How to Get Liberty Mutual Car Insurance Quotes Online in 2025 [Follow These 6 Steps]

How to get Liberty Mutual car insurance quotes online is by entering vehicle and driver details on their website for instant rate comparisons. Liberty Mutual offers up to 12% savings for bundling insurance policies. Online quote comparison tools can help you get Liberty Mutual car insurance quotes quickly

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

UPDATED: Feb 22, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Feb 22, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

You might be wondering how to get Liberty Mutual car insurance quotes online. Enter your details for an instant estimate. Bundling policies with the best home and car insurance companies can help you save, with customers reducing costs by up to 12%. Visit Liberty Mutual’s website, enter your vehicle and driver details, and explore coverage options. Compare plans, adjust deductibles, and see real-time discounts before purchasing. Get a car insurance quote from Liberty Mutual and lock in savings today.

Bundling policies with the best home and car insurance companies can help you save, with customers reducing costs by up to 12%. Visit Liberty Mutual’s website, enter your vehicle and driver details, and explore coverage options. Compare plans, adjust deductibles, and see real-time discounts before purchasing. Get a car insurance quote from Liberty Mutual and lock in savings today.

Savvy shoppers compare prices; enter your ZIP code on our site to compare quotes from multiple insurers.

- Step #1: Start with ZIP Code – Enter your ZIP code to get location-based rates

- Step #2: Enter Info and Prefill – Provide your name and email, and use prefill options

- Step #3: Take Your Time – Save progress and return later to compare options

- Step #4: Add Driving Details – Include experience, past claims, and accident history

- Step #5: Check for Discount – Explore savings like multi-policy and safe driver

- Step #6: Consider RightTrack – Opt into tracking for potential premium discounts

6 Steps to Get Liberty Mutual Car Insurance Quotes Online

Getting a Liberty Mutual car insurance quote online allows drivers to compare coverage options conveniently. By following these essential steps, you can ensure an efficient and personalized quote experience while maximizing potential savings.

Step #1: Start with ZIP Code

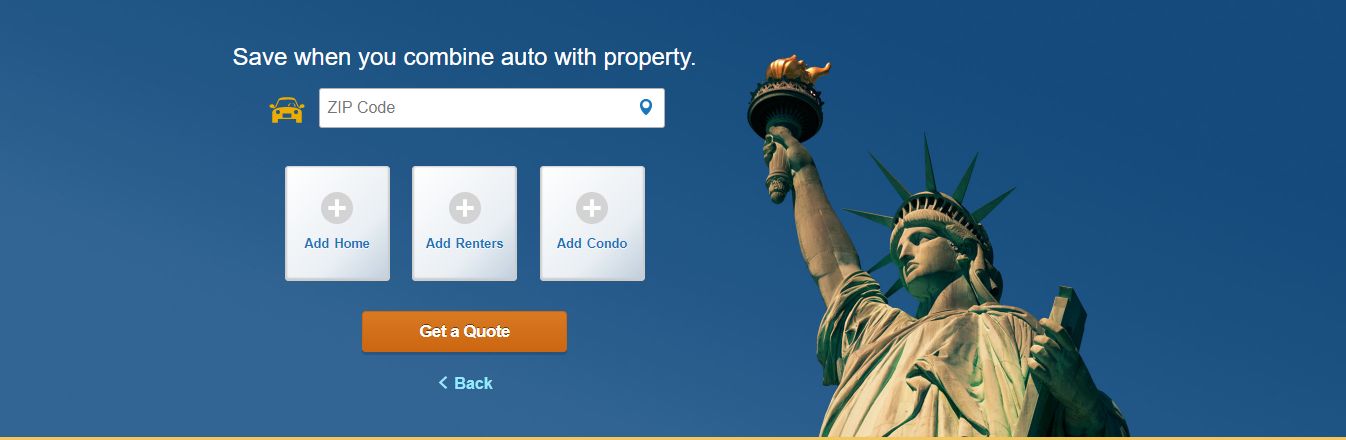

Select “Auto” from the insurance categories on Liberty Mutual’s homepage and enter your ZIP code. You can also click on the location marker in the ZIP code box and hit “Allow” when the popup appears. Liberty Mutual’s site will input the ZIP code for your current location.

If you want an auto insurance bundle policy quote, you can add home, renters, or condo insurance to your request. This article covers the process of finding free car insurance quotes online and how to request a policy. When you’re ready to continue, click “Get a quote.”

Enter Your Address

The first thing you’ll see when you begin the first actual step of the quote request process at Liberty Mutual is this:

