10 Best Car Insurance Companies in Canada for 2025

The best car insurance companies in Canada are Farmers, Progressive, and Allstate, these leading companies offer up to 30% discounts. Renowned for their affordability and stellar customer service, offer comprehensive coverage, innovative technology, and unparalleled claim satisfaction.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Dani Best

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Licensed Insurance Producer

UPDATED: Jan 29, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jan 29, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

3,072 reviews

3,072 reviewsCompany Facts

Full Coverage in Canada

A.M. Best Rating

Complaint Level

Pros & Cons

3,072 reviews

3,072 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage in Canada

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage in Canada

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviewsDiscover the best car insurance companies in Canada with Farmers, Progressive, and Allstate. Analyze data to identify leading companies for varied customer profiles with competitive rates based on factors like credit score, mileage, coverage, and driving record.

There are many hazards Canadian drivers face on the road. From busy city traffic jams to icy, snowy weather, Canadian drivers need quality insurance to protect their vehicles.

Our Top 10 Picks: Best Car Insurance Companies in Canada

| Company | Rank | Multi-Policy Discount | Safe Driver Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 15% | 10% | Comprehensive Coverage | Farmers | |

| #2 | 30% | 15% | Innovative Technology | Progressive | |

| #3 | 25% | 12% | Claim Satisfaction | Allstate | |

| #4 | 15% | 10% | Customer Service | State Farm | |

| #5 | 25% | 12% | Financial Strength | Liberty Mutual |

| #6 | 20% | 10% | Community Involvement | American Family | |

| #7 | 20% | 10% | Vanishing Deductible | Nationwide |

| #8 | 10% | 10% | Multi-Policy Discounts | Travelers | |

| #9 | 10% | 5% | High-Risk Acceptance | The General | |

| #10 | 20% | 8% | Price Stability | Erie |

If you’re struggling to decide which car insurance company might work best for you, you should explore the top 10 Canadian car insurance companies below and check out car insurance rate comparison charts. Then, compare quotes to find the perfect policy for your needs.

Enter your ZIP code above to receive car insurance rates from multiple companies today.

- Farmers, Progressive, and Allstate lead in Canada

- Customize policies based on credit score, mileage, coverage, and driving record

- Shape affordable and personalized insurance plans in Canada

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – Farmers: Top Overall Pick

Pros

- Comprehensive Coverage: Farmers is renowned for providing extensive coverage options to ensure thorough protection for policyholders.

- Low Complaint Level: As mentioned in our Farmers car insurance review, The company boasts a low complaint level, indicating customer satisfaction and efficient conflict resolution.

- Strong Reputation: Farmers has established itself as a reputable insurance provider with positive reviews and high customer ratings.

Cons

- Lack of Specific Rate Information: The review does not provide specific rate information for Farmers, making it challenging for readers to gauge affordability.

- Limited Information on Discounts: The mention of discounts is vague, and more specific details on available discounts could be beneficial for prospective customers.

#2 – Progressive: Best for Innovative Technology

Pros

- Innovative Technology: Progressive is recognized for adopting innovative technology, such as the Snapshot feature, enhancing the customer experience.

- High Multi-Policy Discount: With up to a 30% multi-policy discount, Progressive appeals to customers seeking cost-effective insurance solutions.

- Low Complaint Level: The company maintains a low complaint level, suggesting a positive customer service experience. Read more about their complaint level in our Progressive car insurance review.

Cons

- Potential Customer Service Concerns: Some customers have reported concerns about Progressive’s customer service, indicating a need for improvement.

- Fluctuating Rates: Progressive’s pricing model may lead to fluctuating rates for some customers, potentially causing uncertainty.

#3 – Allstate: Best for Claim Satisfaction

Pros

- Claim Satisfaction: Allstate is highlighted for its claim satisfaction, indicating a positive experience for policyholders when filing claims.

- Customizable Coverage for Savings: The review emphasizes the ability to customize coverage, allowing customers to shape monthly rates and save on premiums.

