Best Car Insurance for Customer Service Occupations in 2024 (Top 10 Companies)

Get the best car insurance for customer service occupations with Allstate, AAA, and The Hartford, exploring comprehensive coverage options and competitive rates with multi-car discounts of up to 30%. Discover why these providers are among the top choices for offering top-notch car insurance rates.

Stop Paying Too Much For Car Insurance

Compare Free Quotes Online In Minutes, Check Now

Secured with SHA-256 Encryption

Michael Leotta

Insurance Operations Specialist

Michael earned a degree in Business Management degree with an insurance focus, which led to a successful 25-year career in insurance claims operations and support. He possesses a high-level of business acumen across multiple areas of the insurance industry. Over the course of his career, he served in multiple roles supporting claims operations including: Claims Specialist, Claims Trainer, Claim Au...

Insurance Operations Specialist

UPDATED: May 13, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: May 13, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Full Coverage for Customer Service Worker

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Customer Service Worker

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Customer Service Worker

A.M. Best Rating

Complaint Level

To understand the difference in car insurance rates from one occupation to the next, it’s important to know what insurance companies are looking at.

| Company | Rank | Service Industry Discount | Multi-Car Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

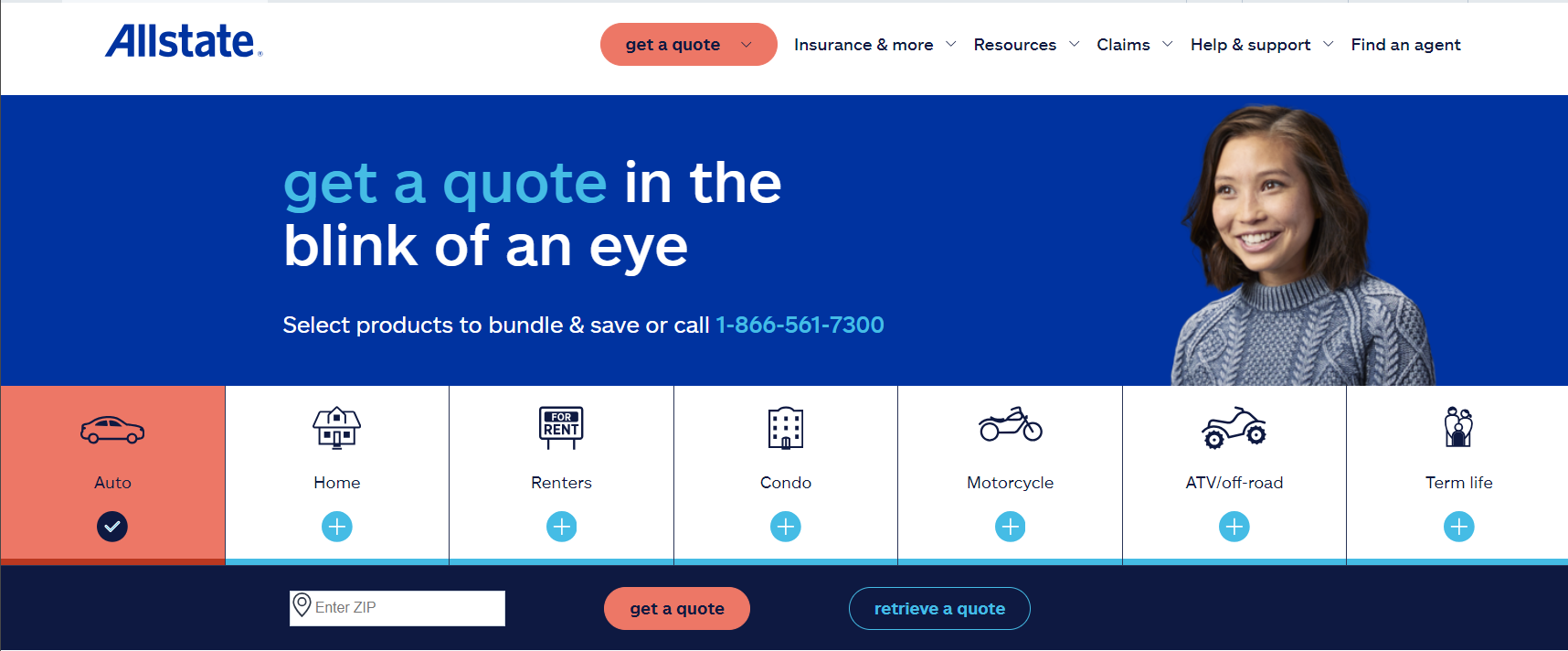

| #1 | 10% | 25% | Online Convenience | Allstate | |

| #2 | 12% | 30% | Organization Discount | AAA |

| #3 | 15% | 20% | Bundle Discounts | The Hartford |

| #4 | 10% | 25% | 24/7 Support | Mercury | |

| #5 | 8% | 15% | Policy Options | National General | |

| #6 | 10% | 20% | Accident Forgiveness | Amica | |

| #7 | 12% | 25% | Quick Claims | Elephant | |

| #8 | 10% | 20% | Customizable Policies | Kemper | |

| #9 | 8% | 15% | Affordable Coverage | SafeAuto |

| #10 | 10% | 20% | Personalized Service | The General |

According to a recent study that listed 60 different career categories according to how much workers pay for car insurance.

