How do you get Allstate car insurance quotes online?

You might be wondering how to get Allstate car insurance quotes online. Finding Allstate car insurance rates on the web is easy. Allstate insurance averages $160/mo for full coverage, but Allstate's liability-only policy is cheaper. Compare rates to find the lowest Allstate auto insurance quote today.

Stop Paying Too Much For Car Insurance

Compare Free Quotes Online In Minutes, Check Now

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

UPDATED: Jul 17, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jul 17, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- Allstate online quotes are fast, free, and easy to obtain

- You can get multi-car quotes through Allstate’s website

- Allstate gives you contact information for a local agent before you finish the quote request

Allstate is one of the largest car insurance companies in the country and a provider drivers should consider when looking for coverage. Although its average rates tend to be higher than other companies, Allstate’s extensive list of insurance options services often makes the higher prices worth it.

Figuring out get competitive car insurance quotes might sound complicated, but an easy-to-use site simplifies getting an Allstate online quote.

So, how do you get Allstate car insurance quotes online? Explore the step-by-step process of getting Allstate car insurance quotes below to learn everything you need to know. Once you have your quote, make sure you learn how to compare car insurance quotes from other companies to ensure you get the right policy for your car.

Getting Allstate Car Insurance Quotes Online

Finding free car insurance quotes online is easier than ever, especially when looking at large providers like Allstate.

While you can use a quote generator tool to get prices from multiple companies at once, the most accurate way to look at Allstate insurance online is to use the company’s website.

Getting multiple quotes at once can give you a good idea of which companies might have the lowest rates for you, but going directly to the Allstate website will give you the most accurate quote.

Brad Larson Licensed Insurance Agent

If you’re interested in Allstate, get a quote online in a few minutes by following the steps below.

Step #1 – Learn More About Allstate Auto Insurance

Before you request a quote, visiting Allstate’s site and exploring your options is a good idea. Allstate offers a variety of coverage options, and you can get a feel for if the company is a good fit for you. You can also explore Allstate insurance discounts to see if you might be eligible for multiple savings.

Allstate also offers other types of policies, such as homeowners insurance, renters insurance coverage, and life policies. Additional coverages for your vehicle include uninsured and underinsured motorist coverage, personal umbrella policy, rideshare insurance, and more.

You’ll get a better understanding of where Allstate’s focus lies as a company and can determine whether or not you think they’d be a good fit for your needs.

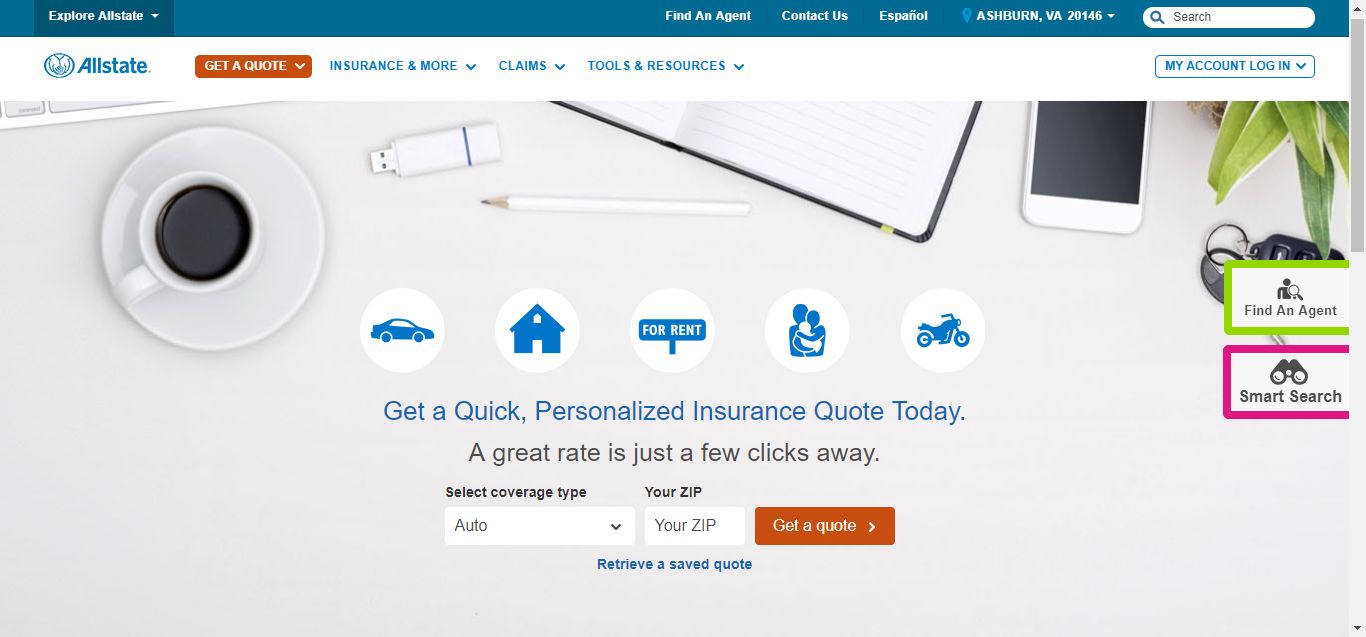

Step #2 – Enter Your ZIP Code

When you enter your zip code, Allstate will present you with all the locations in your vicinity. You can select one of Allstate’s coverage options it offers, enter your ZIP code, and click “Get a Quote.”

