Best Honda Accord Car Insurance in 2025 (Find the Top 10 Companies Here!)

Get the best Honda Accord car insurance with AAA, Allstate, and Erie, offering top overall coverage. AAA provides reliable service, Allstate offers competitive rates, and Erie ensures affordable protection. Monthly rates start at $42, making it easy to compare and save on your Honda Accord insurance.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

UPDATED: Jan 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jan 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

3,027 reviews

3,027 reviewsCompany Facts

Full Coverage for Honda Accord

A.M. Best Rating

Complaint Level

Pros & Cons

3,027 reviews

3,027 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage for Honda Accord

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews 1,883 reviews

1,883 reviewsCompany Facts

Full Coverage for Honda Accord

A.M. Best Rating

Complaint Level

Pros & Cons

1,883 reviews

1,883 reviews

The best Honda Accord car insurance providers are AAA, Allstate, and Erie, offering top overall coverage. AAA stands out for its reliable service, competitive rates, and excellent customer satisfaction, making it our top pick.

Allstate provides comprehensive policies with competitive pricing, while Erie ensures affordability without compromising protection. Monthly rates start at just $42, making it easy to find budget-friendly options. For additional insights, refer to our “Compare 2018 Honda Fit Car Insurance Rates.”

Our Top 10 Company Picks: Best Honda Accord Car Insurance

Company Rank Multi-Vehicle Discount A.M. Best Best For Jump to Pros/Cons

#1 10% A Online App AAA

#2 18% A+ Add-on Coverages Allstate

#3 12% A+ 24/7 Support Erie

#4 20% A++ Military Savings USAA

#5 15% B Many Discounts State Farm

#6 17% A+ Innovative Programs Progressive

#7 14% A+ Usage Discount Nationwide

#8 16% A++ Custom Plan Geico

#9 13% A Customizable Polices Liberty Mutual

#10 19% A Local Agents Farmers

Various factors like age, location, and driving record impact individual rates, but these companies consistently offer the best deals. Honda Accord owners can benefit from safety features that lower insurance costs. Take the first step toward cheaper car insurance rates. Enter your ZIP code to see how much you could save.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – AAA: Top Overall Pick

Pros

- Reliable Coverage: AAA offers comprehensive coverage options for the Honda Accord, ensuring peace of mind.

- Roadside Assistance: With AAA, Honda Accord owners can benefit from superior roadside assistance services.

- Discounts: AAA provides various discounts for Honda Accord drivers, such as multi-policy and safe driver discounts. Look at our “AAA Car Insurance Discounts” for expanded insights.

Cons

- Membership Requirement: AAA requires membership to access their insurance, which can be an additional cost for Honda Accord owners.

- Price Variability: Honda Accord insurance rates with AAA can vary significantly depending on the region.

#2 – Allstate: Best for Reliable Insurance for Car Owners

Pros

- Multiple Discounts: Allstate offers multiple discounts for Honda Accord owners, including new car and safe driving discounts.

- Accident Forgiveness: Honda Accord drivers can benefit from Allstate’s accident forgiveness program. Gain a deeper understanding through our “Allstate Car Insurance Review.“

- Good Coverage Options: Allstate provides a variety of coverage options tailored to the Honda Accord.

Cons

- Higher Premiums: Allstate’s insurance premiums for the Honda Accord can be higher compared to other insurers.

- Mixed Customer Service Reviews: Some Honda Accord owners report mixed experiences with Allstate’s customer service.

#3 – Erie: Best for Affordable Protection for Your Car

Pros

- Competitive Rates: Erie offers competitive insurance rates for the Honda Accord.

- Strong Customer Service: Honda Accord drivers often praise Erie for its excellent customer service. Obtain further insights from our “Erie Car Insurance Review.”

- Comprehensive Coverage: Erie provides robust coverage options for the Honda Accord, including comprehensive and collision.

Cons

- Limited Availability: Erie insurance is not available in all states, which can limit options for some Honda Accord owners.

- Fewer Discounts: Erie may offer fewer discounts for the Honda Accord compared to larger insurers.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#4 – USAA: Best for Exclusive Coverage for Military Families

Pros

- Excellent Customer Service: USAA is known for its top-notch customer service for Honda Accord owners.

- Affordable Rates: USAA offers very competitive rates for insuring the Honda Accord. Enhance your comprehension with our “USAA Car Insurance Review.”

- Exclusive Military Benefits: Honda Accord owners who are military members can benefit from USAA’s unique perks and benefits.

Cons

- Eligibility Restrictions: Only military members and their families are eligible for USAA, limiting access for some Honda Accord owners.

