Cheap Car Insurance for College Students in 2025 (Save Money With These 10 Companies!)

Progressive, USAA, and State Farm are the top providers of cheap car insurance for college students, with starting rates as low as $88. These insurers are known for offering affordable rates, comprehensive coverage, and student-specific discounts, making them ideal options for college students.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

UPDATED: Oct 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

13,283 reviews

13,283 reviewsCompany Facts

Min. Coverage for College Students

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 6,589 reviews

6,589 reviewsCompany Facts

Min. Coverage for College Students

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 18,155 reviews

18,155 reviewsCompany Facts

Min. Coverage for College Students

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviewsThe top pick overall for the cheap car insurance for college students are Progressive, USAA, and State Farm, with rates as low as $88. Progressive stands out for its convenient online services, competitive pricing, and extensive coverage options.

Delve into this guide to explore how these insurers cater to college students’ needs with comprehensive coverage options and potential savings.

Our Top 10 Company Picks: Cheap Car Insurance Rates for College Students

| Company | Rank | Multi-Policy Discount | Low-Mileage Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 12% | 20% | Online Convenience | Progressive | |

| #2 | 10% | 20% | Military Savings | USAA | |

| #3 | 17% | 30% | Many Discounts | State Farm | |

| #4 | 10% | 25% | Add-on Coverages | Allstate | |

| #5 | 15% | 25% | Usage Discount | Nationwide |

| #6 | 10% | 25% | Local Agents | Farmers | |

| #7 | 30% | 30% | Customizable Polices | Liberty Mutual |

| #8 | 10% | 25% | Policy Options | Esurance | |

| #9 | 5% | 20% | Deductible Reduction | The Hartford |

| #10 | 20% | 30% | Student Savings | American Family |

From discounts for good grades to specialized policies tailored for student life, each provider offers unique benefits worth considering. Compare quotes and find the perfect coverage to safeguard your college journey without breaking the bank.

Stop overpaying for car insurance. Our free quote comparison tool allows you to shop for quotes from the top providers near you by entering your ZIP code above.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – Progressive: Top Overall Pick

Pros

- Online Convenience: Progressive is praised for its user-friendly online platform, making it convenient for college students to manage their policies and claims.

- Competitive Rates: Progressive offers competitive rates, with an average monthly rate at $281 for college students, making it an attractive option for budget-conscious students.

- Low Complaint Level: With a low complaint level, Progressive demonstrates a commitment to customer satisfaction. Take a look at our comprehensive Progressive car insurance review for further details.

Cons

- Average Monthly Rate: While competitive, Progressive’s average monthly rate may still be higher compared to some other providers.

- Limited Local Presence: For those who prefer in-person interactions, Progressive may not have as strong a local agent presence as other companies.

#2 – USAA: Best for Military Savings

Pros

- Military Savings: USAA caters to military members and their families, offering exclusive discounts and benefits for this demographic.

- Low Monthly Rate: With an impressively low average monthly rate at $88 for college students, USAA provides affordability. Explore our USAA car insurance review to gain deeper insights.

- High Customer Service Ratings: USAA is known for its exceptional customer service, reflected in its low complaint level and high A+ rating.

Cons

- Eligibility Restrictions: USAA membership is limited to military personnel and their families, excluding a significant portion of the general population.

- Coverage Limitations: Some users may find that USAA’s coverage options are more tailored to military needs, potentially limiting options for non-military-related coverage.

#3 – State Farm: Best for Many Discounts

Pros

- Many Discounts: State Farm offers a wide range of discounts, including up to 17% multi-policy discount and up to 30% low-mileage discount, providing potential for significant savings.

- A+ A.M. Best Rating: With a high A+ rating from A.M. Best, State Farm showcases financial stability and reliability. Dive into our State Farm car insurance review for additional information.

- Customizable Policies: State Farm allows for a high degree of policy customization, ensuring that customers can tailor coverage to their specific needs.

Cons

- Higher Average Monthly Rate: State Farm’s average monthly rate at $125 for college students, which may be higher than some competitors.

- May not be the Cheapest Option: While offering many discounts, State Farm may not always be the most affordable choice for every student.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#4 – Allstate: Best for Add-On Coverages

Pros

- Innovative Mobile App: Allstate’s user-friendly mobile app offers convenience and innovative features for policy management and claims. Investigate our Allstate car insurance review to uncover more insights.

- Add-On Coverages: Allstate provides a variety of add-on coverages, allowing customers to tailor their policies for additional protection.

