Cheapest Wisconsin Car Insurance Rates in 2025 (Earn Savings With These 10 Companies!)

The cheapest Wisconsin car insurance rates are offered by State Farm, Geico, and American Family, with rates starting at $20 per month. These companies offer affordable, comprehensive coverage for Wisconsin drivers. Learn about state laws and coverage requirements to make informed car insurance decisions.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tonya Sisler

Insurance Content Team Lead

Tonya Sisler has been a technical insurance writer for over five years. She uses her extensive insurance and finance knowledge to write informative articles that answer readers' top questions. Her mission is to provide readers with timely, accurate information that allows them to determine their insurance needs and choose the best coverage. Tonya currently leads a team of 10 insurance copywrite...

Insurance Content Team Lead

UPDATED: Jul 26, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jul 26, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,155 reviews

18,155 reviewsCompany Facts

Min. Coverage for Wisconsin

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage for Wisconsin

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews

Company Facts

Min. Coverage for Wisconsin

A.M. Best Rating

Complaint Level

Pros & Cons

Explore the cheapest Wisconsin car insurance rates with State Farm, Geico, and American Family, offering premiums starting at $20 per month. They are known for providing comprehensive coverage tailored to drivers in Wisconsin. Explore more about Wisconsin car insurance laws to ensure you’re fully informed.

Taking the time to compare Wisconsin car insurance rates from the best car insurance companies will ensure you get the cheapest rates on your Wisconsin insurance policy. While it may be tempting to carry the bare minimum of insurance in Wisconsin, full coverage provides complete protection for you and your vehicle.

Our Top 10 Company Picks: Cheapest Wisconsin Car Insurance Rates

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $20 B Competitive Rates State Farm

#2 $21 A++ Affordable Rates Geico

#3 $22 A Multi-Policy Discounts American Family

#4 $26 A++ Financial Strength Travelers

#5 $27 A Claims Handling Safeco

#6 $30 A Customizable Policies Liberty Mutual

#7 $33 A+ Online Tools Progressive

#8 $38 A Personalized Service Farmers

#9 $43 A+ Comprehensive Coverage Allstate

#10 $80 A+ Many Discounts Nationwide

By entering your ZIP code above, you can get instant car insurance quotes from top providers.

- Full coverage options for comprehensive protection

- Compare uninsured/underinsured motorist coverage options

- State Farm offers the lowest minimum coverage rate

- Compare Wisconsin Car Insurance Rates

- Best Wausau, WI Car Insurance in 2025

- Best South Milwaukee, WI Car Insurance in 2025

- Best Port Washington, WI Car Insurance in 2025

- Best Omro, WI Car Insurance in 2025

- Best Manitowoc, WI Car Insurance in 2025

- Best Kaukauna, WI Car Insurance in 2025

- Best Janesville, WI Car Insurance in 2025

- Best Iron River, WI Car Insurance in 2025

- Best Ashland, WI Car Insurance in 2025

#1 – State Farm: Top Pick Overall

Pros

- Lowest Premiums: State Farm offers the most competitive rates in Wisconsin, with monthly premiums starting as low as $20 for minimum coverage. This makes it an ideal choice for budget-conscious drivers seeking affordable insurance.

- Wide Range of Discounts: The company provides numerous discounts such as safe driving and multi-policy discounts, helping to further lower your insurance costs. These savings contribute to its position as the cheapest option in Wisconsin. Unlock details in our State Farm car insurance review.

- Local Agent Availability: State Farm has a strong network of local agents across Wisconsin, offering personalized service and local expertise. This accessibility helps Wisconsin drivers receive tailored advice and support for their insurance needs.

Cons

- Limited Online Features: State Farm’s digital tools are less advanced compared to competitors, which can impact convenience for customers in Wisconsin who prefer managing their policies and claims online, despite its low rates.

- Potential Claims Delays: Some customers in Wisconsin report slower claims processing compared to more modern insurers, which can be a drawback if you value prompt service, even though it remains the most affordable option.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#2 – Geico: Best for Affordable Rates

Pros

- Extremely Low Premiums: Geico offers some of the lowest car insurance premiums in Wisconsin, starting at $21 per month for minimum coverage. This makes it an excellent choice for those prioritizing cost-efficiency in their car insurance.

- Advanced Online Tools: Geico’s robust online platform and mobile app facilitate easy management of policies and efficient claims processing. This digital convenience complements its low rates, making it a practical option for tech-savvy users residing in Wisconsin.

- High Customer Satisfaction: With an A++ rating from A.M. Best, Geico’s strong financial stability and high customer satisfaction ratings in reinforce its reputation as a reliable and affordable insurance provider in Wisconsin. Learn more in our Geico car insurance review.

Cons

- Impersonal Service: Geico’s direct-to-consumer model might lack the personalized service found with Wisconsin local agents, which could be a disadvantage for those who prefer face-to-face interactions despite its low premiums.

- Limited Agent Support: The reliance on digital communication may not appeal to customers in Wisconsin who value personal interaction with insurance agents, potentially affecting those seeking more hands-on customer support.

#3 – American Family: Best for Multi-Policy Discounts

Pros

- Effective Multi-Policy Discounts: As mentioned in our American Family car insurance review, American Family provides significant savings for bundling multiple policies, which can lower your overall insurance costs. With premiums starting at $22 for minimum coverage, these discounts help enhance affordability for Wisconsin drivers.

- Excellent Customer Service: Known for strong customer service through Wisconsin local agents, American Family offers personalized support and guidance, making it a valuable option for those who prioritize service alongside savings.

- Comprehensive Coverage Options: The insurer offers various coverage options beyond basic policies, ensuring that Wisconsin drivers can find affordable solutions tailored to their needs without compromising on protection.

Cons

- Higher Base Rates: Although American Family provides discounts for drivers in Wisconsin, its base rates are higher compared to direct insurers like Geico, which could offset some of the savings from multi-policy discounts.

- Limited Nationwide Availability: American Family’s coverage is not available across all states, which may limit options for customers who move or seek insurance outside Wisconsin.

#4 – Travelers: Best for Financial Strength

Pros

- Financial Strength: Travelers has strong financial stability, rated A++ by A.M. Best, ensuring they can cover claims efficiently for drivers in Wisconsin. See more details on our Travelers car insurance review.

- Strong Financial Ratings: Travelers boasts an A++ rating from A.M. Best, indicating robust financial strength and reliability for drivers in Wisconsin. This ensures that claims are handled effectively, even while offering competitive rates starting at $26 per month.

- Wide Range of Coverage Options: Travelers provides extensive coverage options including unique add-ons like gap insurance for Wisconsin drivers, which can enhance the value of its insurance packages while maintaining reasonable pricing.

Cons

- Premium Rates: Some customers in Wisconsin find their premiums to be higher than those of competitors, especially for full coverage policies.

- Discounts: The number and variety of discounts available in Wisconsin may be less extensive compared to other insurers like Geico or State Farm.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#5 – Safeco: Best for Claims Handling

Pros

- Claims Handling: Safeco is praised for its efficient and straightforward claims handling process, making it easier for Wisconsin policyholders during stressful times.

- Customizable Policies: Offers highly customizable policies that allow customers in Wisconsin to tailor their insurance to their specific needs.

- Online Tools: Strong online tools and mobile app provide ease of access for managing policies and filing claims for Wisconsin drivers. Learn more details in our Safeco car insurance review.

Cons

- Mixed Customer Satisfaction in Wisconsin: Some Wisconsin customers have reported lower satisfaction with Safeco’s overall service, which could impact the value of its affordable rates despite efficient claims handling.

- Higher Premiums for Certain Drivers in Wisconsin: Drivers with less-than-perfect records may face higher premiums with Safeco, which could affect overall affordability despite competitive base rates.

#6 – Liberty Mutual: Best for Customizable Policies

Pros

- Highly Customizable Policies in Wisconsin: Liberty Mutual offers a range of customizable insurance options and add-ons for Wisconsin drivers, allowing them to tailor their coverage while benefiting from competitive rates starting at $30 per month.

- Multiple Discount Opportunities: Liberty Mutual provides various discounts, including bundling and good driving rewards, helping Wisconsin drivers reduce their premiums and enhance affordability.