- Digital-First Approach: Some Honda Accord drivers may find USAA’s digital-first approach less personal.

#5 – State Farm: Best for Trusted Insurance Nationwide

Pros

- Wide Agent Network: State Farm has a vast network of agents to assist Honda Accord owners. Unlock additional information in our “State Farm Car Insurance Review.”

- Multiple Discounts: Honda Accord drivers can benefit from various discounts offered by State Farm.

- Solid Financial Standing: State Farm’s strong financial stability ensures reliable coverage for the Honda Accord.

Cons

- Higher Rates for Young Drivers: Young Honda Accord drivers might find State Farm’s rates higher.

- Mixed Reviews on Claims: Some Honda Accord owners report mixed experiences with State Farm’s claims process.

#6 – Progressive: Best for Innovative Insurance Solutions

Pros

- Usage-Based Insurance: Progressive offers usage-based insurance for Honda Accord drivers through their Snapshot program.

- Competitive Pricing: Honda Accord owners often find competitive pricing with Progressive. Find out more by reading our “Progressive Car Insurance Review.”

- Online Tools: Progressive provides excellent online tools and resources for Honda Accord insurance.

Cons

- Service Variability: Customer service experiences for Honda Accord drivers can vary widely with Progressive.

- Potential Rate Increases: Some Honda Accord owners report significant rate increases after the first policy term.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#7 – Nationwide: Best for Comprehensive Insurance Options

Pros

- Vanishing Deductible: Honda Accord owners can benefit from Nationwide’s vanishing deductible program.

- Strong Coverage Options: Nationwide offers comprehensive coverage options tailored to the Honda Accord. Get the full story by checking out our “Nationwide Car Insurance Discounts .”

- Good Customer Service: Many Honda Accord drivers report positive experiences with Nationwide’s customer service.

Cons

- Higher Premiums: Honda Accord insurance premiums with Nationwide can be higher compared to some competitors.

- Limited Discounts: There may be fewer discount opportunities for Honda Accord drivers compared to other insurers.

#8 – Geico: Best for Cost-Effective Insurance

Pros

- Affordable Rates: Geico is known for offering affordable rates for the Honda Accord. Elevate your knowledge with our “Geico Car Insurance Review.”

- Wide Range of Discounts: Honda Accord owners can benefit from a wide range of discounts with Geico.

- Strong Online Presence: Geico provides excellent online tools and resources for Honda Accord insurance.

Cons

- Mixed Customer Service: Some Honda Accord owners report mixed experiences with Geico’s customer service.

- Policy Management: Honda Accord drivers might find Geico’s policy management less personalized compared to agents.

#9 – Liberty Mutual: Best for Custom Coverage Plans

Pros

- Customizable Coverage: Liberty Mutual offers customizable coverage options for the Honda Accord. Learn more about our “Liberty Mutual Car Insurance Review” for a broader perspective.

- Accident Forgiveness: Honda Accord owners can benefit from Liberty Mutual’s accident forgiveness program.

- Discount Opportunities: Liberty Mutual provides various discount opportunities for Honda Accord drivers.

Cons

- Higher Rates: Honda Accord insurance premiums with Liberty Mutual can be on the higher side.

- Mixed Claim Experiences: Some Honda Accord owners report mixed experiences with Liberty Mutual’s claims process.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#10 – Farmers: Best for Personalized Insurance for Your Car

Pros

- Comprehensive Coverage: Farmers offers comprehensive coverage options for the Honda Accord.

- Strong Agent Network: Honda Accord owners can benefit from Farmers’ extensive agent network.

- Personalized Service: Farmers is known for providing personalized service to Honda Accord drivers. Gain deeper insights by exploring our “Farmers Car Insurance Review.”

Cons

- Higher Premiums: Farmers’ insurance premiums for the Honda Accord can be higher than average.

- Limited Discounts: There may be fewer discounts available for Honda Accord drivers compared to other insurers.

Honda Accord Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

AAA $56 $151

Allstate $63 $193

Erie $76 $236

Farmers $63 $186

Geico $93 $260

Liberty Mutual $76 $238

Nationwide $71 $211

Progressive $65 $190

State Farm $75 $216

USAA $42 $138

Farmers and Geico also feature a range of pricing, depending on the level of coverage chosen. Liberty Mutual, Nationwide, Progressive, and State Farm present additional choices, each with its unique rate structures. USAA stands out with favorable rates, particularly for comprehensive coverage.

Compare these options to find the best fit for your needs. Gain deeper insights by perusing our article named “Compare Honda CR-V Car Insurance Rates.”

