Best Lexus ES 350 Car Insurance in 2025 (Your Guide to the Top 10 Companies)

Geico, USAA, and State Farm offer the best Lexus ES 350 car insurance starting at $62 monthly. These providers lead due to their competitive rates, comprehensive coverage options, and strong customer service records, ensuring value and reliability for Lexus ES 350 owners, making them top choices.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

UPDATED: Jan 9, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jan 9, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for Lexus ES 350

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage for Lexus ES 350

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Lexus ES 350

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews

The best Lexus ES 350 car insurance are Geico, USAA, and State Farm, renowned for their comprehensive coverage and competitive service.

These companies are distinguished by their ability to balance cost, coverage options, and customer satisfaction, making them standout choices for Lexus ES 350 owners. When shopping for insurance, it’s crucial to consider factors like the vehicle’s safety features and your personal driving history, as these can significantly affect premiums. Learn more in our guide titled “Best Lexus Car Insurance Rates.”

Our Top 10 Company Picks: Best Lexus ES 350 Car Insurance

Company Rank Multi-Vehicle Discount A.M. Best Best For Jump to Pros/Cons

#1 25% A++ Multi-Policy Discounts Geico

#2 15% A++ Customer Service USAA

#3 20% B Local Agent State Farm

#4 12% A+ Innovative Programs Progressive

#5 10% A+ Comprehensive Coverage Nationwide

#6 10% A Accident Forgiveness Liberty Mutual

#7 10% A+ Luxury Sedans Allstate

#8 10% A+ Personalized Service Farmers

#9 11% A+ Dividend Policies Amica

#10 8% A++ IntelliDrive Program Travelers

Comparing insurers reveals unique advantages, ensuring you find the best fit for your needs and budget.

Find cheap car insurance quotes by entering your ZIP code above.

#1 – Geico: Top Overall Pick

Pros

- Substantial Multi-Vehicle Discount: Geico offers a 25% discount for Lexus ES 350 owners who insure multiple vehicles.

- Top-Rated Financial Stability: Geico’s A++ A.M. Best rating ensures reliable coverage for Lexus ES 350. Learn more about Geico’s rates in our guide titled “Geico Car Insurance Review.”

- Competitive Premiums: Known for competitive rates, Geico provides affordable options for Lexus ES 350 insurance.

Cons

- Basic Coverage Options: Some Lexus ES 350 owners might find Geico’s coverage options less comprehensive.

- Customer Service Variability: Service experiences can vary, potentially affecting Lexus ES 350 owners who prefer consistent support.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#2 – USAA: Best for Customer Service

Pros

- Dedicated Support: USAA is known for exceptional customer service, beneficial for Lexus ES 350 owners. Find out why USAA ranks among the cheapest providers in our article titled “USAA Car Insurance Review.”

- Strong Financial Rating: With an A++ rating from A.M. Best, USAA promises strong backing for Lexus ES 350 insurance claims.

- Military and Family Benefits: Special rates and discounts for military members and their families owning a Lexus ES 350.

Cons

- Limited Eligibility: USAA services are only available to military members, veterans, and their families, restricting access for many Lexus ES 350 owners.

- Less Competitive Non-Military Rates: Non-military affiliated Lexus ES 350 owners may find better rates elsewhere.

#3 – State Farm: Best for Local Agent

Pros

- Bundling Policies: State Farm offers significant discounts for bundling multiple insurance policies for Lexus ES 350.

- High Low-Mileage Discount: Provides a substantial discount for Lexus ES 350 owners with low mileage usage.

- Wide Coverage: Various options tailored to meet the specific needs of Lexus ES 350 owners. Wondering about their level of customer service? Find out in our guide titled “State Farm Car Insurance Review.”

Cons

- Limited Multi-Policy Discount: The multi-policy discount for Lexus ES 350 insurance is lower compared to some competitors.

- Premium Costs: Despite discounts, premiums might still be relatively higher for certain coverage levels for Lexus ES 350.

#4 – Progressive: Best for Innovative Programs

Pros

- Snapshot Program: Progressive offers personalized rates with Snapshot, useful for safe Lexus ES 350 drivers.

- Strong Financial Outlook: A+ rating by A.M. Best ensures reliable claim support for Lexus ES 350 owners. Learn more about coverage options and monthly rates in our article titled “Progressive Car Insurance Review.”

