Best Food Truck Insurance in 2025 (Top 10 Companies)

Progressive, Farmers, and State Farm stand out as the best food truck insurance. Get discounts of up to 29% and tailored coverage from these companies ensures comprehensive protection for your mobile business. Compare rates to guarantee the success of your venture on the road.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Dani Best

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Licensed Insurance Producer

UPDATED: Jun 28, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jun 28, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Food Truck

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 3,072 reviews

3,072 reviewsCompany Facts

Full Coverage for Food Truck

A.M. Best Rating

Complaint Level

Pros & Cons

3,072 reviews

3,072 reviews 18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Food Truck

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviewsExplore the best food truck insurance providers such as Progressive, Farmers, and State Farm known for their competitive rates and excellent customer service.

Learn about the essential types of insurance coverage required, including commercial car, general liability, commercial property, and workers’ compensation.

Your food truck isn’t just your vehicle, it is your business, and as such, you and your food truck must be adequately protected by having the necessary commercial car insurance in place.

Our Top 10 Company Picks: Best Food Truck Insurance

| Company | Rank | Multi-Policy Discount | Low-Mileage Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 10% | 30% | Online Convenience | Progressive | |

| #2 | 20% | 10% | Local Agents | Farmers | |

| #3 | 17% | 30% | Many Discounts | State Farm | |

| #4 | 25% | 30% | Add-on Coverages | Allstate | |

| #5 | 20% | 10% | Usage Discount | Nationwide |

| #6 | 8% | 10% | Accident Forgiveness | Travelers | |

| #7 | 15% | 10% | Customizable Policies | Hiscox |

| #8 | 5% | 10% | Deductible Reduction | The Hartford |

| #9 | 29% | 15% | Student Savings | American Family | |

| #10 | 16% | 10% | 24/7 Support | Erie |

However, having the proper commercial car insurance for your food truck to drive around town is one of many coverages you will need.

Enter your ZIP code above in our free tool to start seeing quotes today.

#1 – Progressive: Top Overall Pick

Pros

- Online Convenience: Progressive car insurance excels with its user-friendly online platform, providing seamless policy management.

- Competitive Multi-Policy Discount: Offers up to 10% discount for bundling policies.

- Versatile Coverage Options: Progressive provides a variety of coverage options tailored to food truck business needs.

Cons

- Limited Local Presence: Face-to-face interactions with local agents might be limited.

- Moderate Low-Mileage Discount: The low-mileage discount is not as generous as some competitors.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#2 – Farmers: Best for Local Agents

Pros

- Local Agents: Farmers distinguishes itself with a network of local agents, ensuring personalized service.

- High Maximum Multi-Policy Discount: Offers an impressive 20% multi-policy discount.

- Specialized Add-on Coverages: Farmers Car Insurance provides additional coverages catering to specific needs of food truck owners.

Cons

- Online Limitations: Online policy management might not be as comprehensive.

- Moderate Low-Mileage Discount: The low-mileage discount could be more competitive.

#3 – State Farm: Best for Many Discounts

Pros

- Diverse Discounts: State Farm stands out with various discounts, allowing for maximum savings.

- Competitive Multi-Policy Discount: Offers up to 17% discount for bundling policies.

- Customizable Policies: State Farm provides flexibility in tailoring policies to unique requirements.

Cons

- Limited Online Presence: Online tools may not be as robust as some competitors. Read more in our State Farm car insurance review.

- Average Low-Mileage Discount: The low-mileage discount is decent but may not be as high as with other insurers.

#4 – Allstate: Best for Add-on Coverages

Pros

- Generous Multi-Policy Discount: Allstate offers up to 25% discount for bundling policies.

- High Low-Mileage Discount: The potential 30% low-mileage discount is among the industry’s best.

- Comprehensive Add-on Coverages: Allstate provides a range of add-on coverages catering to specific needs.

Cons

- Premium Costs: While discounts are available, Allstate car insurance‘s base premiums may be relatively higher.

- Online Tools Complexity: Some users find Allstate’s online tools to be less intuitive.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Usage Discount

Pros

- Usage Discount: Nationwide stands out with a usage discount, rewarding food truck owners for lower mileage.

- Multi-Policy Discount: Offers up to 20% discount for bundling policies. (Read more: Nationwide Car Insurance Discounts)

- Local Agent Network: Nationwide provides access to local agents for personalized service.

Cons

- Limited Maximum Multi-Policy Discount: The maximum multi-policy discount is lower compared to some competitors.

- Moderate Low-Mileage Discount: The low-mileage discount is competitive but not the highest available.

