Best Car Insurance for Married Couples on Separate Policies in 2025 (Top 10 Providers)

State Farm, USAA, and Progressive are the top picks for the best car insurance for married couples on separate policies. They lead the pack with rates starting as low as $59/month, making them lead the pack for coverage. Explore their tailored coverage options and competitive advantages.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Michael Leotta

Insurance Operations Specialist

Michael earned a degree in Business Management degree with an insurance focus, which led to a successful 25-year career in insurance claims operations and support. He possesses a high-level of business acumen across multiple areas of the insurance industry. Over the course of his career, he served in multiple roles supporting claims operations including: Claims Specialist, Claims Trainer, Claim Au...

Insurance Operations Specialist

UPDATED: Feb 13, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Feb 13, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Companies That Don’t Require Spouses

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage for Companies That Don’t Require Spouses

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Companies That Don’t Require Spouses

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsState Farm stands out as the top choice for the best car insurance for married couples on separate policies. With its reputation for neighborhood coverage and nationwide trust, State Farm offers tailored solutions to meet individual needs.

Married couples are not required to have joint insurance policies to own a car. However, if you and your spouse have good driving records, you may qualify for several discounts, and it may benefit you to share a policy together to bundle multiple cars and other insurance policies.

Our Top 10 Company Picks: Best Car Insurance for Married Couples on Separate Policies

| Company | Rank | Multi-Policy Discount | Low-Mileage Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 17% | 5% | Many Discounts | State Farm | |

| #2 | 15% | 20% | Military Savings | USAA | |

| #3 | 10% | 30% | Online Convenience | Progressive | |

| #4 | 25% | 35% | Add-on Coverages | Allstate | |

| #5 | 20% | 30% | Usage Discount | Nationwide |

| #6 | 10% | 25% | Local Agents | Farmers | |

| #7 | 30% | 25% | Customizable Polices | Liberty Mutual |

| #8 | 8% | 15% | Accident Forgiveness | Travelers | |

| #9 | 20% | 5% | Student Savings | American Family | |

| #10 | 16% | 5% | 24/7 Support | Erie |

Insurance companies will typically charge you lower rates as a married couple. Still, if your spouse has a poor driving history, your insurance rates will be affected. They could increase due to them being included in your policy.

Many insurers will require you to add your spouse to your policy if you’re both living in the same household (unless your state gives you the option to exclude your spouse). But there are a select few that do not have this requirement.

Keep reading to learn more about car insurance rates from car insurance companies that don’t require spouses to be on the same policy. Enter your ZIP code now to compare free quotes from companies in your area today.

#1 – State Farm: Top Pick Overall

Pros

- Extensive Network: Our State Farm car insurance review reveals a vast network of agents and offices, ensuring personalized and accessible customer service.

- Diverse Coverage Options: Offers a wide range of insurance products beyond auto, allowing customers to bundle policies for potential discounts.

- Excellent Financial Strength: Recognized for its financial stability, instilling confidence in customers regarding claims payout reliability.

Cons

- Potentially Higher Rates: While offering comprehensive coverage, State Farm’s rates may be comparatively higher for some individuals.

- Limited Online Presence: The online experience may not be as streamlined as with some competitors, impacting convenience for tech-savvy customers.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#2 – USAA: Best for Military Precision

Pros

- Exclusive Membership Benefits: USAA provides specialized services to military members and their families, including discounted rates and tailored coverage.

- Top-Rated Customer Service: Our USAA car insurance review highlights the company’s consistent high marks for exceptional customer service and claims satisfaction.

- Financial Stability: Known for its strong financial standing, assuring policyholders of the company’s ability to meet obligations.

Cons

- Membership Restrictions: Limited eligibility to military personnel and their families, excluding a broader customer base.

- Product Limitations: USAA primarily focuses on serving military members, offering a more restricted range of insurance products.

#3 – Progressive: Best for Innovative Solutions

Pros

- Competitive Rates: The Progressive car insurance review underscores the company’s reputation for competitive pricing and discounts, making it an appealing choice for cost-conscious customers.

