Best Insurance for Car Rental Businesses in 2025 (Top 10 Providers)

Progressive, USAA, and State Farm stand out as the top picks for the best insurance for car rental businesses. Starting at $22 monthly, their competitive rates and comprehensive coverage options cater to the needs of rental companies. Ensuring reliable protection and safeguarding your rental fleet with confidence.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tonya Sisler

Insurance Content Team Lead

Tonya Sisler has been a technical insurance writer for over five years. She uses her extensive insurance and finance knowledge to write informative articles that answer readers' top questions. Her mission is to provide readers with timely, accurate information that allows them to determine their insurance needs and choose the best coverage. Tonya currently leads a team of 10 insurance copywrite...

Insurance Content Team Lead

UPDATED: Nov 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Nov 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Car Rental Businesses

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage for Car Rental Businesses

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Car Rental Businesses

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviewsThese companies offer comprehensive protection against potential liabilities, including accidents and damage to rental vehicles. With their personalized policies and exceptional customer service, they ensure peace of mind for rental business owners, allowing them to focus on delivering exceptional service to their customers.

Our Top 10 Company Picks: Best Car Insurance for Car Rental Businesses

| Company | Rank | Commercial Discount | Fleet Discount | Best for | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 15% | 10% | Comprehensive Coverage | Progressive | |

| #2 | 12% | 8% | Customer Service | USAA | |

| #3 | 14% | 9% | Local Agents | State Farm | |

| #4 | 13% | 7% | Customizable Policies | Allstate | |

| #5 | 11% | 6% | Bundle Discounts | Nationwide |

| #6 | 12% | 8% | Organization Discount | Farmers | |

| #7 | 10% | 7% | Business-Specific Coverages | Liberty Mutual |

| #8 | 14% | 9% | Policy Options | Travelers | |

| #9 | 13% | 8% | Add-on Coverages | The Hartford |

| #10 | 11% | 6% | Bundling Policies | American Family |

As a car rental business owner, securing various insurance types is crucial. Apart from liability coverage, workers’ compensation insurance is essential, especially with employees. Determining the necessary insurance for your fleet is daunting yet vital for protecting your business from unforeseen risks.

Get the right car insurance at the best price — enter your ZIP code above to shop for coverage from the top insurers.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – Progressive: Top Overall Pick

Pros

- 15% Car Discount: Significant cost savings for businesses.

- Substantial 10% Fleet Discount: Specifically caters to businesses with multiple vehicles.

- Extensive Coverage: According to our Progressive car insurance review, it effectively meets diverse business needs.

Cons

- Premiums Slightly Higher: Comparative pricing concern.

- Regional Scarcity: Geographic restrictions may apply.

#2 – USAA: Best for Customer Service

Pros

- 12% Car Discount: Contributes to substantial cost savings.

- 8% Fleet Discount: In line with our USAA car insurance discounts, USAA adds further value for businesses with multiple vehicles.

- USAA Leads in Support: Provides personalized and customer-centric experiences.

Cons

- Limited Eligibility: Primarily serves military members and their families.

- Limited Non-Military Services: Limited offerings for certain customers.

#3 – State Farm: Best for Local Agents

Pros

- A 14% Commercial Car Discount: Enhances affordability for businesses.

- 9% Fleet Discount: Explore our State Farm car insurance review, which caters to businesses with multiple vehicles.

- Extensive Network of Local Agents: Provides personalized assistance.

Cons

- Digital Services Preference: Limited digital service offerings.

- Fewer Coverage Options: Fewer additional coverage options.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#4 – Allstate: Best for Customizable Policies

Pros

- 13% Car Trade Discount: Contributes to cost-effectiveness.

- 7% Fleet Discount: Adds value for businesses with multiple vehicles.

- Offers Customizable Policies: In accordance with our Allstate car insurance review, the company allows tailored coverage.

Cons

- Custom Premiums Rise: Potential cost concern.

- Claims Processing Feedback: Varied experiences with claims.

#5 – Nationwide: Best for Bundle Discounts

Pros

- 11% Business Car Discount: Enhances affordability.

- 6% Fleet Discount: Our Nationwide car insurance discounts, this option benefits businesses with multiple vehicles.

- Provides Bundle Discounts: Additional savings opportunities.

Cons

- Restricted Bundle Choices: Restrictions on bundling choices.

- Claims Processing Delays: Concerns about claims processing speed.

#6 – Farmers: Best for Organization Discount

Pros

- 12% Business Car Discount: Learn why Farmers car insurance review is cost-effective for businesses.

