Best Tesla Car Insurance Rates in 2025 (Compare The Top 10 Companies)

State Farm, Progressive, and USAA have the best Tesla car insurance rates. Teslas are more expensive to insure, but at State Farm, it costs an average of $146/mo for minimum coverage for a Tesla. You can find also find Tesla insurance through the Tesla company itself if you live in California.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

UPDATED: Nov 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Nov 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Tesla

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Tesla

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage for Tesla

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviewsState Farm, Progressive, and USAA have some of the best Tesla car insurance rates.

There are plenty of car insurance companies that offer insurance for Tesla cars.

Our Top 10 Company Picks: Best Tesla Car Insurance Rates

| Company | Rank | Safety-Feature Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 12% | B | Personalized Policies | State Farm | |

| #2 | 14% | A+ | Coverage Options | Progressive | |

| #3 | 10% | A++ | Military Savings | USAA | |

| #4 | 13% | A++ | Affordable Rates | Geico | |

| #5 | 8% | A+ | Add-on Coverages | Allstate | |

| #6 | 9% | A | Safe-Driving Discounts | Liberty Mutual |

| #7 | 12% | A+ | Usage-Based Coverage | Nationwide |

| #8 | 10% | A | Various Discounts | Farmers | |

| #9 | 7% | A | Roadside Assistance | AAA |

| #10 | 10% | A++ | Specialized Coverage | Travelers |

You’ll want to carry a full coverage Tesla policy — which includes comprehensive car insurance — if you’re ever in an accident. As you look to buy cheap Tesla car insurance, be sure to compare quotes. You can use our free tool above to compare Tesla car insurance quotes from different companies and decide what works best for you.

- State Farm has the best insurance for Tesla drivers

- Car insurance companies that insure Teslas will have higher-than-average rates

- Tesla offers its own in-house insurance program for its cars in California

- Compare Tesla Car Insurance Rates

#1 – State Farm: Top Pick Overall

Pros

- Personalized Policies: State Farm offers assistance with personalizing policies to meet Tesla owners’ needs.

- Customer Service: State Farm has multiple local agents that can assist Tesla customers.

- Discount Variety: Tesla owners will have various opportunities to save. Read more in our State Farm insurance review.

Cons

- Online Tools: State Farm’s focus on in-person assistance means that some online functions may be absent.

- Bad Credit Rates: A bad credit score will result in a rate increase in most states.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#2 – Progressive: Best for Coverage Options

Pros

- Coverage Options: Progressive has loan or lease payoff coverage, custom parts coverage, vehicle protection coverage, and many more that are great for Teslas. Learn more in our Progressive review.

- Snapshot Program: Tesla drivers can save on insurance for good driving practices.

- Deductible Options: Increase deductibles to reduce insurance costs.

Cons

- Snapshot Rate Increases: Snapshot increases rates for poor driving.

- Customer Loyalty: Progressive has issues with negative reviews for claim filing.

#3 – USAA: Best for Military Savings

Pros

- Military Savings: Military and veterans will usually find the cheapest Tesla rates at USAA. Learn more in our USAA review.

- SafePilot: Tesla owners could save up to 30% with SafePilot.

- Bundling Discount: Tesla owners who also purchase home insurance will save on auto insurance.

Cons

- Coverage Options: USAA doesn’t have as many add-on options as its competition.

- Eligibility: Only Tesla owners who are service members or veterans can get insurance.

#4 – Geico: Best for Good Drivers

Pros

- Good Drivers: Geico has affordable rates for Tesla drivers with clean driving records. Learn more about rates in our Geico review.

- Financial Rating: Geico has the highest rating for financial stability.

- Bundling Discount: Tesla owners can also purchase home or renters insurance for a discounted auto insurance rate.

Cons

- High-Risk Rates: Geico’s rates are less affordable if Tesla drivers have poor driving records.

- Add-On Coverages: Some extras, like gap insurance, are missing from Geico’s coverage lineup.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#5 – Allstate: Best for Add-On Coverages

Pros

- Add-On Coverages: Allstate offers rental reimbursement coverage, roadside coverage, and more. Learn more in our Allstate review.

- Milewise Insurance: Pay-per-mile insurance that’s great for low-mileage Tesla owners. Find out more in our Allstate Milewise review.