- Innovative Tools: Offers user-friendly online tools and a mobile app for policy management, claims filing, and rate comparisons.

- Wide Range of Discounts: Progressive provides an array of discounts, allowing customers to save through safe driving habits and other qualifying factors.

Cons

- Mixed Customer Service Reviews: Some customers express dissatisfaction with Progressive’s claims handling and customer support.

- Limited Agent Availability: For those who prefer in-person interactions, Progressive’s agent network may not be as extensive as some competitors.

#4 – Allstate: Best for Protection Policies

Pros

- Comprehensive Coverage Options: Allstate offers a variety of coverage options, including innovative features like accident forgiveness and new car replacement.

- User-Friendly Technology: In our Allstate car insurance review reveals how the company embraces technology with tools like the Drivewise app, rewarding safe driving behaviors with potential discounts

- Nationwide Presence: With a broad network of agents and offices, Allstate provides accessibility and localized service to customers across the country.

Cons

- Premium Costs: Allstate’s premiums may be on the higher side compared to some competitors, potentially impacting budget-conscious customers.

- Mixed Customer Reviews: Customer satisfaction reviews vary, with some expressing dissatisfaction with claims processing and rates.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Ensuring Coverage

Pros

- Multi-Policy Discounts: Our Nationwide car insurance discounts cater to customers seeking comprehensive coverage, encouraging bundling of auto, home, and other policies to unlock significant savings.

- Vanishing Deductible Option: Offers a unique vanishing deductible program, allowing safe drivers to reduce their deductible over time.

- Strong Financial Stability: Nationwide’s financial strength contributes to customer confidence in the company’s ability to meet obligations.

Cons

- Average Customer Service Ratings: Customer service reviews are generally average, with some customers reporting less-than-ideal experiences.

- Limited Standalone Offerings: Nationwide’s primary focus is on bundled policies, potentially limiting choices for customers seeking standalone auto coverage.

#6 – Farmers: Best for Cultivating Coverage

Pros

- Customizable Policies: Farmers provides a range of coverage options, allowing customers to tailor policies to their specific needs.

- Accessible Agents: With a widespread network of agents, Farmers car insurance review offers personalized service and assistance to ensure customers receive tailored coverage options.

- Affinity Discounts: Farmers offer various affinity discounts, such as those for specific occupations or memberships.

Cons

- Rate Competitiveness: Some customers find Farmers’ rates to be relatively higher compared to other insurers.

- Mixed Customer Reviews: While some customers praise Farmers’ service, others express dissatisfaction with claims processing and communication.

#7 – Liberty Mutual: Best for Flexible Spousal Coverage

Pros

- Wide Range of Coverages: Liberty Mutual offers an extensive selection of coverage options, allowing customers to build comprehensive policies.

- Online Tools and Resources: Liberty Mutual car insurance review provides a user-friendly online platform with tools like the HomeGallery app for home inventories, catering to the insurance needs of homeowners.

- New Car Replacement: Offers a new car replacement feature, replacing totaled cars with the latest models if they meet specific criteria.

Cons

- Price Competitiveness: Some customers find Liberty Mutual’s premiums to be relatively higher, impacting overall affordability.

- Customer Service Reviews: Reviews on customer service are mixed, with some customers reporting delays and communication issues.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#8 – Travelers: Best for Secure Driving

Pros

- Multi-Policy Discounts: Travelers car insurance review encourages customers to bundle policies, providing opportunities for cost savings.

- Claim Satisfaction: Travelers has received positive feedback for its claims handling and customer satisfaction in that regard.

- IntelliDrive Program: Offers the Intellidrive program, allowing safe drivers to earn discounts based on their driving habits.

Cons

- Limited Discounts for Auto-Only Policies: Travelers’ auto insurance discounts may be more extensive for customers with bundled policies.

- Premium Costs: Some customers find Travelers’ premiums to be relatively higher for standalone auto coverage.

