Cheapest Oregon Car Insurance Rates in 2025 (10 Most Affordable Companies)

Explore the cheapest Oregon car insurance rates with State Farm, Progressive, and Travelers offering competitive rates as low as $38 per month for minimum coverage. Learn more about the car insurance options available in Oregon and company strengths to help make informed insurance decisions.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Zach Fagiano

Insurance & Finance Analyst

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Insurance & Finance Analyst

UPDATED: Jul 26, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jul 26, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,155 reviews

18,155 reviewsCompany Facts

Min. Coverage for Oregon

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 13,283 reviews

13,283 reviewsCompany Facts

Min. Coverage for Oregon

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 1,733 reviews

1,733 reviewsCompany Facts

Min. Coverage for Oregon

A.M. Best Rating

Complaint Level

1,733 reviews

1,733 reviews

State Farm, Progressive, and Travelers offer the cheapest Oregon car insurance rates, starting at $38 per month, making them the top picks for affordability. This article explores how these insurers excel in coverage and customer satisfaction while detailing discounts and special offers.

Finding cheap car insurance in Oregon starts by taking the time to so that you can make an informed decision about your car insurance.

Our Top 10 Company Picks: Cheapest Oregon Car Insurance Rates

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $38 B Broad Coverage State Farm

#2 $39 A+ Flexible Plans Progressive

#3 $49 A++ Hybrid Discount Travelers

#4 $51 A+ High Satisfaction Amica

#5 $54 A Family Discounts American Family

#6 $56 A+ Vanishing Deductible Nationwide

#7 $57 A Personal Service Farmers

#8 $60 A Budget Friendly The General

#9 $71 A Custom Options Liberty Mutual

#10 $78 A+ Safe Driver Allstate

In our guide, we compare Oregon car insurance rates and coverage, the best companies, driving laws, and more. Find cheap car insurance quotes by entering your ZIP code above.

- Oregon drivers must carry 25/50/20 of liability car insurance to drive

- Average full coverage car insurance cost in Oregon

- Rates will vary based on a driver’s chosen coverages and driving record

#1 – State Farm: Top Pick Overall

Pros

- Most Affordable Rates: State Farm leads the field in affordability with a starting monthly rate of $38 for minimum coverage, making it the cheapest option for Oregon drivers seeking low-cost insurance. This competitive pricing provides significant savings compared to other insurers.

- Extensive Coverage Options: State Farm offers a broad range of coverage options, including customizable policies that allow Oregonians to tailor their insurance to meet specific needs while maintaining low rates. This flexibility ensures that drivers can find coverage that fits their budget. Unlock details in our State Farm car insurance review.

- Strong Discount Program: State Farm provides significant savings through discounts for safe driving, bundling policies, and good credit. Oregon drivers can benefit from these discounts to lower their premiums while still getting comprehensive coverage.

Cons

- Higher Rates for High-Risk Drivers: State Farm’s premiums for drivers in Oregon with a history of accidents or violations are generally higher, which could offset its affordability for high-risk individuals. This limitation means that drivers with less-than-perfect records might not benefit from the lowest rates.

- Limited Discounts: While State Farm offers some discounts, they are less extensive compared to competitors. Oregon drivers might find fewer opportunities to lower their premiums beyond the basic discounts, impacting the overall affordability for some policyholders.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#2 – Progressive: Best for Flexible Plans

Pros

- Customizable Coverage Plans: Progressive provides highly customizable coverage options, allowing Oregon drivers to mix and match their policy features according to their preferences and budget. This flexibility ensures that policyholders can maintain low costs while adjusting coverage to their needs.

- Snapshot Program Discounts: The Snapshot program offers potential discounts based on driving habits, rewarding safe driving with lower premiums. This can significantly reduce insurance costs for responsible Oregon drivers who maintain good driving records.

- Comprehensive Online Tools: Progressive’s user-friendly online tools and mobile app simplify policy management and claims processing, providing Oregon drivers with convenient access to their insurance information and potentially lowering the overall cost of managing their policy. Delve into our evaluation of Progressive car insurance review.

Cons

- Inconsistent Customer Service: Customer service experiences with Progressive can vary, with some Oregon drivers reporting difficulties in service quality. This inconsistency might lead to dissatisfaction, particularly if issues arise while managing a low-cost policy.

- Higher Rates for Certain Drivers: Young drivers and those with poor credit scores may face higher premiums with Progressive, potentially negating the benefits of its competitive rates for those demographics. This factor can impact affordability for a segment of Oregon drivers.

#3 – Travelers: Best for Hybrid Discount

Pros

- Hybrid Vehicle Discounts: Travelers offers significant discounts for hybrid and electric vehicles, making it an attractive option for environmentally conscious Oregon drivers looking to save on insurance costs while benefiting from their vehicle’s eco-friendly features.

- Top-Tier Financial Stability: With an A++ rating from A.M. Best, Travelers provides robust financial stability, ensuring reliable claims handling and support for policyholders even with its competitive pricing. This rating is essential for Oregon drivers seeking dependable coverage.

- Comprehensive Coverage Options: Travelers provides a wide range of coverage options, including specialized policies for unique assets. This extensive coverage ensures that Oregon drivers can find a policy that meets their needs while benefiting from competitive rates. See more details on our Travelers car insurance review.

Cons

- Limited Regional Availability: Travelers’ insurance products are not available in all states, which could restrict access for some Oregon drivers. This limitation means that not everyone in Oregon can take advantage of the low rates offered by Travelers.

- Higher Premiums for Older Vehicles: Travelers tends to charge higher premiums for older vehicles, which might offset the benefits of their competitive rates for those insuring older cars. This factor could be a disadvantage for Oregon drivers with aging vehicles.

#4 – Amica: Best for High Satisfaction

Pros

- High Customer Satisfaction: Amica consistently receives high ratings for customer satisfaction, reflecting its commitment to excellent service and quick claims processing. Oregon drivers can expect a positive experience with their low-cost insurance policy, enhancing overall value.

- Dividend Policies for Savings: Amica’s dividend policies return a portion of premiums to policyholders, effectively reducing the overall insurance cost over time. This feature provides additional savings for Oregon drivers beyond the competitive initial rates.

- Broad Coverage Options: Amica offers a comprehensive range of coverage options, allowing Oregon drivers to bundle policies and potentially save more on their insurance. This flexibility helps maintain affordability while providing extensive protection.

Cons

- Higher Premiums for New Customers: New policyholders may face higher initial premiums compared to long-term customers, which could diminish the appeal of Amica’s low-cost options for those seeking immediate affordability. This factor might impact budget-conscious Oregon drivers.

- Limited Online Tools: While Amica provides good customer service, its online tools and mobile app are less robust compared to some competitors, which may be inconvenient for tech-savvy customers in Oregon. Check out this page titled How do you get an amica mutual car insurance quote online? for more details.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#5 – American Family: Best for Family Discounts

Pros

- Family-Oriented Discounts: American Family offers various discounts tailored for families, such as savings for insuring multiple vehicles and good student discounts. These benefits help Oregon families reduce their insurance costs while enjoying competitive rates.

- Community Engagement: American Family’s strong involvement in local communities enhances customer loyalty and provides a positive impact. Oregon drivers might appreciate the added value of supporting a company that invests in their local area.

- Customizable Coverage Options: As mentioned in our American Family car insurance review, American Family provides a range of customizable coverage options, allowing Oregon drivers to tailor their insurance plans to their specific needs while benefiting from family-related discounts.

Cons

- Higher Rates in Some Regions: American Family’s premiums can be higher in certain areas of Oregon, making it less competitive compared to other insurers for drivers in those regions. This variation can affect overall affordability for some customers.

- Inconsistent Customer Service: Customer service experiences with American Family can be mixed, with some Oregon drivers reporting inconsistent service quality. This variability might impact the satisfaction of those seeking reliable support for their low-cost policy.

#6 – Nationwide: Best for Vanishing Deductible

Pros

- Vanishing Deductible Program: Nationwide’s Vanishing Deductible program reduces your deductible for each year of safe driving, providing tangible rewards for maintaining a clean driving record. This feature offers additional savings for Oregon drivers beyond their low-cost premiums.

- Comprehensive Online Resources: Nationwide’s extensive online resources, including a user-friendly website and mobile app, make it easy for Oregon drivers to manage their policies and file claims efficiently, enhancing the overall value of their insurance.

- Wide Range of Coverage Options: Nationwide provides a broad array of coverage options, ensuring that Oregon drivers can find a policy that fits their needs while benefiting from competitive rates and the Vanishing Deductible program. Check out insurance savings in our complete Nationwide car insurance discount.

Cons

- Higher Premiums for Young Drivers: Nationwide tends to charge higher premiums for young and inexperienced drivers, which can offset the benefits of its low-cost rates for families with teenage drivers. This factor impacts affordability for younger Oregonians.

- Variable Customer Service: Some customers report variability in Nationwide’s customer service, with experiences ranging from excellent to subpar. This inconsistency can affect Oregon drivers’ satisfaction with their insurance experience.

#7 – Farmers: Best for Personal Service

Pros

- Personalized Customer Service: Farmers is known for its personalized customer service, offering tailored support and guidance to Oregon drivers. This approach enhances the value of their affordable insurance policies by ensuring individual needs are met.

- Extensive Coverage Options: Farmers offers a wide range of coverage options, including specialized insurance for motorcycles, boats, and recreational vehicles. This diversity allows Oregon drivers to find comprehensive protection while benefiting from competitive rates.

- Strong Financial Stability: With solid financial stability, Farmers ensures reliable claims handling and support, providing confidence to Oregon drivers that their low-cost insurance will be managed effectively even in the event of a claim. Learn more in our Farmers car insurance review.

Cons

- Higher Premiums for High-Risk Drivers: Farmers often charges higher premiums for drivers with a history of accidents or violations, which can reduce the attractiveness of its low-cost options for those in higher-risk categories. This affects affordability for some Oregon drivers.

- Limited Discounts: Farmers’ discount offerings are not as extensive as those from some competitors, potentially limiting the opportunities for Oregon drivers to lower their premiums further beyond the initial low rates.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#8 – The General: Best for Budget Friendly

Pros

- Affordable Rates for High-Risk Drivers: The General specializes in providing low-cost insurance for high-risk drivers, making it an accessible option for those with less-than-perfect driving records. This affordability helps Oregon drivers who might struggle to find coverage elsewhere.

- Easy Online Application Process: The General’s straightforward online application process simplifies getting a quote and purchasing insurance, providing a quick and convenient way for Oregon drivers to secure affordable coverage without hassle.

