Amica vs. AAA Car Insurance in 2025 [Side-by-Side Comparison]

Amica vs. AAA car insurance compares two top providers with unique strengths for drivers. Amica offers $46 monthly rates, policyholder dividends, and up to 30% savings with bundling discounts. AAA focuses on roadside assistance, $45 rates, travel perks, and membership benefits. Compare Amica vs. AAA to save.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

UPDATED: Jan 31, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jan 31, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

768 reviews

768 reviewsCompany Facts

Min. Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

768 reviews

768 reviews 3,027 reviews

3,027 reviewsCompany Facts

Min. Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

3,027 reviews

3,027 reviewsAmica vs. AAA car insurance compares Amica’s nationwide availability and “A+” A.M. Best rating with AAA’s 24/7 roadside assistance and 69 regional clubs.

Amica provides policyholder-focused services, including investments and property protection. AAA offers trip planning and travel currency options through its membership model.

Amica vs. AAA Car Insurance Rating

| Rating Criteria |  |

|

|---|---|---|

| Overall Score | 4.3 | 4.1 |

| Business Reviews | 4.5 | 4.5 |

| Claim Processing | 4.8 | 3.3 |

| Company Reputation | 4.5 | 4.5 |

| Coverage Availability | 5.0 | 5.0 |

| Coverage Value | 4.3 | 4.1 |

| Customer Satisfaction | 2.1 | 2.1 |

| Digital Experience | 4.5 | 4.0 |

| Discounts Available | 5.0 | 5.0 |

| Insurance Cost | 4.0 | 4.1 |

| Plan Personalization | 4.5 | 4.0 |

| Policy Options | 4.1 | 4.4 |

| Savings Potential | 4.4 | 4.4 |

| Amica Review | AAA Review |

While Amica serves all customers, AAA appeals to over 50 million members with exclusive perks.

These distinctions highlight their strengths among the best car insurance companies in insurance and travel support.

Enter your ZIP codeinto our free comparison tool to see how much car insurance costs in your area.

- Amica holds an “A+” rating with nationwide availability and policyholder benefits

- AAA combines insurance with trip planning and offers 24/7 roadside assistance

- Amica vs. AAA car insurance contrasts open access with AAA’s membership model

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Age Impact on Insurance Rates: Amica vs. American Automobile Association Insurance

Amica and AAA’s full coverage car insurance rates for various age and gender groups are contrasted in this table. Notable price differences are highlighted, highlighting the substantial impact that age and gender have on premiums between the two companies.

Amica vs. AAA Full Coverage Car Insurance Monthly Rates by Age & Gender

| Age & Gender |  |

|

|---|---|---|

| Age: 16 Female | $695 | $445 |

| Age: 16 Male | $735 | $465 |

| Age: 30 Female | $169 | $99 |

| Age: 30 Male | $176 | $103 |

| Age: 45 Female | $153 | $88 |

| Age: 45 Male | $151 | $86 |

| Age: 60 Female | $136 | $76 |

| Age: 60 Male | $140 | $77 |

Amica typically has higher rates for all drivers, but the premiums are highest for teen drivers. For example, a 16-year-old female driver pays $695 with Amica compared to $445 with AAA. Similarly, a 16-year-old male faces $735 from Amica, while AAA charges $465.

As drivers age, the rate gap narrows. A 30-year-old female pays $169 with Amica and $99 with AAA. By age 60, a female driver pays $136 with Amica and just $76 with AAA. These variations underscore the importance of comparing rates based on personal demographics.

Driving History Impacts Insurance Rates

This table shows how your driving record affects full coverage rates with Amica and AAA. It shows how accidents or violations can drive insurance costs and highlights the differences between the companies.

Amica vs. AAA Full Coverage Car Insurance Monthly Rates by Driving Record

| Driving Record |  |

|

|---|---|---|

| Clean Record | $151 | $86 |

| Not-At-Fault Accident | $231 | $133 |

| Speeding Ticket | $187 | $108 |

| DUI/DWI | $283 | $148 |

AAA consistently offers cheaper rates across the board. For drivers with clean records, Amica charges $151, while AAA only charges $86. If you’ve had a not-at-fault accident, rates jump to $231 with Amica compared to $133 with AAA.

