10 Best Usage-Based Car Insurance Companies [2025]

Progressive, Allstate, and Farmers are among the best usage-based car insurance companies that utilize telematics and offer 30% of potential savings on your monthly premiums. On average, Progressive's rates hover around $105 per month, providing an affordable option for drivers.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

UPDATED: Feb 18, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Feb 18, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Avg. Monthly Rate for Good Driver

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Avg. Monthly Rate for Good Driver

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Avg. Monthly Rate for Good Driver

A.M. Best Rating

Complaint Level

Pros & Cons

Adopt a personalized approach to coverage rewarding safe driving and ensuring essential protection. Understanding these policy benefits is crucial for drivers seeking savings and comprehensive coverage as demand grows. That’s why we’ve created this guide for you.

Our Top 10 Picks: Best Usage-Based Car Insurance Companies

Company Rank Usage-Based Discount A.M. Best Best For Jump to Pros/Cons

#1 30% A+ Safe Drivers Progressive

#2 40% A+ Telematics Users Allstate

#3 30% A Personalized Service Farmers

#4 40% A+ Discount Seekers Nationwide

#5 30% A Comprehensive Coverage Liberty Mutual

#6 30% A Budget Drivers Safeco

#7 30% A++ Traditional Policies State Farm

#8 25% A++ Online Users Geico

#9 30% A Family Coverage American Family

#10 30% A++ Customer Service Travelers

These industry leaders offer customized rates tailored to individual driving behaviors through innovative programs like Snapshot, Drivewise, and Signal, making them pioneers in usage-based insurance.

Explore personalized rates from industry leaders like Progressive, Allstate, and Farmers, tailored to your driving habits and needs by entering your ZIP code.

- Explore leading UBI policies offered by top car insurance companies

- Tailored coverage and low rates with top-tier UBI plans from renowned insurers

- Progressive is our top-tier UBI leveraging advanced telematics technology

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – Progressive: Top Overall Pick

Pros:

- Personalized Rates: Offers personalized pricing reflecting unique driving behaviors, ensuring competitive rates Progressive car insurance reviews.

- Variety of Discounts: Provides numerous discounts, including for safe driving and multi-policy bundling.

- Tailored Coverage Solutions: Offers different types of coverage that fit individual preferences.

Cons:

- Geographic Availability: Might not be available everywhere because of rules, how the market works, or choices made by the company.

- Affordability: May not be the lowest for all driver due to factors like individual driving history, vehicle type, and coverage options selected.

#2 – Allstate: Best for Telematics Users

Pros:

- Safe Driving Rewards: The Drivewise program uses telematics technology to monitor driving habits, allowing users to possibly receive discounts for safe driving.

- Specialized Add-Ons: Allstate car insurance reviews offers variety of coverage options, including special features like sound system protection.

- Financial Standing: Allstate is financially stable and dependable always making sure policyholders are safe and confident.

Cons:

- Geographic Availability: Exclusive availability in select areas, ensuring personalized service and tailored coverage for customers in those regions.

- Comparatively Lower Discounts: May not provide discounts as generously as some other insurers due to the difference in their pricing and promotional strategies.

#3 – Farmers: Best for Personalized Service

Pros:

- Customizable Coverage Options: Gives you different coverage choices to fit what you need. Farmers car insurance reviews make sure you have protection that fits your situation and what you want.

- Rewards for Safe Driving: Farmers Signal program presents opportunities for discounts based on safe driving behaviors, rewarding policyholders who demonstrate responsible driving habits with potential savings on their premiums.

- Enhancing Road Safety: Track your driving habits, that help you monitor and enhance your safety on the road.

Cons:

- Selective Availability: Farmers car insurance selectively offers usage-based programs in specific areas, ensuring they provide tailored solutions that meet regulatory requirements.

- Technical Challenges: Occasional technical challenges may arise potentially impacting the discounts offered to policyholders based on their driving habits.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#4 – Nationwide: Best for Discount Seekers

Pros:

- Encouraging Safe Driving: The SmartRide program by Nationwide car insurance provides opportunities for discounts to customers who demonstrate safe driving habits, encouraging and rewarding responsible driving behavior.

- Fostering Responsible Habits & Savings: Ability to track driving behavior and improve safety through usage-based programs promotes responsible driving habits and may lead to long-term cost savings.

- Tailored Protection: Nationwide car insurance offers flexible coverage options tailored to your needs, giving you the freedom to choose protection that fits you best.

Cons:

- Selective Introduction: Nationwide car insurance brings out usage-based programs in selective places because of rules, and plans they make.

- Program Discounts: Customers may be dissatisfied with Nationwide’s usage-based program discounts if they don’t meet their expected savings, affecting their overall satisfaction and view of the program’s value.

#5 – Liberty Mutual: Best for Comprehensive Coverage

Pros:

- Mutual’s RightTrack Program: Liberty Mutual car insurance reviews Right-Track program offers discounts for safe driving, encouraging responsible habits and potentially lowering insurance costs for participants, contributing to safer roads overall.

- Customizable Insurance Plan: Offering greater control over coverage and ensuring that insurance meets unique needs and preferences for everyone.

- Financial Strength: Strong finances and reliable history build trust with customers.

Cons:

- Rate Options: Might not consistently match the competitiveness of other insurers’ offerings, particularly those with usage-based programs.

- Access Challenges: Liberty Mutual might have trouble offering usage-based programs in some places, which could make it harder for certain customers to use them.

#6 – Safeco: Best for Budget Drivers

Pros:

- Promoting Safe Driving: RightTrack program provides discounts to encourage safer driving behaviors, motivating customers to adopt responsible driving practices and potentially save on insurance premiums.

- Customizable Options: Safeco car insurance reviews customizable coverage options cater to individual needs, providing flexibility and choice.

- Savings and Safety Awareness: Utilizing usage-based programs to monitor driving behavior can lead to saving money over time and making people more aware of safety.

Cons:

- Privacy Concerns: Some customers might feel uncomfortable with the tracking part or worry about their privacy with constant monitoring of how they drive.

- Discount Opportunities: Discounts from usage-based programs might not meet expectations, causing some customers to feel disappointed.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#7 – State Farm: Best for Traditional Policies

Pros:

- Flexibility in Options: Coverage options that can be personalized meet individual needs, offering flexibility and options.

- Reputation: State Farm car insurance reviews is considered to have strong financial stability and reliability, which instills trust and confidence in customers.

- Tailored Assistance: Personalized service through a network of agents ensures that customers receive tailored assistance and support.

Cons:

- Limitations in Options: May not provide as many usage-based insurance options as some other insurers do, which could restrict choices for customers looking for this type of coverage.

- Area-Specific Availability: Limited availability of usage-based programs in certain areas may restrict access for some customers.

#8 – Geico: Best for Online Users Insurance

Pros:

- Financial Stability: Geico financially strong and dependable, which encourages customers to rely on the company for their insurance needs.

- Convenient Digital Tools: Mobile app and online tools make managing policies and tracking driving habits easy for customers. They can update policies and monitor driving behavior conveniently on user-friendly platforms.

- Safe Driving and Savings: By participating in the DriveEasy program Geico car insurance reviews, customers can potentially reduce their insurance premiums by demonstrating safer driving habits, thereby promoting road safety and financial savings.

