Best Car Insurance for Scientists in 2025 (Top 10 Companies)

State Farm, USAA, and Progressive emerge as top picks for the best car insurance for scientists, with minimum rates starting at $22 monthly. These companies cater to scientists' precise needs by providing tailored coverage options that align with their careful driving behaviors and professional lifestyles.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

UPDATED: Nov 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Nov 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Scientists

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage for Scientists

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Scientists

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsThe top picks overall for the best car insurance for scientists are State Farm, USAA and Progressive, offering tailored coverage options with low starting rates.

These leading companies cater to scientists’ specific needs by offering comprehensive coverage options aligned with their careful driving behaviors and professional lifestyles.

Our Top 10 Company Picks: Best Car Insurance for Scientists

| Company Logo | Rank | Professional Scientist Discount | Multi-Policy Discount | Best For | Jump Pros/Cons |

|---|---|---|---|---|---|

| #1 | 10% | 15% | Comprehensive Coverage | State Farm | |

| #2 | 12% | 20% | Customer Service | USAA | |

| #3 | 8% | 12% | Policy Options | Progressive | |

| #4 | 15% | 18% | Online Convenience | Allstate | |

| #5 | 10% | 15% | 24/7 Support | Farmers | |

| #6 | 8% | 14% | Vanishing Deductible | Liberty Mutual |

| #7 | 12% | 17% | Safe-Driving Discounts | Nationwide |

| #8 | 10% | 16% | Multi-Policy Discounts | Travelers | |

| #9 | 7% | 13% | Bundle Discounts | American Family | |

| #10 | 9% | 14% | Customizable Policies | Erie |

Through research and analysis, this guide navigates the complex world of car insurance, empowering scientists to make informed decisions and secure reliable protection for their vehicles. Get the right car insurance at the best price — enter your ZIP code above to shop for coverage from the top insurers.

#1 – State Farm: Top Overall Pick

Pros

- Bundling Policies: Our company provides substantial incentives for clients who choose to bundle multiple insurance policies with us.

- High Low-Mileage Discount: Offer a significant reduction in pricing tailored specifically for customers who utilize their vehicles sparingly.

- Wide Coverage Options: State Farm car insurance review reveals a diverse array of coverage choices designed to suit a range of individual business requirements.

Cons

- Limited Multi-Policy Discount: While our multi-policy discount offers significant savings, we understand that in comparison to certain competitors, it may not appear as high.

- Potential Premium Costs: Despite discounts being applied, premiums may still be comparatively elevated for specific coverage tiers.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#2 – USAA: Best for Customer Service

Pros

- Bundling Discount: Our company provides enticing incentives through competitive discounts when customers opt to bundle multiple insurance policies together.

- Low-Mileage Discount: Offers a substantial discount tailored to customers who maintain low mileage on their vehicles, rewarding responsible driving habits with significant savings.

- Outstanding Customer Service: USAA car insurance review, highlighting its outstanding customer service and high member satisfaction.

Cons

- Membership Eligibility: This exclusive offer is reserved solely for active-duty military personnel, veterans who have served honorably, and their cherished families.

- Limited Physical Locations: Without a traditional storefront, individuals who prefer face-to-face interactions or who rely on in-person services may find themselves at a disadvantage.

#3 – Progressive: Best for Policy Innovator

Pros

- Bundling Discount: Our company provides enticing discounts for customers who opt to bundle multiple insurance policies together.

- Low-Mileage Discount: Policyholders who drive fewer miles can enjoy exclusive discounts tailored to their low-mileage usage.

- Comprehensive Policy Options: Provides a diverse array of policy choices to accommodate various requirements, as observed in a Progressive car insurance review.

Cons

- Limited Agent Availability: Some customers may prefer in-person interactions due to the personal touch and immediate assistance they offer, which can be limited in an increasingly digital world.

- Progressive’s Rates: Premiums, the costs associated with insurance coverage, can vary based on a multitude of factors, including demographic characteristics.

#4 – Allstate: Best for Online Convenience

Pros

- Bundling Discount: Provides substantial savings for combining various insurance plans under the Allstate car insurance review.