- Low Complaint Level: With a low complaint level, Allstate demonstrates a commitment to customer satisfaction.

Cons

- Higher Average Monthly Rate: Allstate’s average monthly rate at $223 for college students, which may be on the higher side.

- May Lack Certain Discounts: While offering various discounts, Allstate may not have as extensive a list as some other providers.

#5 – Nationwide: Best for Usage Discounts

Pros

- Usage Discount: Nationwide stands out for its usage discount, which rewards drivers for driving less.

- A+ A.M. Best Rating: Nationwide’s high A+ rating from A.M. Best indicates strong financial stability.

- Low-Mileage Discount: With a potential 25% low-mileage discount, Nationwide offers significant savings for infrequent drivers.

Cons

- Average Monthly Rate: Nationwide’s average monthly rate at $167 for college students, which might be considered relatively high.

- May not be Ideal for High-Mileage Drivers: The emphasis on low-mileage discounts may not benefit those who frequently drive long distances.

#6 – Farmers: Best for Local Agents

Pros

- Local Agents: Farmers offers a personalized touch with local agents, providing in-person support for customers who prefer face-to-face interactions.

- Competitive Discounts: Farmers provides up to 10% multi-policy discount and up to 25% low-mileage discount, making it a competitive choice.

- Solid A.M. Best Rating: Farmers has a good A.M. Best rating, indicating financial stability. Delve into our Farmers car insurance review to discover valuable insights.

Cons

- Higher Average Monthly Rate: Farmers’ average monthly rate at $271 for college students, which might be considered relatively high.

- May not be as Technologically Advanced: For those who prioritize digital interactions, Farmers may not have as advanced online features as some competitors.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#7 – Liberty Mutual: Best for Customizable Polices

Pros

- Customizable Policies: Liberty Mutual offers highly customizable policies, allowing customers to tailor coverage to their specific needs.

- High Maximum Discounts: Liberty Mutual provides up to 30% multi-policy discount and up to 30% low-mileage discount, offering substantial savings potential.

- A.M. Best Rating: Liberty Mutual has a good A.M. Best rating, indicating financial strength. Examine our Liberty Mutual car insurance review to learn more about what we offer.

Cons

- Higher Average Monthly Rate: Liberty Mutual’s average monthly rate at $279 for college students, which may be on the higher side.

- May be Overwhelming for Some: The abundance of customization options may be overwhelming for those who prefer simpler choices.

#8 – Esurance: Best for Policy Options

Pros

- Online Convenience: Esurance, as an online-focused provider, offers a seamless digital experience for policy management and claims.

- Low-Mileage Discount: Esurance provides up to 25% low-mileage discount, making it appealing for those who drive less frequently.

- A+ A.M. Best Rating: Esurance has a high A+ rating from A.M. Best, indicating strong financial stability. Review our resource titled “How do you get an Esurance car insurance quote?“

Cons

- Average Monthly Rate: Esurance’s average monthly rate at $164 for college students, which might be considered relatively high.

- May Lack Extensive Local Support: For those who prefer local agents, Esurance’s online focus may result in less personalized support.

#9 – The Hartford: Best for Deductible Reduction

Pros

- Deductible Reduction Options: The Hartford offers deductible reduction options, providing a unique feature for those looking to lower their deductibles.

- A+ A.M. Best Rating: The Hartford has a high A+ rating from A.M. Best, demonstrating financial strength.

- Potential for Lower Rates: With an average monthly rate at $201 for college students, The Hartford offers competitive pricing.

Cons

- Limited Multi-Policy Discount: The Hartford’s maximum multi-policy discount is up to 5%, which may be lower compared to some competitors.

- Average Low-Mileage Discount: While offering a low-mileage discount, it may not be as high as some other providers.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#10 – American Family: Best for Student Savings

Pros

- Student Savings: American Family caters specifically to students, offering up to 20% multi-policy discount and up to 30% low-mileage discount.

- A.M. Best Rating: American Family has a good A.M. Best rating, indicating financial stability. Browse through our American Family car insurance review to find out more.

- Customizable Policies: American Family provides customizable policies to tailor coverage to individual needs.

Cons

- Average Monthly Rate: American Family’s average monthly rate at $178 for college students, which may be on the higher side.

- Limited Coverage Options: Some users may find that American Family’s coverage options are not as extensive as those offered by larger providers.

