Best Mercury Car Insurance Rates in 2025 (Compare the Top 10 Companies)

Allstate, Progressive, and Geico have the best Mercury car insurance rates for most Mercury owners. At Geico, minimum coverage for a Mercury is an average of $55/mo. Because Mercury vehicles are no longer made, most models are older, making it easier to find affordable Mercury car insurance rates.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

UPDATED: Nov 4, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Nov 4, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

11,638 reviews

11,638 reviewsCompany Facts

Full Coverage for Mercury

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Mercury

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for Mercury

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviewsAllstate, Progressive, and Geico have the best Mercury car insurance rates.

Once one of Ford’s luxury divisions, Mercury was discontinued in 2010 due to slow sales. However, Mercury still has a base of loyal drivers. The brand’s reliability is the main selling point, and you can still take a Mercury to a Ford dealership for repairs.

This combination of reliability and low maintenance costs makes Mercury car insurance very affordable. When you compare car insurance rates by vehicle make and model, you’ll see Mercury is generally cheaper than many other brands.

Our Top 10 Company Picks: Best Mercury Car Insurance Rates

| Company | Rank | Multi-Car Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 22% | A+ | Usage-Based Discount | Allstate | |

| #2 | 18% | A+ | Online Tools | Progressive | |

| #3 | 20% | A++ | Good Drivers | Geico | |

| #4 | 21% | B | Good Students | State Farm | |

| #5 | 15% | A++ | Military Benefits | USAA | |

| #6 | 20% | A | Diverse Coverage | Liberty Mutual |

| #7 | 17% | A+ | Accident Forgiveness | Nationwide |

| #8 | 18% | A | Discount Variety | Farmers | |

| #9 | 15% | A++ | Low-Mileage Drivers | Travelers | |

| #10 | 20% | A | Loyalty Rewards | American Family |

Read on to learn more about Mercury car insurance rates and where to find a cheap car insurance policy, then compare Mercury quotes using our free tool to find the right coverage at the perfect price.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – Allstate: Top Pick Overall

Pros

- Usage-Based Discount: Mercury customers participating in Drivewise could save on their Mercury car insurance costs. Read more in our Allstate Drivewise review.

- Pay-Per-Mile Insurance: A good choice for low-mileage Mercury customers.

- Add-On Coverages: Allstate’s add-on options could be useful for some Mercury owners. See what’s sold in our Allstate review.

Cons

- Customer Reviews: Dissatisfied reviews are more numerous than at other companies.

- High-Risk Rates: Allstate’s rates are best for low-risk Mercury drivers.

#2 – Progressive: Best for Online Tools

Pros

- Online Tools: Progressive has many useful tools to help Mercury customers.

- Coverage Options: Progressive has extras like custom parts coverage that could be useful for some Mercury owners.

- Snapshot Program: Customers will have the opportunity to reduce Mercury insurance rates by joining Snapshot.

Cons

- Snapshot Rate Increases: Bad driving in the program could raise Mercury rates.

- Customer Reviews: Reviews left by customers show customer service could be improved. Read more in our Progressive review.

#3 – Geico: Best for Good Drivers

Pros

- Good Drivers: Rates are affordable at Geico if Mercury customers are good drivers.

- Financial Stability: Geico’s financial management is excellent. Learn more about its ratings in our Geico car insurance review.

- Discount Variety: Geico offers everything from good student discounts to vehicle safety discounts.

Cons

- Lack of Local Agents: Interactions with Geico representatives will be virtual.

- High-Risk Rates: Mercury drivers who are high-risk will be quoted expensive rates.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#4 – State Farm: Best for Good Students

Pros

- Good Students: State Farm is a good choice for young Mercury drivers due to its good student and student-away discounts.

- Roadside Assistance: An add-on option that could be useful for older Mercurys. See what else is offered in our State Farm review.

- Local Assistance: Mercury drivers should have access to local assistance from State Farm in most areas.

Cons

- No Online Purchases: Mercury owners must buy their policy from an agent.

- DUI Rates: DUI Mercury drivers will have high Mercury insurance costs.

