Best Chevrolet Traverse Car Insurance in 2025 (Find the Top 10 Companies Here!)

State Farm, Progressive, and Geico offer the best Chevrolet Traverse car insurance, with rates starting at $65 per month. State Farm excels in coverage, Progressive offers Snapshot savings, and Geico is budget-friendly. Compare rates to find the best Chevrolet Traverse car insurance for your needs.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

UPDATED: Aug 29, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Aug 29, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Chevrolet Traverse

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Chevrolet Traverse

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for Chevrolet Traverse

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews

The best Chevrolet Traverse car insurance providers are State Farm, Progressive, and Geico, each excelling in key areas. State Farm is the best overall, with rates starting at $87/month, making it a great choice for most drivers.

Progressive is ideal for those seeking Snapshot savings and rewards for safe driving, while Geico offers the most budget-friendly options without sacrificing quality. Gain deeper understanding through our article entitled “Best Chevrolet Spark Car Insurance.”

Our Top 10 Company Picks: Best Chevrolet Monte Traverse Insurance

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

#1 17% B Young Drivers State Farm

#2 10% A++ Snapshot Program Progressive

#3 15% A++ Low Rates Geico

#4 10% A++ Military Families USAA

#5 10% A+ Accident Forgiveness Allstate

#6 15% A+ Customer Service Amica

#7 15% A++ Customizable Policies Farmers

#8 10% A+ Comprehensive Coverage Nationwide

#9 12% A New-Car Replacement Liberty Mutual

#10 10% A Hybrid Vehicles Travelers

#1 – State Farm: Top Overall Pick

Pros

- Competitive Rates: Chevrolet Traverse drivers with a clean record can enjoy some of the most affordable rates with State Farm.

- Extensive Network: Easily find State Farm agents nationwide to discuss your Chevrolet Traverse insurance needs.

- Good Driver Discounts: Safe drivers can benefit from substantial discounts on their Chevrolet Traverse insurance. Gain deeper insights by perusing our article named “State Farm Car Insurance Review.”

Cons

- Limited Coverage Options: State Farm might offer fewer specialized coverages for a Chevrolet Traverse than other insurers.

- Average Customer Satisfaction: Customer service for Chevrolet Traverse owners is decent but not exceptional.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#2 – Progressive: Best for Snapshot Savings

Pros

- Snapshot Program: Chevrolet Traverse owners can save by participating in Progressive’s usage-based insurance program.

- Comprehensive Online Tools: Easily manage and customize your Chevrolet Traverse policy online.

- Multi-Car Discount: Chevrolet Traverse owners with more than one vehicle can benefit from Progressive’s multi-car discounts. Dive into the details with our article entitled “Progressive Car Insurance Discounts.”

Cons

- Price Increases: Some drivers report rate increases for their Chevrolet Traverse after claims.

- Customer Service Issues: Chevrolet Traverse owners may experience inconsistent customer service.

#3 – Geico: Best for Budget-Friendly Insurance

Pros

- Affordable Premiums: Chevrolet Traverse drivers, especially those with good driving records, can find low rates with Geico.

- Excellent Mobile App: Easily manage your Chevrolet Traverse insurance policy on the go.

- Multi-Policy Discount: Bundle your Chevrolet Traverse insurance with home or renters insurance for additional savings Explore further in our article titled “Geico Car Insurance Discounts.”

Cons

- Limited Local Agents: Chevrolet Traverse owners who prefer in-person service may find Geico lacking.

- Customization Limitations: There are fewer options for customizing Chevrolet Traverse insurance policies than other providers.

#4 – USAA: Best for Military Drivers

Pros

- Top-Rated Customer Service: USAA consistently ranks high in customer satisfaction for Chevrolet Traverse insurance. Delve into the specifics in our article called “USAA Car Insurance Review.”

- Military Discounts: Significant discounts are available for Chevrolet Traverse owners who are military members or veterans.

- Accident Forgiveness: USAA offers accident forgiveness, which can keep your rates steady after a minor accident with your Chevrolet Traverse.

Cons

- Eligibility Restrictions: Chevrolet Traverse owners who are not military personnel or their families are ineligible for USAA.

- Online Claims Processing: Some Chevrolet Traverse owners find the online claims process slower than competitors.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#5 – Allstate: Best for Comprehensive Plans

Pros

- Drivewise Program: Chevrolet Traverse owners can save by participating in Allstate’s safe driving program.