- Discount Variety: Allstate has young driver discounts, good driver discounts, and many more.

Cons

- Customer Reviews: Allstate struggles with a high number of customer complaints.

- High-Risk Rates: Rates are most affordable for Tesla drivers with clean driving records.

#6 – Liberty Mutual: Best for Safe-Driving Discounts

Pros

- Safe-Driving Discounts: Liberty Mutuals’ RightTrack could save safe drivers up to 30% on their Tesla insurance.

- Customizable Policies: Adjust coverage as needed at Liberty Mutual. Read more in our Liberty Mutual review.

- Bundling Discount: Purchase home or renters insurance to save on Tesla auto insurance.

Cons

- Claims Satisfaction: Customers do have some negative feedback.

- Telematics Tracking: RightTrack does record driving data.

#7 – Nationwide: Best for Usage-Based Coverage

Pros

- Usage-Based Coverage: SmartMiles by Nationwide offers pay-per-mile coverage.

- Vanishing Deductible: Nationwide reduces deductibles for Tesla drivers if they stay claim-free.

- Bundling Discounts: Save by also purchasing home or renters insurance. Learn more in our article on Nationwide car insurance discounts.

Cons

- Availability: Some states Nationwide doesn’t sell in.

- High-Risk Driver Rates: Tesla drivers with poor driving records will have expensive rates.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#8 – Farmers: Best for Various Discounts

Pros

- Various Discounts: Farmers has a good driver discount, bundling discount, and many more.

- Coverage Options: Tesla owners can choose from add-on coverage options like roadside assistance. Read more in our Farmers review.

- Online Convenience: Tesla owners can manage accounts online.

Cons

- Customer Satisfaction: Some customers scored Farmers’ customer service as poor.

- High-Risk Rates: Farmers’ rates aren’t as affordable for poor drivers.

#9 – AAA: Best for Roadside Assistance

Pros

- Roadside Assistance: AAA’s roadside assistance is available across the U.S. and is highly rated. Learn more in our AAA review.

- Bundling Discount: Tesla owners can purchase home or renters insurance as well.

- Membership Perks: AAA members can get discounts on select purchases when shopping.

Cons

- Membership Fee: Tesla owners must join AAA and pay a membership fee to get auto insurance.

- Customer Service: Reviews for customer service can vary by location.

#10 – Travelers: Best for Specialized Coverage

Pros

- Specialized Coverage: Travelers has specialized coverage options for Tesla owners. See what’s available in our Travelers review.

- IntelliDrive Program: IntelliDrive participants could save up to 30% on Tesla insurance.

- Bundling Discount: Save on auto insurance by also purchasing home or renters insurance.

Cons

- IntelliDrive Rate Increases: The IntelliDrive program could raise rates.

- Claims Satisfaction: Most customers rate claim service at Travelers as just average.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Car Insurance Companies That Insure Teslas

Plenty of car insurance companies insure Teslas. Some of the most common companies that insure Teslas include:

- Progressive

- Geico

- Allstate

- Farmers

- AAA

- Mercury (read our article on “Best Mercury Car Insurance Rates” for more information)

- AAA Norcal

You can easily get Tesla insurance quotes directly from companies like State Farm.

If you drive a Tesla, you also have the option of purchasing insurance through the company itself. Tesla only offers car insurance to individuals who drive in California. But the company says its Tesla car insurance rates are 20-30% lower than the average rates for Tesla insurance.

Tesla’s insurance company won’t insure you if you work for a rideshare service or use your vehicle for commercial use. Keep that in mind if you consider reaching out for coverage options.

Companies That Won’t Insure Teslas

While most of the well-known car insurance companies will offer coverage for Teslas, some companies will not. Most of the companies that decline coverage on a Tesla do so because the policy will have to be outside the standard range of insurance coverage or because the driver has a bad driving record.

View this post on Instagram

You may have a hard time with car insurance rates for your Tesla, depending on which Tesla car insurance companies you consider for coverage. But you shouldn’t run into much of a problem when looking to get your Tesla insured.

Tesla Car Insurance Rates

Car insurance rates for Teslas will be higher than average regardless of where you live or what your driving record is like.

While average Tesla insurance costs are high, drivers with clean driving records will have the cheapest Tesla auto insurance quotes.