- 8% Fleet Discount: Caters to businesses with multiple vehicles.

- Organization Discount Available: Benefits groups and associations.

Cons

- Somewhat Intricate Policies: Requires careful consideration.

- Claims Processing Feedback: Varied experiences with claims.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#7 – Liberty Mutual: Best for Business-Specific Coverages

Pros

- 10% Car Discount: In our Liberty Mutual car insurance review, we explore how the company contributes to cost savings.

- 7% Fleet Discount: Benefits businesses with multiple vehicles.

- Business Coverage Expertise: Addresses unique business needs.

Cons

- Higher Premiums: Comparative pricing concern.

- Policy Customization Issues: Concerns about customization options.

#8 – Travelers: Best for Policy Options

Pros

- 14% Car Discount: Enhances affordability.

- 9% Fleet Discount: Caters to businesses with multiple vehicles.

- Broad Policy Choices: Our Travelers car insurance review reveals how the company meets various business needs.

Cons

- Less Competitive Bundles: Limited bundle discount offerings.

- Customer Communication Issues: Concerns about communication.

#9 – The Hartford: Best for Add-On Coverages

Pros

- 13% Business Car Discount: Contributes to cost savings.

- 8% Fleet Discount: The Hartford car insurance discounts offers added value for businesses with multiple vehicles.

- Add-On Coverage Expert: Allows businesses to enhance protection.

Cons

- Limited Availability: Limited availability.

- Varied Claims Feedback: Varied experiences with claims.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#10 – American Family: Best for Bundling Policies

Pros

- Commercial Vehicle Savings: Enhances affordability.

- 6% Fleet Discount: Benefits businesses with multiple vehicles.

- Policy Bundling: American Family car insurance review offers additional savings.

Cons

- Restricted Customization: Restrictions on customization.

- Online Account Management: Concerns about online account features.