From lowest to highest, customer service workers were ranked 32nd. On average, they pay approximately $95 per month. By comparison, students pay about $85.

Enter your ZIP code above for free car insurance rates from top companies in your area.

- Allstate, AAA, and The Hartford offer tailored car insurance solutions

- Comprehensive coverage includes collision, comprehensive, and liability insurance

- Stress levels and job characteristics significantly impact premiums

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Comparing Average Monthly Rates for Customer Service Worker With Top 10 Car Insurance Companies

When it comes to securing car insurance for customer service workers, it’s crucial to find the right balance between comprehensive coverage and affordability. Compare the best car insurance companies average monthly rates for full and minimum coverage to help you make an informed decision.

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| AAA | $32 | $86 |

| Allstate | $61 | $160 |

| Amica | $46 | $151 |

| Elephant | $37 | $97 |

| The Hartford | $43 | $113 |

| Kemper | $47 | $125 |

| Mercury | $29 | $77 |

| National General | $61 | $161 |

| SafeAuto | $35 | $93 |

| The General | $54 | $232 |

Allstate emerges as the top choice, offering a comprehensive package at $160 for full coverage and $61 for minimum coverage per month. Following closely, AAA presents an attractive option with a competitive monthly rate of $86 for full coverage and $32 for minimum coverage, combining affordability with reliable service.

Allstate stands out as the top choice, offering driving confidence with comprehensive coverage and competitive rates for customer service workers.

Melanie Musson Published Insurance Expert

The Hartford, with a balanced approach, provides full coverage at $113 and minimum coverage at $43 per month, making it a noteworthy consideration for customer service professionals seeking a reliable and reasonably priced insurance solution.

Customer Service Agents and Stress

In our modern world of “the customer is always right,” it’s becoming increasingly difficult to explain to customers why they are, in fact, wrong.

Yet customer service representatives must attempt to help disgruntled individuals solve their problems.

It is a job that requires great diplomatic skills and the ability to ignore the attitudes and insults of others.

This particular characteristic would seem to be beneficial when it comes to driving.

On the other hand, spending eight hours per day listening to unhappy customers is enough to crack even the hardest nut. Being a customer service agent is one of the most stressful occupations that an individual can have.

That frustration and stress can build up over the day and then play itself out via aggressive driving on the way home.

When a person is stressed and getting behind the wheel, he’s more likely to cause an accident or be pulled over for a violation. This trait is not so good for insurance purposes.

Read more: How do the police check for car insurance?

Customer Service Agents and Creative Solutions

The most successful customer service representatives are those who can think outside the box and come up with creative solutions to problems.

This is another personality trait that has a positive effect on car insurance.

When service agents come upon a dangerous driving situation, for example, they are more likely to find a creative solution than someone else.

Not only that but the solution will be designed to be something that causes as little negative consequences as possible.

Take a flash flood, for example. A more aggressive driver may be willing to take a risk and attempt to drive his car through a flash flood area.

A customer service representative, on the other hand, is more likely to be a bit more cautious and try to determine if there’s another way to go.

Even if that individual must drive miles of his or her way, he or she is more likely to do that in order to avoid the potential consequences of trying to drive through flood waters. (For more information, read our article titled “How to Drive Safely in Bad Weather“).

This is another good trait your insurance company likes.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Different Kinds of Customer Service Agents

As a whole, customer service representatives perform similar tasks across all industries. But there are some differences depending on where you work.

A customer service representative working the returns counter at a department is much more likely to encounter unhappy customers than one who works at a bank.

Some insurance companies believe these differences are significant enough to warrant asking about the particular work environment.

Some others are not concerned with this type of thing.

For those insurance companies that are concerned, they’ll be looking for things in your work environment that will contribute to stress and a lack of concentration.

It’s not that they’re trying to punish those in high-stress environments, it’s just that they know that workers who are highly stressed tend to be poorer drivers.

On the other hand, the customer service representative whose work environment is more peaceful and stable will tend to be a better driver.

Read more: Car Insurance Discounts: Compare the Best Discounts

Determining Car Insurance Rates

Insurance companies consider a long list of factors when determining what their rates will be. While many of us may in this is not fair, most insurance companies that do business this way have plenty of statistical data to back them up.

In fact, they are so good at crunching the numbers that they can predict fairly accurately which drivers will make claims and how much those claims will be.

While some may perceive this as unfair, these companies rely on extensive statistical data to support their pricing decisions. In fact, their ability to analyze data enables them to predict with considerable accuracy which drivers are likely to file claims and the expected costs associated with those claims.

Understanding how occupation affects car insurance rates is just one piece of the puzzle. To delve deeper into this topic, read our article “How Occupation Affects Car Insurance Rates.”

