Best Car Insurance for High-Risk Drivers in 2025 (Top 8 Companies Ranked)

Geico, State Farm, and USAA have the best car insurance for high-risk drivers, with minimum coverage rates starting at $110 per month. Geico offers the cheapest high-risk car insurance rates for drivers with bad credit scores and at-fault accidents, while USAA has low rates for drivers with a DUI.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Apr 25, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Apr 25, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

19,116 reviews

19,116 reviewsCompany Facts

Full Coverage For High-Risk Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 18,155 reviews

18,155 reviewsCompany Facts

Full Coverage For High-Risk Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage For High-Risk Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviewsGeico, State Farm, and USAA have the best car insurance for high-risk drivers, primarily because of their affordable rates.

Geico is our overall pick for high-risk car insurance. It offers low rates for high-risk drivers with at-fault accidents, speeding tickets, and bad credit scores. Geico can also submit SR-22 car insurance forms on your behalf.

Our Top 8 Company Picks: Best Car Insurance for High-Risk Drivers

| Company | Rank | Multi-Vehicle Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 10% | A++ | Competitive Rates | Geico | |

| #2 | 15% | A++ | Customer Service | State Farm | |

| #3 | 12% | A++ | Military Families | USAA | |

| #4 | 7% | A+ | Custom Plans | Progressive | |

| #5 | 10% | A+ | New Drivers | Allstate | |

| #6 | 8% | A+ | Online Tools | Nationwide |

| #7 | 13% | A | Loyalty Rewards | American Family | |

| #8 | 11% | A++ | Safe Drivers | Travelers |

Explore the best high-risk car insurance companies below to find the right provider for your needs. Then, enter your ZIP code to find the best coverage for your needs.

- Hgh-risk drivers have traffic violations, at-fault accidents, or bad credit scores

- High-risk auto insurance rates are usually much higher

- Geico and State Farm have the best insurance for high-risk drivers

- Best High-Risk Car Insurance

- How do you get car insurance with no license?

- Best Car Insurance for 16-Year-Olds in 2025 (Top 10 Companies)

- Best Car Insurance for a Bad Driving Record in 2025 (Top 10 Companies)

- Cheap Car Insurance After a DUI in 2025 (Top 10 Low-Cost Companies)

- How do I get car insurance if I’ve lost my license?

- Best Car Insurance for a Revoked Driver’s License in 2025 (Top 10 Companies)

- Best Car Insurance for a Provisional License in 2025 (Top 10 Companies)

- Best Car Insurance for a Restricted License in 2025 (Top 10 Companies)

- Best Car Insurance Without a Credit Check in 2025 (Top 10 Companies)

- Best Car Insurance for Convicted Drivers in 2025 (Top 10 Companies Ranked)

- Best Car Insurance for Minors With a DUI in 2025 (Top 10 Companies)

#1 – Geico: Top Pick Overall

Pros

- Low Rates for Most Drivers: Geico has low rates for most drivers, including high-risk drivers with at-fault accidents and bad credit scores. See how much you might pay in our Geico car insurance review.

- User-Friendly Online Tools: It’s easy to sign up for a policy, manage your coverage, and start a claim with Geico’s convenient online tools.

- DriveEasy: High-risk car insurance rates are higher, but you can save up to 25% on your Geico policy with the usage-based insurance (UBI) program, DriveEasy.

Cons

- Higher Rates for DUIs: Geico is an affordable option for most high-risk car insurance quotes, but drivers with a DUI will probably find cheaper rates elsewhere.

- Limited Coverage Options: It may be one of the largest insurance companies in the country, but Geico lacks many of the coverage options some of its competitors have.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#2 – State Farm: Best for Drivers With At-Fault Accidents

Pros

- Affordable Quotes: State Farm is an excellent option for most drivers, but it offers some of the best car insurance for multiple accidents.

- Generous Discounts: State Farm offers 13 discounts to help you find the cheapest car insurance for high-risk drivers. Explore your discount opportunities in our State Farm car insurance review.

