Best Insurance for Luxury Cars in 2025 (Find the Top 10 Companies Here!)

State Farm, Geico, and Travelers stand out as the top picks for the best insurance for luxury cars. With rates starting at a 5% discount, these companies offer comprehensive coverage tailored to the needs of luxury car owners. Their flexible policies ensure reliable and affordable protection for high-end vehicles.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Nov 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Nov 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Luxury Cars

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for Luxury Cars

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 1,733 reviews

1,733 reviewsCompany Facts

Full Coverage for Luxury Cars

A.M. Best Rating

Complaint Level

1,733 reviews

1,733 reviews

Explore the top overall companies in the best insurance for luxury cars, where State Farm, Geico, and Travelers emerge as the premier choices. Each excelling in distinct aspects such as comprehensive coverage, cost-saving solutions, and tailored plans.

Explore our guide to luxury car insurance, meticulously crafted to unravel tailored coverage options and ensure unmatched protection with financial prudence.

Our Top 10 Company Picks: Best Insurance for Luxury Cars

Company Rank A.M. Best Anti-Theft Discount Best For Jump to Pros/Cons

#1 A++ 5% Comprehensive Coverage State Farm

#2 A++ 25% Cost-Conscious Consumers Geico

#3 A++ 10% Customizable Policies Travelers

#4 A+ 5% Tech-Savvy Customers Progressive

#5 A 5% Personalized Service American Family

#6 A+ 10% Enhanced Coverage Allstate

#7 A 15% Asset Protection Farmers

#8 A++ 20% High-Value Assets Chubb

#9 A 15% Classic Car Owners Hagerty

#10 A+ 10% Customer Satisfaction Amica

Overall, rates for luxury cars are higher because more expensive vehicles cost more to insure. Insurance companies pay more to repair or replace your vehicle in the event of an accident. Use this analysis to make informed decisions that protect your prized possessions while balancing quality and budget.

Get the right car insurance at the best price — enter your ZIP code above to shop for coverage from the top insurers.

- State Farm is the top pick for luxury car insurance, with a 5% discount rate

- Tailored coverage for luxury vehicles, ensuring comprehensive protection

- Affordable premiums for high-end cars, balancing quality and cost effectively

#1 – State Farm: Top Overall Pick

Pros

- Established Reputation: State Farm is one of the largest and most well-known insurance companies in the United States, with a long history of providing reliable coverage.

- Extensive Coverage Options: State Farm offers a wide range of insurance products, including auto, home, life, and specialty coverage, which may include options tailored for luxury cars.

- Personalized Service: Our State Farm car insurance review highlights how agents offer personalized assistance, aiding customers in selecting tailored coverage options.

Cons

- Potentially Higher Premiums: As a larger insurance company, State Farm may have higher premiums compared to smaller, specialized insurers.

- Limited Specialty Coverage: While State Farm offers a variety of insurance products, their coverage options for luxury cars may not be as comprehensive or specialized as those from companies specializing in high-value vehicles.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#2 – Geico: Best for Streamlined Insurance

Pros

- Competitive Rates: Geico car insurance review highlights the company’s competitive rates, making it a potential choice for affordable luxury car insurance options.

- Convenient Online Tools: Geico provides online tools and resources that make it easy for customers to get quotes, manage policies, and file claims.

- Variety of Discounts: Geico offers various discounts that may help lower the cost of luxury car insurance, such as multi-policy discounts or discounts for safety features.

Cons

- Limited Specialty Coverage: While Geico offers auto insurance coverage for a wide range of vehicles, including luxury cars, their options may not be as specialized or comprehensive as those from specialty insurers.

- Potentially Less Personalized Service: Geico is primarily known for its direct-to-consumer model, which may result in less personalized service compared to working with a local agent.

#3 – Travelers: Best for Comprehensive Protection

Pros

- Flexible Coverage Options: Travelers offers a variety of coverage options that may be tailored to meet the needs of luxury car owners, including specialized coverage for high-value vehicles.

- Strong Financial Stability: Travelers has a strong financial stability rating, which provides reassurance that they can fulfill their obligations to policyholders, including claims payments.

- Nationwide Presence: In our Travelers car insurance review, discover how this company operates in all 50 states, ensuring accessible coverage for luxury car owners nationwide.