Case Studies: Navigating Car Insurance for Customer Service Worker With the Industry Leaders

Through three compelling case studies, we explore how leading insurance providers like Allstate, AAA, and The Hartford offer tailored solutions to meet the diverse needs of individuals navigating the complexities of modern life.

- Case Study #1 – Allstate’s Assurance in Times of Need: Meet Sarah, a dedicated customer service representative who encountered an unexpected accident on her way to work. Sarah, being an Allstate policyholder, benefited from the comprehensive coverage that Allstate provides.

- Case Study #2 –AAA’s Navigating the Roads of Organization Discounts: Join David, a customer service manager juggling a busy schedule. David’s hectic routine is made more manageable with AAA’s organization discount. As a leader, he’s responsible for ensuring his team’s efficiency. Learn more about their discounts in our Allstate car insurance review.

- Case Study #3 – The Hartford’s Bundle Discounts: Experience the story of Emily, a customer service agent looking for an insurance solution that caters to both her car and home. Emily opted for The Hartford due to its balanced approach, providing both affordability and comprehensive coverage.

Whether it’s comprehensive coverage in times of need, specialized discounts for organizational members, or bundled packages for enhanced value, these case studies underscore the importance of choosing an insurance provider that prioritizes customer satisfaction and peace of mind.

If you’re a customer service agent looking for better car insurance rates, start your search now by entering your ZIP code below.

Frequently Asked Questions

How do I find the best car insurance for a Customer Service Worker?

To find the best car insurance for a Customer Service Worker, consider factors like coverage options, discounts, and customer satisfaction. Allstate, AAA, and The Hartford are top choices, offering comprehensive coverage and competitive rates. Compare quotes and choose based on your specific needs.

What discounts are available for Customer Service Workers in car insurance?

Many insurance companies offer discounts for Customer Service Workers. Allstate provides a service industry discount of up to 10%, AAA offers an organization discount of up to 12%, and The Hartford provides bundle discounts of up to 15%. Compare these discounts to optimize your savings.

Read more: Car Insurance Discounts: Compare the Best Discounts

Is there a connection between stress in customer service jobs and car insurance rates?

Yes, stress in customer service jobs can impact car insurance rates. High-stress occupations may lead to more aggressive driving, increasing the likelihood of accidents or violations. Insurance companies often consider stress levels when assessing risk, affecting rates for occupations like customer service.

Ready to find affordable car insurance? Get started today by entering your ZIP code below into our free comparison tool.

What should a Customer Service Worker look for in a car insurance policy?

Customer Service Workers should prioritize comprehensive coverage, affordability, and available discounts. Look for insurers offering benefits like online convenience, multi-car discounts (up to 30% with AAA), and competitive rates. Consider your driving habits and needs for tailored protection.

How do I navigate car insurance as a Customer Service Worker with a medium complaint level?

If your chosen insurer has a medium complaint level, focus on understanding the reasons behind complaints. Ensure that the coverage, service, and claims processing meet your expectations. Consider companies like Allstate with a low complaint level or The Hartford, which balances affordability and coverage effectively.

How can customer service workers find specialized car insurance tailored to their needs?

Customer service workers can find specialized car insurance by researching insurance companies that offer discounts or benefits specifically for their occupation. It’s also helpful to compare coverage options and rates from multiple insurers to find the best fit for their individual needs.

Read more: Compare Specialty Car Insurance Rates

Are there specific coverage options recommended for customer service workers?

While the specific coverage needs may vary depending on individual circumstances, customer service workers may benefit from comprehensive coverage that includes protection against a wide range of risks, such as liability, collision, and comprehensive coverage for damages to their vehicle.

Do insurance companies offer discounts for customer service workers based on their driving habits?

Some insurance companies offer discounts for safe driving habits, which may be available to customer service workers as well. These discounts often reward drivers for factors like maintaining a clean driving record, participating in safe driving programs, or using telematics devices to monitor driving behavior.

What steps can customer service workers take to lower their car insurance rates?

Customer service workers can take several steps to lower their car insurance rates, including maintaining a clean driving record, bundling policies for multi-policy discounts, increasing deductibles, and taking advantage of available discounts for their occupation or driving habits. Learn more in our article titled “Different Ways to Lower Car Insurance Rates“.

Are there any additional benefits or perks that insurance companies offer specifically for customer service professionals?

Some insurance companies may offer additional benefits or perks for customer service professionals, such as specialized customer service support, priority claims processing, or exclusive discounts on other insurance products. It’s worth exploring these options with insurers to see what additional benefits may be available.

By entering your ZIP code below, you can get instant car insurance quotes from top providers.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Michael Leotta

Insurance Operations Specialist

Michael earned a degree in Business Management degree with an insurance focus, which led to a successful 25-year career in insurance claims operations and support. He possesses a high-level of business acumen across multiple areas of the insurance industry. Over the course of his career, he served in multiple roles supporting claims operations including: Claims Specialist, Claims Trainer, Claim Au...

Insurance Operations Specialist

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.