#6 – Travelers: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Travelers offers accident forgiveness, providing a safety net for food truck owners.

- Multi-Policy Discount: Provides up to 8% discount for bundling policies.

- Strong Financial Stability: Travelers boasts financial stability, ensuring reliable coverage.

Cons

- Limited Maximum Multi-Policy Discount: The multi-policy discount is lower compared to some competitors.

- Usage Discount Absence: As stated in our Travelers car insurance review, they do not provide a specific usage discount.

#7 – Hiscox: Best for Customizable Policies

Pros

- Customizable Policies: Hiscox allows for highly customizable policies, catering to the unique needs of food truck businesses.

- Competitive Discounts: Offers a range of discounts, including 5%-15% for multi-policy, providing potential cost savings.

- Financial Stability: Hiscox is known for its financial stability, ensuring reliability in coverage.

Cons

- Limited Industry Focus: Hiscox’s primary focus is not exclusively on food truck insurance.

- Usage Discount Absence: Does not provide a specific usage discount.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#8 – The Hartford: Best for Deductible Reduction

Pros

- Deductible reduction: This stands out with a deductible reduction feature, potentially lowering out-of-pocket costs for food truck owners.

- Local agent support: Provides access to local agents for personalized assistance and guidance.

- Financial stability: Hartford boasts financial stability, ensuring reliable and secure coverage for food truck businesses.

Cons

- Lower multi-policy discount: Offers up to 5% discount for bundling policies. Learn more in our article titled “The hartf0rd Car Insurance Discounts“.

- Online tools limitations: Online tools may not be as comprehensive as some competitors.

#9 – American Family: Best for Student Savings

Pros

- Impressive Multi-Policy Discount: American Family offers up to 29% discount for bundling policies.

- Student Savings: Stands out with a unique student savings discount, beneficial for food truck owners in education.

- Usage Discount Options: Provides a range of discounts, including 5%-15% for multi-policy and customizable options.

Cons

- Limited Industry Focus: American Family car insurance‘s primary focus may not be exclusively on food truck insurance.

- Online Limitations: Online tools may not be as comprehensive as some competitors.

#10 – Erie: Best for 24/7 Support

Pros

- Reliable 24/7 Support: Erie emphasizes customer support with 24/7 availability, ensuring assistance whenever needed.

- Multi-Policy Discount: Offers up to 16% discount for bundling policies.

- Financial Stability: Erie car insurance boasts financial stability, ensuring reliable coverage for food truck owners.

Cons

- Limited Maximum Multi-Policy Discount: The multi-policy discount is lower compared to some competitors.

- Usage Discount Absence: Does not provide a specific usage discount.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