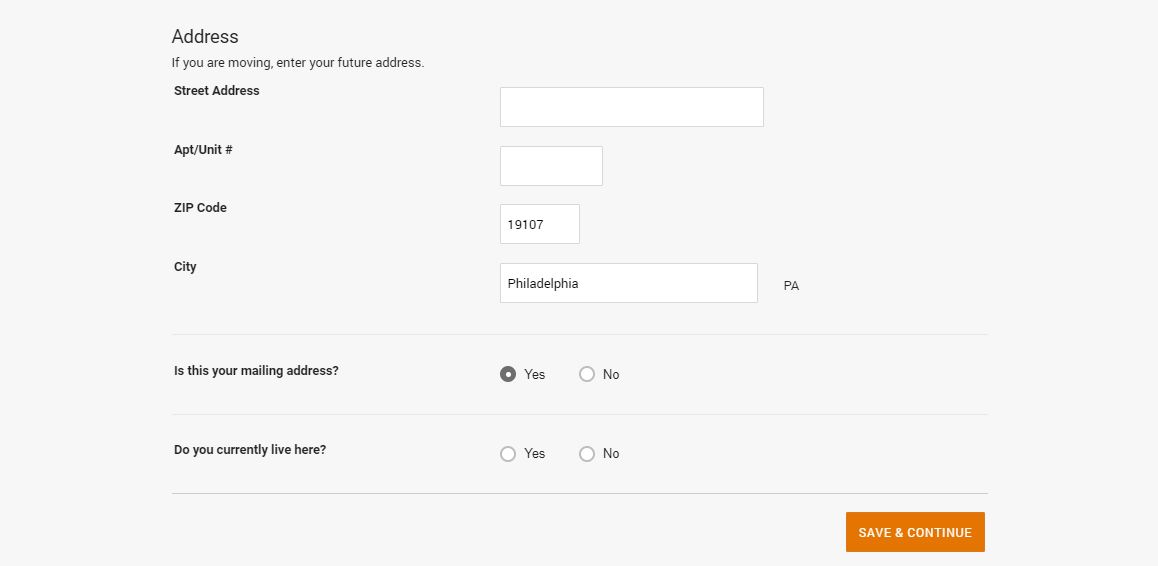

This simple introduction leads you to the first prompt of the process, a form to enter your address. If you’re moving, you can provide your address in the future.

Your location influences the cost of car insurance. Each state has its requirements, and the average price of auto insurance in the US varies from state to state and county to county.

When you’re ready to proceed, hit “Save & Continue”.

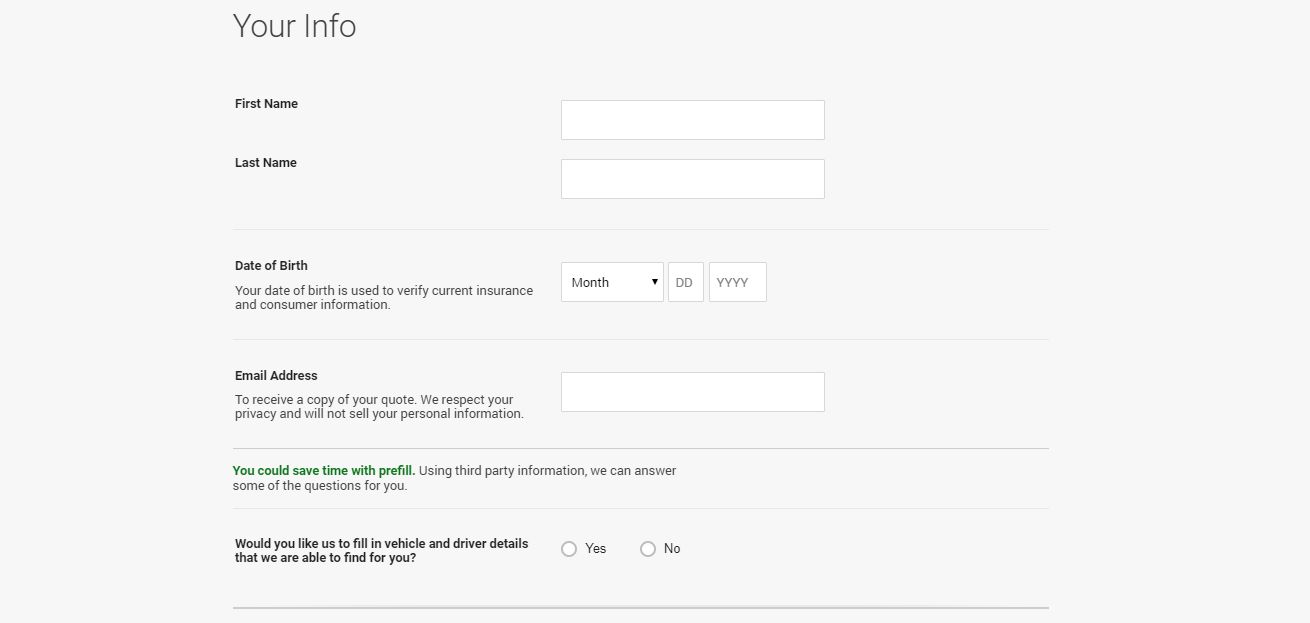

Step #2: Enter Info and Prefill

Now, it’s time to provide more personal information to assist the quote process and help give you an accurate rate. Enter your legal first and last names, followed by your date of birth.

Liberty Mutual explains on the page that your birthdate is used to confirm your identity and current insurance status, but your age is also another important factor when it comes to calculating car insurance costs.

If you’d like, Liberty Mutual can use the address, name, and birthdate provided to find any vehicles registered to you through a third party. This information can then be automatically added to the system, saving you the time to input everything yourself.

If you aren’t comfortable with this idea, that’s okay. You can click “No” on the question prompt. If you’d like to learn more before you decide, check out the Information Disclosure agreement at the bottom of the screen and read the popup.

You’ll also have to enter your email at this stage so Liberty Mutual can use it to send you your quote.