- Multiple Discount Options: Offers various discounts that Lexus ES 350 owners can qualify for, enhancing affordability.

Cons

- Variable Customer Feedback: Customer satisfaction can vary, which might concern Lexus ES 350 owners seeking dependability.

- Higher Rates for High-Risk Drivers: Lexus ES 350 owners with prior claims or violations might face higher rates.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Comprehensive Coverage

Pros

- Broad Coverage Options: Nationwide offers extensive coverage choices, ideal for Lexus ES 350 owners seeking thorough protection.

- Vanishing Deductible: Nationwide reduces your deductible for each year of safe driving, beneficial for Lexus ES 350 owners.

- Strong Financial Health: A+ rating from A.M. Best ensures dependable coverage for Lexus ES 350 insurance. Explore more discount options in our guide titled “Nationwide Car Insurance Discounts.”

Cons

- Higher Premiums for Some Policies: Some Lexus ES 350 owners might find Nationwide’s premiums higher than competitors.

- Customer Service Variance: The quality of customer support can vary, which could impact Lexus ES 350 owners’ satisfaction.

#6 – Liberty Mutual: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Liberty Mutual offers accident forgiveness that may prevent premium increases after a first at-fault accident, beneficial for Lexus ES 350 owners.

- Customizable Policies: Provides highly customizable insurance options for Lexus ES 350, allowing owners to tailor their coverage.

- Multiple Discounts Available: Offers a range of discounts that can significantly lower premiums for Lexus ES 350 insurance. To see monthly premiums and honest rankings, read our guide titled “Liberty Mutual Car Insurance Review.”

Cons

- Variable Premiums: Premiums can vary greatly based on individual circumstances, potentially making it costly for some Lexus ES 350 owners.

- Mixed Customer Reviews: Customer service experiences can be inconsistent, which might concern Lexus ES 350 owners looking for reliable interactions.

#7 – Allstate: Best for Luxury Sedans

Pros

- Specialized Coverage for Luxury Cars: Allstate provides specific policies tailored for luxury vehicles like the Lexus ES 350, ensuring appropriate coverage.

- New Car Replacement: Offers new car replacement that can benefit Lexus ES 350 owners in case of total loss. Find more information about Allstate’s rates in our article titled “Allstate Car Insurance Review.”

- Safe Driving Bonuses: Rewards safe driving with bonuses and discounts, ideal for responsible Lexus ES 350 drivers.

Cons

- Higher Cost for Additional Features: Enhanced coverage options and benefits come at a higher cost, which might not suit all Lexus ES 350 budgets.

- Customer Satisfaction Variability: Some Lexus ES 350 owners might find the level of customer support less than satisfactory compared to other insurers.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#8 – Farmers: Best for Personalized Service

Pros

- Tailored Insurance Options: Farmers offers personalized service and customized policy options ideal for Lexus ES 350 owners.

- Dedicated Agents: Provides access to dedicated agents who can help Lexus ES 350 owners navigate their insurance needs effectively.

- Discounts for Multiple Policies: Significant discounts available for Lexus ES 350 owners who bundle their policies. Take a look at our article titled “Farmers Car Insurance Review.”

Cons

- Higher Premiums without Discounts: Without qualifying for discounts, Lexus ES 350 owners may find Farmers’ premiums higher than some competitors.

- Limited Coverage Innovations: Some Lexus ES 350 owners might seek more innovative coverage options not currently offered by Farmers.

#9 – Amica: Best for Dividend Policies

Pros

- Dividend Policies: Offers policies that can return a portion of the premium as dividends, providing potential savings for Lexus ES 350 owners.

- High Customer Satisfaction: Known for high customer satisfaction, Amica ensures a positive insurance experience for Lexus ES 350 owners.

- Competitive Pricing: Offers competitive pricing that can be advantageous for Lexus ES 350 owners looking for value. See average monthly rates in our guide titled “How do you get an Amica Mutual car insurance quote online?“

Cons

- Limited Availability: Amica’s coverage and services might not be available in all regions, affecting some Lexus ES 350 owners.

- Fewer Physical Locations: The lack of widespread physical branches might inconvenience Lexus ES 350 owners who prefer face-to-face service.