- Up to 25% Multi-Policy Discount: Allstate offers a significant multi-policy discount, making it attractive for customers bundling insurance services.

Cons

- Higher Rates Compared to Competitors: Allstate’s rates, while commendable for balanced affordability and service, may be higher compared to some competitors.

- Rate Information: Learn more about their rates in our Allstate car insurance review.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#4 – State Farm: Best for Customer Service

Pros

- Customer Service Excellence: State Farm is recognized for its exceptional customer service, providing policyholders with a reliable and supportive experience.

- Up to 15% Multi-Policy Discount: Offering a substantial multi-policy discount, State Farm appeals to customers looking to bundle their insurance needs.

- Reputation for Financial Stability: The company boasts a strong financial standing, assuring customers of its ability to handle claims efficiently.

Cons

- Potentially Higher Rates: While offering comprehensive coverage, State Farm’s rates might be relatively higher compared to some competitors.

- Limited Availability: State Farm car insurance may not be available in all regions, restricting options for customers in certain locations.

#5 – Liberty Mutual: Best for Financial Strength

Pros

- Up to 25% Multi-Policy Discount: Liberty Mutual offers a significant multi-policy discount, encouraging customers to bundle their insurance services.

- Strong Financial Strength: As mentioned in our Liberty Mutual car insurance review, the company maintains financial strength, instilling confidence in customers regarding its ability to fulfill claims.

- Community Involvement: Liberty Mutual is involved in community initiatives, showcasing a commitment to social responsibility.

Cons

- Mixed Customer Reviews: Some customers have reported mixed experiences, citing concerns about claims processing and communication.

- Policy Customization Challenges: Liberty Mutual’s policy customization options may be less flexible compared to some competitors.

#6 – American Family: Best for Community Involvement

Pros

- Up to 20% Multi-Policy Discount: American Family offers a substantial multi-policy discount, making it appealing for customers bundling insurance services.

- Community Involvement: The company actively engages in community initiatives, demonstrating a commitment to social responsibility.

- Up to 10% Community Involvement Discount: Recognizing community involvement, American Family provides discounts to customers engaged in community service.

Cons

- Regional Availability: American Family may have limited availability in certain regions, limiting choices for customers in specific locations. Learn more in our American Family car insurance.

- Limited Discounts for Safe Drivers: While offering discounts, American Family may have fewer options for safe driver discounts compared to some competitors.