- Solid Financial Stability in Wisconsin: With an A rating from A.M. Best, Liberty Mutual’s financial stability supports dependable claim handling, making it a reliable choice for Wisconsin drivers seeking both customization and cost-effectiveness. Learn more in our Liberty Mutual car insurance review.

Cons

- Potentially Higher Premiums in Wisconsin: Liberty Mutual’s premiums might be higher compared to some other low-cost providers, which could impact overall affordability for Wisconsin drivers.

- Mixed Reviews on Claims in Wisconsin: Some customers have reported mixed experiences with Liberty Mutual’s claims handling and customer service, which could affect satisfaction despite customizable policy options.

#7 – Progressive: Best for Online Tools

Pros

- Advanced Online Tools for Wisconsin Drivers: Progressive is known for its robust online tools and mobile app, making it easy for Wisconsin residents to manage their policies and file claims. Premiums start at $33 per month.

- Innovative Savings Programs: The Snapshot program offers usage-based insurance options that can lead to significant savings based on driving habits, benefiting Wisconsin drivers who are conscientious about their driving behavior.

- Competitive Rates for Wisconsin Drivers: Progressive provides competitive premiums, particularly for those with clean driving records, offering cost-effective insurance solutions alongside its advanced digital features. Learn more in our Progressive car insurance review.

Cons

- Less Personalized Service in Wisconsin: Progressive’s digital-first approach may lack the personal touch of traditional insurers, which could be a drawback for Wisconsin drivers who value direct interactions with agents.

- Claims Processing Concerns: Some Wisconsin customers report dissatisfaction with Progressive’s less personalized claims handling, which may impact overall value despite its low rates.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#8 – Farmers: Best for Personalized Service

Pros

- Highly Personalized Service in Wisconsin: Farmers offers strong personalized service through local agents in Wisconsin, providing tailored support that enhances the value of its competitive rates starting at $38 per month.

- Comprehensive Coverage Options: The insurer provides a wide range of coverage options, including specialized policies like rideshare insurance, ensuring that Wisconsin drivers can find affordable, comprehensive solutions.

- Discount Opportunities: Farmers offers various discounts, such as multi-policy savings and safe driving rewards, helping Wisconsin drivers reduce their insurance costs while benefiting from personalized service.

Cons

- Higher Premiums: Farmers’ premiums for Wisconsin drivers can be higher than those of some direct competitors, especially for full coverage. Learn more in our Farmers car insurance review.

- Less Advanced Digital Tools for Wisconsin Drivers: Farmers’ online tools and mobile app may not be as advanced or user-friendly as those offered by digital-first insurers, potentially affecting convenience.

#9 – Allstate: Best for Comprehensive Coverage

Pros

- Extensive Coverage Options in Wisconsin: Allstate offers a broad range of coverage options and add-ons, such as accident forgiveness and new car replacement, with premiums starting at $43 per month, providing valuable comprehensive coverage for Wisconsin drivers.

- Strong Financial Stability: With an A+ rating from A.M. Best, Allstate’s financial strength ensures reliable claim handling for Wisconsin policyholders, supporting its reputation for comprehensive and dependable coverage.

- Diverse Discounts Available: The insurer provides various discounts, including safe driver and bundling discounts, which help Wisconsin drivers lower their premiums and increase affordability. Discover more about offerings in our Allstate car insurance review.

Cons

- Higher Premium Rates in Wisconsin: Allstate’s base premiums are higher compared to some competitors, which may offset the savings from discounts and impact the overall cost-effectiveness of its comprehensive coverage.

- Mixed Customer Service in Wisconsin: Some customers report mixed experiences with Allstate’s customer service and claims handling, which could affect satisfaction despite its extensive coverage options.

#10 – Nationwide: Best for Many Discounts

Pros

- Wide Range of Discounts in Wisconsin: Nationwide offers numerous discounts, including multi-policy and good student discounts, which can significantly lower premiums starting at $80 per month, enhancing overall affordability for Wisconsin drivers. Check out insurance savings in our complete Nationwide car insurance discount.

- Comprehensive Coverage Options: The insurer provides extensive coverage options and add-ons, such as roadside assistance and rental reimbursement, adding value to its insurance packages for Wisconsin drivers.

- Financial Stability: Strong financial stability with an A+ rating from A.M. Best, ensuring dependable claims processing for Wisconsin policyholders.

Cons

- Premium Costs: Some customers in Wisconsin find Nationwide’s premiums to be higher compared to other insurers, especially without applicable discounts.

- Digital Experience: For Wisconsin customers, they find the online platform and mobile app not as intuitive or feature-rich as those of competitors like Progressive or Geico.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Wisconsin Car Insurance Rates

Trying to wade through the waters of confusing laws and jargon about the hundreds of car insurance companies in Wisconsin is a tough and uncomfortable task. Mercifully, we’ve mucked our way through all the discomforting data and details, so you don’t have to. The table below compares monthly rates for minimum and full coverage car insurance for drivers in Wisconsin from various providers.

Wisconsin Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $43 $123

American Family $22 $63

Farmers $38 $109

Geico $21 $62

Liberty Mutual $30 $84

Nationwide $80 $226

Progressive $33 $94

Safeco $27 $71

State Farm $20 $58

Travelers $26 $72

We will show you all the relevant facts and figures you need to make your choice for your car insurance needs. We’ll help you understand the requirements of Wisconsin, what you may want for coverage, and where you can get it at the best rates.

Wisconsin Minimum Car Insurance Coverage

Wisconsin is a traditional, “at fault” state, meaning that the person who was at fault for causing the car accident is also responsible for any resulting harm and damages. All drivers in Wisconsin are required to carry minimum liability car insurance coverage levels of 25/50/10 to satisfy basic overage. This means that car owners must carry the following minimum levels of liability insurance:

- $25,000 for bodily injury or death per person in an accident caused by the owner of the insured vehicle

- $50,000 for total bodily injury or death per accident caused by the owner of the insured vehicle

- $10,000 for property damage per accident caused by the owner of the insured vehicle

The state of Wisconsin requires its residents to carry the following limits for uninsured/underinsured motorist (UM/UIM) coverage:

- $25,000 for Injury per Person for Both UM and UIM

- $50,000 for Injury per Accident for UM and UIM

Motorists who are unable or unwilling to provide proof of insurance at a traffic stop or after an accident may face a $10 fine, but driving without insurance at all can result in a fine of up to $500.