Cons

- Potentially Higher Premiums: Travelers’ coverage options for luxury cars may come with higher premiums compared to standard auto insurance policies due to the higher value and repair costs associated with luxury vehicles.

- Limited Local Agents: While Travelers offers coverage nationwide, their reliance on independent agents may result in limited availability of local agents in some areas, which could affect the level of personalized service.

#4 – Progressive: Best for Innovative Technology

Pros

- Advanced Technology: Progressive utilizes advanced technology and online tools to provide a seamless and convenient experience for customers, including quote comparisons and policy management.

- Variety of Discounts: Progressive offers a wide range of discounts that may help lower the cost of luxury car insurance, such as safe driver discounts, multi-policy discounts, and discounts for safety features.

- Strong Financial Stability: Progressive car insurance review reveals the company’s robust financial stability, instilling confidence in meeting policyholder obligations, including claims payments

Cons

- Potentially Higher Premiums: Progressive’s rates for luxury car insurance may be higher compared to standard auto insurance policies due to the higher value and repair costs associated with luxury vehicles.

- Limited Local Agents: While Progressive offers online and phone support, their reliance on a direct-to-consumer model may result in limited availability of local agents for personalized assistance.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#5 – American Family: Best for Tailored Coverage

Pros

- Personalized Service: American Family agents often provide personalized service and guidance to help customers choose the right coverage for their needs, including options tailored for luxury cars.

- Variety of Coverage Options: American Family offers a variety of insurance products and coverage options, allowing customers to customize their policies to suit their unique needs, including coverage for luxury vehicles.

- Community Involvement: For customers seeking a company with strong values, American Family car insurance review highlights its community involvement and support, showcasing its commitment to service and reliability.

Cons

- Limited Availability: American Family primarily operates in select states, which may limit availability for customers outside of those areas.

- Potentially Higher Premiums: American Family’s rates for luxury car insurance may be higher compared to standard auto insurance policies due to the higher value and repair costs associated with luxury vehicles.

#6 – Allstate: Best for Trusted Protection

Pros

- Established Reputation: Allstate car insurance review shows Allstate as one of the largest and most well-known insurance companies in the United States, with a long history of providing reliable coverage.

- Extensive Coverage Options: Allstate offers a wide range of insurance products, including auto, home, life, and specialty coverage, which may include options tailored for luxury cars.

- Innovative Features: Allstate offers innovative features such as DriveWise and Claim Satisfaction Guarantee, which may provide additional value and peace of mind for customers.

Cons

- Potentially Higher Premiums: Allstate’s rates for luxury car insurance may be higher compared to standard auto insurance policies due to the higher value and repair costs associated with luxury vehicles.

- Limited Specialty Coverage: While Allstate offers a variety of insurance products, their coverage options for luxury cars may not be as specialized or comprehensive as those from companies specializing in high-value vehicles.

#7 – Farmers: Best for Personalized Service

Pros

- Personalized Service: Farmers agents often provide personalized service and guidance to help customers choose the right coverage for their needs, including options tailored for luxury cars.

- Variety of Coverage Options: Farmers offers a variety of insurance products and coverage options, allowing customers to customize their policies to suit their unique needs, including coverage for luxury vehicles.

- Strong Financial Stability: Farmers car insurance review highlights the company’s robust financial stability, instilling confidence in meeting policyholder obligations, such as claims payments.

Cons

- Potentially Higher Premiums: Farmers’ rates for luxury car insurance may be higher compared to standard auto insurance policies due to the higher value and repair costs associated with luxury vehicles.

- Limited Availability: Farmers primarily operates in select states, which may limit availability for customers outside of those areas.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#8 – Chubb: Best for Specialized Coverage

Pros

- Specialized Coverage: Chubb specializes in high-value insurance and offers specialized coverage options specifically tailored for luxury cars, including agreed value coverage and high coverage limits.

- Exceptional Service: Chubb is known for its exceptional customer service, providing personalized assistance and guidance to high-net-worth individuals with unique insurance needs.

- Global Presence: Chubb offers international car insurance, providing coverage options for luxury car owners who travel internationally.

Cons

- High Premiums: Chubb’s coverage options for luxury cars may come with higher premiums compared to standard auto insurance policies due to the higher value and repair costs associated with luxury vehicles.

- Limited Availability: Chubb’s coverage may be limited to high-net-worth individuals and select markets, potentially excluding customers who do not meet their eligibility criteria.