A speeding ticket? Amica’s rate is $187, while AAA’s is $108. The biggest jump is for a DUI/DWI, with Amica charging $283 and AAA $148.

What Real Customers Say About Amica and AAA

This table compares Amica Mutual and AAA regarding ratings, customer satisfaction, and financial strength. It clearly shows how the two compare in different areas.

Insurance Business Ratings & Consumer Reviews: Amica vs. AAA

| Agency |  |

|

|---|---|---|

| Score: 903 / 1,000 Above Avg. Satisfaction | Score: 823 / 1,000 Avg. Satisfaction |

|

| Score: A+ Great Business Practices | Score: A Good Business Practices |

|

| Score: 85/100 Excellent Customer Feedback | Score: 74/100 Good Customer Feedback |

|

| Score: 0.73 Fewer Complaints Than Avg. | Score: 0.58 Fewer Complaints Than Avg. |

|

| Score: A+ Superior Financial Strength | Score: A Excellent Financial Strength |

Amica outperforms AAA in most categories. J.D. Power rates Amica 903/1,000 (“Above Average”) vs. AAA’s 823/1,000 (“Average”). Consumer Reports scores Amica 85/100 for feedback, while AAA earns 74/100. Amica also secures an A+ from A.M. Best compared to AAA’s A, with fewer complaints (0.73 vs. 0.58), showing its reliability.

Personalized services like policyholder dividends make Amica a standout choice for insurance.

