Best Insurance for Exotic Cars in 2025 (Compare the Top 10 Companies)

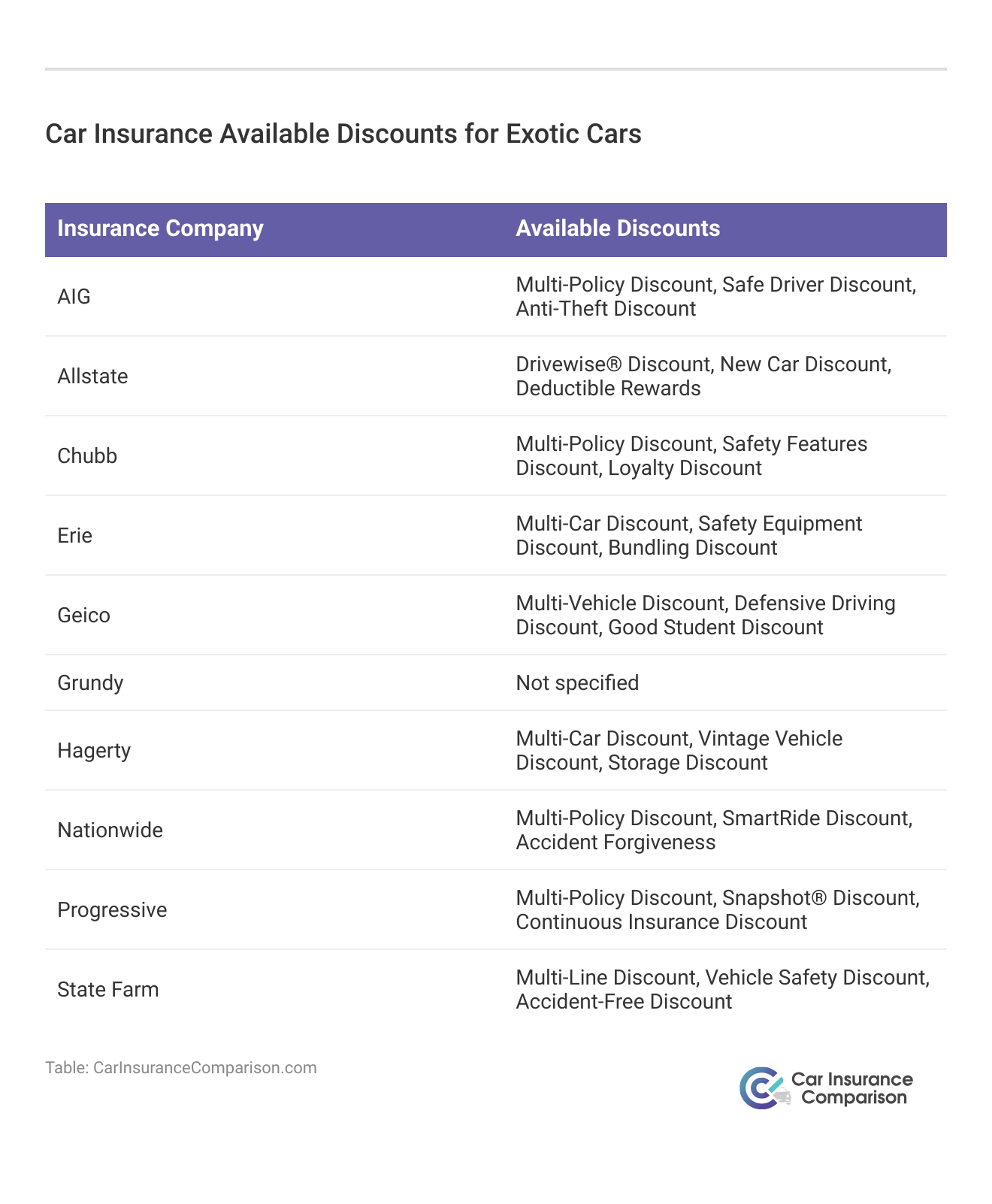

Geico, Hagerty, and Allstate provide the best insurance for exotic cars, offering rates beginning at just $230 per month. These insurers provide affordable and comprehensive coverage, making them the best insurance for individuals looking for discounts and dependable protection tailored to their driving needs and peace of mind.

