Best Car Insurance for Tourists in the USA in 2025 (Top 10 Companies Ranked)

State Farm, USAA, and Progressive stand out as the top providers for the best car insurance for tourists in the USA, with rates beginning at $80 monthly. These companies excel by offering extensive coverage specifically tailored to the unique requirements of international drivers.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Dani Best

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Licensed Insurance Producer

UPDATED: May 13, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: May 13, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Tourists in the USA

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage for Tourists in the USA

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Tourists in the USA

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsThe top picks for the best car insurance for tourists in the USA are State Farm, USAA, and Progressive, offering competitive rates and tailored coverage.

Whether coming to the United States on a work, student, or temporary visa, if you plan on driving, you will need to get car insurance. This is true whether you’re on a short vacation or planning to live here for an extended period.

Our Top 10 Picks: Best Car Insurance for Tourists in the USA

| Company | Rank | Multi-Policy Discount | Low-Mileage Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 17% | 15% | Many Discounts | State Farm | |

| #2 | 10% | 10% | Military Savings | USAA | |

| #3 | 12% | 30% | Online Convenience | Progressive | |

| #4 | 25% | 22% | Add-on Coverages | Allstate | |

| #5 | 10% | 12% | Local Agents | AAA |

| #6 | 13% | 15% | Accident Forgiveness | Travelers | |

| #7 | 10% | 20% | Local Agents | Farmers | |

| #8 | 20% | 20% | Usage Discount | Nationwide |

| #9 | 30% | 15% | Customizable Polices | Liberty Mutual |

| #10 | 20% | 20% | Student Savings | American Family |

Even if it’s just a week, buying insurance from your rental car agency could give you peace of mind and save you thousands if something happens to the car. If you’re living in the US, not having the proper insurance could lead to you losing your driving privileges and more.

Read on to learn all about visas and car insurance comparisons in America then enter a U.S. zip code to consider insurance quotes from many different auto insurance companies.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Bundling Policies: State Farm offers significant discounts for bundling multiple insurance policies.

- High Low-Mileage Discount: State Farm provides a substantial discount for low-mileage usage.

- Diverse Coverage Options: Offers a range of coverages tailored to various needs. Discover insights in our State Farm car insurance review.

Cons

- Limited Multi-Policy Discount: State Farm’s multi-policy discount is not as competitive, at 17%.

- Higher Premium Costs: Despite discounts, premiums can be higher for some coverage levels.

#2 – USAA: Best for Military Savings

Pros

- Military Discounts: USAA offers special rates and discounts for military members and their families.

- Bundling Policies: Provides a 10% discount for bundling multiple types of insurance. Unlock details in our USAA car insurance review.

- Dedicated Support: Known for excellent customer service tailored to military needs.

Cons

- Limited Availability: USAA services are available only to military personnel and their families.

- Lower Low-Mileage Discount: Offers a lower low-mileage discount of 10%.

#3 – Progressive: Best for Online Convenience

Pros

- High Low-Mileage Discount: Progressive offers a significant 30% discount for low-mileage drivers.

- Innovative Online Tools: Leading in online services for policy management and claims. Delve into our evaluation of Progressive car insurance review.

- Flexible Policy Options: Progressive provides various add-ons and customizable policies.

Cons

- Moderate Multi-Policy Discount: Offers a 12% discount for bundling, which is not the highest available.

- Variable Customer Service: Online focus can impact personalized service quality.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#4 – Allstate: Best for Add-on Coverages

Pros

- High Multi-Policy and Low-Mileage Discounts: Offers 25% and 22% discounts, respectively, for these features.

- Range of Add-Ons: Provides extensive additional coverage options for customized protection.

- Strong Local Presence: Numerous agents provide localized and personalized service. Access comprehensive insights in our Allstate car insurance review.

Cons

- Higher Cost for Add-Ons: Enhanced coverage comes at a significantly higher price.

- Complex Policy Management: Some users find policy management less straightforward.

#5 – AAA: Best for Local Agents

Pros

- Community and Local Agent Support: Strong local presence with agents knowledgeable about regional needs.

- Decent Discounts: Offers 10% multi-policy and 12% low-mileage discounts. Discover more about offerings in our AAA car insurance review.