Cons:

- Program Discounts: Geico’s car insurance might not give as big discounts as customers expect from their usage-based programs, which can make customers unhappy.

- Restricted Access: Limited availability of usage-based programs in certain areas may restrict access for some customers.

#9 – American Family: Best for Family Coverage

Pros:

- Savings Program: KnowYourDrive program rewards safe driving habits, encouraging customers to drive responsibly and save money.

- Personalized Insurance: Offers flexible coverage options tailored to individual needs, giving customers the freedom to choose according to their preferences.

- Agent Network: American Family car insurance reviews provides customized assistance and support through a network of agents, ensuring that customers receive personalized service.

Cons:

- Usage-Based Insurance Options: American Family’s range of usage-based insurance options may not be as extensive as some competitors.

- Discount Expectations: Customers using usage-based programs might not get as big discounts as they hoped for.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#10 – Travelers: Best for Customer Service

Pros:

- Safe Driving Incentives: Offers discounts to drivers who demonstrate safe behaviors, motivating them to drive responsibly and develop better habits behind the wheel.

- Customized Choices: Travelers car insurance reviews offers flexible coverage choices tailored to individual requirements, ensuring customers have options and adaptability in their policies.

- Safer Driving with Habit Tracking: Tracking driving habits through programs can save money and make driving safer in the long run, increasing safety awareness.

Cons:

- Rate Awareness: Might not consistently match the competitiveness of other insurers’ offerings, particularly those with usage-based programs.

- Not Everywhere: May have limited access to usage-based programs, which could restrict certain customers’ ability to participate. This limitation impacts access to potential discounts and personalized pricing based on driving habits.

What you Need to Know about Usage-Based Car Insurance

Let’s begin by addressing the two main types of usage-based car insurance: pay-as-you-drive car insurance (PAYD) and pay-how-you-drive (PHYD).

Choosing between Pay-as-you-drive or Pay-how-you-drive programs is not just about saving money, it's about fostering safer driving habits.

Justin Wright Licensed Insurance Agent

Pay-as-you-drive (PAYD) insurance, according to Texas A&M University, “replaces a regular annual automobile insurance payment with one based on mileage actually driven.” Insurance companies incentivize this, the university explains, because “generally, crash rates tend to increase with miles driven and dangerous driving behavior.” This is a great system for people who want to get lower car insurance by driving less.

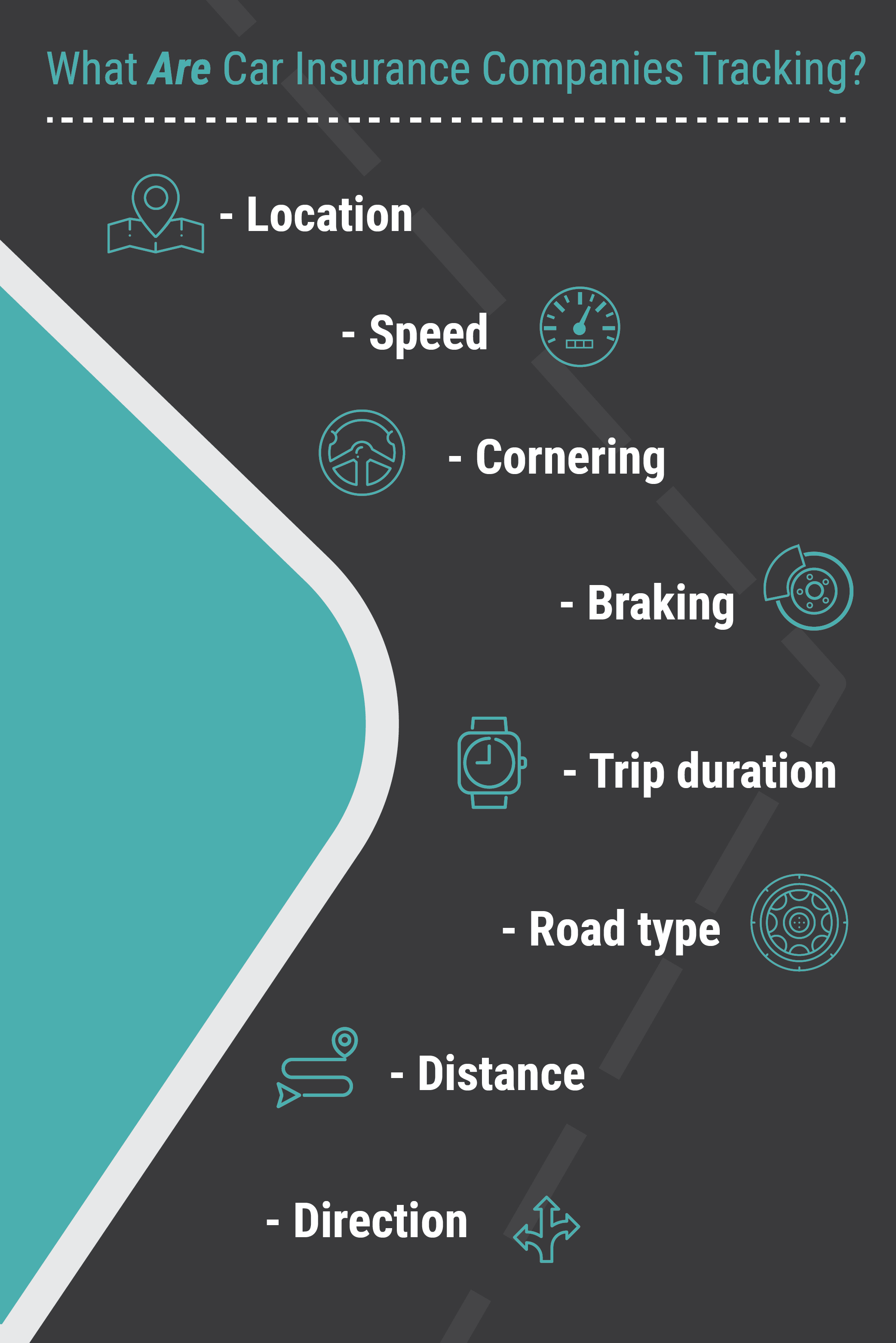

Pay-how-you-drive (PHYD) insurance, not surprisingly, rewards safe drivers with lower rates. According to the National Association of Insurance Commissioners (NAIC), Pay-how-you-drive programs tend to track not only your lane usage, but also:

- When you drive

- Where you drive

- How fast you drive

- How hard you brake

- How fast you turn

- How quickly you accelerate

In short, usage-based insurance is a quickly growing form of car insurance that can benefit both drivers and car insurance companies. According to MarketWatch:

The global usage-based insurance market is expected to garner $123 billion by 2022, registering a CAGR [compound annual growth rate] of 36.4 percent during the forecast period of 2016–2022. North America is expected to grow at the fastest pace during the forecast period, owing to the upsurge in demand from the U.S. and Canada.

Is UBI the same thing as a low-mileage discount? Read on to find out.

The Impact of Car Insurance on Driving Experience and Peace of Mind

Auto insurance doesn’t just keep your money safe, it also affects how you feel when you’re on the road. Things like how well the company helps you, how quickly they handle claims, and how flexible their policies are matter a lot when picking the right insurance. So, let’s check out the monthly costs from top car insurance companies for basic and full coverage, especially for those who use usage-based plans.