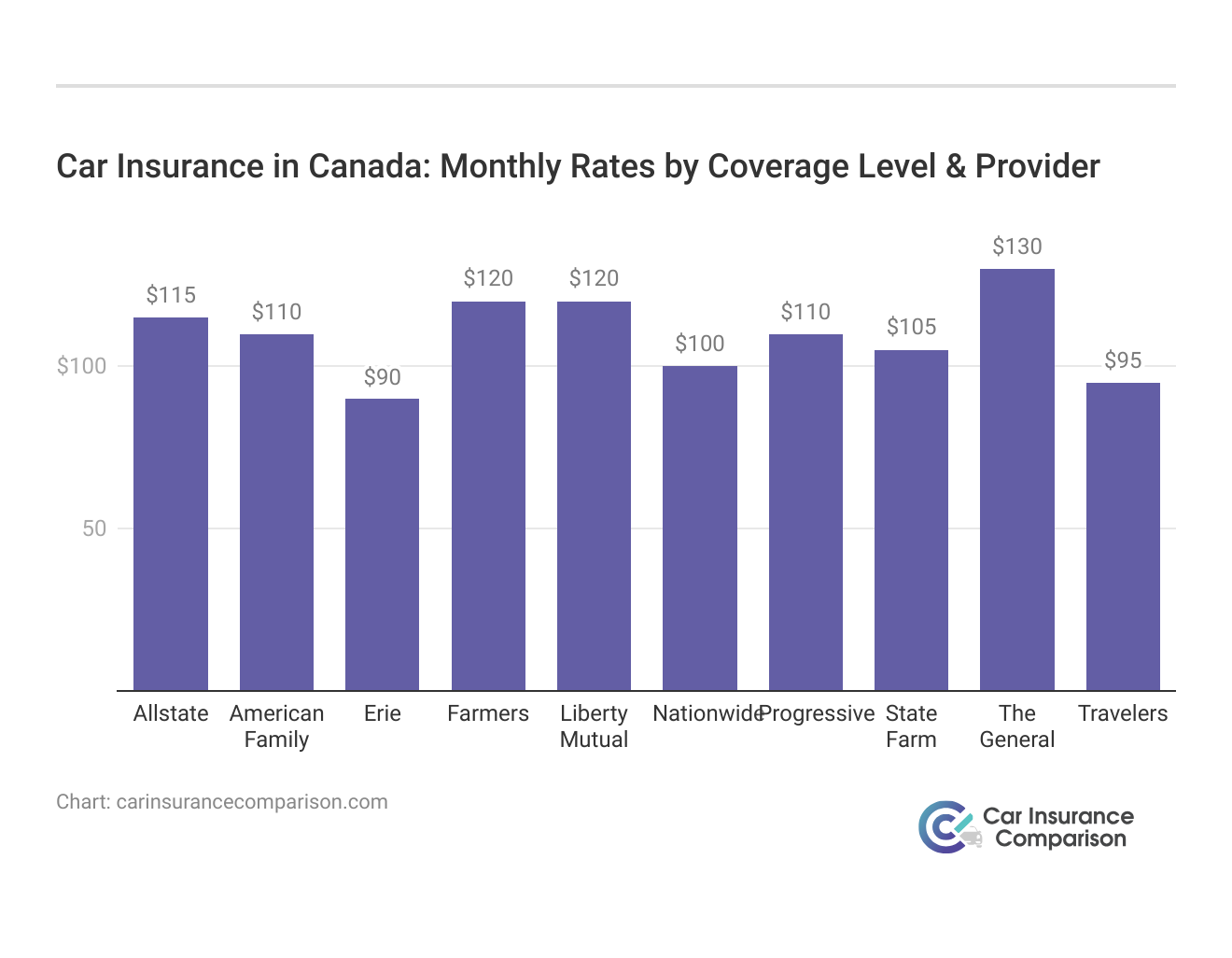

Exploring Average Monthly Car Insurance Rates in Canada With Leading Providers

When delving into the realm of car insurance in Canada, it’s crucial to navigate the diverse landscape of providers to ensure both comprehensive and cost-effective coverage. Let’s break down the average monthly rates for both minimum and full coverage offered by the best car insurance companies:

Canada Car Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $87 | $228 | |

| $62 | $166 | |

| $65 | $180 |

| $76 | $198 | |

| $96 | $248 |

| $63 | $164 |

| $56 | $150 | |

| $47 | $123 | |

| $77 | $141 | |

| $53 | $331 |

Canadian car insurance reveals distinct contenders, with Farmers Insurance shining as a standout choice, offering robust coverage at $120 for minimum and $250 for full coverage. Progressive follows closely, presenting competitive rates of $110 for minimum and $220 for full coverage, making it an attractive option for budget-conscious individuals.

Farmers Insurance stands out as the top choice in Canada, offering comprehensive coverage, competitive rates, and stellar customer satisfaction.

Brad Larson Licensed Insurance Agent

Allstate, while commendable for its balanced combination of affordability and reputable service, positions itself as a reliable choice with rates at $115 for minimum and $230 for full coverage. In this comparison, the trio of Farmers, Progressive, and Allstate emerge as top players, each catering to diverse preferences and needs in the Canadian insurance landscape.

The Best Car Insurance Companies in Canada

One of the most important decisions you make when buying car insurance is choosing the right company for your unique needs. While Canada has several excellent car insurance providers, below are the top 10.

Ranked #1: The Co-operators

The Co-operators Group Limited is consistently named one of the best Canadian insurance companies and has an impressive five-star rating from the J.D. Power Canada Auto Insurance Satisfaction Study.