- Financially Stable: State Farm has a rating of A++ from A.M. Best, meaning you’ll never have to worry about your claims being unpaid.

Cons

- No Gap Insurance: There are plenty of coverage options to choose from with State Farm, but it doesn’t offer gap insurance.

- Numerous Complaints: State Farm receives more complaints than other similarly sized companies.

#3 – USAA: Best for Military Families

Pros

- SafePilot: Save up to 30% on your insurance with SafePilot, USAA’s UBI program. See if SafePilot can help you save in our USAA car insurance review.

- Low Rates: No matter what you have in your driving record, USAA almost always has the lowest high-risk auto insurance prices.

- Great Coverage Options: USAA offers a variety of insurance options, like rideshare insurance and new car replacement assistance.

Cons

- Membership Requirements: USAA only offers membership to military members and their immediate families.

- Customer Complaints: Although it has a reputation for being one of the best insurance companies on the market, USAA receives more complaints than average.

#4 – Progressive: Best After a DUI

Pros

- Low Rates After a DUI: Progressive is usually affordable, but its rates are some of the best for car insurance after a DUI.

- Snapshot: Snapshot offers savings of up to 30% for drivers who consistently practice safe habits on the road. See how Snapshot can help you save in our Progressive car insurance review.

- Innovative Online Tools: Progressive offers its drivers an innovative digital approach to insurance. For example, its Name Your Price tool helps Progressive drivers get the best high-risk insurance while sticking to a budget.

Cons

- Average Rate for Other High-Risk Drivers: Progressive’s high-risk car insurance prices are good for people with a DUI but are less competitive for drivers with at-fault accidents or speeding tickets.

- Limited Local Agents: With its focus on online experiences, Progressive doesn’t have the largest network of in-person agents.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#5 – Allstate: Best for UBI Savings

Pros

- Accident Forgiveness: Accident forgiveness from Allstate is an excellent option for people prone to driving mistakes because it ensures your rates won’t increase after one accident.

- Policy Customization Options: Allstate has a variety of coverage options, so you can create the perfect plan for your needs. See what you can choose from in our Allstate car insurance review.

- Ample Discounts: With 12 discounts to help you save, finding affordable insurance for high-risk drivers at Allstate is easy. For example, you can save up to 40% with Allstate’s UBI program Drivewise.

Cons

- Higher Rates: Although Allstate offers excellent discounts, it almost always has higher high-risk auto insurance rates.

- Mixed Reviews: Allstate customers generally leave mixed reviews – some people love their policies, while others are less than impressed.

#6 – Nationwide: Best for Drivers With Bad Credit

Pros

- Vanishing Deductible: Enroll in Nationwide’s Vanishing Deductible program to save $100 on your deductible for every year you spend claims-free, up to a maximum of $500.

- UBI Programs: Nationwide offers two UBI programs – SmartRide and SmartMiles. See which plan would best fit your lifestyle in our Nationwide car insurance review.

- Low Rates for Bad Credit: Most insurance companies charge much higher rates when you have a low credit score, but high-risk auto insurance quotes from Nationwide are more forgiving. See more ways to save with Nationwide car insurance discount options.

Cons

- Higher Premiums for Some: Nationwide is usually one of the cheapest high-risk car insurance providers, but that’s not always true for drivers with DUIs or accidents that cause an injury.

- No Rideshare: Nationwide offers several valuable car insurance add-ons, but rideshare insurance is not one of them.

#7 – American Family: Best for Affordable High-Risk Insurance

Pros

- Low Level of Complaints: Although it’s not without flaws, American Family receives fewer complaints than many of its competitors.

- Affordable Rates After a DUI: American Family doesn’t always have the cheapest high-risk auto insurance quotes, but it does offer affordable rates for drivers with a DUI.

- Wide Range of Coverage Options: Add coverage like accidental death and dismemberment or gap insurance to your American Family policy for the very best coverage.

Cons

- Less Competitive Rates for Teens: Teens always see higher rates than older drivers, but American Family can be particularly expensive.