#10 – Travelers: Best for IntelliDrive Program

Pros

- Usage-Based Savings: Travelers’ IntelliDrive program tracks driving behavior and can reduce rates for safe Lexus ES 350 drivers.

- Wide Range of Discounts: Offers a variety of discounts that can lower the insurance costs for Lexus ES 350 owners. Read more about Travelers’ ratings in our article titled “Travelers Car Insurance Review.”

- Robust Coverage Options: Provides extensive and flexible coverage options that can meet the diverse needs of Lexus ES 350 owners.

Cons

- Program Availability: IntelliDrive is not available in all states, which could limit options for some Lexus ES 350 owners.

- Data Privacy Concerns: Some Lexus ES 350 owners might have concerns about the privacy implications of usage-based insurance programs.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Comparative Monthly Insurance Rates for Lexus ES 350

When selecting car insurance for the Lexus ES 350, it’s essential to compare both the minimum and full coverage rates offered by various providers. This information helps owners make an informed decision based on their budget and coverage needs. See more details on our guide titled “Types of Car Insurance Coverage.”

Lexus ES 350 Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $73 $155

Amica $67 $145

Farmers $74 $155

Geico $68 $145

Liberty Mutual $75 $160

Nationwide $70 $150

Progressive $70 $150

State Farm $72 $155

Travelers $71 $148

USAA $62 $140

The table below outlines the monthly rates for different insurance companies. For minimum coverage, rates range from as low as $62 by USAA to $75 by Liberty Mutual. In terms of full coverage, USAA again offers the lowest rate at $140 per month, while Liberty Mutual presents the highest rate at $160 per month.

Such variance highlights the importance of comparing rates to identify the most cost-effective and comprehensive insurance for your Lexus ES 350. Other providers like Geico and Amica also offer competitive rates for both coverage levels, making them viable options for Lexus owners seeking quality insurance without overstretching their budget.

What’s the Lexus ES 350 Average Insurance Cost

Wondering how much is a Lexus ES 350? The average Lexus ES 350 car insurance costs are $123 a month. Check out insurance savings in our complete article titled “Does car insurance follow the car or the driver?”

Lexus ES 350 Car Insurance Monthly Rates by Coverage Type

Type Rate

Discount Rate $72

High Deductibles $106

Average Rate $123

Low Deductibles $154

High Risk Driver $261

Teen Driver $448

The average Lexus ES 350 insurance cost of $123 per month underscores the importance of exploring rate comparisons and discounts to optimize your coverage and expenses.

How Much Does the Lexus ES Cost to Insure

The cost of ownership includes all the expenses, both obvious and hidden, of owning and operating a vehicle, excluding the purchase price. The hidden costs are depreciation and financing of the automobile loan. Add to these the insurance premiums, state fees, fuel, and maintenance and repair costs, to arrive at the yearly cost of ownership.

On a brand-new car, this cost is always higher the first year because of the larger amount of depreciation. The Lexus ES series has historically been a very reliable car with lower maintenance and repair costs than other similar vehicles. Thus, Automobile Magazine has rated it as an “Excellent Value” car in its report on the 350.

Obviously, these costs will vary by state and owner. The insurance costs alone can vary by hundreds of dollars a year from person to person and from one insurance company to the next. Discover more about offerings in our article titled “Minimum Car Insurance Requirements by State.”

Are Lexus ES 350s Expensive to Insure

The chart below details how Lexus ES 350 insurance rates compare to other luxury cars like the Audi A7, Lexus IS 300, and Cadillac CT6.

Lexus ES 350 Car Insurance Monthly Rates vs. Similar Vehicles by Coverage Type

Vehicle Comprehensive Collision Minimum Coverage Full Coverage

Lexus ES 350 $30 $55 $26 $123

Audi A7 $34 $70 $33 $150

Lexus IS 300 $30 $57 $33 $133

Cadillac CT6 $32 $65 $33 $143

Mercedes-Benz E300 $33 $62 $28 $134

Infiniti Q70 $31 $65 $28 $135

Cadillac CTS-V $34 $67 $28 $140

However, there are a few things you can do to find the cheapest Lexus insurance rates online.

Read more: Compare Mercedes Car Insurance Rates

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Is Lexus Insurance Expensive

If you live in a high-crime area, especially high in car thefts, expect to pay more. Those in larger cities tend to pay more while drivers in rural areas pay less. Where the car is stored can be a factor. If you have a home with a garage, be sure to mention that for an extra discount. Believe it or not, your occupation will also influence insurance premiums.