#9 – Hagerty: Best for Unique Coverage

Pros

- Specialized Coverage: Hagerty specializes in classic and collector car insurance and offers specialized coverage options specifically tailored for vintage and high-value vehicles, including agreed value coverage and spare parts coverage.

- Extensive Experience: Hagerty has extensive experience in the classic car insurance industry, with a deep understanding of the unique needs and challenges faced by collectors and enthusiasts.

- Club Memberships: Hagerty car insurance review reveals membership benefits and discounts for classic car enthusiasts, providing access to events, publications, and resources.

Cons

- Limited Coverage Options: Hagerty’s coverage options may be limited to classic and collector cars, potentially excluding coverage for modern luxury vehicles or daily drivers.

- Membership Requirements: Hagerty’s coverage may require membership in a classic car club or organization, which may not be suitable for all luxury car owners.

#10 – Amica: Best for Customer-Focused Service

Pros

- Exceptional Customer Service: For personalized assistance and support, get an Amica mutual car insurance quote online. Amica is consistently rated highly for its customer service.

- Strong Financial Stability: Amica has a strong financial stability rating, providing confidence that they can fulfill their obligations to policyholders, including claims payments.

- Variety of Coverage Options: Amica offers a variety of insurance products and coverage options, allowing customers to customize their policies to suit their unique needs, including coverage for luxury vehicles.

Cons

- Potentially Higher Premiums: Amica’s rates for luxury car insurance may be higher compared to standard auto insurance policies due to the higher value and repair costs associated with luxury vehicles.

- Limited Availability: Amica primarily operates in select states, which may limit availability for customers outside of those areas.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Exploring the Cost of Insuring Luxury Vehicles

Where can you find cheap luxury car insurance is that offers full coverage? Who has the best rates on auto insurance?

No matter what type of vehicle you have, an insurance provider will look at a variety of factors to determine how much your auto insurance rates will be. These include your:

- Driving history

- Credit score

- Commute length

- Home city and ZIP code

- Occupation

Auto insurance companies also look at the listed value of your vehicle. What car is the most expensive to insure?

Luxury cars are more expensive to insure. That’s because one factor in determining car insurance rates is the model of your vehicle.

You can often check the value of your vehicle on a site like Kelley Blue Book, but there’s one rule that’s always true:

The more expensive the vehicle is, the more expensive your car insurance will be.

Luxury vehicle insurance is very similar to ensuring other specialty cars, such as:

- Classic or antique car insurance

- Exotic or import car insurance

- Vintage car coverage

- Kit car auto insurance

And it is generally more expensive than normal car insurance.

You can see average rates for classic car insurance per state in the table below.

Average Annual Classic Car Insurance Rates by State

| States | Average Annual Comprehensive Insurance Rates | Average Annual Collision Insurance Rates | Average Annual Liability Insurance Rates | Average Annual Full Coverage Insurance Rates |

