Best Ford Explorer Car Insurance in 2025 (Top 10 Companies Ranked)

State Farm, AAA, and USAA offer the best Ford Explorer car insurance, starting at just $42 a month. These providers excel with competitive rates, comprehensive coverage options, and exceptional customer service, making them ideal choices for Ford Explorer owners seeking reliable insurance solutions.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

UPDATED: Jan 10, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jan 10, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Full Coverage for Ford Explorer

A.M. Best Rating

Complaint Level

Pros & Cons

3,027 reviews

3,027 reviewsCompany Facts

Full Coverage for Ford Explorer

A.M. Best Rating

Complaint Level

Pros & Cons

3,027 reviews

3,027 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage for Ford Explorer

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews

The best Ford Explorer car insurance are State Farm, AAA, and USAA, known for their superior coverage and customer service.

These companies offer policies that combine affordability with extensive protection, making them the go-to choices for Ford Explorer owners. Each provider is celebrated for its commitment to excellence and reliability in the insurance market. Learn more in our detailed review on our article titled “Best Ford Car Insurance Rates.”

Our Top 10 Company Picks: Best Ford Explorer Car Insurance

Company Rank Multi-Vehicle Discount A.M. Best Best For Jump to Pros/Cons

#1 11% B Many Discounts State Farm

#2 15% A Online App AAA

#3 10% A++ Military Savings USAA

#4 18% A+ Add-on Coverages Allstate

#5 12% A++ Accident Forgiveness Travelers

#6 14% A+ Innovative Programs Progressive

#7 17% A Customizable Polices Liberty Mutual

#8 16% A++ Custom Plan Geico

#9 13% A Local Agents Farmers

#10 19% A+ 24/7 Support Erie

Ford Explorer Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

AAA $88 $183

Allstate $42 $180

Erie $72 $235

Farmers $60 $151

Geico $73 $131

Liberty Mutual $53 $246

Progressive $61 $200

State Farm $70 $181

Travelers $58 $228

USAA $61 $204

The insurance costs for Ford Explorer vary significantly between providers and coverage levels. For minimum coverage, Allstate offers the lowest rate at $42, while the highest is from AAA at $88 per month. Read more about this provider in our guide titled “AAA Car Insurance Discounts.”

On the other hand, full coverage rates show a broader range, with Geico providing the most affordable option at $131, and Liberty Mutual being the most expensive at $246. This range indicates the importance of comparing rates and coverage options to find the best insurance plan for your Ford Explorer, balancing cost against the breadth of coverage.

Ford Explorer Insurance Cost

The average monthly car insurance rates for a Ford Explorer stand at $109. This amount reflects the standard cost typically associated with insuring this type of vehicle.

Ford Explorer Car Insurance Monthly Rates by Coverage Type

Category Rates

Average Rate $109

Discount Rate $64

High Deductibles $94

High Risk Driver $232

Low Deductibles $137

Teen Driver $398

Conclusively, the average monthly insurance cost for a Ford Explorer stands at $109, reflecting a standard rate for insuring this popular vehicle. It’s crucial for owners to compare insurance rates, considering factors like deductibles and driver profiles, to find the most suitable and cost-effective coverage. Discover more in our article titled “Is car insurance tax deductible?”

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Are Ford Explorers Expensive to Insure

The chart below compares Ford Explorer insurance rates with other SUVs such as the Acura MDX, Acura RDX, and BMW X3. It details how the rates vary across these models. Explore additional information in our guide titled “Best Acura Car Insurance Rates.”

Ford Explorer Car Insurance Monthly Rates vs. Similar Vehicles by Coverage Type

Vehicle Comprehensive Collision Minimum Coverage Full Coverage

Ford Explorer $26 $39 $31 $109

Acura MDX $31 $47 $31 $122

Acura RDX $26 $44 $26 $108

BMW X3 $31 $55 $31 $130

Jeep Wrangler $23 $31 $35 $105

Mitsubishi Outlander $26 $45 $28 $110

Ford Flex $28 $47 $33 $121

There are several strategies you can employ to secure the lowest online rates for Ford insurance. These methods can help you find the most cost-effective options available.

What Impacts the Cost of Ford Explorer Insurance

The trim and model of your Ford Explorer can significantly affect the total price of your auto insurance coverage. Choosing different versions will impact the insurance costs you incur.

Age of the Vehicle

The average Ford Explorer auto insurance rates are higher for newer models. For example, auto insurance for a 2020 Ford Explorer costs approximately $109 per month, while 2010 Ford Explorer insurance costs about $91 per month, a difference of $18 per month.