People who drive as part of their jobs, like salespeople and delivery personnel, have a higher probability of being in a wreck simply because they are on the road more. Thus, they will pay more than someone who sits behind a desk all day. Those who put a lot of miles on a car every year also pay more. Access comprehensive insights into our article titled “How much does mileage affect car insurance rates?”

Do you live in a flood area or an area often hit by hurricanes? You might think this would only affect your home owner’s insurance, but it can impact your car insurance as well. All of these factors are weighed by the insurance company when determining your premiums. Different companies might account for some of these differently, so it’s best to shop around.

What Impacts the Cost of Lexus ES 350 Insurance

What factors affect the cost of my insurance? The Lexus ES 350 trim and model you choose can impact the total price you will pay for Lexus ES 350 insurance coverage.

The type of car you own is not the only factor in determining the price you’ll pay for insurance premiums. Who you are and how you drive matter as well.

Geico leads with a 25% multi-vehicle discount, making it an exceptional choice for families insuring multiple Lexus ES 350s.

Scott W. Johnson Licensed Insurance Agent

Your age, whether you are male or female, and your marital status are primary statistics used by insurance companies. Married people and women tend to pay lower premiums, as do people who have been driving for several years. Delve into our evaluation of our guide titled “Why are car insurance rates higher for singles vs. married couples?”

Age Of the Vehicle

Older Lexus ES 350 models generally cost less to insure. For example, auto insurance for a 2020 Lexus ES 350 costs about $123 monthly, while 2010 Lexus ES 350 insurance costs approximately $96 monthly, a difference of $27.

Lexus ES 350 Car Insurance Monthly Rates by Model Year

Model Year Comprehensive Collision Minimum Coverage Full Coverage

2024 Lexus ES 350 $32 $58 $24 $130

2023 Lexus ES 350 $31 $57 $25 $128

2022 Lexus ES 350 $31 $56 $25 $127

2021 Lexus ES 350 $30 $55 $26 $125

2020 Lexus ES 350 $30 $55 $26 $123

2019 Lexus ES 350 $29 $53 $28 $120

2018 Lexus ES 350 $28 $52 $28 $119

2017 Lexus ES 350 $27 $51 $30 $118

2016 Lexus ES 350 $26 $49 $30 $116

2015 Lexus ES 350 $24 $47 $31 $114

2014 Lexus ES 350 $24 $44 $32 $111

2013 Lexus ES 350 $23 $41 $32 $107

2012 Lexus ES 350 $22 $37 $33 $102

2011 Lexus ES 350 $20 $34 $33 $98

2010 Lexus ES 350 $20 $32 $33 $96

The cost of insuring a Lexus ES 350 tends to decrease as the vehicle ages, reflecting lower premiums for older models.

Driver Age

Driver age can significantly impact Lexus ES 350 car insurance rates. For instance, a 30-year-old driver pays approximately $5 more each month for their Lexus ES 350 car insurance compared to a 40-year-old driver. Unlock details in our article titled “Best Car Insurance for New Drivers Over 21.”

Lexus ES 350 Car Insurance Monthly Rates by Age

Age Rates

Age: 16 $448

Age: 18 $352

Age: 20 $278

Age: 30 $128

Age: 40 $123

Age: 45 $118

Age: 50 $112

Age: 60 $109

Understanding how driver age influences Lexus ES 350 insurance costs can lead to more informed and potentially cost-saving decisions when selecting a policy.

Driver Location

Where you live can have a large impact on Lexus ES 350 insurance rates. For example, drivers in New York may pay approximately $32 a month more than drivers in Chicago. Discover insights in our guide titled “Best Chicago, IL Car Insurance.”

Lexus ES 350 Car Insurance Monthly Rates by City

State Rate

Los Angeles, CA $210

New York, NY $194

Houston, TX $192

Jacksonville, FL $178

Philadelphia, PA $164

Chicago, IL $162

Phoenix, AZ $142

Seattle, WA $119

Indianapolis, IN $104

Columbus, OH $102

Given the significant variations in Lexus ES 350 insurance rates by location, it’s clear that where you drive as much as how you drive can influence your annual premiums.