#5 – USAA: Best for Military Benefits

Pros

- Military Benefits: USAA offers multiple benefits, such as shopping discounts, for military and veterans.

- Customer Ratings: USAA is positively rated by most USAA customers. Read more in our USAA review.

- Discount Variety: USAA has good driver discounts, good student discounts, and more.

Cons

- Add-On Coverages: Specialized coverages aren’t as numerous.

- Eligibility: USAA sells insurance exclusively to Mercury customers who are veterans or military.

#6 – Liberty Mutual: Best for Diverse Coverage

Pros

- Diverse Coverage: Diverse coverage options at Liberty Mutual can help customers fully protect their Mercury vehicles.

- Quick Claims: Liberty Mutual has an online claims filing option (learn more: How do you file a car insurance claim?).

- Availability: Mercury owners can usually keep Liberty Mutual as a provider if they move, thanks to the company’s widespread availability.

Cons

- Discount Options: Some states may not have as many Liberty Mutual discounts available.

- Customer Service: Low ratings from some of Liberty Mutual’s customers.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#7 – Nationwide: Best for Accident Forgiveness

Pros

- Accident Forgiveness: A great way for good drivers to save at Nationwide, along with other Nationwide car insurance discounts.

- SmartMiles Insurance: Coverage paid by the mile, which is ideal for low-mileage Mercury customers.

- Vanishing Deductible: Another way good drivers can save over time at Nationwide.

Cons

- Telematics Tracking: SmartMiles and Nationwide’s UBI program track driving data.

- Customer Ratings: Not always the highest-rated company for customer representatives.

#8 – Farmers: Best for Discount Variety

Pros

- Discount Variety: Mercury drivers can take advantage of discounts ranging from good student to bundling discounts. Learn what is offered in our Farmers review.

- Local Agents: Mercury customers who prefer personalized assistance can search for a local agent near them.

- Accident Forgiveness: Mercury owners may be able to avoid increased rates if they are good drivers.

Cons

- Online Functions: Online functions may be less robust at Farmers than at other companies.

- Customer Satisfaction: Farmers has some negative ratings from its customers.

#9 – Travelers: Best for Low-Mileage Drivers

Pros

- Low-Mileage Drivers: Mercury drivers with lower annual mileage will have some of the cheapest Mercury car insurance rates. Discover more in our Travelers review.

- IntelliDrive Program: IntelliDrive participation could help Mercury customers save.

- Online Convenience: Mercury customers can choose to make policy changes online from Travelers’ app.

Cons

- IntelliDrive Rate Increases: The program may raise rates for bad drivers.

- Customer Reviews: Customer service could be improved.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#10 – American Family: Best for Loyalty Rewards

Pros

- Loyalty Rewards: American Family discounts rates for customers who stick with American Family.

- Roadside Assistance: An optional coverage that can be great for older Mercury models.

- Discount Variety: American Family has accident forgiveness, good student discounts, and more.

Cons

- Availability: Because coverage isn’t sold in every state, some Mercury drivers may be unable to purchase coverage.

- DUI Rates: DUI drivers will find Mercury insurance rates less competitive. Learn more in our American Family review.

Finding the Right Mercury Car Insurance Policy

Before you sign up for a policy, you should understand what each type of insurance does for your car. When you shop for coverage, these are the basic types of insurance most companies offer:

- Liability: Liability car insurance pays for damages and injuries you cause to other people in an at-fault accident. It never covers your health care needs or car repairs.

- Collision: Collision car insurance pays for your car repairs after an at-fault accident. It also covers you if you collide with an object, such as a mailbox or tree.

- Personal Injury Protection/Medical Payments: Medical payments and personal injury protection insurance pay health care bills for you and your passengers after an at-fault accident. The type you can purchase depends on your state.

- Uninsured/Underinsured Motorist: If a driver without enough coverage hits you, uninsured motorist insurance will pay for your car repairs and medical bills. It also covers hit-and-run incidents.

- Comprehensive: Comprehensive car insurance covers floods, fire, extreme weather, animal contact, theft, and vandalism.