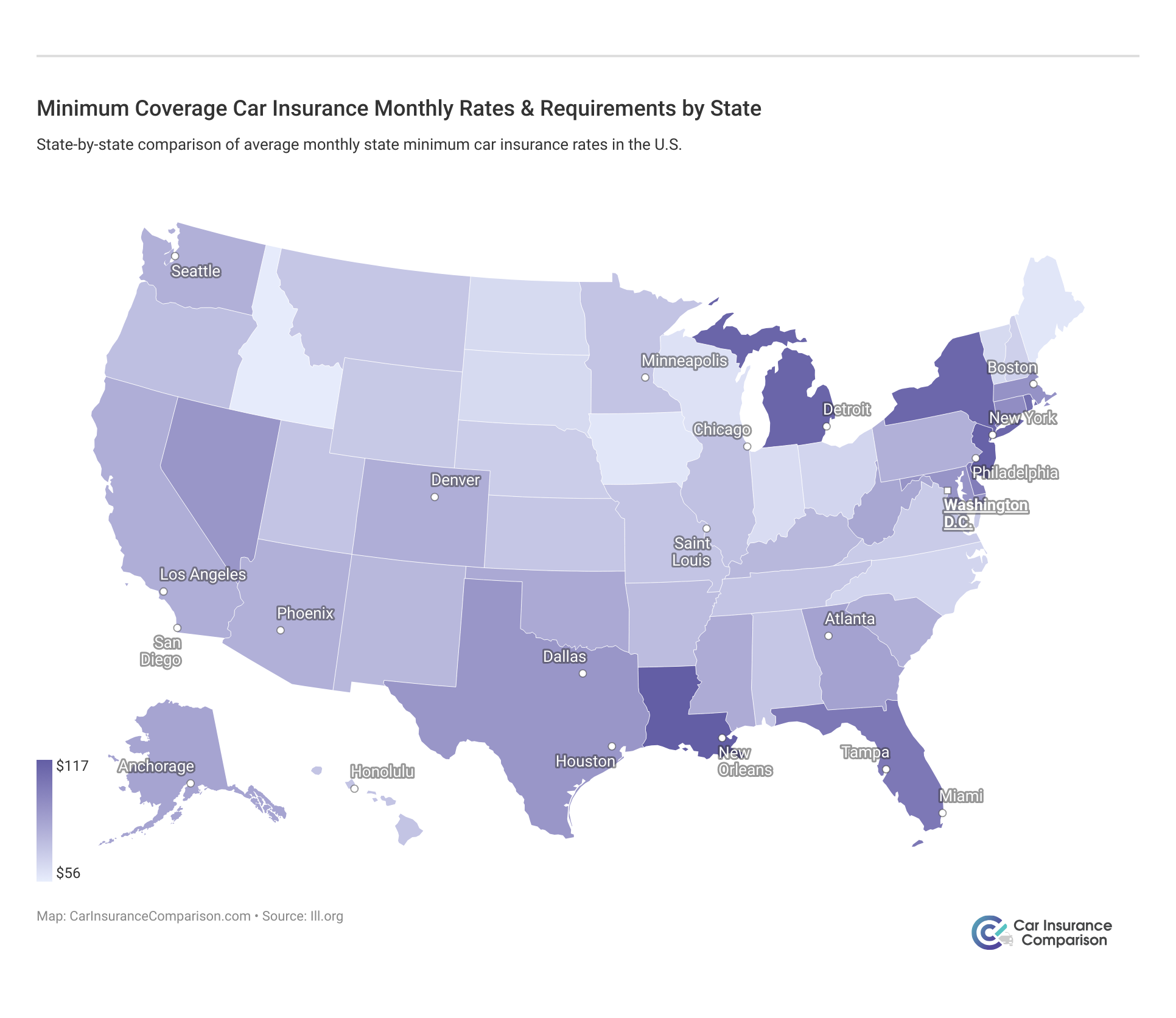

How much risk you’re willing to assume is solely up to you. You must do a cost-benefit analysis to decide whether the basic, legal minimums required by the state of Wisconsin are enough to protect your current and future assets. Know, too, that the cost for minimum coverage is unique from state to state.

Drivers that have substantial wealth to protect should purchase liability coverage with increased limits of 100/300/50.

Moving on, we will look at the amount of money that motorists in Wisconsin spend on auto insurance. The amount you will actually pay will more than likely differ from these given amounts; however, this data should serve as an informative baseline that you can use to draw conclusions about your personal circumstance.

Wisconsin Car Insurance Loss Ratios

First, let’s take a look at loss ratio and how it affects your insurance. The insurance loss ratio is the proportion of incurred losses compared to earned premiums expressed as a percentage.

A high loss ratio means that an insurance company has paid out too many claims, which will subsequently lead to a rise in future premiums for all consumers.

A high loss ratio indicates that an insurance company may need to adjust premiums to maintain financial stability and cover future claims effectively.

Michelle Robbins LICENSED INSURANCE AGENT

For example, if an auto insurer collects $100,000 of premiums in a given year and pays out $55,000 in claims, the company’s loss ratio is 55 percent ($55,000 incurred losses/$100,000 earned premiums).

Wisconsin Car Insurance Add-ons, Endorsements, Riders

According to the Insurance Information Institute, a little over 14 percent of drivers in Wisconsin (14.3 to be exact) are driving without insurance, which ranks as just the 15th highest percentage in the nation.

Pay-per-mile car insurance plans offered by companies like Metromile are growing in their popularity, unfortunately, they are not yet active in Wisconsin. Other usage-based car insurance (UBI) programs are active and available to drivers in Wisconsin.

In addition to these add-ons, there are several more optional enhancements that you can explore to decide which ones may be right for you:

- Gap Insurance

- Personal Umbrella Policy (PUP)

- Rental Car Reimbursement Coverage

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

You can read about UBI programs in our American Family KnowYourDrive review to learn about the discounts offered to drivers based on their driving habits and capabilities.

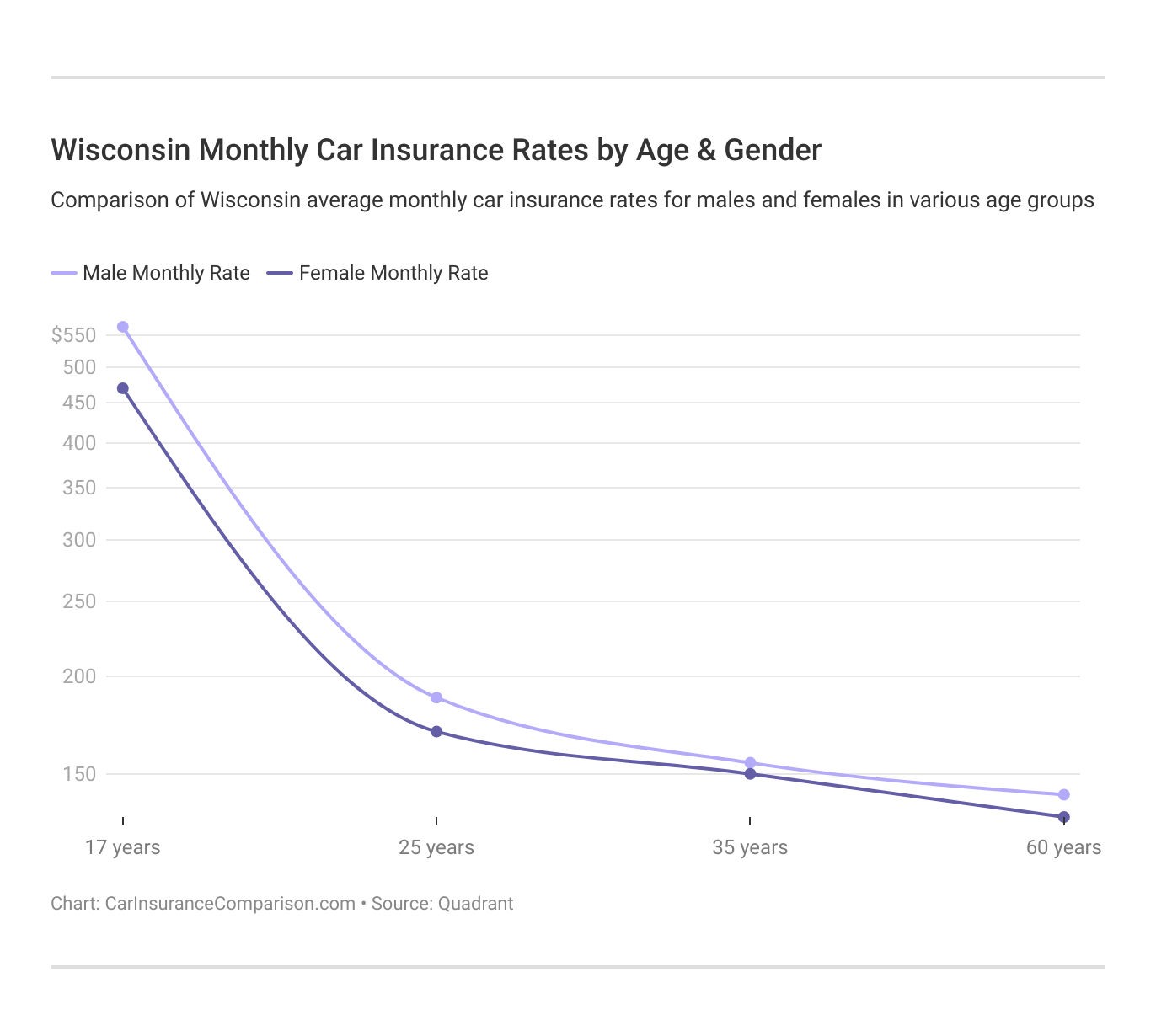

Wisconsin Car Insurance Rates by Driver Age and Gender

Let’s take a look at the table below to see which gender would enjoy the more affordable rates as drivers.