|---|---|---|---|---|

| Oregon | $56.32 | $136.10 | $350.48 | $542.90 |

| California | $60.32 | $237.93 | $293.80 | $592.05 |

| Hawaii | $60.94 | $187.90 | $275.12 | $523.97 |

| Maine | $62.99 | $155.99 | $203.32 | $422.29 |

| Washington | $63.83 | $159.44 | $358.00 | $581.28 |

| Utah | $65.70 | $159.54 | $298.52 | $523.76 |

| New Hampshire | $66.46 | $184.45 | $240.34 | $491.25 |

| Florida | $69.92 | $169.78 | $514.58 | $754.28 |

| Idaho | $69.93 | $131.43 | $206.57 | $407.93 |

| Nevada | $70.58 | $182.32 | $408.94 | $661.83 |

| Ohio | $72.97 | $161.90 | $238.27 | $473.14 |

| Indiana | $73.24 | $150.17 | $229.61 | $453.02 |

| Delaware | $73.49 | $191.26 | $479.58 | $744.34 |

| Vermont | $75.29 | $177.25 | $205.87 | $458.41 |

| Illinois | $76.88 | $185.83 | $268.03 | $530.74 |

| New Jersey | $78.81 | $229.12 | $521.74 | $829.67 |

| Connecticut | $78.97 | $221.11 | $390.56 | $690.64 |

| Rhode Island | $79.31 | $246.91 | $455.88 | $782.10 |

| Massachusetts | $80.98 | $232.97 | $363.62 | $677.57 |

| North Carolina | $81.65 | $176.15 | $215.65 | $473.45 |

| Virginia | $81.92 | $168.31 | $255.37 | $505.60 |

| Wisconsin | $82.09 | $135.60 | $224.62 | $442.31 |

| Alaska | $82.36 | $210.49 | $323.81 | $616.65 |

| Kentucky | $84.83 | $160.75 | $317.53 | $563.11 |

| Pennsylvania | $86.53 | $196.34 | $299.44 | $582.31 |

| Tennessee | $89.07 | $185.44 | $248.35 | $522.86 |

| Maryland | $91.63 | $212.39 | $365.84 | $669.87 |

| Michigan | $92.91 | $248.30 | $477.19 | $818.40 |

| Alabama | $93.79 | $190.78 | $236.53 | $521.09 |

| Georgia | $95.51 | $199.10 | $334.43 | $629.04 |

| New York | $102.67 | $231.01 | $482.71 | $816.40 |

| New Mexico | $103.54 | $166.19 | $292.82 | $562.55 |

| Colorado | $104.77 | $172.20 | $312.02 | $588.98 |

| South Carolina | $108.56 | $159.04 | $316.25 | $583.86 |

| Missouri | $108.76 | $165.17 | $249.53 | $523.46 |

| Iowa | $110.12 | $131.85 | $179.51 | $421.48 |

| Minnesota | $110.56 | $140.64 | $274.09 | $525.29 |

| Arizona | $111.67 | $166.78 | $305.26 | $583.71 |

| Arkansas | $114.25 | $193.08 | $236.48 | $543.80 |

| West Virginia | $122.57 | $197.80 | $295.10 | $615.47 |

| Texas | $123.85 | $224.69 | $317.25 | $665.80 |

| Mississippi | $126.20 | $193.93 | $276.30 | $596.43 |

| Montana | $127.15 | $159.19 | $231.77 | $518.11 |

| Louisiana | $129.10 | $248.62 | $465.50 | $843.22 |

| Oklahoma | $135.50 | $191.08 | $276.61 | $603.19 |

| Nebraska | $137.55 | $142.28 | $218.78 | $498.61 |

| North Dakota | $138.62 | $146.45 | $178.91 | $463.98 |

| District of Columbia | $139.94 | $281.20 | $377.29 | $798.44 |

| Kansas | $144.82 | $158.00 | $214.94 | $517.76 |

| Wyoming | $148.54 | $167.30 | $192.62 | $508.46 |

| South Dakota | $154.87 | $125.15 | $180.13 | $460.15 |

As you can see, rates vary wildly by the state. Classic car insurance rates in Idaho averaged $407.93/year, while rates in Louisiana are more than twice as much at around $843.22/year. To save money on luxury car insurance, maintaining a good driving record is key. Similar to other types of car insurance, avoiding violations and accidents can help keep rates reasonable.

If you already have a less-than-ideal driving record, making a concerted effort to steer clear of further infractions can ultimately lead to more affordable premiums. The longer you go without a ticket or a claim, the less expensive your insurance will be. You should see changes on your insurance every six months that you keep your record clean. To keep your car insurance rates reasonable, consider these strategies.

Firstly, avoid letting teen drivers use your luxury car, as they often result in increased rates. Additionally, if your luxury car is primarily for occasional driving, explore options like pay-as-you-go insurance or inquire about discounts for low mileage. If you drive infrequently, negotiate for reduced rates to reflect your decreased risk.

Adjusting your deductible can also impact premiums; while excessively high deductibles should be avoided, opting for a moderate increase, such as $250 to $500, can yield significant savings. Moreover, joining a club for luxury car owners may qualify you for insurance discounts, demonstrating your commitment to vehicle maintenance and responsible driving habits.

When you join a club, the insurance company believes you will drive more carefully because you really care about your vehicle more than the average car owner does.

Luxury Car Insurance: Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $130 $160

American Family $115 $144

Amica $98 $135

Chubb $170 $200

Farmers $135 $170

Geico $95 $125

Hagerty $110 $140

Progressive $125 $158

State Farm $100 $138

Travelers $120 $155

The journey of insuring your luxury car demands a meticulous comparison of coverage options and premiums offered by top insurance providers. This table presents a comprehensive overview of monthly insurance rates for luxury cars, delineating the minimum and full coverage options provided by leading companies, including liability, collision, and comprehensive coverage.