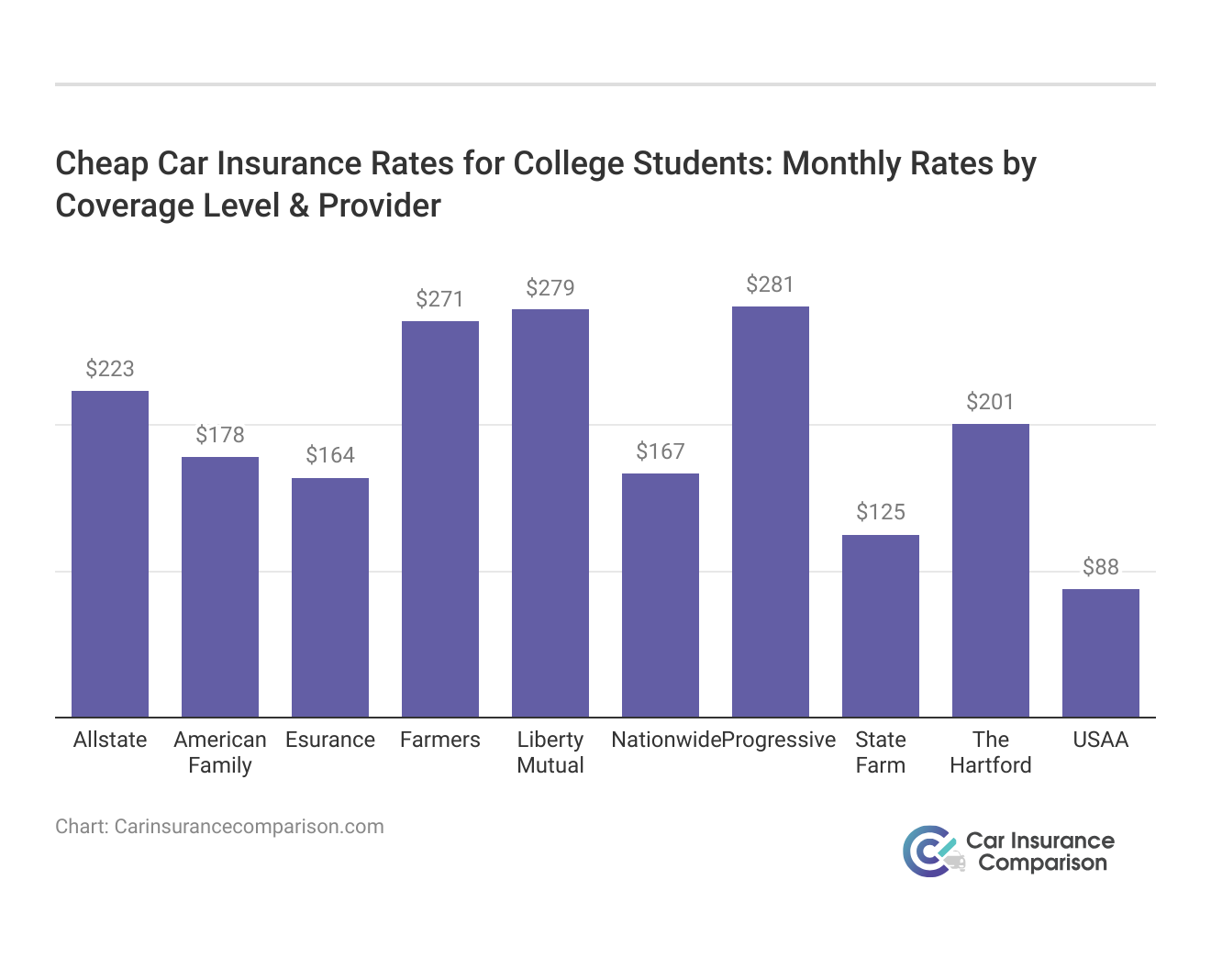

Understanding the Top 10 Car Insurance Providers for College Students

Understanding the top 10 car insurance providers and their associated rates can be a crucial step in making an informed decision. According to recent data, the average monthly car insurance rates for college students vary across different providers. Progressive stands out with rates of $281 for minimum coverage and $662 for full coverage, making it a notable choice for those seeking comprehensive protection.