Your Driving Record

Your driving record can have an impact on the cost of Lexus ES 350 car insurance. Teens and drivers in their 20’s see the highest jump in their Lexus ES 350 car insurance rates with violations on their driving record.

Lexus ES 350 Car Insurance Monthly Rates by Age & Driving Record

Age Clean Record One Ticket One Accident One DUI

Age: 16 $448 $493 $537 $624

Age: 18 $352 $387 $421 $492

Age: 20 $278 $302 $341 $397

Age: 30 $128 $139 $168 $212

Age: 40 $123 $133 $162 $204

Age: 45 $118 $128 $157 $198

Age: 50 $112 $122 $151 $190

Age: 60 $109 $119 $148 $185

Maintaining a clean driving record is crucial, as violations and accidents can significantly increase Lexus ES 350 insurance costs, particularly for younger drivers.

Lexus ES 350 Safety Ratings

The Lexus ES 350’s safety ratings will affect your Lexus ES 350 car insurance rates. See the chart below:

Lexus ES 350 Safety Ratings

Test Rating

Small overlap front: driver-side Good

Small overlap front: passenger-side Good

Moderate overlap front Good

Side Good

Roof strength Good

Head restraints and seats Good

The consistent “Good” ratings across all test categories by the Insurance Institute for Highway Safety affirm the Lexus ES 350’s reputation as a safe vehicle, which can favorably influence your insurance rates.

Lexus ES 350 Crash Test Ratings

Not only do good Lexus ES 350 crash test ratings mean you are better protected in a crash, but good Lexus ES 350 crash ratings also mean cheaper insurance rates.

Lexus ES 350 Crash Test Ratings

Vehicle Tested Overall Frontal Side Rollover

2024 Lexus ES 350 4 DR FWD 5 stars 4 stars 5 stars 4 stars

2023 Lexus ES 350 4 DR FWD 5 stars 4 stars 5 stars 4 stars

2022 Lexus ES 350 4 DR FWD 5 stars 4 stars 5 stars 4 stars

2021 Lexus ES 350 4 DR FWD 5 stars 4 stars 5 stars 4 stars

2020 Lexus ES 350 4 DR FWD 5 stars 4 stars 5 stars 4 stars

2019 Lexus ES 350 4 DR FWD 5 stars 4 stars 5 stars 4 stars

The strong crash test ratings of the Lexus ES 350 not only enhance safety but also contribute to lower insurance costs, reflecting its reliability and security.

Lexus ES 350 Safety Features

The Lexus ES 350 safety features play a vital role in keeping passengers safe in crashes, but they can also help lower your Lexus ES 350 auto insurance rates. The Lexus ES 350’s safety features include:

- Air Bags: Includes driver, passenger, front/rear head, and front/rear side airbags.

- Brakes: Features 4-wheel ABS and disc brakes equipped with brake assist.

- Safety Features: Offers electronic stability control, traction control, and daytime running lights.

- Driver Assist: Equipped with blind spot monitoring, lane departure warning, lane keeping assist, and cross-traffic alert.

- Additional Safety: Includes child safety locks, integrated turn signal mirrors, and auto-leveling headlights.

Known for catering to drivers who want comfort, safety, and luxury, the Lexus sedans come standard with many advanced safety features, which include stability and traction control, and four disk anti-lock brakes. The air bag system employs front- and rear-side air bags, and front knee air bags, as well as side curtain air bags.

The Insurance Institute for Highway Safety awards the Lexus ES 350 a “Good” rating in both frontal offset and side-impact tests in its most recent report. While these come standard, other safety features do not.

The newest optional feature from Lexus is the Enform with Safety Connect system. Similar to Chevrolet’s OnStar system, Safety Connect includes three different features: automatic collision notification, a locator if the Lexus is stolen, and emergency roadside assistance.

Another optional feature is the adaptive cruise control. This feature will automatically slow the car if it senses you are following another vehicle too closely. The pre-collision system uses radar to warn you of a possible impact.

All of these features result in a very safe car, which usually leads to lower premiums on car insurance.

However, the Lexus is a luxury vehicle and, as such, uses high-end parts. The parts are more expensive to replace, offsetting the discounts the enhanced safety features would provide.

Lexus ES 350 Insurance Loss Probability

Another contributing factor that affects Lexus ES 350 car insurance rates is the loss probability for each type of coverage.