- Limited Availability: American Family is currently only available in 19 states. See if your state is covered in our American Family car insurance review.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#8 – Travelers: Best for Discount Opportunities

Pros

- Responsible Driver Plan: The Responsible Driver Plan combines accident forgiveness and minor violation forgiveness into a convenient package.

- Long List of Discounts: Travelers has one of the best lists of insurance on the market, with 23 options to take advantage of. Explore all 23 in our Travelers car insurance review.

- Multiple Coverage Options: Add more coverage to your policy with Travelers selection of optional insurance, like new car replacement and roadside assistance.

Cons

- No SR-22 Insurance: Many high-risk drivers need SR-22 insurance to legally drive. Unfortunately, Travelers does not offer it.

- Higher Rates for Teens: Travelers has higher average insurance costs for teens. If you’re a young driver or looking to add a teen to your policy, Travelers is probably not the right choice.

High-Risk Auto Insurance Costs

Finding an affordable policy can be difficult and that’s why learning about high-risk car insurance is essential. Some companies refuse to work with high-risk drivers, especially if the driver has serious charges on their record, like a DWI or DUI. Learning how to compare car insurance companies that accept a DUI is essential in this case to find affordable rates.

Insurance companies look at the same factors to determine your rates but use them in unique formulas. So while your rates will be more expensive as a high-risk driver, some companies are more forgiving than others.

Car Insurance Monthly Rates for High-Risks Drivers by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $150 | $310 |

| American Family | $125 | $260 |

| Geico | $120 | $250 |

| Nationwide | $135 | $280 |

| Progressive | $140 | $290 |

| State Farm | $130 | $270 |

| Travelers | $145 | $300 |

| USAA | $110 | $230 |

As you can see, you can get affordable State Farm and Geico high-risk insurance. Some companies specifically sell insurance for high-risk drivers, such as The General, but rates aren’t usually as affordable.

High-risk drivers also make it more difficult for other people to get affordable insurance, too. Insurance companies have detailed statistics for every ZIP code, meaning states with more drunk driving, road rage incidents, and speeding violations typically have higher rates.

The 10 worst states for drunk driving, ranked https://t.co/qD8KLgrwRL

— Business Insider (@BusinessInsider) January 2, 2024

Buying car insurance from a standard company is a better choice, even when you’re a high-risk driver. However, having a high-risk designation sometimes makes finding car insurance a problem.

The General has higher rates than standard companies but rejects fewer applicants. So you can find high-risk auto insurance with The General even when other companies reject you.

How to Get High-Risk Auto Insurance When Companies Won’t Insure You

Most states require drivers to buy car insurance before driving on a public street or registering a vehicle. If you live in a state with insurance requirements, understanding what your rights are when you’re refused car insurance coverage is crucial to driving legally if your insurance application is rejected. It’s also important to be prepared, because you likely won’t be rejected when you first fill out your quote request form.

If standard insurance companies refuse to sell you a policy, you have two choices: non-standard companies and state-sponsored insurance plans. Non-standard insurance companies are usually regional, meaning they’re unavailable statewide. Some famous non-standard car insurance companies include The General car insurance, National General car insurance, Safe Auto, and Dairyland car insurance.

State-sponsored insurance plans exist to provide coverage to people who can’t find an affordable policy elsewhere. For example, you can buy coverage through your state's Automobile Insurance Plan. Contact the Service Office for more information about this insurance plan.

Scott W. Johnson Licensed Insurance Agent

Regardless of your choice, rates are higher than at a standard insurance company because the customer base consists of more high-risk drivers.

People Considered High-Risk by Car Insurance Companies

A DUI charge might be the first thing that comes to mind, but high-risk auto insurance companies designate drivers as high-risk for many reasons. While having a high-risk designation always increases car insurance rates, some incidents have a stronger effect than others.

For example, a DUI can double your auto insurance rates, while having a low credit score usually results in a 60% increase. You’ll need to look at companies that are more forgiving, like car insurance companies for bad credit scores if your score is low. Explore some of the most common reasons people get a high-risk designation below, but keep in mind that your auto insurance rates vary based on several factors.