- Strong Local Agent Network: Easily find local agents to help with your Chevrolet Traverse insurance needs. For a comprehensive understanding, consult our article titled “Allstate Car Insurance Review.”

- Comprehensive Coverage Options: Allstate offers various coverage add-ons tailored to Chevrolet Traverse drivers.

Cons

- Higher Premiums: Chevrolet Traverse owners may find Allstate’s rates higher than some competitors.

- Discounts Not Easily Accessible: Chevrolet Traverse drivers might find it challenging to qualify for all available discounts.

#6 – Amica: Best for Premium Service

Pros

- High Customer Satisfaction: Amica is known for its top-rated customer service for Chevrolet Traverse insurance. Enhance your knowledge by reading our “Amica vs. The Hartford Car Insurance Comparison.”

- Dividend Policies: Chevrolet Traverse owners can receive a portion of their premium back at the end of the policy term.

- Excellent Claims Handling: Amica has a reputation for smooth and efficient claims processing for Chevrolet Traverse owners.

Cons

- Higher Rates: Amica’s premiums for Chevrolet Traverse drivers can be higher than average.

- Limited Online Tools: There are fewer online resources and tools for managing Chevrolet Traverse insurance compared to other major insurers.

#7 – Farmers: Best for Customizable Policies

Pros

- Customizable Coverage: Farmers offers a range of options to tailor your Chevrolet Traverse insurance to your specific needs.

- Good Student Discount: Chevrolet Traverse owners with students on their policy can benefit from this discount. Uncover more by delving into our article entitled “Farmers Car Insurance Review.”

- Extensive Agent Network: Farmers has a large network of agents to assist with Chevrolet Traverse insurance questions.

Cons

- Above-Average Premiums: Chevrolet Traverse drivers may pay more compared to other insurers.

- Mixed Customer Service Reviews: Some Chevrolet Traverse owners report inconsistent customer service experiences.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#8 – Nationwide: Best for Bundle Savings

Pros

- Vanishing Deductible: Chevrolet Traverse owners can lower their deductible for safe driving with Nationwide.

- On Your Side Review: Get a free annual review to ensure your Chevrolet Traverse insurance policy meets your needs.

- Multi-Policy Discount: Bundle Chevrolet Traverse insurance with other policies for substantial savings. Get a better grasp by checking out our article titled “Nationwide Car Insurance Discounts.”

Cons

- Limited Coverage Options: Nationwide may not offer as many specialized coverages for a Chevrolet Traverse as other insurers.

- Higher Premiums: Chevrolet Traverse drivers may find Nationwide’s rates higher than some competitors.

#9 – Liberty Mutual: Best for Extensive Coverage

Pros

- Comprehensive Coverage Options: Liberty Mutual offers a wide range of coverages for Chevrolet Traverse insurance.

- Better Car Replacement: If your Chevrolet Traverse is totaled, Liberty Mutual offers better car replacement options.

- Accident Forgiveness: Chevrolet Traverse owners can benefit from accident forgiveness with Liberty Mutual. Expand your understanding with our article called “Liberty Mutual Car Insurance Discounts.”

Cons

- Pricey Premiums: Chevrolet Traverse owners may find Liberty Mutual’s rates higher than average.

- Mixed Customer Service Reviews: Some Chevrolet Traverse drivers report inconsistent service.

#10 – Travelers: Best for Usage-Based Discounts

Pros

- IntelliDrive Program: Chevrolet Traverse owners can save by participating in Travelers’ usage-based insurance program.

- Comprehensive Coverage Options: Travelers offers a variety of coverages tailored to Chevrolet Traverse drivers. For additional insights, refer to our “Travelers Car Insurance Review.”

- Green Car Discount: Chevrolet Traverse owners with eco-friendly features may qualify for discounts.

Cons

- Slow Claims Processing: Some Chevrolet Traverse drivers report slower-than-average claims handling.

- Higher Premiums: Chevrolet Traverse drivers may find Travelers’ rates higher than other insurers.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Chevrolet Traverse Car Insurance Monthly Rates by Coverage Level & Provider

Chevrolet Traverse Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $95 $195

Amica $85 $190

Farmers $93 $198

Geico $80 $175

Liberty Mutual $90 $190

Nationwide $88 $185

Progressive $75 $180

State Farm $87 $195

Travelers $98 $198

USAA $65 $170

Whether you prioritize comprehensive protection or budget-friendly options, find the right fit for your Chevrolet Traverse and make an informed decision with ease. Gain deeper understanding through our article entitled “Best Chevrolet Spark Car Insurance.”