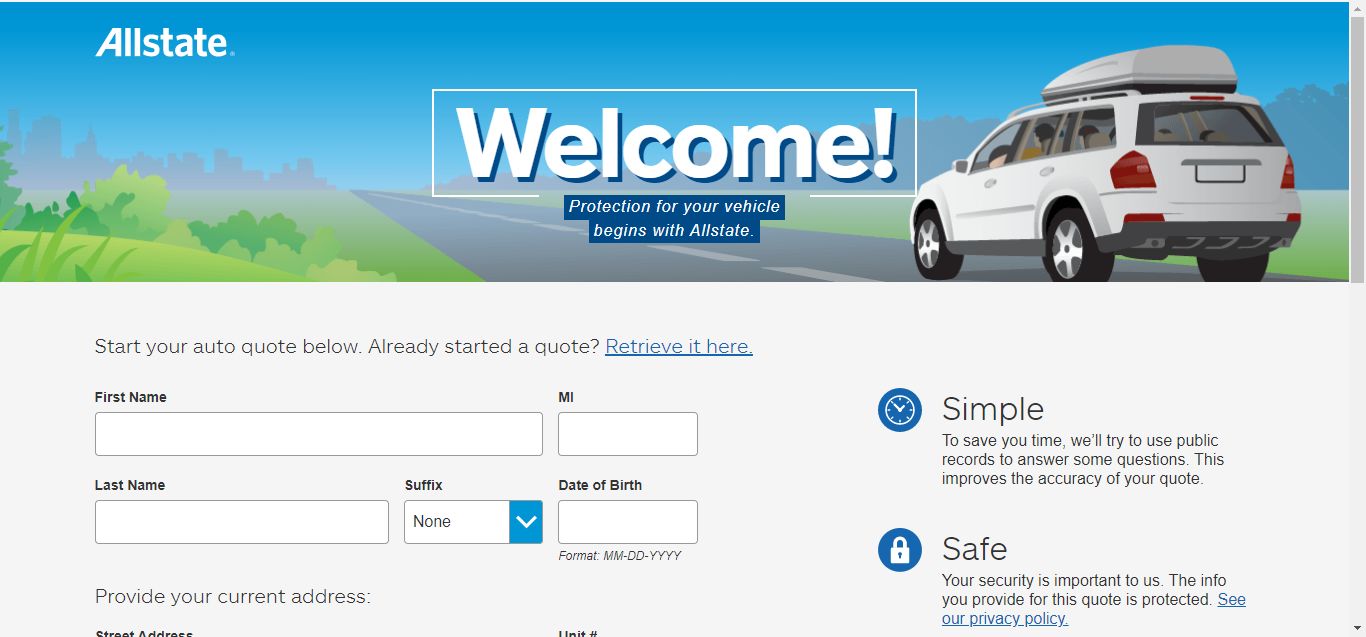

Step #3 – Enter Your Information

Enter your first and last name, date of birth, and current address. When you enter your personal info, you give Allstate permission to draw from consumer records and collect relevant driving records and related information. It’s crucial to provide Allstate with this information to get the most accurate car insurance quote.

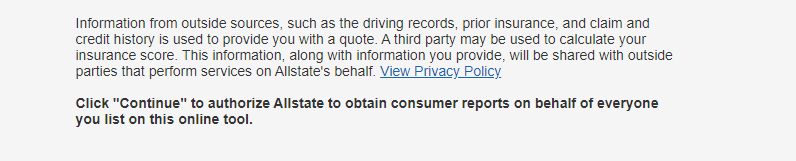

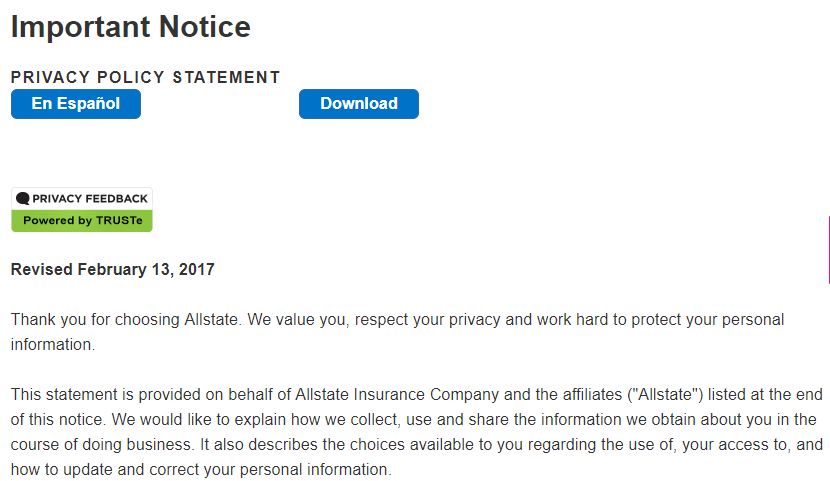

Step #4 – Agree to Allstate Auto Insurance’s Privacy Terms and Conditions

At the bottom of the page, you’ll find a brief description of Allstate’s Privacy Policy, which you agree to by continuing the quotes process. By clicking “continue,” you permit Allstate to give the information you provide to a third party in order to provide you with an accurate quote estimate.

Click “View Privacy Policy” to learn more about Allstate’s terms and conditions; you can also download a copy of the Privacy Policy if you want to review it later.