Car Insurance for College Students: Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $223 | $519 |

| American Family | $178 | $414 |

| Esurance | $164 | $192 |

| Farmers | $271 | $629 |

| Liberty Mutual | $279 | $626 |

| Nationwide | $167 | $387 |

| Progressive | $281 | $662 |

| State Farm | $125 | $284 |

| The Hartford | $201 | $469 |

| USAA | $88 | $203 |

USAA, with rates at $88 for minimum coverage and $203 for full coverage, emerges as an appealing option, particularly for students with military affiliations or family members who are eligible for USAA membership. State Farm offers rates of $125 for minimum coverage and $284 for full coverage, providing a balanced option for students looking for affordable and comprehensive insurance.

Allstate presents rates of $223 for minimum coverage and $519 for full coverage, while Nationwide follows closely with rates of $167 for minimum coverage and $387 for full coverage. Farmers, Liberty Mutual, Esurance, The Hartford, and American Family also offer competitive rates, ranging from $164 to $279 for minimum coverage and $192 to $629 for full coverage.

These options give college students a range of choices to fit their budget and coverage needs, ensuring they can make informed decisions to safeguard their vehicles during their college years.

Read more:

- Allstate vs. The Hartford Car Insurance Comparison

- Esurance vs. Geico vs. Progressive Car Insurance Comparison

- Geico vs. Allstate Car Insurance Comparison

- Geico vs. Liberty Mutual Car Insurance Comparison

- Geico vs. The Hartford Car Insurance Comparison

- AAA vs. The Hartford Car Insurance Comparison

Cheapest Car Insurance for College Students Under 18

The most affordable auto insurance for college students is to stay on your parent’s policy. In this instance, we discovered that Geico offers the most affordable insurance, costing our sample of 18-year-old first-year college students around $210 monthly.

You will need to get your own policy if you live away from home and maintain your car on campus. In this case, we discovered that State Farm is the least expensive company, charging the same driver $240

Compare these rates to how much it costs to stay on an existing policy before you buy car insurance for 18 year olds.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Cheapest Car Insurance for College Students Under 19

Unfortunately, teen car insurance rates are among the most expensive and remain high until drivers turn 21.

When purchasing your own auto insurance policy as a freshman or sophomore student at the age of 19, you’ll discover that the premiums might be a little bit lower than when you were 18 years old if you maintained a good driving record.

According to our research, State Farm has the lowest average monthly rates for 19-year-old students at $205. However, you should always compare multiple companies, as our sample driver received fairly comparable pricing from Allstate and Geico.

Read more: Compare 19-Year-Old Driver Car Insurance Rates

Cheapest Car Insurance for College Students Under 20

Rates continue to drop as students get older. If you’re a 20-year-old sophomore or junior looking for car insurance, we found that Allstate is the cheapest company on average, with monthly rates of around $180.

Geico and State Farm are also competitively priced, as they are for other ages.

Cheapest Car Insurance for College Students Under 21

The first step for junior or senior students looking for affordable auto insurance should be to request a quote from Geico. Our sample 21-year-old driver paid an average of $140 monthly, which is significantly less than the next-closest rivals, State Farm or Allstate.

Remember that speeding tickets, at-fault accidents, and other moving violations on your record will increase your rates, especially as a teen or young driver. So if you’re looking for cheap auto insurance for college students, keep your driving record clean. Check out to gain more “How do you get competitive quotes for car insurance?“

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Geico has the Best Car Insurance Rates for College Students

Although car insurance rates vary based on where you live, we discovered that Geico consistently provides young drivers in college with affordable auto insurance. See how Geico compares to the other top companies in the table below and read our Geico car insurance review to get a complete breakdown of company rates.

Members of college-related organizations like alumni clubs, fraternities, and sororities are also eligible for discounts from Geico. Therefore, there is a significant chance that you might get cheap car insurance rates if you are a college student actively participating on campus.

Keep in mind that if you want a Geico student discount, you’ll need to let Geico know your status because it won’t have access to that information immediately.

Read more:

- Compare Drivers Without a College Degree Car Insurance Rates

- Compare Car Insurance Rates for College Students

State Farm Offers the Best Car Insurance Discounts for College Students

Students who qualify for State Farm’s good-student discount can save up to 25% annually on their auto insurance. The criteria for qualifying vary by state, but normally the driver must be enrolled full-time and have a GPA of at least 3.0. (out of 4.0).

Fortunately, the discount is valid until they are 25, even if drivers complete college before that age. College students who live on campus can save greatly with State Farm’s student discount. Drivers who attend school 100 miles away and leave their cars at home will also save money, but students may only use their car when they are home on vacation or during a holiday in order to qualify for the discount.

All drivers under the age of 25 have the chance to save money on their auto insurance through State Farm’s Steer Clear program. Through training resources and by independently noting noteworthy events that happen during trips, the program enables drivers to develop safe habits behind the wheel and earn discounts.