Read moreFree Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Dani Best

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Licensed Insurance Producer

UPDATED: Nov 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Nov 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for Exotic Cars

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 17 reviews

17 reviewsCompany Facts

Full Coverage for Exotic Cars

A.M. Best Rating

Complaint Level

17 reviews

17 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage for Exotic Cars

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews

- Geico provides competitive rates starting at $230 per month

- Safe driving and defensive vehicles can lower costs with top insurance plans

- Customized options and discounts ensure optimal insurance for exotic cars

#1 – Geico: Top Overall Pick

Pros

- Competitive Rates: Geico offers competitive rates for exotic car insurance, starting as low as $230 per month, making it affordable for many drivers.

- Comprehensive Coverage Options: Geico provides a wide range of coverage options tailored to the specific needs of exotic car owners, ensuring comprehensive protection against various risks.

- User-Friendly Online Tools: Geico’s online platform makes it easy for customers to manage their policies, file claims, and access support, enhancing convenience and efficiency.

Cons

- Limited Specialty Expertise: While Geico offers coverage for exotic cars, its specialization in this niche market may not be as extensive as some other providers, potentially leading to less personalized service for exotic car owners.

- Lack of Exclusive Benefits: Our Geico insurance review highlights in comparison to some specialty insurers, Geico may not offer as many exclusive benefits or perks specifically tailored to exotic car owners, such as concierge services or specialized repair networks.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#2 – Hagerty: Best for Nationwide Coverage

Pros

- Extensive Experience: Hagerty specializes in classic and collector car insurance, bringing years of expertise and understanding to the unique needs of exotic car owners, ensuring tailored coverage and service.

- Agreed Value Coverage: Hagerty offers agreed value coverage, guaranteeing a predetermined value for the exotic car in the event of a total loss, providing peace of mind and financial security to owners.

- Nationwide Coverage: With nationwide coverage, Hagerty ensures that exotic car owners can receive specialized insurance regardless of their location, offering convenience and accessibility. Read more through our Hagerty car insurance review.

Cons

- Limited Policy Flexibility: Hagerty’s policies may have less flexibility in terms of coverage options compared to some other providers, potentially limiting customization based on individual needs and preferences.

- Membership Requirement: To access Hagerty’s insurance offerings, individuals may need to become members of the Hagerty Drivers Club, which could involve additional fees or requirements, adding complexity to the insurance process.

#3 – Allstate: Best for Competitive Rates

Pros

- Competitive Rates: Allstate offers competitive rates for exotic car insurance, providing affordable coverage options for owners of high-value vehicles. Consult our Allstate car insurance review for guidance.

- Comprehensive Coverage: Allstate provides comprehensive coverage options tailored to the specific needs of exotic car owners, ensuring protection against various risks and liabilities.

- Wide Availability: Allstate operates nationwide, making it accessible to exotic car owners across the country, with numerous local agents available to provide personalized service and support.

Cons

- Average Customer Satisfaction: While Allstate offers quality coverage and a wide range of services, some customers may find their overall satisfaction with the company to be average compared to other providers, with occasional issues related to claims processing or customer service.

- Limited Specialty Focus: Allstate’s specialization in mainstream auto insurance may result in less specialized expertise and coverage options for exotic cars, potentially leaving owners with less tailored solutions for their unique needs and preferences.

#4 – Grundy: Best for Collector Focus

Pros

- Specialized Focus: Grundy specializes in collector car insurance, offering extensive expertise and understanding of the unique needs of exotic car owners, ensuring tailored coverage and personalized service.

- Agreed Value Coverage: Grundy provides agreed value coverage, guaranteeing a predetermined value for the exotic car in the event of a total loss, offering peace of mind and financial security to owners.

- Flexible Usage Options: Grundy offers flexible usage options for exotic cars, allowing owners to choose coverage based on their intended usage, whether for occasional pleasure driving or regular use.

Cons

- Limited Availability: Grundy’s coverage may not be available in all states or regions, potentially limiting accessibility for exotic car owners outside of certain areas. Find out more through our Grundy car insurance review.

- Membership Requirement: Similar to Hagerty, Grundy may require individuals to become members of their organization to access insurance offerings, which could involve additional fees or requirements, adding complexity to the insurance process.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#5 – Erie: Best for Reliable Service

Pros

- Local Expertise: Erie Insurance often provides personalized service and a deep understanding of local driving conditions, which can be beneficial for exotic car owners navigating unique road and weather challenges. Read more through our Erie car insurance review.

- Flexible Policy Options: Erie offers a range of policy options, allowing exotic car owners to customize coverage based on their specific needs and preferences, ensuring they get the protection they require without paying for unnecessary extras.

- Excellent Customer Service: Erie is known for its exceptional customer service, with representatives who are responsive, knowledgeable, and dedicated to providing assistance and support throughout the insurance process.

