Compare Quotes for Car Insurance in Winston-Salem, NC

It is easy to contact one insurance company and sign a policy. However, by comparing insurance policies, drivers will determine whether the policy is beneficial for various situations.

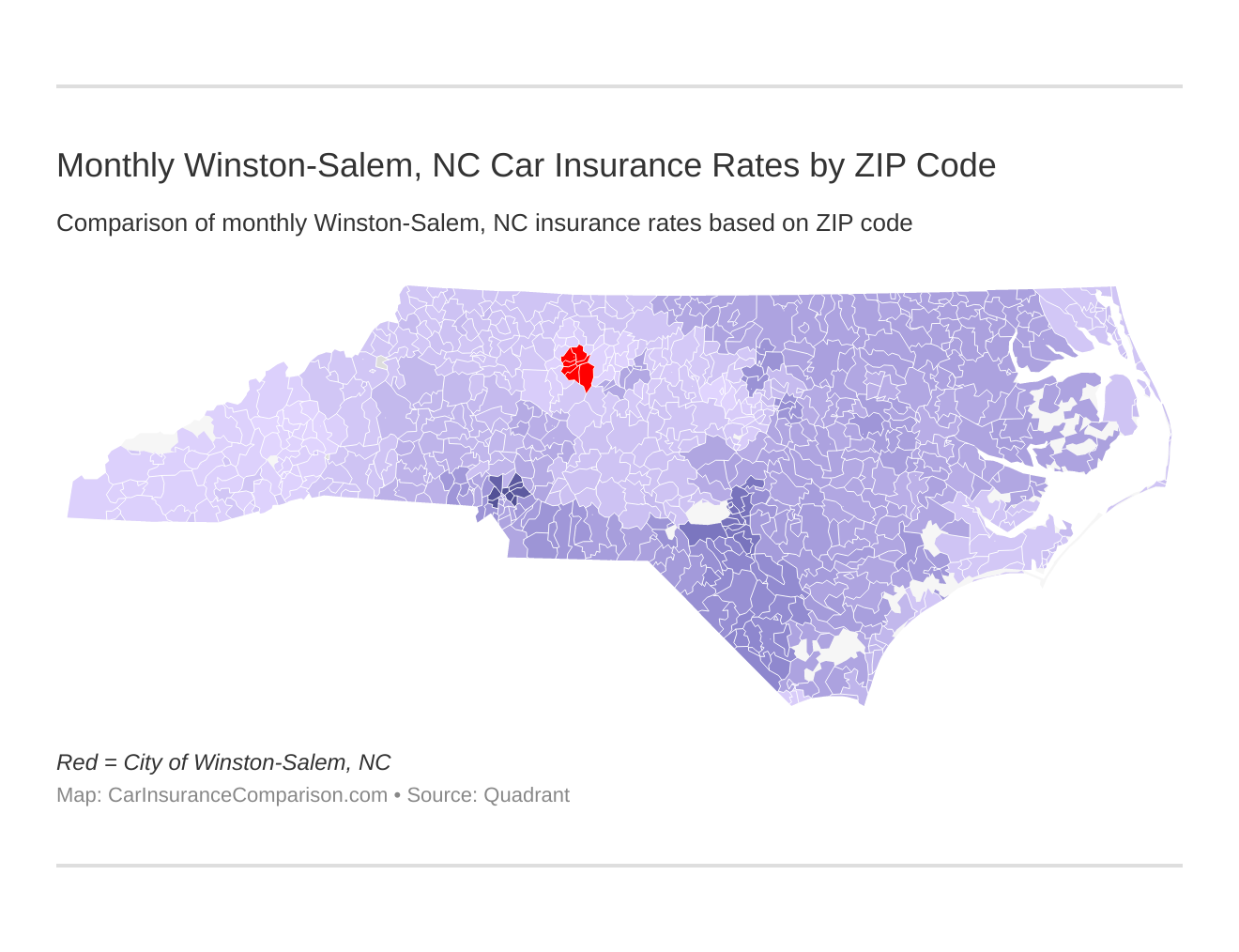

The best way to compare car insurance quotes in NC is to use our zip code search. Residents should consider the types of coverage and what is the best and most affordable insurance in Winston-Salem, North Carolina.

Some policies offer liability car insurance and comprehensive car insurance coverage; others may include roadside assistance and rental coverage to temporarily replace transportation after an accident.

By comparing prices and policy features, residents can save hundreds of dollars each year. So don’t wait any longer! Find cheap car insurance and begin saving today!