Usage-Based Car Insurance Monthly Rates by Provider & Coverage Level

Insurance Company Minimum Coverage Full Coverage

$61 $160

$44 $117

$53 $139

$30 $80

$68 $174

$44 $115

$39 $105

$27 $71

$33 $86

$37 $99

Among the surveyed companies, Safeco tops with the cheapest rates for both basic and full insurance, ensuring affordability and safety. Progressive shines with low rates for basic coverage, ideal for budget-conscious drivers. Nationwide stands out for comprehensive coverage, balancing affordability and quality.

Liberty Mutual ranks priciest, especially for usage-based plans. Despite variations, drivers can use this data wisely to choose the right coverage for their needs and budget.

Leading insurance companies like Progressive, State Farm, and Allstate give discounts for things like how much you drive, driving safely, and factors related to your car. Providers such as Nationwide and Safeco also focus on safe driving and how you use your car. Liberty Mutual and Geico offer discounts based on when you drive, while Travelers and Farmers care about your car’s health. American Family offers discounts based on telematics data, which is about how you drive.

See if you’re getting the best deal on car insurance by entering your ZIP code above.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Understanding Telematics

Unless you’re an insurance or tech nerd like us, you might not be familiar with the term telematics. But don’t sweat it, we’re here to help you learn. Before you select the best car insurance for you might also want to consider doing telematics insurance comparison research different providers, review their offerings, compare pricing and discounts, and consider customer reviews and satisfaction ratings to make an informed decision.

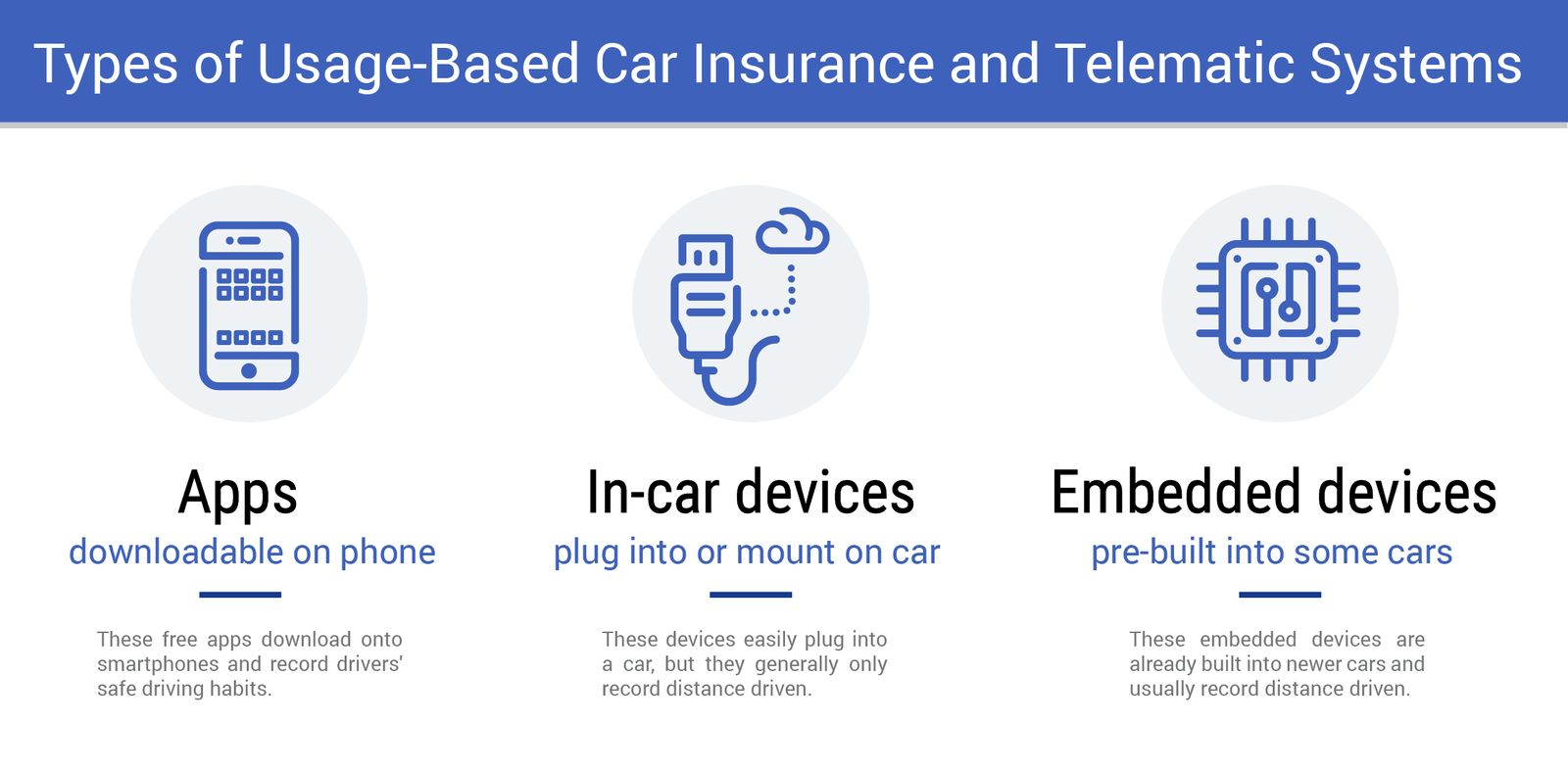

According to Geotab, telematics is “a method of monitoring an asset (car, truck, heavy equipment, or even ship) by using GPS and onboard diagnostics to record movements on a computerized map.” As we’ve seen above, telematics can track your driving behavior through either a device installed in your vehicle or a smartphone application.

Put more simply, telematics is simply the “long-distance transmission of computerized information,” according to GPS Insight.

But what is telematics even tracking?

Types of Data Car Insurance Companies Monitor

Car insurance companies use telematics to track a variety of things, including your: location, speed, cornering, braking, trip duration, road type, distance, and direction.

So we’ve talked a bit about telematic devices, but let’s take a deeper dive.

Methods to Gather Driving Data

Industry leader IMS reports that car insurance by miles providers primarily use five telematic devices to capture driving data:

- Smartphone/Mobile: A mobile app utilizes smartphone sensors to track driving behavior, collecting trip data for analysis. It’s ideal for assessing driver behavior, targeting cost-effective markets, acquiring trial customers, and identifying low-risk driver.

- Bluetooth-Enabled Self-Powered Devices: Two Bluetooth devices in cars connect to a phone app, making trip tracking better by connecting the vehicle with trip data. It’s great for families sharing cars, safe drivers, occasional use, older cars, and young driver.

- Bluetooth-Enabled OBD: This Bluetooth device in the car gathers driving info and sends it to a phone for analysis. It’s good for mileage programs, car services, preventing fraud, high-risk car insurance and evaluating vehicles.

- OBD: This cellular-based fixed plug-in device collects driving data and transmits directly over cellular networks for analysis. It’s best for mileage-based programs, connected car/value-added services, driver fraud concerns, high-risk drivers, mature drivers/seniors, less technically sophisticated drivers, and vehicle-centric evaluation.