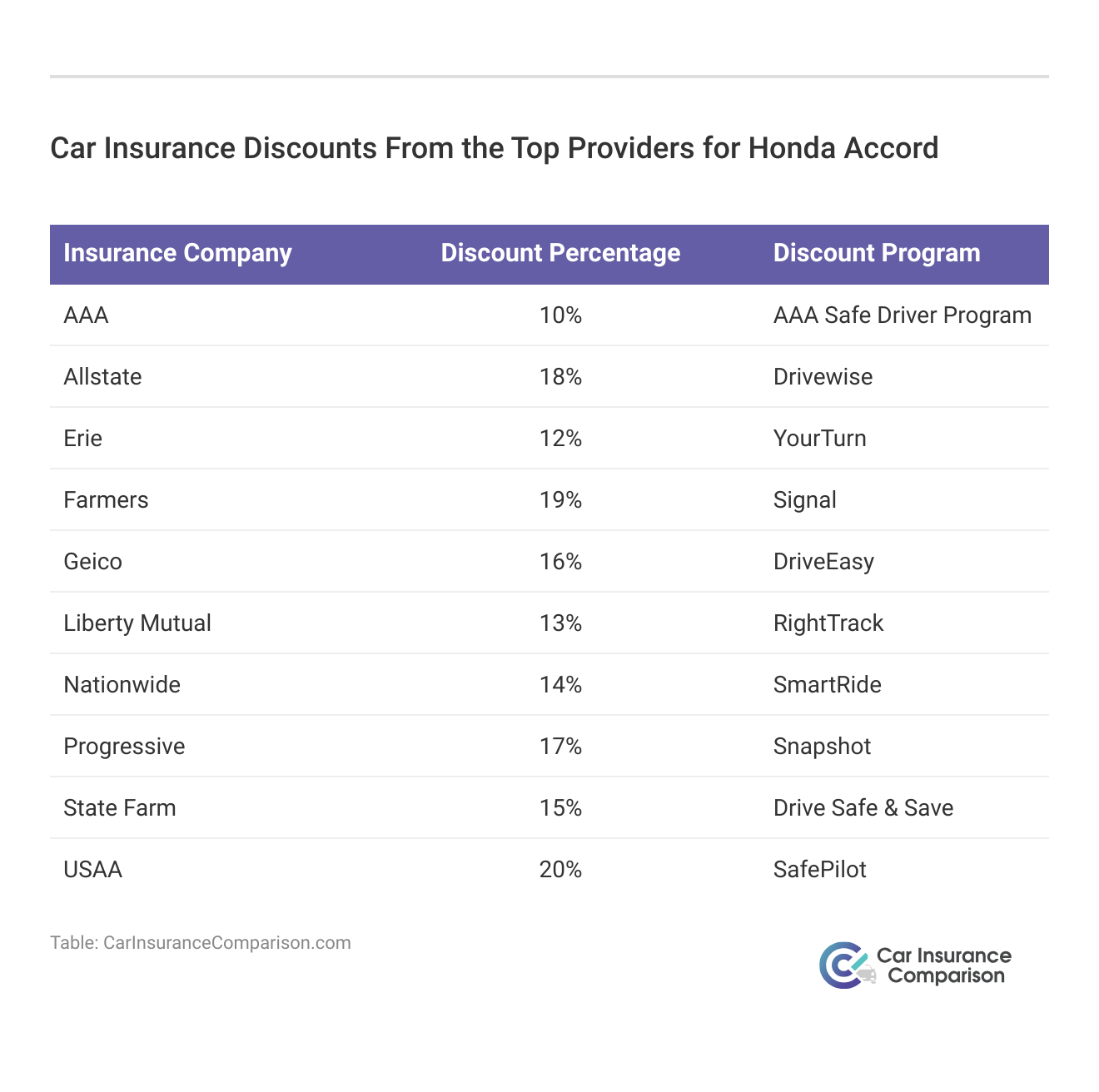

Unlock Savings with Top Honda Accord Insurers

Explore the top car insurance discounts available for Honda Accord owners. Each provider offers unique savings programs, ranging from AAA’s Safe Driver Program to USAA’s SafePilot. Compare discounts from leading insurers to find the best rate for your coverage needs.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Honda Accord Insurance Cost

Insurance costs for the Honda Accord are influenced by its reputation for safety, reliability, and overall affordability. As a popular midsize sedan, the Accord benefits from favorable safety ratings and a lower likelihood of costly repairs, which can help keep insurance premiums in check.

Factors such as the model year, trim level, and any advanced safety features also play a role in determining insurance costs. Additionally, the Accord’s wide availability of parts and relatively low repair costs contribute to its generally manageable insurance rates.