Lexus ES 350 Insurance Loss Probability

Category Probability

Collision 26%

Property Damage -21%

Comprehensive 60%

Personal Injury -9%

Medical Payment 0%

Bodily Injury -22%

Understanding the varying loss probabilities across different insurance coverage categories can significantly influence the premiums and choices for Lexus ES 350 car insurance. Learn more in our article titled “What cars have the lowest car insurance rates?”

What’s the Lexus ES 350 Finance and Insurance Cost

When financing a Lexus ES 350, the overall costs go beyond the sticker price, incorporating both financing and insurance expenses that are pivotal in calculating the total cost of ownership. The insurance premiums for a Lexus ES 350, as one of the more prominent recurring costs, vary based on the level of coverage chosen, the driver’s history, and geographic location.

With an A++ rating from A.M. Best, Geico stands out for its financial stability and reliable claims service for Lexus ES 350 owners.

Tracey L. Wells Licensed Insurance Agent & Agency Owner

Financing costs depend on the loan terms, including interest rates and the loan duration, which directly influence the monthly payments. On average, insurance costs for the Lexus ES 350 can range significantly, with full coverage typically being recommended to protect this luxury vehicle adequately. This comprehensive coverage ensures protection against a wide array of potential damages and liabilities.

Overall, the combined monthly cost of financing and insuring a Lexus ES 350 can be a significant portion of the vehicle’s total expense, making it crucial for potential owners to get detailed quotes and carefully plan their budgets to accommodate these costs. See more details on our article titled “Ways to Lower the Cost of Your Insurance.”

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

How to Save on Lexus ES 350 Insurance

There are many ways that you can save on Lexus ES 350 car insurance to get the best value possible. Below are five scenarios you can explore to help keep your Lexus ES 350 car insurance rates low.

- Don’t always pick the cheapest Lexus ES 350 insurance policy.

- Move to an area with better weather.

- Drive your Lexus ES 350 safely.

- Move to the countryside.

- Move to an area with a lower cost of living.

To maximize savings on your Lexus ES 350 car insurance, it’s essential to weigh various factors beyond just the lowest premium. Opting for a safe driving area, maintaining a good driving record, and considering geographical factors like weather and cost of living can lead to substantial insurance savings. Discover more about offerings in our guide titled “Safe Driver Car Insurance Discounts.”

