Best Car Insurance for a Provisional License in 2025 (Top 10 Companies)

Progressive, USAA, and State Farm are leading the way for the best car insurance for a provisional license. Offering discounts of up to 30%, they provide tailored coverage at competitive rates, ensuring comprehensive protection for drivers navigating the roads with a provisional license.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

UPDATED: Nov 1, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Nov 1, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Provisional License

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage for Provisional License

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Provisional License

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews

Our Top 10 Company Picks: Best Car Insurance for a Provisional License

| Company | Rank | Personalized Rate Discount | Multi-Policy Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 30% | 17% | Innovation Leader | Progressive | |

| #2 | 25% | 14% | Military Savings | USAA | |

| #3 | 15% | 10% | Customer Service | State Farm | |

| #4 | 35% | 15% | Academic Achievers | Allstate | |

| #5 | 12% | 10% | Family Coverage | Nationwide |

| #6 | 18% | 20% | Personalization Coverage | Farmers | |

| #7 | 10% | 20% | Safety Features | Liberty Mutual |

| #8 | 20% | 10% | Safe Drivers | Travelers | |

| #9 | 22% | 12% | Membership Benefits | AAA |

| #10 | 12% | 8% | Online Discounts | Esurance |

These insurers focus on the specific needs of provisional license holders, enabling drivers to obtain reliable coverage and peace of mind. By selecting one of these top contenders, drivers can be confident that they have the necessary support and protection as they navigate the complexities of driving with a provisional license.

Get the right car insurance at the best price — enter your ZIP code above to shop for coverage from the top insurers.

- Progressive offers up to 30% discounts for provisional license holders

- Tailored coverage options meet the specific needs of provisional drivers

- Comprehensive protection ensures peace of mind on the road

#1 – Progressive: Top Overall Pick

Pros

- Offers up to 30% Discounts: Read our Progressive car insurance review to learn more about their commitment to competitive pricing for potential savings.

- Innovation Leadership: Progressive is recognized for providing forward-thinking coverage solutions.

- Online Tool Suite: Ensures efficient policy management and claims processing.

Cons

- Higher Premium Perception: Certain individuals may perceive premiums as relatively higher compared to competitors.

- Variable Discount Criteria: Variability in discount eligibility criteria could limit accessibility for some customers.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#2 – USAA: Best for Military Savings

Pros

- Military Discounts 25%: USAA offers significant discounts for military members.

- Military Family Service: Ensures specialized coverage tailored to the unique needs of military families.

- Excellent Service Satisfaction: In line with our USAA car insurance review, USAA is recognized for delivering excellent customer service.

Cons

- Military-Exclusive Access: Accessibility is restricted to a specific demographic.

- Limited Non-Military Services: Non-military customers may have limited access to USAA services.

#3 – State Farm: Best for Customer Service

Pros

- Up to 15% Discounts: Showcases affordability with a focus on customer savings.

- Exceptional Personalized Support: State Farm is recognized for providing outstanding customer service.

- Broad Coverage Options: In accordance with our State Farm car insurance review, the company ensures diverse coverage options to meet various needs.

Cons

- Higher Demographic Rates: Some individuals may find State Farm’s rates comparatively higher.

- Traditional Policy Channels: Lack of some digital conveniences in policy management.

#4 – Allstate: Best for Academic Achievers

Pros

- Academic Achiever Discounts: Rewards academic excellence with significant discounts.

- Student Coverage Perks: Offers tailored coverage and perks for student policyholders.

- Online Policy Tools: Explore our Allstate car insurance review for a convenient online experience.

Cons

- Less Competitive Rates: Non-academic achievements may result in less competitive rates.

- Claims Processing Issues: Occasional challenges reported in the claims processing experience.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Family Coverage

Pros

- Family Coverage Discounts: Addresses diverse household needs with discounted family coverage.

- Customer Education Focus: Our Nationwide car insurance review to learn how Nationwide emphasizes educating and supporting its customers.