- Flexible Payment Options: As outlined in our The General car insurance review, The General offers flexible payment plans, allowing Oregon drivers to manage their premiums more easily. This flexibility supports maintaining continuous coverage while benefiting from budget-friendly rates.

Cons

- Limited Coverage Options: The General’s range of coverage options is more limited compared to some competitors, which may not meet the needs of all Oregon drivers. This limitation could impact the suitability of their low-cost policies for some customers.

- Mixed Customer Service Reviews: While some customers report positive experiences, others have noted issues with customer service responsiveness and claim processing times. This variability can affect the overall satisfaction of Oregon drivers with their insurance.

#9 – Liberty Mutual: Best for Custom Options

Pros

- Customizable Coverage Options: Liberty Mutual provides a variety of add-ons and coverage options, allowing Oregon drivers to tailor their insurance plans to their specific needs. This customization enhances the value of their policies while maintaining competitive rates.

- Strong Financial Ratings: With high financial stability ratings, Liberty Mutual ensures that claims will be handled reliably, providing peace of mind for Oregon drivers who seek reliable coverage while benefiting from their competitive rates. This robust financial foundation is crucial for long-term security. Learn more in our Liberty Mutual car insurance review.

- Various Discount Opportunities: Liberty Mutual offers a range of discounts, including multi-policy and safety feature discounts, which can further reduce insurance costs for Oregon drivers. These discounts provide additional savings beyond the already competitive rates.

Cons

- Higher Premiums for Young Drivers: Liberty Mutual’s premiums for Oregon’s young and inexperienced drivers can be higher compared to other insurers, which may diminish the appeal of their low-cost options for families with teenage drivers. This factor impacts overall affordability for certain demographics.

- Complex Policy Options: The wide range of customizable options can make it challenging for some Oregon drivers to navigate and select the best policy for their needs. This complexity may affect the ease of finding the most cost-effective coverage.

#10 – Allstate: Best for Safe Driver

Pros

- Wide Range of Coverage Options: Allstate offers extensive coverage choices that cater to various needs, from basic liability to comprehensive and collision coverage. For Oregon drivers seeking the best protection, these options ensure tailored policies that can accommodate specific coverage requirements, including uninsured motorist protection and roadside assistance. Discover more about offerings in our Allstate car insurance review.

- Numerous Discount Opportunities: Allstate provides a variety of discounts that can help lower insurance premiums for Oregon drivers. Discounts include those for bundling policies, safe driving, and installing safety features. These opportunities can significantly reduce overall insurance costs while maintaining robust coverage.

- Local Agents for Personalized Service: With a strong presence in Oregon, Allstate’s local agents offer personalized assistance, helping drivers understand their coverage options and find the most cost-effective solutions. This hands-on approach ensures that policyholders receive tailored advice and support in selecting the best insurance plan for their needs.

Cons

- Higher Rates for Some Drivers: While Allstate offers comprehensive coverage, their rates may be higher compared to other insurers, particularly for drivers with less-than-perfect driving records or high-risk profiles. This factor can impact the affordability of insurance for certain Oregon drivers seeking the cheapest options.

- Potential for Increased Premiums: Allstate’s rates might increase significantly after an accident or claim, which can affect long-term affordability. This trend could be a concern for Oregon drivers looking for stable and consistent premium rates over time.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Oregon Car Insurance Coverage and Rates

What coverage should you be getting? What rates will you have to pay for that coverage? In this section, we’ll go over all of the information you’ll need to know about picking out the optimal coverage and rates for driving safely in Oregon. The bottom line is that we want you to know what it is you’re paying for.

The table below compares monthly rates for minimum and full coverage car insurance in Oregon from various providers.

Oregon Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $78 $153

American Family $54 $106

Amica $51 $131

Farmers $57 $111

Liberty Mutual $71 $141

Nationwide $56 $111

Progressive $39 $78

State Farm $38 $75

The General $60 $150

Travelers $49 $97

It is your money after all. We’ve gone through and explained items such as minimum liability coverage, forms of financial responsibility, average rates in Oregon, and more. Keep reading to learn more.

Oregon Minimum Liability Coverage

Is car insurance mandatory in Oregon? Oregon requires each driver has something known as liability car insurance coverage on their vehicle. What does this mean? The minimum liability coverage is the absolute minimum insurance coverage you can have in order to drive in Oregon.

It basically means that if you are in a car accident, you’re able to pay off all of the costs of that accident without having to go into debt. So what is Oregon’s minimum coverage? Oregon follows what’s known as a 25/50/20 liability coverage system. Below we’ve gone through what exactly this means.

- 25 = $25,000 to pay for bodily injuries per person

- 50 = $50,000 for total bodily injury per accident

- 20 = $20,000 for property damage per Accident

Keep in mind as well, Oregon law also requires that drivers also have the following coverage (in addition to the minimum coverage rates above)

- $15,000 for personal injury protection

- $25,000 per person and $50,000 total per accident for uninsured motorist coverage

This additional coverage is different by state, as a lot of states do not require this additional coverage and make it optional to drivers. Oregon, however, wants to ensure the best protection for their drivers and make these two items required. This can make the minimum coverage costs more expensive in Oregon than in other states.

Keep in mind that this is just the mininum coverage you must have in Oregon. It’s always recommended to get more than this minimum amount. The better protection you have for yourself, the less you have to worry in the future.

Forms of Financial Responsibility

As it is required to have car insurance, Oregon auto insurance law also requires that all drivers have at least one form of financial responsibility on them while operating a vehicle. What is a form of financial responsibility? Also known as proof of insurance, they are forms of documentation that serve as proof that you have Oregon’s required minimum liability coverage.

There are a few acceptable forms of proof of insurance, which can be at least one of the following:

- Valid (and Current) Insurance ID Card

- Current Liability Insurance Binder or a copy of your Insurance Policy

- Signed letter from an insurance agent or company official (must be on company letterhead)

- DMV certificate of self-insurance that names the vehicle owner

You need to have at least one of the above with you when you are driving. If you are pulled over by law enforcement for whatever reason (traffic violation, traffic stop, accident, etc.), you will need to provide some form of proof. If you do not, you may face penalties such as fines or license/registration suspension.

If you have been driving without insurance, you may also need to file an SR-22 form in order to prove that you do have insurance. It’s another form of financial responsibility that guarantees that you will hold at least the minimum required car insurance for a full three years. There are a few reasons why you would need to file an SR-22:

- You were convicted of driving without insurance

- You own a vehicle that was uninsured at the time of an accident

- You want to reinstate your driving privileges

- You are applying for a hardship or probationary permit

All of these require you to have an SR-22 certificate, and all start on the date you received one of the above. You will be required to carry this with you for a minimum of three years. If you do NOT file an SR-22 when you are ordered to, your license will be immediately suspended.

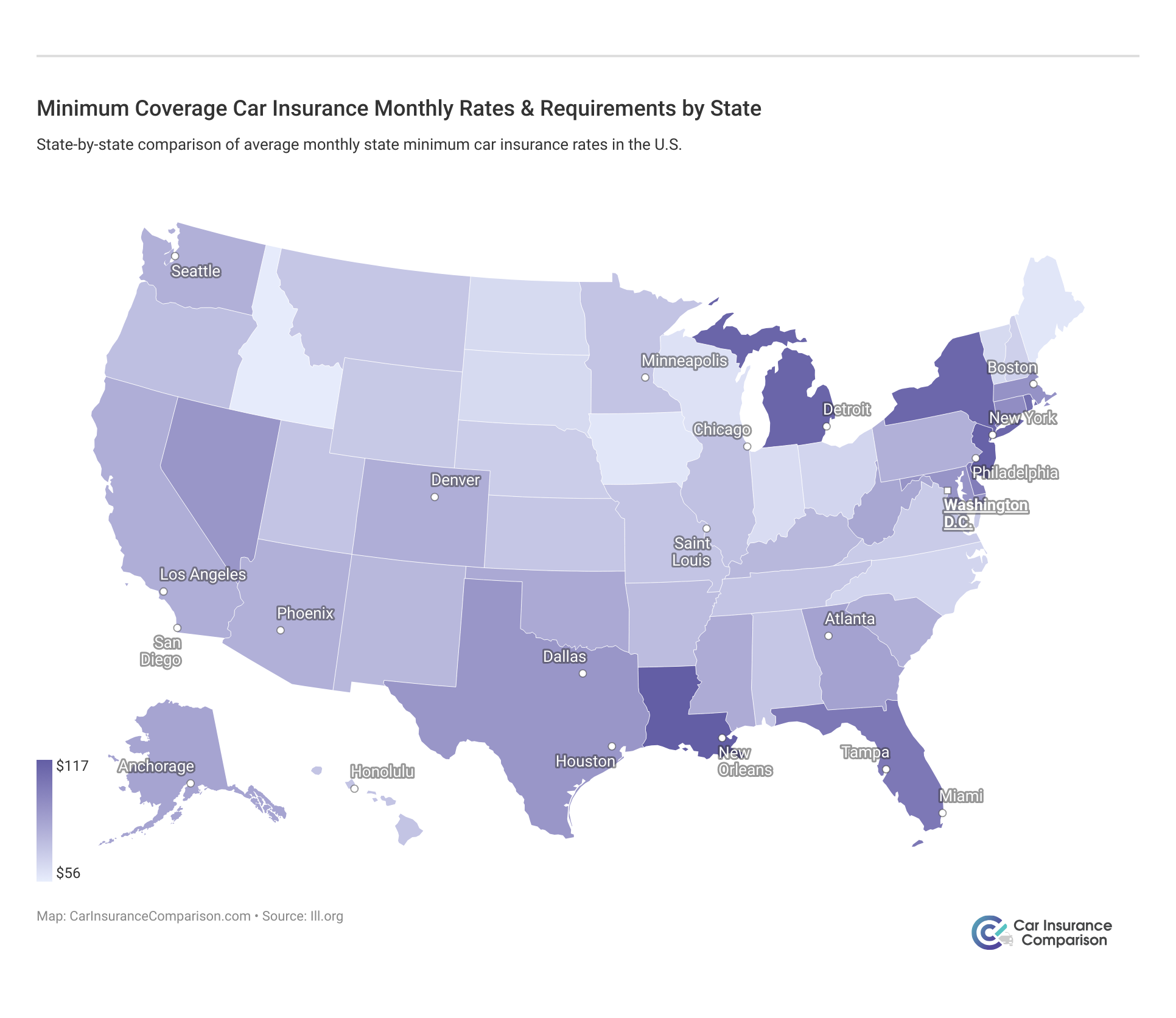

Premiums as a Percentage of Income

Disposable income per capita refers to the money individuals have after taxes. In Oregon, the monthly per capita disposable income is $3,000. On average, Oregonians spend $75 per month on full coverage car insurance from this income, alongside other essential expenses like health insurance and utilities.