Customers praise The Co-operators for its excellent customer service, long list of car insurance discounts, optional add-ons, and affordable prices. Although it only receives three stars for its financial stability, The Co-operators seem to pay claims without any problems.

The Co-operators Group also offers homeowners and life insurance, brokerage, and institutional asset management.

Ranked #2: The Personal Insurance

Another company that is consistently recommended is The Personal Insurance. Especially popular in Quebec and Ontario, J.D. Power gave the company five stars. The Personal Insurance loses out on the top company spot in Canada simply because it has limited availability.

As long as you’re eligible, The Personal Insurance offers basic car insurance that includes:

- Third-party liability

- Accident benefits

- Collisions

- Uninsured motorists

While these coverages can be cheaper, be sure to consider the pros and cons of purchasing basic car insurance before you make your final decision. You can also buy comprehensive insurance for damage outside of accidents; check out our comprehensive car insurance guide to learn more about how that works.

As for optional coverage, The Personal Insurance offers new vehicle protection, transportation replacement, and liability for non-owned vehicle coverages, plus a $0 deductible option.

Ranked #3: Intact Insurance

While Intact Financial Corporation has slightly worse customer service ratings than the top two companies, it has a solid financial strength. With above-average numbers for discounts and optional coverage, Intact probably has the coverage you need.

Although it’s not the highest-rated insurance company in Canada, it is the largest — in fact, it’s the largest provider of specialty insurance in North America.

Not only does Intact offer car insurance, but you can also insure:

- Motorcycles

- RVs

- Snowmobiles

- ATVs

- Boats

Intact offers a unique “My Drive” program to reward drivers for safe habits with an insurance discount. Aside from personal car insurance, Intact also covers Uber and Turo drivers.

Read more: Turo Car Insurance Review

Ranked #4: Desjardins

Desjardins is popular because it offers affordable rates, discounts, and a solid list of additional coverage options. This company also has a high rating for its financial strength. What brings Desjardins’s rating down to fourth place is its customer service.

Despite the lower customer service rating, Dejardins is specifically recommended for new car owners because the company offers them many discounts. Regardless of the age of your car, you can buy third-party liability, collision, comprehensive, and uninsured motorist insurance, as well as accident benefits.

As for optional coverage, Desjardins offers new vehicle protection, a $0 deductible option, and an accident-free protection add-on.

Ranked #5: Belairdirect

Belairdirect is particularly suited for Uber drivers and has a relatively high score for customer service, especially in Ontario. With affordable prices and plentiful options for discounts and additional coverage, Belairdirect has something for everyone.

Belairdirect is actually a subsidiary of another entry list – Intact.

Most customers are satisfied with the service from Belairdirect, especially the automerit program, which rewards safe driving. Car owners that drive less than 10,000 km per year can also take advantage of the automerit program.

You can also buy additional coverages, including roadside assistance, accident forgiveness, and Autocomfort, which provides insurance that covers rental cars.

Ranked #6: Aviva

While Aviva has very affordable prices, this insurance provider struggles with customer service. As a subsidiary of U.K.-owned Aviva PLC, it has considerable financial strength and a decent list of available discounts and additional coverage options.

Canadian residents can earn a discount for the following:

- Bundling car and home insurance policies

- Having multiple cars on the same policy

- Staying claims-free

- Being a retiree

Despite great discount options, Aviva has low satisfaction ratings in Alberta, Quebec, and Ontario. However, Aviva is a fantastic choice for Lyft drivers as the company has partnered with Lyft Canada to offer insurance for both drivers and passengers.

Ranked #7: TD Insurance

With the overall cheapest average ratings of any of the top 10 Canadian car insurance companies, TD Insurance boasts its affordable rates. It does well in other departments, too, including a solid financial presence and decent discounts.

TD Insurance also sells home insurance and is one of the largest direct-response providers in Canada. Customers enjoy TD’s modernized website, where you can get online quotes, apply for discounts, buy more insurance, and manage your account with ease.