Ford Explorer Car Insurance Monthly Rates by Age of the Vehicle

Vehicle Comprehensive Collision Minimum Coverage Full Coverage

2024 Ford Explorer $27 $41 $32 $110

2023 Ford Explorer $26 $40 $32 $110

2022 Ford Explorer $26 $40 $31 $109

2021 Ford Explorer $25 $40 $31 $109

2020 Ford Explorer $26 $39 $31 $109

2019 Ford Explorer $25 $38 $33 $108

2018 Ford Explorer $24 $37 $33 $107

2017 Ford Explorer $23 $36 $35 $107

2016 Ford Explorer $22 $35 $36 $106

2015 Ford Explorer $21 $34 $37 $104

2014 Ford Explorer $20 $31 $38 $102

2013 Ford Explorer $19 $29 $38 $100

2012 Ford Explorer $18 $26 $38 $96

2011 Ford Explorer $17 $24 $38 $93

2010 Ford Explorer $17 $23 $39 $91

In conclusion, the cost of insuring a Ford Explorer varies significantly with the age of the vehicle, with newer models generally commanding higher insurance rates. For instance, the monthly premium for a 2020 Ford Explorer is $18 higher than that for a 2010 model, underscoring the impact of vehicle age on insurance costs.

Driver Age

Driver age can significantly affect Ford Explorer car insurance rates. For example, 20-year-old drivers pay approximately $133 more per month for their Ford Explorer car insurance than 30-year-old drivers.

Ford Explorer Car Insurance Monthly Rates by Age

Age Rates

Age: 16 $580

Age: 18 $398

Age: 20 $247

Age: 30 $114

Age: 40 $109

Age: 45 $105

Age: 50 $99

Age: 60 $97

In conclusion, driver age plays a crucial role in determining the cost of Ford Explorer car insurance, with younger drivers, such as those aged 20, paying significantly more than older drivers. As drivers mature, their insurance rates tend to decrease, reflecting the increased experience and decreased risk they bring to the road. Find further information in our guide titled “Best Car Insurance for High-Risk Drivers.”

Driver Location

Where you live can have a large impact on Ford Explorer insurance rates. For example, drivers in Los Angeles may pay approximately $94 a month more than drivers in Indianapolis.

Ford Explorer Car Insurance Monthly Rates by City

City Rates

Los Angeles, CA $186

New York, NY $172

Houston, TX $171

Jacksonville, FL $158

Philadelphia, PA $146

Chicago, IL $144

Phoenix, AZ $126

Seattle, WA $106

Indianapolis, IN $93

Columbus, OH $91

In conclusion, the location of a driver plays a significant role in determining the insurance rates for a Ford Explorer, with costs varying considerably across different cities.

For instance, the monthly premium difference between Los Angeles and Indianapolis highlights the geographic disparities in insurance pricing, emphasizing the importance of location in insurance cost assessments. Explore insurance savings in our comprehensive guide titled “Do car accidents where you live affect car insurance rates?”

Your Driving Record

Your driving record can have an impact on the cost of Ford Explorer auto insurance. Teens and drivers in their 20’s see the highest jump in their Ford Explorer auto insurance rates with violations on their driving record.

Ford Explorer Car Insurance Monthly Rates by Age & Driving Record

Age Clean Record One Accident One DUI One Ticket

Age: 16 $580 $750 $1,050 $720

Age: 18 $398 $580 $820 $500

Age: 20 $247 $410 $630 $340

Age: 30 $114 $180 $290 $160

Age: 40 $109 $170 $280 $155

Age: 45 $105 $165 $275 $150

Age: 50 $99 $160 $270 $145

Age: 60 $97 155 $260 $140

Your driving record significantly influences your Ford Explorer insurance costs, with rates escalating notably for younger drivers who have violations or accidents recorded.

Ford Explorer Safety Ratings

The safety ratings of your Ford Explorer significantly influence your auto insurance rates. These ratings are a key factor in determining the cost of your policy. See the breakdown below:

Ford Explorer Safety Ratings

Type Rating

Small overlap front: driver-side Good

Small overlap front: passenger-side Good

Moderate overlap front Good

Side Good

Roof strength Good

Head restraints and seats Good

The safety ratings of the Ford Explorer, ranging from “Acceptable” to “Good” across various tests, play a crucial role in shaping the cost of your auto insurance policy. Explore our guide titled “Can I change my car insurance company mid-policy?” to learn more about the offerings.