Drivers With a DUI or DWI

DUIs have one of the most significant impacts on your car insurance rates. If you have a DUI charge on your record, comparing rates from the top cheap high-risk car companies is vital to finding affordable rates. While your quotes will vary by your unique situation, you can understand what you might pay for car insurance after a DUI below.

Car Insurance Monthly Rates With a DUI by Provider

| Insurance Company | DUI Rates |

|---|---|

| Allstate | $270 |

| American Family | $194 |

| Farmers | $192 |

| Geico | $216 |

| Liberty Mutual | $313 |

| Nationwide | $234 |

| Progressive | $140 |

| State Farm | $112 |

| Travelers | $206 |

| USAA | $133 |

| Average | $209 |

As you can see, car insurance gets expensive after a DUI. Most states also require drivers to submit SR-22 car insurance forms. You’ll probably need to submit SR-22 forms for three years after a DUI.

Though rates are higher after a DUI, you don’t have to be stuck with them forever. DUIs usually fall off your record after seven years.

Drivers With Multiple Speeding Tickets

While one speeding ticket will increase your rates, it won’t make you a high-risk driver. However, multiple speeding tickets — or citations for other traffic violations — might classify you as a high-risk driver. Find out how much your car insurance will go up after a speeding ticket.

Multiple tickets on your record will significantly increase the price of your car insurance. You might also face other serious consequences, like being dropped by your insurer or having your registration revoked.

Young or First Time Drivers

Most high-risk auto insurance costs apply to drivers because of their driving habits, but you’ll also pay higher rates for young drivers car insurance.

Young drivers are statistically more likely to drive recklessly, get into accidents, and engage in dangerous driving habits. Rates for young drivers are some of the highest for any demographic, and you can check how much you might pay below.

Full Coverage Car Insurance Monthly Rates for 18-Year-Old Drivers by Gender & Provider

Insurance Company Male Drivers Female Drivers

$518 $448

$628 $597

$253 $219

$625 $521

$387 $302

$661 $590

$283 $229

$739 $530

Teen drivers can get high-risk Geico car insurance for about $312 monthly, making it an affordable option when you compare teen driver car insurance rates to the national average of $618. However, high-risk car insurance rates begin to go down at 25 if you keep your driving record clean.

Young drivers don’t need high-risk car insurance just for being inexperienced. However, insurance companies judge young drivers harsher than adults so you might need high-risk insurance after even a minor incident.

Drivers With Low Credit Scores

Some factors that affect car insurance rates are obvious, but one that often surprises drivers is credit scores. Insurance companies look at credit scores when crafting rates for two reasons. The first is that they assume that people with high credit scores are more likely to pay their bills on time.

Secondly, companies charge up to 60% more for lower credit scores because they’re statistically more likely to file claims. Check below for the difference in average car insurance rates based on your credit score.

Auto Insurance Monthly Rates by Credit Score & Provider

Insurance Company Poor Credit Fair Credit Good Credit

Allstate $296 $197 $166

American Family $203 $136 $115

Farmers $269 $160 $139

Geico $148 $100 $82

Liberty Mutual $355 $226 $177

Nationwide $166 $133 $120

Progressive $206 $138 $109

State Farm $200 $118 $91

Travelers $194 $128 $107

USAA $129 $76 $63

U.S. Average $226 $148 $123

A low credit score doesn’t mean you can only buy from high-risk auto insurance companies, but you might find lower rates with one. Comparing high-risk car insurance quotes at multiple companies is especially important when you have a low credit score — you’ll likely overpay if you don’t. Read more about good credit car insurance discounts.

While your rates will be higher with a low credit score, you can decrease your high-risk auto insurance costs by improving your credit score.

Drivers With a Lapse in Insurance Coverage

Insurance companies consider a lapse in insurance as a red flag. Whether your lapse was a few days because you missed a monthly payment or a few years, you’ll see higher rates when you reactivate your coverage.