Ranked #8: Economical Insurance

Despite the name, Economical Insurance does not have the cheapest rates. It does, however, offer a stellar list of discounts and decent customer service.

Getting insurance through Economical is a little more difficult because the company sells through brokers in most regions. It might be worth the extra effort because Economical offers insurance for a lot more than cars.

You can get insurance for snowmobiles, ATVs, motorcycles, campers, RVs, mopeds, and motorhomes.

Ranked #9: RSA Group

RSA does reasonably well with its discount and additional coverage options, customer service, and financial strength. Prices run a little higher than some of the cheaper options, but policies come with some great benefits.

With an RSA policy, you get rewarded miles for making your payments on time. You can redeem those miles for things like:

- Rental cars

- Accommodations

- Travel vouchers

- Concert tickets

- Other entertainment rewards

Like Economical, you can’t buy RSA insurance online. Instead, you’ll probably have to go through a broker. It is worth noting that the claims protection plan and lifetime repair guarantee make RSA worth checking out.

Ranked #10: Sonnet

Sonnet’s best feature is its list of discounts and add-ons, but it can be expensive. Sonnet is a great choice for people that prefer to handle things online.

With a website built for easy access, you can get quotes, pay your bills, and manage your account all in one convenient spot.

Sonnet’s standard policy includes third-party liability, comprehensive, collision, and accident benefits. You can also buy accident or ticket forgiveness, rental insurance, or a Vroom service bundle.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Canada Car Insurance Requirements

Canadian drivers are required to have car insurance. Canada requires drivers to carry third-party liability of $200,000. The only exception is in Quebec, where drivers only need $50,000.

Additionally, all territories and provinces (except Labrador and Newfoundland) require insurance for lost income and medical expenses. Driving laws vary by territory and province, so you can always check with your local area to find what insurance you need.

If you plan on driving to Canada with American insurance, your U.S. policy will cover you as long as you’re on vacation. People planning to move to Canada from the U.S. will need to open a new car insurance policy.

For car renters, there are two options for insuring your rental car. If you have a personal car insurance policy, it might cover rental cars, so check with your insurance company before leaving for Canada. For more information, read our article titled “Can I use my own car insurance when renting a car?“.

If you don’t have your own policy or your policy does not cover rental vehicles, you’ll have the option to purchase insurance through the rental company.

Find the Best Canadian Car Insurance

Whether you live in Saskatchewan or Prince Albert Island, you can find quality, affordable car coverage with any top insurance company in Canada.

There are many more insurance companies in Canada than the 10 listed above, most of which provide excellent service. To find the perfect policy and price for your car, compare prices with as many companies as possible.

Read more:

- Compare Canadian vs. US Car Insurance: Rates, Discounts, & Requirements

- Compare Car Insurance for Traveling in Canada: Rates, Discounts, & Requirements

- Case Study #1 – The Comprehensive Coverage Dilemma: Meet Sarah, a diligent driver residing in a bustling Canadian city. Sarah values comprehensive coverage to safeguard her vehicle against unexpected hazards. After thorough research, she decided to go with Farmers, enticed by their renowned reputation for providing extensive coverage options.

- Case Study #2 – Innovating With Progressive: David, a tech-savvy driver, is always on the lookout for innovative insurance solutions. His interest in cutting-edge technology leads him to choose Progressive. As mentioned in our Progressive car insurance review, the Snapshot feature, which tracks driving habits and offers potential discounts, aligns perfectly with David’s preferences.

- Case Study #3 – Claim Satisfaction Matters: Emma prioritizes peace of mind and seamless claim processes. Having heard positive reviews about claim satisfaction, she opts for Allstate. When her vehicle is involved in a minor accident, the ease of filing a claim with Allstate, coupled with the customizable coverage options that allowed her to shape her monthly rates, reinforces her choice. The A+ A.M. Best Rating further solidifies her confidence in Allstate’s financial stability.