#9 – American Family: Best for Family Safety Guardians

Pros

- Variety of Discounts: American Family offers a range of discounts, including those for bundling, good driving, and safety features.

- Local Agents: With a network of local agents, American Family provides personalized service and support.

- Emergency Roadside Assistance: Our American Family car insurance review reveals that the company offers optional roadside assistance coverage for added peace of mind, ensuring comprehensive protection for drivers.

Cons

- Limited Regional Availability: American Family operates primarily in specific regions, limiting availability for customers in other areas.

- Mixed Customer Service Reviews: While some customers praise the service, others express concerns about claims handling and communication.

#10 – Erie: Best for Reliable Coverage

Pros

- Rate Lock Feature: Erie’s Rate Lock feature allows customers to lock in their auto insurance rates, providing stability.

- High Customer Satisfaction: Erie consistently receives high ratings for customer satisfaction and claims handling.

- Add-On Coverages: In our Erie car insurance review, we showcase how the company caters to various insurance needs, offering a variety of additional coverages such as pet coverage and locksmith services.

Cons

- Limited Availability: Erie operates in a limited number of states, restricting access for customers outside those areas.

- Online Presence: The online quote process and digital tools may not be as advanced as those of larger insurers.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

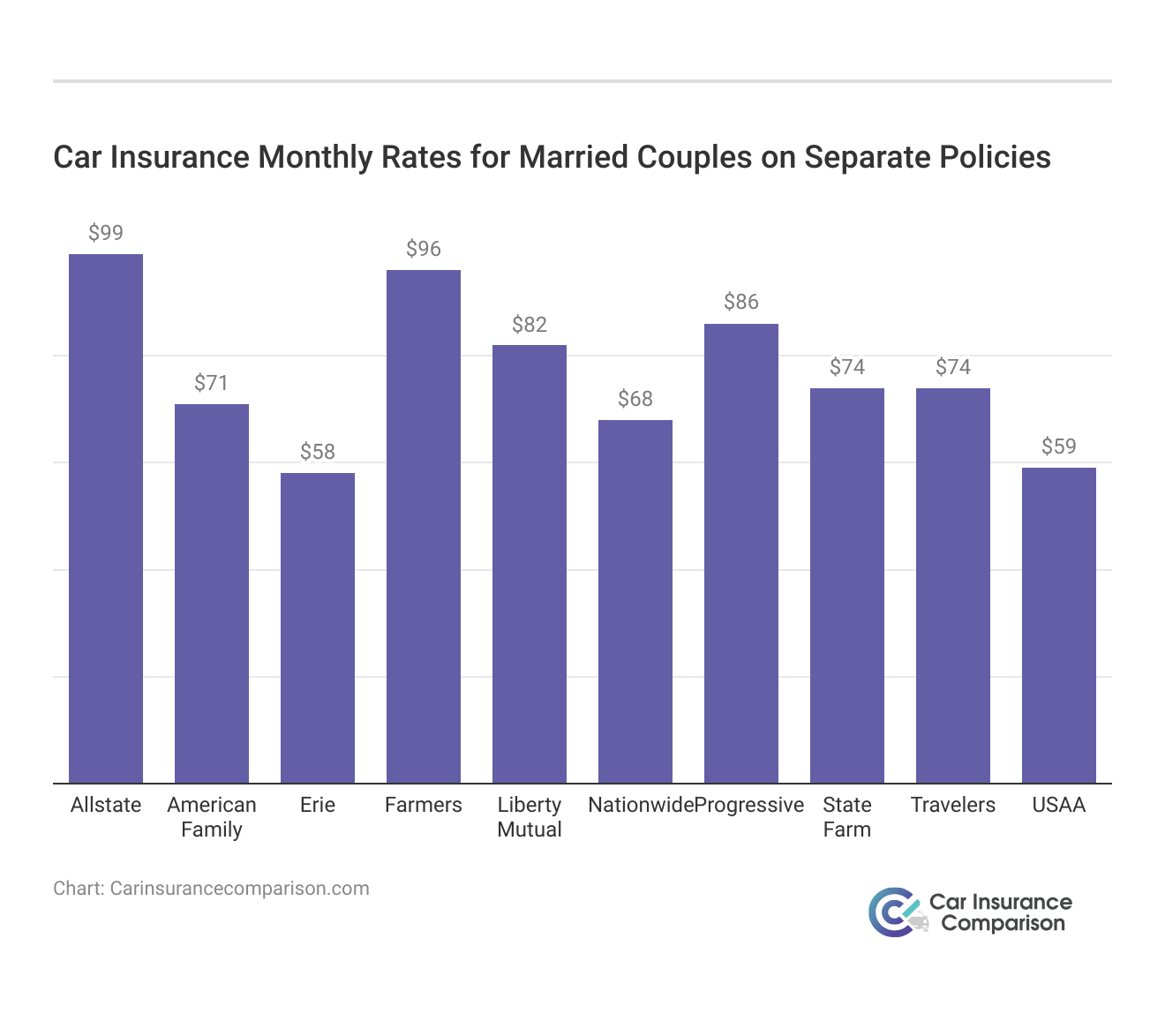

Exploring Car Insurance Providers Allowing Separate Policies for Spouses

Understanding the cost implications of car insurance is essential when comparing companies that don’t require spouses to share policies. The table below provides a comprehensive overview of the average monthly rates for both minimum and full coverage from the leading insurers in this category.

Car Insurance Monthly Rates for Married Couples on Separate Policies

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $99 | $179 | |

| $71 | $209 | |

| $58 | $189 |

| $96 | $235 | |

| $82 | $250 |

| $68 | $203 |

| $86 | $168 | |

| $74 | $150 | |

| $75 | $208 | |

| $59 | $142 |

When considering insurance companies that allow spouses to maintain separate policies, it’s crucial to examine the average monthly rates for various coverage levels. State Farm offers competitive rates, starting at $74 for minimum coverage and $150 for full coverage. USAA demonstrates affordability with $59 for minimum and $142 for full coverage.