- Low-Mileage Discount: Offers a significant reduction in price for vehicles driven fewer miles, rewarding conscientious drivers with impressive savings.

- User-Friendly Online Platform: Allstate offers a user-friendly and easily navigable online platform, designed to provide customers with unparalleled convenience and accessibility.

Cons

- Premium Costs: Even with discounts factored in, premiums can still vary significantly depending on the level of coverage you choose.

- Variable Customer Service Reviews: Customer satisfaction, the golden gauge of business success, is a nuanced metric that dances to the tune of individual experiences.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#5 – Farmers: Best for Support Provider

Pros

- Bundling Discount: Farmers car insurance review highlights savings opportunities when combining various insurance plans.

- Low-Mileage Discount: Offers a special discount tailored for customers who maintain a low-mileage usage pattern, ensuring that those who drive less frequently are rewarded with even greater savings.

- 24/7 Customer Support: Farmers goes above and beyond to provide unwavering support to its policyholders, guaranteeing round-the-clock assistance.

Cons

- Premium Costs: While discounts are available, some customers may still perceive the premiums as relatively higher compared to their expectations or previous experiences.

- Limited Digital Presence: Farmers, often deeply rooted in tradition and practicality, might not always possess the same level of digital prowess as their counterparts in other industries.

#6 – Liberty Mutual: Best for Vanishing Deductible

Pro

- Bundling Discount: Unlock substantial savings with our exclusive bundling options, designed to tailor-fit your insurance needs.

- Low-Mileage Discount: Liberty Mutual car insurance review highlighting a special discount designed for customers who drive fewer miles.

- Vanishing Deductible Feature: Deductible decreases for safe driving, rewarding policyholders with lower out-of-pocket expenses as a result of their responsible behavior behind the wheel.

Cons

- Average Customer Satisfaction: Some customers express high levels of contentment, citing prompt responses, helpful assistance, and effective issue resolution.

- Policy Customization Limitations: Several customers might encounter a situation where the available options for customizing policies are somewhat constrained.

#7 – Nationwide: Best for Safe-Driving Discounts

Pros

- Bundling Discount: Our company provides an enticing opportunity for our valued customers to maximize savings through our exclusive bundling discount program

- Low-Mileage Discount: Offers an enticing discount tailored specifically for those who drive fewer miles, rewarding prudent and conscientious usage of their vehicle.

- Safe-Driving Discounts: By upholding a safe driving history, you not only enhance community safety but also qualify for special perks and incentives with Nationwide car insurance discounts.

Cons

- Higher Premiums for Certain Demographics: These increased premiums are often reflective of the increased risk associated with insuring certain individuals or groups.

- Limited Coverage Options: Nationwide may have fewer policy options compared to some competitors.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#8 – Travelers: Best for Multi-Policy Discounts

Pros

- Bundling Discount: By consolidating your insurance needs under one comprehensive plan, you not only simplify your coverage management but also unlock significant savings.

- Low-Mileage Discount: Travelers car insurance review, highlighting an attractive discount designed specifically for valued customers who drive fewer miles.

- Multi-Policy Discounts: Encouraging customers to bundle multiple policies not only provides them with comprehensive coverage but also unlocks significant savings.

Cons

- Limited Digital Tools: While our online interface offers robust functionality, it may not possess the same level of sophistication or user-centric design found in certain rival platforms.

- Average Customer Service Ratings: Some customers have voiced their concerns regarding their interactions with our customer service team, citing experiences that fell short of their expectations.

#9 – American Family: Best for Bundling Discounts

Pros

- Bundling Discount: Our company provides enticing incentives through substantial discounts when you opt to bundle multiple insurance policies.

- Low-Mileage Discount: This exclusive benefit rewards those who drive less frequently, reflecting our commitment to fairness and affordability.

- Bundle Discounts: American Family car insurance review promotes and inspires customers to bundle their insurance needs into a single, all-inclusive policy.

Cons

- Limited Geographical Availability: Availability of American Family services and coverage may vary by region and geographical area, and therefore may not be accessible in all regions.

- Potential Premium Variability: Certain customers may encounter variations or fluctuations in the costs associated with their insurance premiums.