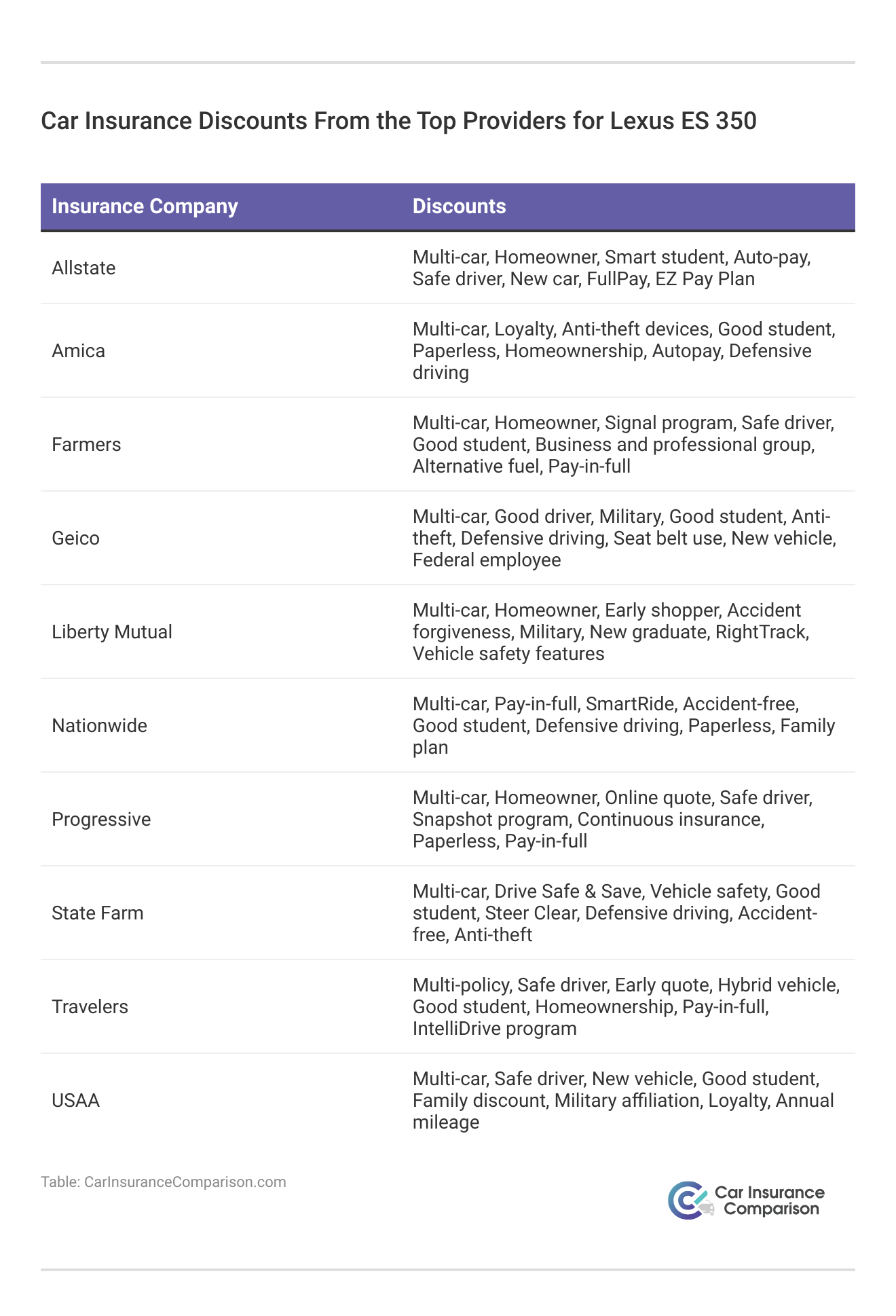

What Are the Top Lexus ES 350 Insurance Companies

Who is the top auto insurance company for Lexus ES 350 insurance rates? While the actual rates you pay will depend on many factors, here are some of the top companies offering Lexus ES 350 auto insurance coverage (ordered by market share). Many of these companies offer discounts for security systems and other safety features that the Lexus ES 350 offers.

Top Lexus ES 350 Car Insurance Companies by Market Share

Rank Insurance Company Premium Written Market Share

#1 State Farm $65.6 million 9.3%

#2 Geico $46.1 million 6.6%

#3 Progressive $39.2 million 5.6%

#4 Liberty Mutual $35.6 million 5.1%

#5 Allstate $35.0 million 5%

#6 Travelers $28.0 million 4%

#7 USAA $23.4 million 3.3%

#8 Chubb $23.3 million 3.3%

#9 Farmers $20.6 million 2.9%

#10 Nationwide $18.4 million 2.6%

State Farm leads as the top insurer for the Lexus ES 350 by market share, reflecting its significant role in the auto insurance industry.

Top Lexus ES 350 Car Insurance Companies by Market Share

Insurance Company Premium Written

State Farm $66.1 million

Geico $46.3 million

Progressive $41.7 million

Allstate $39.2 million

Liberty Mutual $36.1 million

Travelers $28.7 million

USAA $24.6 million

Chubb $24.1 million

Farmers $20 million

Nationwide $18.4 million

Prospective and current Lexus ES 350 owners should consider these leading companies, which not only dominate the market but also offer tailored coverages enhanced by various safety feature discounts. Access comprehensive insights into our guide titled “Safety Features Car Insurance Discounts.”

How to Compare Free Lexus ES 350 Insurance Quotes Online

When looking for Lexus insurance, you might think you’ll be paying an enormous amount of money on insurance rates. As long as you shop around, maintain good credit, and have a clean driving record you can get lower rates.

Other factors also contribute to these rates, such as the driver’s age, location, driver’s history, type of the vehicle and its mileage, etc. To reduce your Lexus insurance costs, limit your annual mileage, limit your claims fillings, and add certain features such as passive restraint systems, anti-lock brakes, and anti-theft devices. Discover insights in our guide titled “How do you file a car insurance claim?”

Need the cheapest car insurance possible? Enter your ZIP code below into our free comparison tool to find the most affordable rates for your vehicle.

Frequently Asked Questions

How do Lexus ES 350 car insurance rates compare to other vehicles?