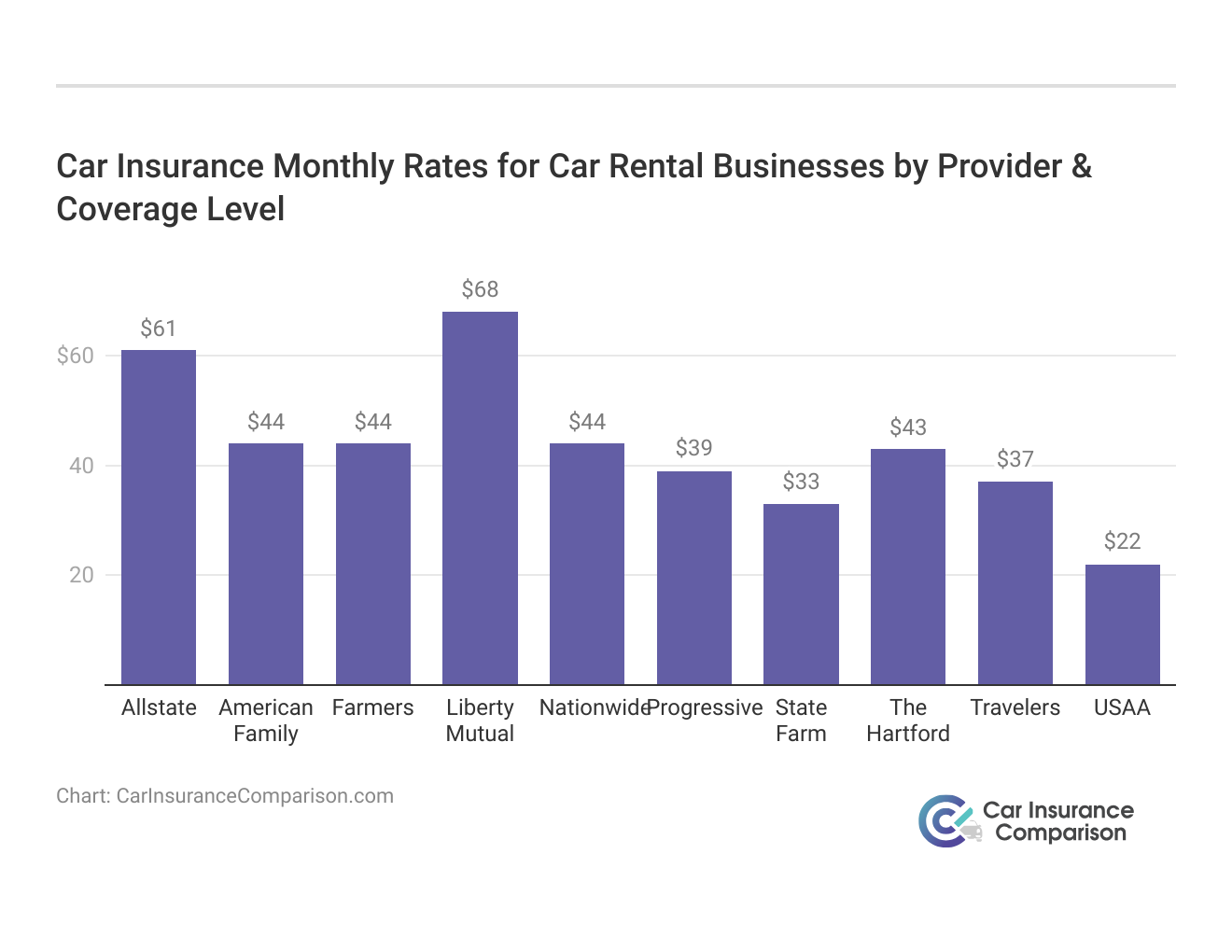

Unlocking Savings: Comparing Insurance Rates for Car Rental Businesses

Car rental businesses require specialized insurance coverage to protect their vehicles and operations. As such, understanding the average monthly car insurance rates offered by various companies catering to car rental businesses is crucial for industry professionals.

Car Insurance Monthly Rates for Car Rental Businesses by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $61 | $160 |

| American Family | $44 | $117 |

| Farmers | $44 | $139 |

| Liberty Mutual | $68 | $174 |

| Nationwide | $44 | $115 |

| Progressive | $39 | $105 |

| State Farm | $33 | $86 |

| The Hartford | $43 | $113 |

| Travelers | $37 | $99 |

| USAA | $22 | $59 |

The table above details the average monthly car insurance rates for companies providing coverage tailored for car rental businesses, encompassing both full and minimum coverage options. This information is invaluable for rental companies seeking comprehensive insurance solutions that align with their budget and operational requirements.

Examining the table reveals distinct variations in the monthly insurance rates for companies specializing in coverage for car rental businesses. USAA emerges as a cost-effective choice, offering minimum coverage at $22 and full coverage at $59. State Farm provides a balanced option with rates of $33 for minimum coverage and $86 for full coverage.

Progressive stands out as a top choice for car rental businesses, offering comprehensive coverage enriched with discounts, making it a reliable partner for safeguarding your fleet.

Dani Best Licensed Insurance Producer

On the higher end, Liberty Mutual presents rates of $68 for minimum coverage and $174 for full coverage. These figures underscore the importance of evaluating insurance options tailored to the unique needs of car rental businesses, considering factors such as coverage limits, deductibles, and additional protections.

Rental companies should carefully assess these rates to ensure they secure comprehensive coverage that adequately safeguards their fleet and operations while maintaining financial viability.

The table displays monthly car insurance rates for car rental businesses from various providers, categorized into minimum and full coverage levels. The providers listed include Allstate, American Family, Farmers, Liberty Mutual, Nationwide, Progressive, State Farm, The Hartford, Travelers, and USAA.

Rates vary notably between minimum and full coverage options, reflecting a broad range of prices depending on the insurance provider and coverage level chosen.

Insuring Your Rental Fleet: Top Providers for Business Owners

When it comes to owning your own business, it’s important that you are able to protect your assets as well as the people that are working for you. By having the right type and right amount of coverage, you’ll have the peace of mind of running your business without having to worry. According to a recent study, there are currently more than 5.4 million fleet cars in service in the U.S. Of these fleet cars, about 1.7 million are rental cars.

When researching car insurance quotes from car insurance companies that offer insurance for businesses that rent cars, you’ll first need to consider how big you want your inventory to be. Evaluating the type of fleet you want will largely dictate what kind of insurance you need, how much it will cost, and what the best insurers are for you to consider.