Cons

- Limited Availability: Erie Insurance operates primarily in the Mid-Atlantic and Great Lakes regions, so exotic car owners outside of these areas may not have access to their coverage options, limiting their choices.

- Potentially Higher Premiums: While Erie offers quality coverage and service, their premiums may be slightly higher compared to some other providers, which could be a drawback for budget-conscious exotic car owners seeking more affordable options.

#6 – State Farm: Best for Established Brand

Pros

- Established Brand: State Farm is a well-known and trusted insurance provider with a long history of serving customers, offering peace of mind to exotic car owners regarding the reliability and stability of their coverage. Refer to our State Farm car insurance review.

- Extensive Network: State Farm has a vast network of agents and offices across the country, providing convenient access to personalized service and support for exotic car owners, no matter their location.

- Multiple Policy Discounts: State Farm offers discounts for bundling multiple policies, such as home and auto insurance, potentially reducing overall costs for exotic car owners who also need other types of coverage.

Cons

- Limited Specialty Coverage: While State Farm offers coverage for exotic cars, its specialization in this niche market may not be as extensive as some other providers, potentially leading to less tailored solutions for unique needs and preferences.

- Potentially Higher Premiums: Depending on factors such as driving history and location, State Farm’s premiums for exotic car insurance may be higher compared to specialty insurers, making it less affordable for some drivers.

#7 – Chubb: Best for High-Value Protect

Pros

- High-Value Protection: Chubb specializes in providing insurance for high-value assets, including exotic cars, offering comprehensive coverage options and high policy limits to ensure adequate protection for valuable vehicles.

- Customized Policies: Chubb offers tailored insurance solutions designed to meet the specific needs of exotic car owners, allowing for personalized coverage options and enhanced peace of mind. Find out more through our Chubb car insurance review.

- Exceptional Service: Chubb is known for its exceptional customer service, with dedicated representatives who provide prompt assistance and support to exotic car owners throughout the insurance process.

Cons

- Premium Pricing: Chubb’s premiums for exotic car insurance may be higher compared to some other providers, reflecting the comprehensive coverage and high-value protection they offer, which could be a deterrent for budget-conscious drivers.

- Limited Availability: Chubb’s coverage may not be available in all states or regions, potentially limiting accessibility for exotic car owners outside of certain areas, requiring them to seek coverage elsewhere.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#8 – Progressive: Best for Customized Options

Pros

- Customized Options: Progressive offers a variety of customizable coverage options for exotic car owners, allowing them to tailor their policies to meet their specific needs and preferences. Read more through our Progressive car insurance review.

- Innovative Tools: Progressive provides innovative online tools and resources, such as the Name Your Price® tool and Snapshot® program, to help exotic car owners find affordable coverage and save money on their premiums.

- Discount Opportunities: Progressive offers various discounts, such as multi-policy discounts and safe driving discounts, which can help exotic car owners lower their insurance costs and maximize savings.

Cons

- Average Customer Service: While Progressive offers competitive rates and innovative tools, some customers may find their customer service to be lacking compared to other providers, with longer wait times and less personalized assistance.

- Limited Specialty Expertise: Progressive’s specialization in mainstream auto insurance may result in less specialized expertise and coverage options for exotic cars, potentially leaving owners with gaps in coverage or inadequate protection.

#9 – AIG: Best for Trusted Provider

Pros

- Trusted Reputation: AIG is a well-established insurance provider with a strong reputation for reliability and financial stability, offering peace of mind to exotic car owners regarding the security of their coverage.

- Customized Coverage Solutions: AIG provides personalized coverage solutions tailored to the unique needs of exotic car owners, ensuring comprehensive protection against various risks and liabilities. Find out more through our AIG car insurance review.

- Wide Range of Coverage Options: AIG offers a diverse range of coverage options for exotic cars, allowing owners to tailor their policies to meet their specific needs and preferences, providing flexibility and comprehensive protection.

Cons

- Higher Premiums: AIG’s premiums for exotic car insurance may be higher compared to some other providers, potentially making it less affordable for drivers seeking budget-friendly options.

- Limited Online Resources: AIG’s online platform may lack some of the user-friendly tools and resources offered by other providers, potentially making policy management and support less convenient for customers.

#10 – Nationwide: Best for Classic Expertise

Pros

- Classic Expertise: Nationwide offers specialized coverage for classic cars, including exotic vehicles, leveraging their expertise in this niche market to provide tailored solutions and comprehensive protection, as highlighted in our Nationwide insurance review.