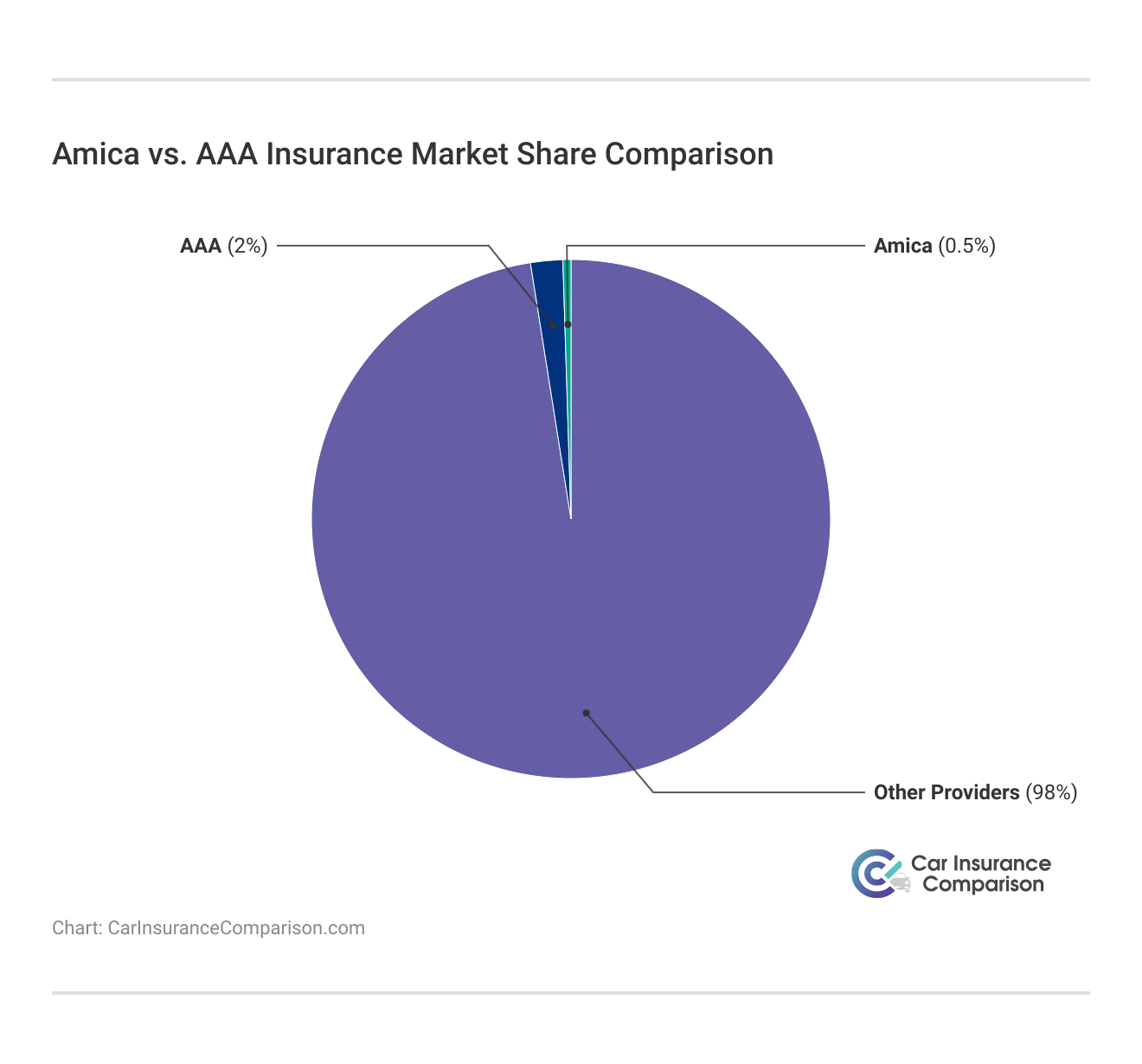

Brad Larson Licensed Insurance Agent

This chart shows the divided market between Amica, AAA, and other insurance companies. It highlights how smaller providers fit into an industry dominated by more prominent players.

With an emphasis on specialist services, Amica retains 0.5% of the market; AAA’s 2% combines insurance with travel and roadside assistance. The remaining 98% draws attention to industry competitiveness and the importance of smaller companies like Amica and AAA for customized advantages.

A Reddit user shared a positive experience with AAA, mentioning how quickly they handled things when their car was totaled by a red light runner in 2022. They also praised AAA’s friendly and personable customer service.

Comment

byu/MShorter02 from discussion

inInsurance

Since switching, they’ve been happy with the savings and overall support. The comment received 6 upvotes and 1 reply, showing others found it helpful.

Read more:

- AAA vs. Liberty Mutual Car Insurance Comparison

- AAA vs. Nationwide Car Insurance Comparison

- Amica vs. Nationwide Car Insurance Comparison

- Amica vs. Progressive Car Insurance Comparison

Origins and Growth of Automobile Mutual Insurance Company of America

Amica is the oldest operating mutual insurance in the nation, having been in service since 1902, and has grown to become one of the largest insurance providers.

Beginning as a small automobile insurance company in Providence, Rhode Island, Amica was founded on sound business investments that have helped it to show steady growth and profit, even in the roughest of economic times.

Amica is a mutually held company controlled by policyholders. Today, Amica offers a wide range of standard services, from investments and advice to property and casualty protection.

Learn how you can get Amica Mutual car insurance quotes online.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

The Early Mission of the American Automobile Association

The AAA organization we see today is far different from the original group of car enthusiasts that formed in 1902.

The original group, which had just one thousand members, was more concerned with improving the conditions of roads and highways than with insurance and actually lobbied for that end.

AAA steadily evolved into a multifaceted company, providing maps, directions, travel guides, and even trip planning in addition to their traditional services.

It may seem like AAA Insurance Company only offers towing and roadside assistance, but they have more options. AAA has focused more on the traveler with travel currency and its historic roadside assistance, but it also offers traditional insurance that varies from region to region.

If you’re exploring coverage options, check AAA car insurance quotes online to see what fits your needs. If someone gets a flat tire, they’ll call AAA because they have a wide range of roadside assistance coverage. However, AAA can appeal to its consumer base in a number of other ways as well.

AAA Insurance Services started with just nine original regions, but today, there are sixty-nine regions in the U.S. and Canada with over fifty million members.

Key Coverage Options Across Amica Mutual and AAA Insurance

Amica and AAA have several standard property and casualty insurance offerings, but their specific features set them apart.

- Automobile Insurance

- Life Insurance

- Homeowners Insurance

- Online Services

Amica stands out with policyholder dividends and up to 30% savings when bundling home and auto insurance. Meanwhile, AAA is an industry leader in travel insurance, and it has recently expanded its offerings to include coverage for rideshares and gap insurance.

