Best Isuzu Car Insurance Rates in 2025 (Check Out the Top 10 Companies)

You'll find the best Isuzu car insurance rates at The General, Progressive, and State Farm. Minimum coverage at The General averages $40/mo for Isuzus. Many Isuzu drivers opt for carrying just minimum insurance on an older Isuzu, as it offers the most budget-friendly coverage and meets state requirements.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

UPDATED: Jun 28, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jun 28, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

843 reviews

843 reviewsCompany Facts

Full Coverage for Isuzu

A.M. Best Rating

Complaint Level

Pros & Cons

843 reviews

843 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Isuzu

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Isuzu

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviewsThe General, Progressive, and State Farm have some of the best Isuzu car insurance rates.

Although it was discontinued in 2009, Isuzu is still a popular brand due to its reliability and low prices. Many factors affect how much you pay for car insurance, but Isuzu drivers tend to pay a much lower rate than the national average.

Our Top 10 Company Picks: Best Isuzu Car Insurance Rates

| Company | Rank | Multi-Car Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 11% | A | High-Risk Coverage | The General | |

| #2 | 16% | A+ | Coverage Options | Progressive | |

| #3 | 10% | B | Personalized Policies | State Farm | |

| #4 | 13% | A+ | Add-on Coverages | Allstate | |

| #5 | 9% | A+ | Multi-Policy Discounts | Nationwide |

| #6 | 14% | A++ | Military Drivers | USAA | |

| #7 | 10% | A++ | High-Value Vehicles | Chubb | |

| #8 | 10% | A | Diminishing Deductible | Safeco | |

| #9 | 11% | A | Roadside Assistance | AAA |

| #10 | 8% | A+ | AARP Members | The Hartford |

Since the newest Isuzu you can currently buy is more than 10 years old, you’ll have plenty of options to keep your insurance rates down. Many Isuzu drivers choose the minimum car insurance required in their state. Others opt for a few extra coverages to help protect their Isuzu.

Read on to explore your coverage options, including where to find affordable Isuzu car insurance rates. Then use our free tool to compare Isuzu car insurance rates and find the best policy for your Isuzu.

- The General has some of the best Isuzu insurance rates

- Isuzu drivers usually pay less because repair and replacement costs are low

- Drivers can save more by carrying the right amount of coverage for their Isuzu

#1 – The General: Top Pick Overall

Pros

- High-Risk Coverage: The General insures drivers who are high-risk. Learn more in our review of The General.

- Online Tools: Customers can manage Isuzu policies online.

- Coverage Options: Isuzu owners have plenty of options for their cars.

Cons

- Customer Service: The General could definitely improve its ratings.

- Good Driver Rates: The General is best for high-risk drivers, as its good driver rates aren’t as competitive.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#2 – Progressive: Best for Coverage Options

Pros

- Coverage Options: There are plenty of Isuzu car insurance options. Learn more in our review of Progressive car insurance.

- Online Tools: There are various useful tools for customers, such as a free budgeting tool.

- Snapshot Program: Isuzu customers can potentially save up to 30% with Snapshot.

Cons

- Snapshot Rate Changes: Snapshot participation can raise rates for bad drivers.

- Customer Loyalty Issues: Loyalty numbers are lower than expected at Progressive.

#3 – State Farm: Best for Personalized Policies

Pros

- Personalized Policies: Local agent assistance makes it simple for customers to personalize their Isuzu policy. Read our State Farm review for more information.

- Discount Variety: State Farm has good student discounts, paperless discounts, and more.

- Adjustable Deductibles: Lower your Isuzu rates by adjusting deductibles on different coverages.

Cons

- Financial Rating: A.M. Best recently gave State Farm a low rating.

- Agent Purchases: You won’t be able to quickly purchase an Isuzu policy online.

#4 – Allstate: Best for Add-On Coverages

Pros

- Add-On Coverages: Allstate’s coverage options include roadside assistance, gap insurance, and more. Find out more in our Allstate review.

- Pay-Per-Mile Coverage: This insurance is ideal for drivers who travel less than 10,000 miles annually in their Isuzu.