#10 – Erie: Best for Customizable Policies

Pros

- Bundling Discount: Our company believes in maximizing value for our clients, which is why we offer enticing discounts when you bundle multiple insurance policies together.

- Low-Mileage Discount: Erie car insurance review highlights an attractive discount designed for customers who drive fewer miles, acknowledging their safe driving behavior with significant savings on insurance costs.

- Customizable Policies: This feature empowers customers to customize their insurance coverage according to their unique requirements and circumstances.

Cons

- Regional Limitations: Erie’s availability may be restricted in certain states due to regulatory limitations or market factors.

- Fewer Policy Options: While our insurance offerings cater to a wide range of needs, it’s important to note that some customers might encounter a more streamlined selection of coverage options.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

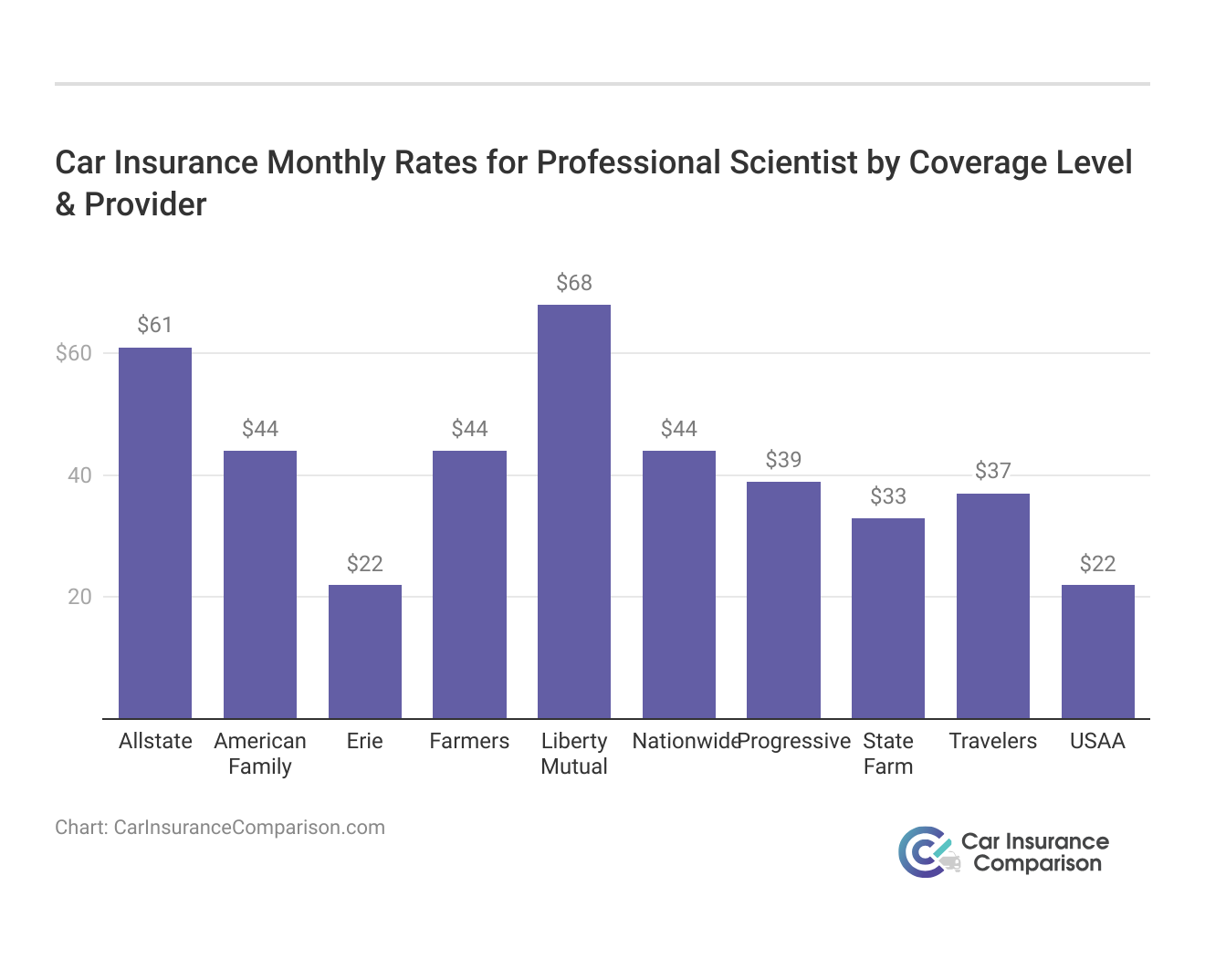

Comparing Car Insurance Coverage Rates for Professional Scientists

Being a professional scientist not only ensures precision in your work but can also lead to precision in your car insurance rates. We’ve compiled a list of average monthly car insurance rates for professional scientists from various insurance companies, both for full coverage and minimum coverage. To gain further insights, consult our comprehensive guide titled “Compare Car Insurance by Coverage Type.”

Car Insurance for Scientists: Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $61 | $160 |

| American Family | $44 | $117 |

| Erie | $22 | $58 |

| Farmers | $44 | $139 |

| Liberty Mutual | $68 | $174 |

| Nationwide | $44 | $115 |

| Progressive | $39 | $105 |

| State Farm | $33 | $86 |

| Travelers | $37 | $99 |

| USAA | $22 | $59 |

Identifying the Highest-Paying Car Insurance Providers

There are two things that will most impact your rates in a negative fashion. The first thing is if you are a terrible driver, and you have a number of points on your driving record. High insurance rates will be impacted even further if you have a DUI conviction on the books.

USAA stands out as the top choice for professional scientists, offering unparalleled customer service and the most competitive rates.

Brad Larson Licensed Insurance Agent