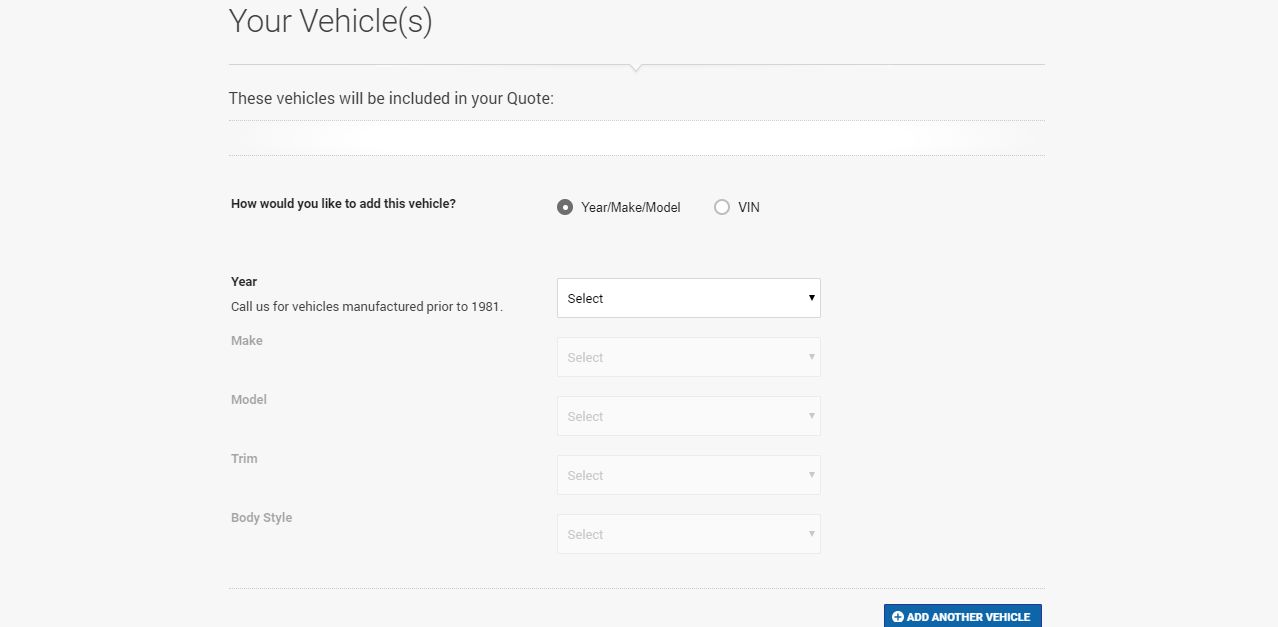

Enter Your Vehicle Information

The Vehicles section of Liberty Mutual’s quote process is straightforward to navigate. You won’t be bombarded with many boxes; instead, you only have to fill information out one step at a time.

However, you can preview the details you’ll have to provide, so now is a good time to ensure you have all the necessary documents and information on your car(s) before proceeding.

You can enter your vehicle’s make, model, trim, body type, and other specifics by hand. Get the best VIN etching car insurance discounts here. This ID is unique to every car and can tell an insurance provider everything they need to know quickly.

Your VIN is on your driver’s side door frame or the windshield where the glass meets your dashboard.

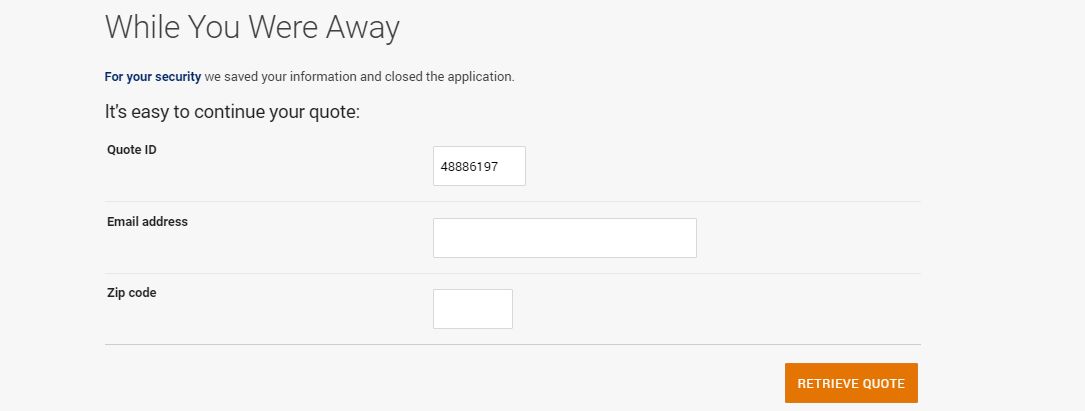

Step #3: Take Your Time

If you need to take a break and come back later, don’t worry. Your quote will be saved right where you left off. If you’re inactive for a certain period, the system will save your info with a unique quote ID. To resume your progress, enter your email address and ZIP code.