Progressive, Allstate, Nationwide, Farmers, Liberty Mutual, Travelers, American Family, and Erie also present their respective rates, giving you a comprehensive understanding of the cost associated with different coverage options. Utilize this information to make an informed decision based on your specific coverage needs and budget.

In some states — New York, Kansas, Michigan, Virginia, and Wisconsin — excluding a driver is not allowed. This is because car insurers in those states will not sell you a policy unless you include every person you live with (of driving age) on your policy, impacting how car insurance covers excluded drivers.

State Farm stands out as the top choice for couples seeking car insurance flexibility without requiring spouses to share policies, offering tailored coverage and nationwide trust.

Brad Larson Licensed Insurance Agent

It is best to check state laws if you plan to move to another state or simply need a better policy in the state you’re currently residing in. But there are a few affordable car insurance companies that allow spouse exclusions, which don’t require spouses to be on the same policy.

USAA car insurance does not mandate listing all licensed drivers on your policy, though it’s strongly advised. While your policy covers those who use your vehicle with permission, adding your spouse may not always be advantageous. USAA highlights potential reasons for rate increases when adding your spouse, emphasizing the importance of considering individual circumstances before making this decision.

How Having a Spouse Listed on Car Insurance Policy Affects Rates

| What Affects Your Rates | How It Affects Your Rates |

|---|---|

| Spouse has a bad driving record | Keeping them off your car insurance policy would ensure you are not financially penalized for their driving mistakes |

| Spouse has a low credit score | Insurance companies in most states use credit score as a determining factor when setting rates; like a poor driving record, a low credit score can impact your rates significantly |

| Spouse drives an expensive sports car | Insurance companies will often soften the risk of covering an expensive or luxury car by charging high premiums |

| Spouse has a longer commute | Work commutes will often result in higher rates because there is a higher risk of an accident while traveling longer distances |

Excluding a spouse from your car insurance can often lead to reduced deductibles and more affordable rates, particularly if they have a history of poor driving habits. USAA offers Named Driver Exclusions within their comprehensive policies, which prevent specific drivers from being covered by collision and/or comprehensive coverage on a particular vehicle.