Here’s a look at the Wisconsin car insurance rates by age and gender. Find out which company offers the best deal for your situation:

Wisconsin Monthly Car Insurance Rates by Age & Gender

| Insurance Company | Age: 17 Male | Age: 17 Female | Age: 25 Male | Age: 25 Female | Age: 35 Male | Age: 35 Female | Age: 60 Male | Age: 60 Female |

|---|---|---|---|---|---|---|---|---|

| Allstate | $611 | $784 | $191 | $208 | $188 | $199 | $174 | $192 |

| AMCO | $616 | $944 | $365 | $433 | $300 | $315 | $248 | $262 |

| American Family | $237 | $261 | $95 | $101 | $80 | $84 | $76 | $76 |

| Artisan and Truckers | $558 | $629 | $176 | $191 | $147 | $140 | $120 | $125 |

| Geico | $358 | $386 | $100 | $103 | $108 | $119 | $112 | $128 |

| Mid-Century | $755 | $782 | $181 | $190 | $160 | $160 | $141 | $150 |

| Safeco | $499 | $560 | $157 | $170 | $148 | $161 | $119 | $136 |

| State Farm | $319 | $404 | $126 | $144 | $112 | $112 | $100 | $100 |

| USAA | $281 | $325 | $142 | $156 | $110 | $109 | $99 | $101 |

Car insurance for young male drivers is typically the most. For example, a married 35-year-old male in Wisconsin will pay $140 monthly on his premiums with Geico compared to $375 with AMCO.

Wisconsin Car Insurance Rates by ZIP Code

Here are charts with the average monthly premiums in Wisconsin broken down by zip code for each insurance carrier:

Are you more likely to get higher car insurance premiums in Madison or Milwaukee? Do the residents of Green Bay enjoy lower premiums than citizens in Appleton? To answer these questions, we need to take a look at the table above for the most expensive ZIP codes in Wisconsin.

Best Wisconsin Car Insurance Companies

The late, great Packers QB Bart Starr was a class act on and off the field. His reputation as a leader on the gridiron and as a mentor in the community is above reproach. Unfortunately, we all can’t be Bart Starr. And very few people on the planet, never mind a car company, can boast a public reputation as stellar as Bryan Bartlett Starr.

The public perception of a car insurance company can be a leading indicator of the kind of rates and service it provides to its consumers. We’ll show how the top companies in Wisconsin rate in the areas of financial stability and customer satisfaction.

Wisconsin Car Insurance Company Financial Ratings

AM Best is a credit rating agency. It evaluates insurance companies and grades them based on their financial stability.

A.M. Best Financial Strength Ratings From the Top Wisconsin Car Insurance Providers

| Insurance Company | A.M. Best |

|---|---|

| Allstate | A |

| CSAA | A |

| Geico | A++ |

| Liberty Mutual | A- |

| Nationwide | A+ |

| Progressive | A+ |

| State Farm | B |

| The Hartford | A+ |

| Travelers | A+ |

| USAA | A++ |

The table above shows the ten largest insurance companies in Wisconsin as measured by direct premiums written with their AM Best rating.

Wisconsin Car Insurance Companies Complaints

Some relationships start out with the best intentions, but they slowly begin to waste away or drift apart under the pressures that life throws their way. Other relationships feature unlikely unions of disparate parts that, at first glance, would threaten to produce a monstrous disaster; yet, instead, that unexpected grouping results in something extraordinary that will stand the test of time.

Whatever the initial status of the relationship may have been, when the consumer’s experience with an insurance company has transformed into a dark, twisted fantasy of a nightmare, he or she can file a complaint. Those complaints, justified or not, contribute to a company’s complaint ratios.

Read More: Car Insurance Companies With the Worst Customer Satisfaction

The complaint ratio is how many complaints a company receives per one million dollars of business written. The Wisconsin Office of the Commissioner of Insurance will respond to each complaint in the order in which it was received.

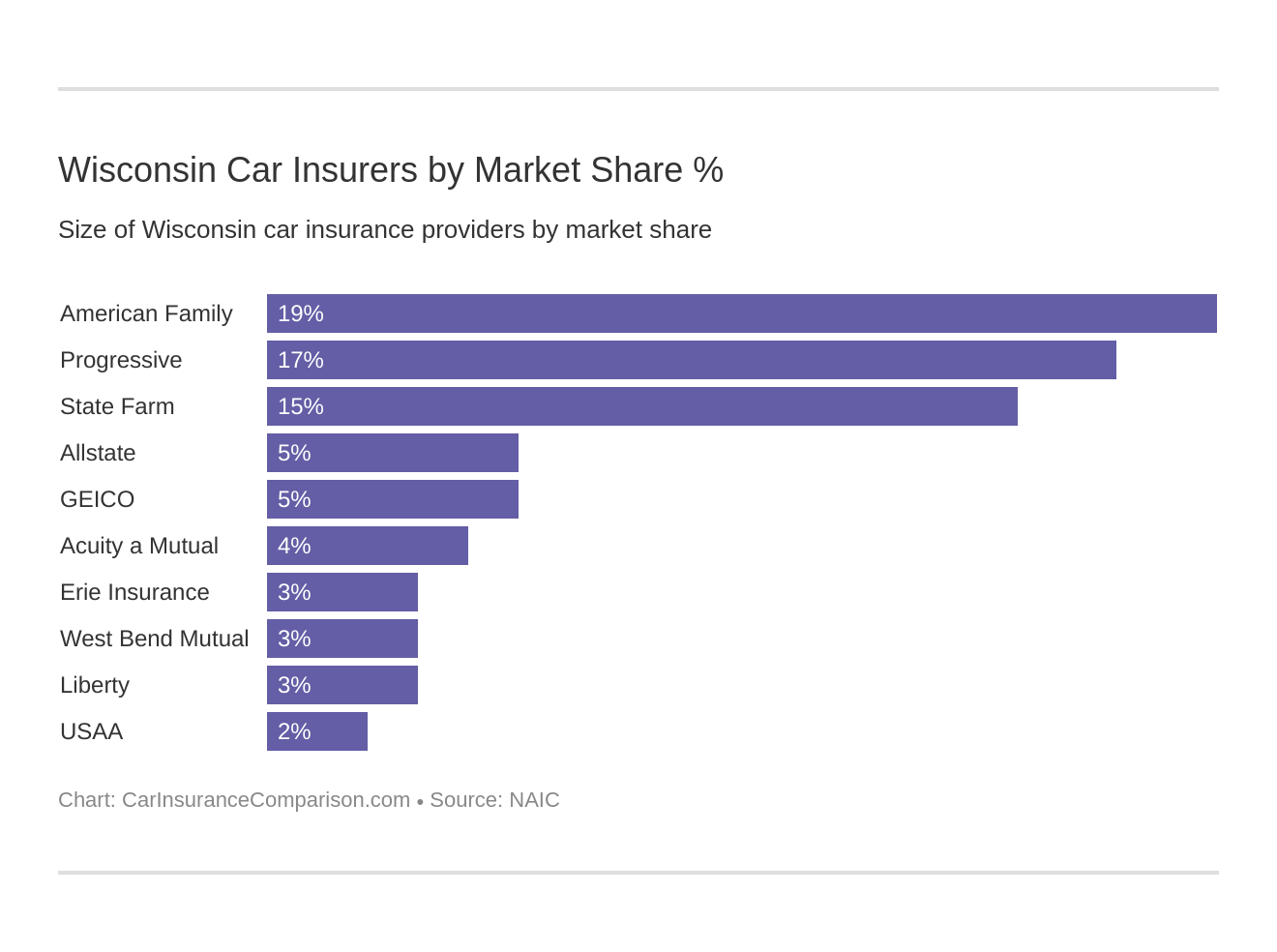

Largest Car Insurance Companies in Wisconsin by Market Share

The car insurance market share in Wisconsin is dominated by several key providers. Understanding the distribution of market share among these companies can give insight into the competitive landscape. Here is the breakdown of the largest car insurance companies in Wisconsin by market share:

Knowing the market share of the top car insurance companies in Wisconsin helps consumers and businesses understand the competitive dynamics and make informed decisions when choosing an insurance provider. This data is essential for both market analysis and personal decision-making.