Navigating the realm of luxury car insurance requires careful consideration of both coverage levels and associated costs. By exploring the monthly rates offered by prominent insurance providers, encompassing essential coverages such as liability, collision, and comprehensive, you can make informed decisions to ensure optimal protection for your prized possession while aligning with your budgetary preferences.

Type of Luxury Car Insurance Should Buy

When buying a luxury car, ensure substantial protection as the minimum car insurance requirements by state, listed on the Insurance Information Institute’s website, likely won’t cover accident costs. For adequate coverage, check the table below for state minimums and necessary coverage for your location.

Car Insurance Coverage Requirements by State

| State | Coverages | Limits |

|---|---|---|

| Alabama | Bodily injury and property damage liability | 25/50/25 |

| Alaska | Bodily injury and property damage liability | 50/100/25 |

| Arizona | Bodily injury and property damage liability | 25/50/15 |

| Arkansas | Bodily injury and property damage liability, personal injury protection (PIP) | 25/50/25 |

| California | Bodily injury and property damage liability | 15/30/5 |

| Colorado | Bodily injury and property damage liability | 25/50/15 |

| Connecticut | Bodily injury and property damage liability, uninsured/underinsured motorist (UM, UIM) | 25/50/25 |

| Delaware | Bodily injury and property damage liability, personal injury protection (PIP) | 25/50/10 |

| Florida | Property damage liability, personal injury protection (PIP) | 10/20/10 |

| Georgia | Bodily injury and property damage liability | 25/50/25 |

| Hawaii | Bodily injury and property damage liability, personal injury protection (PIP) | 20/40/10 |

| Idaho | Bodily injury and property damage liability | 25/50/15 |

| Illinois | Bodily injury and property damage liability, uninsured/underinsured motorist (UM, UIM) | 25/50/20 |

| Indiana | Bodily injury and property damage liability | 25/50/25 |

| Iowa | Bodily injury and property damage liability | 20/40/15 |

| Kansas | Bodily injury and property damage liability, personal injury protection (PIP) | 25/50/25 |

| Kentucky | Bodily injury and property damage liability, personal injury protection (PIP), uninsured/underinsured motorist (UM, UIM) | 25/50/25 |

| Louisiana | Bodily injury and property damage liability | 15/30/25 |

| Maine | Bodily injury and property damage liability, uninsured/underinsured motorist (UM, UIM), medical payments (Medpay) | 50/100/25 |

| Maryland | Bodily injury and property damage liability, personal injury protection (PIP), uninsured/underinsured motorist (UM, UIM) | 30/60/15 |

| Massachusetts | Bodily injury and property damage liability, personal injury protection (PIP) | 20/40/5 |

| Michigan | Bodily injury and property damage liability, personal injury protection (PIP) | 20/40/10 |

| Minnesota | Bodily injury and property damage liability, personal injury protection (PIP), uninsured/underinsured motorist (UM, UIM) | 30/60/10 |

| Mississippi | Bodily injury and property damage liability | 25/50/25 |

| Missouri | Bodily injury and property damage liability, uninsured/underinsured motorist (UM) | 25/50/25 |

| Montana | Bodily injury and property damage liability | 25/50/20 |

| Nebraska | Bodily injury and property damage liability, uninsured/underinsured motorist (UM, UIM) | 25/50/25 |

| Nevada | Bodily injury and property damage liability | 25/50/20 |

| New Hampshire | Financial responsibility (FR) only | 25/50/25 |

| New Jersey | Bodily injury and property damage liability, personal injury protection (PIP), uninsured/underinsured motorist (UM, UIM) | 15/30/5 |

| New Mexico | Bodily injury and property damage liability | 25/50/10 |

| New York | Bodily injury and property damage liability, personal injury protection (PIP), uninsured/underinsured motorist (UM, UIM) | 25/50/10 |

| North Carolina | Bodily injury and property damage liability, uninsured/underinsured motorist (UM, UIM) | 30/60/25 |

| North Dakota | Bodily injury and property damage liability, personal injury protection (PIP), uninsured/underinsured motorist (UM, UIM) | 25/50/25 |