- Black Box: This professionally installed device in your car is dependable, flexible, and keeps data streaming all the time. Great for mileage programs, car services, emergency collision detection, theft prevention, fraud prevention, high-risk and senior drivers, as well as vehicle evaluation.

Your insurance company’s usage-based program may require a specific device, so it’s best to check with your car insurance agent.

Exploring the Benefits of Usage-Based Car Insurance

In the ever changing field of auto insurance, usage-based car insurance stands out as a game-changer. This new way of providing coverage adjusts premiums based on how each person drives, giving a more precise idea of the risk involved. By partnering with the top 10 usage-based car insurance companies drivers to get policies that adjust to their specific driving styles.

Through the utilization of telematics technology, these insurers provide real-time data insights, empowering drivers to make informed decisions about their coverage. With the potential for lower premiums and improved driving habits, usage-based car insurance is reshaping the way we think about auto coverage, putting drivers in the driver’s seat of their insurance experience.

According to Washington State’s Office of the Insurance Commissioner, “Usage-based insurance (UBI), also called ‘telematics,’ is when an auto insurer monitors and tracks your driving behavior through a device installed in your vehicle or through a smartphone application. These wireless devices transmit data in real time back to insurers, such as:

- Number of miles you drive

- Time of day

- Where you drive the vehicle

- If you rapidly accelerate, rapidly decelerate and/or take corners hard

- Your air bag deploys”

In the sections below, we’ll cover the basics of what you need to know about usage-based car insurance.

Average Savings by State for UBI Programs

What we’ve done is average the typical savings for UBI programs based on the companies we researched below. That number was 29 percent. We then looked at NAIC rate data by state and deducted the 29% for each state. That will give you baseline as you’re researching which UBI may be right for you.

Usage-Based Car Insurance Companies Average Savings

| State | Average |

|---|---|

| Alabama | $818 |

| Alaska | $1,049 |

| Arizona | $932 |

| Arkansas | $869 |

| California | $927 |

| Colorado | $899 |

| Connecticut | $1,109 |

| Delaware | $1,186 |

| District of Columbia | $1,308 |

| Florida | $1,206 |

| Georgia | $965 |

| Hawaii | $856 |

| Idaho | $657 |

| Illinois | $833 |

| Indiana | $725 |

| Iowa | $672 |

| Kansas | $819 |

| Kentucky | $904 |

| Louisiana | $1,327 |

| Maine | $680 |

| Maryland | $1,078 |

| Massachusetts | $1,075 |

| Michigan | $1,252 |

| Minnesota | $827 |

| Mississippi | $935 |

| Missouri | $825 |

| Montana | $843 |

| Nebraska | $779 |

| Nevada | $1,058 |

| New Hampshire | $778 |

| New Jersey | $1,354 |

| New Mexico | $897 |

| New York | $1,300 |

| North Carolina | $745 |

| North Dakota | $738 |

| Ohio | $741 |

| Oklahoma | $941 |

| Oregon | $856 |

| Pennsylvania | $934 |

| Rhode Island | $1,219 |

| South Carolina | $911 |

| South Dakota | $718 |

| Tennessee | $824 |

| Texas | $1,026 |

| Utah | $832 |

| Vermont | $738 |

| Virginia | $808 |

| Washington | $923 |

| West Virginia | $1,016 |

| Wisconsin | $696 |

| Wyoming | $817 |

| Countrywide | $955 |

With potential savings ranging from $580.75 in Alabama to $928.41 in the District of Columbia, it’s worth exploring these options to see how much you could save in your state simply enter your ZIP code above.

Alternative Names for Usage-Based Auto Insurance

If you’re shopping for usage-based insurance, you might hear it called one of the following names: pay-per-mile insurance, black box insurance, pay-as-you-go insurance, UBI, or telematics.

Soon we’ll cover the particulars of the United States’ top UBI Insurance companies car programs. But for now, it might be handy to know their program titles:

- Allstate – Drivewise

- American Family – KnowYourDrive

- Farmers – Signal

- Geico – DriveEasy

- Liberty Mutual – RightTrack

- Nationwide – SmartRide

- Progressive – Snapshot

- State Farm – Drive Safe & Save

- Travelers – IntelliDrive

- USAA – SafePilot

When you begin to research usage-based car insurance, you’re bound to run into the phrase telematics again and again. So let’s take a look at what that even means.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Determining If Pay-Per-Mile Car Insurance Fits Your Needs

Auto insurance by the mile is the best car insurance if you don’t drive much. It is also good for people who want more transparency in their car insurance prices and for those who track their mileage religiously.

Others who may benefit from using car insurance by the mile include:

- Students who drive less due to the convenience of living on campus

- Remote workers without a commute

- Those who have additional methods of transportation

- Retirees who no longer drive to work looking for discount car insurance for seniors

Pay-per-mile car insurance allows you to control the amount you pay for coverage, making it an attractive option for those who want more clarity in their auto insurance plans.

Usage-Based Car Insurance Availability & Savings for Best Usage-Based Car Insurance Provider

| Insurance Company | Program Name | Earned Savings | Areas Available |

|---|---|---|---|

| Drivewise® | 40% | Most states, excluding, CA, DC | |

| KnowYourDrive | 20% | Available in specific states: AZ, CO, GA, ID, IL, IN, IO, KS, MN, MO, NE, NV, ND, OH, OR, SD, UT, WA, WI | |

| Signal® | 30% | Most states, excluding: AK, HI, LA, MA, MI, NJ, NY | |

| DriveEasy | 25% | Most states, excluding: AK, CA, DC, DE, HI, KS, ME, MA, MO, MS, MT, ND, HD, NY, RI, SD, VT, WV, WY |

|

| TrueLane® | 25% | Most states, excluding: FL |

| RightTrack® | 30% | Most states, excluding: AK, CA, DC, |

| SmartRide® | 40% | Most states, excluding: CA, HI, MA, MI, NY |

| Snapshot | 30% | Most states, excluding: DC | |

| RightTrack® | 30% | Available in specific states, including: FL, IL, MA, MO, RI, NJ, NV, NY |

|

| Drive Safe and Save™ | 30% | Most states, excluding: DC | |

| IntelliDrive® | 30% | Most states, excluding: CA, HI, NY | |

| SafePilot | 30% | Available in specific states, including: AZ, OH, TX, OK |

Programs like Allstate’s Drivewise®, American Family’s KnowYourDrive, and Progressive’s Snapshot offer potential savings of up to 40%. Availability varies by state, so check which programs are offered in your area.

Read more: Safeco RightTrack App Review: Compare Rates, Discounts, & Requirements

Telematics Utilization Growth in Car Insurance

You might be wondering: Is telematics merely a fad in car insurance, or is it something that will be around for a while? Our research shows that it’s more than just a fad. Telematics is one of the fastest-growing components of the car insurance industry.

The National Association of Insurance Commissioners (NAIC) reports that “by the end of 2018, it’s estimated that 80 percent of new cars for sale in the U.S. will be equipped with onboard telematics devices and by 2020, 70 percent of all auto insurers will use telematics.”

But where is this growth coming from?

History of telematics technology

According to the Federal Aviation Administration, telematics technology has its roots in GPS, or global positioning system technology.