Lexus ES 350 car insurance rates can vary depending on factors such as the model year, driver’s profile, location, coverage options, deductibles, and insurance provider. Generally, due to its luxury status and higher value, the Lexus ES 350 may have slightly higher insurance rates compared to more affordable and less luxurious vehicles.

For additional details, explore our comprehensive resource titled “What does a $500 car insurance deductible mean?”

Which factors influence Lexus ES 350 car insurance rates?

Several factors influence Lexus ES 350 car insurance rates, including the vehicle’s value, safety features, repair costs, theft rates, the driver’s age, driving history, location, coverage selections, deductibles, and the specific rating factors used by the insurance company.

Are Lexus ES 350 car insurance rates similar across different model years?

While Lexus ES 350 car insurance rates can vary based on various factors, including the model year, newer models of the ES 350 may generally have slightly higher insurance rates due to their higher value and potential repair costs. However, rates can also depend on the safety features and technology advancements in each model year.

How can I find the best Lexus ES 350 car insurance rates?

To find the best Lexus ES 350 car insurance rates, it’s advisable to shop around and obtain quotes from multiple insurance providers. Comparing rates, coverage options, and customer reviews can help you identify insurance companies that offer competitive rates and good customer service for Lexus ES 350 owners.

Protect your vehicle from whatever the road throws at it by entering your ZIP code into our free comparison tool below to see affordable car insurance quotes.

Are there any specific insurance companies known for offering competitive rates on Lexus ES 350 car insurance?

It’s advisable to choose reputable insurers like Geico, Progressive, Allstate, State Farm, and Farmers for luxury vehicles like the Lexus ES 350, but always compare quotes and coverage to find the best rates.

Do Lexus ES 350 cars require specialized insurance coverage?

While Lexus ES 350 cars don’t typically need specialized insurance, it’s vital to secure adequate comprehensive and collision coverage for protection against theft, accidents, and other risks, and to meet state liability requirements.

What is the 2007 Lexus ES 350 insurance cost?

The insurance cost for a 2007 Lexus ES 350 typically ranges from $100 to $150 per month, depending on factors like location, driving history, and coverage levels.

To find out more, explore our guide titled “Do all car insurance companies check your driving records?”

How much does insurance cost for a 2016 Lexus ES 350?

For a 2016 Lexus ES 350, insurance costs average between $120 and $170 per month, influenced by the driver’s age, driving record, and chosen insurance provider.

What are the key features of the 2023 Lexus ES 350?

The 2023 Lexus ES 350 features enhanced safety technologies, updated interior designs, and improved fuel efficiency, making it a competitive option in the luxury sedan market.

Are Lexus expensive to insure?

Yes, Lexus vehicles, including the ES 350, are generally more expensive to insure than non-luxury models due to higher repair costs and the vehicle’s value.

To learn more, explore our comprehensive resource on “Best Lexus LC 500 Car Insurance.”

How much is insurance for a Lexus?

Insurance for a Lexus can range widely, generally between $100 and $166 per month, varying by model, location, and the driver’s insurance history.

What do people say about Lexus ES 350 insurance cost on Reddit?

On Reddit, users often discuss that the Lexus ES 350 insurance cost is moderately priced for a luxury car, with many noting that shopping around for quotes can significantly reduce premiums.

Is insurance on a Lexus expensive?

Yes, insurance on a Lexus tends to be higher than average due to its status as a luxury brand with costly repairs and high replacement values.

Comparing quotes is the easiest way to find affordable car insurance. Simply enter your ZIP code below into our free comparison tool to see rates in your area.

At what age is Lexus ES 350 car insurance cheapest?

Lexus ES 350 car insurance is typically cheapest for drivers in their mid-50s to mid-60s, as insurers view these age groups as less risky due to their experience and lower accident rates.

Who typically has the cheapest Lexus ES 350 insurance?

Generally, large, well-established insurers like Geico, State Farm, and USAA offer the cheapest Lexus ES 350 insurance, especially for drivers with clean driving records and good credit.

Learn more by reading our guide titled “Good Credit Car Insurance Discounts.”

How can I lower my Lexus ES 350 car insurance rate?

You can lower your Lexus ES 350 car insurance rate by qualifying for discounts, maintaining a clean driving record, increasing your deductible, and bundling policies. Additionally, regularly comparing quotes from different insurers can help you find the best rates.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.