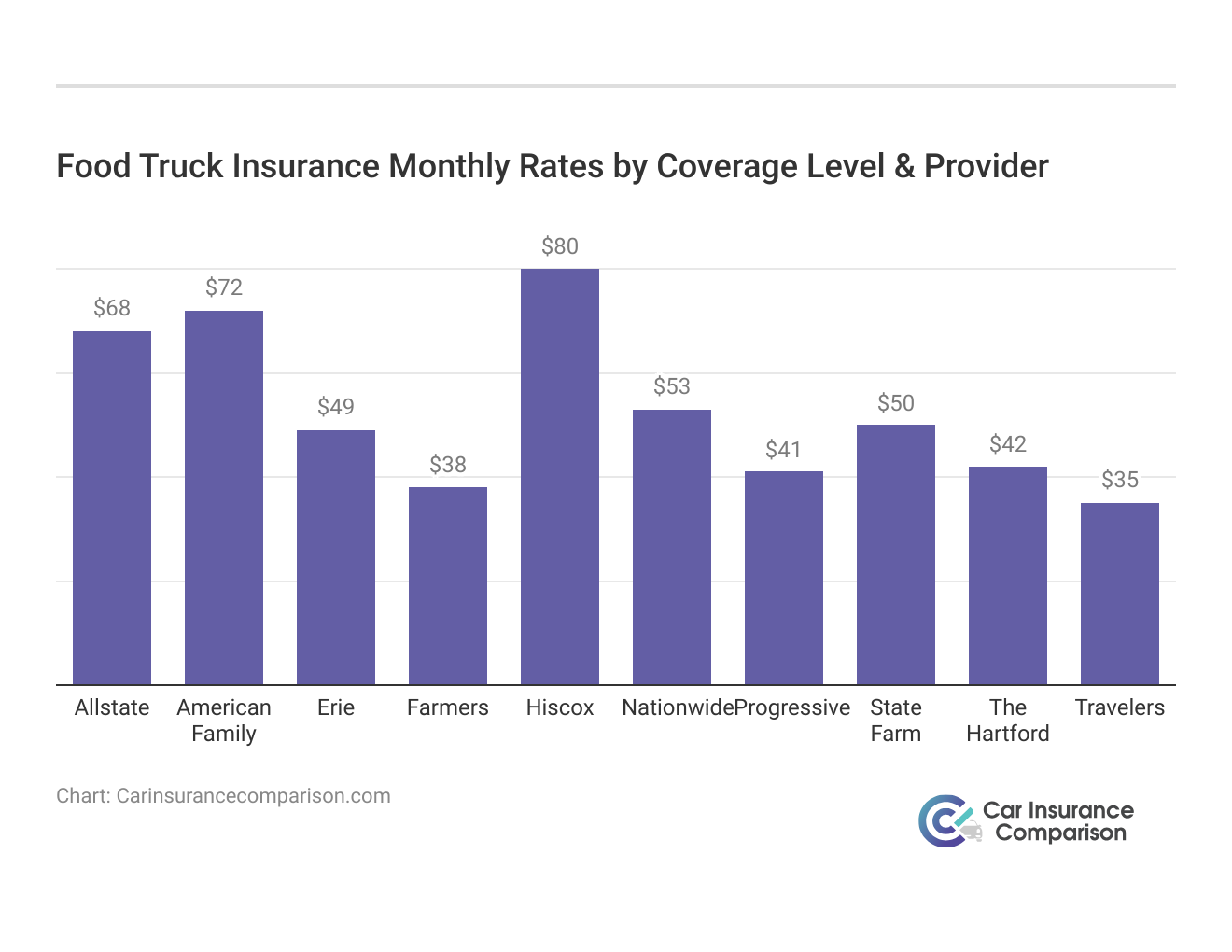

Understanding Food Truck Insurance

This table offers a comprehensive overview of the average monthly auto insurance rates for food trucks, delineating both minimum coverage and full coverage options. As entrepreneurs in the mobile food industry seek to safeguard their businesses on wheels, this comparative analysis provides valuable insights into the cost considerations and coverage offerings from various insurance companies. (Read more: Does car insurance cover food delivery vehicles?)

Food Truck Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $68 | $198 |

| American Family | $72 | $185 |

| Erie | $49 | $135 |

| Farmers | $38 | $110 |

| Hartford | $42 | $118 |

| Hiscox | $80 | $205 |

| Nationwide | $53 | $145 |

| Progressive | $41 | $120 |

| State Farm | $50 | $155 |

| Travelers | $35 | $85 |

For minimum coverage, Travelers emerges as the most cost-effective option with a monthly rate of $35, while Hiscox presents the highest rate at $80. When considering full coverage, Travelers maintains its affordability with a rate of $85 per month, while Hiscox again leads with the highest cost at $205.

Progressive, with its online convenience and budget-friendly rates, stands out as the top choice for food truck insurance, ensuring optimal coverage and peace of mind for mobile business owners.

Brad Larson Licensed Insurance Agent

The data underscores the importance of tailored insurance solutions for the mobile food industry, allowing entrepreneurs to make informed decisions based on their unique operational needs and budget considerations.

Available Insurance Types for Food Truck Owners

Now that you have successfully launched your food truck business, it is time for you to find the types of insurance policies you will need.

While it’s true that there is no “food truck car insurance” company, per se, most insurance providers will offer the various policies that a food truck owner needs. Let’s see how much insurance you need.

While each state may have its own requirements for insuring your food truck, here’s a list of the essential insurance policies you will need for your food truck.

- Commercial car insurance

- Commercial property insurance

- General liability insurance

- Workers’ compensation insurance

With one of these policies, in conjunction with the others, your food truck will not be adequately insured. Find out what insurance coverage is required for a food truck in North Carolina.

Commercial Car Insurance

Since your personal vehicle is now used for business purposes, your vehicle must be covered under a commercial car policy. Commercial car insurance protects your vehicle in the line business, whether delivering food, parking and serving food, transporting employees, or driving to work locations.

A commercial car policy often covers:

- Liability (if you or an employee causes an injury while operating the vehicle)

- Medical payments if anyone is injured

- Coverage against uninsured drivers

- Physical damage to company vehicles

Learn more about personal injury protection coverage. These coverages, however, are only enough when bundling them with other insurance policies.