Step #5 – Have Important Information Ready

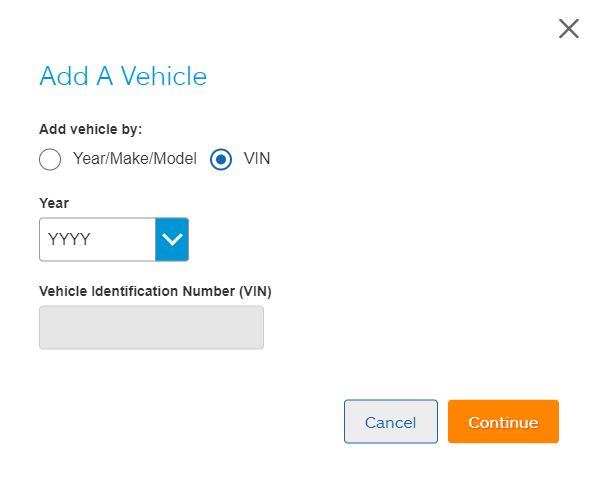

There are many ways you can improve the accuracy of your quotes and speed up the request process; have important information about your car(s) on hand. Getting accurate Allstate quotes online requires your Vehicle Identification Number (VIN), make and model, and mileage. You can estimate figures you aren’t 100% certain about, but it’s best to gather details before looking for Allstate auto quotes to ensure the rates you receive are accurate.

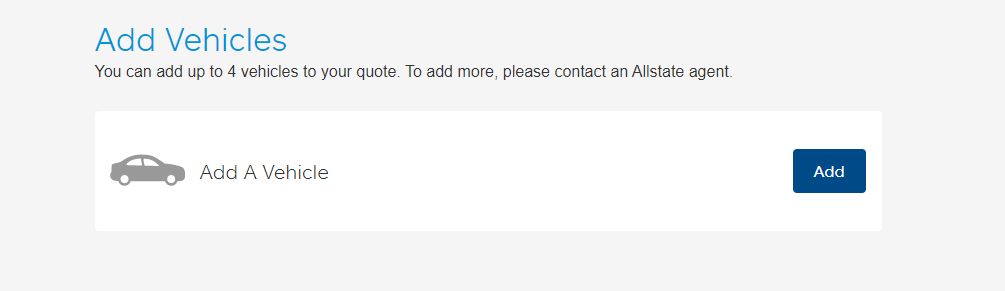

Step #6 – Enter Your Vehicle Details

Using the information you provided, Allstate’s system will pull up vehicles associated with your address from records. If you see your vehicle, select it and enter the information prompted. If you do not see your vehicle listed, you can add one by clicking the box at the bottom of the screen.

Once you reach this part of the quote request, you’ll see a local Allstate agent profile listed on the right side of the screen. If you run into trouble or have questions, you can contact them directly using the number provided.

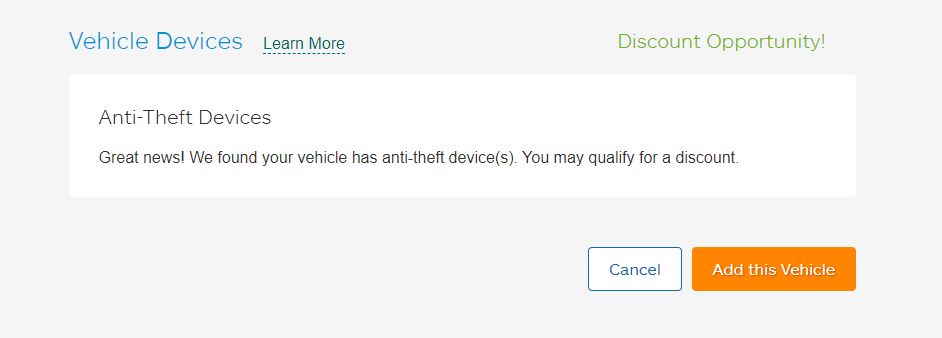

If your car has anti-theft devices, Allstate’s system will detect this and inform you of potential discount opportunities. You can find out more about this and other parts of the process by clicking “Learn More” whenever it appears on the screen.

Step #7 – Get Help

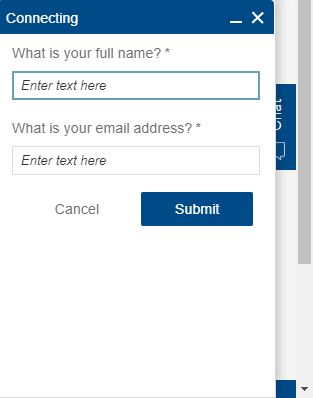

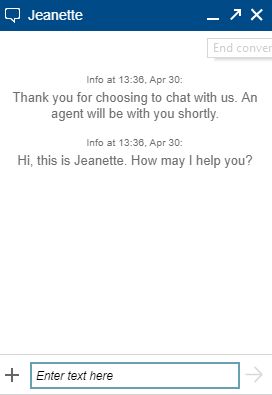

If you find yourself with questions or stuck somewhere along the process, you can click the “Chat” button located on the right side of the screen.

When the box appears, enter the full name you provided on the previous screen and your email address to receive live help. You’ll be connected with an Allstate chat support specialist who can answer any questions you have about coverage, adding a vehicle, or other steps of the Allstate auto insurance quotes process.

If you want to end the chat at any time, simply click the X and answer “Yes” to the confirmation prompt that appears.