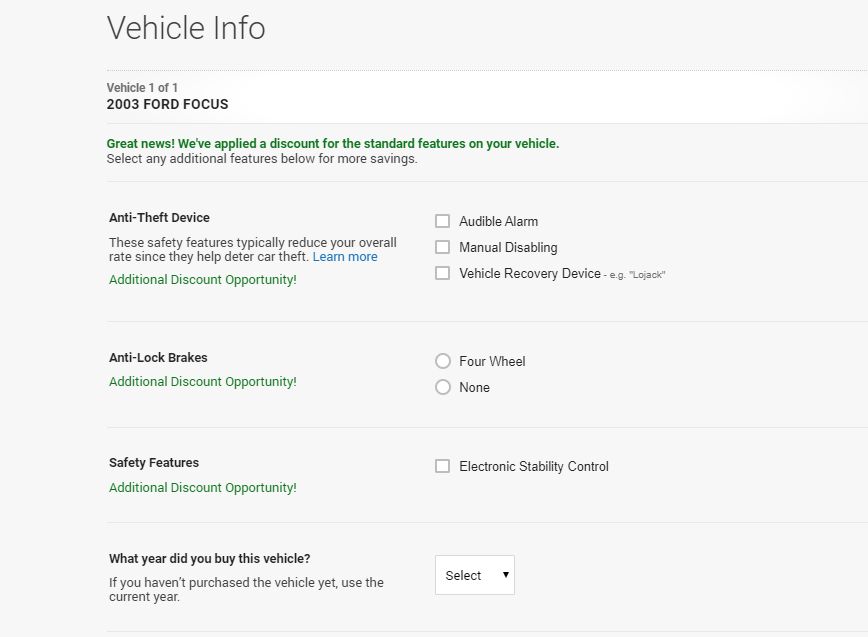

Learn About Discounts

In many cases, Liberty Mutual will automatically apply discounts that your vehicle qualifies for once you provide the necessary information.

There are many ways to save money on car insurance, and selecting the safety features that the quotes wizard presents can help you save even more. Anti-lock brakes, anti-theft devices, and additional safety features can save you premiums.

Check out our comprehensive guide to auto insurance discounts, which you can discuss with an agent when you sign up for a new policy.

Read more: Liberty Mutual Car Insurance Discounts

Step #4: Add Driving Details

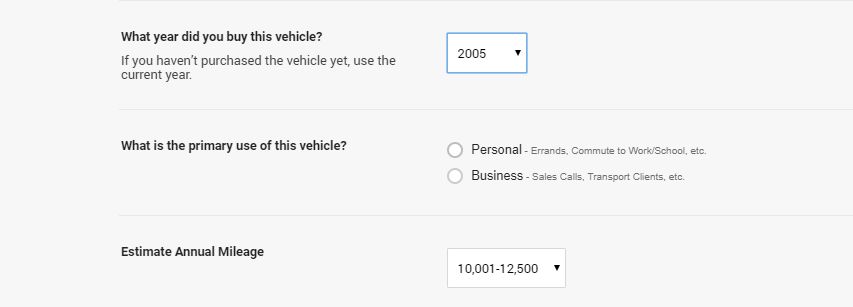

The final stage of the vehicle information collection process will require you to specify the year you got your current vehicle, answer whether it’s owned, financed, or leased, and the primary use. Most people will select personal, but you’ll choose a business if you use your car to operate a business or conduct work-related activities like sales calls.

You will also have to estimate your annual mileage; as of March 2018, the Federal Highway Administration found that the average American drives 13,476 miles yearly.

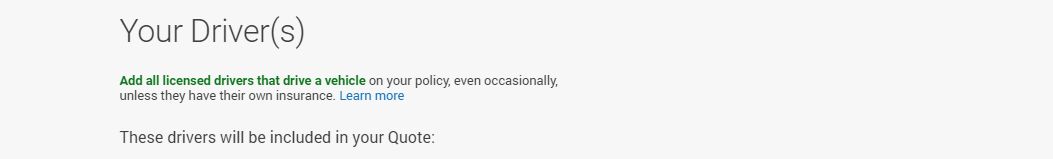

Add Drivers

Next, you’ll want to list every driver of the vehicle(s) for whom you’re requesting quotes, even if they already have insurance. If you’re married, include your spouse’s information, as marital status can affect rates. Your name and age will be listed, so select a gender and indicate if you’re in a civil union. Insurers analyze these details and location data to assess risk factors and determine which state has the best drivers.

You will have to provide additional information for each new driver. As you proceed, you’ll have to input your homeownership status, when you were first licensed, and answer whether or not you’ve been involved in any accidents within the last 5 years.

You can also provide your SSN, but we recommend holding off on this until you buy a policy.