Overall, the Honda Accord is often viewed as a cost-effective choice for drivers seeking comprehensive coverage at a reasonable price. Explore further in our article titled “Compare Honda vs. Ford Car Insurance Rates.”

Honda Accord Insurance Costs Explained

Honda Accord insurance costs are shaped by several key factors, including the vehicle’s safety features, repair expenses, and the driver’s profile. The Accord’s strong safety ratings and reliable performance typically lead to more favorable insurance rates.

The model year and trim level can also impact costs, as newer models with advanced technology may come with higher premiums due to increased repair or replacement expenses. Additionally, factors such as the driver’s age, location, and driving history are critical in determining overall insurance costs.

By understanding these elements, drivers can better manage their insurance expenses and find appropriate coverage for their Honda Accord. Delve into the specifics in our article called “Compare 2018 Honda Fit Car Insurance Rates.”

The Honda Accord trim and model you choose can impact the total price you will pay for Honda Accord insurance coverage. Unlock additional information in our “Factors That Affect Car Insurance Rates.”

Age of the Vehicle

Driver Age

Driver Location

Your Driving Record

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Honda Accord Safety Ratings

Honda Accord Safety Features

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Honda Accord Insurance Loss Probability

This fluctuation in loss probability reflects the vehicle’s overall risk profile and affects how insurers set their rates. Understanding these probabilities can help drivers better manage their insurance costs and choose the most cost-effective coverage options.

Broaden your knowledge with our article named “Top 10 Most Popular Cars.”

Honda Accord Finance and Insurance Cost

If you are financing a Honda Accord, buying insurance directly from the dealership can often lead to higher premiums. Dealerships may offer convenience but usually do not provide the most competitive rates.

By comparing quotes, you can potentially save a significant amount on your auto insurance while still meeting your financing requirements. Gain insights by reading our article titled “Compare Car Insurance Rates by Vehicle Make and Model.”

5 Smart Tips to Slash Your Honda Accord Car Insurance Costs

You have more options at your disposal to save money on your Honda Accord car insurance costs. For example, try these five tips:

- Ask about mature driver discounts for drivers over 50.

- Ask for a Honda Accord discount if you have a college degree or higher.

- Consider renting a car instead of buying a second Honda Accord.

- Compare Honda Accord quotes for free online.

- If you’re a young driver living at home, add yourself to your parent’s plan.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Compare Free Honda Accord Insurance Quotes Online

To start comparing Honda Accord car insurance quotes for free, use our online car insurance comparison tool.

How expensive is car insurance for a Honda Accord? For sheer reliability, customer loyalty, and reasonable price, practically no car brand matches the Honda Accord’s legendary track record.

It is not any surprise that these cars rank in the top five best-selling cars in the United States every year, generally just behind or in front of the Toyota Camry and Toyota Corolla.

A prospective buyer of a new Honda Accord will likely wonder how much they will have to pay for car insurance if they purchase this impressive new vehicle. Read on to learn some of the things that contribute to the Honda Accord’s car insurance costs and then enter your ZIP code to compare Honda Accord auto insurance quotes online.

For further details, consult our article named “Best Car Insurance for Modified Cars.”

Safety Features of the Honda Accord

- Anti-Lock Braking System (ABS): Standard four-wheel anti-lock disc brakes with Electronic Brake Distribution (EBD) help maintain vehicle control during difficult braking conditions.

- Dual-Stage, Multiple-Threshold Front Airbags (SRS): Front airbags that deploy at different intensities depending on the severity of the collision.

- Dual-Chamber Front Side Airbags with Passenger-Side Occupant Position Detection System (OPDS): Front-side airbags designed to provide additional protection for the front passengers.

- Side Curtain Airbags: Standard front, front side, and side curtain airbags reduce the risk of injury in the event of a side collision.

- Driver’s and Front Passenger’s Active Head Restraints: Designed to reduce the risk of neck injuries in rear-end collisions.

Honda Accords come equipped standard with a security system. Insurance companies generally give discounts to vehicles that possess alarms or security systems. Explore further with our article entitled “Can you drive a car with airbags deployed?“

Honda Accord Performance Features

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Compare Honda Accord Car Insurance Rates

A car buyer must never forget the importance of shopping around and comparing quotes from many different insurance companies so that they can find the best car insurance rates for their vehicle.

Although various factors influence Honda Accord car insurance rates, consumers can generally expect to pay an average amount for coverage.

Keep in mind that this is only a guideline number and that the insurance rates will vary not only by region to region, but also by state, and even by city. Get a better grasp by reading our article titled “Safest Cars in America.”