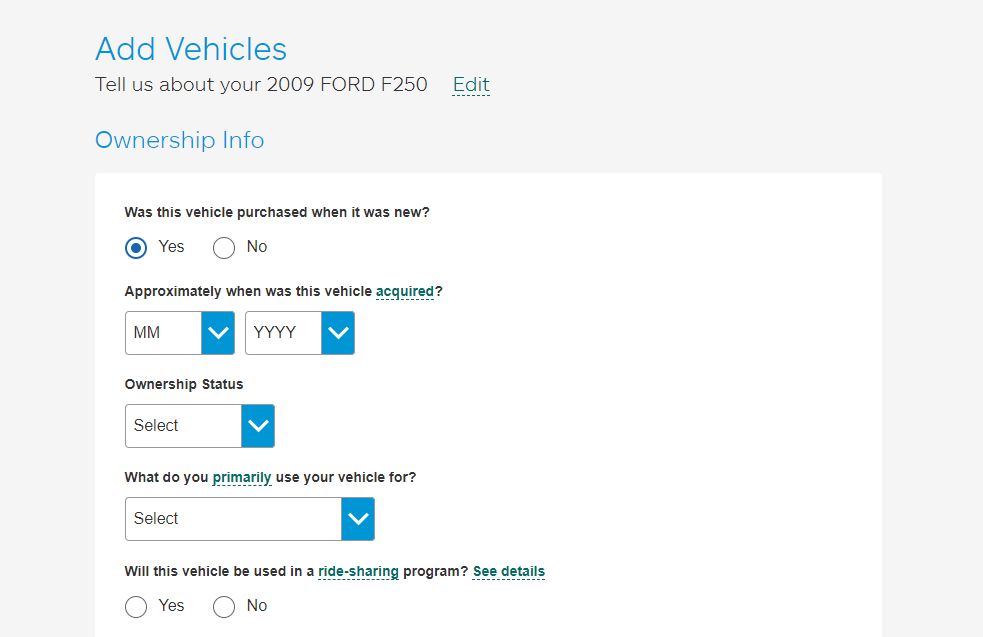

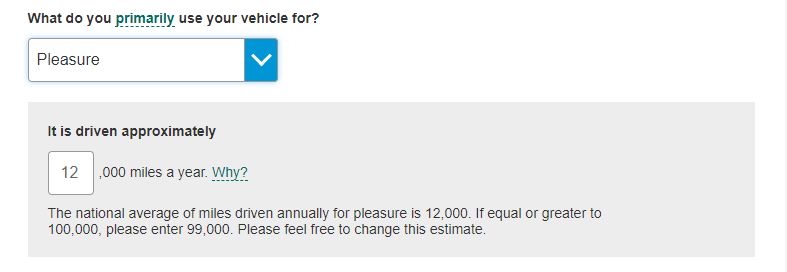

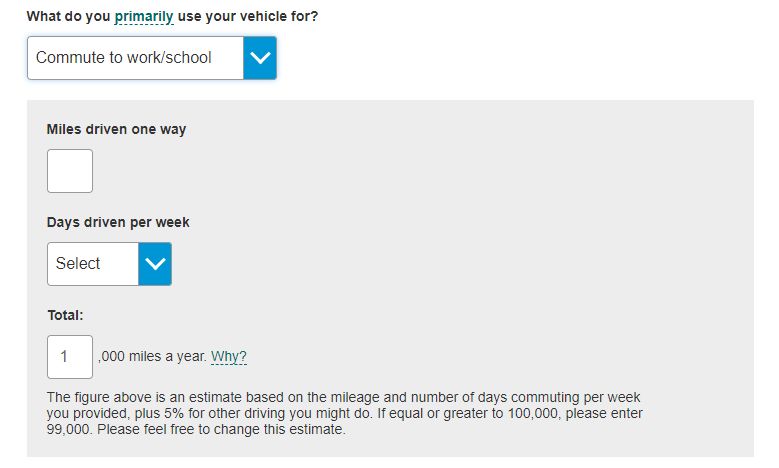

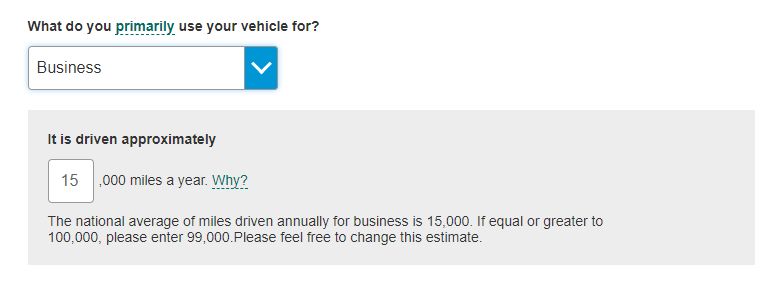

Step #8 – Determine How You Use Your Car

There are three options for car usage to choose from: pleasure, commuting to work/school, and business. You may consider your car’s primary use pleasure even if you drive it to and from work every day, but there is a difference in an insurance provider’s eyes.

The type of insurance and level of coverage will differ depending on what you use your car for since different uses expose drivers to different risks.

Pleasure

This option means you only drive your car for fun; it’s not your primary means of transportation to work or school and typically isn’t driven daily. A vehicle driven for pleasure is not considered your main mode of transportation.