Drivers with a lapse in coverage are considered high risk for several reasons. First, insurance companies look at drivers as less responsible financially when they fail to maintain coverage.

Another reason is that driving without insurance is illegal in most states. As a result, even the cheapest high-risk auto insurance companies view a driver with an active registration but no insurance as potentially breaking the law, resulting in higher rates.

Like other factors negatively affecting car insurance rates, a lapse in coverage won’t hurt your prices forever. Instead, your rates will likely be higher for about six months before they return to normal. That’s why you should avoid coverage lapses for lower rates.

Drivers With Other Serious Traffic Violations

You’ve already seen how serious infractions like DUIs or speeding tickets can affect your high-risk car insurance quotes. Still, several other incidents can also impact your car insurance and designate you as a high-risk driver.

Other high-risk infractions include:

- Hit-and-runs

- Reckless driving charges

- Road rage behaviors

Aside from needing car insurance for bad drivers, many traffic infractions have other consequences. For example, drivers can face hefty fines, license suspension, and even jail time for breaking traffic laws.

You can also face higher rates just for living in the top states for reckless drivers, DUIs, or road rage incidents.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

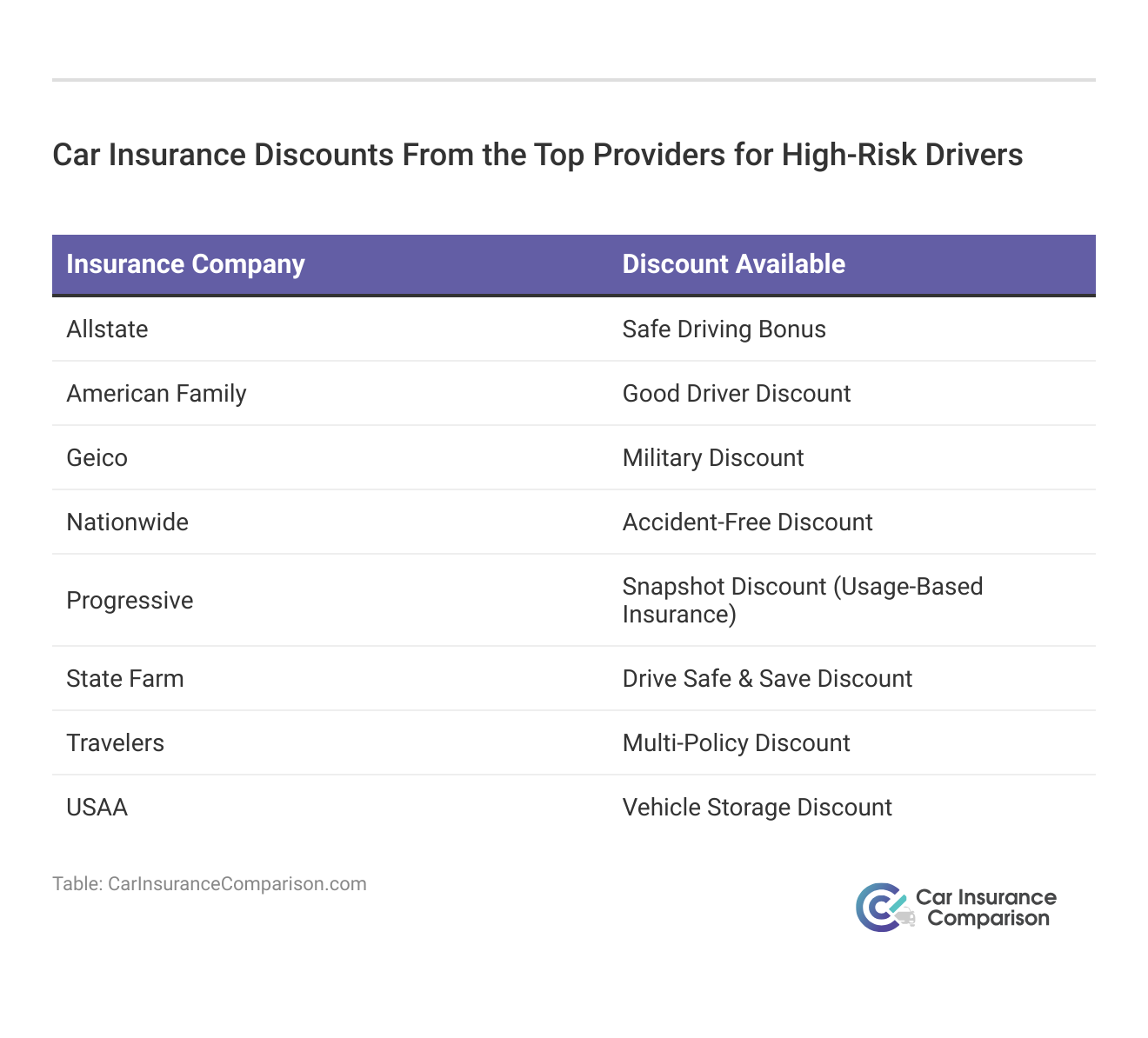

How to Find Cheap Car Insurance for High-Risk Drivers

Finding the best insurance for high-risk drivers can be difficult because rates are higher, and some companies might refuse coverage. When you need cheap car insurance for high-risk drivers, try the following tips:

- Consider Driver Education: Most of the best high-risk auto insurance companies offer a driver’s ed car insurance discount for taking a safe or defensive driving course. As a bonus, course completion usually makes past incidents look a little better.

- Raise Your Deductible: Your deductible is the portion you must pay before your insurance kicks in. You can save money on your monthly bill by choosing a higher car insurance deductible, but you’ll have to pay more if you need to file a claim.

- Look for Discounts: Most high-risk auto insurance companies offer discounts to help drivers save money, including those specializing in high-risk coverage. Check with a representative to ensure you get every eligible car insurance discount.