- Membership Benefits: Provides additional benefits and discounts through AAA membership.

Cons

- Membership Requirement: Insurance services require a AAA membership, which has an associated cost.

- Less Competitive Discounts: Discounts are not as high compared to some larger insurers.

#6 – Travelers: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Offers accident forgiveness policies, preventing rate increases after a first accident.

- Good Discounts: Provides a 13% discount for multi-policies and 15% for low-mileage.

- Reputation for Reliability: Known for dependable coverage and consistent service. Check out insurance savings in our complete Travelers car insurance review.

Cons

- Higher Base Rates: Initial rates may be higher, even with discounts.

- Limited Global Reach: Primarily services are more focused in the U.S. than internationally.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#7 – Farmers: Best for Local Agents

Pros

- High Low-Mileage Discount: Offers a competitive 20% discount for low-mileage drivers.

- Strong Local Agent Network: An extensive network of agents provides personalized service.

- Diverse Policy Options: Wide array of coverage options to meet varied customer needs. Read up on Farmers car insurance review for more information.

Cons

- Average Multi-Policy Discount: Only a 10% discount for bundling policies.

- Higher Premiums for Certain Coverages: Some specific coverages come at a higher premium cost.

#8 – Nationwide: Best for Usage Discount

Pros

- High Discounts for Usage: Offers 20% discounts for both multi-policy and low-mileage usage. More information is available about this provider in our Nationwide car insurance discounts.

- Usage-Based Insurance Options: Provides innovative insurance options based on actual driving.

- Comprehensive Coverage: Wide coverage options including pet insurance during travel.

Cons

- Complex Discount Structures: Some customers may find the discount criteria complex.

- Mixed Customer Service Reviews: Customer service quality can vary widely.

#9 – Liberty Mutual: Best for Customizable Policies

Pros

- Highest Multi-Policy Discount: Offers a leading 30% discount for bundling policies.

- Customizable Policies: Allows extensive customization to fit individual needs.

- Good Low-Mileage Discount: Provides a solid 15% low-mileage discount. See more details on our Liberty Mutual car insurance review.

Cons

- Premium Pricing: Customizable options can significantly increase the cost.

- Inconsistent Service Levels: Customer experience can vary depending on the region and agent.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#10 – American Family: Best for Student Savings

Pros

- Student Discounts: Offers discounts and benefits tailored to student needs. Learn more in our American Family car insurance review.

- Strong Multi-Policy and Low-Mileage Discounts: Both are set at a competitive 20%.

- Personalized Service: Known for a high level of customer service and support.

Cons

- Limited Availability: Not available in all states, which can be a drawback for some.

- Higher Rates for Non-Students: Those not qualifying for student discounts may find rates higher.