Commute

Choose this option if you primarily use your car to drive your car to and from work or school. It’s okay if you also use this car to drive to and from the store, run errands, etc., but if its main use is getting to and from work, you’ll want to select this choice.

Business

A business vehicle is used to provide business services. If you primarily use your car to make sales calls, drive to various locations pertaining to a business operation, or the vehicle is leased from your company, this is the option you should choose.

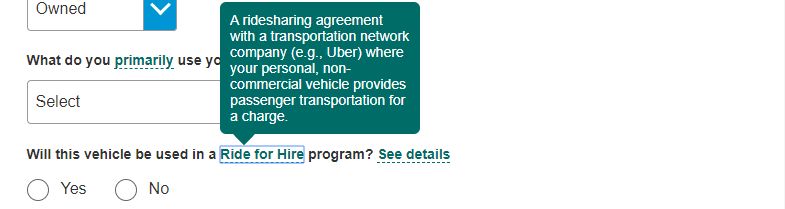

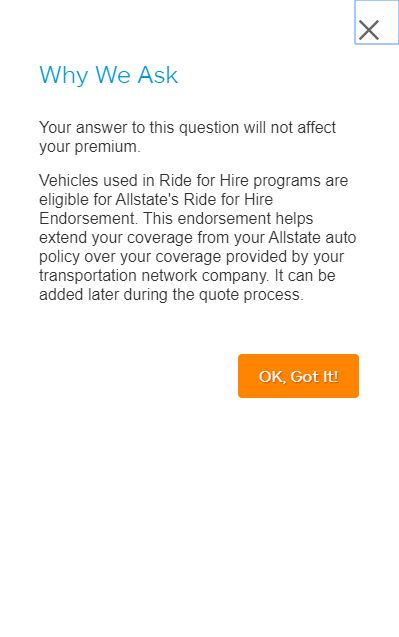

You don’t need to put business as your car’s primary use if you use it for part-time ridesharing. Instead, you can get a regular Allstate car quote and sign up for the rideshare add-on if you want extra coverage.

Step # 9 – Learn as You Go

Throughout the Allstate quotes wizard, you’ll notice highlighted and underlined words. Sometimes, you’ll also have the option to “see details.” When you click this, you’ll be given more information on what a highlighted term means and how it can affect your car insurance rates. In other cases, you’ll learn why you’re being prompted for certain information.

This feature helps you learn more about Allstate’s endorsements and discounts as you move through the wizard, allowing you to make a more informed decision after you’ve received your quote and are comparing rates.

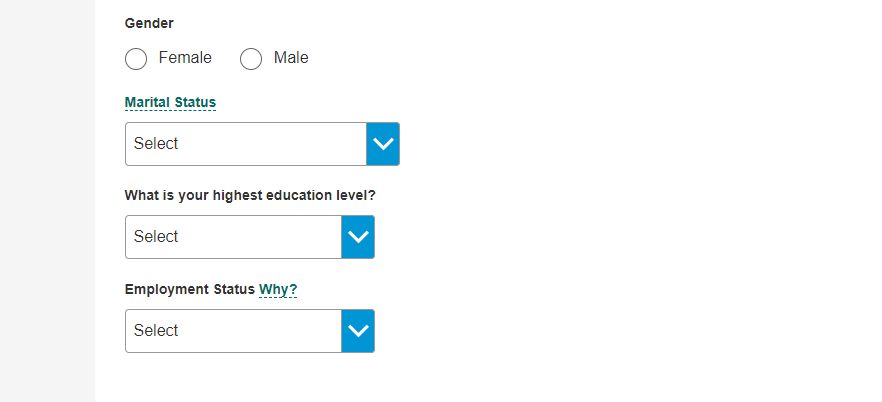

Step #10 — Add Driver Info

Enter driver information for your vehicle(s). You can add multiple drivers, and you may qualify for a multi-car discount if there is more than one car in your household. Make sure that all information entered is truthful and as detailed as possible. If you don’t, your quote won’t be accurate.

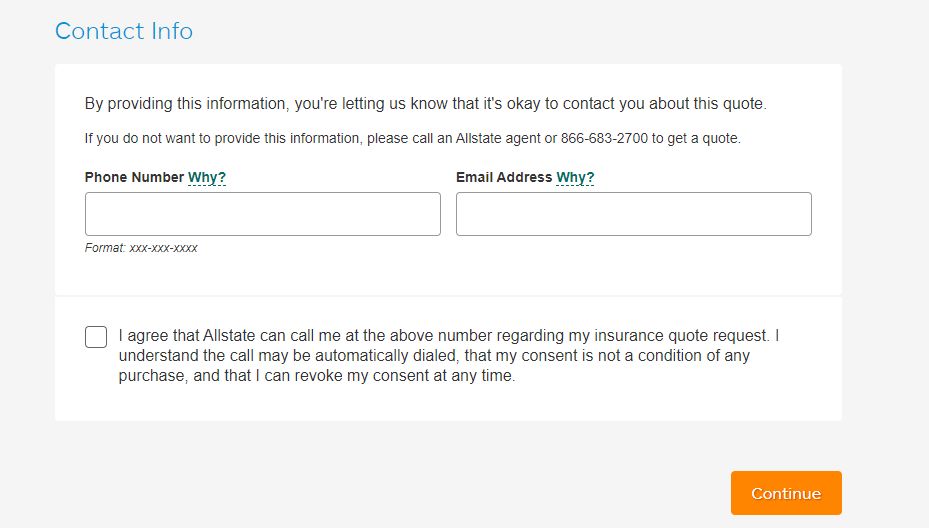

Step #11 – Get Your Allstate Car Insurance Quote

Your Allstate car insurance quote will be delivered to you once you enter your phone number. You aren’t obligated to sign up for a policy after receiving a quote.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Cost of Allstate Car Insurance

Getting online quotes is easy, but Allstate car insurance rates tend to be some of the highest on the market. However, average rates can be a bit misleading since a variety of factors impact how much you’ll pay. There are also plenty of Allstate car insurance discounts to help lower your rates.