Chevrolet Traverse Insurance Cost

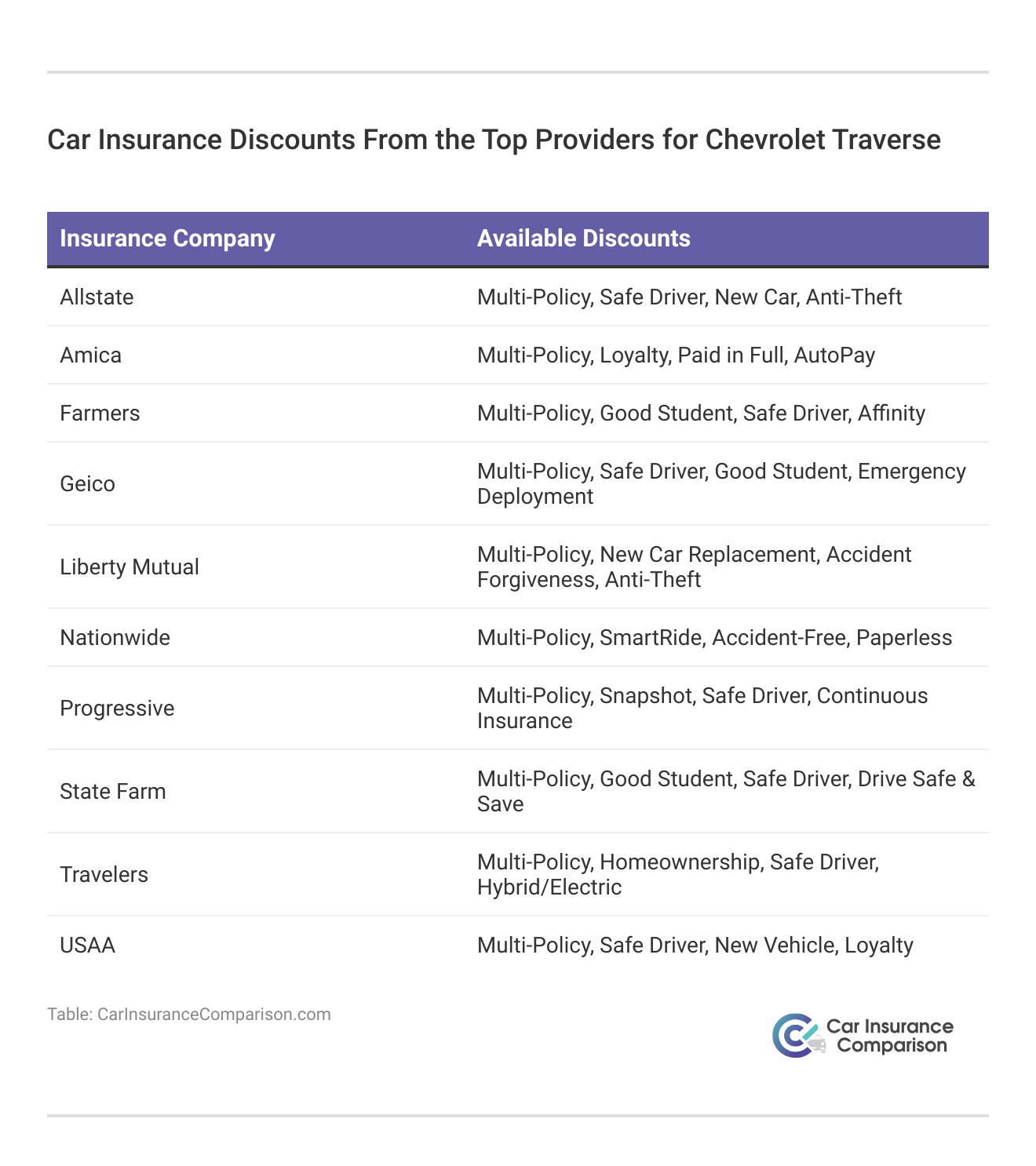

Learn how different providers reward you for maintaining a clean driving record and bundling insurance policies. Discover which discounts can help you save the most and make the most of these opportunities to get the best value for your Chevrolet Traverse coverage.

Find out more by reading our article titled “Best Chevrolet Aveo Car Insurance.“

Key Influencers on Chevrolet Traverse Insurance Premiums

The Chevrolet Traverse trim and model you choose can impact the total price you will pay for affordable Chevrolet Traverse car insurance coverage.