In fact, if you have multiple DUIs, you may be in a position where only a high-risk specialty company will write a policy for you. The second thing that will most affect your rates negatively is having a number of car insurance claims on your records, such as theft or natural damage.

These claims don’t even have to be related to an auto accident. Each incident is an auto insurance claim, and every single one of them that requires your insurance company to write you a check for repairs or replacements will cause your rates to increase.

Influential Factors Shaping Car Insurance Rates

If you have a long history of good driving, then your rates will be lower than someone who has had a rough driving history. In addition, if you are married, then you might find your rates are lower than an unmarried scientist. Keeping your rates low will require you to keep your driving record clean.

This table presents the monthly car insurance rates for professional scientists categorized by age and gender, offered by various insurance companies. The rates vary depending on factors such as age and gender, with each company offering different premiums.

Car Insurance for Scientists: Monthly Full Coverage Rates by Age, Gender, & Provider

| Insurance Company | 20-Year-Old Female | 20-Year-Old Male | 30-Year-Old Female | 30-Year-Old Male | 45-Year-Old Female | 45-Year-Old Male | 60-Year-Old Female | 60-Year-Old Male |

|---|---|---|---|---|---|---|---|---|

| Allstate | $100 | $110 | $90 | $100 | $80 | $90 | $70 | $80 |

| American Family | $95 | $105 | $85 | $95 | $75 | $85 | $65 | $75 |

| Erie | $90 | $100 | $80 | $90 | $70 | $80 | $60 | $70 |

| Farmers | $110 | $115 | $100 | $105 | $90 | $95 | $80 | $85 |

| Liberty Mutual | $105 | $110 | $95 | $100 | $85 | $90 | $75 | $80 |

| Nationwide | $100 | $105 | $90 | $95 | $80 | $85 | $70 | $75 |

| Progressive | $95 | $100 | $85 | $90 | $75 | $80 | $65 | $70 |

| State Farm | $85 | $90 | $75 | $80 | $65 | $70 | $55 | $60 |

| Travelers | $100 | $105 | $90 | $95 | $80 | $85 | $70 | $75 |

| USAA | $80 | $85 | $70 | $75 | $60 | $65 | $50 | $55 |

From Allstate to USAA, the rates for 20-year-old females range from $80 to $110, while for 60-year-old males, they range from $55 to $80. These rates reflect the complex interplay between demographic variables and insurance policies within the industry.