General Liability Insurance

As a mobile restaurant, you risk being liable for causing personal harm to your customers, not just other vehicles. For example, suppose a customer is rendered ill with food poisoning from what you served out of your food truck. As the business owner, you would be held liable. On another occasion, let us suppose you or an employee backs your food truck into something and causes damage on someone else’s property. In this case, you could also be held liable.

This policy covers

- Physical Injury: If an employee or your food truck injures a customer.

- Property Damage: If your food truck damages nearby buildings or vehicles.

- Food Poisoning: If a customer claims your food was the source of their illness.

These are just a few reasons why having general liability insurance is so important.

Read more: car accidents

Commercial Property Insurance

No food truck is complete, nor can it conduct business, without the equipment needed to serve your delicious, handheld meals. With the cooking equipment and utensils proving invaluable to your business’s success, it is only logical to protect these assets. Fortunately, commercial property insurance will cover anything you use for your business that isn’t attached to the vehicle, from pots, pans, and stoves, to unforeseen events like fires, floods, theft, and more.

Workers’ Compensation

You won’t need workers’ compensation if you work in your food truck daily and have no plans to hire employees.

Suppose you have a few employees. In that case, whether full-time or part-time, it is essential to remember that your employees are not covered under your general liability insurance because they are a part of your business operations.

With workers’ compensation, if an employee is injured while on the clock, this policy will pay for their medical expenses and lost wages. This coverage is required in most states and is essential in protecting your business from lawsuits filed by injured employees.

Factors That Affect the Cost of Insurance for Business Vehicles

The process of choosing your insurance carrier can be overwhelming. Several factors go into selecting not just the best insurance for your business vehicles but the best commercial car insurance company for your business vehicles at the best prices.

Due to the nature of the business, food truck insurance can be costly because of the multiple policies necessary to operate your business correctly. Many factors can affect the insurance cost for business vehicles, including location, property value, payroll (if you have employees), the coverage limits you choose, your deductibles, and the actual cash value of your property and equipment. Learn more about collision and comprehensive coverage.

Many factors will determine the cost of your business vehicle insurance that overlap with your primary car insurance risks, including

- Vehicle: What’s your vehicle’s year, make, and model? Calculate how much your car might cost you.

- Drivers: How many people drive your vehicle? More drivers equal more risk.

- Driving Record: Are you a high-risk driver? Tickets and claims can affect premiums. Learn how to compare car insurance rates with a bad driving record.

- Mileage: How many miles a day do you drive? Lower mileage can save you money.

These are a few elements that can determine how much your insurance policy will cost. There may still be other factors that will affect the cost of your coverage. Find out whether car insurance can be paid monthly.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Tips for Finding the Best Policy for a Food Truck Business

First, it is essential to remember that no matter how much insurance coverage for food trucks you get, it is vital that you find the best companies to insure your business vehicle. Start with companies offering discounts for bundling all your policies, and go from there.

Most big-name insurance companies offer the commercial insurance you’ll need for your food truck. Each company, however, still has its own rates, discounts, and eligibility requirements. To find the best commercial car insurance quote, you should start by comparing companies.

While there are no set prices for food truck insurance, it is essential that you, as a food truck owner, do your research and start putting together a financial plan to calculate the median cost of the policies you will need.

Read More:

- What insurance coverage is required for a food truck in California?

- What insurance coverage is required for a food truck in Connecticut?

- What insurance coverage is required for a food truck in Florida?

- What insurance coverage is required for a food truck in Georgia?

- What insurance coverage is required for a food truck in Montana?

- What insurance coverage is required for a food truck in North Carolina?

- What insurance coverage is required for a food truck in Ohio?

- What insurance coverage is required for a food truck in Pennsylvania?

- What insurance coverage is required for a food truck in Texas?

- What insurance coverage is required for a food truck in Washington, D.C.?

- What insurance coverage is required for a food truck in Wisconsin?

Case Studies: Insights From the Road- Food Truck Car Insurance

Let’s delve into three compelling case studies featuring Sarah, John, and Jessica, each navigating the bustling streets of the food truck industry with the backing of renowned insurance providers. From Progressive’s online convenience to Farmers’ personalized approach and State Farm’s cost-saving discounts, discover how these entrepreneurs safeguard their mobile culinary ventures while focusing on what they do best – serving up delectable dishes to their patrons.

- Case Study #1 – Thriving on the Road With Progressive: Meet Sarah, the proud owner of “Tasty Travels,” a popular food truck known for its gourmet tacos. Seeking reliable insurance, Sarah chose Progressive for its online convenience and budget-friendly rates.

