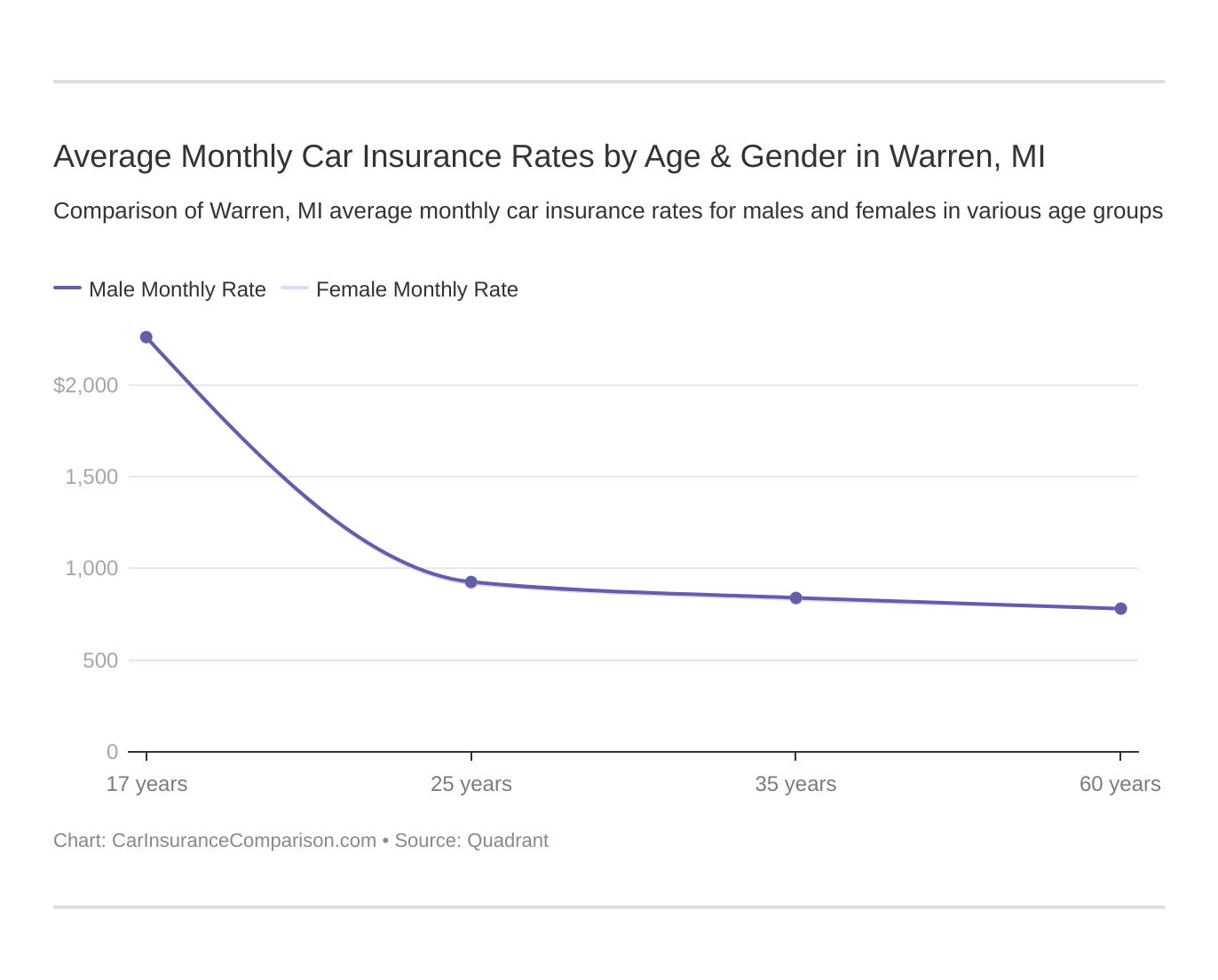

These states no longer use gender to calculate your car insurance rates — Hawaii, Massachusetts, Michigan, Montana, North Carolina, and Pennsylvania. But age is still a large factor because young drivers are considered high-risk drivers in Warren. Therefore, teen car insurance is more expensive. MI does not use gender, so check out the average monthly car insurance rates by age in Warren, MI.