To get an idea of how Allstate car insurance premiums compare to other top providers, check the table below.

Read more: Is it cheaper to purchase car insurance online?

| State | Allstate | American Family | Farmers | Geico | Liberty Mutual | Nationwide | Progressive | State Farm | Travelers | USAA |

|---|---|---|---|---|---|---|---|---|---|---|

| Alabama | $108 | $105 | $133 | $89 | $162 | $96 | $112 | $108 | $79 | $56 |

| Alaska | $135 | $105 | $127 | $76 | $164 | $108 | $97 | $65 | $93 | $60 |

| Arizona | $180 | $114 | $135 | $65 | $178 | $116 | $84 | $81 | $104 | $63 |

| Arkansas | $162 | $137 | $165 | $91 | $99 | $128 | $131 | $80 | $111 | $55 |

| California | $199 | $138 | $167 | $101 | $216 | $142 | $132 | $108 | $122 | $74 |

| Colorado | $166 | $118 | $163 | $94 | $92 | $107 | $120 | $94 | $114 | $78 |

| Connecticut | $196 | $125 | $151 | $62 | $201 | $112 | $133 | $91 | $83 | $77 |

| Delaware | $207 | $130 | $157 | $101 | $494 | $144 | $90 | $116 | $82 | $43 |

| D.C. | $241 | $115 | $139 | $69 | $180 | $172 | $115 | $111 | $102 | $48 |

| Florida | $183 | $188 | $227 | $89 | $161 | $103 | $153 | $99 | $166 | $47 |

| Georgia | $165 | $124 | $149 | $61 | $263 | $152 | $115 | $107 | $110 | $71 |

| Hawaii | $118 | $82 | $99 | $60 | $128 | $84 | $78 | $64 | $72 | $44 |

| Idaho | $128 | $93 | $92 | $57 | $79 | $82 | $91 | $53 | $57 | $40 |

| Illinois | $176 | $114 | $117 | $47 | $76 | $93 | $89 | $64 | $87 | $62 |

| Indiana | $140 | $107 | $79 | $63 | $183 | $97 | $69 | $71 | $69 | $43 |

| Iowa | $126 | $95 | $82 | $81 | $116 | $73 | $75 | $65 | $92 | $55 |

| Kansas | $160 | $114 | $144 | $75 | $174 | $92 | $127 | $81 | $87 | $56 |

| Kentucky | $236 | $164 | $197 | $80 | $168 | $184 | $111 | $98 | $139 | $72 |

| Louisiana | $206 | $176 | $212 | $141 | $274 | $181 | $161 | $124 | $156 | $98 |

| Maine | $143 | $99 | $120 | $72 | $155 | $103 | $95 | $78 | $88 | $53 |

| Maryland | $201 | $116 | $140 | $135 | $181 | $106 | $121 | $107 | $103 | $80 |

| Massachusetts | $108 | $84 | $117 | $37 | $120 | $87 | $94 | $59 | $61 | $37 |

| Michigan | $406 | $204 | $335 | $99 | $424 | $257 | $152 | $209 | $183 | $107 |

| Minnesota | $160 | $93 | $108 | $90 | $375 | $87 | $101 | $67 | $94 | $68 |

| Mississippi | $147 | $120 | $145 | $72 | $119 | $96 | $120 | $82 | $88 | $54 |

| Missouri | $148 | $106 | $135 | $90 | $129 | $66 | $98 | $85 | $114 | $50 |

| Montana | $154 | $125 | $164 | $82 | $59 | $88 | $171 | $70 | $111 | $50 |

| Nebraska | $125 | $112 | $130 | $92 | $179 | $77 | $95 | $69 | $102 | $56 |

| Nevada | $165 | $140 | $155 | $110 | $111 | $112 | $82 | $103 | $91 | $69 |

| New Hampshire | $128 | $77 | $93 | $50 | $198 | $77 | $63 | $59 | $69 | $41 |

| New Jersey | $157 | $115 | $231 | $74 | $279 | $119 | $93 | $113 | $136 | $61 |

| New Mexico | $158 | $103 | $131 | $90 | $161 | $96 | $86 | $69 | $91 | $65 |

| New York | $147 | $137 | $165 | $78 | $200 | $164 | $96 | $137 | $175 | $85 |

| North Carolina | $169 | $82 | $99 | $69 | $82 | $111 | $32 | $77 | $99 | $44 |

| North Dakota | $136 | $145 | $107 | $61 | $398 | $77 | $110 | $76 | $88 | $44 |

| Nebraska | $125 | $112 | $130 | $92 | $179 | $77 | $95 | $69 | $102 | $56 |

| New Hampshire | $128 | $77 | $93 | $50 | $198 | $77 | $63 | $59 | $69 | $41 |

| New Jersey | $157 | $115 | $231 | $74 | $279 | $119 | $93 | $113 | $136 | $61 |