Wisconsin Car Insurance Rates by Carrier and Commute

Here’s a comparison of monthly rates by carrier for different commute distances:

The cost of car insurance in Wisconsin can vary depending on the insurance provider and the length of your daily commute.

Understanding how commute distances affect insurance rates can help you choose the best provider and policy for your needs. This comparison allows you to make an informed decision based on your specific driving habits and commute length.

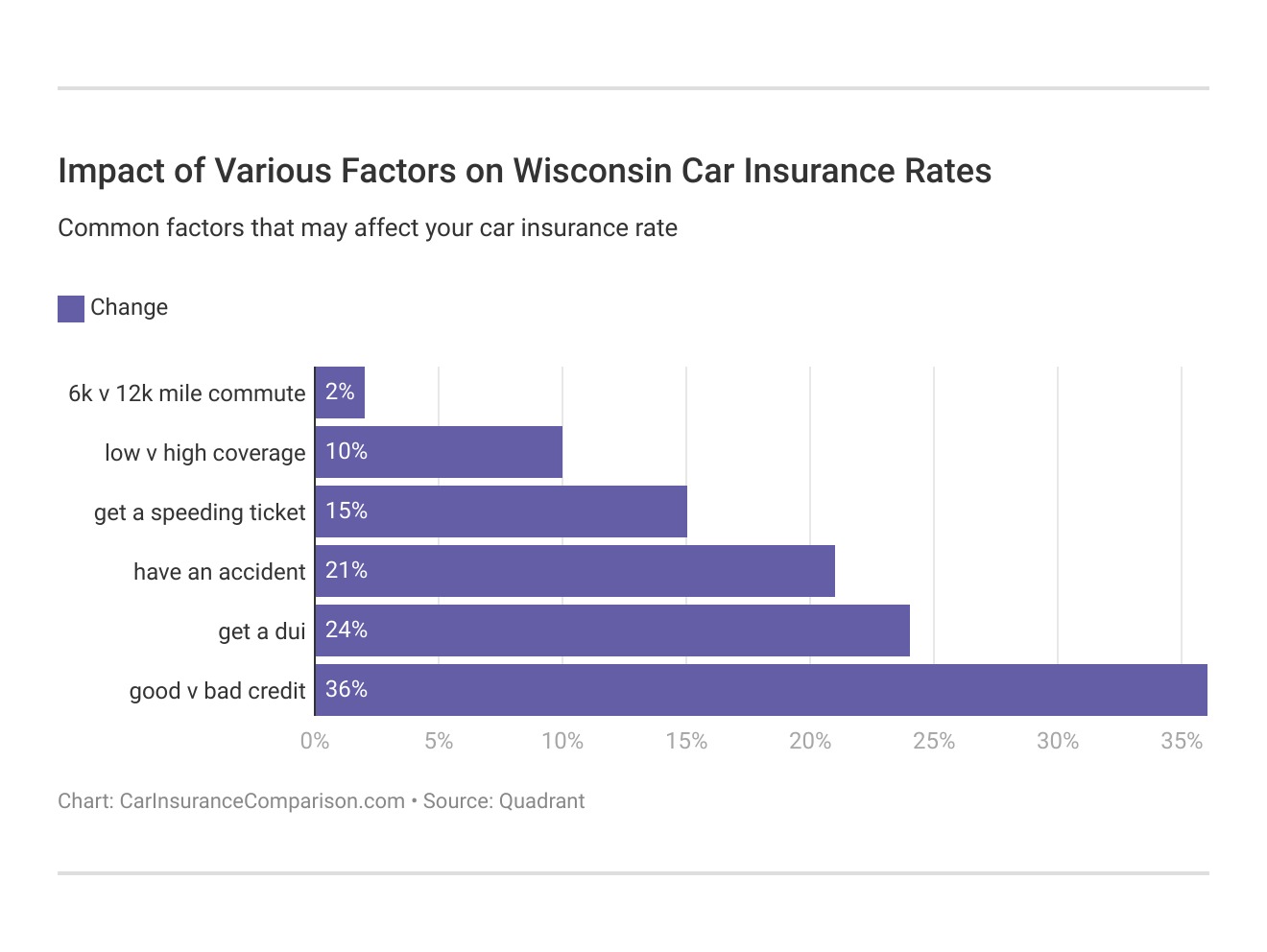

Wisconsin Car Insurance Rates by Carrier and Demographic

Be sure to make all your dreams of saving money on your car insurance premiums come true by doing it your way, based on your own situation and nobody else’s.

Note: The company you choose should provide the best quality coverage based on your specific needs.

Compare and contrast rates from multiple car insurance companies to make sure you're getting the best deal on your auto insurance.

Michelle Robbins LICENSED INSURANCE AGENT

Another way to keep your premiums low is to maintain a spotless driving record. Knowing the traffic laws and following them will help your record to stay as clean as possible. We’ll review the laws of the land in Wisconsin to help you keep your driving record impressive. High-risk car insurance comes with a high price.

How Much Auto Insurance Costs in Wisconsin

Explore car insurance costs in Wisconsin cities like Ashland, Janesville, Kaukauna, Manitowoc, Omro, Port Washington, South Milwaukee, Wausau, and Iron River.

Wisconsin Car Insurance Cost by City

This city wise analysis offers insights into factors shaping car insurance rates, empowering you to make informed decisions about coverage based on your specific location in the Badger State.

Wisconsin Car Insurance Laws

Thumbing through page after page of all the state traffic statutes would be hardly the best use of your time. We’ve compiled the most relevant rules and regulations for you to know when driving in Wisconsin.

Wisconsin Car Insurance Laws

State insurance commissioners are afforded lots of leeway and authority to administer laws and regulations on the auto insurance industry in their respective commonwealths. Each state determines the type of tort law and threshold (if any) that applies in the state, the type and amount of liability insurance required, and the system used for approval of insurer rates and forms.

Wisconsin's insurance regulations, overseen by its commissioner, ensure fairness and compliance with national standards.

Scott W. Johnson LICENSED INSURANCE AGENT

Insurance companies in Wisconsin are subject to the regulations set by that state’s insurance commissioner. Ultimately, all rates and regulations must meet the fair competition standards set by the National Association of Insurance Commissioners (NAIC).

Wisconsin High-Risk Car Insurance

If you are the owner of an uninsured vehicle and had only your registration privileges withdrawn under the safety responsibility law, you are required to carry SR-22 car insurance for all vehicles owned by you.

Wisconsin Car Insurance Windshield Coverage

Wisconsin law places no specific requirements on insurance companies to provide broken windshield car insurance; however, the companies can choose to offer such protection along with their comprehensive car insurance coverage.

The insurance companies can choose aftermarket parts for the windshield if the parts are at least equal in like, kind, and quality in terms of fit, quality, and performance. The insurer has the right to select the repair vendor. The customer has the right to choose the repair vendor but may have to pay the difference in the quote.

Car Insurance Fraud in Wisconsin

Insurance fraud is the second-largest economic crime in America. Premium rates are raised dramatically by insurance companies and passed on to consumers in attempts to combat fraud. There are two classifications of fraud: hard and soft.

- Hard Fraud: A purposefully fabricated claim or accident

- Soft Fraud: A misrepresentation of information to the insurance company

Soft fraud is more common than hard fraud. Twenty to 40 percent of consumers admitted to lying to their insurer about one of the following:

- Number of annual miles driven

- Number of drivers in the household

- How the vehicle would be used

Insurance fraud is a crime no matter how you slice it. Even the “little, white lie” you tell to get a lower rate can lead to harmful consequences. That kind of willful misrepresentation of facts is called known as “rate evasion” and is a $16 billion annual expense to auto insurers. If you suspect insurance fraud or have been the victim of fraud, you can contact the Wisconsin Department of Health Services.

Statute of Limitations for Wisconsin Car Insurance

Wisconsin’s statute of limitations for filing a claim is three years for both personal injury and property damage.