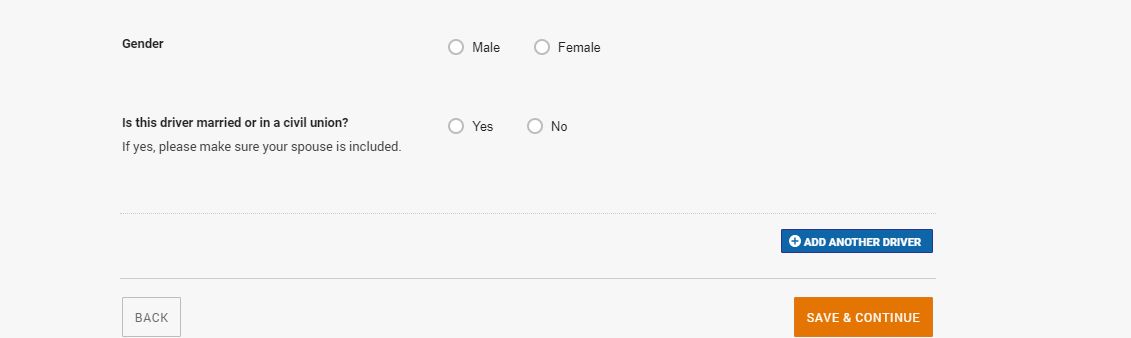

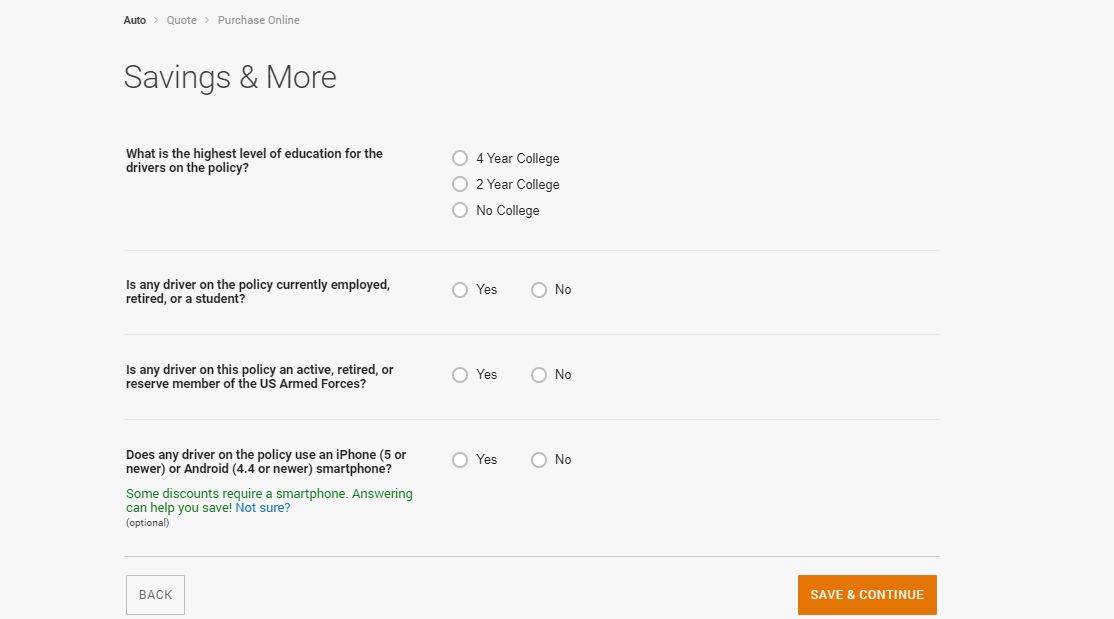

Step #5: Check for Discount

You can provide additional information that can qualify you for more significant discounts. For example, being a college student or graduate, an active duty, reserve member, or veteran, and even owning a smartphone can qualify you for discounts.

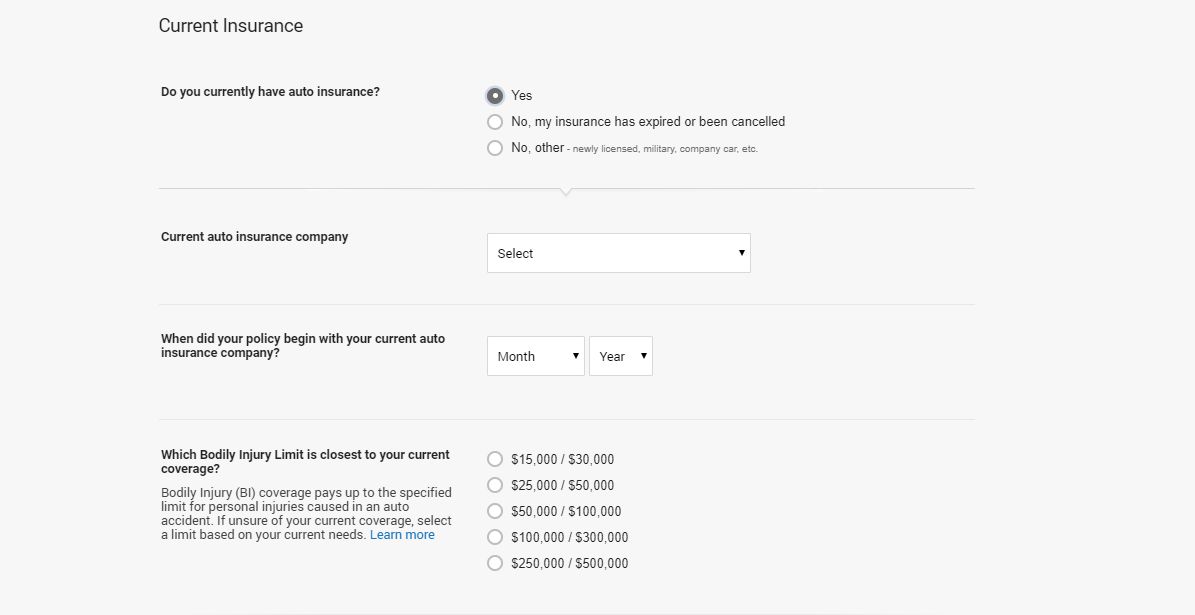

Provide Insurance Information

If you’re wondering how to upgrade car insurance, you must provide details about your current company and policy before switching carriers. Before purchasing a new plan, consult your current insurer to ensure you can transfer coverage or cancel your existing policy without issues.