While this may lower your rates, if the excluded driver operates the vehicle and gets into an accident, you won’t be insured for collision and/or comprehensive coverage, potentially leaving you personally responsible. Named Driver Exclusion is available under USAA’s standard policy, but not under the basic liability policy. However, there are alternative options in the event of an accident involving your spouse if you opt for liability coverage.

Liability Insurance Through USAA

| Liability covers: | Options That Cost Less And Cover Less | What Most Drivers Most Often Choose | Options that Cost More And Cover More |

|---|---|---|---|

| Bodily Injury and Property Damage | $15,000 per person; $30,000 per accident OR $25,000 per person; $50,000 per accident OR $50,000 per person; $100,000 per accident | $100,000 per person; $300,000 per accident | $500,000 per person; $500,000 per accident |

These will also be determined state to state when you buy car insurance from car insurance companies that don’t require spouses to be on the same policy. Travelers car insurance typically offers coverage when someone drives your car with your permission, including extended family members visiting, sharing driving responsibilities on road trips, or borrowing your car for short periods.

However, certain scenarios, like paid car-sharing, excluded drivers in some states, and commercial activities such as delivery services, may not be covered. In such cases, additional insurance policies or supplements may be necessary, especially if married couples have separate car insurance policies.

State Farm shines as the premier option for couples desiring car insurance flexibility, providing customized coverage and trusted service nationwide.

Brandon Frady Licensed Insurance Agent

Farmers Car Insurance offers a provision called permissive use, allowing any person, including your spouse, to be covered under your policy while using your insured car with your permission. This feature is available with collision coverage from Farmers, but it’s essential to ensure it’s included and active before lending your vehicle. Under permissive use, the borrower or spouse receives coverage similar to yours, with minor limitations.

Collision coverage is vital for permissive use to cover damages to your vehicle. If damages exceed covered costs, it’s best for your spouse to have their own insurance to avoid surpassing your policy limits, leaving you liable for the excess. Permissive use is intended for occasional, short-term borrowing, so if your spouse drives your car regularly, they should be added to your policy.

Several car insurance companies offer policies that don’t require spouses to be on the same policy, providing flexibility and tailored coverage options. Whether you choose State Farm, USAA, or another provider, it’s essential to understand the implications and options available to you. Make sure to compare quotes and coverage details to find the best fit for your needs.

Understanding Car Insurance Requirements for Married Couples

In most cases, all licensed drivers, including spouses, are required to be listed on the same car insurance policy. This ensures coverage if a family member or spouse needs to use the vehicle and is involved in an accident.

While this is the norm, there are circumstances, such as one spouse having poor credit or a history of traffic violations, where separate insurance policies may be preferred. In such cases, exploring options for separate spousal policies could be beneficial.

Joint Car Insurance for Unmarried Couples

Unmarried couples can share a single car insurance policy if they are both licensed drivers. In this scenario, car insurance companies require information about the people who live with you, necessitating all licensed drivers in the same household to be listed on the policy to ensure coverage in case of an accident.

Adding your partner to your policy may not affect rates much if they have a good credit score, driving record, and live nearby. Joint coverage often means discounts and lower rates for unmarried couples. Comparing options lets you tailor coverage to your needs. Unmarried couples can enjoy similar coverage and savings as married couples with joint ownership car insurance.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Car Insurance Verification of Marriage Status

While not universally required, certain insurers may request completion of a formal form indicating your intention to include your spouse on your insurance plan. Should your car insurance provider necessitate verification of marriage, a basic photocopy of your marriage certificate suffices to confirm marital status.

The importance of finding insurance that fits your lifestyle and preferences. Whether you prioritize neighborhood-centric coverage, military-specific benefits, or innovative solutions, there’s an insurance provider out there for everyone.