| New Mexico | $158 | $103 | $131 | $90 | $161 | $96 | $86 | $69 | $91 | $65 |

| Nevada | $165 | $140 | $155 | $110 | $111 | $112 | $82 | $103 | $91 | $69 |

| New York | $147 | $137 | $165 | $78 | $200 | $164 | $96 | $137 | $175 | $85 |

| Ohio | $120 | $62 | $96 | $59 | $106 | $114 | $85 | $70 | $63 | $41 |

| Oklahoma | $135 | $118 | $136 | $109 | $184 | $122 | $110 | $91 | $105 | $68 |

| Oregon | $153 | $106 | $111 | $93 | $141 | $111 | $78 | $75 | $97 | $58 |

| Pennsylvania | $148 | $108 | $131 | $68 | $219 | $86 | $148 | $76 | $75 | $57 |

| Rhode Island | $189 | $151 | $183 | $125 | $235 | $190 | $116 | $76 | $103 | $65 |

| South Carolina | $133 | $118 | $166 | $79 | $185 | $118 | $105 | $88 | $105 | $69 |

| South Dakota | $136 | $151 | $113 | $57 | $230 | $76 | $105 | $67 | $97 | $58 |

| Tennessee | $144 | $102 | $86 | $78 | $11 | $118 | $92 | $72 | $88 | $58 |

| Texas | $201 | $176 | $137 | $105 | $178 | $154 | $121 | $90 | $101 | $62 |

| Utah | $117 | $105 | $115 | $73 | $119 | $93 | $95 | $103 | $88 | $50 |

| Virginia | $103 | $83 | $100 | $69 | $129 | $86 | $61 | $63 | $73 | $43 |

| Vermont | $142 | $85 | $103 | $38 | $100 | $77 | $181 | $87 | $75 | $42 |

| Washington | $114 | $91 | $102 | $75 | $92 | $70 | $60 | $69 | $81 | $46 |

| West Virginia | $123 | $63 | $109 | $62 | $84 | $226 | $94 | $58 | $72 | $47 |

| Wisconsin | $162 | $115 | $139 | $83 | $196 | $104 | $110 | $79 | $102 | $67 |

| Wyoming | $155 | $111 | $130 | $111 | $75 | $114 | $106 | $82 | $98 | $57 |

You’ll notice that Allstate is frequently the most expensive option for car insurance in most states. However, Allstate’s rates vary by several factors, with some drivers seeing lower rates than others. Check below to see how much you might pay for Allstate car insurance based on your age.

| Age | Allstate | Farmers | Geico | Progressive | State Farm | Average Rates |

|---|---|---|---|---|---|---|

| 16 Years Old | $638 | $773 | $312 | $814 | $349 | $618 |

| 18 Years Old | $519 | $629 | $254 | $662 | $284 | $519 |

| 25 Years Old | $190 | $180 | $93 | $146 | $111 | $150 |

| 30 Years Old | $177 | $167 | $87 | $136 | $87 | $139 |

| 45 Years Old | $160 | $139 | $80 | $105 | $80 | $119 |

| 55 Years Old | $152 | $131 | $76 | $100 | $82 | $113 |

| 60 Years Old | $154 | $128 | $74 | $95 | $76 | $110 |

| 65 Years Old | $157 | $136 | $78 | $103 | $84 | $117 |

Young, inexperienced drivers always pay more for insurance compared to older adults, and that’s true with Allstate. Older drivers can also take advantage of Allstate senior car insurance discounts, which can be hard to find with other providers. On the other hand, drivers that will see high Allstate rates include people with DUIs, low credit scores, and at-fault accidents.

While it's always a good idea to compare quotes with multiple companies, it's especially important if you have a DUI, multiple speeding tickets, or at-fault accidents. Allstate rates are usually expensive for high-risk drivers, and you'll likely find lower prices at another company.

Michelle Robbins Licensed Insurance Agent

Your rates are also affected by how much insurance you purchase. Minimum insurance is your cheapest option but doesn’t cover your vehicle. Adding comprehensive and collision insurance better protects your vehicle, but it costs more. To see how much each option costs from Allstate, check the rates below.