Dani Best Licensed Insurance Producer

Just like other car insurance rates, your Tesla car insurance rates will be based on several factors, including:

- The model of Tesla

- How much you drive

- The type of coverage you want

- Your home address

The average monthly rate for Tesla car insurance is well over $400, or over $4,500 a year. At the best companies for Teslas, rates will average around $250 for minimum coverage.

Tesla Car Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| AAA | $189 | $465 |

| Allstate | $260 | $638 |

| Farmers | $317 | $773 |

| Geico | $125 | $377 |

| Liberty Mutual | $325 | $785 |

| Nationwide | $195 | $476 |

| Progressive | $327 | $814 |

| State Farm | $146 | $420 |

| Travelers | $362 | $910 |

| USAA | $102 | $310 |

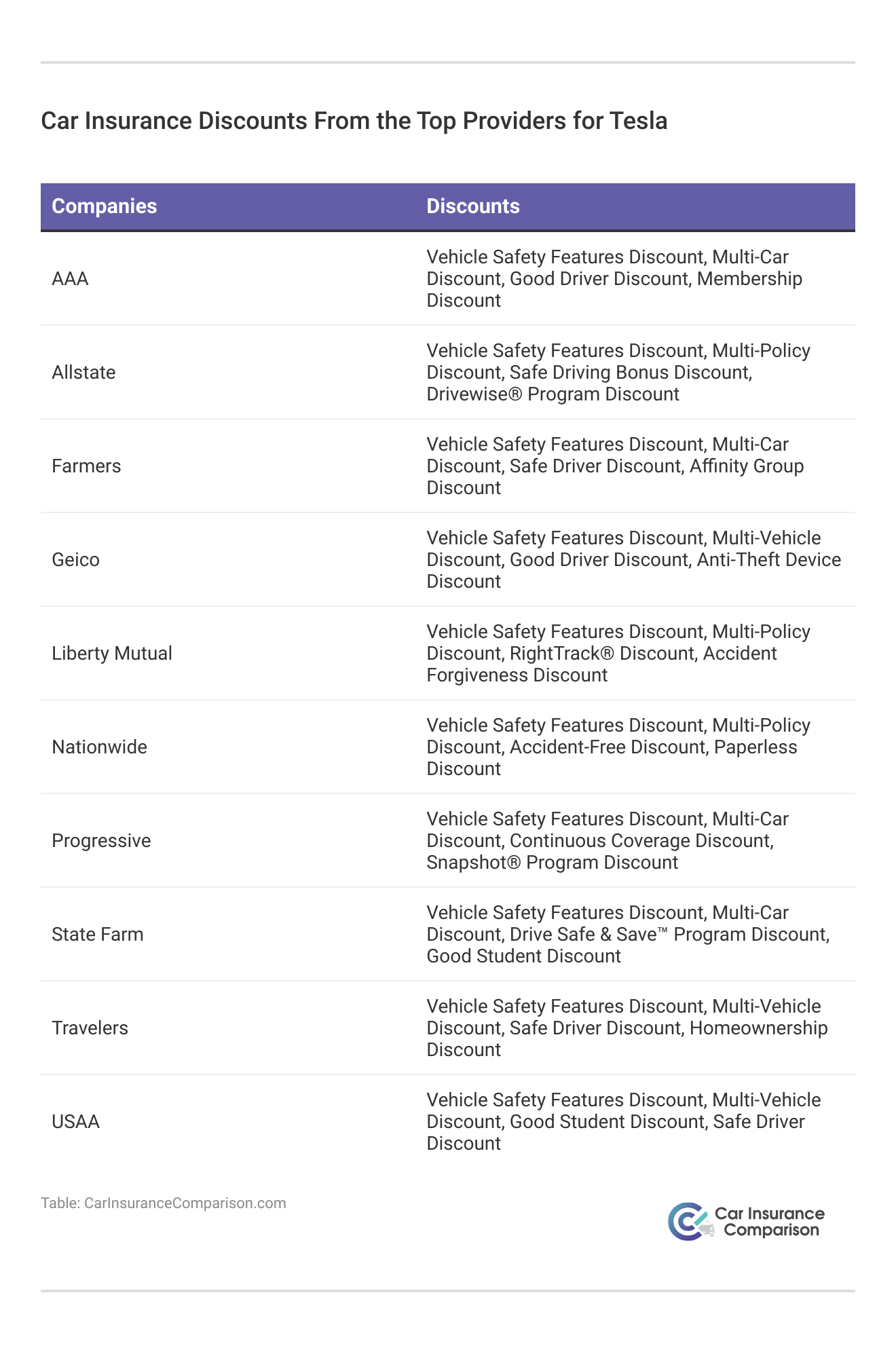

This price is due to the cost of the car and the technology it carries. You will also want a full coverage policy when you drive your Tesla. This will ensure you are fully protected if you get into an accident. However, because it costs more, you’ll want to make sure that you look for car insurance discounts at your current company to try and reduce rates.

Other ways you can save include:

- Raising your deductible

- Keeping a clean driving record

- Shopping for quotes

Even with saving opportunities, though, you can expect to pay more for Tesla insurance than if you owned a cheaper car.

The Final Word on the Best Tesla Car Insurance Rates

State Farm, Progressive, and USAA have some of the best Tesla insurance rates. While the cost of insuring a Tesla sounds like a lot, you may be able to find cheaper rates if you shop around online to compare quotes (learn more: How do you get competitive quotes for car insurance?). You should also take the time to compare Tesla insurance reviews to see which companies are highly rated in your area.

If you are looking for affordable Tesla car insurance, use our free quote tool below to compare rates and decide what works best for you.

Frequently Asked Questions

Which car insurance companies are known for providing coverage for Teslas?

Some of the popular companies include:

- State Farm

- Geico

- Progressive

- Allstate

- Liberty Mutual

Several other car insurance companies also offer coverage specifically tailored for Tesla vehicles.

What factors should I consider when choosing a car insurance company for my Tesla?

When selecting an insurance company for your Tesla, consider the following factors:

- Coverage Options: Look for comprehensive coverage, collision coverage, and coverage for specific Tesla features.

- Cost: Compare premium rates and deductibles to find the most affordable option for your needs.

- Customer Service: Research the company’s reputation for customer support and claims handling.