- Flexible Coverage Options: Nationwide provides flexible coverage options for exotic car owners, allowing them to customize their policies to meet their specific needs and preferences, ensuring adequate protection against various risks.

- Strong Financial Stability: Nationwide is a financially stable and reputable insurance provider, offering peace of mind to exotic car owners regarding the security and reliability of their coverage.

Cons

- Potentially Higher Premiums: Nationwide’s premiums for exotic car insurance may be higher compared to some other providers, reflecting the comprehensive coverage and specialized expertise they offer, which could be a drawback for budget-conscious drivers.

- Limited Availability of Specialty Services: While Nationwide offers comprehensive coverage for exotic cars, some specialty services or benefits commonly provided by niche insurers may be lacking, potentially leaving owners with fewer perks or benefits associated with their policy.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Exotic Car Insurance

How Exotic Car Insurance Differs from Standard Policies

Best Insurance Company for Exotic Cars

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Exotic Car Insurance Coverage

Exotic Car Insurance: The Bottom Line

Frequently Asked Questions

What is exotic car insurance?

Exotic car insurance is a specialized type of coverage designed specifically for high-value and rare vehicles, often referred to as exotic or luxury cars. These vehicles are typically unique, expensive, and require specialized maintenance and repair, making their insurance needs distinct from regular automobiles.

Why do I need exotic car insurance?

Exotic car insurance provides essential protection for your high-value vehicle. Due to their rarity and higher price tags, exotic cars are often more susceptible to theft, vandalism, and accidents. Exotic car insurance ensures that you have coverage for these potential risks, as well as any damage or loss resulting from accidents, natural disasters, or other incidents. Enter your ZIP code now to begin.

How does exotic car insurance differ from regular car insurance?

How can I compare exotic car insurance rates?

To compare exotic car insurance rates, you can follow these steps:

- Research: Start by researching insurance companies that specialize in exotic car insurance. Look for providers with experience in insuring high-value vehicles and a good reputation for customer service.

- Gather Information: Collect the necessary information about your exotic car, such as its make, model, year, and any modifications or additional features. This information will be required to obtain accurate insurance quotes.

- Request Quotes: Contact several insurance companies and request quotes for your exotic car insurance. Provide them with the information you gathered about your vehicle.

- Compare Coverage and Rates: Once you have received quotes from different insurers, compare the coverage options and rates. Pay attention to the coverage limits, deductibles, and any additional features or benefits offered by each policy.

- Consider Customer Reviews and Ratings: In addition to comparing rates, take into account the customer reviews and ratings of the insurance companies. Look for feedback on their claims process, customer support, and overall satisfaction.

- Make an Informed Decision: Based on your research, quotes, and customer feedback, make an informed decision on which exotic car insurance policy best suits your needs and budget.

These steps will be your guide in comparing exotic car insurance rates.

What factors can affect exotic car insurance rates?

Several factors can influence the rates for exotic car insurance, including:

- Vehicle Value: The higher the value of your exotic car, the more expensive the insurance premiums are likely to be.

- Driving Record: Your driving history, including any previous accidents or traffic violations, can impact your insurance rates.

- Location: The area where you live and park your exotic car can affect rates, as certain areas may have higher rates of theft or vandalism.

- Usage: How often and for what purposes you use your exotic car can impact your rates. For example, if you use it for daily commuting, your rates may be higher compared to occasional recreational use.

- Security Measures: The security features and anti-theft devices installed in your exotic car can potentially lower your insurance premiums.

- Deductible and Coverage Limits: The deductible amount you choose and the coverage limits you select will affect your insurance rates. Higher deductibles typically result in lower premiums, but you’ll have to pay more out of pocket in the event of a claim. Enter your ZIP code now to begin.

These factors will be your guideline in knowing what affects the insurance rates.

What are the top three insurance providers recommended for exotic cars in 2024?

What are some key factors that differentiate exotic car insurance from standard policies?

Exotic car insurance differs from standard policies due to the high value, unique characteristics, and specialized maintenance and repair requirements of exotic vehicles.

How does Geico’s exotic car insurance policy differ from its standard auto insurance coverage?

Geico’s exotic car insurance policy falls under its classic car insurance policy, offering tailored coverage specifically designed for high-value and rare vehicles. Enter your ZIP code now to start.

What are some benefits of Hagerty’s coverage for exotic car owners?

How does AIG ensure personalized coverage solutions for exotic car owners?

AIG ensures personalized coverage solutions for exotic car owners by providing a wide range of coverage options tailored to their unique needs and preferences.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Dani Best

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Licensed Insurance Producer

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.