In addition, you need to choose the type of car you drive carefully. If you drive a high-performance sports car, then you are going to pay higher rates than if you purchase an economical sedan, for example. There are many different ways that you can keep your rates low including:

- Maintaining a good credit record

- Purchasing anti-theft devices for your vehicle

- Carrying multiple policies with the same insurance company

- Comparing prices between auto insurance companies

Understanding the intricate dynamics of car insurance is crucial for consumers. By discerning the influential factors shaping rates, individuals can take proactive measures to manage their premiums effectively and customize coverage to align with their specific requirements.

Leading the field with comprehensive coverage tailored for scientists, State Farm stands out with an unbeatable monthly rate of $22.

Dani Best Licensed Insurance Producer

This comprehensive grasp empowers consumers to make informed decisions, fostering a confident and empowered approach to navigating the complex landscape of auto insurance.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

The Bottom Line: Navigating Car Insurance for Scientists

This guide offers scientists insights into navigating the complex world of car insurance, with a focus on finding the best coverage tailored to their profession. It provides a curated list of top insurance companies, highlights influential factors shaping insurance rates, and offers practical tips for maintaining low premiums.

From understanding why scientists often qualify for lower rates to comparing quotes and optimizing coverage, this guide equips scientists with the knowledge needed to make informed decisions and secure reliable protection for their vehicles.

Stop overpaying for car insurance. Our free quote comparison tool allows you to shop for quotes from the top providers near you by entering your ZIP code below.

Frequently Asked Questions

Can scientists get special car insurance rates?

Yes, scientists often qualify for lower car insurance rates due to their careful and methodical driving habits. Insurance companies recognize their lower risk profile, making them eligible for competitive offers and discounts.

What are the differences between USAA and Erie car insurance for scientists?

USAA is known for its exceptional customer service and competitive rates, while Erie offers customizable policies and extensive coverage options. Scientists should compare the benefits and premiums of each insurer to find the best fit for their needs.

Shop for the best liability-only car insurance with our free quote comparison tool. Enter your ZIP code below to begin.

Which category of car insurance is best?

Yes, the premium for comprehensive care insurance is on the higher side when compared to the other types of car insurance in India. This is only because comprehensive car insurance offers more protection for your car than other types of motor insurance.

For additional details, explore our comprehensive resource titled “Compare Motorcycle vs. Car Insurance Rates.”

Which insurance cover is best for car?

Comprehensive’ insurance cover provides the widest cover and covers for theft and hijacking, damages due to an accident, fire or explosion and natural disasters like hail and floods.

What is premium insurance?

An insurance premium is the amount you pay each month (or each year) to keep your insurance policy active. Your premium amount is determined by many factors, including risk, coverage amount and more depending on the type of insurance you have.

What major car insurance is the cheapest?

The cheapest car insurance rate is $38 a month from Geico according to our research team’s cost analysis of national average prices for minimum coverage. The top 10 cheapest car insurance companies are Nationwide, Geico, State Farm, Travelers, Progressive, AAA, Allstate, Chubb, Farmers and USAA.

To learn more, explore our comprehensive resource titled “Cheapest Car Insurance in the World.”

Which is the most expensive form of car insurance?

In most cases, third party insurance will incur a lower premium than third party fire and theft cover, while comprehensive insurance is generally the most expensive form of cover. Many insurers also offer optional extra forms of cover that increase the cost of your premium.

What is the difference between an insurance premium and an insurance policy?

An insurance premium is the amount you pay for an insurance policy. Therefore, when you hear premium, think insurance price. You typically pay premiums monthly, semiannually or annually, depending on the policy.

What type of insurance is most important for cars?

Auto liability coverage is mandatory in most states. Drivers are legally required to purchase at least the minimum amount of liability coverage set by state law. Liability coverage has two components: Bodily injury liability may help pay for costs related to another person’s injuries if you cause an accident.

To delve deeper, refer to our in-depth report titled “Compare Liability Car Insurance: Rates, Discounts, & Requirements.”

What is standard insurance coverage?

Standard auto insurance is the auto insurance offered to average-risk drivers. With only a few blemishes on their driving, insurance, or credit histories, drivers usually qualify for standard auto insurance coverage.

When you’re ready to see how much you can save on your car insurance, enter your ZIP code below into our free comparison tool.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.