Ford Explorer Crash Test Ratings

Ford Explorer crash test ratings significantly impact your car insurance rates. These ratings are crucial in determining the cost of insuring your Ford Explorer.

Ford Explorer Crash Test Ratings

Vehicle Tested Overall Frontal Side Rollover

2024 Ford Explorer SUV RWD 5 stars 5 stars 5 stars 4 stars

2024 Ford Explorer SUV 4WD 5 stars 5 stars 5 stars 4 stars

2024 Ford Explorer PHEV SUV RWD N/R 5 stars 5 stars 4 stars

2024 Ford Explorer PHEV SUV 4WD N/R 5 stars 5 stars 4 stars

2024 Ford Explorer HEV SUV RWD 5 stars 5 stars 5 stars 4 stars

2024 Ford Explorer HEV SUV 4WD 5 stars 5 stars 5 stars 4 stars

2023 Ford Explorer SUV RWD 5 stars 5 stars 5 stars 4 stars

2023 Ford Explorer SUV 4WD 5 stars 5 stars 5 stars 4 stars

2022 Ford Explorer SUV RWD 5 stars 5 stars 5 stars 4 stars

2022 Ford Explorer SUV 4WD 5 stars 5 stars 5 stars 4 stars

2021 Ford Explorer SUV RWD 5 stars 5 stars 5 stars 4 stars

2021 Ford Explorer SUV 4WD 5 stars 5 stars 5 stars 4 stars

2020 Ford Explorer SUV RWD 5 stars 5 stars 5 stars 4 stars

2020 Ford Explorer SUV 4WD 5 stars 5 stars 5 stars 4 stars

2019 Ford Explorer 4 DR SUV FWD 5 stars 5 stars 5 stars 4 stars

2019 Ford Explorer 4 DR SUV AWD 5 stars 5 stars 5 stars 4 stars

2018 Ford Explorer 4 DR SUV FWD 5 stars 5 stars 5 stars 4 stars

2018 Ford Explorer 4 DR SUV AWD 5 stars 5 stars 5 stars 4 stars

2017 Ford Explorer 4 DR SUV FWD 5 stars 5 stars 5 stars 4 stars

2017 Ford Explorer 4 DR SUV AWD 5 stars 5 stars 5 stars 4 stars

2016 Ford Explorer 4 DR SUV FWD 5 stars 5 stars 5 stars 4 stars

2016 Ford Explorer 4 DR SUV AWD 5 stars 5 stars 5 stars 4 stars

The crash test ratings of the Ford Explorer, consistently high across several models, play a vital role in influencing insurance costs for this vehicle.

Ford Explorer Safety Features

The more safety features your Ford Explorer has, the higher your chances of earning a discount. Safety enhancements directly impact the likelihood of reduced insurance rates. The Ford Explorer’s safety features include:

Ford Explorer Insurance Loss Probability

The Ford Explorer’s insurance loss ratio varies between different coverage types. While some types of insurance loss ratios are higher for the Ford Explorer, others are more favorable and lead to lower insurance rates.

Ford Explorer Insurance Loss Probability

Insurance Coverage Category Loss Rate

Collision -20%

Property Damage -10%

Comprehensive -21%

Personal Injury -25%

Medical Payment -30%

Bodily Injury -18%

The Ford Explorer’s varying insurance loss ratios across different coverage categories highlight its overall risk and cost-effectiveness. While certain categories like personal injury and medical payment show more favorable ratios, leading to potentially lower premiums, others may reflect higher costs depending on the insurer’s risk assessment.

Ford Explorer Finance and Insurance Cost

When financing a Ford Explorer, it’s essential to consider both the loan payment and insurance costs, as they collectively determine the monthly financial commitment. Interest rates and loan terms can significantly influence the total cost of ownership, with dealerships occasionally offering special financing rates.

Insurance expenses also vary widely depending on factors like the driver’s age, driving record, and chosen coverage level. On average, full coverage might cost between $100 and $200 monthly, but this can fluctuate based on location and the insurance provider.

Prospective Ford Explorer owners can reduce costs by comparing financial and insurance options, selecting higher deductibles for lower premiums, or bundling policies for discounts. Such strategic planning makes ownership more affordable and ensures adequate protection for their investment. Explore our analysis in our guide titled “How to Find Your Car Insurance Deductible Amount.”

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Ways to Save on Ford Explorer Insurance

Save more on your Ford Explorer car insurance rates. Take a look at the following five strategies that will get you the best Ford Explorer auto insurance rates possible.