Full coverage car insurance includes everything listed above and is usually required when you have a car loan or lease. It costs more, but full coverage offers much better protection for your car.

However, many Mercury drivers don’t need full coverage. Since Mercury models are at least 10 years old, you can probably get away with a minimum insurance policy.

Minimum insurance for a Mercury car is the least amount of coverage required in your state. It typically includes liability coverage, with uninsured motorist and personal injury protection often being required as well.

Dani Best Licensed Insurance Producer

When your car is older and worth less than a few thousand dollars, you probably don’t need Mercury insurance full coverage and can opt out of extras like Mercury insurance gap coverage. However, you should be prepared to pay for your own car repairs if anything happens to your vehicle. Learn more about the differences between collision and comprehensive car insurance.

What Influences Mercury Car Insurance Rates

Estimating how much you’ll pay for Mercury car insurance can be difficult because there are a lot of factors to look at. Aside from the regular things that affect your insurance, like your age and location, many insurance companies are wary of older cars.

This is especially true when you’re not the car’s original owner. If you plan on buying more coverage than the minimum required amount of liability insurance, you might have to submit pictures of your Mercury before your policy will start. This helps insurance companies verify pre-existing damage in case you need to file a car insurance claim. You can expect the following rates at popular companies for Mercury insurance:

Mercury Car Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $80 | $210 |

| American Family | $70 | $176 |

| Farmers | $76 | $198 |

| Geico | $55 | $149 |

| Liberty Mutual | $91 | $220 |

| Nationwide | $66 | $163 |

| Progressive | $70 | $188 |

| State Farm | $40 | $102 |

| Travelers | $53 | $140 |

| USAA | $33 | $90 |

The average Mercury driver pays between $48 and $68 a month for car insurance, but there are several factors to consider that might change those rates. For example, the amount of coverage you want to purchase will significantly impact your rates. Mercuries often don’t need very much insurance, but the level of protection you want for your car is up to you.

How to Determine Your Mercury Car Insurance Rates

Since you can no longer buy a new Mercury, you’ll be looking at used car insurance. Although rates are generally a little lower, used car insurance rates look at the same factors as standard coverage. If you need Mercury car insurance, the following factors will affect your car insurance rates:

- Age: Younger drivers pay more for car insurance because they get into more accidents and file more claims. However, a parent or guardian can help teens keep their rates low by adding them to an existing policy.

- Gender: Men also pay more for insurance because they are more likely to drive recklessly, get into accidents, and file claims. The good news is that the price gap lessens with age. Learn how to compare auto insurance rates by age and gender.

- Your Car: The type of car you drive plays a big role in your car insurance rates. For example, Mercuries usually have lower rates because they’re older cars and cheaper to replace.

- Marital Status: Married people pay a little less for insurance because they file fewer claims than single drivers. Find out the cost of married car insurance vs. single car insurance.

- Driving Record: Car insurance companies check driving records, so you’ll pay more for your insurance if you have any incidents in your driving record. Even a single reckless driving charge can increase your rates by 70%.

- Credit Score: Most states allow insurance companies to use your credit score when calculating your rates. The higher your credit score, the less you’ll pay for coverage. Find the best car insurance companies for bad credit.

- Location: Insurance companies carefully track claim numbers, and they know how many claims are made in each ZIP code. You can see different rates by moving even a single ZIP code.

The last thing to consider for your insurance rates is how much coverage you want to buy. Since Mercuries are at least 10 years old, most drivers can get away with minimum insurance. While you can buy more coverage for your Mercury, it’s often not a cost-effective choice.

Quickly compare car insurance rates for Mercury models, including Milan, Montego, and Sable. Start now to find the best rates for your Mercury.