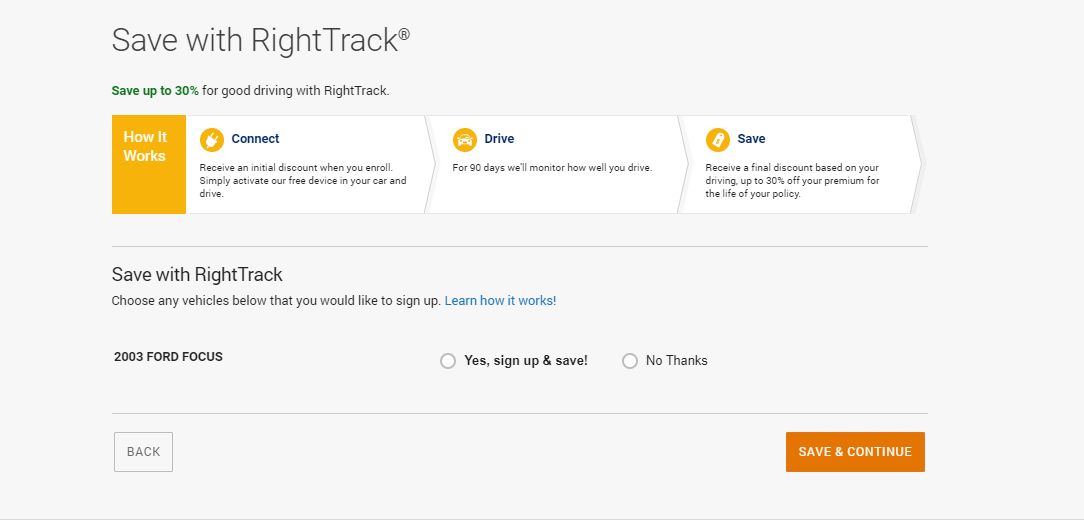

Step #6: Consider RightTrack

Liberty Mutual’s RightTrack program rewards drivers with good records to help them qualify for additional discounts and savings on their auto insurance. Enrolling in the RightTrack program automatically gets you a discount.

You’ll have to install the RightTrack device in your car and drive for 90 days; Liberty Mutual will monitor and record your driving habits and mileage. At the end of the 90 days, if you’ve driven responsibility, a discount of up to 30% will be applied to your policy.

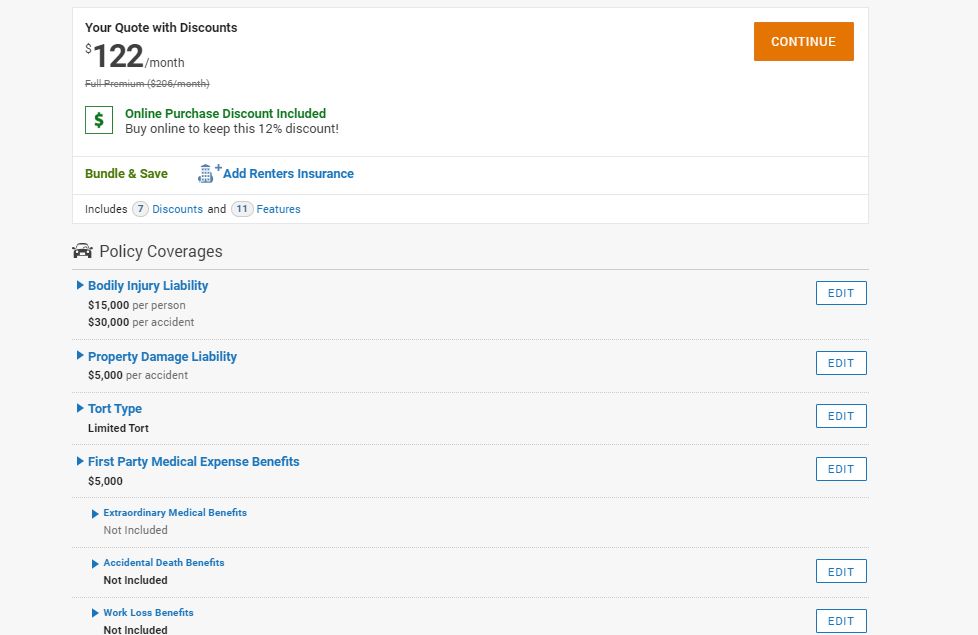

Review Your Quote

On the next page, your quote estimate will be divided into amounts. From this screen, you can edit coverages, change the information you provided, and chat with a live agent if you have questions or want to proceed with purchasing a policy.

Reviewing your Liberty Mutual car insurance quote helps you verify coverage details, identify discounts, and ensure you're getting the most competitive rate.

Brandon Frady Licensed Insurance Agent

Our suggestion? Keep your quote and enter your ZIP code to get several others for comparison. It pays to shop around, and since auto insurance varies from provider to provider, it’s a good idea to compare at least three before making a final decision.

To sum up, Liberty Mutual is an excellent choice for anybody looking for customizable policy options, convenient online tools, and a full range of discounts. Suppose you’re wondering where you can find the lowest car insurance quotes. In that case, Liberty Mutual’s online tools make it easy for current and prospective customers to compare options based on coverage limits.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Key Factors That Influence Your Liberty Mutual Car Insurance Quote

Several factors determine your premium when requesting a Liberty Mutual car insurance quote online. Age impacts rates, with younger and older drivers often paying more. A clean driving history lowers costs, while accidents or violations increase them. Vehicle type matters—luxury and sports cars are more expensive to insure.