Lancer Insurance

Lancer Insurance is a specialty insurer offering commercial car insurance, and liability coverage, for small businesses across the country. Lancer’s commercial car insurance coverages are designed to meet the distinctive needs of any car rental businesses without breaking the budget. Its commercial liability coverage covers the following:

Lancer Rental Car Insurance Coverage Details

| Coverage Name | What it Covers |

|---|---|

| Bodily Injury & Property Damage Liability | Offers compensation for injuries or damages resulting from an accident with an insured vehicle. Includes up to $1 million Combined Single Limit. Covers Personal Injury Protection, Uninsured Motorist, and Underinsured Motorist. |

| Physical Damage (Collision & Comprehensive) | Collision: Covers repair/replacement costs following an accident involving your vehicle and others or stationary objects. Comprehensive: Protects against non-collision damages such as theft, fire, vandalism, and weather incidents. Deductibles start at $500 to increase affordability. |

| Personal Injury Protection | Provides coverage for medical expenses, lost wages, and other related costs regardless of who is at fault in the accident. |

| Uninsured/Underinsured Motorist Coverage | Protects you if you're in an accident with a driver who either lacks sufficient insurance or is uninsured. Covers medical treatments and, in some states, vehicle damage. |

| Roadside Assistance | Offers services like towing, flat tire changes, battery jump-starts, and lockout assistance to help you when your vehicle breaks down. |

Additionally, general liability coverage is offered as well. Protection for your facility, office areas, parking areas, outside storage facilities and vacant land are all covered under this policy. Lancer offers exclusive products to help reduce the costs of your rates. Policyholders have access to a 24/7/365 claims hotline for a streamlined service is the event of a loss of your vehicle or serious injury. Other complimentary products include:

Easy-to-use accident and claim reporting aids:

- Accident report forms

- Emergency procedures visor cards for your customers

- SafetyLink Hotline: a complimentary policyholder-exclusive service to help you get answers or additional information on safety and regulatory issues

- Safety Stop: Lancer’s blog for valuable information, how-to’s, regulatory updates, and more to help you run a safer and more profitable business

- Complimentary 24/7 online access: to helpful safety and loss prevention resources

- The Right Driver Every Time: CSR Training Video

- Special Alert!: important time-sensitive information for the car rental industry

- Featured articles and presentations that highlight issues that impact the car rental industry and offer best practices to help you reduce your potential for loss

- Loss Recovery Program: Lancer’s claims team will help you recover out-of-pocket and down-time expenses, including your deductible, whenever another party is at-fault for an accident or loss at no additional cost

Because these policies can involve complex rating factors and each rental company will look different, each unique rating is done by outside insurers to ensure accuracy. For consumers who are looking for car insurance rates for car insurance companies that offer insurance for car rental businesses, Lancer is a great option.

Zurich Insurance

Zurich provides commercial vehicle insurance (including liability and physical damage coverage) for customer service fleet rental enterprises of any size. It is one of the leading providers of insurers for rental car insurance, bringing over 25 years of experience to the businesses as the largest provider of property-casualty insurance to the franchised commercial fleet industry. Zurich offers both liability and physical damage insurance.

What Zurich Rental Insurance Covers

| Liability Insurance | Physical Damage |

|---|---|

| Financial responsibility limit: state-mandated liability coverage for at-fault bodily injury and property damages | Specified perils: fire, lightning, windstorm, hail, earthquake, flood explosion, theft, vandalism, sinking, burning, collision or derailment transporting covered auto, and more |

| No-fault personal injury protection (PIP): coverage for economic losses for injuries caused by automotive accidents, regardless of who was at fault | Catastrophic: protects large fleets from occurrences such as hail, wind or tornado; applies to all forms of physical loss except collision, overturn and conversion |

| Owner limits: insurance protection for bodily injury and property damage liability resulting from ownership, maintenance or use of covered automobiles | Collision: damage to insured vehicles due to colliding of an automobile (stationary or moving) with any object (stationary or moving), including overturning (upset) of insured auto |

| Underinsured motorists: coverage for losses due to a negligent third party lacking sufficient insurance Uninsured motorists: coverage for losses due to a negligent, uninsured third party | Comprehensive: losses to covered vehicles or their equipment from any cause of loss except collision with another object or its overturn, conversion/trick and devise, or exclusions such as rust, vermin and depreciation |

Zurich’s commercial insurance policies range from $47/mo. to over $179/mo., mainly based on your business’s industry, location, gross sales, employees, payroll, policy limits, endorsements, deductibles, experience, and claims history.

Additionally, Zurich also provides workers’ compensation coverage, business interruption coverage, equipment insurance, and office contents coverage. These additions are all offered under Zurich’s general liability coverage insurance.