Here is a complete list of car insurance discounts offered by State Farm to see which you qualify for and how much you can save.

Metromile has the Best Pay-Per-Mile Insurance for College Students

College students who drive less than 12,000 miles annually will get the best rates with Metromile, a pay-per-mile insurance company. What is pay-per-mile car insurance? Car insurance by-the-mile determines rates based on how far you drive in a month.

With Metromile, your monthly car insurance rates will be made up of a basic cost and a per-mile charge. So the less you drive, the more you save on car insurance.

Depending on the state, Metromile does not charge policyholders for driving more than 250 miles each day. If college students or inexperienced drivers decide to drive home or on a road trip, they can think of this as a cap on the amount they can be charged. For example, Metromile won’t charge drivers in New Jersey for more than 150 miles per day.

The company’s restricted availability is its main flaw. Only eight states — Arizona, California, Illinois, New Jersey, Oregon, Pennsylvania, Virginia, and Washington — currently offer Metromile. If you live in one of these states, start comparing Metromile car insurance quotes.

Otherwise, you can ask your insurance provider for a low-mileage discount if Metromile isn’t available where you reside. The majority of auto insurance companies provide this benefit.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Allstate as the Best Car Insurance App for College Students

Students can use Allstate Mobile to manage claims and policy coverage or contact an insurance representative right away. The nicest feature of the app is that you may submit a claim directly from it. By doing this, you avoid making lengthy phone conversations during a stressful time.

The QuickTrip app from Allstate is a trip optimizer that reduces travel time and distance. The software will determine the best multi-stop route for the day based on the number of locations that drivers enter. This is a fantastic extra benefit for college students, especially those with busy schedules.

Allstate provides a wide network of agents who are accessible to answer your inquiries in person, in addition to providing excellent mobile apps. This can be a major benefit for college students who might not be familiar with the specifics of their auto insurance plans.

However, Allstate is frequently among the most expensive major insurers. Student drivers should carefully assess how to balance service quality and car insurance costs. The bottom line is that Allstate provides excellent mobile functionality and doesn’t scrimp on in-person help. Read our Allstate car insurance review and compare student driver car insurance rates to learn more.

How to Save Money on Student Car Insurance

Consider the strategies outlined below as a way to reduce the cost of student auto insurance if you are a college student who drives on campus or the parent of one.

Keep College Students on a Parent’s Policy

As opposed to purchasing the student a separate policy, adding a college student to car insurance should typically result in lower car insurance rates for the family, especially if the other family members have good driving records.

Due to the likelihood that the parents have a long relationship with the insurance provider, auto plans in the parents’ names are frequently less expensive. On the other hand, if a college student on family insurance has an accident while driving, the premiums for the parents could go up.

We advise comparing costs for the student to purchase a separate policy as well as costs for including them in (or keeping them on) the family policy.

Students may be required to acquire individual coverage from their insurer if they are relocating far from home for college. Although some insurers are more accommodating when it comes to young drivers continuing on their parent’s policy, it’s still crucial to be open and honest.

For example, if you submit a claim under your parents’ insurance and the company is unaware that you have moved out, it may reject your claim or possibly revoke your coverage. It is, therefore typically better to go over your options with your carrier.

Look for Low-Mileage Programs and Discounts

If your child doesn’t have a car and is attending college more than 100 miles from home, you may be able to get an away-from-home discount or drop them from the family policy while they’re away.

During spring and winter breaks, the student may continue to operate the vehicle as long as they don’t drive more than a predetermined number of days straight, as determined by the insurance provider.

Additionally, based on the lower mileage, you can qualify for a further premium discount since the student is now driving the car less or less. Confirm the features offered with your policy before you buy car insurance to ensure you get the best coverage at the best price.

Maintain Good Grades for Good Student Discounts

Insurance firms claim that good students drive more safely, which is usually reflected in vehicle insurance costs. If you match any of the following criteria and are a full-time high school or college student, most major insurance companies will reduce your rates:

- Students must have grades that are at least a B and have a 3.0 GPA or higher.

- Obtain a score on a particular standardized test from the previous year that is in the top 20%.

- It is essential to inquire about any savings your specific insurance provider may provide to college students with high GPAs.

To save money on student auto insurance, compare quotes from at least three different companies.