In March of 1996, they report, President Bill Clinton signed a Presidential Decision Directive on GPS to “encourage acceptance and integration of GPS into peaceful civil, commercial and scientific applications worldwide; and to encourage private sector investment in and use of U.S. GPS technologies and service.”

Soon thereafter, the insurance industry realized it could harness the power of GPS to both protect and serve its consumers. On August 18, 1998, Progressive Insurance published United States Patent US5797134A, becoming the first insurance provider to utilize a motor vehicle monitoring system for determining the cost of insurance.

So where is telematics in usage-based insurance headed?

The future of telematics-based car insurance

Telematics is more than just a fad. When it comes to car insurance, it’s our future, research consistently shows.

According to Global Market Insights, “the global usage-based insurance (UBI) market is expected to grow from its current value of USD 34 billion to over USD 107 billion by 2024.” Or take a look at this Allied Market Research report, where researchers project an annual growth rate of 36.4 percent from 2016 to 2022 for UBI.

While telematics growth has been steady since Progressive took up the technology for insurance purposes first in 1998, growth moving forward is expected to be astronomical.

According to McKinsey & Company, telematics will likely “grow significantly through the first part of the next decade, according to the GSM Association, an organization comprised of mobile-network operators.

“There are two reasons for this. First is the increased willingness of governments to mandate specific telematics services, such as emergency-call capabilities, which is already happening in the European Union and Russia. Second is the increasing appetite from consumers for greater connectivity and intelligence in their vehicles.”

As a car insurance consumer, it’s important for you to have a basic knowledge of telematics technology and usage-based insurance overall, which is why we created this guide. But at this point, you might be wondering: Do telematics help?

Telematics’ Impact on Driving Performance

The short answer is a complicated yes.

According to the Insurance Information Institute (III), “studies indicate crash rates fell between 20 percent and one-third in cars monitored via telematics.”

Telematics is especially helpful in reducing unsafe driving practices in fleet vehicles for fleet car insurance and safety. According to fleet vehicle industry leader Donlen, there are seven specific ways telematics improve fleet driver safety. They report that telematics:

- Track speeding and other unsafe driving habits

- Reduce unnecessary time spent on the roads

- Keep up with the maintenance needs of every vehicle in the fleet

- Respond quickly to emergency situations

- Assign safety training to employees with bad driver behavior

- Reward good driver behavior

- Cut down on fuel costs

Of course, as famed French philosopher Michel Foucault predicted in his book Discipline & Punish, explained in the video below, such technologies train us to regulate ourselves, for better and for worse.

Read more:

- Compare Car Insurance for Track Days: Rates, Discounts, & Requirements

- Compare Fleet Car Insurance: Rates, Discounts, & Requirements

- Compare Smart Car Insurance Rates

Top Car Insurance Companies with Comprehensive Usage-Based Insurance Programs

Discover how leading insurers in the United States offer comprehensive usage-based insurance (UBI) programs to cater to diverse driver needs. Learn about enrollment discounts, potential savings, and the features of each company’s UBI program.

Usage-Based Car Insurance Programs by Savings Amount

| Insurance Company | Program | Device | Enrollment Discount | Earned Savings |

|---|---|---|---|---|

| AAA | AAADrive | Mobile App | 15% | 30% |

| Allstate | Drivewise | Mobile App | 3% | 15% |

| American Family | KnowYourDrive | Mobile App or Plug-in | 5% | 20% |

| Esurance | DriveSense | Mobile App | 5% | 30% |

| Geico | DriveEasy | Mobile App | NA | 20% |

| Liberty Mutual/SafeCo | RightTrack | Mobile App or Plug-in | 5% and up | 30% |

| MetLife | My Journey | Plug-in | 10% | 30% |

| Metromile | Metromile | Mobile App | NA | 60% |

| Mile Auto | Mile Auto | Neither | NA | 40% |

| Nationwide | SmartRide | Mobile App or Plug-in | 10% | 40% |

| Progressive | Snapshot | Mobile App or Plug-in | average of $25 | 20% |

| State Farm | Drive Safe & Save | Mobile App or Plug-in | 5% | 30% |

| The Hartford | TrueLane | Plug-in | 5% | 25% |

| Travelers | IntelliDrive | Mobile App | 10% | 20% |

| USAA | SafePilot | Mobile App | 5% | 20% |

If by this point you’re interested in usage-based car insurance, we’ve got some good news: the top car insurance companies in the United States all offer comprehensive UBI programs to serve their consumers. And it’s not exactly the same thing as a low-mileage discount as you may have already figured out.

Let’s take a look at each of those company’s UBI programs.

Read more:

- Geico vs. The Hartford Car Insurance Comparison

- Liberty Mutual vs. Travelers Car Insurance Comparison

- Farmers vs. MetLife Car Insurance Comparison

- Farmers Signal Review: Compare Rates, Discounts, & Requirements

- Farmers vs. The Hartford Car Insurance Comparison

- Farmers vs. Travelers Car Insurance Comparison

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Major Car Insurance Companies With Usage-Based Insurance Programs

In 2008, as we’ve already discussed, leading provider Progressive Insurance took a bold, innovative step: introducing the first wireless telematics device for personal vehicles. Since then, more and more car insurance companies followed suit, to the point where each of the country’s top 10 providers (in private passenger auto) now offers some form of UBI.

#1 – Allstate Drivewise

Since 2010, the Allstate Drivewise program has focused on improving safe driving habits for its consumers.

How to participate:

- Customers and non-customers can begin by downloading the Drivewise app. Drivers who are not customers will be directed to a Drivewise only option.

- Customers opting to use the plug-in device will need to contact their agent to sign up. A device will be mailed to your home, along with instructions.

- You can review your performance on the app, even if you’e using the device.

What’s being tracked:

- Safe speed

- Braking

- Time of day

- Mileage

Potential savings:

- With the device, you can earn up to 10 percent when you sign up, and up to 30 percent every six months for safe driving. For finishing challenges, you can also earn Allstate Rewards Points that can be used toward travel, gift cards, and more.

- With the app, you can earn up to 10 percent cash back for signing up and up to 25 percent cash back every six months for safe driving. You can additionally earn Allstate Rewards Points toward purchases.

#2 – American Family KnowYourDrive

Since 2017, the American Family KnowYourDrive program has centered safe driving habits by tracking driving mostly through a mobile app. The company promises that whatever the results of this tracking, your premium will not increase through participation in this program.

How to participate:

- Customers can enroll by contacting their agent. Drivers will then be directed to download the app, which calculates a driver’s score. This score will be used to determine your discount.

What’s being tracked:

- How often you drive

- Braking

- Acceleration

Potential savings:

- American Family promises a 5 percent discount for signing up, and up to 20 percent in savings. The lowest discount you can receive is 2 percent.

#3 – Farmers Signal

Since 2017, the Farmers Signal program has used an easy mobile app to monitor safe driving habits. This program is not available in all states, and discounts will vary from location to location.

How to participate:

- Contact your agent for a quote and ask to enroll in the program

- Your agent will then text you a link with instructions on how to download the app

What is being tracked:

- Speeding

- Braking

- Distracted driving

- Location

- Mileage

Potential savings:

- There’s a 5 percent discount for signing up and completing 10 qualifying trips, including up to 15 percent savings at renewal. Additional savings may be possible when multiple drivers on one policy enroll, including those under the age of 25.