- Family Coverage Options: Ensures flexibility with coverage options for various family structures.

Cons

- Higher Individual Rates: Rates for individual policyholders may not be the most competitive.

- Enhanced Digital Services: Nationwide’s digital tools may benefit from additional features.

#6 – Farmers: Best for Personalization Coverage

Pros

- Personalized Discounted Coverage: As per our Farmers car insurance review, the company offers personalized coverage with attractive discounts.

- Customizable Coverage Options: Allows customers to customize coverage with various add-ons.

- App for Policy Management: Provides a mobile app for on-the-go policy management.

Cons

- Premium Variations Reported: Higher premiums may be reported for specific coverage options.

- Regional Restrictions: Farmers’ availability may be restricted in certain regions.

#7 – Liberty Mutual: Best for Safety Features

Pros

- Safety Feature Discounts: Promotes safe driving with discounts for safety features.

- Coverage Choices: Liberty Mutual provides a variety of coverage options and additional features.

- Intuitive Web Tools: Ensures a user-friendly online experience. Learn more about Liberty Mutual car insurance review.

Cons

- Not Budget-Friendly: Affordability may vary depending on the customer profile.

- Claims Processing Issues: Challenges in claims processing have been reported.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#8 – Travelers: Best for Safe Drivers

Pros

- Safe Driver Discounts: With our Travelers car insurance review, the company rewards safe driving behaviors with significant discounts.

- Flexible Perks: Provides flexibility with coverage options and additional perks.

- Reputable Stability: Travelers maintains strong financial stability and a positive industry reputation.

Cons

- Higher Risk Premiums: Higher premiums may be associated with specific high-risk profiles.

- Regional Limits: Travelers may have limited availability in certain regions.

#9 – AAA: Best for Membership Benefits

Pros

- Membership Savings: Browse our AAA car insurance review to learn about the significant discounts available for members.

- Service Network Expansion: Ensures a broad network for service and assistance.

- AAA Member Benefits: Provides extra perks and discounts exclusive to AAA members.

Cons

- Exclusive Membership: Full access to benefits is contingent on AAA membership.

- Competitive Premiums Lack: Non-members may experience less competitive premiums.

#10 – Esurance: Best for Online Discounts

Pros

- Online Shopping Discounts: Rewards online customers with discounts.

- Efficient Policy Handling: Our Esurance car insurance quote for a streamlined online experience in quoting and policy management.

- Mobile Accessibility: Provides a user-friendly mobile app for convenient access.

Cons

- Limited Personalization: Personalized service may vary compared to traditional insurers.

- Regional Limits: Esurance’s availability may be limited in certain regions.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