Wisconsin Car Insurance Vehicle Licensing Laws

Wisconsin’s DMV, which is a division of the Department of Transportation (WisDOT), has an online portal where residents can perform tasks such as renewing their registrations and driver’s licenses, updating or changing their addresses, and retrieving their driving history.

Wisconsin Car Insurance Proof of Financial Responsibility

Wisconsin’s statutes regarding Proof of Financial Responsibility, which can be found on the Wisconsin Department of Transportation website, require all drivers to show proof of financial responsibility whenever requested by a law enforcement officer. Failure to provide such proof may result in a citation or fine.

Teen Driver Laws in Wisconsin

In Wisconsin, driver’s education is required for permit applicants younger than 18. During the learner’s stage, permit holders may carry three passengers if supervised by a driving instructor in a dual-control vehicle. Permit holders 16 and older may carry one passenger 25 or older who has been licensed for at least two years. Driver’s education is mandatory for all license applicants under the age of 18 in the Badger State.

Wisconsin Teen Driver License Laws

| License Type | Minimum Age | Mandatory Holding Period | Required Supervised Driving | Time Restrictions | Nighttime Restrictions | Passenger Restrictions |

|---|---|---|---|---|---|---|

| Instructional Permit (Class D) | 15 years, 6 months | 6 months | 30 hours, 10 at night | Midnight to 5 a.m. | 9 months or until age 18 | 9 months or until age 18, no more than one passenger except immediate family |

| Probationary License | 16 | 9 months or until age 18 | 30 hours, 10 at night (if under 18) | Midnight to 5 a.m. (if under 18) | 9 months or until age 18 | 9 months or until age 18, no more than one passenger except immediate family (if under 18) |

The safety of teenage drivers is a top priority of the Wisconsin DOT. The Department of Transportation has curated a handful of additional resources and information to assist teenage drivers and their families.

Driver License Renewal in Wisconsin

The state of Wisconsin practices equal opportunity when it comes to its license renewal procedures. All drivers must renew every eight years. Drivers of all ages must show proof of adequate vision at every renewal. And no renewals are yet eligible to be done online or through the mail.

New Resident Licensing in Wisconsin

New Wisconsin residents with an out-of-state driver’s license or nondriver license have 60 days to register for a Wisconsin license and must provide the following documents:

- Proof of name and date of birth

- Proof of identity

- Proof of citizenship or legal status in the U.S.

- Proof of Wisconsin residency

- Proof of Social Security Number

For additional information regarding new resident licensing and registration, visit this webpage.

REAL ID in Wisconsin

Wisconsin is in full compliance with the REAL ID Act passed by Congress and enforced by Homeland Security. This means that a driver’s license or state ID issued by the Badger State is an acceptable form of identification at federal facilities, airports, and nuclear power plants.

As of October 1, 2020, anyone wishing to fly on a commercial flight or enter a federal facility must have a REAL ID-compliant form of identification.

Penalties for Driving Without Car Insurance in Wisconsin

The Department of Transportation makes the rules in Wisconsin. Your job is to make sure you follow those rules or face serious consequences.

You can be caught one of three ways for driving without insurance in Wisconsin. The first way is through your lender. They check your insurance policy regularly to ensure you have one. If you don’t, they send you a notice requiring immediate action or they issue a policy for you.

You can also be caught driving without insurance if you’re pulled over for any reason or involved in a car accident. If either of these things occurs, you’re facing serious penalties.

If you are caught driving without insurance, you’re forced to pay up to $510 in fines.

Your license and registration are then suspended until you buy insurance and prove you have a policy. Once you do this, you can pay a $60 fee to reinstate your license with the state. You are then required to prove you have a valid insurance policy every month for three years. If you are caught driving without insurance because you are involved in an accident, the penalties are worse.

- The fines are the same

- You’re also required to pay for repairs to your car

- You have to cover your medical bills

- You could become the victim of a lawsuit if the other driver chooses to sue

- Your license and registration are suspended for up to three years

If this happens, you don’t get to purchase insurance and then reinstate your license at your own pace. You must purchase insurance and prove it monthly for three years, but you must also wait out the terms of your suspension. Once your suspension is lifted, you may reinstate your license and registration for $110.

Wisconsin Rules of the Road

Wisconsinites are known as polite motorists, but that doesn’t necessarily mean that driving through the Badger State is without its share of hazards. Whether you’re driving in perfect conditions or trying to drive safely in bad weather, here’s what you need to know about the traffic laws in Wisconsin.

Wisconsin Keep Right and Move Over Laws

Wisconsin law requires drivers to keep right if driving slower than the average speed of traffic around you unless passing or turning left.

WisDOT created a handy brochure to help Wisconsin residents better understand its “Move Over” Law.

Wisconsin Speed Limits

Wisconsin has specific speed limits for different types of roadways to promote safe driving. Here are the designated speed limits for various road types in the state:

Wisconsin Speed Limits

| Roadway Type | Speed Limit |

|---|---|

| Rural Interstates | 70 mph |

| Urban Interstates | 70 mph |

| Other Limited Access Roads | 70 mph |

| Other Roads | 55 mph |

Always be mindful of the speed limits to ensure a safe driving experience for yourself and others on Wisconsin roads.

Wisconsin Seat Belt Laws

Seat belt laws require the driver and all front-seat passengers aged 8 and older to wear a seat belt.

Read More: Do seat belt laws impact my car insurance?

Wisconsin Car Seat Laws

Children younger than one-year-old and all children who weigh less than 20 pounds are required to be in a rear-facing car seat. Children ages 1-3 years old who weigh at least 20 pounds but less than 40 pounds must be in either a rear-facing or a forward-facing car seat.

Children who are between the ages of 4-7 who both weigh at least 40 pounds but less than 80 pounds and who are less than 57 inches tall are required to be in a forward-facing car seat or booster seat.

Wisconsin Pickup Trucks and Cargo Area

Wisconsin law prohibits or puts restrictions on riding in the cargo areas of a truck with the following exceptions: farm operations, parades, deer hunting; employees, and people riding in truck bodies in spaces intended for merchandise.