- Discount Options: Allstate has usage-based discounts, student discounts, and more.

Cons

- Claim Satisfaction: Complaints are higher than at competing companies.

- Young Driver Rates: Rates are pricy for young drivers purchasing their own Isuzu policy.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Multi-Policy Discounts

Pros

- Multi-Policy Discounts: Customers can buy auto and home coverage to earn a discount on Isuzu insurance (read more: Nationwide car insurance discounts).

- Low-Mileage Insurance: SmartMiles by Nationwide is cost-effective for Isuzu owners who drive fewer than 10,000 miles annually.

- Coverage Options: Nationwide offers plenty of optional add-on coverages for Isuzu policies.

Cons

- Limited Agent Interaction: Local Nationwide agents can be difficult to find.

- Customer Ratings: Ratings could be improved upon.

#6 – USAA: Best for Military Drivers

Pros

- Military Drivers: Military and veterans will find affordable rates and great benefits at USAA.

- Discount Variety: Customers have plenty of opportunities to save on Isuzu coverage by bundling policies, driving safely, and more.

- Add-On Coverages: USAA’s selection of add-ons is decent. Read more in our USAA car insurance review.

Cons

- Eligibility: Active service members and veterans are the only drivers who can buy USAA coverages.

- Local Agent Availability: Online services reduce the need for local agents, which can be a deterrent to those who want in-person assistance.

#7 – Chubb: Best for High-Value Vehicles

Pros

- High-Value Vehicles: Chubb is best for those insuring higher-value Isuzus or specialty cars (learn more: Best Car Insurance for Specialty Vehicles).

- Coverage Options: Chubb has plenty of choices for Isuzu customers.

- Policy Perks: Chubb has numerous perks, such as a lifetime repair guarantee.

Cons

- Insurance Rates: Average rates from Chubb are on the pricier side.

- Satisfactory Rating: Chubb isn’t rated by J.D. Power.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#8 – Safeco: Best for Diminishing Deductible

Pros

- Diminishing Deductible: Safeco reduces deductibles on coverages for claims-free customers.

- Add-On Coverages: Fully protect your vehicle with optional add-ons. Learn more in our Safeco review.

- UBI Program: Safeco offers a discount to drivers who prove their safe driving habits.

Cons

- Customer Satisfaction: Rated lower than expected by customers.

- Discount Options: Vary by location, and options may not be as numerous as at other companies.

#9 – AAA: Best for Roadside Assistance

Pros

- Roadside Assistance: Choose from one of three plans for your Isuzu. Read more in our AAA review.

- Member Benefits: AAA members receive additional perks, like shopping discounts.

- Coverage Options: AAA has a full list of optional car insurance add-ons.

Cons

- Fee for Membership: You must purchase a membership before purchasing Isuzu auto insurance.

- Service Ratings Vary: With various clubs selling AAA insurance, customer service ratings may be higher or lower in some locations.

#10 – The Hartford: Best for AARP Members

Pros

- AARP Members: Members of AARP will get discounted rates and special perks on their Isuzu policies.

- Accident Forgiveness: A huge plus if Isuzu drivers are claims-free and want to avoid future accident rate increases.

- Discount Options: The Hartford has a full list of customer saving options (learn more: The Hartford car insurance discounts).

Cons

- Young Drivers: The Hartford specializes in older drivers, so young drivers’ rates and service won’t be as great at The Hartford.

- Customer Reviews: Not always outstanding, as negative ratings are mixed in with good reviews.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Types of Isuzu Car Insurance

Since Isuzu stopped selling passenger cars in America in 2009, you can only buy used models. On top of their used status, Isuzus also come with lower price tags than similar vehicles.

Because Isuzus are older cars, many drivers choose minimum insurance to keep their costs down. Minimum insurance is your cheapest option for car insurance, and it’s the least amount of coverage you can buy in your state.

Dani Best Licensed Insurance Agent

The table below shows the cost differences between minimum and full coverage.

