Best Vehicle Recovery Car Insurance Discounts in 2026 (Save up to 20% With These Companies)

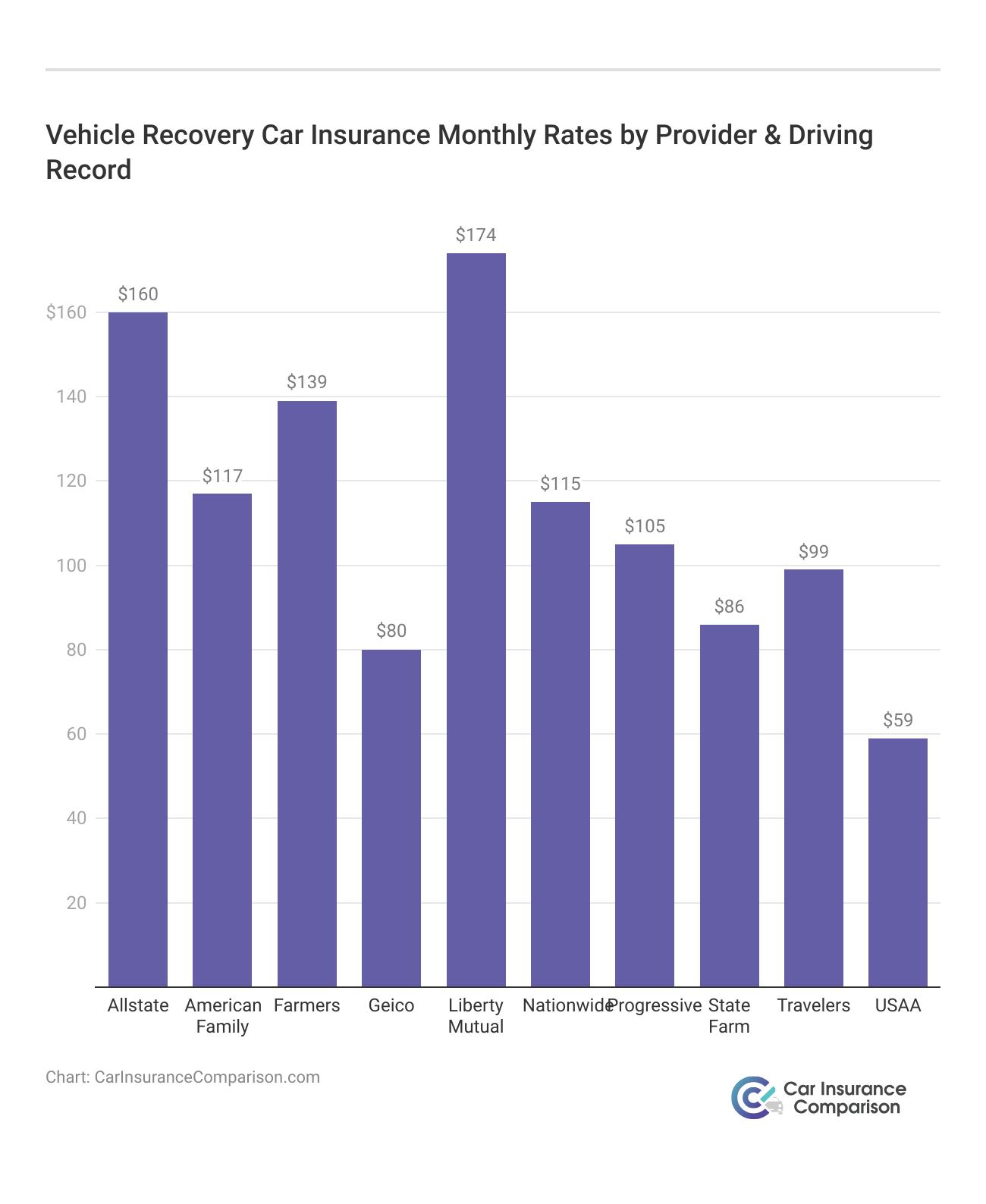

The best vehicle recovery car insurance discounts are offered by Geico, State Farm, and Allstate, providing up to 20% savings on premiums. They offer car insurance discounts for recovered vehicles, including roadside assistance. Installing an anti-theft device can further increase savings.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance and Finance Writer

Alexandra Arcand is an outreach administrator and insurance expert located in North Central Ohio. She has a passion for writing, investing, and education. As an insurance content writer for over three years, Alexandra has first-hand experience in business finance, economics, and real estate. She leads an outreach writing team that specializes in travel, real estate, healthcare, law, finance, an...

Alexandra Arcand

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Justin Wright

Updated March 2026

Our Top 10 Company Picks: Best Vehicle Recovery Car Insurance Discounts

| Company | Rank | Savings Potential | A.M. Best | Who Qualifies? |

|---|---|---|---|---|

| #1 | 20% | A++ | Drivers with approved anti-theft systems | |

| #2 | 18% | B | Policyholders with comprehensive coverage | |

| #3 | 17% | A+ | Drivers with anti-theft devices or vehicle tracking | |

| #4 | 16% | A+ | Drivers with GPS tracking or LoJack systems | |

| #5 | 15% | A | Vehicles with recovery tech |

| #6 | 14% | A | Drivers using approved vehicle recovery systems | |

| #7 | 13% | A+ | Customers with factory-installed tracking devices |

| #8 | 12% | A++ | Active military, veterans with vehicle recovery tools | |

| #9 | 11% | A++ | Vehicles with certified anti-theft equipment | |

| #10 | 10% | A | Vehicles with GPS tracking |

These discounts not only enhance your savings but also ensure peace of mind in case of an unfortunate event. With the added benefit of vehicle recovery system discounts, Geico offers comprehensive coverage tailored to your needs.

Start your journey to lower car insurance rates today. Enter your ZIP code above to discover your potential savings with the best vehicle recovery car insurance discounts.

- Explore the best vehicle recovery car insurance discounts for you

- Benefit from safety features discount for vehicle recovery coverage

- Save up to 20% monthly with exclusive car insurance discounts

Monthly Rates for Vehicle Recovery Insurance

Factors Influencing Discounts

Additional Ways to Save on Car Insurance

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Maximize Your Savings on Vehicle Recovery Insurance

Frequently Asked Questions

What is a recovery device on a car?

What is a vehicle recovery system with an active subscription?

A vehicle recovery system with an active subscription is a service that provides real-time tracking and recovery assistance for stolen vehicles, typically requiring a monthly or annual fee.

Do I get a discount if my car is theft?

No, having a theft claim generally does not qualify for a discount; however, having anti-theft features may lead to discounts.

Do Teslas have a vehicle recovery system?

Yes, Teslas come with built-in tracking capabilities that assist in vehicle recovery.

Does Lojack lower car insurance?

Does my car have a vehicle recovery system?

Check your vehicle’s specifications or manual; many newer vehicles have built-in recovery systems or can be equipped with them.

Does VIN etch lower insurance?

Yes, VIN etching can lower insurance premiums, as it deters theft by making the vehicle easier to trace. Receive instant car insurance quotes from leading providers by submitting your ZIP code below to find the best vehicle recovery car insurance discounts.

How do I know if my car has a vehicle recovery system?

Consult your owner’s manual or contact your dealership for information on whether your vehicle is equipped with a recovery system.

What does a theft recovery title mean?

What is an active vehicle recovery system?

An active vehicle recovery system continuously tracks a vehicle’s location and can assist in its recovery if stolen.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.