- Ask about mature driver discounts for drivers over 50.

- Ask about Ford Explorer low mileage discounts.

- Don’t always pick the cheapest Ford Explorer insurance policy.

- Pay your Ford Explorer insurance upfront.

- Avoid the temptation to file a claim for minor incidents.

By exploring mature driver discounts, considering low mileage rates, choosing quality over cost, paying upfront, and minimizing claims for minor incidents, you can significantly reduce your Ford Explorer car insurance expenses. Discover specifics in our guide called “How long does a car insurance claim take to process?”

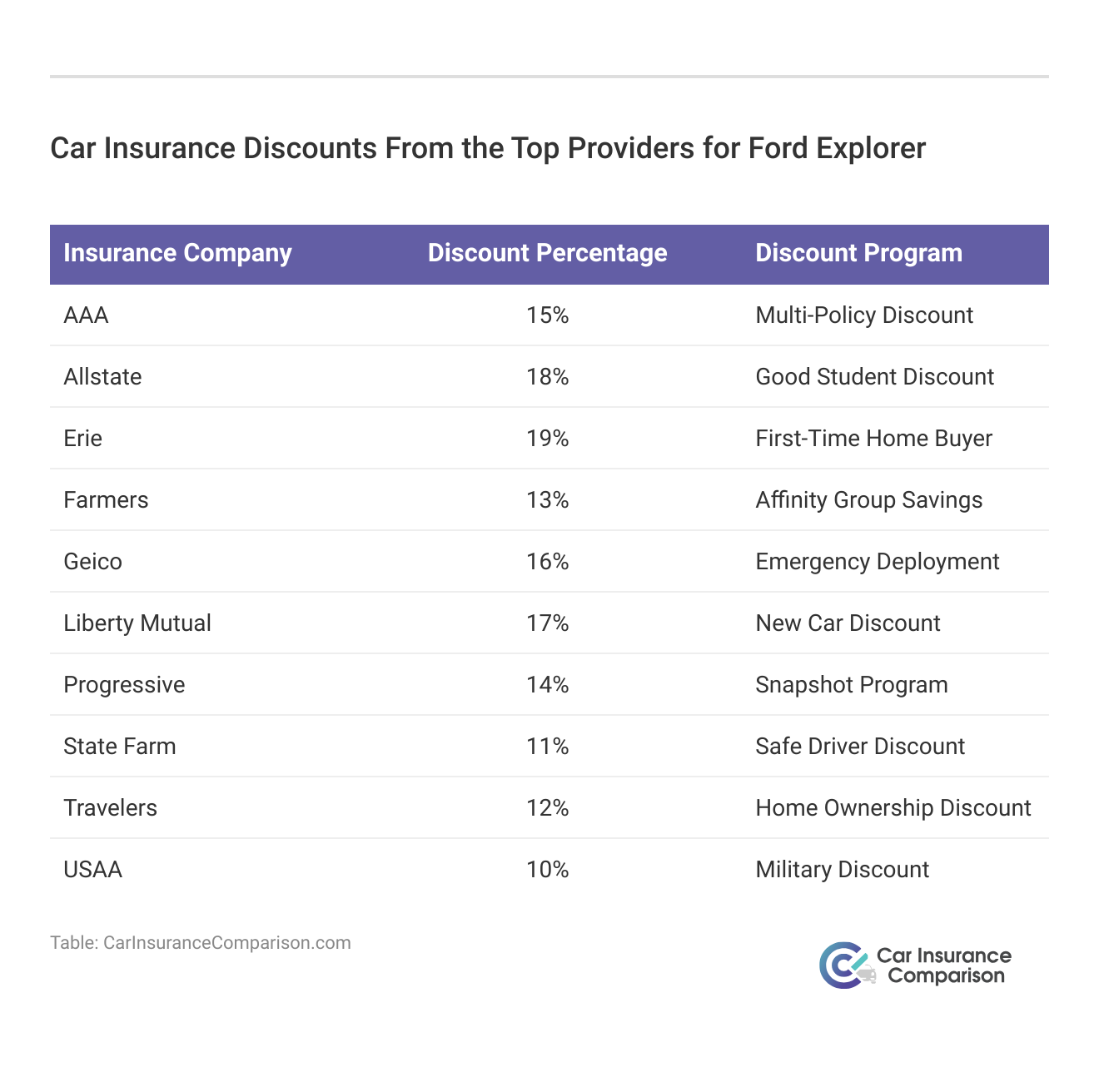

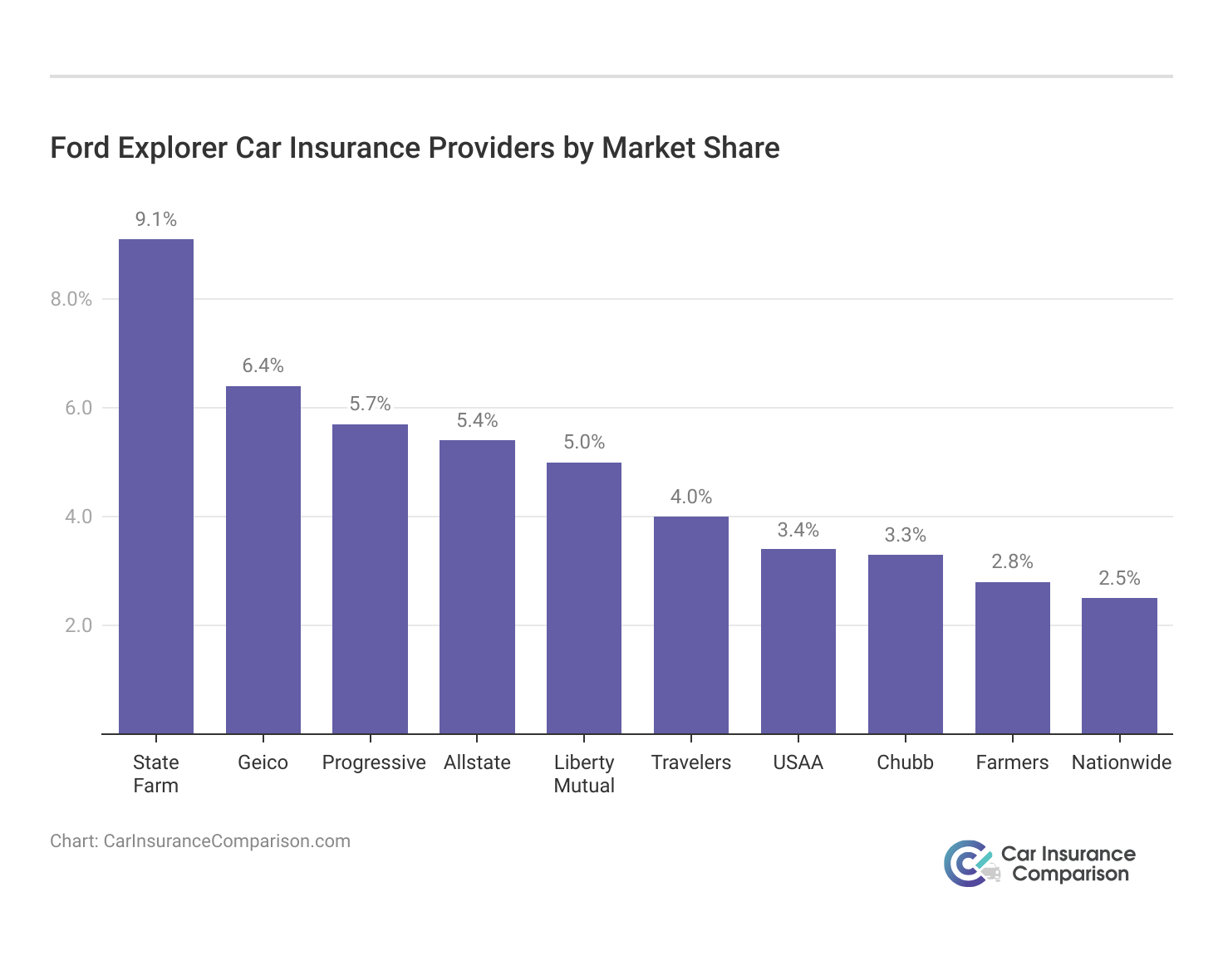

Top Ford Explorer Insurance Companies

Who is the top car insurance company for Ford Explorer insurance rates? While the actual rates you pay will depend on many factors, here are some of the top companies offering Ford Explorer auto insurance coverage (ordered by market share). Many of these companies offer discounts for security systems and other safety features that the Ford Explorer offers.