Additional Insurance Companies

Affordable car insurance from car insurance companies that offer insurance for car rental businesses are going to come in many different shapes and sizes. Since covering your fleet is going to look different depending on the size and type of cars you have, you’ll have the advantage of plenty of options when it comes to policies. Here are some additional providers:

- CoverWallet: is an inline platform that sells business insurance through its agency partners and helps keep policy information in one cloud-based location

- The Package Group: employs a team of insurance professionals that specialize in transportation industry insurance products, including rental fleet insurance and business car insurance

- ARRC: provided access to car fleet insurance including commercial car liability and physical damage programs at group rates through our master fleet insurance policies

- Period X: a unique insurance product created to meet the needs of anyone who is renting a single vehicle or fleet on any ride share platform and needs a garage policy to cover minimum coverages

- Period X Fleet Insurance: comes with perks such as an in-car device for each vehicle, and a web-based app to track every vehicle; this coverage, once implemented, ensures that no rental vehicle is ever in a period without coverage as long as the platform you are renting on provides insurance to the renter

- Nationwide: offers comprehensive commercial fleet coverage through its car policies and also provides dedicated solutions for car service and repair businesses

- Allstate: in addition to its general business insurance offerings, provides specific coverage options for rental service businesses, including car coverage

Insurance providers cater to the needs of car rental businesses, offering tailored insurance solutions to safeguard rental fleets effectively and ensure peace of mind for business owners.

Whether you’re seeking streamlined solutions, specialized coverage, or comprehensive options, exploring these offerings can help you find the right coverage for your business.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Insurance Coverage Essentials for Your Car Rental Company

Your car rental insurance should offer comprehensive coverage to safeguard your business beyond just your inventory. Consider essential policies like general liability insurance, which protects against third-party claims such as bodily injury or property damage, and commercial property insurance, covering damages or theft of property and equipment.

Business interruption insurance compensates for income lost due to disasters, while workers’ compensation covers employee injuries. Excess liability insurance can bolster coverage limits, particularly beneficial for car rental businesses facing heightened risks.

Bundling policies into a customized package may offer cost-saving benefits, but prioritize comprehensive coverage tailored to your business’s unique needs to ensure adequate protection.

Case Studies: Driving Personal Success in Car Rental Insurance

Navigating insurance challenges is crucial for entrepreneurs to ensure the longevity and success of their ventures. Through real-life case studies, we explore how top insurance providers have supported car rental business owners in overcoming obstacles and thriving in their industry.

- Case Study #1 – Protective Umbrella: Sarah Thompson, an entrepreneur in the car rental business, encountered a hurdle when one of her vehicles had a significant accident. Progressive provided comprehensive coverage with a 15% Commercial Car Discount and a 10% Fleet Discount, minimizing expenses and expediting claims, securing Sarah’s business’s resilience.

- Case Study #2 – Seamless Journey: Michael Rodriguez, a car rental business owner, sought fleet car insurance solutions that aligned with his values. USAA offered a 12% Commercial Car Discount and an 8% Fleet Discount, demonstrating their unwavering dedication to customer service and ensuring a seamless experience for Michael.

- Case Study #3 – Local Touch: Emily Chen, a proactive car rental business owner, valued State Farm’s localized approach. State Farm’s policies, with a 14% Commercial Car Discount and a 9% Fleet Discount, were tailored to meet Emily’s needs. The extensive network of local agents provided invaluable support, contributing to Emily’s venture’s success and growth.

These case studies exemplify the importance of selecting the right insurance partner for car rental businesses. With tailored coverage options, discounts, and dedicated customer service, insurance providers have demonstrated their commitment to supporting entrepreneurs in the car rental industry, ensuring their continued growth and resilience.

Progressive stands out with an impressive 90% customer review rating, ensuring businesses can rely on its comprehensive coverage and discounts to safeguard their fleets effectively.

Brandon Frady Licensed Insurance Agent

By choosing a trusted insurance provider that understands the unique needs of car rental businesses, entrepreneurs can confidently navigate challenges and thrive in their ventures.

Car Insurance Companies That Offer Insurance for Car Rental Businesses: Key Takeaways

Determining the cost of rental car insurance can be complex. Insurance rates for car rental businesses are often higher than for other small businesses due to driving-related risks. Choosing the appropriate coverage for your rental car business is crucial.

Lancer is an excellent choice for those seeking savings on comprehensive car insurance and benefiting from its policy perks. Zurich is another strong option for consumers needing support from an experienced company in the rental car insurance industry.

Now that you know which car insurance companies offer insurance for car rental businesses, take the time to enter your ZIP code in our free, and easy-to-use tool and start comparing quotes in your area today.