These perks are designed for drivers who work for ridesharing companies or who finance their autos. Although both companies offer basic coverage, some customers may be more interested in Amica’s dividends or AAA’s unique travel and gap insurance features.

The table breaks down the coverage options offered by Amica and AAA, showing where they’re similar and differ. While both provide strong basics like liability, collision, and comprehensive coverage, AAA pulls ahead with extras like gap insurance and rideshare protection.

Car Insurance Coverage Options: Amica vs. AAA

| Coverage Name |  |

|

|---|---|---|

| Liability | ✅ | ✅ |

| Collision | ✅ | ✅ |

| Comprehensive | ✅ | ✅ |

| Gap Insurance | ✗ | ✅ |

| Medical Payments (MedPay) | ✅ | ✅ |

| Personal Injury Protection (PIP) | ✅ | ✅ |

| Rental Car Reimbursement | ✅ | ✅ |

| Rideshare Insurance | ✗ | ✅ |

| Roadside Assistance | ✅ | ✅ |

| Uninsured/Underinsured Motorist | ✅ | ✅ |

Amica and AAA cover the essentials: liability, uninsured motorist, and medical-related options like MedPay and PIP. Both providers also offer rental car reimbursement and roadside assistance.

But AAA has you covered if you’re an Uber or Lyft driver or if you require gap insurance for a car loan, while Amica doesn’t. While both providers provide viable choices, some drivers may find that AAA’s additional benefits are more to their liking. Finding what suits your needs is the most important thing.

Pros and Cons of Amica

Pros

- Top Financial Rating: Amica has an A+ rating from A.M. Best, proving its strong reliability.

- All-Inclusive Travel Support: Offers roadside help around the clock, travel currency options, and trip planning services.

- Regular Coverage: Offers access across the country without requiring membership.

Cons

- Pricey for Teens: Teen drivers pay steep premiums, starting at $695, way higher than AAA.

- Costly DUI Rates: The company charges $283 for DUI coverage, compared to AAA’s much lower $148. For additional info, read our Amica car insurance review.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Pros and Cons of AAA

Pros

- Affordable Rates: Offers competitive rates, such as $445 for a 16-year-old female compared to $695 with Amica.

- Comprehensive Travel Support: Provides trip-planning services, travel currency options, and 24/7 roadside assistance.

- Membership Perks: Includes exclusive benefits for its 50+ million members across 69 regional clubs. Delve into our evaluation of the AAA review.

Cons

- Membership Obligation: Coverage access is limited to paying members, reducing inclusivity.

- Regional Differences: Availability and offerings differ across various locations.

Choosing Between Amica and AAA for Affordable Insurance Coverage

The most significant difference between the two companies is AAA’s membership requirements and the limited regions in which they operate.

AAA is more significant in its number of members but specializes more in travelers’ needs than in insurance, while Amica is nationwide and focuses on insurance and investments alone.

So before you decide whether to switch providers or sign up for a new policy, consider a few things. Look at customer reviews, overall cost, whether or not you could receive car insurance discounts, and your policy limits.

By looking into your policy limits, you can determine what you’re offered and at what price. For example, if you’re interested in towing services, ask if that’s provided within your policy or if it’s considered additional coverage. The last thing you want is to be in an accident and then be told you’ll have to pay to tow your car to a mechanic because it wasn’t covered under your policy.

Shop around and take your time to find the right fit. Competitive rates and affordable insurance policies are out there, including options for cheap car insurance that still meets your needs. Just a click away are reasonably priced auto insurance quotes; utilize our free quote tool to identify the best policy for you.

Frequently Asked Questions

What is the difference between AAA and Amica?

AAA specializes in travel and roadside assistance, while Amica offers nationwide insurance with strong financial stability and an A+ rating.

How does Infinity compare to Amica?

Amica provides top-rated customer satisfaction and dividends for policyholders. At the same time, Infinity stands out as one of the car insurance companies for high-risk drivers, offering tailored auto policies to meet their unique needs.

How does Amica compare to USAA?