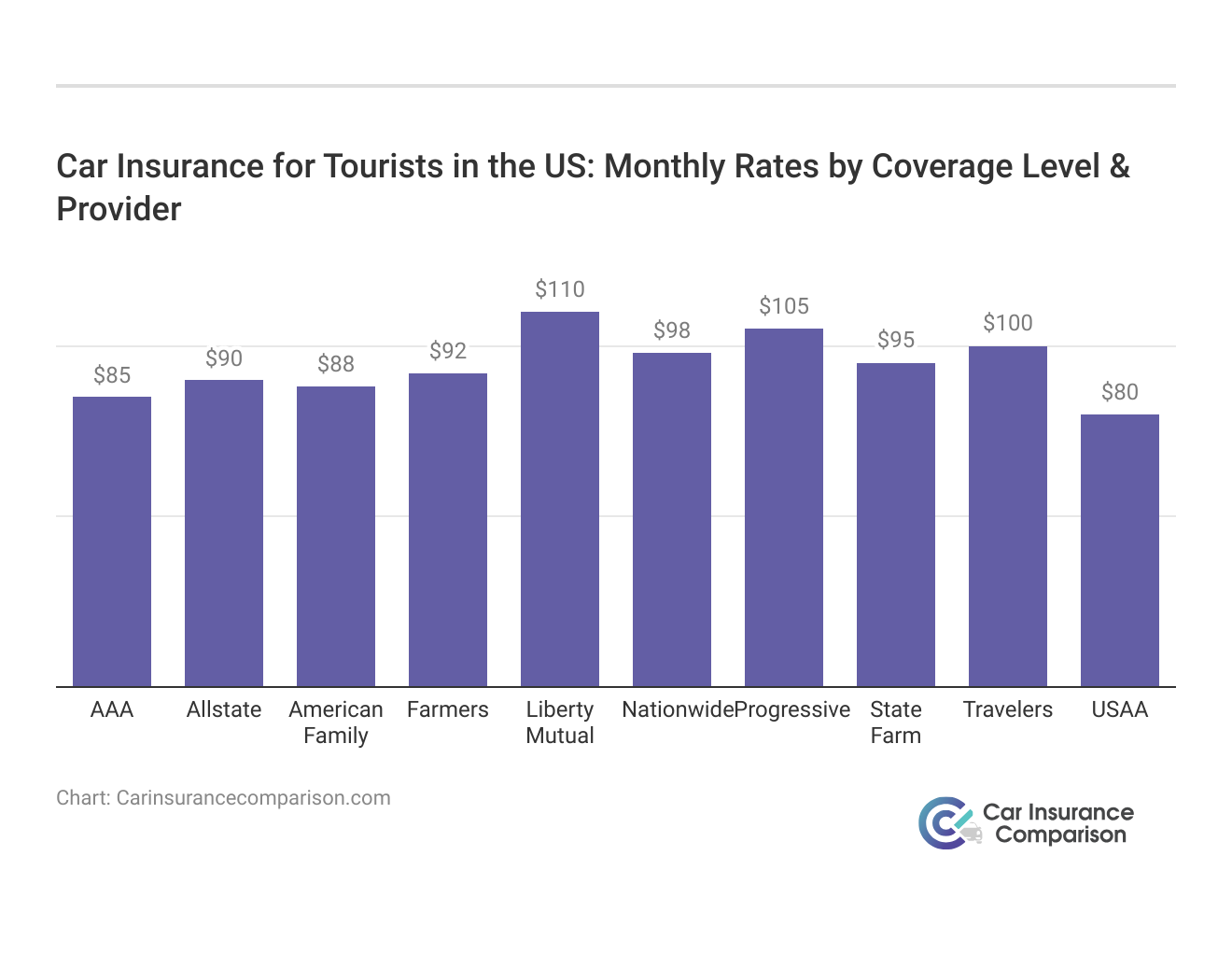

Comparing Car Insurance Rates for International Visa Holders in the US

If you’re an international visa holder in the United States, understanding the cost of car insurance is crucial. The rates can vary significantly depending on factors like coverage type, insurance company, and your circumstances.

Car Insurance for Tourists in the US: Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| AAA | $85 | $160 |

| Allstate | $90 | $170 |

| American Family | $88 | $165 |

| Farmers | $92 | $175 |

| Liberty Mutual | $110 | $210 |

| Nationwide | $98 | $180 |

| Progressive | $105 | $200 |

| State Farm | $95 | $185 |

| Travelers | $100 | $190 |

| USAA | $80 | $150 |

What Are the Requirements to Drive While in the United States

Some of the laws that regulate driving while on a visa vary from state to state. You can contact the Department of Motor Vehicles in the city where you will be living for specific laws. One of the most important things for foreign nationals to do before driving in many states is to get the proper international drivers permit. It acts as a translation tool and can be used in a variety of different countries and languages.

Keep in mind, the US does not issue international driving permits to current residents. You’ll need to get your international driving permit before you move with the motor vehicle department that oversees the license you have. In other words, if your drivers license was issued in France, you would need to visit an office in France.

In most cases, you cannot register for an international driver’s license from America once you move, although there are some exceptions to this rule. You cannot get car insurance without an international driver’s license.

International driver’s licenses only last for one year. If you have a visa that will be longer than that, you need to apply for a license in the state in which you live. Again, different states have different laws that govern those on visa status, so do your due diligence.

State Farm emerges as the top choice for international visa holders, offering diverse coverage options and expertise.

Melanie Musson Published Insurance Expert

This could mean you’ll need to return to your country of origin or make arrangements with your country’s motor vehicle department once a year to renew your permit. Be very cautious of anything not directly connected to them. Unfortunately, there are many scams that take advantage of those looking for international permits, visa insurance, and more.