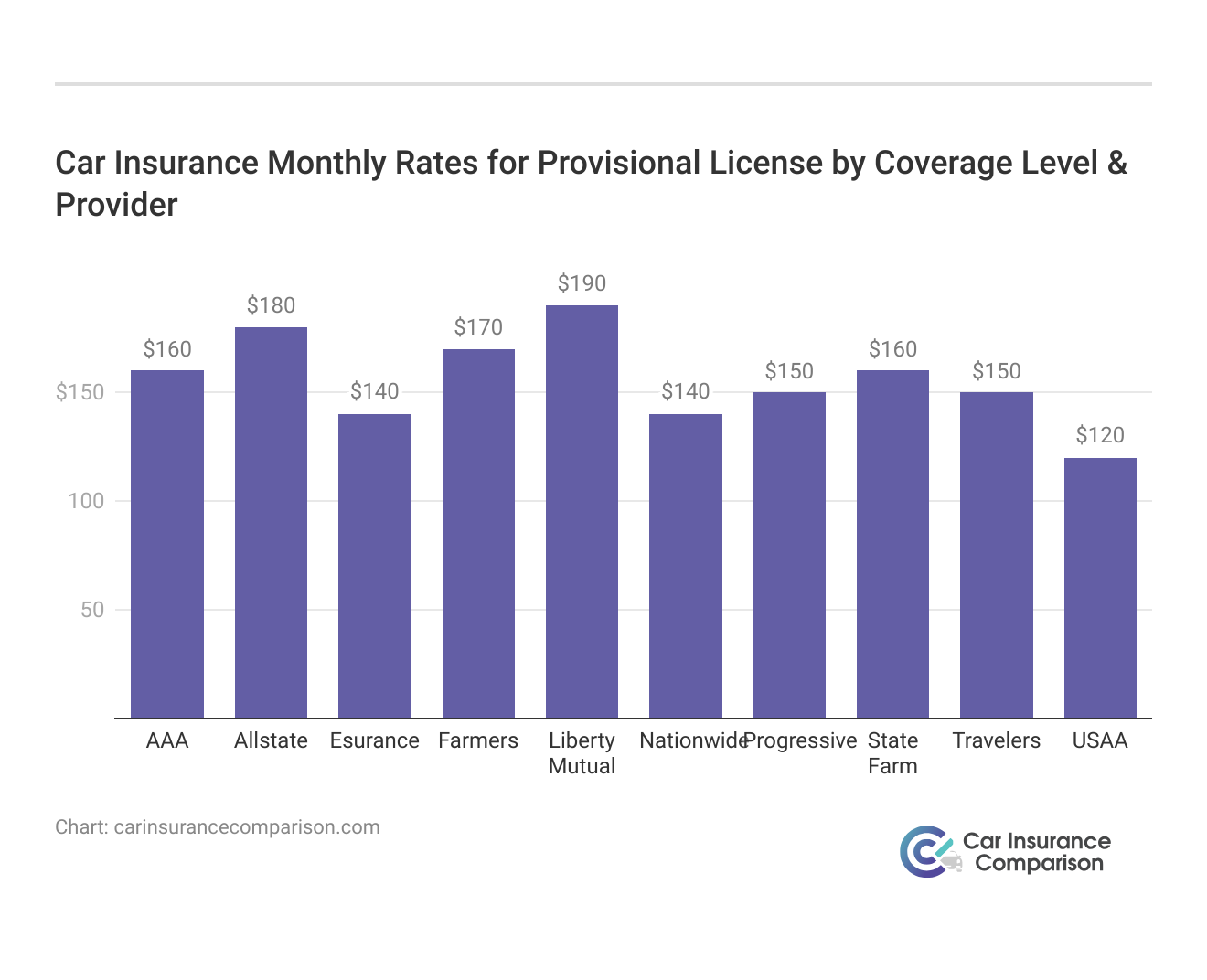

Navigating the Open Road: Tailored Car Insurance Rates for Provisional License Holders

The table provides a comprehensive overview of the average monthly car insurance rates for individuals holding a provisional license. These rates are categorized into two main coverage types: Minimum Coverage and Full Coverage. It is crucial to understand the specific coverage rates offered by different insurance companies to make informed decisions when seeking insurance with a provisional license.

Car Insurance Monthly Rates for Provisional License by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| AAA | $160 | $320 |

| Allstate | $180 | $350 |

| Esurance | $140 | $280 |

| Farmers | $170 | $330 |

| Liberty Mutual | $190 | $370 |

| Nationwide | $140 | $280 |

| Progressive | $150 | $300 |

| State Farm | $160 | $320 |

| Travelers | $150 | $300 |

| USAA | $120 | $250 |

Analyzing the table, one can observe variations in the monthly insurance rates among different providers. For Minimum Coverage, USAA stands out with the lowest rate at $120, followed closely by Nationwide and Esurance, both offering coverage at $140 per month. On the other hand, Liberty Mutual presents the highest Minimum Coverage rate at $190.

When considering Full Coverage, USAA continues to offer the most affordable option at $250, and Nationwide and Esurance maintain competitive rates at $280. Liberty Mutual, once again, emerges as the most expensive option for Full Coverage, charging $370 per month.