Oregon citizens only pay 2.45 percent of their income towards car insurance

Do you know why this is so awesome for Oregon citizens? The average monthly rate for car insurance countrywide is $98. That means that Oregon citizens are paying about $87 LESS on average than the rest of the nation. Way to go Beaver State.

Additional Liability Coverage

As mentioned previously, uninsured/underinsured motorist coverage and MedPay coverage options are required in the state of Oregon.

- MedPay Coverage is the coverage that pays for your medical expenses after you’re in an accident

- Uninsured/Underinsured Coverage protects you if you are in an accident with someone who is uninsured or underinsured. This means if they are the one who caused the accident and are unable to pay for your accident costs, this coverage comes in to cover you.

Below we’ve listed something known as the loss ratios for these coverages.

Oregon Car Insurance Loss Ratios by Coverage Type

| Loss Ratio | 2021 | 2022 | 2023 |

|---|---|---|---|

| Medical Payments (MedPay) | 125% | 116% | 116% |

| Uninsured/Underinsured Motorist Coverage | 65% | 73% | 77% |

What does all this mean for you? Loss ratios essentially tell you how companies are paying out claims; are they paying too much (making them at risk for going bankrupt) or are they not paying enough?

If a company has a loss ratio over 100 percent, they are paying out too much, but if their loss ratio is far below that, they likely aren’t paying enough for claims. In Oregon, The Underinsured/Uninsured loss ratios are pretty good but are high for MedPay.

Add-Ons, Endorsements, and Riders

In the previous sections, we’ve talked about the minimum coverage and how sometimes it might not give you all of the coverage you may need. But what could you add, you may ask, that will give you more coverage? There is an abundance of additional coverage options that you could add to your policy, so many so that it can feel overwhelming.

- Gap Insurance

- Personal Umbrella Policy (PUP)

- Rental Car Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Low-Mileage Car Insurance Discount

To help make the ordeal less difficult for you, we’ve found a list of some of the most affordable coverage options to add to your plan. These coverages are cost effective and are useful in both the case of an accident or any other mishap you might encounter.

Average Car Insurance Rates by Age & Gender in OR

In case you didn’t have enough factors contributing to what your car insurance rate is, did you know that even your own gender can contribute? Even though there shouldn’t be, there is still a trend in differences between the rates for males and females.

Oregon Monthly Car Insurance Rates by Age & Gender

| Insurance Company | Age: 17 Male | Age: 17 Female | Age: 25 Male | Age: 25 Female | Age: 35 Male | Age: 35 Female | Age: 60 Male | Age: 60 Female |

|---|---|---|---|---|---|---|---|---|

| Allstate | $434 | $389 | $137 | $136 | $130 | $121 | $119 | $120 |

| American Family | $372 | $238 | $101 | $96 | $96 | $96 | $86 | $86 |

| Blank | $262 | $210 | $97 | $92 | $80 | $80 | $72 | $75 |

| Farmers | $365 | $357 | $99 | $97 | $86 | $85 | $76 | $81 |

| Geico | $235 | $258 | $92 | $106 | $100 | $97 | $93 | $94 |

| NICOA | $265 | $212 | $114 | $108 | $93 | $92 | $83 | $87 |

| Progressive | $380 | $345 | $91 | $96 | $81 | $73 | $70 | $72 |

| Safeco | $398 | $369 | $112 | $112 | $116 | $122 | $101 | $112 |

| Standard Fire | $268 | $221 | $84 | $82 | $79 | $80 | $71 | $74 |

| State Farm | $269 | $214 | $88 | $77 | $68 | $68 | $62 | $62 |

| USAA | $219 | $204 | $90 | $86 | $67 | $65 | $67 | $64 |

You can see in the data above that there are a few providers that offer similar rates for both married females and married males, such as American Family Mutual and State Farm Mutual Auto.

The biggest trend you could probably see from the data above is how rates differ depending on how old you are. Yes, this also contributes. Teenage boys, in particular, can’t seem to catch a break for their insurance rates.

They seem to be paying thousands of dollars more for some companies than older drivers. Why is that? Companies tend to charge higher rates for teenagers as they are considered more inexperienced drivers, and therefore more likely to be reckless or get into an accident.

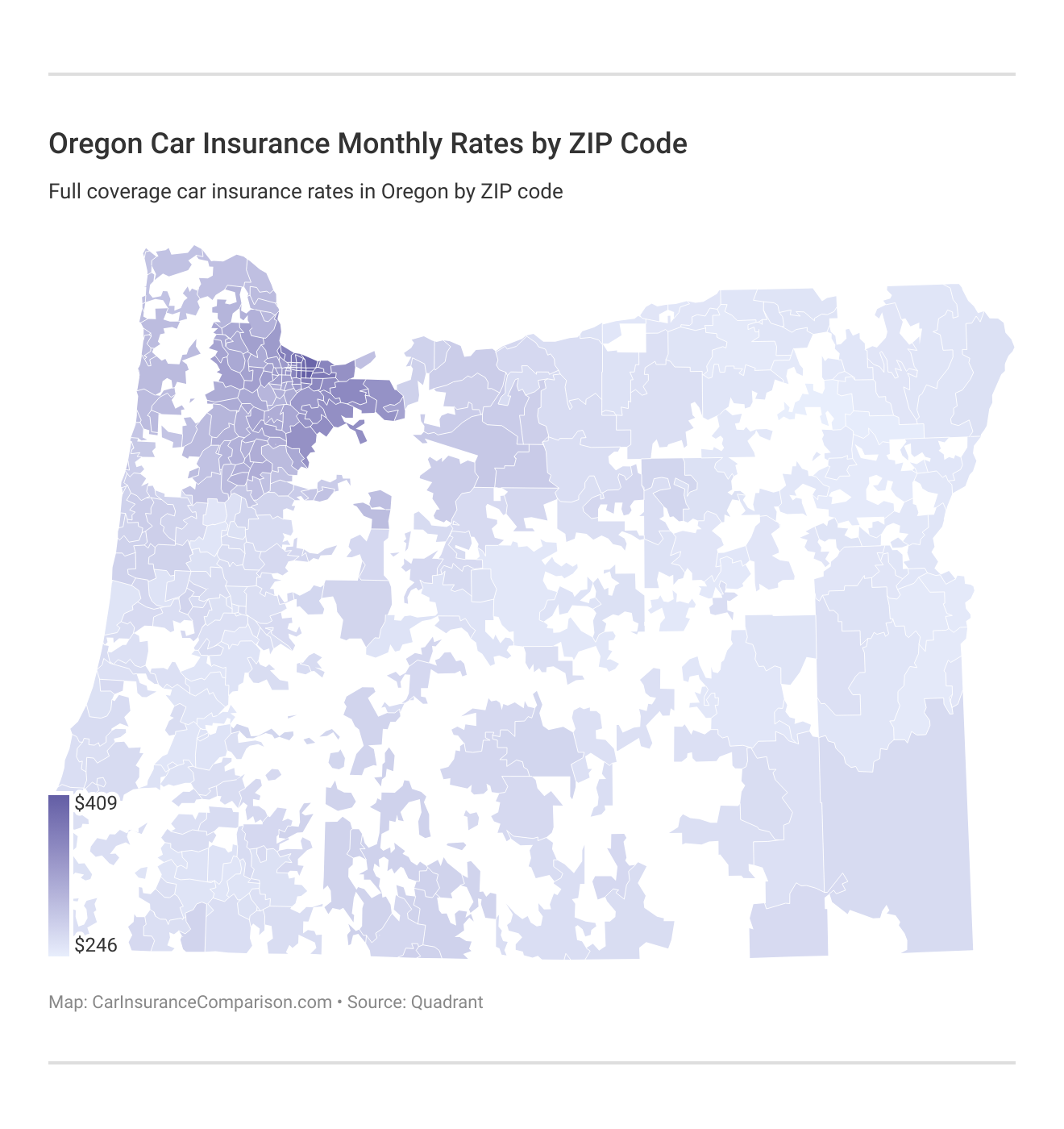

Insurance Rates by ZIP Code

Below we’ve gone through and listed all of the provider’s costs next to the ZIP code. Hopefully, this will give you a helpful snapshot of what you should ideally be paying for your area.

Most of the expensive ZIP codes can be found in Portland.