Read more: Compare Foreign Driver Car Insurance Rates

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

What Kind of Insurance Options Do International Drivers Have in the US

There are many car insurance options available for those who are visiting the United States on a visa with an international driver’s license.

First, if you will be in the United States on a temporary visa for six months or less, the best option may be to rent a vehicle which comes with car insurance. With renter’s insurance, you will have to pay an additional fee.

Second, if you have family in the states, they can add you to an existing car insurance policy. They would add you as an international driver on their policy. Once added you would make payments to your family member for the cost.

Being added to an existing policy will be cheaper than setting up your own policy and can even serve as a temporary solution until you get settled. Of course, your family member has to authorize you as an addition to the policy.

Third, you can obtain car insurance through your credit card. If you rent a car using your credit card, you may already have car insurance coverage for no additional fee.

You should always consider your timeline and other plans. It doesn’t make sense to get a long-term insurance plan of any kind if you’re only staying a few weeks. But it could make sense to find a good insurance company you trust if you plan to get a college degree or otherwise stay for an extended period.

You’d want to compare minimum coverage with more comprehensive coverage and make an informed decision. If you get a few quotes, a comprehensive coverage plan could be more affordable than you might expect. Access comprehensive insights on how you get competitive quotes for car insurance.

Check with your credit card company as well as with the car rental agency to make sure this option is available.

Where Should You Shop for Car Insurance for International Drivers

If you are going to drive with an international driver’s license, you must have car insurance. If you decide on traditional car insurance, you can research U.S. companies that offer car insurance for international drivers before you come to the United States. Some of those companies may also offer visitors medical insurance options.

Many of the large companies in the United States offer this kind of insurance but most of the smaller or family owned companies in the United States do not.

One of the best ways to study your options is with an online comparison tool. A comparison tool will help you see rates and quotes side by side. You can look at policy options and find the one that will fit best with your overseas travel plans. When you go online, you can run multiple quotes at once getting comparable coverage to see who is actually offering the most competitive rates. You can also contact an insurance agent to run quotes and discuss your options.

Having this information ready when you apply for your insurance will be helpful. Coming to the United States already prepared will make your transition a lot simpler (For more information, read our “How do I get car insurance when moving to the USA?“).

Case Studies: Car Insurance for International Visa Holders in the US

Navigating car insurance options in the U.S. can be a daunting task for international visa holders. This series of case studies explores how individuals from different backgrounds and needs have found tailored insurance solutions that align with their unique circumstances.

- Case Study #1 – State Farm’s Comprehensive Protection for a Global Citizen: John, an international visa holder, chose State Farm for his car insurance needs in the U.S. With a diverse background, he valued State Farm’s comprehensive coverage options tailored to his unique situation. Whether on a work, student, or temporary visa, State Farm’s policies provided the peace of mind John needed.

- Case Study #2 – USAA’s Military Precision for International Service: Sarah, a military personnel on a temporary visa, found USAA to be the ideal choice for her car insurance needs. USAA’s exclusive discounts for military members, coupled with convenient online tools for policy management, resonated with Sarah’s preferences.

- Case Study #3 – Progressive’s Tech-Savvy Solution for a Busy Professional: Alex, an international professional on a work visa, opted for Progressive due to its emphasis on online convenience. With a hectic schedule, Alex appreciated Progressive’s user-friendly online tools for policy management. The company’s innovative Snapshot program aligned well with Alex’s desire for a tech-savvy and cost-effective solution.

These case studies underscore the importance of choosing a car insurance provider that meets the specific requirements of international visa holders in the U.S. Whether it’s comprehensive coverage, military precision, or tech-savvy solutions, finding the right fit ensures both peace of mind and financial protection on the road. More information is available in our “Compare International Car Insurance: Rates, Discounts, & Requirements.”

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Where Can You Get a Medical Insurance Plan on an International Visa

If you’re moving to the US on a visa, you should also consider your health insurance options. Medical expenses can be extremely high, and the rates you get elsewhere likely won’t match what you see in the US without insurance. Delve into our evaluation of “Best Car Insurance for Healthcare Workers.”