- Case Study #2 – Local Flavor Secured With Farmers: John, the owner of “Local Bites on Wheels,” opted for Farmers as his go-to insurance provider. With a monthly rate of $38 and an annual cost of $110, Farmers’ local agents provided personalized assistance, understanding the unique risks of his food truck business.

- Case Study #3 – State Farm’s Discounts Fueling Success: Jessica, a culinary entrepreneur running “Flavor Fusion,” found a valuable partner in State Farm for her food truck insurance needs. With a monthly rate of $50 and an annual cost of $155, as mentioned in our State Farm car insurance review, many discounts played a crucial role in keeping Jessica’s operational costs in check.

Whether it’s the seamless online management offered by Progressive, the hands-on assistance provided by Farmers’ local agents, or the tailored discounts from State Farm, each entrepreneur has found a trusted ally in their insurance provider.

The Bottom Line: Key Points to Remember When Insuring Your Food Truck

Here are a few critical pieces of information to keep in mind when insuring your food truck:

- A food truck is both a vehicle and a business.

- As a business, you will need multiple policies to protect your food truck adequately.

- General liability, commercial property insurance, a commercial car policy, and workers’ compensation are the central policies needed to get your business up and running.

- You can find the best rates by shopping around for multiple insurance carriers and researching which companies offer discounts for bundling multiple policies.

Now it’s time to get your business up and running and get your food truck on the road.

Explore your car insurance options by entering your ZIP code below and finding which companies have the lowest rates.

Frequently Asked Questions

What types of coverage do I need for my food truck business?

For comprehensive protection, consider a combination of coverage, including Commercial Car Insurance for your vehicle, General Liability Insurance for accidents and injuries, Commercial Property Insurance for equipment and inventory, and Workers’ Compensation if you have employees. Each of these policies ensures your food truck is adequately covered on and off the road.

How can I find the best insurance policy for my food truck business?

Start by comparing insurance providers that offer discounts for bundling policies. Look for reputable companies like Progressive, Farmers, and State Farm, and analyze their rates and coverage options. Customizing your coverage based on your specific needs and budget is key to finding the best insurance policy for your food

Can I use my personal auto insurance for my food truck?

Personal auto insurance typically excludes coverage for commercial activities like operating a food truck. To ensure proper coverage, it’s crucial to obtain separate Commercial Auto Insurance specifically tailored for your food truck business. This ensures that your unique risks and business activities are adequately protected.

What are the liabilities for a food truck owner?

As a food truck owner, you are liable for injuries, illnesses, or damages that occur due to your business operations. For example, if a customer gets sick from your food or if someone is injured on your premises, you could be held responsible. General Liability Insurance helps cover these liabilities, protecting your business from potential legal and financial consequences.

Ready to find cheaper car insurance coverage? Enter your ZIP code below to begin.

What is the typical cost range for food truck insurance?

Food truck insurance costs can vary based on factors like location, coverage types, and the value of your equipment. On average, monthly premiums can range from $100 to $300, but this can fluctuate depending on individual circumstances.

How do I determine the cost of insurance for my food truck?

Several factors affect car insurance rates of food truck insurance, including location, property value, payroll (if you have employees), coverage limits, deductibles, and the actual cash value of your property and equipment. It’s essential to work closely with insurance providers to customize coverage that suits your business needs while considering your budget.

Do I need insurance if my food truck is stationary?

Yes, even if your food truck is stationary at a specific location, you still need insurance coverage. General liability insurance, for example, protects against customer injuries or property damage that can occur on or around your stationary food truck.

Find cheap car insurance quotes by entering your ZIP code below.

Can I adjust my insurance coverage as my food truck business grows?

Absolutely. As your food truck business evolves and expands, you may need to adjust your insurance coverage accordingly. This could involve increasing coverage limits, adding additional types of coverage, or updating your policy to reflect changes in your operations or location.

Are there specialized insurance options for unique food truck businesses?

Yes, insurance providers often offer specialized coverage options tailored to unique food truck businesses. For example, if your food truck specializes in high-risk foods like raw seafood or exotic meats, you may need additional coverage to mitigate specific risks associated with your business.

Read more: Does car insurance cover food delivery vehicles?

What happens if my food truck is involved in an accident?

If your food truck is involved in an accident, your insurance coverage will typically kick in to help cover the costs of property damage, bodily injuries, legal expenses, and more. It’s crucial to report any accidents to your insurance provider promptly and cooperate fully with their claims process to ensure a smooth resolution.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Dani Best

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Licensed Insurance Producer

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.