These diverse rates highlight the importance of comparing insurance options for individuals with provisional licenses, as they can significantly impact monthly expenses. Additionally, factors such as the provider’s reputation, coverage features, and customer service should be considered alongside these rates to make a well-informed decision.

Understanding Provisional Driver’s Licenses and Car Insurance Policies

A provisional license is typically granted to drivers who have lost their license due to serious traffic violations, such as driving without insurance. In such cases, where drivers have lost their license, the court mandates them to secure insurance on their vehicle before regaining their full license. Car insurance companies may provide temporary policies to facilitate the driver in obtaining their full license.

If an insured lacks a driver’s license, their policy may be canceled. Not all insurers cover those with suspended or provisional licenses. Adding a provisional driver without notification can lead to policy cancellation. However, some insurers offer car insurance for drivers with a suspended license under certain conditions.

It is always good to check with your car insurance providers prior to adding provisional drivers to know how the company handles them. Also, new provisional drivers are often seen as inexperienced. They are seen as high-risk because they have not been licensed long.

Progressive stands out as an innovation leader, offering personalized coverage solutions and empowering provisional license holders like Sarah to manage their insurance seamlessly.

Melanie Musson Published Insurance Expert

Therefore, driving on a provisional license may cause your rates to increase. Now that you know what is a provisional driver license, let’s find out how to get car insurance with a provisional driver’s license.

Insuring Provisional Drivers: Tips and Considerations

Do you need car insurance with a learner’s permit? In most cases, you’ll need to inform the insurance company that you’re a provisional driver without a full license, typically holding a learner’s permit. They might issue a temporary policy until you obtain your full license. It’s advisable to add a young driver with a learner’s permit to an existing policy.

However, expect a likely increase in rates. Shopping around for the best rate when making significant policy changes is crucial to saving money. Each insurance company treats provisional drivers differently, so honesty with your agent is key to avoid future complications. Remember, failing to add a provisional driver to your policy when needed could be considered rate evasion and may lead to increased rates or policy cancellation.

The table displays monthly car insurance rates for drivers with a provisional license, categorized by insurance provider and coverage level. It lists rates for ten providers: AAA, Allstate, Esurance, Farmers, Liberty Mutual, Nationwide, Progressive, State Farm, Travelers, and USAA. Rates are shown for both minimum coverage, ranging from $100 to $200, and full coverage, spanning from $250 to $370.

This breakdown helps compare the costs across different providers and coverage levels, aiding in informed decision-making for provisional license holders seeking insurance.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

The Influence of Provisional Driver’s Licenses on Auto Insurance Premiums

If you are a new driver, your inexperience on the road means higher rates until you reach 25 years old. About 10 years’ worth of driving history is the average time needed to lower your risk factor. Adding an individual with a provisional driver’s license to a pre-existing car insurance policy may be one way to keep rates down. However, doing so will cause the original policy holder’s rates to go up.

If a driver has a suspended license and needs proof of insurance, like an SR-22 form, to regain their full license, an insurance company may issue a policy under car insurance for drivers with a suspended license. When a provisional driver’s old policy was canceled due to a suspension and they seek to purchase a new policy and file for SR-22 insurance, they may face higher rates.

When looking for insurance with a provisional driver’s license it is always best to shop around with different insurance carriers. Not only does this help you find the best rate, but it also helps you find companies willing to insure drivers with provisional driver’s licenses.

Effects of Provisional Driver’s Licenses on Car Insurance Rates

Males with a provisional driver’s license will pay more for insurance than a female with a provisional driver’s license. According to Quality Planning, teen males have more car accidents at a rate of four to one. These statistics determine the insurance rates for males versus females, and they will affect your rates for the rest of your life.