There are clinics that provide medical care to those without US insurance. If you work for an international company, they may also provide insurance that can be used in different countries including the US. This is especially common for companies now using self-insured plans. While you’re shopping for auto insurance, make sure to consider your health options as well even if it’s just for emergency medical treatment.

You can get rate quotes on car insurance right now. Just enter your ZIP code below.

Frequently Asked Questions

Where should international drivers shop for car insurance?

Research US companies that offer car insurance for international drivers or use online comparison tools to compare rates and policies.

For additional details, explore our comprehensive resource titled “How often should you check car insurance quotes?“

What are the driving requirements for international visa holders in the US?

Driving requirements vary by state. Contact the local DMV for specific laws.

What insurance options do international drivers have in the US?

International drivers can consider rental car insurance, being added to a family member’s policy, or utilizing insurance through their credit card.

Where can international visa holders get medical insurance?

Consider health insurance options provided by international companies or seek clinics and self-insured plans for medical care.

Can tourists purchase auto insurance for tourists in USA?

Yes, tourists can buy auto insurance for tourists in the USA through various providers, often including rental car companies.

To find out more, explore our guide titled “The Top 5 Car Insurance Companies.”

Can international drivers get car insurance without an international driver’s license?

No, an international driver’s license is typically required to obtain car insurance as an international driver in the US.

What do USA visitors need to obtain car insurance for USA visitors?

USA visitors require a valid driver’s license and may need an International Driving Permit to buy car insurance for USA visitors.

Explore your car insurance options by entering your ZIP code below and finding which companies have the lowest rates.

Is one-day car insurance temp cover available in the USA?

Yes, one-day car insurance temp cover is available and can be arranged through certain insurers specializing in temporary coverage.

Where can I find three-day car insurance in the USA?

Three-day car insurance is available from companies that offer temporary auto insurance policies, suitable for brief visits or short-term vehicle use.

To learn more, explore our comprehensive resource on “Compare Short-Term Car Insurance: Rates, Discounts, & Requirements.”

How can visitors secure car insurance for visitors to USA?

Visitors can secure car insurance for visitors to USA by purchasing temporary coverage from rental agencies or insurers offering short-term policies.

What is 30-day car insurance?

30-day car insurance provides temporary coverage for drivers needing short-term protection, typically used during vehicle transitions or brief periods of driving.

What is AAA accident forgiveness in California?

AAA accident forgiveness in California is a feature that prevents your insurance rates from increasing after your first at-fault accident, provided you meet certain criteria set by AAA.

What is AAA Mexican auto insurance?

AAA Mexican auto insurance offers coverage for drivers traveling to Mexico, ensuring compliance with Mexican law by providing liability, legal assistance, and other necessary protections.

Access comprehensive insights in our “Compare Liability Car Insurance: Rates, Discounts, & Requirements.”

What is AAA Mexico auto insurance?

AAA Mexico auto insurance provides necessary coverage for drivers while they are in Mexico, including liability, theft, and damage, customizable based on travel needs and duration of stay.

What are Allstate permit services?

Allstate permit services assist with obtaining necessary permits for various activities that require them, such as building or remodeling, streamlining the process for policyholders.

Finding cheap car insurance quotes is easy. Just enter your ZIP code into our free comparison tool below to instantly compare quotes near you.

What is auto insurance for foreign drivers?

Auto insurance for foreign drivers provides coverage tailored to non-US residents who are driving in the United States temporarily.

How does auto insurance for foreigners in the USA work?

Auto insurance for foreigners in the USA covers liabilities and damages while driving in the country, similar to policies for US citizens but tailored for non-residents.

Delve into our evaluation of “Finding Free Car Insurance Quotes Online.”

Can international students get auto insurance?

Yes, international students can obtain auto insurance, which is necessary for legally driving while studying in the US.

What should international visitors know about auto insurance?

International visitors should know that auto insurance is mandatory in most states, and they must ensure they have adequate coverage during their stay.

Is auto insurance available for visitors to the USA?

Yes, auto insurance is available for visitors to the USA and can be obtained through rental agencies or by purchasing a temporary policy from an insurance provider.

Discover insights in our “Where can I find the lowest car insurance quotes?“

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Dani Best

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Licensed Insurance Producer

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.