Age of the Vehicle

Understanding these differences can help you anticipate potential insurance expenses and make informed decisions when purchasing or maintaining your Chevrolet Traverse. Being aware of how vehicle age impacts insurance can also aid in budgeting and exploring options for cost-effective coverage.

Explore further with our article entitled “Best Chevrolet Impala Car Insurance.”

Driver Age

This disparity is attributed to factors like risk assessment and driving experience, which influence how insurers price coverage. Understanding how age affects insurance rates can help you plan better and explore ways to potentially reduce your premiums as you gain experience and maintain a clean driving record.

Gain insights by reading our article titled “Best Chevrolet Cruze Car Insurance.”

Driver Location

Understanding this can help you anticipate insurance costs and explore ways to reduce them based on your location. Deepen your understanding with our article called “Best Chevrolet Cobalt Car Insurance.”

Your Driving Record

Maintaining a good record is crucial for managing your insurance expenses effectively. For further details, consult our article named “Best Chevrolet Blazer Car Insurance.”

Chevrolet Traverse Safety Ratings

Chevrolet Traverse Crash Test Ratings

As a result, prioritizing safety in your Chevrolet Traverse can be a strategic way to manage and potentially reduce your insurance expenses. Get a better grasp by reading our article titled “Best Chevrolet Trax Car Insurance.”

Chevrolet Traverse Safety Features

Chevrolet Traverse Insurance Loss Probability

Understanding how different coverages affect loss probability can help you choose the most cost-effective insurance for your needs. Explore further details in our “Best Chevrolet Bolt EV Car Insurance.”

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Chevrolet Traverse Finance and Insurance Cost

5 Strategies to Lower Your Chevrolet Traverse Insurance Costs

There are many ways that you can save on Chevrolet Traverse car insurance to get the best value possible. Below are five scenarios you can explore to help keep your Chevrolet Traverse car insurance rates low.

- Avoid the temptation to file a claim for minor incidents.

- Check your Chevrolet Traverse policy carefully to ensure all information is correct.

- Ask about farm and ranch vehicle discounts.

- Take a refresher course as an older driver.

- Watch your insurer closely when your Chevrolet Traverse needs repairs.

Factors That Determine Chevrolet Traverse Car Insurance Rates

Chevrolet Traverse Full Coverage Auto Insurance Monthly Rates by Driving Record

| Insurance Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| Allstate | $230 | $278 | $360 | $245 |

| American Family | $215 | $268 | $340 | $230 |

| Amica | $220 | $275 | $355 | $240 |

| Farmers | $242 | $295 | $375 | $255 |

| Geico | $160 | $210 | $315 | $190 |

| Liberty Mutual | $250 | $305 | $380 | $270 |

| Nationwide | $210 | $265 | $350 | $225 |

| Progressive | $218 | $270 | $340 | $235 |

| State Farm | $150 | $195 | $285 | $175 |

| Travelers | $245 | $290 | $365 | $260 |

Some states also allow insurers to look at your credit score when determining rates. Getting your credit score as high as you can will not only save you on car insurance, but it will also save you when you make a large purchase like a car or home.

Discover a wealth of knowledge in our “Compare Chevrolet Captiva Sport Car Insurance Rates.”

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Key Factors Influencing Your Car Insurance Premium

Learn actionable tips to potentially lower your rates and get the best value for your coverage. Watch now to understand what drives your insurance costs and how you can make informed decisions.

Safety Features on the Chevrolet Traverse

- Multi-car or multi-policy

- Good student

- Military or occupation

- Senior driver

- Driver’s education

Keep in mind that not all companies offer the same discounts or the same discount amounts. Always be sure to check with a company to see what is offered and compare companies to get the best rates. Gain deeper insights by exploring our “Best Chevrolet Avalanche Car Insurance.”

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Other Chevy Traverse Car Insurance Aspects

Where you live can affect how much your Chevrolet Traverse automobile insurance rates cost as well. Living in a city will most likely mean you pay more for the same vehicle than someone who lives in a rural area. If an area has a high crime rate, you can bet your car insurance rates will go up.

How much you drive is important as well, because the more time you spend on the road, the higher your chances of having an accident are. Some companies charge more if you have a longer commute.

To make sure you get the best rate, shop around and compare quotes since they can vary greatly between insurance providers. Enhance your comprehension with our “The 80 Fastest Cars Ranked by 0-60 Times.”