State Farm, renowned for its flexibility in car insurance without mandating shared policies for spouses, boasts an impressive customer satisfaction rating of 92%

Michelle Robbins Licensed Insurance Agent

As you consider your insurance options, remember to explore the offerings of different providers to find the best fit for your needs. Whether it’s State Farm’s personalized coverage, USAA’s military benefits, or Progressive’s innovative solutions, there’s a policy tailored just for you.

Car Insurance Companies That Don’t Require Spouses To Be on the Same Policy: Key Takeaways

Car insurance rates vary by state for companies that don’t require spouses to share policies, so it’s essential to check if your state mandates spousal listing. While comprehensive coverage is ideal for spouses borrowing vehicles, it may not always be feasible financially. Factors like poor driving records or credit scores could warrant separate policies for spouses.

Companies like USAA, Travelers, and Farmers offer diverse options for understanding accidents and ensuring coverage for spouses, even as unlisted drivers.

Now that you know more about car insurance companies that don’t require spouses to be on the same policy enter your ZIP code below into our free comparison tool to compare companies in your area.

Frequently Asked Questions

What are the benefits of joint car insurance for married couples?

Joint car insurance can simplify management, offer potential cost savings through discounts, and provide comprehensive coverage for both spouses and their vehicles.

Do married couples have to add their spouse to their car insurance after marriage?

Generally, insurance companies require spouses to be listed on the same policy after marriage. However, policies may vary depending on the insurer and state regulations.

For deeper understanding, refer to our extensive manual titled “Can married couples have separate car insurance policies?” for all your inquiries on this matter.

Can unmarried couples have joint car insurance policies?

While unmarried couples can have joint car insurance policies, requirements may vary depending on the insurer’s policies and state regulations.

When you’re ready to see how much you can save on your car insurance, enter your ZIP code below into our free comparison tool.

Can married couples have separate car insurance policies?

Yes, some insurance companies allow married couples to have separate policies. This provides flexibility, especially if one spouse has a poor driving record or other factors affecting rates.

For further insights, delve into our extensive guide on auto insurance named “Do all car insurance companies check your driving records?” and explore now for a clearer understanding.

What is the average cost of car insurance for a married couple?

The average cost of car insurance for a married couple can vary depending on factors such as driving records, vehicles, coverage levels, and location. However, married couples often benefit from lower rates compared to single individuals.

Does my spouse need to be on my car insurance policy?

In most cases, insurance companies require spouses to be listed on the same policy if they live in the same household and have access to the insured vehicles.

For a more thorough understanding, consult our detailed document entitled “Understanding Your Car Insurance Policy” and check the nuances and intricacies of your coverage.

What should I consider when adding my spouse to my car insurance?

When adding your spouse to your car insurance, consider factors such as their driving record, coverage needs, and potential impact on your premium. Comparing quotes from multiple insurers can help you find the best option for your specific situation.

Is joint car insurance available for married couples?

Yes, many insurance companies offer joint car insurance policies for married couples, allowing them to combine coverage and potentially qualify for discounts.

To gain a comprehensive understanding, consult our in-depth examination entitled “Compare Joint Ownership Car Insurance: Rates, Discounts, & Requirements” for further details and considerations.

Are there car insurance companies that don’t require spouses to share a policy?

Yes, some insurance companies, like State Farm and Progressive, offer policies that don’t require spouses to be on the same policy. This provides flexibility for couples with different insurance needs.

Explore your car insurance options by entering your ZIP code below and finding which companies have the lowest rates.

What is the best auto insurance for married couples?

The best auto insurance for married couples often depends on individual needs and preferences. Companies like State Farm, USAA, and Progressive are popular choices due to their competitive rates and tailored coverage options.

For additional details, explore our comprehensive resource titled “Best Car Insurance Companies” for expert insights

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Michael Leotta

Insurance Operations Specialist

Michael earned a degree in Business Management degree with an insurance focus, which led to a successful 25-year career in insurance claims operations and support. He possesses a high-level of business acumen across multiple areas of the insurance industry. Over the course of his career, he served in multiple roles supporting claims operations including: Claims Specialist, Claims Trainer, Claim Au...

Insurance Operations Specialist

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.