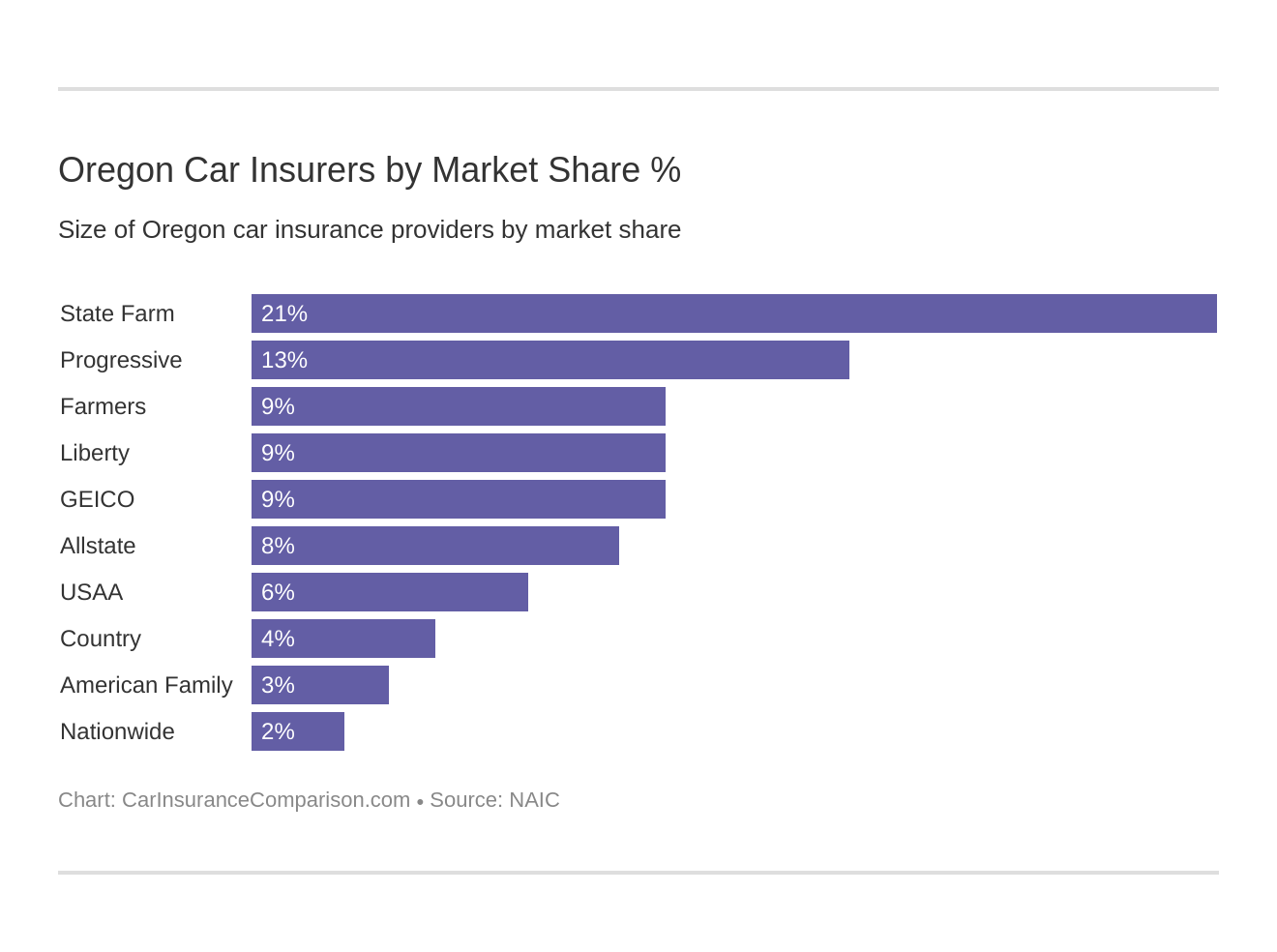

Oregon Car Insurance Companies

There are so many different car insurance companies out there that are fighting tooth and nail for your business. So many so that trying to find which company is going to give you the best rates AND the best coverage is like finding a needle in a haystack. ‘

But rest assured, we are here to help. We want you to know exactly what you’re spending your money on, and that you’re getting exactly what you want. What’s the point of paying for coverage that isn’t going to help you the way you need it to? One way to almost guarantee solid coverage is to go with one of the largest companies in the state. Take a look at the market share percentages of the largest companies in Oregon.

Below we’re going to talk specifically about some of the biggest car insurance companies in Oregon. We’ll provide you with some of the much-needed information you’ll want to know such as company ratings, financial ratings, and more.

The Largest Companies Financial Ratings

What’s the best way to tell what insurance providers financial health is like? You check their A.M. Best Rating. What exactly does this mean?

A.M. Best Financial Strength Ratings From the Top Oregon Car Insurance Providers

| Insurance Company | A.M. Best |

|---|---|

| Allstate | A+ |

| American Family | A+ |

| Country Financial | A |

| Farmers | A |

| Geico | A++ |

| Liberty Mutual | A |

| Nationwide | A+ |

| Progressive | A+ |

| State Farm | B |

| USAA | A++ |

From the above table, you can see all of the top insurance providers in Oregon and what their individual A.M. Best Rating is. An A.M. Best Rating is an insurance provider rating given to them based on their financial, health.

How Much Auto Insurance Costs in Oregon

Explore auto insurance rates in Oregon cities – Bend, La Grande, Lake Oswego, Tangent. Gain insights into the dynamics shaping car insurance rates for informed decision-making.

Oregon Car Insurance Cost by City

Understanding auto insurance costs in Oregon can help you make informed decisions and gain valuable insights into the factors influencing car insurance prices.

Number of Insurers in Oregon

Now that we’ve gone over the insurance companies in Oregon, we’ll briefly touch on exactly how that translates to how MANY options there are for those of you in Oregon. There are currently 18 domestic insurance providers and 848 foreign insurance providers. What does this mean?

- Domestic Provider: a provider that is based in that state (think of that local hometown kind of provider)

- Foreign Provider: a provider that is based in another state (think larger companies such as Geico, Allstate, etc.)

Is this something you should worry about? No, because in order for a company to do business in Oregon they will have to abide by the laws of the state and write policies that conform to the state-specific requirements.

Oregon State Laws

We will move onto the specific laws that are unique to Oregon. It can be pretty confusing, as laws vary from state to state. New residents may find it hard to keep track of which state allows what because of this. It can be really frustrating getting a ticket for a law you didn’t even know existed.

We want you to be safe while driving in Oregon, so we went ahead and listed all of the important driving laws you’ll need to know. Read through this section to familiarize yourself with all of these laws before driving.

Car Insurance Laws

We touched on the minimum liability coverage in an earlier section, and how it is required to drive legally in Oregon. Need a refresher?

- $25,000 to pay for Bodily Injuries per Person

- $50,000 to pay for Total Bodily Injuries per Accident

- $20,000 to pay for Property Damages per Accident

- $15,000 for Personal Injury Protection (also known as Medical Payments/MedPay)

- $25,000 per person and $50,000 total per accident for Uninsured Motor Coverage

So when you are shopping for insurance plans, make sure that they are able to meet these requirements. Keep reading in order to learn more.

High-Risk Insurance

Have you had a good number of traffic violations stamped onto your record? If you have, you could be considered a “high-risk driver” and therefore could have a harder time finding insurance providers willing to provide you coverage. The more stamps you have on your driving record, the harder it may be.

If you can’t get some of the best car insurance for high-risk drivers, in Oregon, there is a plan known as the Automobile Insurance Plan of Oregon (also known as OR AIP), that can help you get the coverage you need. This organization assigns high-risk drivers to existing Oregon insurers, who will then have to provide you with at least the minimum liability coverage. How do they allocate high-risk drivers?

If you're a high-risk driver in Oregon, the Automobile Insurance Plan of Oregon (OR AIP) ensures coverage, though options may be limited with potentially higher costs.

Brad Larson LICENSED INSURANCE AGENT

Well if Allstate, for example, were to make up 20 percent of the auto insurance market in Oregon, they would then be assigned 20 percent of these high-risk drivers. What does all of this mean for you? Well, you are able to get the coverage you need to legally drive, but you may not get the provider you wanted.

Also, this provider is able to charge you whatever they deem appropriate to provide you with that coverage. So if you have no other options, you will have to pay whatever it is they charge you. You’ve exhausted all other options and you need to apply to OR AIP, how do you do that? Well to be eligible for the program, you must meet the following requirements:

- Licensed Driver

- Vehicle Registered in Oregon

- Certify on your application that you were unable to find voluntary insurance coverage within the last 60 days

There are also a few conditions that may prevent you from even being accepted into this program:

- If you have an unpaid insurance premium

- Failed to present your vehicle for inspection

- If your vehicle is over 25 years old (considered an ‘antique’)

Oregon recommends that citizens should only apply to this program if absolutely necessary. So if you are a high-risk driver and are able to find insurance coverage with a provider, you should take that coverage as opposed to applying to this program.

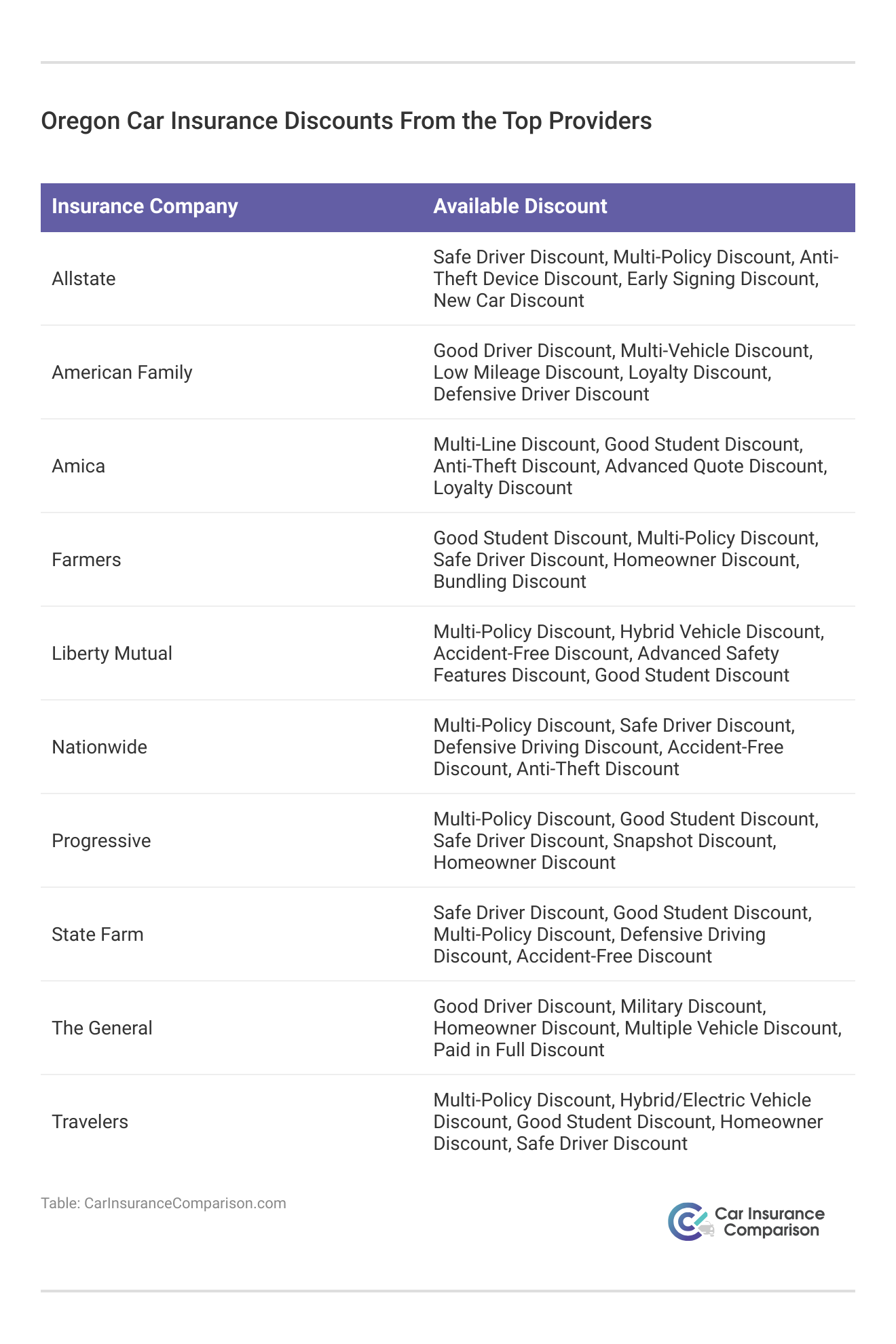

Low-Cost Insurance

If you are in a low-income household there is, unfortunately, no government-sponsored insurance program currently. California, Hawaii, and New Jersey offer car insurance for welfare recipients, but most of the other states have no options similar to these areas. Don’t let this information discourage you though, as there are plenty of other ways that you can cut down on costs to save money.