| Ohio | Bodily injury and property damage liability | 25/50/25 |

| Oklahoma | Bodily injury and property damage liability | 25/50/25 |

| Oregon | Bodily injury and property damage liability, personal injury protection (PIP), uninsured/underinsured motorist (UM, UIM) | 25/50/20 |

| Pennsylvania | Bodily injury and property damage liability, personal injury protection (PIP) | 15/30/5 |

| Rhode Island | Bodily injury and property damage liability | 25/50/25 |

| South Carolina | Bodily injury and property damage liability, uninsured/underinsured motorist (UM) | 25/50/25 |

| South Dakota | Bodily injury and property damage liability, uninsured/underinsured motorist (UM, UIM) | 25/50/25 |

| Tennessee | Bodily injury and property damage liability | 25/50/15 |

| Texas | Bodily injury and property damage liability, personal injury protection (PIP) | 30/60/25 |

| Utah | Bodily injury and property damage liability, personal injury protection (PIP) | 25/65/15 |

| Vermont | Bodily injury and property damage liability, uninsured/underinsured motorist (UM, UIM) | 25/50/10 |

| Virginia | Bodily injury and property damage liability, uninsured/underinsured motorist (UM, UIM) | 25/50/20 |

| Washington, D.C | Bodily injury and property damage liability | 25/50/10 |

| West Virginia | Bodily injury and property damage liability, uninsured/underinsured motorist (UM, UIM) | 25/50/25 |

| Wisconsin | Bodily injury and property damage liability, uninsured/underinsured motorist (UM, Medpay) | 25/50/10 |

| Wyoming | Bodily injury and property damage liability | 25/50/20 |

When buying liability car insurance, plan for the worst-case scenario. Collision insurance is essential as it’s the only type covering vehicle repairs post-accident. Comprehensive insurance covers damages from fire, weather, and theft. Both are the priciest options in your policy. Here’s a short video discussing the difference between the two.

Consider gap insurance if you’ve financed your vehicle and it’s available in your state. This insurance covers the difference between your car’s market value and what you owe if it’s totaled, potentially saving you significant money in a severe accident.

High-End Car Insurance Companies

Standard insurance often falls short for special imports, kits, or supercars, necessitating car insurance for specialty vehicles. Specialty insurers such as Hagerty Car Insurance, Grundy Insurance, and Heacock Classic offer tailored coverage at competitive rates.

Unlike standard providers like Geico, these companies agree on your car’s value based on comprehensive criteria beyond Kelley Blue Book, ensuring proper coverage.