Compare Mercury Car Insurance Rates by Model

| Mercury Model |

|---|

| Mercury Milan |

| Mercury Montego |

| Mercury Sable |

The more expensive a model is, the more you’ll pay for Mercury auto insurance.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

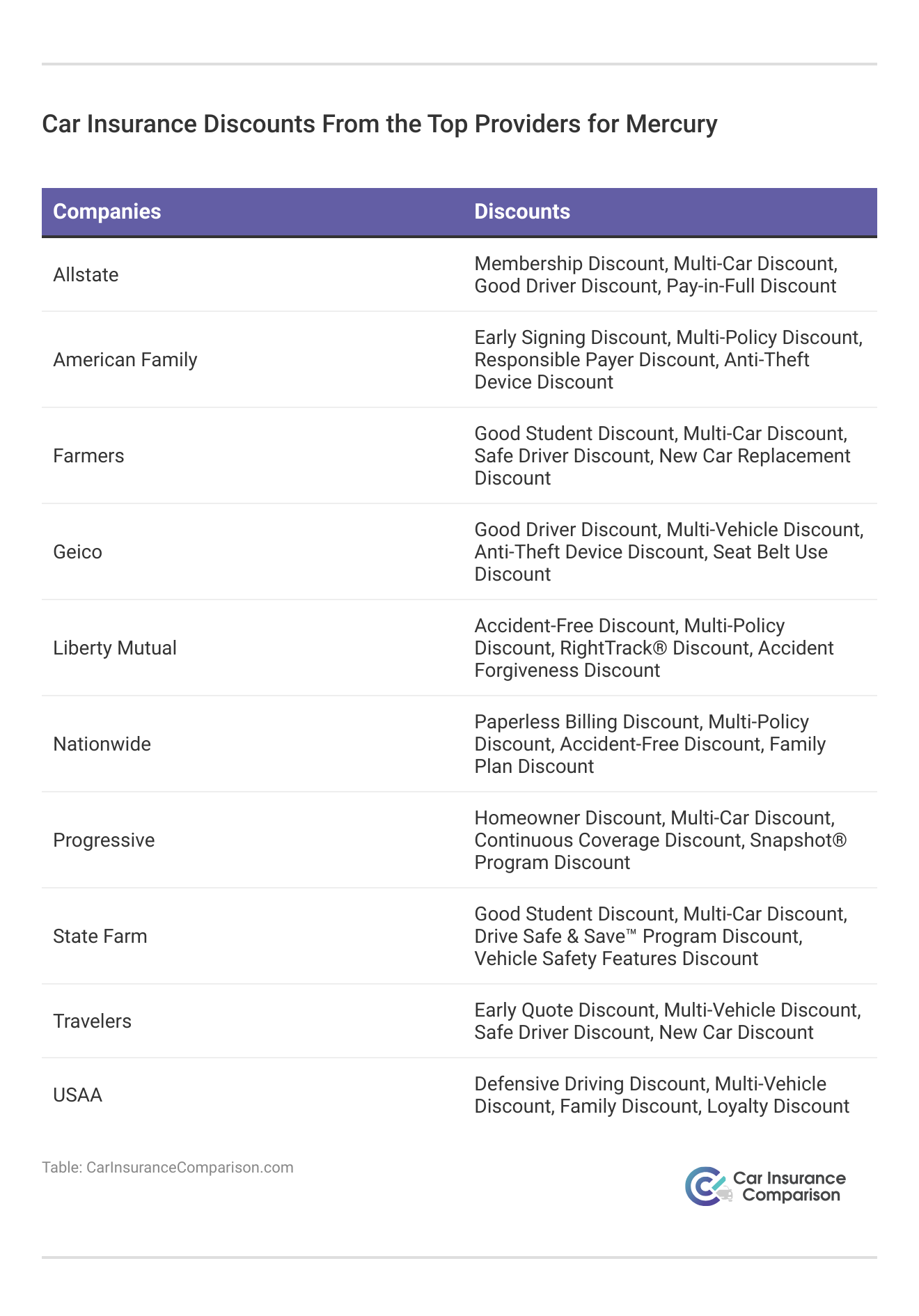

Ways to Save Money on Mercury Car Insurance

Since Mercury was discontinued in 2010, you can only buy older, used models. Used cars tend to have cheaper rates since they’re cheaper to repair, but there are plenty of ways to lower your Mercury insurance rates. For example, you can find Mercury insurance discounts.