Isuzu Car Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| AAA | $32 | $86 |

| Allstate | $61 | $160 |

| Chubb | $75 | $185 |

| Nationwide | $42 | $98 |

| Progressive | $35 | $85 |

| Safeco | $42 | $98 |

| State Farm | $33 | $86 |

| The General | $40 | $95 |

| The Hartford | $50 | $115 |

| USAA | $22 | $59 |

Although it’s not always the best option for an Isuzu, full coverage offers better protection for your car. Full coverage includes a variety of insurance types, but it costs much more than minimum insurance.

Before you decide how much insurance to buy for your Isuzu, check out your options below:

- Liability: If you cause an accident, you’d be financially responsible for any damages or injuries you cause. Liability insurance picks up the bill instead, but it doesn’t cover your car.

- Collision: To have your car repairs covered after an at-fault accident, you need collision insurance. Collision coverage also applies when you hit a stationary object.

- Comprehensive: Comprehensive insurance protects you from events you cannot control, including theft, vandalism, bad weather, fire, and animals.

- Uninsured/Underinsured Motorist: If a driver without insurance hits you – or you’re the victim of a hit-and-run – uninsured motorist insurance will pay for your repairs and medical bills.

- Medical Payments/Personal Injury Protection: Medical bills can be prohibitively expensive after an accident. Medical payments and personal injury protection insurance covers medical bills for you and your passengers.

Since Isuzus are more than 10 years old today, many drivers choose to buy their state’s minimum insurance. Insurance experts usually recommend dropping full coverage when your car is worth less than a few thousand dollars. Buying full coverage is usually not cost-effective once your vehicle reaches a certain age.

Isuzu Car Insurance Rates

Since the newest Isuzu you can buy is over 10 years old, you’ll probably pay less for car insurance. One of the biggest factors that impact your rates is how much it costs to repair or replace your car. Most Isuzus are worth less than $10,000, so your insurance rates will likely be low.

The average Isuzu driver pays about $82 a month for car insurance, much less than the national average. However, there are several factors that will impact your rates.

For example, you might have difficulty finding insurance if your Isuzu has a rebuilt car title. Your insurance company will have difficulty telling you what damage already exists when you need to make a claim. Even if you can find rebuilt title car insurance, it will likely cost much more.

Factors That Affect Isuzu Car Insurance Rates

Isuzu might be discontinued, but insurance companies don’t treat the brand any differently. When you want to buy Isuzu insurance, here are the factors that affect car insurance rates:

- Age: Younger drivers pay more for car insurance because they lack driving experience and often don’t know how to handle dangerous situations. Car insurance rates for teen drivers are usually the highest.

- Location: The state you live in plays an important role in your insurance rates for a few reasons. Among them are local laws, weather risks, accidents, and theft rates.

- Gender: Men pay higher rates because they are more likely to get into accidents, drive recklessly, and file other claims. The good news is that the price gap lessens with age.

- Your Car: Companies look at your car’s age, model, and title history. For example, finding affordable coverage for vehicles with a rebuilt title can be challenging. The type of car can also affect auto insurance rates. Isuzu Rodeo car insurance is not the same as Isuzu Trooper car insurance.

- Credit Score: Insurance companies use your credit score to determine your rates, except in states where the practice is banned. You’ll pay more for insurance if you have a low credit score.

- Driving History: Insurance rates are higher for people with incidents in their driving records. If you have too many infractions on your record, you might need high-risk car insurance.

- Marital Status: Insurance rates are higher for singles because married people file fewer claims than single, widowed, or divorced people, so they usually get slightly lower rates.

You’ll also pay more if you want more coverage. Since the newest Isuzu model you can buy is more than 10 years old, many drivers choose minimum insurance.

View this post on Instagram

Minimum insurance is your cheapest option for coverage, but it doesn’t fully protect your car.

How to Save on Isuzu Car Insurance

Most used cars come with cheaper insurance quotes because they aren’t worth as much, so insurance companies don’t have to pay too much to replace them. While there are some exceptions to this rule, Isuzu insurance costs are generally affordable.