#4 – Geico DriveEasy

One of the more recent additions to the usage-based insurance scene, since 2019, the Geico DriveEasy program has used the award-winning Geico app to track and score customers’ driving behavior. And some good news: multiple drivers on one policy can participate. Plus, explore Geico Pay Per Mile Car Insurance option for tailored coverage.

DriveEasy began as a pilot program with a test group in June 2019 under the name Geico Drive. The program has since expanded and is open to all customers. For more information, read our Geico DriveEasy App review.

How to participate:

- Simply download the DriveEasy app, type in your phone number, and enter the code.

What’s being tracked:

- Speeding

- Braking

- Phone Use

- Time of day

- Distance

Potential savings:

- Neither Geico’s DriveEasy page nor its FAQs indicate a driver discount for this UBI program. However, with the program still in its infancy, it’s possible discounts could be offered to customers down the road.

#5 – Liberty Mutual RightTrack

Beginning in 2016, the Liberty Mutual Insurance RightTrack app-based program has rewarded safe driving with substantial car insurance premium savings.

How to participate:

- After enrolling in the program (you can do so online or through an agent), download the Liberty Mutual RightTrack app. Your download will trigger the shipment of a device, which needs to be linked to your app. Drive for 90 days to confirm the discount.

What’s being tracked:

- Braking

- Acceleration

- Nighttime driving

- How many miles you drive

Potential savings:

- Liberty Mutual promises an unspecified discount for signing up, and up to 30 percent savings for the life of your policy.

#6 – Nationwide SmartRide

Quick to jump on the telematics UBI market, Nationwide Insurance began Its Nationwide SmartRide program in 2008. The program offers savings for safe driving after four to six months of participation.

How to participate:

- This program requires the use of a device. Contact your agent to sign up.

What’s being tracked:

- Miles driven

- Hard braking and acceleration

- Idle time

- Nighttime driving

Potential savings:

- Nationwide promises a 10 percent discount for signing up, and potential savings of up to 40 percent.

#7 – Progressive SnapShot

Since 2011, Flo and the folks over at Progressive Insurance have offered the SnapShot program. SnapShot looks at your overall driving habits and mileage and lets multiple drivers on one policy participate easily.

Unlike some other car insurance company’s safe driving programs, you should know that your rates can go up as a result of high-risk driving monitored in the SnapShot program. However, the company claims only two out of 10 drivers see an increase.

How to participate:

- Drivers can participate with a plug-in device or the mobile app. Where the app isn’t available, customers can use the device. Customers also have the option of enrolling in a 30-day trial.

What’s being tracked:

- Time of day you drive

- Hard braking and rapid acceleration

- The amount you drive

- How you’re using your mobile phone while driving (app users only, in participating states)

Potential savings:

- An average $26 discount for signing up, and an average discount of $145 savings upon program completion (about six months). Discounts are not available in the following states: Alaska, California, Hawaii, North Carolina, or New York.

https://www.youtube.com/watch?v=Qp1SlGuL6Eo&feature=youtu.be

#8 – State Farm Drive Safe & Save

A relative newcomer to the UBI scene, the United States’ largest car insurance provider, State Farm Insurance, began its Drive Safe & Save program in 2019 to offer savings based upon, not surprisingly, safe driving.

How to participate:

- Drivers can choose to use the app or their vehicle’s OnStar system.

- To download the app and enroll, text SAVE to 78836. Setup will be complete upon the receipt of a Bluetooth beacon sent by State Farm.

- Drivers with OnStar are asked to enroll in OnStar Vehicle Diagnostics (OVD) within 30 days of enrolling in Drive Safe & Save. State Farm will then request odometer information from OnStar within 30 days of you signing up.

What is being tracked:

- Annual mileage

- Braking

- Speed

- Time of day travel

- Acceleration

- Fast cornering

Potential savings:

- Up to 5 percent for signing up (per vehicle), and up to 50 percent in savings. According to the website: “Your discount is adjusted at each policy renewal (typically every six months). Changes in your driving will be reflected in your discount amount, so your discount amount can increase or decrease at each renewal.”

#9 – Travelers IntelliDrive

Since 2017, Travelers Insurance‘s IntelliDrive program has monitored participating customer’s safe driving behaviors. IntelliDrive works by a smartphone app and runs for 90 days. It’s important to note that IntelliDrive is only available in certain states and that savings can vary by state.

The program is available in Alabama, Arizona, Colorado, Connecticut, the District of Columbia, Florida, Georgia, Iowa, Idaho, Illinois, Indiana, Kansas, Kentucky, Maryland, Maine, Minnesota, Missouri, Mississippi, Montana, Nebraska, New Hampshire, New Jersey, New Mexico, Nevada, Ohio, Oklahoma, Pennsylvania, South Carolina, Tennessee, Texas, Utah, Virginia, Vermont, Washington, and Wisconsin.

How to participate:

- The IntelliDrive program requires an app and can be used by multiple drivers on one policy. Travelers will send participants a link to download the app.

What’s being tracked:

- Time of day

- Acceleration

- Speed

- Braking

Potential savings:

- 10 percent for signing up, and potential savings of up to 30 percent at renewal if you’ve driven 13,000 miles or less in a year. Note that riskier driving habits may result in higher premiums, depending on the state you live in.

#10 – USAA SafePilot

Beginning in 2019, USAA’s SafePilot began rewarding its members for their safe driving. As the company claims, “The better you drive, the bigger the discount you’ll earn.” It’s important to remember that USAA car insurance is only available to members of the military community and their immediate family members.

How to participate:

- Participation requires downloading the USAA SafePilot app, available on iOS and Android.

What’s being tracked:

- Phone handling and hands-free phone use

- Braking

Potential savings:

- Earn 5 percent for enrolling and up to 20 percent at renewal.

Car Insurance Companies Offering Pay-Per-Mile Coverage

There are different options available for drive per mile insurance or pay-per-mile auto insurance that may work for your budget and needs. Here’s a roundup of popular companies that offer car insurance by the mile.

Metromile

Metromile offers pay-per-mile car insurance, and your bill is divided into two parts: the monthly base rate and a per-mile rate. Because of this, your monthly bill may change depending on how much you drive.

Your base rate is determined by your driving profile. The “Metromile Pulse” device attaches to your odometer and tracks your mileage to determine your rates. The company also offers an app integration that allows you to view your record and monthly bill estimate.

For added value, Metromile comes with a daily cap. After driving 250 miles (150 in New Jersey) in a day, there is no extra charge.

Metromile offers coverage to Arizona, California, Illinois, Oregon, New Jersey, Pennsylvania, Virginia, and Washington residents.

Esurance

Esurance only sells pay-per-mile car insurance to Oregon drivers at this time. For everyone else, it offers an alternative program called DriveSense that includes pay-per-mile options.

Along with being an alternative to insurance by the mile, DriveSense’s main goal is to give personalized discounts based on driving habits. It is similar to pay-as-you-go car insurance in that Esurance calculates your rates based on how many miles you drive, but you can receive additional discounts for safe driving.