Factors Affecting Your Insurance Quote

| Factor | Description |

|---|---|

| Age | Younger and older drivers typically pay more due to higher perceived risk. |

| Driving History | Accidents, tickets, or violations can significantly increase your premiums. |

| Vehicle Type | Luxury or sports cars cost more to insure than standard or economy vehicles. |

| Coverage Levels | Higher coverage limits or additional options like comprehensive and collision raise costs. |

| Location | Urban areas with high accident or theft rates lead to higher premiums compared to rural areas. |

| Credit Score | Lower credit scores can increase rates in states where credit is factored into pricing. |

| Mileage | Higher annual mileage increases risk exposure, leading to higher premiums. |

| Marital Status | Married drivers often receive lower rates compared to single drivers. |

| Claims History | Frequent or large claims may result in increased premiums. |

| Policy Discounts | Discounts for bundling, safe driving, or installing safety features can lower costs. |

Higher coverage limits raise premiums, while bundling and safe driving discounts lower them. What affects a car insurance quote? Location, credit score (where applicable), annual mileage, claims history, and marital status all impact pricing. Married drivers often get better rates. Understanding these factors helps secure the best quote.

How Annual Mileage Affects Your Liberty Mutual Car Insurance Quote

The number of miles you drive each year directly impacts your Liberty Mutual car insurance quote. Higher annual mileage increases your risk of accidents, leading to higher premiums.

Drivers who log fewer miles may qualify for lower rates or usage-based discounts. Wondering how much mileage affects car insurance rates? If you drive less than the average, consider Liberty Mutual’s programs that reward low-mileage drivers with potential savings.

About Liberty Mutual and Its Insurance Offerings

Founded in 1912, Liberty Mutual has spent the last 106 years becoming a leading insurance provider in the United States. They’re currently the fourth-largest property and casualty insurance company in America. From personal to business coverage, Liberty Mutual offers plenty of options for businesses, homeowners, renters, and drivers nationwide.

When applying for a quote from Liberty Mutual, website said this

by inInsurance

Whether you’ve seen one of the many catchy Liberty Mutual commercials or got a suggestion from someone you know, there’s lots to learn about Liberty Mutual.

The company is especially worth investigating if you want to save money on auto coverage through bundling. They offer auto insurance bundles with home, renters, and condo insurance.

Before we jump into quotes, though, take some time to learn about Liberty Mutual. On the official site of Liberty Mutual Group, you can explore the company’s values, awards, and innovations while finding tips on lowering your car insurance rates through discounts and coverage options.

If you’re on social media, check out the official Liberty Mutual Twitter and YouTube channel. Here, you can see how the brand engages with its clients and promotes itself in a much more natural, conversational fashion.

If you like what you see, head over to LibertyMutual.com to start getting your free quote.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Case Studies: Liberty Mutual Car Insurance Quote Online

Real-life case studies show how different factors impact Liberty Mutual car insurance quotes online. You can see how pricing changes by analyzing quotes for various driver profiles, coverage levels, and vehicle types. These examples highlight how discounts, driving history, and location influence rates, helping you make informed decisions.

Case Study 1: John’s Bundled Coverage With Liberty Mutual

John, a homeowner and car owner, sought ways to save money on his insurance coverage. He decided to explore Liberty Mutual’s auto insurance bundles with home insurance. As he reviewed his options, he considered gap insurance pricing and coverage to protect himself from potential financial loss if his car was ever totaled. By bundling his policies, John could get comprehensive coverage for his home and car while enjoying significant savings on his premiums.

Case Study 2: Sarah’s Personalized Coverage With Liberty Mutual

As a renter and frequent traveler, Sarah wanted insurance coverage that would fit her unique needs. She turned to Liberty Mutual and discovered their customizable car insurance options. With Liberty Mutual, Sarah was able to tailor her policy to include the best full coverage car insurance, ensuring comprehensive protection, personal injury coverage, and features aligned with her lifestyle. She felt secure.

Case Study 3: Mark’s Safe Driving Discounts With Liberty Mutual

Mark wanted car insurance for pleasure driving that rewarded his safe habits. He chose Liberty Mutual’s RightTrack program, installed the device, and drove responsibly for 90 days. As a result, he earned a 30% discount on his policy while keeping his costs low.

Getting Liberty Mutual Car Insurance Quotes Online: Key Information to Remember

Understanding how to get Liberty Mutual car insurance quotes online helps you compare rates and find savings. Factors like age, driving history, and coverage levels affect your premium, while discounts can lower costs.

Using Liberty Mutual’s online tools ensures quick, accurate estimates, helping you choose the best policy while understanding why car insurance quotes change daily.

Get the right coverage for your vehicle by entering your ZIP code in our free comparison tool to find competitive insurance rates.

Frequently Asked Questions

How can I obtain a car insurance quote from Liberty Mutual online?

Getting a car insurance quote from Liberty Mutual online is a simple process. Follow these steps:

- Visit the Liberty Mutual website.

- Locate the “Car Insurance” section and click on it.

- Look for the “Get a Quote” or “Start a Quote” button and click on it.

- Fill out the required information, including personal details, vehicle information, and coverage preferences.

- Review your provided information, make any necessary adjustments, and click “Submit” or “Get Quote.”