- Lower Your Coverage: While having more coverage means your car is better protected, it also costs more. You can save money by purchasing the minimum amount required in your state or by your car loan or lender.

- Improve Your Credit Score: It might take longer than other options, but improving your credit score is a great way to lower your rates. When your score rises, your high-risk auto insurance rates will change at your next policy renewal date.

- Compare Quotes: Looking at as many high-risk car insurance companies as possible is integral to finding affordable car insurance for a bad driving record.

Of all the steps listed above, the most important is comparing quotes. All insurance companies charge more when you have high-risk violations on your driving record, but some are more forgiving than others.

However, it’s also important to find discounts. Check below to see available discounts from our top companies.

Finding affordable coverage after getting a high-risk designation might be more difficult, but using the tips listed above will help you find the lowest rates.

Case Studies: Best High-Risk Car Insurance

Still need help understanding high-risk auto insurance? Take a look at the case studies below to get a better idea.

- Case Study 1 – The General Insurance: John was labeled as a high-risk driver due to a history of traffic violations. After struggling to find affordable insurance options, John saw a car insurance review of The General. The General offered a policy with competitive high-risk rates. With their specialized approach to high-risk drivers, The General provided John with the coverage he needed.

- Case Study 2 – ShieldSafe Auto Insurance: Sarah, a young driver with limited experience, was categorized as high-risk due to her age and a recent at-fault accident. Sarah was worried about high premiums and didn’t understand car accidents. However, ShieldSafe Auto Insurance tailored a policy that accounted for Sarah’s history. She was able to get affordable coverage.

- Case Study 3 – TrustGuard Insurance: Michael had a DUI conviction and faced immense difficulty in finding insurance. Many companies either refused coverage or provided unaffordable rates, and he was worried if his car insurance can be canceled because of speeding tickets or a DUI. However, Michael found TrustGuard Insurance, which offered him a policy that had reasonable premiums.