As mentioned in the previous sections, having a clean driving record, a good credit history, and having a shorter commute can help you save. Another way to help you save is to ask your insurance provider if they have any discounts that you could qualify for. Ask them about any of the following common discounts:

- Homeowner’s Discount

- Military Discount

- Good Driver / Accident-Free Discount

- Good Student Discount

- Multi-Car Discount

- “Green” Discount (for either having a ‘green’ vehicle or opting for a paperless policy)

- Employee Discount (some companies offer their employees discounts for things such as car insurance)

- Anti-Theft Device Discount

While government-sponsored insurance programs for low-income households are limited, you can still find ways to save on your car insurance. Explore available discounts and maintain a clean driving record to help reduce your premiums.

Discover the variety of car insurance discounts offered by top providers in Oregon to help you save on your premiums.

The other best way to save some hard-earned cash? Shop around to all of the providers you can to get the most cost-efficient rate while still providing you with the best coverage you’ll need.

Windshield Coverage

So let’s say that you’re driving down the road and that garbage truck in front of you accidentally hits a bump in the road and kicks a huge rock at your window. The rock slams right through the window, leaving a noticeable rock-shaped hole in your windshield. Alright so that might be a little dramatic, but did you know that some states have extremely specific laws you have to follow in order to repair/replace your windshield?

Luckily Oregon is not one of them, they allow consumers to choose who repairs your windshield. Insurers may also use aftermarket crash parts if is the same quality with respect to fit, finish, function, and is also corrosion resistant.

If you want this coverage though added onto your plan, you can shop around so that you can find coverage for this. Find out what states have full glass coverage so you can look into it.

Automobile Insurance Fraud in Oregon

It should come to no surprise that car insurance fraud is a massive crime. Not only in Oregon but all across the nation. How exactly does one commit insurance fraud?

- Faking an accident on purpose in order to claim for damages or injuries that never actually occurred

- Adding additional (‘extra’) costs onto a claim that is actually legitimate

If you commit insurance fraud in Oregon, you could be facing some heavy penalties and even jail time. Avoid this by only making legitimate claims with no ‘extra’ costs. It’s simply not worth it otherwise.

Statute of Limitations

So let’s say that you have been in a legitimate accident and need to make a claim, how long do you have? There is something known as the statute of limitations that essentially caps how long you have to make a claim. How long do you have in Oregon?

- Personal Injuries: Two years

- Property Damage: Six years

Oregon gives a generous amount of time for filing property damage claims, but keep in mind that you only have two years to submit a personal injury claim. This may still seem like a pretty generous amount of time, but if you are dealing with all of the other repercussions of the accident, that time may fly by before you know it. Save yourself the worry and make sure you submit your claims as soon as you are able to. Get the money you need to help you while you can.

Oregon’s Failure to Obey a Traffic Control Device Laws

You are driving down the road and you see the traffic light ahead turn yellow, what do you do? If you’re like most American citizens, you likely will speed up in order to make it through the light before it turns red. Well, if you’re driving in Oregon, you’ll actually be ticketed for doing this.

According to the statute ORS 811.265, you are required to stop at a yellow light just like you would at a red light.

There is an exception to this law, that you only are to proceed through the yellow light if you are unable to stop your vehicle safely. But if you have the ability to stop safely and fail to do so, you could be ticketed. So make sure that when you see a yellow light in Oregon, STOP.

Vehicle Licensing Laws

Oregon requires all drivers to have their insurance on them while operating a vehicle, such as a car insurance certificate. Due to this, they have some specific requirements for vehicle licensing in order to ensure all drivers are safe, and are able to drive legally in the state. Just in case you need a quick reminder, any of the following are acceptable forms of financial responsibility (proof of insurance) in Oregon:

- Valid (and Current) Insurance ID Card

- Current Liability Insurance Binder or a copy of your Insurance Policy

- Signed letter from an insurance agent or company official (must be on company letterhead)

- DMV certificate of self-insurance that names the vehicle owner

In Oregon, drivers must carry proof of insurance to ensure compliance and safety on the roads. Acceptable forms of financial responsibility include a valid insurance ID card, an insurance binder, or a DMV certificate of self-insurance.

Penalties for Driving Without Insurance

Even for a first-time offense of driving without your insurance, you’ll be facing the following penalties:

- Registration suspended for three months (unless lapse was for less than 31 days and vehicle not operated during that time)

- $88 restoration fee plus proof of insurance required to get it back

- $500 civil penalty fee is optional in lieu of registration suspension plus $88 restoration fee — can only use this option once within a 12-month period

All just for your first offense. So if you take anything away from this section of this guide, keep your proof of insurance with you at all times while operating a vehicle.

Teen Driver Laws

Teens are allowed to apply for their learner’s license as young as 15 years old. There are a few requirements that they will additionally have to follow in order to then also receive a license or restricted license.

Oregon Teen Driver Requirements

| Requirements | Details |

|---|---|

| Minimum Age (Learner's Permit) | 15 years old |

| Minimum Age (Driver's License) | 16 years old |

| Mandatory Holding Period | 6 months |

| Minimum Supervised Driving Time | 50 hours (100 hours without driver education) |

| Nighttime Restrictions | During Intermediate/Restricted License Stage: Midnight - 5 a.m. Restrictions Lifted: 12 months or age 18 (whichever comes first) |

| Passenger Restrictions | During Intermediate/Restricted License Stage: first 6 months–no passengers younger than 20; second 6 months–no more than 3 passengers younger than 20 Restrictions Lifted: 12 months or age 18 (whichever comes first) |

Keep in mind that in Oregon, driver’s education is required for applicants who are younger than 18 years old. The only exception to this rule is if the applicant has an additional 50 hours of supervised driving.

Older Driver License Renewal Procedures

In Oregon, drivers aged 50 and older must adhere to specific renewal procedures. These include an 8-year renewal cycle, mandatory vision tests at each renewal, and in-person visits for license renewal.

Oregon Older Driver Requirements

| Requirements | Details |

|---|---|

| License Renewal Cycle | 8 years |

| Proof of Adequate Vision (required at renewal) | 50 and older, every renewal |

| Mail or Online Renewal Permitted | No |

This means that you have to go in person to renew your license, as well as scheduling a visit with an eye doctor for every renewal.

New Residents

We recommend stopping by your local Oregon DMV to make sure you don’t forget this one. We’ve mentioned a few times before about having the minimum liability insurance, as well as the required personal injury protection and uninsured/underinsured motorist coverage. Here’s a reminder in case you might have forgotten:

- $25,000 to pay for Bodily Injuries per Person

- $50,000 to pay for total bodily injuries per accident

- $20,000 to pay for Property Damages per Accident

- $15,000 for Personal Injury Protection (also known as Medical Payments/MedPay)

- $25,000 per person and $50,000 total per accident for Uninsured Motor Coverage

Thinking of officially taking the plunge and becoming part of the Beaver State? If you are, there are a few requirements that you’ll need to have in order to legally drive in the state. Handling car insurance when moving to a new state can be a little complex, after all. After you’ve become a resident, you will have 30 days to title and register your vehicle in Oregon.

License Renewal Procedures

For most drivers, Oregon’s license renewal procedures are straightforward and occur every eight years. Although proof of vision is not required, renewals must be done in person at the DMV.

- Renewal Cycle: Eight years

- Proof of Adequate Vision: No

- Online/Mail Renewal: No

The good news for the general population is that you don’t have to provide proof of adequate vision when renewing your license. You do, however, unfortunately, have to go into the DMV for every renewal instead of doing it online or through the mail. Rest assured though, you only have to go in every eight years to do this.

Negligent Drivers

In Oregon, there are two ways in which a driver can drive negligently, “reckless” driving and “careless” driving. Reckless driving is when a driver knowingly (and is proven to have known) does something risky while behind the wheel. It is considered a class A misdemeanor and carries up to a year of jail time as well as a maximum of $6,250 in fines.

In addition to all of this, someone convicted of reckless driving may also face a license suspension period of:

- First Offense: 90 days

- Second Offense (within five years): One year

- Third Offense (within five years): Three years

Careless driving is when a driver does not realize how dangerous their driving was at the time. The penalties for this are generally less severe, but still can be hefty nonetheless.

- Careless Driving: class B traffic violation, fines ranging from $130 to $1,000

- Careless Driving Involving an Accident: class A traffic violation, fines ranging from $220 to $2,000

- Careless Driving Involving Injuries or Fatalities: fines ranging from $200 to $2,000, 200 hours of community service, and must complete a traffic safety course

Keep in mind that violations such as this add to your driving record, which can increase your insurance rates. To avoid having to pay for all of this, as well as the increased rates, avoid driving negligently. Keep yourself and others safe on the road.

Oregon’s Rules of the Road

Knowing Oregon’s rules of the road is going to keep you safe on the road, as well as preventing you from breaking the law. We will cover topics including keep right and move over laws, speed limits, seat belt/car seat laws, and more. Avoid losing the money you worked so hard for by continuing to learn about Oregon’s rules of the road.

Fault Versus No-Fault

Oregon is considered an at-fault state. What does this mean? If you are the driver who caused an accident, you are the at-fault driver. You are then the person who is responsible for paying for the other driver’s medical and property damages as well as your own.

If you don’t have the appropriate car insurance coverage, these costs can really add up and cause you to have to pay out of pocket. This is why it is so crucial to make sure you have the optimal coverage to match what you need.

While Oregon does require MedPay and Uninsured/Underinsured coverage, depending on the severity of the accident, it may not be enough. Make sure you purchase the best coverage you can in order to prevent you from having to pay for any accident costs out of your pocket.

Keep Right and Move Over Laws

The law requires that if you are approaching any stationary vehicle that has flashing lights that are traveling in the same direction, that you are to move over to the closest lane. If it is not safe or possible for you to do so, you are to reduce your speed to at least 5 mph under the speed limit posted. What are some examples of vehicles you are to move over for?