What car insurance coverage is required in Warren, MI?

Most states, including Michigan, require drivers to carry at least a minimum amount of car insurance.

Warren drivers must carry at least:

- $50,000 per person and $100,000 per incident for bodily injury liability

- $10,000 per incident for property damage

- $50,000 in personal injury protection (PIP) coverage for drivers in Medicaid and $250,000 for all others

- $1 million in personal property protection (PPI)

Michigan is a no-fault state. This means that your own car insurance pays for damages and bodily injury no matter who caused the accident. That’s why drivers are required to carry PIP and PPI coverages.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

What affects car insurance rates in Warren, MI?

As a Detroit suburb, Warren gets a lot of traffic, which means there’s a higher risk of getting into an accident.

INRIX doesn’t have data for Warren, but it does list Detroit, MI as the 68th most congested city in the U.S.

City-Data reports that most drivers in Warren commute about 25 minutes, but a large number of drivers commute an hour or more.

Auto theft can also drive up your car insurance rates. According to the FBI, there were 437 motor vehicle thefts in Warren, MI in one year.

Warren, MI Car Insurance: The Bottom Line

Warren car insurance rates are very expensive, and they are higher than the state and national averages.

Before you buy Warren, MI car insurance, shop around and compare rates from several companies to find the best deal.

Enter your ZIP code now to compare Warren, MI car insurance rates near you today.

Frequently Asked Questions

What is the cheapest car insurance company in Warren, MI?

The cheapest car insurance company in Warren, MI, offering coverage to all drivers, is Progressive. However, it’s important to note that USAA has even cheaper rates, but it only provides coverage to military personnel, veterans, and their families. Below is a list of the top car insurance companies in Warren, MI, ranked from cheapest to most expensive:

- Progressive

- State Farm

- Allstate

- Farm Bureau Insurance

- Liberty Mutual

What factors affect car insurance rates in Warren, MI?

Several factors can influence car insurance rates in Warren, MI. These factors include:

- Age: Younger drivers typically have higher rates due to their perceived higher risk.

- Driving record: A clean driving record will generally result in lower rates, while accidents, tickets, or DUIs can increase rates.

- Credit score: In most states, including Michigan, your credit score can affect your car insurance rates.

- Coverage level: The extent of coverage you choose can impact your rates.

- Location: Warren’s traffic congestion, crime rates, and auto theft statistics can affect insurance rates.

What car insurance coverage is required in Warren, MI?

In Warren, MI, drivers must carry car insurance coverage that meets the state’s minimum requirements, which are as follows:

- Liability coverage: 50/100/10 (meaning $50,000 bodily injury liability coverage per person, $100,000 bodily injury liability coverage per accident, and $10,000 property damage liability coverage per accident).

- Personal Injury Protection (PIP): $250,000 coverage.

- Property Protection Insurance (PPI): $1 million coverage.

How can I find affordable car insurance in Warren, MI?

To find affordable car insurance in Warren, MI, it’s recommended to shop around and compare quotes from different insurance providers. By comparing rates, you can find the best deal that suits your needs and budget. Additionally, maintaining a clean driving record, improving your credit score, and considering higher deductibles or adjusting coverage levels can help lower your premiums.

Why are car insurance rates higher in Warren, MI?

Warren, MI, has higher car insurance rates due to several factors, including its status as a Detroit suburb. The city experiences heavy traffic, increasing the risk of accidents. It also has a higher incidence of auto theft. These factors contribute to the higher cost of insuring vehicles in Warren. Furthermore, Michigan as a whole has the highest average car insurance rates in the United States.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.