However, as you age, the division between genders changes as far as price goes, as the number of accidents involving male drivers decreases after they reach the age of 27. If you are looking to save money on your teen’s car insurance, whether they have a provisional driver’s license or a regular one, then you need to ensure that your child takes both driver’s education courses and defensive driving classes.

Many schools offer driver’s education classes with defensive driving included. While you are still going to pay more for your child’s insurance than you will for an adult of the same gender, taking courses that teach safe driving techniques will at least get you a discount on those rates of between 10 and 25%. Naturally, you will also want to compare rates between car insurance companies.

Car Insurance Monthly Rates for Provisional License by Age, Gender, & Provider

| Insurance Company | 20-Year-Old Female | 20-Year-Old Male | 30-Year-Old Female | 30-Year-Old Male | 45-Year-Old Female | 45-Year-Old Male |

|---|---|---|---|---|---|---|

| AAA | $200 | $220 | $180 | $200 | $180 | $200 |

| Allstate | $220 | $240 | $200 | $220 | $200 | $220 |

| Esurance | $180 | $200 | $160 | $180 | $160 | $180 |

| Farmers | $210 | $230 | $190 | $210 | $190 | $210 |

| Liberty Mutual | $230 | $250 | $210 | $230 | $210 | $230 |

| Nationwide | $180 | $200 | $160 | $180 | $160 | $180 |

| Progressive | $190 | $210 | $170 | $190 | $170 | $190 |

| State Farm | $200 | $220 | $180 | $200 | $180 | $200 |

| Travelers | $190 | $210 | $170 | $190 | $170 | $190 |

| USAA | $150 | $170 | $140 | $160 | $140 | $160 |

Discover the varying monthly car insurance rates for provisional license holders across different ages and genders with our comprehensive comparison. From young adults to middle-aged individuals, explore the premiums offered by top insurers like AAA, Allstate, Esurance, Farmers, Liberty Mutual, Nationwide, Progressive, State Farm, Travelers, and USAA.

As illustrated in the table, rates for provisional license holders fluctuate based on age, gender, and insurer, with premiums ranging from $140 to $250 per month. Whether you’re a 20-year-old female or a 45-year-old male, finding the right coverage at an affordable rate is crucial. Take advantage of this insightful comparison to make an informed decision and secure the insurance that best fits your needs and budget.

Coverage for Teen Drivers in Provisional Car Insurance

Teens embarking on their driving journey require adequate coverage, typically provided by teen car insurance, especially with a provisional car insurance policy. Learning alongside a friend or family member can be a cost-effective option post obtaining a learner’s permit, enabling teens to gain valuable real-world driving experience.

While some opt for formal driving schools, others prefer informal instruction, though finding affordable insurance for young drivers remains challenging. Provisional driver’s insurance offers parents or guardians the means to safeguard teens during their learning phase, acknowledging the heightened risk of accidents.

This coverage instills a sense of security, ensuring protection in the event of an accident during the learning process, backed by the assurance of support from the insurance company.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Reasons to Opt for Provisional Car Insurance

Accidents can happen to everyone, whether they have been driving for two months or ten years. Provisional car insurance is used in case anything does happen while a teen is learning to drive. Once they have their license, they will be legally required to be covered by the minimum car insurance required by the state.

Getting a teen insured before they are covered by an car insurance policy will allow them to better understand all about the various aspects of insurance. Although many people may choose to let their teens drive without insurance thinking that nothing bad will happen, it is not wise to do so. People who choose to remain optimistic often end up unprepared for dealing with accidents.

Provisional car insurance coverage covers teens while they are learning a difficult skill while at the same time protecting parents from paying out of pocket if there are any accidents.

Locating Provisional Car Insurance

In many states, individuals aged 16 or older must be included in a car insurance policy, with provisional car insurance typically carrying higher rates than those for licensed drivers. To secure the best full coverage, several steps should be followed: Begin by researching various insurance companies through search engines, phonebooks, or referrals to compile a list of options.