Get the minimum car insurance coverage you need to drive legally by entering your ZIP code into our free quote comparison tool.

Frequently Asked Questions

What factors determine the cost of Chevrolet Traverse car insurance?

The cost of Chevrolet Traverse car insurance is influenced by factors such as your driving record, age, location, model year of the vehicle, safety features, and the coverage options you select. Access supplementary details in our “Compare Chevrolet Beretta Car Insurance Rates.”

How can I find the cheapest Chevrolet Traverse car insurance?

To find the cheapest insurance, compare quotes from multiple insurers, consider higher deductibles, and take advantage of discounts like safe driver or multi-policy discounts.

What are the best companies for Chevrolet Traverse car insurance?

State Farm, Progressive, and Geico are among the best companies, offering competitive rates and specialized coverage options for Chevrolet Traverse owners.

Does the trim level of my Chevrolet Traverse affect insurance rates?

Yes, higher trim levels with more features may increase your insurance premiums due to the higher cost of repairs and replacement. Unlock additional information in our “Best Chevrolet Equinox Car Insurance.”

How do safety features on the Chevrolet Traverse impact insurance costs?

Safety features can lower insurance premiums as they reduce the risk of injury or damage. Insurers may offer discounts for vehicles equipped with advanced safety systems. Explore your car insurance options by entering your ZIP code and finding which companies have the lowest rates.

Is full coverage recommended for a Chevrolet Traverse?

Full coverage, which includes liability, collision, and comprehensive, is recommended if you have a newer model or are financing the vehicle, to protect your investment.

How does my driving history affect Chevrolet Traverse insurance premiums?

A clean driving record can lead to lower premiums, while accidents or violations can increase your insurance costs. Find out more by reading our “Best Chevrolet Camaro Car Insurance.”

Are there any discounts specific to Chevrolet Traverse car insurance?

Some insurers may offer discounts for specific safety features found in the Chevrolet Traverse, such as anti-lock brakes or electronic stability control.

How does my location impact Chevrolet Traverse insurance rates?

Insurance rates vary by location due to factors like crime rates, traffic congestion, and accident statistics. Urban areas typically have higher premiums than rural areas.

What coverage options should I consider for my Chevrolet Traverse?

Consider liability, collision, comprehensive, uninsured/underinsured motorist coverage, and personal injury protection based on your needs and budget. Get the full story by checking out our “Compare Chevrolet Silverado 1500 Car Insurance Rates.”

Can I get usage-based insurance for my Chevrolet Traverse?

Yes, companies like Progressive offer usage-based insurance programs like Snapshot, which can provide discounts based on your driving habits. Ready to find affordable car insurance? Use our free comparison tool to get started.

What is the average monthly cost of insuring a Chevrolet Traverse?

The average monthly cost for Chevrolet Traverse insurance can range from $75 to $150, depending on your coverage level, location, and other factors.

How does the age of my Chevrolet Traverse affect insurance rates?

Older models typically have lower insurance premiums due to their lower replacement value, while newer models may cost more to insure. Elevate your knowledge with our “Best Chevrolet Tahoe Car Insurance.”

What is the best way to lower my Chevrolet Traverse insurance costs?

To lower costs, maintain a clean driving record, choose a higher deductible, bundle policies, and explore available discounts.

Do Chevrolet Traverse insurance rates differ between providers?

Yes, rates can vary significantly between providers, so it’s important to compare quotes to find the best deal for your specific situation.

Is it more expensive to insure a Chevrolet Traverse than other SUVs?

Insurance costs for the Chevrolet Traverse are generally comparable to similar SUVs but can vary based on factors like safety ratings and repair costs. Learn more about our “Best Chevrolet Corvette Z06 Car Insurance” for a broader perspective.

Can I bundle my Chevrolet Traverse insurance with other policies?

Yes, many insurers offer discounts for bundling auto insurance with other policies like homeowners or renters insurance. When you’re ready to see how much you can save on your car insurance, enter your ZIP code into our free comparison tool.

What should I know about insuring a financed Chevrolet Traverse?

If you’re financing your Chevrolet Traverse, your lender may require full coverage insurance to protect their investment until the loan is paid off.

What are common mistakes to avoid when purchasing Chevrolet Traverse car insurance?

Avoid mistakes like not comparing quotes, underestimating necessary coverage, overlooking discounts, and failing to update your policy as your circumstances change.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.