- Liberty Mutual will then generate a car insurance quote based on your provided information.

What information must I provide to get an accurate car insurance quote online?

To receive an accurate car insurance quote online from Liberty Mutual, you will typically need to provide the following information:

- Personal details: Name, address, date of birth, and contact information.

- Vehicle information: Year, make, model, mileage, and VIN (Vehicle Identification Number).

- Driving history: Details about your driving record, including any accidents or violations.

- Coverage preferences: The type and level of coverage you desire.

Can I customize my car insurance coverage when obtaining a quote online?

Liberty Mutual offers customizable car insurance options when getting a quote online. Coverage choices include liability, collision, comprehensive, personal injury protection, and uninsured/underinsured motorist. If you’re wondering what uninsured motorist property damage is, it helps cover vehicle repairs if an uninsured driver causes an accident. You can adjust coverage limits and deductibles to fit your needs and budget.

Will I receive my car insurance quote instantly?

In most cases, Liberty Mutual provides a car insurance quote instantly after you submit your information online. However, additional underwriting may sometimes be required, and the quote may take longer. You can contact Liberty Mutual directly for further assistance or clarification.

What is the Liberty Mutual phone number?

Liberty Mutual’s leading customer service phone number is 1-800-290-7933. This number connects you with their support team for policy inquiries, claims, and general assistance.

Can I save my progress and return to complete the car insurance quote later?

Yes, Liberty Mutual’s online quoting system allows you to save your progress and return later to complete your car insurance quote, which is helpful if you’re wondering how long it takes to get car insurance. You may need to create an account or provide your email address to save and access your quote. This feature helps you gather any necessary information before finalizing your policy.

How do I get a Liberty Mutual car insurance quote for a Tesla?

To get a Tesla car insurance quote from Liberty Mutual, visit their website and enter your vehicle details, ZIP code, and personal information. You can also call customer service for assistance in customizing your coverage.

How to get a Liberty Mutual third-party insurance quote for a Tesla?

A Liberty third-party insurance quote for a Tesla covers damages you may cause to other people’s vehicles or property. While this policy does not cover damages to your own Tesla, it provides financial protection against liability claims.

How can I obtain Liberty Mutual insurance quotes online?

To explore online car insurance quotes without personal information, visit Liberty Mutual’s website, enter your ZIP code, and review estimated rates before sharing detailed personal and vehicle information for a more accurate quote.

How do I get a Liberty Mutual comprehensive insurance quote for a Tesla?

A Liberty comprehensive insurance Tesla quote includes protection against theft, vandalism, natural disasters, and non-collision-related damages. Get a quote online or speak with an agent for coverage options.

What are Liberty Mutual’s customer service hours?

Liberty Mutual customer service hours vary by department, but general support is available Monday to Friday from 8 AM to 10 PM ET and Saturday from 8 AM to 8 PM ET. Claims support is available 24/7.

Where can I find my Liberty Mutual quote ID?

Your Liberty Mutual quote ID can be found in your confirmation email after obtaining a quote. You can also log into your Liberty Mutual account to access saved quotes and explore options on how to get cheaper car insurance quotes by adjusting coverage or applying discounts.

How does Liberty Mutual roadside assistance work?

Liberty Mutual roadside assistance provides towing, battery jump-starts, flat tire changes, lockout services, and fuel delivery. It is available 24/7 for policyholders who have added this coverage.

What do Liberty Mutual reviews say about their coverage?

Liberty Mutual reviews highlight competitive pricing, customizable policies, and a user-friendly claims process. However, some customers mention higher premiums compared to other providers.

How do I get an online quote for Liberty Mutual?

To obtain a Liberty Mutual quote online, visit their website, enter your personal details and vehicle information, and compare coverage options instantly. Knowing how often you should check car insurance quotes is important to ensure you’re always getting the best rate.

What is the Liberty Mutual address for claims or inquiries?

Liberty Mutual’s headquarters is at 175 Berkeley Street, Boston, MA 02116. Check your policy documents or visit their website for location-specific contact details for claims or inquiries.

Can you provide an example of a Liberty Mutual policy number?

A Liberty Mutual policy number example typically follows a format like A123456789 or B987654321. Your policy number can be found on your insurance card or billing statement.

How do I add an interested party to renters insurance with Liberty Mutual?

To add an interested party to your Liberty Mutual renters insurance, log into your online account, navigate to policy management, and add the interested party’s name and address. You can also call customer service for assistance.

Ensure your car is protected using our free comparison tool—enter your ZIP code to explore affordable insurance options.

How can I contact Liberty Mutual customer service?

You can contact Liberty Mutual customer service by calling 1-800-290-7933 or using their online chat feature on the Liberty Mutual website. Customers can also reach out through the mobile app or visit a local office.

How does Liberty Mutual vs. Infinity compare in terms of coverage and cost?

Liberty Mutual vs. Infinity comparisons show that Liberty Mutual offers more extensive coverage options, discounts, and better financial stability. Infinity may be a more affordable option for high-risk drivers.

How can I retrieve a Liberty Mutual quote?

To retrieve a Liberty Mutual quote, log into your online account, access your saved quotes section, or enter your quote ID on their website. If you’re looking for where to get multiple car insurance quotes, consider using online comparison tools to compare rates from different insurers. If needed, call customer service for assistance.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.