View this post on Instagram

Some of the best discounts for used cars include bundling with other policies, remaining claims-free, and maintaining a good GPA as a full-time student.

Try the additional tips below to find the lowest rates for your Mercury:

- Try Telematics Programs: Insurance companies offer usage-based insurance programs to help safe drivers lower their rates. If you regularly practice safe habits, you can save up to 40% on your insurance.

- Raise Deductibles: Your car insurance deductible is your financial responsibility when you file a claim. Choosing a larger deductible will lower your rates, but you’ll have to pay more out-of-pocket if you need to file a claim.

- Lower Coverage: It’s important to periodically review your policy to make sure you don’t have too much insurance. You might be able to save by lowering your current coverage.

- Practice Safe Driving: Drivers with clean records pay less than those with speeding tickets, at-fault accidents, or DUIs.

Even if you don’t try to save on your insurance, you’ll likely see affordable rates for a Mercury. No matter what else you do, you should always compare Mercury car insurance quotes with as many companies as possible. You can get quotes directly from companies like Allstate or use a quote comparison tool.

Comparing quotes is the best way to ensure you don’t overpay on your Mercury insurance monthly payment.

Find the Best Mercury Car Insurance Rates Today

You might not be able to buy a brand-new Mercury today, but that doesn’t mean they’re gone. Many Mercury drivers keep their vehicles on the road for years. With the right amount of cheap car insurance for older vehicles and regular maintenance, your Mercury could last for years to come.

There are many ways to save on Mercury car insurance, but none are as helpful as comparing quotes from multiple companies and reading Mercury auto insurance reviews. The only way to find the lowest price for your Mercury is to see what different companies offer. Compare rates now with our free tool to find the best Mercury insurance online quotes.

Frequently Asked Questions

Is Mercury insurance expensive?

Mercury car insurance rates are usually affordable because they cost less to replace and repair. However, you might see Mercury insurance rate increases if you have a low credit score, traffic violations, or if you want extra coverage.

Which company has the cheapest Mercury car insurance rates?

The company that offers you the lowest rates depends on a variety of factors, like where you live and how old you are. However, Mercury insurance estimates show that State Farm and USAA are often the cheapest options for Mercury car insurance. Use our free tool to find affordable Mercury insurance quotes today.

Can adding a teen driver to my policy increase my Mercury car insurance rates?

Adding a teen driver to your policy can often result in higher insurance rates. However, you can mitigate the increase by adding them to an existing policy and exploring discounts for young drivers (learn more: Compare Teen Driver Car Insurance Rates).

Is Mercury a good brand for a used car?

Generally speaking, Mercury is a good used car option. Mercuries tend to be reliable and safe. You can also take your Mercury into Ford dealerships for service, which makes maintaining them relatively easy.

Why is Mercury so cheap?

Mercury is discontinued in the United States, but replacement parts are still relatively easy to find. making them affordable to maintain and insure.

Can I take my Mercury to a Ford dealership for repairs?

Even though Mercury was discontinued, you can still take your Mercury vehicle to a Ford dealership for repairs. Ford’s network of dealerships can provide maintenance and repairs for Mercury vehicles.

Is it necessary to compare quotes from different companies for Mercury car insurance?

Comparing quotes from multiple insurance companies and reading Mercury car insurance reviews to find the best company is highly recommended. This allows you to find the best coverage options and prices for your Mercury, ensuring you don’t overpay for insurance (learn more: How do you get competitive quotes for car insurance?).

Who owns Mercury car insurance?

Mercury Insurance Company is not associated with Ford or Mercury vehicles. It was founded by George Joseph in Los Angeles, CA, but you can only compare Mercury car insurance rates from Mercury Insurance if you live in Arizona, California, Florida, Georgia, Illinois, Nevada, New Jersey, New York, Oklahoma, Texas, or Virginia.

Who is cheaper, Geico or Allstate?

Geico is cheaper on average for good drivers. Learn more in our Geico vs. Allstate car insurance comparison.

Are Mercury vehicles reliable?

Yes, Mercury vehicles tend to be reliable if maintenance is kept up.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.