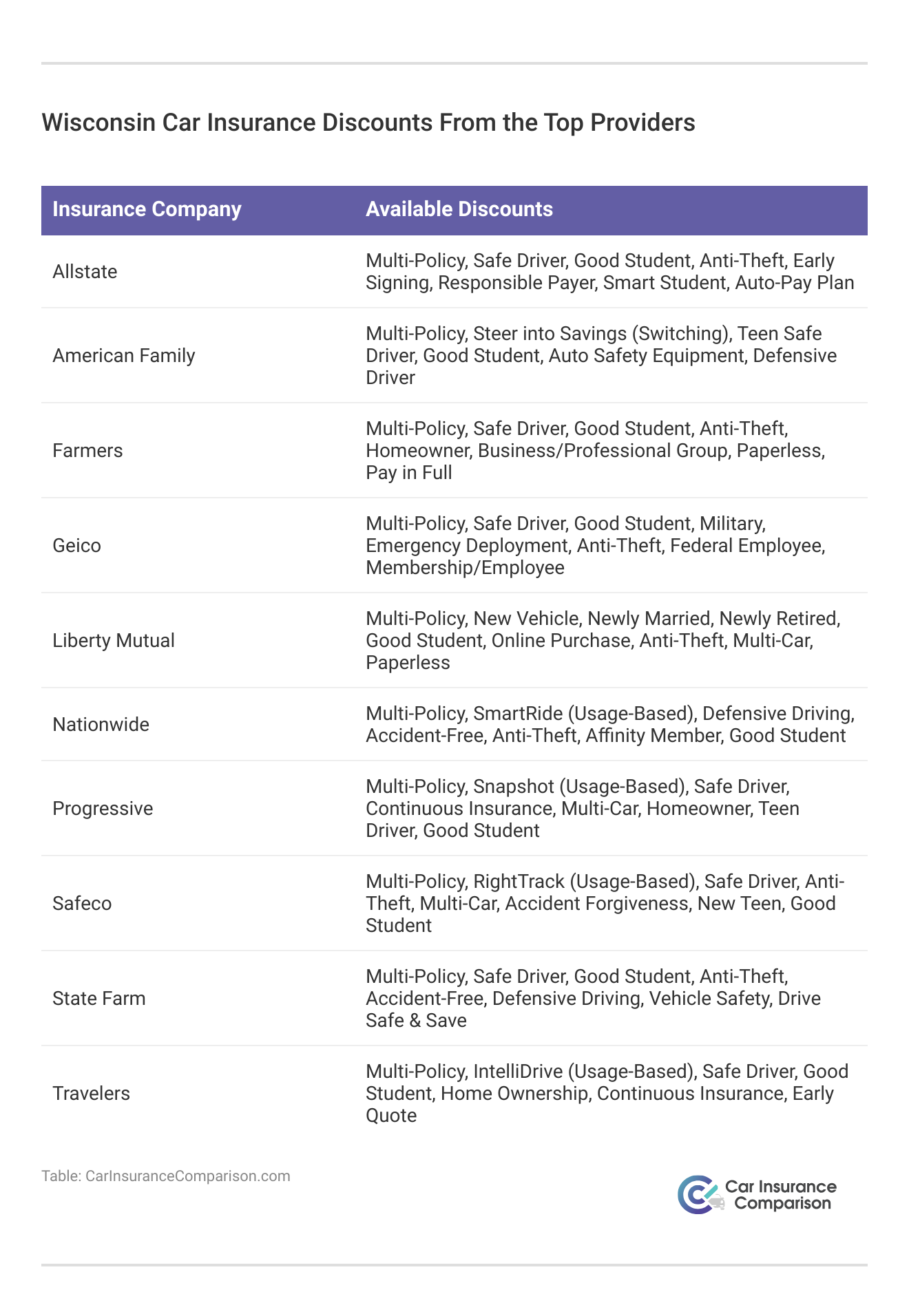

Discounts offered by car insurance providers in Wisconsin help drivers lower their premiums, making coverage more affordable and accessible.

Wisconsin Safety Laws

Promoting safety and preventing chaos are the ultimate goals of any traffic laws. The Wisconsin Department of Transportation (WisDOT) has developed resources and initiatives in the hopes of reducing roadway fatalities and injuries.

Also, WisDOT’s Traffic Safety division has developed resources such as training videos and mobile apps and initiatives such as “The Power of Zero” to promote traffic safety and stem the tide of vehicular fatalities in the state. The Badger State has produced its Strategic Highway Safety Plan in accordance with the National Highway Traffic Saftey Administration (NHTSA).

Wisconsin DUI Laws

The Blood-Alcohol Content (BAC) limit in Wisconsin is 0.08 percent; the High BAC limit is between 0.17 percent and above. The OWI (Operating While Impaired) penalties in the state of Wisconsin can be found in the underneath table.

Wisconsin DUI Penalties

| OWI in Wisconsin | 1st Offense | 2nd Offense | 3rd Offense | 4th Offense | 5th Offense |

|---|---|---|---|---|---|

| Jail | NA; Unless passenger under 16 in vehicle: Five days to Six months | Up to Six months | 45 days to Two years; Possible felony charges | Class H felony; 60 days to Six years | Class G felony; Six months to 10 years |

| Fines and Penalties | $150 to $300 | $150 to $1,100 | $600 to $2,000 | $600 to $10,000 | $600 to $25,000 |

| License Suspension | Up to Nine months | 12 to 18 months | 24 to 36 months | 24 to 36 months | 24 to 36 months |

| IID** Required | Yes for High BAC; Six points on license | Yes; alcohol assement required; Six points on license | Yes; alcohol assement required; Six points on license | Required for One to Three Years | Required for One to Three Years |

Being convicted of a DUI in Wisconsin has serious consequences. The difficulty of getting car insurance after a DUI is one such consequence. The lesson here is simple: don’t drink and drive.

Wisconsin Drug-Impaired Driving Laws

At present, Wisconsin has a zero-tolerance policy for THC only.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Wisconsin Can’t-Miss Car Insurance Facts

Here are some fascinating trinkets of knowledge about Wisconsin, the Badger State.

Vehicle Theft in Wisconsin

Home is where the heart is, but it’s also where most auto thefts take place. Here is the chart of the top stolen vehicles in the state of Wisconsin.

Top 10 Wisconsin Car Thefts by Model

| Make & Model | Year | Total Thefts |

|---|---|---|

| Ford F-150 | 2019 | 125 |

| Hyundai Elantra | 2020 | 120 |

| Chevrolet Silverado 1500 | 2018 | 115 |

| Honda Civic | 2018 | 110 |

| Kia Optima | 2019 | 105 |

| Toyota Corolla | 2017 | 100 |

| Hyundai Sonata | 2020 | 95 |

| GMC Pickup (Full Size) | 2018 | 90 |

| Honda Accord | 2017 | 85 |

| Dodge Pickup (Full Size) | 2001 | 80 |

As you can see, motor vehicles manufactured in either the United States or Japan are the prime targets for larceny in the state of Wisconsin.

Wisconsin Vehicle Theft by City

The table below provides a breakdown of the top cities for auto theft within the state of Wisconsin. Knowing which areas have higher rates of vehicle theft can help residents and visitors take extra precautions when parking their cars.

Top 10 Wisconsin Car Thefts by City

| City | Total |

|---|---|

| Madison | 253 |

| Superior | 100 |

| Green Bay | 98 |

| Racine | 95 |

| West Allis | 92 |

| Kenosha | 73 |

| Eau Claire | 48 |

| Wauwatosa | 47 |

| Beloit | 45 |

| La Crosse | 43 |

Understanding the distribution of vehicle thefts by city in Wisconsin helps identify high-risk areas and encourages community efforts to enhance security. Being aware of these statistics can prompt both residents and policymakers to take action in reducing auto theft rates across the state.

Read More: 15 States with the Highest Vehicle Theft Rates

Wisconsin Risky and Harmful Behavior

Below is a harrowing statistics of all driving-related fatalities in Wisconsin.

Wisconsin Fatality by Speeding and OWI

Speeding and operating while intoxicated (OWI) are significant causes of traffic fatalities. The following table presents the number of fatalities in Wisconsin due to these causes:

Wisconsin Traffic Fatalities by Crash Type

| Type | Total |

|---|---|

| Speeding | 180 |

| DUI-related | 190 |

This data underscores the critical need for continued efforts in combating speeding and impaired driving. By understanding these trends, policymakers and law enforcement can develop more effective strategies to reduce fatalities and improve road safety in Wisconsin.

Wisconsin Fatal Crashes by County (Five-Year Trend)

Analyzing traffic fatalities by county helps identify regions with higher risks and fatalities. Here is a five-year trend of fatal crashes in the top 10 counties in Wisconsin:

Wisconsin Car Crash Fatalities by County

| County Name | Total Fatalities (2021) | Total Fatalities (2022) | Total Fatalities (2023) |

|---|---|---|---|

| Brown County | 15 | 18 | 25 |

| Dane County | 30 | 38 | 32 |

| Dodge County | 11 | 12 | 20 |

| Kenosha County | 6 | 18 | 18 |

| Marathon County | 15 | 9 | 15 |

| Milwaukee County | 81 | 74 | 86 |

| Outagamie County | 13 | 14 | 20 |

| Shawano County | 6 | 8 | 16 |

| Walworth County | 14 | 24 | 21 |

| Waukesha County | 10 | 27 | 26 |

Understanding county-specific fatality trends is vital for implementing targeted road safety measures. This information assists local authorities in prioritizing their efforts to reduce fatalities and enhance traffic safety in these high-risk areas.

Wisconsin Fatality Rates Rural vs. Urban

The type of roadway—rural or urban—can impact the frequency and severity of traffic fatalities. Here’s a comparison of traffic fatalities on rural and urban roadways in Wisconsin:

Wisconsin Traffic Fatalities by Area Type

| Type | Total |

|---|---|

| Rural | 126 |

| Urban | 61 |

Recognizing the differences in fatality rates between rural and urban areas can help in tailoring safety initiatives and resource allocation to address the unique challenges of each environment, thereby improving overall traffic safety.