Case Studies: Tailored Car Insurance Solutions for College Students

These case studies demonstrate the tailored car insurance solutions available for college students, catering to their diverse needs and preferences. Let’s break down each case study:

- Case Study #1– Academic Advantage With AAA Insurance: College sophomore Alex needed affordable car insurance while focusing on academics. AAA’s student discounts provided substantial savings, highlighting the importance of tailored insurance for students.

- Case Study #2– Effortless Experience With Geico: Tech-savvy junior Emma prioritized simplicity and affordability. Geico’s low rates and user-friendly tech aligned perfectly with her needs, resulting in both savings and convenience.

- Case Study #3– Financial Savvy With Metromile: Senior James sought pay-per-mile insurance due to limited driving. Metromile’s model suited his sporadic habits and budget, offering a tailored, cost-effective solution.

This illustrate how car insurance companies like AAA car insurance review, Geico, and Metromile tailor their solutions to meet the unique needs and preferences of college students.

Progressive earns the top spot as the best company for college students, offering excellence in online convenience, comprehensive coverage, and competitive rates.

Melanie Musson Published Insurance Expert

Whether through discounts for good students, user-friendly technology, or innovative pricing models based on miles driven.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

The Bottom Line on Cheap Car Insurance for College Students

It’s important to note that not all college students will pay the same amount for auto insurance. For instance, a college student who is 18 years old will probably pay a lot more than someone who is 25 years old.

Shopping around and comparing prices is one of the best methods to reduce your auto insurance costs. Auto insurance rates vary by driver and ZIP code, so it’s wise to compare multiple companies to ensure you’re getting a fair rate.

Discover your options and find the right car insurance coverage that suits your needs and budget. Finding cheap car insurance quotes is easy. Just enter your ZIP code into our free comparison tool below to instantly compare quotes near you.

Frequently Asked Questions

How can college students benefit from good-student discounts on car insurance?

Many insurance providers offer good-student discounts to full-time high school or college students who maintain good grades. These discounts reflect the belief that responsible academic behavior correlates with safe driving habits, leading to reduced insurance rates for eligible students.

Explore our guide to the “Best Car Insurance Companies” and make informed decisions to secure reliable coverage for your needs.

What is pay-per-mile insurance, and how can it be advantageous for college students?

Pay-per-mile insurance, exemplified by companies like Metromile, calculates insurance rates based on the number of miles driven. College students who don’t use their cars frequently can benefit from this model as they only pay for the miles they drive, potentially resulting in lower overall insurance costs.

Take the first step toward cheaper car insurance rates. Enter your ZIP code below to see how much you could save.

How can college students save money on car insurance while maintaining financial stability?

College students can explore discounts offered by insurance providers for good grades, on-time payments, affiliations with certain organizations, and other factors. Additionally, being mindful of low-mileage programs and considering options like pay-per-mile insurance can contribute to financial savings.

Is it advisable for college students to stay on their parents’ car insurance policy?

In many cases, adding a college student to their parents’ car insurance policy can result in lower overall rates for the family, especially if the parents have a good driving record.

How can college students balance the need for comprehensive coverage with budget constraints?

College students can balance the need for comprehensive coverage by exploring discounts, comparing quotes from multiple providers, and adjusting coverage levels based on their budget. It’s essential to prioritize coverage that provides adequate protection while staying within financial means.

Explore further information, read our best full coverage car insurance for more insights.

What factors should college students consider when choosing the right car insurance provider for their needs?

College students should consider factors such as the provider’s reputation, available discounts (e.g., good-student, low-mileage), coverage options, financial stability, and customer service.

What is the cheapest car insurance option for college students under 18?

For college students under 18, staying on their parents’ policy is often the most affordable option. Companies like Geico and State Farm typically offer competitive rates for this demographic.

How do car insurance rates for college students change as they age?

Car insurance rates for college students typically decrease as they age, especially after turning 21. Young drivers are considered high-risk, but with a clean driving record and responsible behavior, rates tend to decrease gradually.

Can college students get discounts for joining certain organizations or clubs?

Yes, some insurance companies offer discounts for college students who are members of certain organizations, such as alumni clubs, fraternities, or sororities. These discounts can help reduce insurance premiums for eligible students.

To gain further insights, read our guide “What is a car insurance premium?“

What should college students do if they need to file a claim while away at school?

College students can typically file a claim through their insurance company’s mobile app or website. It’s essential to document the incident thoroughly and contact the insurance company as soon as possible to start the claims process.

Instantly compare car insurance quotes from the top providers by entering your ZIP code into our free comparison tool below.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.