- Case Study 4 – SafeRide Assurance: Emma, a driver with a history of multiple speeding tickets, was worried about how much her insurance would go up after speeding tickets. Traditional insurers viewed her as a high-risk driver, resulting in exorbitant premiums. However, Emma discovered SafeRide Assurance, which provided her with a policy that acknowledged her efforts to improve her driving habits.

As you can see, finding affordable high-risk auto insurance takes a little research, but it’s certainly not impossible.

Find the Best High-Risk Car Insurance Coverage Today

Now that you understand your car insurance policy needs as a high-risk driver, finding affordable coverage with non-standard companies can be a challenge. However, it’s not hopeless — companies like Geico and State Farm car insurance generally offer low rates regardless of your situation.

While they’re a good choice for many drivers, Geico high-risk insurance and State Farm aren’t the only options on the market. So enter your ZIP code into our free quote tool to find the most affordable car insurance policy for bad drivers.

Frequently Asked Questions

What is high-risk car insurance?

High-risk car insurance offers similar coverage as standard policies but usually costs much more. Drivers need high-risk car insurance after certain traffic violations and other factors, including low credit scores.

What is considered high risk for car insurance?

Car insurance companies consider many factors risky, but you usually don’t need high-risk car insurance. People who need high-risk car insurance include:

- Younger and older drivers with minor incidents on their driving records

- Drivers with low credit scores

- Drivers with multiple speeding tickets and other violations

- Drivers with a DUI charge

- Drivers who have multiple at-fault accidents on their record

No matter why you need car insurance for high-risk drivers, you’ll pay much higher rates until you no longer have the risky designation. How long an auto accident stays on your insurance depends on your state, but most drivers will be clear after three years.

How can you remove a high-risk driver designation?

While you can’t control every factor, keeping your driving record clean is one of the best ways to remove a high-risk auto insurance designation. You can also complete a driving education course, improve your credit score, and keep your car insurance active.

How much does high-risk insurance cost?

While rates vary by company and your unique situation, the average high-risk driver pays about $287 per month for car insurance, while low-risk drivers pay around $119. The cheapest high-risk car insurance companies are State Farm and Geico.

However, rates can vary drastically between companies. Enter your ZIP code into our free comparison tool to find the cheapest rates for you.

Where can I find cheap car insurance for high-risk drivers?

Finding affordable car insurance for high-risk drivers can be challenging, but it’s not impossible. While some companies may refuse coverage to high-risk drivers, others specialize in serving this market segment. We recommending comparing high-risk car insurance quotes from the best insurance companies for drivers with bad driving records to find the best rates.

Companies like Geico and State Farm often offer competitive car insurance rates for high-risk drivers, but exploring non-standard insurance companies and state-sponsored insurance plans can also be options to consider.

What is the best car insurance after getting a speeding ticket?

While it depends on several factors, Geico usually has the cheapest car insurance for drivers with a speeding ticket. However, you should still compare multiple free car insurance quotes before signing up for a policy.

Are there companies that specialize in high-risk auto insurance?

Several companies specialize in offering the cheapest high-risk car insurance on the market. One of the biggest is The General, where high-risk drivers are almost always approved for coverage. However, The General has higher average monthly car insurance payments because it has so many high-risk customers.

What is SR-22 insurance?

Many states require drivers to submit SR-22 forms after a serious traffic violation, like a DUI or driving without insurance. The good news is that you don’t have to do anything special to receive SR-22 car insurance quotes from most major companies.

How many accidents are considered high-risk?

There’s no set amount of accidents you can have before you’re considered a high-risk driver. In general, insurance companies will consider you a high-risk driver if you have multiple at-fault accidents in a short amount of time. Make sure to compare quotes to find the best high-risk auto insurance rates for you.

How long are you considered a high-risk driver?

Wondering how you get rid of car insurance points?

The amount of time a high-risk designation stays with you depends on a few factors. One is the nature of your high-risk designation – a DUI will stay on your record longer than a speeding ticket. Another is where you live, with some states having much harsher laws than others.

In general, though, you can expect to lose your high-risk designation after a few years as long as you avoid future violations.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.