Frequently Asked Questions

What insurance do I need for a car rental business, and how do I get it?

To adequately protect your car rental business, you’ll need a comprehensive insurance policy that includes coverage for liability, property damage, business interruption, and workers’ compensation. To get insurance for your rental car business, you can reach out to insurance providers specializing in commercial fleet insurance for rental cars. They can tailor a policy to suit your specific needs, ensuring your business is adequately covered.

To expand your knowledge, delve into our extensive guide on insurance coverage titled “Compare Fleet Car Insurance: Rates, Discounts, & Requirements,” providing insights into various aspects of fleet insurance.

How can I find the best fleet insurance companies for my car rental business?

To ensure your car rental business insurance meets legal requirements, work with an insurance provider knowledgeable about the regulations governing commercial auto car rental insurance. They can help you understand and comply with state and federal insurance requirements, ensuring your business operates legally and avoids potential penalties.

Shop for the best liability-only car insurance with our free quote comparison tool. Enter your ZIP code below to begin.

What factors determine the cost of insurance for a car rental business?

When looking for the best fleet insurance companies for your car rental business, consider factors such as reputation, coverage options, customer reviews, and pricing. Conducting research and comparing quotes from multiple insurance companies specializing in commercial fleet insurance for rental cars can help you identify the best fit for your business.

For an in-depth understanding, delve into our extensive guide titled “How do you get competitive quotes for car insurance?” for valuable insights and tips on finding the best rates, ensuring informed decisions.

How do I ensure my car rental business insurance meets legal requirements?

The cost of insurance for a car rental business can vary based on factors such as the size of your auto rental fleet, location, claims history, coverage limits, and the types of vehicles in your fleet. Insurance providers will assess these factors when calculating your premium for auto rental business insurance.

For a thorough assessment, consult our comprehensive guide named “Car Insurance Calculator: Get Free Car Insurance Estimates Online,” ensuring you have all the information you need to make informed decisions.

How much does insurance cost for a car rental business, and how can I get the best rates?

The cost of insurance for a car rental business varies depending on factors such as location, fleet size, coverage options, and insurer. To get the best rates, compare quotes from multiple insurance providers specializing in business insurance for car rental companies. Additionally, consider bundling policies or taking advantage of discounts offered by insurers.

What are the top car insurance companies offering coverage for car rental businesses?

The top car insurance companies offering coverage for car rental businesses include Progressive, USAA, State Farm, and others. These companies provide specialized insurance solutions tailored to the needs of rental car businesses, ensuring comprehensive protection for your fleet.

For detailed insights, consult our extensive guide titled “5 Best Car Insurance Companies,” ensuring you find the ideal coverage for your needs.

Why is it essential to have commercial fleet insurance for rental cars for my car rental business?

Commercial fleet insurance for rental cars is essential for your car rental business because it provides comprehensive coverage tailored to the unique risks associated with renting out vehicles. This insurance protects your fleet, employees, and business assets from potential liabilities, ensuring financial security and peace of mind.

What are the benefits of Progressive car rental insurance for my car rental business?

Progressive car rental insurance offers comprehensive coverage options tailored to the needs of car rental businesses. With features such as customizable policies, competitive pricing, and discounts for fleet owners, Progressive ensures reliable protection for your rental fleet and business operations.

See if you’re getting the best deal on car insurance by entering your ZIP code below.

What is the cheapest hire and reward insurance for a car rental business?

Finding the cheapest hire and reward insurance for a car rental business involves comparing quotes from different insurers specializing in commercial auto car rental insurance. Factors such as coverage limits, deductibles, and discounts can impact the overall cost of insurance for your rental business.

For more detailed insights, delve into our comprehensive guide titled “Compare Commercial Car Insurance: Rates, Discounts, & Requirements,” and gain a deeper understanding of business insurance.

What steps should I take to get insurance for my rental car business?

To get insurance for your rental car business, start by researching insurance providers specializing in business insurance for car rental companies. Compare coverage options, request quotes, and consult with insurance agents to tailor a policy that meets your business needs. Be prepared to provide information about your fleet, operations, and desired coverage levels to expedite the process.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Tonya Sisler

Insurance Content Team Lead

Tonya Sisler has been a technical insurance writer for over five years. She uses her extensive insurance and finance knowledge to write informative articles that answer readers' top questions. Her mission is to provide readers with timely, accurate information that allows them to determine their insurance needs and choose the best coverage. Tonya currently leads a team of 10 insurance copywrite...

Insurance Content Team Lead

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.