Next, compare quotes, considering prices, policy limits, terms, and any exclusions to identify the most suitable policy within your budget. Finally, select the policy that best meets your family’s needs and provides adequate coverage. Additionally, ensure that a licensed driver aged at least 18, without restrictions on their license, accompanies the teen driver at all times during their learning process.

Saving on Car Insurance for Provisional License Holders

US drivers must insure their teens with a standard car insurance policy before they can legally drive. Some car insurance companies offer car insurance discounts for teens such as the Good Student Discount. Additionally, some states require teens to have car insurance before they can get their license.

When you have a child with a provisional driver’s license, you may be looking for provisional car insurance to lower the cost of your car insurance. Unfortunately, in the US, there is no option to purchase provisional car insurance. This is only something available overseas.

Progressive's commitment to tailored coverage solutions ensures optimal protection for provisional drivers, backed by user-friendly tools and up to 30% discounts.

Michelle Robbins Licensed Insurance Agent

No matter what state you live in or what type of license your teen has, they are required to have car insurance coverage before they can get behind the wheel of their vehicle.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Exploring Options Beyond Provisional Car Insurance

In certain states like North Carolina, having car insurance is mandatory before obtaining a driver’s license, extending to provisional licenses. While a dedicated provisional car insurance policy isn’t available, an alternative is a non-owner car insurance policy, suitable for individuals without their own vehicle but needing coverage while driving others’ cars.

However, this option isn’t applicable if the individual regularly drives a specific vehicle. Non-owner policies offer flexibility, ideal for parents of teen drivers, as they can maintain separate coverage without affecting existing policies. These policies meet state requirements without additional coverage, offering potential savings on premiums.

Absence of Provisional Coverage

Many states require teens to carry a provisional license. A provisional license is a driver’s license that restricts the driver from certain activities while driving. Typically, these restrictions apply to driving after 9 p.m. or transporting other people under a certain age. With these types of restrictions, it seems plausible that a provisional car insurance policy would be available to teen drivers.

A policy that takes into account their reduced driving ability, such as a provisional car insurance policy, makes sense. Unfortunately, insurance companies are bound by the states requirements for all drivers, which is that they are required to carry a certain amount of insurance.

Insurance companies do make certain allowances for how a person drives and, while that isn’t shown on a provisional car insurance policy, it is possible to receive some discounts for limited driving time.

Factors Influencing Teen Car Insurance Costs

Teen car insurance typically comes at a higher cost compared to insurance for adults, reflecting statistics showing that over half of US accidents involve teenage drivers. Moreover, teen drivers are more prone to accidents resulting in fatalities, contributing to elevated premiums.

Gender also plays a role, with insurance for teen boys generally being more expensive due to higher risk factors. To mitigate costs, consider enrolling your teen in training courses and encouraging good grades for potential discounts. Defensive driving courses post-licensing can further reduce rates.

However, financing a new vehicle and subsequent comprehensive insurance can be costly, especially if your teen has a history of accidents. It’s crucial to understand how insurance premiums are determined and to prioritize safety and responsible driving habits to minimize risks and expenses.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Case Study Section: Empowering Individuals With Provisional Licenses

In the realm of car insurance, personalized solutions are vital, especially for those with provisional licenses. These case studies showcase leading insurers’ innovative approaches to tailoring coverage for such drivers.

- Case Study #1 – Innovation in Tailored Coverage: Sarah, a young driver with a provisional license, benefited from Progressive’s personalized coverage solutions, including young driver car insurance rates. Using their online tools, she customized her policy, accessing discounts of up to 30%, enabling seamless management of her insurance.

- Case Study #2 – Dedicated Support for Military Member: John, a military service member with a provisional license, found valuable support with USAA, which offered discounts of up to 25% and specialized coverage for military families, ensuring comprehensive protection tailored to his unique needs.