Wisconsin Fatalities by Person Type

Different types of road users face varying levels of risk in traffic incidents. The table below shows the number of traffic fatalities in Wisconsin by person type:

Wisconsin Traffic Fatalities by Person Type

| Type | Total |

|---|---|

| Bicyclist and Other Cyclist | 7 |

| Motorcyclist | 77 |

| Passenger Vehicle Occupant | 437 |

| Pedestrian | 56 |

This breakdown of fatalities by person type highlights the importance of tailored safety measures for different groups of road users. It provides valuable insights for developing targeted interventions to protect the most vulnerable and reduce overall traffic fatalities in Wisconsin.

Wisconsin Transportation

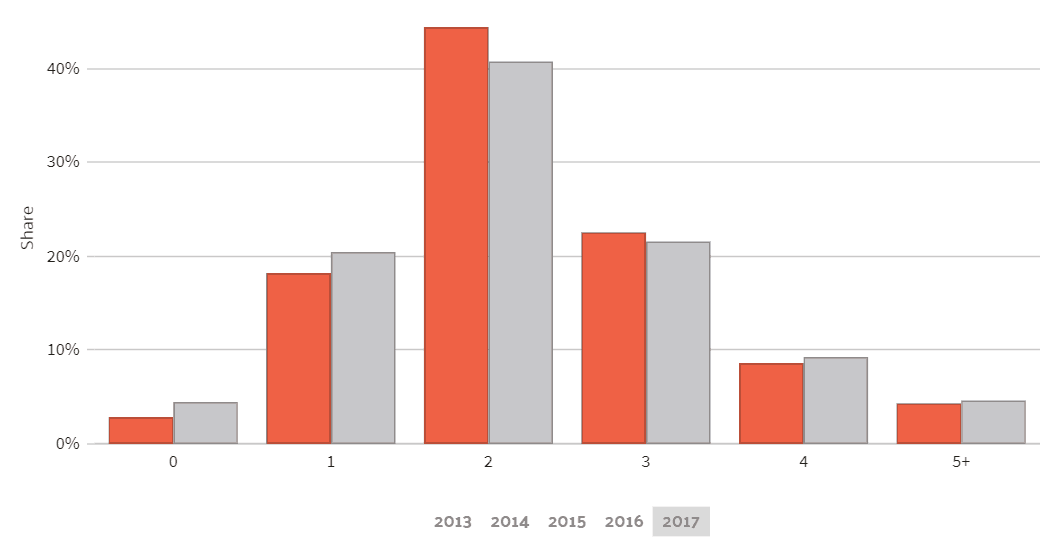

Here is a chart of the details car ownership stats in Wisconsin.

Wisconsin Car Ownership

The number of vehicles owned by households can influence commuting patterns and transportation choices. The following chart illustrates the share of households with varying numbers of vehicles and how this has changed over the years:

Understanding the distribution of vehicle ownership helps in planning for transportation needs and infrastructure development. These trends provide insights into how vehicle ownership affects commute times and transportation preferences.

Wisconsin Commute Time

At 21.1 minutes, drivers in Wisconsin have significantly less commute time than the national average of 25.3 minutes. Only 1.62 percent of drivers in Wisconsin experience a “super commute” of 90 minutes or more. According to Inrix, Milwaukee is the 37th most congested city in the United States and ranks 171st in the world. Drivers in Madison spent 61 hours in congested traffic in 2018.

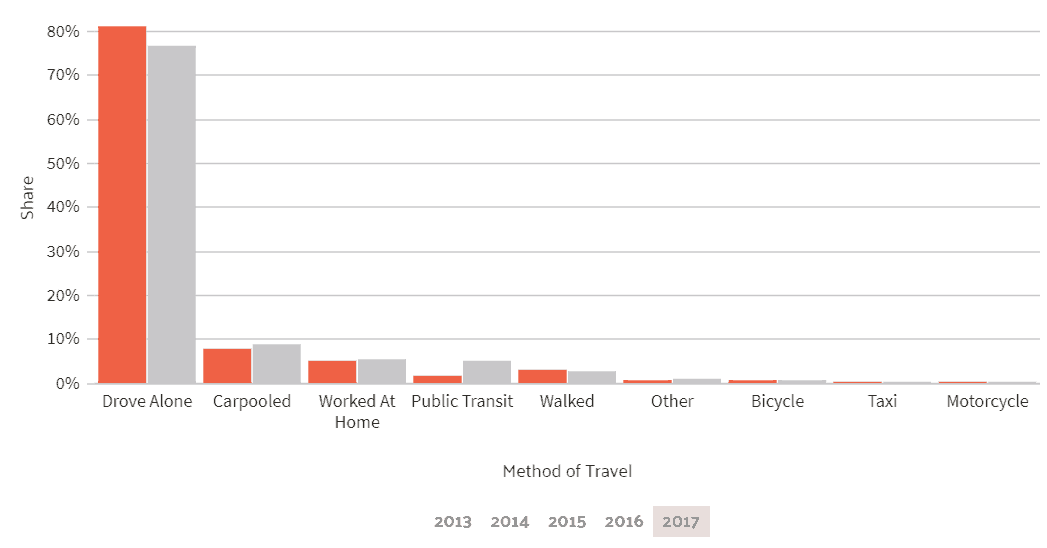

Wisconsin Commuter Transportation

Commuting methods vary widely among workers, reflecting the availability and convenience of different transportation options. The chart below shows the share of different commuting methods used by workers:

Examining the methods of travel to work highlights the reliance on different transportation modes and can guide improvements in public transit and infrastructure. These insights are valuable for enhancing the commuting experience and reducing traffic congestion.

You are now fully caught up on all the relevant stats and statutes concerning auto insurance in the state of Wisconsin.

Now that you know how to compare Wisconsin car insurance rates, enter your ZIP code to get started on finding affordable Wisconsin car insurance.

Frequently Asked Questions

What are the average car insurance rates in Wisconsin?

The average car insurance rates in Wisconsin are $61/month.

What are the minimum coverage requirements for car insurance in Wisconsin?

Wisconsin requires a minimum of 25/50/10 for bodily injury and property damage coverage, uninsured motorist coverage, and MedPay coverage.

Read More: Compare Uninsured/Underinsured Motorist (UM/UIM) Coverage

Do I need to have car insurance in Wisconsin?

Yes, car insurance is mandatory in Wisconsin. See how much you’ll pay for car insurance by entering your ZIP code below into our free comparison tool.

What is the penalty for driving without insurance in Wisconsin?

Motorists who are unable or unwilling to provide proof of insurance at a traffic stop or after an accident may face a $10 fine. Driving without insurance at all can result in a fine of up to $500.

How can I compare car insurance rates in Wisconsin?

To compare car insurance rates in Wisconsin, you can use a free car insurance comparison tool by entering your ZIP code. The more quotes you compare, the more chances you have to save.

What types of coverage are recommended for Wisconsin drivers?

Beyond the state’s minimum requirements, Wisconsin drivers should consider adding comprehensive and collision coverage. Comprehensive covers non-collision damages like theft or weather-related issues, while collision covers repairs from accidents. These additions offer more complete protection for your vehicle.

What is the cheapest car insurance company in Wisconsin?

Some companies that are cheaper include State Farm, Geico, and USAA.

What are the best car insurance rates in Wisconsin?

Some companies that have the best Wisconsin car insurance rates are USAA, Geico, and State Farm. Finding affordable car insurance doesn’t have to be a challenge. Enter your ZIP code below into our free comparison tool to find the lowest prices in your area.

Is car insurance in Wisconsin expensive?

Wisconsin auto insurance rates are usually affordable, as the average rate for a full coverage insurance policy is only $101 per month.

Is Wisconsin a no-fault car insurance state?

Wisconsin is an at-fault auto insurance state. Read More: Compare No-Fault Car Insurance

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Tonya Sisler

Insurance Content Team Lead

Tonya Sisler has been a technical insurance writer for over five years. She uses her extensive insurance and finance knowledge to write informative articles that answer readers' top questions. Her mission is to provide readers with timely, accurate information that allows them to determine their insurance needs and choose the best coverage. Tonya currently leads a team of 10 insurance copywrite...

Insurance Content Team Lead

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.