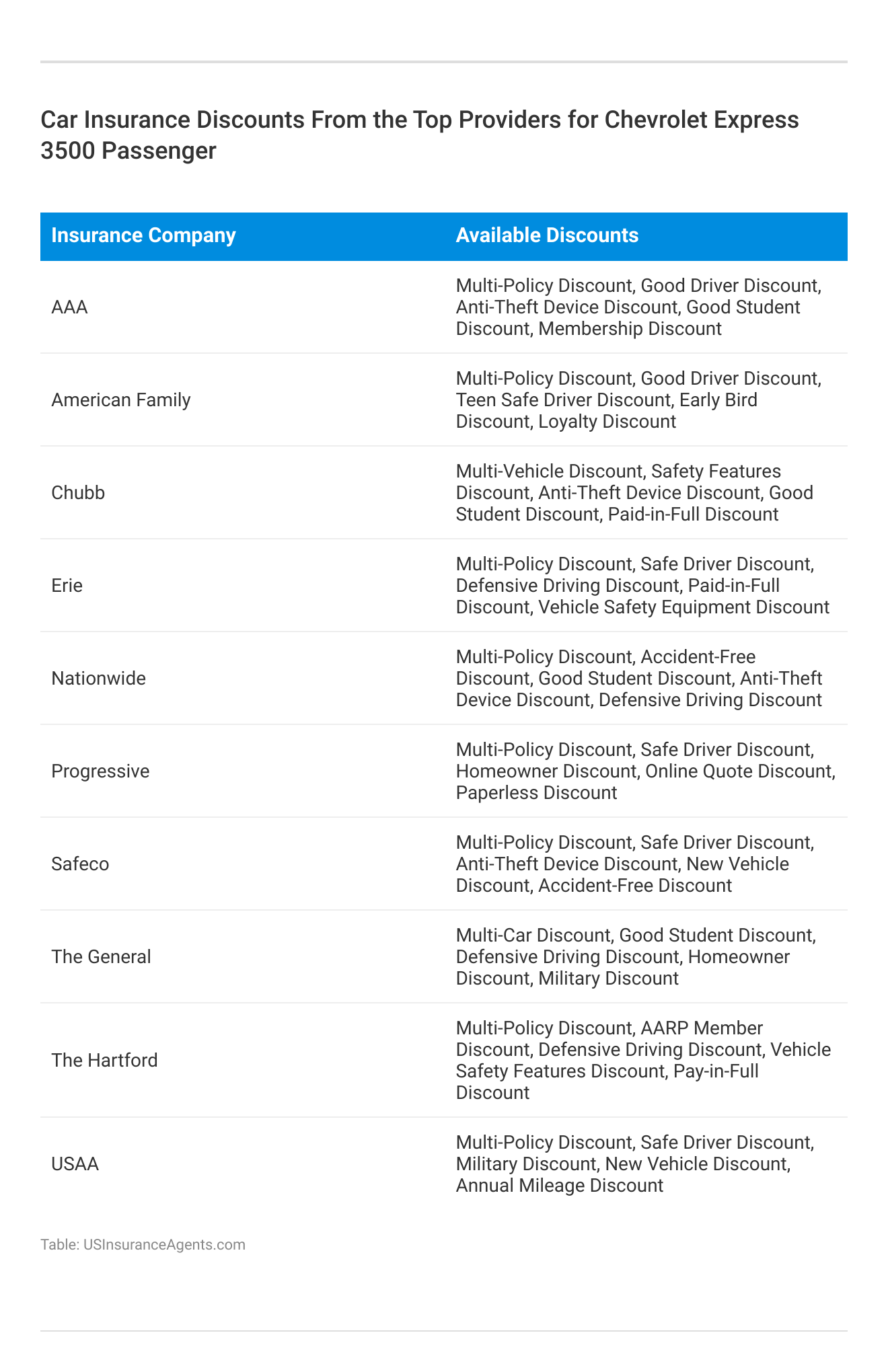

Although Isuzu car insurance is usually cheap, there’s always room to save. A crucial step in saving money is finding every discount you’re eligible for. Most companies apply discounts when you apply, but you can always check with a representative.