- Case Study #3 – Personalized Assistance: Emily, a provisional license holder, found personalized support with State Farm, benefiting from up to 15% discounts and a range of coverage options tailored to her needs. These case studies showcase how insurance providers like Progressive, USAA, and State Farm offer tailored solutions to provisional license holders.

These case studies exemplify insurers’ commitment to providing tailored solutions and steadfast support for provisional license holders.

With an impressive customer review rating of 95%, Progressive stands out as the top choice for tailored coverage solutions for provisional license holders.

Brandon Frady Licensed Insurance Agent

Through innovative tools, military discounts, and personalized assistance, insurers are reshaping the insurance landscape to ensure drivers with provisional licenses receive the protection they need.

Smart Strategies for Affordable Car Insurance With a Provisional License

Save on insurance for provisional drivers. Insurance for teens is higher than for safe-driving adults. Opt for liability-only coverage or meet state minimums, especially if your teen owns a vehicle. Selecting a modern model can inflate premiums.

Shop around for the best price; costs vary between companies. Explore other options for savings, including safe driver car insurance discounts.

When you’re ready to see how much you can save on your car insurance, enter your ZIP code below into our free comparison tool.

Frequently Asked Questions

Can you get insurance with a provisional license, and how does it work?

Yes, you can obtain insurance with a provisional license, typically designed for learners. Insurance companies offer specific policies for provisional drivers, providing coverage while they gain driving experience.

Referencing our comprehensive report titled “Do you need car insurance with a learner’s permit?” provides further insights into this topic.

Can I add a provisional driver to my insurance policy?

Yes, many insurance companies allow adding a provisional driver to an existing policy. Contact your insurer to discuss adding a provisional driver to your coverage.

Get the minimum car insurance coverage you need to drive legally by entering your ZIP code into our free quote comparison tool below.

What is provisional driver insurance, and who needs it?

Provisional driver insurance is tailored coverage for individuals holding a provisional license, usually teenagers learning to drive. It’s essential for those with temporary licenses seeking protection on the road.

Consult our comprehensive analysis titled “Best Temporary Car Insurance for Drivers Under 21” for a comprehensive overview, ensuring you make an informed decision.

Are there any restrictions or conditions for adding a provisional driver to my insurance?

Insurance companies may impose certain restrictions or conditions when adding a provisional driver to your policy, such as limitations on driving hours or requirements for supervision by a licensed driver.

What factors determine the cost of provisional insurance?

Several factors influence the cost of provisional insurance, including the driver’s age, location, driving record, and the type of vehicle being insured. Younger drivers and high-performance vehicles typically result in higher premiums.

How can I find cheap insurance for provisional drivers?

Researching and comparing quotes from various insurance providers is the best way to find affordable coverage for provisional drivers. Look for insurers offering discounts or specialized policies for learners.

For valuable insights, refer to our comprehensive guide on “How do you get competitive quotes for car insurance?” and find the best deals available.

Can I get insurance with a provisional license for a temporary period?

Yes, some insurers offer short-term provisional insurance policies tailored for individuals with temporary licenses. These policies provide coverage for a specified duration, offering flexibility for learners.

How do I add a provisional driver to my car insurance?

To add a provisional driver to your car insurance, contact your insurance provider and inform them of your intention. They will guide you through the process and update your policy accordingly.

Comparing quotes is the easiest way to find affordable car insurance. Simply enter your ZIP code below into our free comparison tool to see rates in your area.

Does a provisional driver need insurance when learning to drive?

Yes, individuals with provisional licenses must have insurance coverage while learning to drive. It’s a legal requirement in many jurisdictions to ensure financial protection in case of accidents.

For deeper insight, consult our extensive guide named “Understanding Car Accidents,” offering valuable information on this topic.

Can adding a provisional driver to my insurance affect my premiums?

Adding a provisional driver to your insurance may impact your premiums, as insurers consider factors such as the driver’s age, driving history, and the type of vehicle being insured. Contact your insurer to understand how adding a provisional driver may affect your rates.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.