- Law Enforcement

- Ambulances

- Fire Trucks

- Utility Service Trucks

- Roadside Assistance

- Tow Vehicles

Keep Right and Move Over laws are fairly simple to understand in Oregon, just like other traffic laws. Keep Right laws in Oregon state that you are to keep right if you are driving slower than the average speed of traffic around you. Not too bad right? Move Over laws are also easy to understand in Oregon.

Speed Limits

Speeding is one of the most common traffic violations that results in a traffic ticket. No one likes getting a speeding ticket, so making sure you know what Oregon’s speed limits are will help prevent you from shelling out speeding fines.

Oregon Speed Limits

| Road Type | Speed Limit |

|---|---|

| Rural Interstates | 65 mph |

| Urban Interstates | 55 mph |

| Other Limited Access Roads | 65 mph |

| Other Roads | 65 mph |

Don’t forget that these are the MAXIMUM speed limits for these types of roads. Speed limits will vary between different roadways, so make sure you pay attention to all traffic signs you see.

Seat Belt and Car Seat Laws

One of Oregon’s top priorities for drivers is that everyone is safe. For that reason, they have very strict rules regarding seat belt use and car seats.

Oregon Seat Belt Laws

| Laws | Details |

|---|---|

| Effective Date | 12/07/1990 |

| Primary Enforcement | Yes ; Effective 12/07/1990 |

| Age/Seats Applicable | 16+ years in all seats |

| 1st Offense Max Fine | $115 |

Oregon enforces strict seat belt laws with primary enforcement, ensuring all drivers and passengers aged 16 and older comply. A fine of up to $115 applies for non-compliance, emphasizing the state’s commitment to road safety.

Oregon Car Seat Laws

| Law | Details |

|---|---|

| Must be in child safety seat | Younger than 2 years: rear-facing restraint; 7 or younger: 40 pounds or less: child restraint; more than 40 pounds but 4 feet 9 inches or less: booster seat |

| Adult belt permissible | Taller than 4 feet 9 inches; 8 through 15 years old |

| Max base fines for 1st offense | $75 |

| Preference for rear seat | No preference stated |

In addition to the above rules, there are also restrictions in Oregon for passengers riding in the cargo areas of trucks:

- Who is not covered:

- People 18 and older

- Minors secured with a safety belt or harness

- Parades

- Minors seated on the floor of the open bed of a motor vehicle in which all available passenger seats are occupied by minors, the tailgate is securely closed and the minor is being transported either in the course and scope of employment or between a hunting camp and hunting site or between hunting sites during hunting season and the minor has a hunting license

You’re probably wondering what primary enforcement means. Primary enforcement is if law enforcement sees a driver violating any of the above rules, they are able to pull them over and ticket them for the offense.

Ridesharing

In today’s society, you’re bound to have at least heard of ridesharing services such as Uber and Lyft. If you are thinking of earning some extra cash and hoping to work for one of these companies, you will need to purchase rideshare car insurance. This is insurance coverage IN ADDITION to your already required minimum coverage plan.

The following providers in Oregon offer this type of coverage: State Farm and USAA.

Keep in mind that if your insurance provider does not carry this type of coverage, you may have to purchase an additional policy with the provider that does carry it.

Automation on the Road

Automated vehicles have often been portrayed as the self-driving vehicles seen in the latest sci-fi movies. In reality, however, most of this technology can actually be found in features such as cruise control or parallel parking.

There are no specific automated driving laws, but Oregon is one of 19 states that have regulated platooning technology. This allows groups of specific vehicles (trucks or buses namely) to travel within set distances between them at electronically controlled speed together.

Safety Laws

To further keep Oregon drivers safe, there are a few rules regarding safety. Items that are easily avoidable, such as DUI’s, marijuana-impaired driving, and distracted driving are focused on in Oregon.

DUI Laws

In 2017 there were 137 fatalities related to alcohol-impaired driving. It’s a very sad statistic that comes from a very easily avoidable cause. Due to this, however, Oregon has some pretty strict laws regarding DUI‘s, and some even more strict penalties if you are caught drinking and driving.

Think you can drink and drive and get away with just a little slap on the hand? Not in Oregon. Check out some of the penalties you’ll be facing if you drink and drive.

Oregon DUI Penalties

| Offense Number | License Revocation | Jail Time | Fine Amount | Other Penalties |

|---|---|---|---|---|

| 1st | 1 year | 2 days - 1 year or 80 hrs community service | Min $1000 (BAC); Min $2000 (HBAC); Up to $10000 (child in car) | Drug/alcohol program, victim impact panel, IID for 1 year |

| 2nd | 3 years | Min 2 days, up to 1 year | Min $1500; HBAC Min $2000; Up to $10000 (child in car) | IID for 2 years, treatment program, victim impact panel |

| 3rd | Lifetime, no hardship | 90 day minimum | Min $2000; additional $2000 for HBAC | N/A |

Oregon takes this crime extremely seriously. Even your first offense results in your license being suspended for a year, plus fines in the thousands. Your third offense suspends your license indefinitely. That means you’ll never be allowed to legally drive again.

Your fourth offense is considered a felony.

If you decide to go out for some drinks with friends, have a plan to get home. Have a friend be your designated driver, call a taxi, or even call a ridesharing service so that you can safely get home. There are countless options available to you to prevent you from getting behind the wheel in this kind of a state. It’s simply not worth it. You’re putting not only yourself in danger but others around you as well.

Marijuana-Impaired Driving Laws

Oregon is one of the few states in the United States where marijuana is fully legalized. This is a fairly new law, so there are currently no marijuana-specific driving laws. While there are no laws currently specific to this, however, we would highly recommend that you avoid driving while marijuana-impaired.

Driving under anything less than a completely sober state of mind can be dangerous and lead to slower reaction times, which could cause you to get into an accident.

This does NOT necessarily mean that if you drive under the influence of marijuana, you won’t get pulled over. You could still be charged with driving under the influence, especially if your driving is considered dangerous or reckless.

Distracted Driving Laws

Almost everyone these days has some sort of smartphone or cellphone. So it is inevitable that people will try to use their phone while they are driving. This is extremely dangerous for not only yourself but others around you. Not to mention that Oregon has some strict laws in place for the use of these devices while you are driving.

According to the IIHS, an addendum to all of this was added as of October 1, 2017. This addendum states that drivers may not hold a personal electronic device in either hand or both hands while operating a motor vehicle on a public highway. This includes when you are temporarily stationary because of traffic, at a stop sign/light, or other momentary delays.

Learn More: Texting While Driving Statistics

This means that if a law enforcement officer even sees you using your cellphone when in your vehicle, you’ll be given a ticket. Avoid all of the trouble and simply put your cellphone/smartphone device in a place that you can’t reach it while driving. You could also place your phone on airplane mode so you are unable to receive messages/notifications to keep yourself from looking at the device.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Oregon Can’t-Miss Facts

Now that we’ve covered all of the rules and laws you’ll need to know, what else should you know before getting behind the wheel in Oregon?

Oregon Statistics Summary

| Summary | Details |

|---|---|

| Road Miles | Total in State: 73,544 Vehicle Miles Driven: 35.9 billion |

| Vehicles Registered | 3.5 million |

| State Population | 4,190,713 |

| Most Popular Vehicle | Subaru Outback |

| Motorists Uninsured | 12.7% State Rank: 21st |

| Driving Deaths | 2017-2019 Speeding Total: 1,158 Drunk Driving Total: 1,150 |

| Average Premiums (Monthly) | Liability: $49 Collision: $19 Comprehensive: $8 Combined Premium: $75 |

| Cheapest Provider | State Farm |

We’ve discussed why some of the above laws are in place, but how do they translate in real life? In this section, we’ll go over some of the facts for driving in Oregon that you absolutely need to know.

Vehicle Theft in Oregon

Every state has particular vehicles that are more prone to being stolen than others. And before you ask, no they are not the BMW’s and Mercedes. Think more common vehicles than that, like Honda or Toyota for instance.

Top 10 Oregon Car Thefts by Model

| Make & Model | Year | Total Thefts |

|---|---|---|

| Ford F-150 | 2018 | 661 |

| Hyundai Elantra | 2017 | 1009 |

| Chevrolet Silverado 1500 | 2004 | 989 |

| Hyundai Sonata | 2013 | 892 |

| Honda Civic | 2000 | 828 |

| Kia Optima | 2015 | 629 |

| Honda Accord | 1997 | 871 |

| GMC Pickup (Full Size) | 2018 | 693 |

| Honda CR-V | 2001 | 577 |

| Kia Soul | 2020 | 877 |

Poor Honda owners, they can’t catch a break. Where you live also plays a factor in the number of these vehicles being stolen. The FBI created a report on the number of Oregon’s vehicle thefts by cities.

Top 10 Oregon Car Thefts by City

| City | Total |

|---|---|

| Eugene | 935 |

| Gresham | 845 |

| Hillsboro | 652 |

| Bend | 604 |

| Beaverton | 512 |

| Corvallis | 411 |

| Grants Pass | 410 |

| Albany | 287 |

| Forest Grove | 220 |

| Ashland | 214 |

These figures highlight the cities in Oregon with the highest car theft rates, emphasizing the need for vigilance and preventative measures. Residents in these areas should be particularly cautious about securing their vehicles.

Oregon Crash Report

As with anything, there are many different factors that contribute to accidents. Below, we’ve broken up some of the most common factors in traffic fatalities in Oregon.

Fatal Crashes by Weather Condition and Light Condition

Yes, the weather is a common factor in traffic fatalities. The harder it is for you to drive safely and see the road in front of you, the more likely you are to get into an accident. Below we’ve given the data for the number of fatalities related to these conditions.

Oregon Fatal Crashes by Weather/Light Conditions

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 180 | 42 | 61 | 12 | 3 | 298 |

| Rain | 17 | 14 | 24 | 1 | 0 | 56 |

| Snow/Sleet | 10 | 0 | 3 | 0 | 0 | 13 |

| Other | 4 | 2 | 5 | 1 | 0 | 12 |

| Total | 220 | 58 | 102 | 14 | 6 | 400 |

Oregon is quite famous for its rainy weather, so it would make sense for there to be fatalities related to it. Driving in bad weather conditions takes great judgment. Just make sure that while these particular conditions are out, that you take extra precautions to keep yourself safe, such as following our bad weather driving tips.

Road Type Fatalities

The type of road you drive on significantly impacts traffic safety. The table below breaks down traffic fatalities in Oregon by area type, illustrating the risks associated with rural versus urban driving.

Oregon Traffic Fatalities by Area Type

| Type | Total |

|---|---|

| Rural | 425 |

| Urban | 610 |

There are more fatalities seen on rural roads than on urban roads. Why would that be? Well, typically rural roads have higher speeds that can be reached as there isn’t as much traffic on them in comparison with urban roads.