Top Ford Explorer Car Insurance Providers by Market Share

Rank Insurance Company Premiums Written Market Share

#1 State Farm $66,153,063 9%

#2 Geico $46,358,896 6%

#3 Progressive $41,737,283 6%

#4 Allstate $39,210,020 5%

#5 Liberty Mutual $36,172,570 5%

#6 Travelers $28,786,741 4%

#7 USAA $24,621,246 3%

#8 Chubb $24,199,582 3%

#9 Farmers $20,083,339 3%

#10 Nationwide $18,499,967 3%

State Farm leads the market in providing Ford Explorer insurance, highlighting their significant share and commitment to offering competitive rates and discounts tailored to the vehicle’s safety features.

As consumers consider various insurers, it’s clear that choices abound, with companies like Geico and Progressive also offering substantial market presence and customized policies for Ford Explorer owners. Learn more about coverage options and monthly rates in our guide titled “Progressive Car Insurance Discounts.”

Compare Free Ford Explorer Insurance Quotes Online

Finding the right car insurance for your Ford Explorer doesn’t have to be a complex process. With the convenience of online tools, you can easily compare free insurance quotes tailored to your vehicle. This approach helps you assess various insurance options from top providers, ensuring that you find a policy that offers the best balance of coverage, cost, and customer service.

By entering simple details about your Ford Explorer and your driving history, you can quickly receive a range of quotes. This allows you to see side-by-side comparisons of what different insurers charge, what discounts you might qualify for, and how different coverage levels affect your premium.

State Farm leads the pack for Ford Explorer insurance, offering robust coverage at competitive rates.

Brad Larson Licensed Insurance Agent

Taking advantage of these free online quote tools not only saves you time but also empowers you to make informed decisions, potentially saving you money while securing optimal protection for your Ford Explorer. “What information do you need for a car insurance quote?”

Affordable car insurance rates are just a click away. Enter your ZIP code into our free quote tool below to find the best policy for you.

Frequently Asked Questions

How much does car insurance for a Ford Explorer cost?

On average, Ford Explorer car insurance rates are $109 per month.

What factors affect the cost of Ford Explorer insurance?

The cost of Ford Explorer insurance is influenced by factors such as the age of the vehicle, driver age, location, driving record, safety ratings, and insurance loss probability.

To learn more, check out our guide called “How do you calculate total loss for car insurance?”

Are Ford Explorers expensive to insure?

Ford Explorer insurance rates are comparable to other SUVs. However, you can find cheaper rates by comparing quotes online.

How does the age of the vehicle impact Ford Explorer insurance rates?

Newer models of Ford Explorer tend to have higher insurance rates compared to older models.

What safety features can lower Ford Explorer insurance rates?

Having safety features on your Ford Explorer, such as anti-lock brakes and air bags, can potentially earn you a discount on your insurance.

For more information, check out our detailed resource called “Can you drive a car with air bags deployed?”

What is the average insurance cost for a 2020 Ford Explorer?

The average insurance cost for a 2020 Ford Explorer typically ranges around $109 per month, but rates can vary based on factors like location, driving history, and chosen coverage levels.

Are Explorers expensive to insure?

Ford Explorers are moderately priced to insure compared to other SUVs, with costs influenced by factors such as model year, driving history, and coverage type.

Who is known for the cheapest Ford Explorer car insurance?

Allstate often offers some of the lowest rates for Ford Explorer insurance, especially for minimum coverage.

Ready to find affordable car insurance? Get started today by entering your ZIP code below into our free comparison tool.

What is the best type of Ford Explorer car insurance to get?

Comprehensive car insurance is generally best for Ford Explorers, covering a wide range of incidents beyond just collisions.

Why are Fords more expensive to insure?

Fords may be more expensive to insure due to higher repair costs, theft rates, and performance capabilities relative to other vehicles.

Is Geico cheaper than Progressive for Ford Explorer insurance?

This can vary, but Geico frequently offers slightly cheaper rates than Progressive for Ford Explorer insurance.

Find out more by consulting our guide titled “Geico Car Insurance Discounts.”

Who is most expensive for Ford Explorer car insurance?

Liberty Mutual typically has higher premiums for Ford Explorer insurance due to its comprehensive coverage options and add-ons.

Which one is best for Ford Explorer car insurance?

State Farm is often recommended for Ford Explorer car insurance for its balance of cost, coverage, and customer service.

Which insurance company is best at paying claims for Ford Explorer?

USAA is highly regarded for its efficient and reliable claim payments for Ford Explorer, particularly valued by military families.

Check out insurance savings for military members and their families in our complete guide titled “USAA Car Insurance Discounts.”

Does AWD like in a Ford Explorer lower insurance?

AWD may lower insurance costs for a Ford Explorer by enhancing vehicle stability and safety, potentially reducing accident risks.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.