In addition, try the following methods if you want to lower your Isuzu car insurance rates even more:

- Reduce Coverage: Older cars don’t often need as much coverage as newer ones. Reducing the coverage in your policy can significantly lower your monthly rates.

- Increase Deductibles: Your car insurance deductible is the amount you must pay before your insurance kicks in after filing a claim. Higher deductibles mean lower monthly rates, but you’ll have to pay more if you ever need to file a claim.

- Be a Safe Driver: Regularly practicing safe driving habits not only keeps you out of trouble but also keeps your insurance rates low. Even a single speeding ticket can raise your rates by 25%.

- Try Telematics: Insurance companies offer usage-based insurance programs to help low-mileage, safe drivers save. Letting the company track you with a device can save up to 40%.

Saving on your car insurance for an Isuzu is important but doesn’t have to be a challenge. Most insurance companies will work with you to maximize your savings when you get quotes from companies like Progressive.

As long as you’ve compared quotes from multiple companies to find the lowest rates, a representative can double-check for other types of savings.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Find the Best Isuzu Car Insurance Today

Although Isuzu was discontinued in 2009, it remains a popular choice for used cars. The average Isuzu driver has affordable rates, especially after applying car insurance discounts, but you might pay higher rates depending on your situation.

While there are many ways to save on Isuzu car insurance, the best way to find affordable coverage is to compare quotes. If you skip this step, you’ll probably overpay for your car insurance. Enter your ZIP into our free quote tool to shop for cheap Isuzu car insurance today.

Frequently Asked Questions

Are Isuzus expensive to insure?

Isuzu car insurance is usually low, with the average driver spending only $81 a month. However, you might see much higher rates, depending on your unique situation. For example, drivers with low credit scores typically pay more for Isuzu car insurance.

Are Isuzus cheap to maintain?

While older cars always come with higher maintenance costs than newer models, Isuzus are generally affordable. The average Isuzu owner spends between $300 and $400 annually to keep their car running.

What factors affect Isuzu car insurance rates?

Several factors can affect Isuzu car insurance rates. These factors include your driving record, location, age, gender, credit history, the model and year of your Isuzu, the coverage options you choose, and the deductible amount. Insurance companies assess these factors to determine the risk associated with insuring your Isuzu, and they adjust the rates accordingly (learn more: Factors That Affect Car Insurance Rates).

It’s recommended to maintain a clean driving record, improve your credit score, and compare quotes from different insurers to find the most competitive rates.

How much will Isuzu car insurance cost?

The average Isuzu driver pays about $82 a month for car insurance, which is lower than the national average. Since the newest Isuzu models available are over 10 years old, insurance rates for Isuzu cars tend to be affordable. However, several factors can impact your rates, such as your driving history, location, coverage options, and more.

It’s best to compare Isuzu car insurance quotes from multiple insurance companies to find the most suitable car insurance for Isuzus. Use our free quote tool to find cheap Isuzu quotes today.

Is it worth it to buy a used Isuzu?

Old Isuzu cars are usually considered excellent used cars because they are reliable and tough. Before you buy a used car, you should always look into the vehicle’s history. A good place to start looking is at the car’s title — you should be cautious of vehicles with rebuilt titles.

Who has the most reasonable car insurance rates?

State Farm and USAA usually have the most reasonable rates.

What is the cheapest form of car insurance?

Your Isuzu payments will be the cheapest if you purchase minimum coverage only (learn more: Minimum Car Insurance Requirements by State).

Who is cheaper, Geico or Progressive?

Geico is usually a little cheaper for good drivers, but Progressive may be cheaper for other drivers.

Is Allstate cheaper than Progressive?

No, Progressive is usually cheaper than Allstate.

Is USAA only for the military?

Yes, USAA is only for military and veteran drivers. USAA has some of the cheapest Isuzu auto insurance rates for drivers (read more: Compare Military Personnel Car Insurance Rates).

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.