Esurance by Allstate pay-per-mile utilizes a mileage tracking device that will monitor your braking habits, acceleration, and deceleration to determine your monthly rate.

It’s important to note that your monthly UBI insurance rates will not increase for unsafe driving habits, like abrupt braking or accelerating too quickly, but you can receive discounts for keeping these to a minimum.

Nationwide Smartmiles

Nationwide Smartmiles pay-per-mile program is geared toward low-mileage drivers, and rates are a sum of the base rate and rate per mile. It offers a safe driver discount of up to 10%, with an in-car device that counts miles and tracks your driving habits, such as braking, acceleration, speed, and deceleration.

Nationwide Smartmiles is available in 40 states and the District of Columbia. However, unsafe driving habits may be penalized with this plan, which can raise your monthly rates. Consider your driving habits and compare different pay-per-mile insurance companies when deciding which premium will work for you.

Allstate Milewise

Allstate Milewise is one of the companies that offers auto insurance by the mile commonly known as pay-per-mile car insurance provides full coverage in 21 states. For people who drive less than 13,000 miles a year, it offers valuable savings and additional discount options. Allstate’s Mileage Tracker lets policyholders monitor driving habits and mileage, potentially earning discounts. One insurance company that offers “auto insurance by the mile”

This tool provides insight into driving patterns, promoting safer practices and lower premiums. Allstate pay-per-mile uses a daily base rate and mileage rate to calculate your premium, and your miles are tracked via a plug-in device with a mobile app for convenience. Drivers must keep a credit card on file for payment, as charges are assessed after each trip.

Hugo Insurance

Hugo pay-per-mile car insurance calculates your premium by combining a daily and per-mile rate. It doesn’t offer additional discounts but utilizes micropayments and on-demand coverage. These allow drivers to pay for insurance only when they need it and can add to your overall savings.

While their “pay-only-when-you-need-it” insurance model is noteworthy, it can present some potential risks to drivers. For example, turning off your insurance in a public area or while parked could leave your vehicle unprotected from unexpected accidents.

Enhancing Insurance Management with Pay-Per-Mile Innovation emphasizes how Apps like Hugo insurance introduces a novel approach to insurance management through its pay-per-mile model.

Hugo is a new option on this list, and its coverage options are more limited. Currently, it only offers liability insurance in nine states California, Georgia, Alabama, South Carolina, Florida, Illinois, Ohio, Indiana, and Tennessee.

Mile Auto

Mile Auto offers coverage to Ohio, Arizona, Georgia, Oregon, Illinois, Tennessee, Pennsylvania, Texas, and California. Premiums are calculated with a low base rate and a per-mile rate. They offer additional discounts for safe driving habits, students, and seniors.

Mile Auto allows drivers to send in the number of miles driven at the end of the month by taking a picture of their odometer instead of using a plug-in device. Mile Auto is one of the known insurance providers that offers auto insurance based on driving habits.

Noblr by USAA

Noblr assesses your fixed monthly rates based on your primary characteristics, such as age, gender, and driving record. Then it determines the monthly variable rate based on how much you drive and adds it to your total cost.

The Noblr app breaks down your variable write via five characteristics:

- Smoothness

- Focus

- Road choice

- Time of day

- Mileage

This allows drivers to receive a premium that reflects their driving habits, as well as low mileage and encourages transparency.

Noblr provides auto insurance by the mile to Arizona, Ohio, Colorado, and Texas residents and relies on an app to track how much you drive.

Considering Noblr insurance? Discover its innovative approach combining fixed and variable rates based on driving behavior in our detailed Noblr insurance review.

Downsides of Usage-Based Insurance Policies

There are certainly some pros to purchasing usage-based car insurance. Most obviously, perhaps, are the potential savings and the ability to live with more frugality and on a better budget.

And we don’t want to downplay the positive change in driving habits usage-based insurance programs are proving to have when people are promised a safe driving insurance discount. A recent study by the Institute for Operations Research and the Management Sciences, for instance, reports that after just six months, UBI users showed a 21 percent decrease in hard braking.

And a survey from the Insurance Research Council shows that 56 percent of its respondents changed their driving behaviors after installing an insurance-issued telematics device in their vehicles.

But did you also know that UBI can result in policies better tailored to your needs and, with some companies, even the option for an expedited and more accurate claims process?

Now let’s dive into some of the cons a little more deeply.

Considerations Regarding Privacy Issues

There’s no other way to say it: privacy matters. And there’s no question that consumers are taking more steps to ensure privacy in all areas, whether that’s in securing the best VPN “or virtual private network” for home internet use, or just being wary about who gets their personal information.

Given the requisite use of telematics and driver tracking technology, there are legitimate privacy concerns when it comes to consumer protections for usage-based insurance policies.

According to the National Association of Insurance Commissioners (NAIC), “a major barrier remains for the public acceptance and the complete mainstreaming of telematics.”

They add that “many consumers have concerns regarding the privacy of the data they share with insurance companies, and they question insurers’ ability to safeguard their data given the recent cases of major corporate security breaches.”

Car insurance companies tout the lower premiums telematics-based insurance can lead to.

But according to the Insurance Journal, “privacy advocates say the lower premiums are not worth the tradeoffs because the data could be used for unexpected purposes like penalizing drivers who visit unsafe neighborhoods. That argument holds sway with the California Department of Insurance, which is opposed to expanding the technology.”

As more and more consumers turn to telematics and usage-based insurance policies, keep a watch out for public conversations around regulatory structures and privacy guarantees for consumers.

Ability of Usage-Based Car Insurance Policies to Identify Multiple Drivers

In short: sometimes, but not always. It depends entirely on the car insurance company’s telematics capabilities.

Our research shows that the following companies can distinguish between multiple drivers when tracking driving behaviors:

- Farmers

- Geico

- Progressive

- Travelers

while some usage-based car insurance policies can distinguish between multiple drivers, this capability varies depending on the insurer’s telematics technology. Companies such as Farmers, Geico, Progressive, and Travelers have been found to offer this feature. Explore your options further to find the best fit for your needs.

The Compatibility of Telematics with Older Vehicles

Again: sometimes, but not always.

If your car insurance provider uses a mobile app to track your driving behavior and determine your car insurance premium, then you’re probably fine driving an older vehicle.

If your car insurance provider requires the installation of a black box monitoring device, however, some older vehicles might not be capable of holding the technology. Check with your insurance agent if you’re in doubt.

The Potential for Insurance Rates to Rise with Usage-Based Car Insurance

A few companies, such as American Family Insurance, guarantee that whatever the results of your driving behavior monitoring, your premium won’t increase.

That’s not always the case, however. A recent University of Connecticut study found that when it came to Progressive Insurance’s SnapShot program, “two out of 10 participants of its UBI program see an increase in their premiums after the discount period ends.”

Two out of 10 drivers might be a vast minority, but it’s worth considering whether your driving behaviors could put you at risk for higher premiums under a usage-based car insurance program.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Case Studies: Pay-Per-Mile Car Insurance

Discover real-life examples showcasing the benefits of Pay-Per-Mile Car Insurance. These case studies demonstrate how drivers can save money, gain pricing transparency, and receive rewards for safe driving habits

- Case Study #1 – Sarah’s Savings With Low Mileage: Sarah, a low-mileage driver, chose pay-per-mile car insurance, driving 6,000 miles annually. This plan helped her save significantly on premiums based on her miles, showcasing its benefits for infrequent drivers.