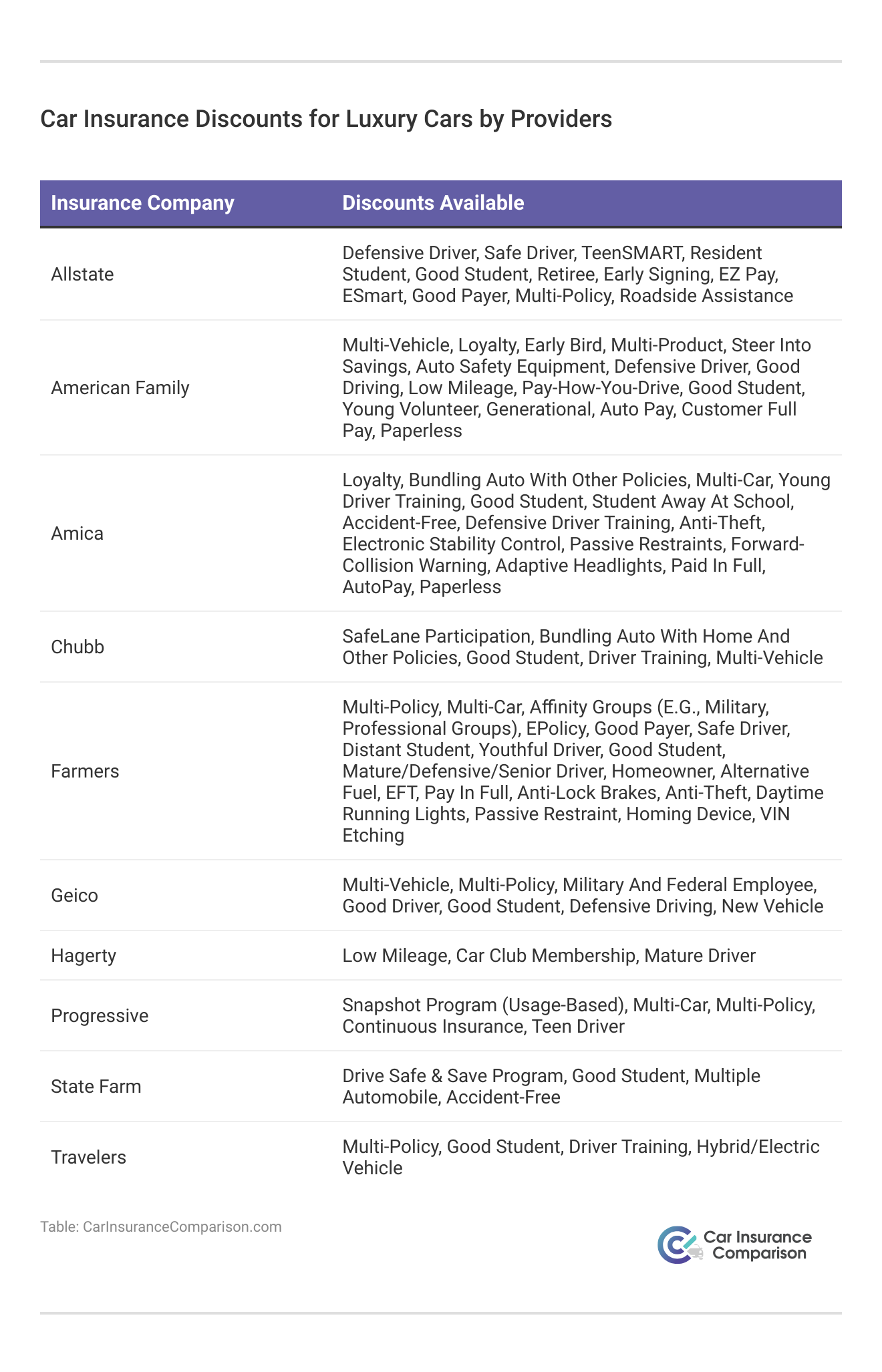

When it comes to insuring luxury cars, finding the right discounts can make a significant difference in premiums. This guide outlines the various discounts provided by top insurance companies, tailored specifically for owners of high-end vehicles.

Understanding the available discounts can lead to substantial savings on luxury car insurance. Review this guide to identify which discounts you might qualify for and discuss them with your insurance provider to optimize your policy.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Comparison Shopping for Luxury Car Insurance

When you purchased your luxury car, did you buy the first one you saw or did you shop around and try to get the best deal? Chances are you went online and checked every car dealership that sold the car you were considering buying to see who had the best deal. Similarly, when looking for car insurance for car dealerships, it’s crucial to compare options to ensure you’re getting the most favorable terms and rates.

When you shop for car insurance, you should do the same thing. You need to check with different companies to see who has the best rates for you. Remember that prices everywhere will vary; luxury car insurance costs in Australia, India, and the U.K. will be different from the U.S.

Fortunately, this process is a lot easier than it was when you were looking for the perfect car; you can find the perfect luxury car insurance without having to look at multiple sites.

The easiest way to accomplish this is to use our free quote tool. You’ll be able to compare the rates from several different quality companies in a single location.

Luxury Car Insurance Case Studies: Tailored Solutions for High-End Vehicles

Comprehensive insurance coverage is essential for safeguarding valuable assets and ensuring seamless business operations, especially in the realm of luxury automobiles. Through carefully tailored insurance solutions, companies in the luxury car industry mitigate risks and preserve financial stability. Let’s explore three case studies highlighting the effectiveness of such insurance provisions.

- Case Study #1 – Comprehensive Coverage for Luxury Cars: Lakeside Motors, a luxury car dealership, required insurance for their high-end vehicles. State Farm provided Lakeside Motors with robust general liability coverage tailored specifically for luxury cars, managing medical expenses and legal proceedings seamlessly, ensuring financial stability.

- Case Study #2 – Tailored Insurance Protection for Luxury Cars: Adventure Motors, a luxury car rental company, needed insurance to provide tailored protection for their fleet of high-end vehicles. Geico’s commercial car insurance facilitated medical care and vehicle repairs swiftly, enabling Adventure Motors to resume operations without disruption.