Person Type Fatalities

Person type is another factor in traffic fatalities, but not in the way you would think. We’re not talking about the demographic information, such as a person’s race or gender. See table:

Oregon Traffic Fatalities by Person Type

| Type | Total |

|---|---|

| Passenger Car Occupants | 134 |

| Light Pickup Truck Occupants | 37 |

| Light Utility Truck Occupants | 33 |

| Large Truck Occupants | 5 |

| Other/Unknown Occupants | 3 |

| Van Occupants | 11 |

| Bus Occupants | 0 |

| Motorcyclists | 34 |

| Pedestrians | 48 |

| Bicyclists and Other Cyclists | 3 |

| Non-Occupants | 4 |

| State Total | 313 |

We’re talking more about what type of vehicle they are driving, and whether or not they are a pedestrian or occupant of the vehicle.

Crash Type Fatalities

The type of crash also plays a significant role in the number of fatalities. Various factors, such as whether it involved a single vehicle, a large truck, speeding, a rollover, a roadway departure, or an intersection, can drastically affect the outcome. Below is a detailed breakdown of fatalities in Oregon based on different crash types over the past five years:

Oregon Traffic Fatalities by Crash Type

| Type | Total |

|---|---|

| Single Vehicle | 190 |

| Involving a Large Truck | 33 |

| Involving Speeding | 95 |

| Involving a Rollover | 67 |

| Involving a Roadway Departure | 187 |

| Involving an Intersection (or Intersection Related) | 69 |

| Total Fatalities (All Crashes) | 313 |

Analyzing these figures reveals critical insights into the nature and severity of different crash types. Was it just one single vehicle, or did it involve a large truck? Did speeding or a roadway departure play a role? By understanding these factors, we can better address the root causes of fatalities and work towards reducing them.

Five-Year Trend for the Top 10 Counties in Oregon

Fatality rates can vary significantly from county to county. Understanding these trends helps identify areas that may require more focused safety interventions. We have compiled a five-year trend for the top 10 counties in Oregon with the highest fatality rates, providing valuable insights into regional safety challenges and improvements.

Top 10 Oregon Car Crash Fatalities by County

| County Name | Total Fatalities (2021) | Total Fatalities (2022) | Total Fatalities (2023) |

|---|---|---|---|

| Multnomah | 88 | 95 | 102 |

| Marion | 52 | 58 | 61 |

| Lane | 48 | 55 | 60 |

| Clackamas | 45 | 50 | 55 |

| Jackson | 40 | 45 | 48 |

| Douglas | 37 | 42 | 46 |

| Deschutes | 33 | 37 | 42 |

| Washington | 30 | 35 | 40 |

| Josephine | 27 | 31 | 35 |

| Klamath | 25 | 29 | 33 |

Reviewing this data allows us to see if your county made it onto this list. By comparing rates, we can understand the impact of different safety measures and identify which counties might need more attention to reduce fatalities.

Speeding Fatalities

Speeding is a leading cause of driving fatalities across the nation, and Oregon is no exception. Analyzing speeding-related fatalities by county helps us understand where speeding is most prevalent and where intervention might be necessary to improve road safety.

Oregon Speeding Fatalities by County

| County Name | Total Fatalities (2021) | Total Fatalities (2022) | Total Fatalities (2023) |

|---|---|---|---|

| Baker | 7 | 9 | 11 |

| Benton | 12 | 14 | 15 |

| Clackamas | 45 | 50 | 55 |

| Clatsop | 8 | 10 | 12 |

| Columbia | 6 | 8 | 9 |

| Coos | 13 | 15 | 17 |

| Crook | 5 | 7 | 8 |

| Curry | 4 | 5 | 6 |

| Deschutes | 33 | 37 | 42 |

| Douglas | 37 | 42 | 46 |

| Gilliam | 1 | 2 | 2 |

| Grant | 3 | 4 | 5 |

| Harney | 2 | 3 | 3 |

| Hood River | 7 | 8 | 9 |

| Jackson | 40 | 45 | 48 |

| Jefferson | 8 | 9 | 10 |

| Josephine | 27 | 31 | 35 |

| Klamath | 25 | 29 | 33 |

| Lake | 4 | 5 | 5 |

| Lane | 48 | 55 | 60 |

| Lincoln | 12 | 14 | 16 |

| Linn | 20 | 23 | 26 |

| Malheur | 10 | 12 | 13 |

| Marion | 52 | 58 | 61 |

| Morrow | 3 | 4 | 4 |

| Multnomah | 88 | 95 | 102 |

| Polk | 14 | 16 | 18 |

| Sherman | 1 | 1 | 2 |

| Tillamook | 6 | 7 | 8 |

| Umatilla | 15 | 17 | 19 |

| Union | 7 | 8 | 9 |

| Wallowa | 2 | 3 | 3 |

| Wasco | 8 | 10 | 11 |

| Washington | 30 | 35 | 40 |

| Wheeler | 1 | 1 | 1 |

| Yamhill | 14 | 16 | 18 |

In 2017 alone, Oregon had 119 fatalities due to speeding. Reviewing this data helps us identify patterns and develop targeted strategies to reduce speeding-related fatalities in the most affected counties.

Drunk Driving Fatalities

Drunk driving continues to be a major issue, contributing to numerous fatalities each year. By examining the data on alcohol-impaired driving fatalities by county, we can identify hotspots and work towards implementing more effective measures to combat drunk driving.

Oregon DUI Fatalities by County

| County Name | Total Fatalities (2021) | Total Fatalities (2022) | Total Fatalities (2023) |

|---|---|---|---|

| Baker | 2 | 3 | 3 |

| Benton | 3 | 4 | 4 |

| Clackamas | 10 | 12 | 13 |

| Clatsop | 2 | 3 | 3 |

| Columbia | 1 | 2 | 2 |

| Coos | 4 | 5 | 5 |

| Crook | 1 | 2 | 2 |

| Curry | 1 | 1 | 1 |

| Deschutes | 6 | 7 | 8 |

| Douglas | 8 | 9 | 10 |

| Gilliam | 0 | 0 | 1 |

| Grant | 1 | 1 | 1 |

| Harney | 0 | 1 | 1 |

| Hood River | 2 | 2 | 2 |

| Jackson | 8 | 10 | 11 |

| Jefferson | 1 | 2 | 2 |

| Josephine | 5 | 6 | 7 |

| Klamath | 4 | 5 | 5 |

| Lake | 1 | 1 | 1 |

| Lane | 10 | 12 | 13 |

| Lincoln | 3 | 4 | 4 |

| Linn | 4 | 5 | 6 |

| Malheur | 2 | 3 | 3 |

| Marion | 12 | 14 | 15 |

| Morrow | 1 | 1 | 1 |

| Multnomah | 25 | 28 | 30 |

| Polk | 3 | 4 | 4 |

| Sherman | 0 | 1 | 1 |

| Tillamook | 1 | 1 | 2 |

| Umatilla | 5 | 6 | 7 |

| Union | 2 | 3 | 3 |

| Wallowa | 0 | 1 | 1 |

| Wasco | 2 | 2 | 3 |

| Washington | 8 | 10 | 11 |

| Wheeler | 0 | 0 | 0 |

| Yamhill | 3 | 4 | 4 |

In 2017 alone, Oregon saw a total of 139 alcohol-impaired driving fatalities. By reviewing these figures, we can better understand where drunk driving is most prevalent and work towards reducing these incidents through education, enforcement, and community programs.

Teen Drinking and Driving

A statistic that makes the above data even more jarring is that fact that the fatalities include teens who drink and drive. In 2018, Oregon had 108 DUI arrest for individuals under 18 years old.

This ranks Oregon as the 16th most dangerous state for drunk driving of teen drivers.

Drinking and driving is a pretty serious problem in Oregon, which is why it has the strict DUI laws we talked about in a previous section. Underage drinking and driving have become a HUGE problem in Oregon, so make sure you set a good example for those younger drivers. The loss of life is too high of a price to pay for this. Stay informed about the most dangerous states for drunk driving so you can be careful on the road.

EMS Response Time in Oregon

Let’s say that you are in an accident and you are injured, who do you call? The Emergency Medical Service (EMS) of course. Depending on where you are located at the site of the accident, response times may vary in how quickly they are able to get to you and get you to the hospital.

Oregon EMS Response Time by Location

| Location | Notification | Arrival |

|---|---|---|

| Rural | 5 min | 14 min |

| Urban | 1 min | 7 min |

Luckily for Oregon citizens, both rural and urban areas are under an hour from the time the EMS arrives to the time they get you to the hospital. This is precious time that could mean the difference between life and death. So numbers like this are extremely good.

Transportation in Oregon

We’ve made it to the final section. Hooray. In this last small section, we’ll go over some of the statistics of transportation in the Beaver State. We’ll briefly dissect the different aspects of transportation such as how many cars Oregon citizens typically own, what commute times you can expect, and more.