- Case Study #2 – John’s Transparent Pricing: John wanted more transparency and decided to switched to pay-per-mile insurance, tracking mileage meticulously. This plan allowed him precise control over costs, paying solely for miles driven, showcasing the pricing transparency of pay-per-mile insurance.

- Case Study #3 – Laura’s Safe Driving Discount: Laura, a safe driver, switched to pay-per-mile car insurance for rewards based on her driving. The plan tracked metrics like braking and acceleration, offering extra discounts. By maintaining her safe habits, Laura enjoyed added savings, showing how pay-per-mile insurance encourages safe driving.

- Case Study #4 – Michael’s Occasional Driver Benefits: Michael, an occasional driver, opts for pay-per-mile insurance, saving significantly by paying solely for the miles he drives. This tailored coverage prevents overpayment for unused miles, providing a cost-effective solution for drivers with sporadic usage patterns.

- Case Study #5 – Emily’s Environmental Consciousness: Emily, embracing pay-per-mile reduces her carbon footprint while enjoying financial savings. By aligning her insurance choice with her sustainability efforts, she contributes to eco-friendly driving practices while benefiting from tailored coverage that fits her driving habits.

These real-life case studies demonstrate the flexibility, transparency, and rewards associated with pay-per-mile insurance, empowering drivers to align their coverage with their unique lifestyles and values.

In Conclusion: Usage-Based Car Insurance

If you’re a consistently safe driver, or if you don’t drive more than the average American, usage-based insurance may prove to be profitable for you and your family.

You should know, however, that signing up. for usage-based insurance is taking a bet on your driving, and that if that bet doesn’t pay off, your car insurance premiums may actually increase.

Thus it’s important to keep in mind that trackable habits such as hard braking and rapid acceleration will be seen by your car insurance company through the use of telematics.

Of course, none of the potential savings we’ve talked about are possible unless you are willing to consent to be tracked through a telematics device, such as a mobile app or a black box installed in your vehicle. Our research shows that for many, this lack of privacy remains a point of concern.

Bottom line? If you’re still unsure about usage-based insurance, it never hurts to speak to an agent or to pursue programs with car insurance companies that offer trial periods.

Regardless, usage-based insurance is a quickly growing segment of the car insurance industry, and we hope this guide has helped you learn more about it.

What part was the most helpful? Is there something we could explain more clearly?

Use our Free quote tool below to get started on your car insurance journey today simply by entering your ZIP code.

Frequently Asked Questions

Can usage-based car insurance save me money?

Yes, if you’re a safe driver with low mileage, it can potentially lower your premiums. Make the first step toward cheaper car insurance rates.

Unlock savings with our safety features car insurance discounts.

Do I need a specific vehicle for usage-based car insurance?

Usage-based car insurance is typically available for a wide range of vehicles.

Can I switch back to traditional car insurance after using usage-based car insurance?

In most cases, you can switch back to a traditional policy.

Are there additional benefits to using usage-based car insurance?

Yes, such as personalized feedback, access to driving data, and vehicle tracking.

Finding affordable car insurance doesn’t have to be a challenge. Enter your ZIP code below into our free comparison tool to find the lowest prices in your area.

Are there restrictions on when and where I can drive with usage-based car insurance?

Generally, there are no driving restrictions, but there may be specific programs or discounts for off-peak hours or limited distances.

Explore our comprehensive car insurance guide for expert insights and tips to help you find the perfect coverage.

Can usage-based car insurance help inexperienced or young drivers?

Yes, it can help them improve driving skills and potentially lower premiums based on driving performance.

Does pay-per-mile auto insurance include full coverage car insurance?

Full coverage car insurance generally includes liability, collision, and comprehensive insurance. These coverage options are available with pay-per-mile plans from some companies, so compare different insurers to find the best one.

What are the disadvantages of usage based insurance?

The drawbacks of usage-based insurance include privacy concerns, limited discounts for some drivers, potential technical issues with tracking devices or apps, the risk of rate increases for risky driving, and the limited availability of such programs from insurance companies.

How do insurance companies check mileage?

There are two main ways that insurance companies check mileage. The first is through a device that drivers attach to their vehicles. This device will count their miles and track their driving habits for potential safety discounts.

The other option is for you to take a picture of your mileage counter each month and submit it to the company to get your rates. Many insurance companies offer an app integration to view mileage as well.

To learn more, explore our comprehensive resource low-mileage discount.

Which car insurance companies provide pay-per-mile coverage?

There are several car insurance companies that offer pay-per-mile coverage. Some popular options include Metromile, Esurance, Nationwide Smartmiles, Allstate Milewise, Hugo Insurance, Mile Auto, and Noblr by USAA. Each company has its own pricing structure and coverage options, so it’s important to compare quotes and find the one that suits your needs.

Comparing quotes is the easiest way to find affordable car insurance. Simply enter your ZIP code below into our free comparison tool to see rates in your area.

What should I consider when choosing car insurance by mileage?

When choosing car insurance by mileage, it’s important to consider factors such as your actual mileage, the cost per mile, and any additional discounts or benefits offered by the insurance company. You should also ensure that the insurance company provides the coverage you need, whether it’s liability, collision, or comprehensive insurance.

Which company has the best car insurance black box?

Determining the absolute best car insurance black box provider can vary based on individual needs and preferences. However, companies like Progressive with their Snapshot program and Allstate with their Drivewise program are often recognized for offering advanced telematics devices that track driving behavior and provide potential discounts based on safe driving habits.

What are the best insurance rates for cars?

Best insurance rates for cars vary based on driving habits, vehicle type, and coverage needs. Usage-based car insurance companies like Progressive, Allstate, and State Farm offer competitive rates tailored to individual driving behaviors through programs like Snapshot, Drivewise, and Signal, potentially saving drivers money while improving habits.

What is “Pay by mile insurance”?

Pay by mile car insurance, also called usage-based insurance, adjusts premiums based on mileage driven. It uses telematics to monitor driving habits for personalized rates, best for people aiming to save money and enhance safety.

Can Drivewise Raise Your Rates?

Yes, Drivewise can raise your rates if it detects risky driving behaviors such as speeding, hard braking, or sudden accelerations. Allstate reserves the right to adjust your rates based on this data.

How does car insurance based on usage work?

Usage-based insurance programs use telematics devices or smartphone apps to track driving habits, gathering data on speed, mileage, braking, and time of day. Insurers analyze this to set premiums, often offering lower rates for safer driving.

Can I get car insurance discounts with pay-per-mile auto insurance?

Some insurance companies will offer a discount based on a mileage threshold. For example, if the threshold is 10,000 miles, and you drive less than that, your insurance company may provide a discount on your monthly rates. Visit Car Insurance Discounts to learn more.

You may also receive safety discounts, like with Nationwide SmartMiles and Metromile. For these discounts, the mileage counter you receive will also track your driving habits, such as sharp turns or abrupt braking, to determine if you are practicing safe driving.

What are pay as you go insurance companies?

Pay-as-you-go insurance companies offer policies where premiums are based on actual mileage driven, providing potential savings for low-mileage drivers.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.