Enter your ZIP code below now to compare personalized Honda Accord auto insurance rates!

Frequently Asked Questions

What factors should I consider when choosing the best insurance for my Honda Accord?

Consider factors like coverage options, premium costs, customer service, claim handling, and discounts available for safety features or bundling policies. Uncover additional insights in our article called “Understanding Your Car Insurance Policy.”

Are there specific insurance providers known for offering the best coverage for Honda Accords?

Providers like Geico, State Farm, Progressive, and Allstate are often recommended due to their competitive rates and comprehensive coverage options for Honda Accord owners.

How does the model year of my Honda Accord affect my insurance rates?

Newer models may have higher insurance rates due to their higher replacement costs and value. However, they may also qualify for discounts due to advanced safety features. Finding cheap car insurance quotes is easy. Just enter your ZIP code into our free comparison tool to instantly compare quotes near you.

What are the typical insurance costs for a Honda Accord compared to other sedans?

Insurance costs for a Honda Accord are generally moderate compared to other sedans, balancing affordability and reliability. Rates can vary based on location, driver profile, and specific model. Explore further details in our “How much car insurance coverage do I need for a new car?“

Can I get discounts on car insurance for my Honda Accord?

Yes, you can often get discounts for features like anti-theft devices, good driving records, bundling policies, and advanced safety features.

What types of coverage should I include in my Honda Accord insurance policy?

Essential coverages include liability, comprehensive, collision, uninsured/underinsured motorist, and possibly gap insurance if the car is financed. Shop for the best liability-only car insurance with our free quote comparison tool. Enter your ZIP code to begin.

How does my driving record impact the insurance premium for my Honda Accord?

A clean driving record can significantly lower your premium, while accidents, traffic violations, and DUIs can increase it. Dive deeper into our “What cars will increase the cost of insurance?” for a comprehensive understanding.

Is it more expensive to insure a new Honda Accord versus a used one?

Generally, insuring a new Honda Accord is more expensive due to its higher value and replacement cost. However, new cars may qualify for additional safety discounts.

What is the best way to compare insurance quotes for a Honda Accord?

Use online comparison tools, get quotes from multiple insurers, and consider both price and coverage details to find the best option. Take the first step toward cheaper car insurance rates. Enter your ZIP code to see how much you could save.

How can I lower my insurance premium for my Honda Accord?

You can lower your premium by maintaining a clean driving record, increasing your deductible, taking advantage of discounts, and bundling with other insurance policies. Delve into the depths of our “The Most Fuel-Efficient Cars” for additional insights.

Does the Honda Accord have any safety features that can reduce my insurance costs?

Yes, features like anti-lock brakes, airbags, adaptive cruise control, and collision warning systems can qualify you for discounts.

What is the average insurance premium for a Honda Accord per year?

The average annual premium can vary widely but typically ranges from $1,200 to $1,500, depending on factors like location, driver profile, and coverage options.

Do insurance companies offer special plans or benefits for Honda Accord owners?

Some insurers may offer tailored plans or benefits, such as loyalty discounts or special rates for certain model years with advanced safety features. Uncover more about our “Classic vs. Standard Car Insurance” by reading further.

How does the location where I live affect my Honda Accord insurance rates?

Insurance rates can be higher in areas with high traffic, crime rates, or accident statistics. Urban areas typically have higher rates than rural areas.

Are there any specific insurance riders recommended for a Honda Accord?

Consider riders like gap insurance, roadside assistance, and rental car reimbursement to enhance your coverage.

What should I do if I have an accident with my Honda Accord?

Ensure everyone’s safety, call the police, exchange information with the other driver, document the scene, and contact your insurance company to file a claim. Expand your understanding with our “Buying Car Insurance for Your New Car.”

How does my credit score affect my Honda Accord insurance premium?

Insurers often use credit scores to predict risk; a higher credit score can result in lower premiums, while a lower score might increase rates.

Can I get gap insurance for my Honda Accord, and is it necessary?

Yes, gap insurance is available and recommended if you owe more on your loan or lease than the car’s current value, as it covers the difference in case of total loss. See how much you’ll pay for car insurance by entering your ZIP code into our free comparison tool.

What is the difference between comprehensive and collision coverage for a Honda Accord?

Comprehensive coverage pays for damage from non-collision events like theft or natural disasters, while collision coverage pays for damage resulting from a collision with another vehicle or object. Learn more about our “Do red cars cost more for car insurance coverage?” for a broader perspective.

Are there insurance options available for modified or custom Honda Accords?

Yes, some insurers offer specialized policies or riders for modified or custom cars. Ensure that all modifications are disclosed to get appropriate coverage.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.