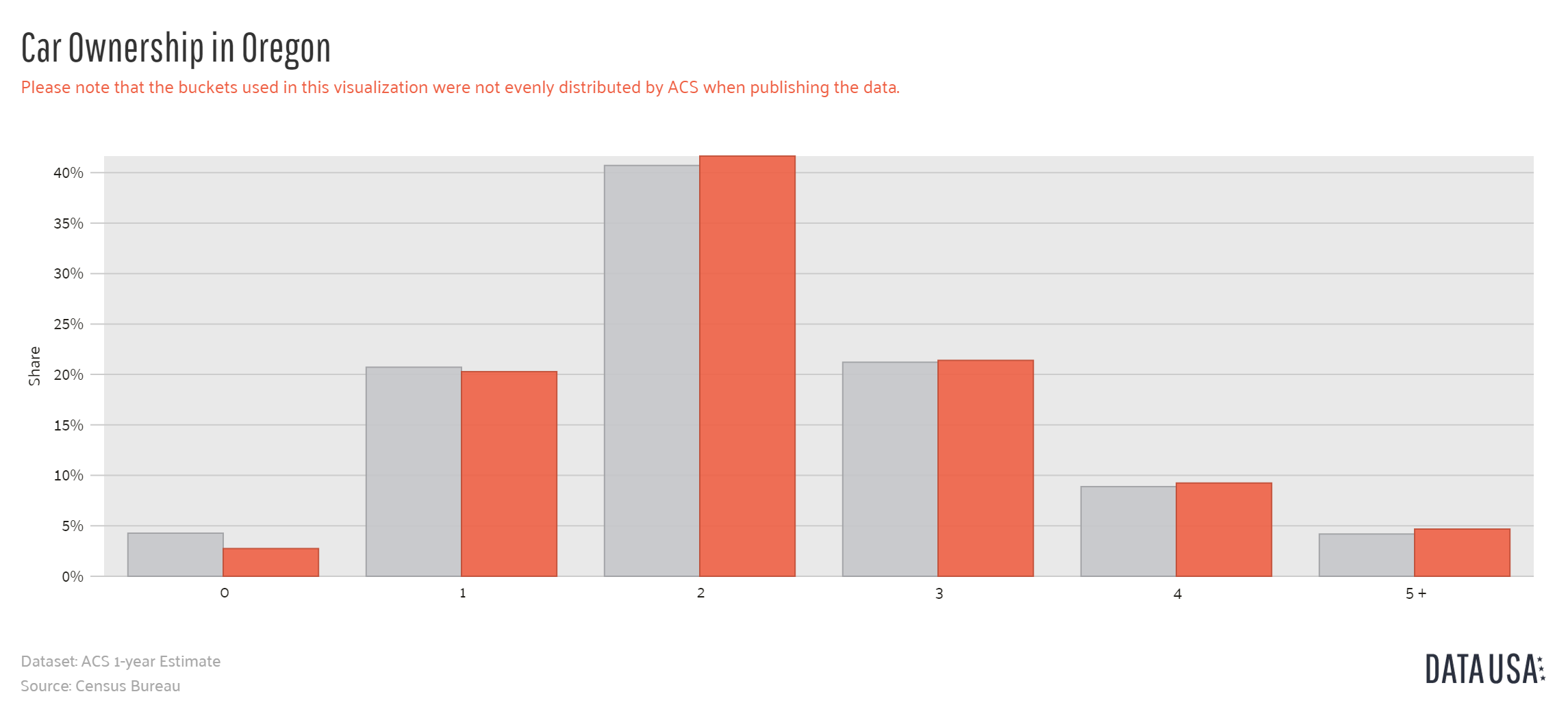

Car Ownership

If you live in Oregon, chances are your household owns two cars. It’s the average number of cars owned per household in the state, followed closely by three cars.

Most Oregon households have at least two cars, with three being a common number as well. This reflects the state’s tendency towards multiple vehicle ownership.

Commute Time

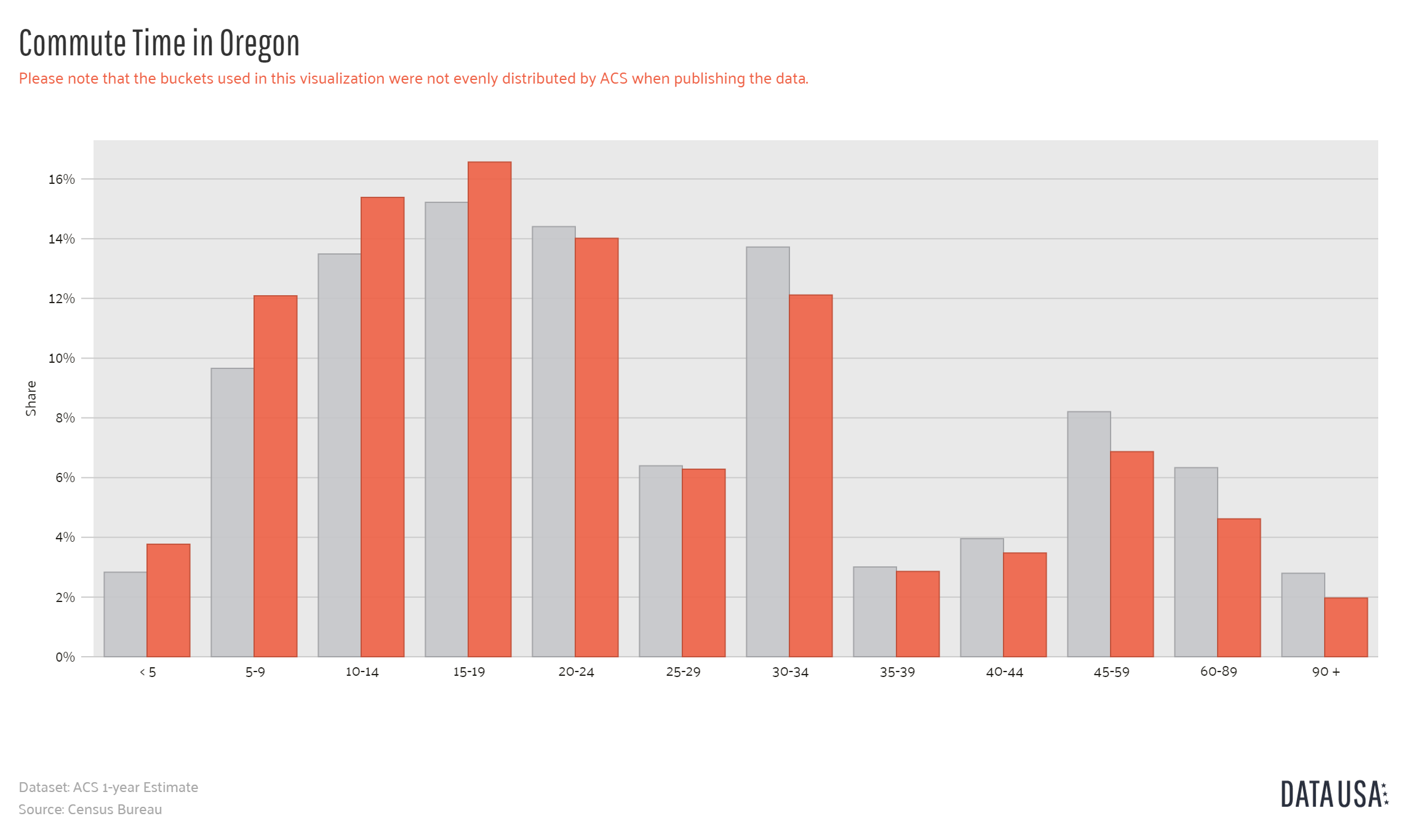

Good news Oregon, you only have an average commute time of 22 minutes. This may sound long, but when you consider that the average national commute time is 25 minutes, Oregon actually spends less time commuting.

With Oregon’s average commute time being shorter than the national average, residents enjoy more time off the road. This can lead to less stress and more time for personal activities.

Commuter Transportation

When you’re commuting to work, how do you prefer to travel? Do you just jump in your own car and hit the road? Or do you carpool with a few buddies from work? Well in Oregon, 72.4 percent of drivers prefer to drive alone.

In Oregon, the majority of commuters choose the convenience of driving alone. This preference highlights a common trend in personal transportation despite the benefits of carpooling.

Traffic Congestion

The larger and more popular a city is, the heavier the traffic congestion is going to be. Portland is one of the most populated cities in the country, so it would make sense for it to make it onto INRIX’s scorecard for global traffic.

Oregon Traffic Congestion by City

| City Name | Impact Rank | Hours Lost | Yearly Change | Cost per Driver | Travel Time | Mile Speed |

|---|---|---|---|---|---|---|

| Portland, OR | 70 | 116 | -9% | $1,625 | 5 | 13 |

Portland’s high traffic congestion is reflected in its significant impact on daily commutes and costs. Despite a recent decrease in hours lost, navigating the city remains a challenge for its drivers.

Because of this, there are peak times of the day in terms of how fast you will travel in Portland, Oregon.

- Peak Speed: 21 miles per hour

- Off Peak Speed: 35 miles per hour

- Free Flow: 42 miles per hour

That’s all folks. You’ve made your way through this comprehensive guide like a champ. We hope that this guide was helpful for you and was able to arm you with the tools to choose the best insurance coverage for you.

If you want to compare Oregon car insurance rates today, you can use our free quote comparison tool to get started. When you’re ready to see how much you can save on your car insurance, enter your ZIP code below into our free comparison tool.

Frequently Asked Questions

Are there specific discounts available to lower car insurance costs in Oregon?

Yes, car insurance discounts in Oregon include bundling policies, maintaining a safe driving record, and installing safety features in your vehicle. These can significantly reduce premiums.

Are there gender-based differences in car insurance rates in Oregon?

Yes, there can be differences in car insurance rates based on gender in Oregon. Rates may vary depending on factors such as age, marital status, and gender.

Can I add additional coverage to my car insurance policy in Oregon?

Yes, there are various additional coverage options available in Oregon, such as Guaranteed Auto Protection (GAP), Personal Umbrella Policy (PUP), Rental Reimbursement, Emergency Roadside Assistance, and more. These coverages can provide extra protection and peace of mind.

How much do Oregon citizens pay for car insurance on average?

The average annual full coverage premium for car insurance in Oregon is $894.10, which translates to an average monthly payment of $74.51. Oregon citizens only pay 2.45% of their income towards car insurance, which is lower than the national average. See how much you’ll pay for car insurance by entering your ZIP code below into our free comparison tool.

What are the minimum liability coverage requirements in Oregon?

Oregon follows a 25/50/20 liability coverage system. This means drivers must have at least $25,000 coverage for bodily injury per person, $50,000 coverage for total bodily injuries per accident, and $20,000 coverage for property damages per accident.

Read More: Compare Liability Car Insurance

What forms of financial responsibility are acceptable in Oregon?

Acceptable forms of proof of insurance in Oregon include a valid insurance ID card, a current liability insurance binder or policy copy, a signed letter from an insurance agent or company official, or a DMV certificate of self-insurance.

Are there additional coverage requirements in Oregon?

Yes, Oregon also requires drivers to have $15,000 for Personal Injury Protection (PIP) or Medical Payments, as well as $25,000 per person and $50,000 total per accident for Uninsured Motorist Coverage.

What factors determine the cheapest car insurance rates in Oregon?

Factors that affect car insurance rates in Oregon includes driving history, vehicle type, coverage limits, and credit score. Insurers use these details to assess risk and set premiums.

Does my location within Oregon affect my car insurance rates?

Yes, your location within Oregon can impact rates. Urban areas generally have higher premiums due to more traffic and risks, while rural areas may offer lower rates.

How can I compare car insurance rates effectively in Oregon?

Compare quotes from multiple insurers using online tools that provide quotes from several companies at once. Review coverage options and discounts for the best value. Finding affordable car insurance doesn’t have to be a challenge. Enter your ZIP code below into our free comparison tool to find the lowest prices in your area.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Zach Fagiano

Insurance & Finance Analyst

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Insurance & Finance Analyst

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.