Amica is open to the general public, delivering personalized service and financial strength, while USAA focuses on military families with exclusive benefits.

How does AAA compare to American Family?

AAA combines roadside assistance and travel benefits, while American Family emphasizes flexible insurance options and reward programs.

What are the differences between Liberty Mutual and Amica?

Liberty Mutual offers more discounts and bundling options, as highlighted in the Liberty Mutual car insurance review, while Amica focuses on fewer complaints, financial stability, and policyholder dividends.

How do Farmers compare to Amica?

Farmers provides a wider variety of products, but Amica stands out for its high customer satisfaction and straightforward policies.

How does Amica compare to Geico?

Amica prioritizes financial reliability and personalized service, while Geico is best known for its low rates and digital convenience.

What is the difference between Nationwide and Amica?

As noted in the Nationwide car insurance review, Nationwide offers banking services alongside insurance, while Amica focuses on top-notch customer service and policyholder-focused programs.

How does Progressive roadside assistance compare to AAA?

Progressive covers basic towing and lockouts, while AAA provides more comprehensive roadside services and exclusive travel perks for members.

How does AAA compare to Liberty Mutual?

AAA combines travel benefits with insurance, while Liberty Mutual provides a broader range of discounts and flexible policy options.

How does USAA roadside assistance compare to AAA?

USAA provides essential roadside services to military families, as noted in the USAA car insurance review, while AAA offers members extensive travel benefits and discounts.

How does Amica compare to State Farm?

Amica offers fewer complaints and a strong financial rating, while State Farm provides more agents and broader policy options.

How does AAA compare to Geico?

AAA pairs insurance with travel and roadside assistance perks, while Geico focuses on affordable rates and digital tools for convenience.

How does Progressive compare to Amica?

As noted in the Progressive car insurance review, Progressive offers flexible rates and discounts, while Amica emphasizes financial strength, customer service, and personalized coverage.

How does Liberty Mutual roadside assistance compare to AAA?

Liberty Mutual offers towing and essential roadside services, while AAA includes travel discounts and more robust assistance programs.

How does Progressive compare to AAA?

Progressive excels in flexible pricing and discounts, while AAA provides standout roadside assistance and travel benefits for members.

How does Travelers compare to AAA?

As the Travelers car insurance review highlights, Travelers offers comprehensive home and auto insurance policies, while AAA focuses on combining insurance with travel-related benefits.

How does AAA compare to Nationwide?

AAA emphasizes member-exclusive benefits for roadside and travel, while Nationwide focuses on customizable insurance and financial services.

How does Amica home insurance compare to State Farm?

Amica offers strong financial backing and fewer complaints, while State Farm provides more agents and flexible home insurance options.

How does American Family compare to Amica?

American Family focuses on customizable coverage and loyalty programs, as highlighted in the American Family car insurance review, while Amica delivers top-tier customer service and financial stability.

What makes Amica auto insurance unique?

Amica’s policyholder dividends, A+ rating, and lower complaint rate than industry averages make its vehicle insurance stand out.

How do Amica vs. Auto-Owners handle claims?

Amica is known for fast, direct claims service and excellent customer satisfaction. Auto-Owners relies on local agents for a personalized claims process.

Which offers better customer satisfaction, Amica vs. USAA auto insurance?

Both rank high in customer satisfaction, but USAA often leads due to its military-focused benefits. Amica shines with policyholder dividends and fewer complaints. You can purchase the right car insurance quote online to compare these providers and find the best fit for your needs.

Is AAA auto insurance good?

AAA auto insurance is suitable for drivers seeking affordable rates, comprehensive coverage, and added perks like roadside assistance and travel discounts.

Is AAA the best insurance?

AAA is among the best insurance providers for drivers needing roadside assistance and travel benefits, but the best choice depends on your individual coverage needs.

Is Amica good at paying claims?

Yes, Amica is known for its excellent claims handling. It has high customer satisfaction ratings and a streamlined process for resolving claims efficiently. Additionally, you can file a claim on someone else’s car insurance if you were involved in an accident and they were at fault.

Want to get affordable car insurance? Just input your ZIP code to begin using our free comparison tool.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.