| State | Collision | Liability | Comprehensive |

|---|---|---|---|

| Alabama | $29 | $46 | $14 |

| Alaska | $29 | $49 | $14 |

| Arizona | $23 | $45 | $16 |

| Arkansas | $26 | $36 | $12 |

| California | $36 | $56 | $17 |

| Colorado | $32 | $50 | $15 |

| Connecticut | $35 | $51 | $14 |

| Delaware | $27 | $67 | $10 |

| Florida | $24 | $74 | $10 |

| Georgia | $31 | $49 | $14 |

| Hawaii | $29 | $40 | $13 |

| Idaho | $19 | $31 | $10 |

| Illinois | $26 | $38 | $11 |

| Indiana | $21 | $33 | $10 |

| Iowa | $22 | $31 | $10 |

| Kansas | $26 | $41 | $11 |

| Kentucky | $27 | $42 | $13 |

| Louisiana | $32 | $60 | $15 |

| Maine | $23 | $34 | $10 |

| Maryland | $30 | $53 | $13 |

| Massachusetts | $33 | $51 | $11 |

| Michigan | $37 | $70 | $15 |

| Minnesota | $28 | $45 | $12 |

| Mississippi | $29 | $39 | $13 |

| Missouri | $29 | $39 | $12 |

| Montana | $23 | $31 | $11 |

| Nebraska | $25 | $34 | $11 |

| Nevada | $34 | $62 | $14 |

| New Hampshire | $27 | $40 | $10 |

| New Jersey | $32 | $75 | $11 |

| New Mexico | $24 | $38 | $11 |

| New York | $36 | $62 | $15 |

| North Carolina | $28 | $40 | $11 |

| North Dakota | $24 | $32 | $10 |

| Ohio | $23 | $34 | $10 |

| Oklahoma | $26 | $38 | $12 |

| Oregon | $19 | $51 | $8 |

| Pennsylvania | $28 | $42 | $12 |

| Rhode Island | $34 | $50 | $14 |

| South Carolina | $29 | $45 | $13 |

| South Dakota | $24 | $30 | $10 |

| Tennessee | $27 | $38 | $13 |

| Texas | $32 | $46 | $17 |

| Utah | $26 | $42 | $12 |

| Vermont | $23 | $33 | $10 |

| Virginia | $24 | $36 | $12 |

| Washington | $22 | $51 | $9 |

| Washington D.C. | $39 | $55 | $19 |

| West Virginia | $28 | $42 | $17 |

| Wisconsin | $23 | $33 | $10 |

| Wyoming | $24 | $30 | $10 |

While it certainly isn’t the cheapest option for insurance, many customers decide the benefits of Allstate car insurance policies are worth the extra cost.

Required Allstate Car Insurance Coverages

Although Allstate sells a variety of add-ons and optional coverage, most drivers opt for one of two policies — minimum or full coverage insurance.

Minimum insurance is the least amount of coverage required by your state. It’s your cheapest option for insurance, but it won’t pay for your car repairs if you cause an accident. Full coverage car insurance costs more, but it offers better protection for your car.

Once again, Allstate is typically the most expensive option for both minimum and full coverage insurance. Check below to see how Allstate rates compare with other companies.

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $61 | $160 |

| American Family | $44 | $117 |

| Farmers | $53 | $139 |

| Geico | $30 | $80 |

| Liberty Mutual | $68 | $174 |

| Nationwide | $44 | $115 |

| Progressive | $39 | $105 |

| State Farm | $33 | $86 |

| Travelers | $37 | $99 |

| USAA | $22 | $59 |

Allstate is usually never the cheapest option for insurance, regardless of how much coverage you need. That’s particularly true of Allstate full coverage car insurance, which can cost much more than cheaper companies like Geico and State Farm. One thing to remember about Allstate’s higher rates is that the company offers a variety of discounts. For example, many drivers can take advantage of Allstate family car insurance discounts to lower their rates.

Case Studies: Real-Life Examples of Obtaining Allstate Car Insurance Quotes Online

Case Study 1: John’s Experience With Allstate Car Insurance

John, a resident of California, was in the market for car insurance and decided to get quotes from different companies, including Allstate. He followed the 11-step process provided by Allstate’s website to obtain a quote. After comparing quotes from various providers, John found that Allstate offered competitive rates and coverage options that suited his needs.

Case Study 2: Sarah’s Comparison Shopping Journey

Sarah, a college student from New York, wanted to find the best car insurance rates. She used Allstate’s online quote tool and entered her ZIP code to compare quotes from multiple companies. Sarah considered Allstate’s competitive rates but ultimately chose a different insurance company with better student discounts.

Case Study 3: Mark’s Research and Education

Mark, a small business owner from Texas, was looking for car insurance coverage for his company vehicles. He visited Allstate’s website and explored their resources, including their blog and educational articles. Mark found valuable information about commercial auto insurance, coverage options for business owners, and tips for managing insurance costs.

Frequently Asked Questions

How can I get Allstate car insurance quotes online?

Visit Allstate’s website, enter your ZIP code, and follow the steps to get your quote.

What do I need to get an online Allstate quote?

You’ll need to provide personal details, car information (such as the VIN), and driver information if necessary.

Can I compare quotes from other companies?

Yes, you can enter your ZIP code to compare quotes from multiple car insurance providers.

How can I get help during the quote process?

Allstate’s website offers a chat feature where you can get live help from a support specialist.

Is Geico less expensive than Allstate?

Generally speaking, Geico is the cheaper insurance option. However, Geico has high rates for drivers with low credit scores, so you should always compare rates to make sure you’re getting the best price.

Does Allstate give online quotes?

Allstate provides online quotes in a matter of minutes. Simply visit the company’s website and enter your personal information in the quote request form.

Are Allstate’s online car insurance quotes accurate?

Allstate’s online car insurance quotes are accurate as long as you provide accurate information when you request a quote.

Can I purchase car insurance online after I get a quote from Allstate?

Yes, you can purchase an Allstate policy after getting an online quote. To purchase your policy, follow the instructions from Allstate after they send you your quote. If you’re having trouble, an Allstate representative can help.

Who has better auto insurance than Allstate?

That depends on what you’re looking for in an insurance company. Companies like Geico and State Farm have cheaper rates, but Allstate has a longer list of discounts and coverage options. USAA has the best customer service ratings, but only military members and their families are eligible for coverage.

Is Drivewise with Allstate worth it?

Drivewise is Allstate’s telematics insurance program. It tracks driving behaviors like hard braking, rapid acceleration, and what time you drive to determine how much of a discount you’ll earn. Drivewise is worth it for people who consistently drive safely, as they can save up to 40% on their policy.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.