- Financial Stability: Ensure the insurance company has a strong financial standing.

- Discounts: Inquire about any discounts available for Tesla owners or specific safety features.

The best insurance company for Teslas will be one that balances affordability with great coverage. Compare rates with our free tool today to find the best rates for Tesla insurance.

Are there any specific car insurance considerations for Teslas?

Yes, Teslas have some unique insurance considerations. These may include:

- Cost of Repairs: Teslas often have higher repair costs due to specialized parts and technology, which can impact insurance premiums.

- Battery Coverage: Check if the insurance policy includes coverage for Tesla’s battery, as it is a vital and expensive component.

- Autopilot Coverage: Confirm whether the policy covers any accidents or incidents related to the use of Tesla’s Autopilot feature.

Make sure to compare car insurance by coverage type to ensure these factors are covered by your Tesla insurance policy.

Can I insure my Tesla with a standard car insurance policy?

Yes, many standard car insurance policies can provide coverage for Teslas. However, it’s important to review the policy details to ensure that it adequately covers your specific Tesla model and its features.

What are the cons of insuring Teslas with different insurance companies?

Some of the cons are:

- Higher insurance premiums due to the expensive repair costs of Tesla vehicles

- Limited availability of specialized coverage options

- Some insurance companies may have less experience with electric vehicles and their unique requirements

It’s important to consider the level of expertise a company has when looking for the cheapest Tesla insurance.

What are the pros of insuring Teslas with different insurance companies?

Some of the pros include:

- Full coverage car insurance options tailored for Teslas

- Competitive rates and discounts for Tesla owners

- Knowledgeable customer support for Tesla-specific concerns

- Fast and efficient claims handling processes

To find the best company for Tesla insurance in your area, enter your ZIP into our free tool.

Is Tesla insurance cheaper than Geico?

Tesla is generally more expensive, so Geico has the best Tesla insurance rates out of the two companies.

What is the best insurance for a Tesla?

Full coverage policies are the best car insurance for Teslas.

Can you get Tesla Insurance without a Tesla?

No, you can only buy insurance from Tesla if you own a Tesla.

Why is Tesla so hard to insure?

Teslas are harder to insure because they are expensive to repair and replace. To lower your rates, make sure to check out our guide on 16 ways to lower the cost of your insurance.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.