- Case Study #3 – Comprehensive Insurance Solutions for Luxury Cars: Prestige Motors, a luxury car dealership, sought insurance to protect their valuable inventory and employees. Travelers provided comprehensive insurance solutions tailored for luxury cars, covering medical bills and wage replacement for employees in case of accidents, ensuring financial stability and business continuity.

These case studies underscore the importance of tailored insurance solutions in the luxury car industry. Whether it’s protecting high-end vehicles, facilitating swift repairs, or ensuring employee well-being, comprehensive insurance coverage plays a pivotal role in maintaining business continuity and financial security.

By partnering with trusted insurers, companies in the luxury car sector can navigate challenges confidently, knowing their assets and operations are adequately protected.

Ensuring Optimal Protection: Navigating Luxury Car Insurance Choices

Securing insurance coverage for luxury cars requires thorough consideration of protection levels and costs. With rates typically higher than regular monthly car insurance, owners can explore strategies for affordable premiums, such as low mileage coverage, higher deductibles, or leveraging discounts.

The most effective approach is comparing luxury car insurance options from multiple providers to identify suitable coverage tailored to their needs, ensuring optimal protection while maintaining financial prudence.

See if you’re getting the best deal on car insurance by entering your ZIP code below.

Frequently Asked Questions

What is the best insurance for expensive cars?

State Farm, Travelers and Progressive are the best car insurance companies for luxury cars. Exotic cars usually need a specialty insurance company like Hagerty, Grundy Insurance or PURE Insurance.

For further insights into the Best Insurance for Exotic Cars, refer to our comprehensive guide titled “Best Insurance for Exotic Cars Guide” for expert recommendations.

How to determine insurance premium?

Insurance premiums vary based on the coverage and the person taking out the policy. Many variables factor into the amount that you’ll pay, but the main considerations are the level of coverage that you’ll receive and personal information such as age and personal information.

Ready to shop around for the best car insurance company? Enter your ZIP code below and see which one offers the coverage you need.

What age is car insurance most expensive?

Young drivers ages 16 to 24 tend to have the most expensive car insurance. Drivers in this age group are often inexperienced and are more likely to get into car accidents and file insurance claims. As a result, car insurance companies often charge higher premiums to young drivers.

To delve deeper, explore our comprehensive resource on commercial auto insurance titled “Understanding Car Accidents” for invaluable insights.

What car has the cheapest insurance?

Mazdas, Chryslers and Subarus are the cheapest cars to insure. Certain car makes tend to be more expensive to insure than others. For example, a Mazda tends to be cheaper to insure when compared to a luxury brand such as Tesla.

What are the 4 recommended type of insurance?

Four types of insurance that most financial experts recommend include life, health, auto, and long-term disability.

What is the best insurance company for Lamborghini?

Many insurance companies won’t cover Lamborghinis due to their expensive parts, high horsepower and increased risk of a more expensive accident. Specialty insurance companies like Chubb or Hagarty are more likely to offer coverage for the supercar. However, you’ll likely pay significantly more for insurance.

For further exploration, consult our comprehensive report titled “Cheap Car Insurance for Supercars” for detailed insights.

What is the best car insurance for a 50 year old woman?

We found that the best car insurance companies for 50-year-olds include USAA, Geico, State Farm, Erie and The Hartford. This list comes from extensive research using quoted annual premiums sourced from Quadrant Information Services and third-party rankings like the J.D. Power 2023 Auto Claims Satisfaction Study.

How is insurance calculated?

All insurance companies use data and statistics to predict levels of risk for various individuals or groups. This risk calculation information is also used to develop rating plans. Generally, higher risk factors will result in higher premium rates and lower risk factors will drive premiums lower.

By entering your ZIP code below, you can get instant car insurance quotes from top providers.

What is the most expensive car insurance?

Our research on average rates found that Dodge tends to be the automaker with the most expensive coverage and that the Dodge Charger has the most expensive car insurance of any model.

For additional information, explore our comprehensive resource titled “Compare Dodge Charger Car Insurance Rates” for detailed insights.

What is an example of premium insurance?

Premiums are earned over the life of the insurance policy for which they’ve been paid—a concept known as earned premiums. For example, let’s say you buy a new home insurance policy that lasts one year, and you pay your $1,000 annual premium up-front.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.