By prioritizing their individual needs and preferences, they were able to find insurance providers like Farmers, Progressive, and Allstate that not only met but exceeded their expectations. In a landscape filled with choices, these case studies serve as a reminder of the significance of comprehensive coverage, innovative solutions, and reliable claim processes in safeguarding vehicles against the myriad of hazards on Canadian roads.

Frequently Asked Questions

What are the top three car insurance companies in Canada?

Farmers, Progressive, and Allstate emerge as the forefront leaders among car insurance companies in Canada. They stand out for offering a balanced combination of affordability, innovative technology, and excellent claim satisfaction.

How do the average monthly car insurance rates compare among the leading providers in Canada?

Farmers Insurance leads the pack with rates at $120 for minimum and $250 for full coverage. Progressive follows closely with competitive rates of $110 for minimum and $220 for full coverage. Allstate, known for its balanced affordability and reputable service, has rates at $115 for minimum and $230 for full coverage.

Enter your ZIP code below into our free comparison tool to see how much car insurance costs in your area.

What discounts do these top car insurance companies in Canada offer to policyholders?

The top companies provide various discounts to policyholders. For instance, Farmers offers up to 15% multi-policy discount and up to 10% safe driver discount. Progressive provides up to 30% multi-policy discount and up to 15% safe driver discount. Allstate offers up to 25% multi-policy discount and up to 12% safe driver discount.

Read more: Car Insurance Discounts: Compare the Best Discounts

How does Farmers Car Insurance stand out among the top choices in Canada?

Farmers Car Insurance stands out for its comprehensive coverage, low complaint level indicating customer satisfaction, and tailored rates based on individual needs. The company has a strong reputation, and its review benefits from the expertise of a former State Farm Insurance Agent.

What factors should Canadians consider when customizing their car insurance coverage for savings?

Canadians can shape their monthly rates by adjusting deductibles, adding coverage, and securing safe driving discounts. Understanding factors like credit score, mileage, coverage level, and driving record empowers budget-conscious consumers to customize coverage for maximum savings.

What types of coverage are typically included in car insurance policies in Canada?

In Canada, standard car insurance policies typically include third-party liability coverage, which is mandatory in most provinces, as well as accident benefits coverage for medical expenses and lost income. Optional coverages such as collision, comprehensive, and uninsured motorist coverage may also be available depending on the insurer and the policyholder’s preferences.

Read more: Understanding Your Car Insurance Policy (Complete Guide)

Are there any specific discounts available for drivers in Canada?

Yes, many car insurance companies in Canada offer a variety of discounts to help policyholders save on their premiums. These discounts may include multi-policy discounts for bundling car insurance with other types of insurance, safe driving discounts for maintaining a good driving record, and discounts for installing anti-theft devices or safety features in the vehicle.

What factors can affect the cost of car insurance premiums in Canada?

Several factors can influence the cost of car insurance premiums in Canada, including the driver’s age, driving experience, location, type of vehicle insured, and coverage options selected. Additionally, factors such as the driver’s claims history, credit score, and annual mileage driven may also impact premium rates.

Do car insurance companies in Canada offer online policy management and claims filing options?

Many car insurance companies in Canada now offer online platforms or mobile apps that allow policyholders to manage their policies, make payments, and file claims conveniently from their computers or mobile devices. These digital tools can streamline the insurance process and provide policyholders with greater flexibility and accessibility.

Read more: Finding Free Car Insurance Quotes Online

What steps should I take if I’m involved in a car accident in Canada?

If you’re involved in a car accident in Canada, it’s important to prioritize safety and assess any injuries or damage to vehicles involved. You should exchange insurance information with the other driver(s) and notify your insurance company as soon as possible to report the accident and initiate the claims process. Additionally, it may be helpful to document the scene of the accident and gather witness statements or evidence to support your claim.

Need the cheapest car insurance possible? Enter your ZIP code below into our free comparison tool to find the most affordable rates for your vehicle.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Dani Best

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Licensed Insurance Producer

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.