Best VIN Etching Car Insurance Discounts in 2026 (Your Guide to the Top 10 Companies)

AAA, Allstate, and Safeco offer the best VIN etching car insurance discounts, offering a minimum of 22% discount. Discover how VIN etching can lead to significant savings on your policy with these top providers. Learn why these companies are the leaders in leveraging VIN etching for enhanced vehicle security.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance and Finance Writer

Luke Williams is a finance, insurance, real estate, and home improvement expert based in Philadelphia, Pennsylvania, specializing in writing and researching for consumers. He studied finance, economics, and communications at Pennsylvania State University and graduated with a degree in Corporate Communications. His insurance and finance writing has been featured on Spoxor, The Good Men Project...

Luke Williams

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Scott W. Johnson

Updated July 2024

Company Facts

Full Monthly Rate for VIN Etching

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Monthly Rate for VIN Etching

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Monthly Rate for VIN Etching

A.M. Best Rating

Complaint Level

Pros & Cons

The top providers for the best VIN etching car insurance discounts are AAA, Allstate, and Safeco. These companies have been recognized for offering competitive benefits to customers who opt for VIN etching.

VIN etching involves engraving a vehicle’s unique identification number on its windows, making it less attractive to thieves and often leading to lower insurance premiums.

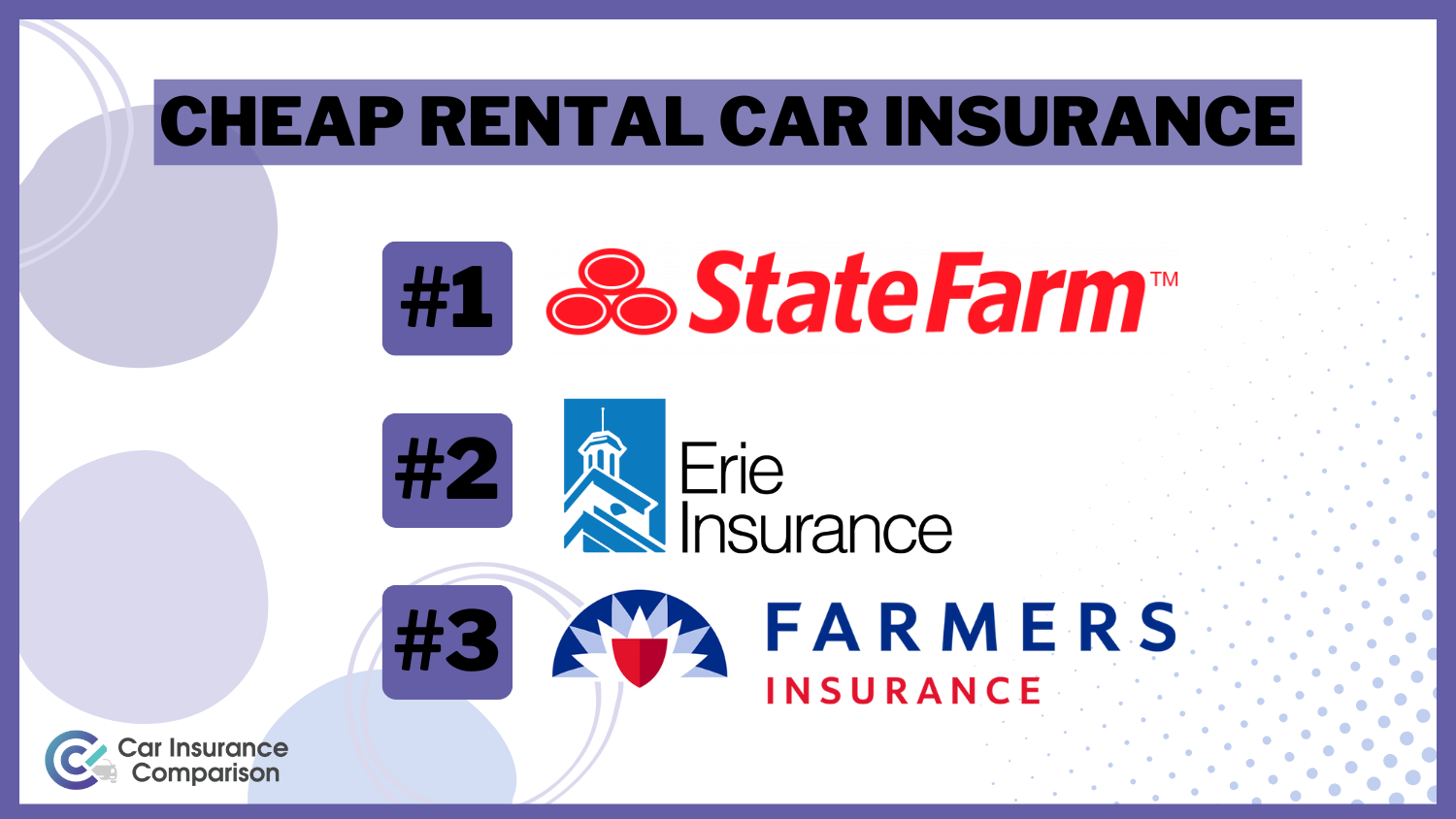

Our Top 10 Company Picks: Best VIN Etching Car Insurance Discounts

Company Rank VIN Etching Discount A.M. Best Best For Jump to Pros/Cons

#1 22% A Enhanced Security AAA

![]()

#2 18% A+ Vehicle Protection Allstate

#3 20% A+ Security Enhancement Safeco

#4 15% B Anti-Theft Measures State Farm

#5 17% A Theft Deterrence The Hartford

#6 12% A Vehicle Security Farmers

#7 14% A+ Enhanced Safety Nationwide

#8 10% A+ Theft Protection Progressive

#9 16% A+ Roadside Assistance Erie

#10 13% A+ Excellent Service Amica

Exploring these discounts can be a smart move for car owners looking to enhance security and reduce insurance costs. Learn more in our “What is the best car insurance?”

Compare quotes today to find the best price for the coverage you need. Enter your zip code above to get started.

- AAA is top pick for the best VIN etching auto insurance discounts

- VIN etching reduces theft risk, potentially lowering insurance premiums

- Opting for VIN etching supports enhanced vehicle security and recovery

#1 – AAA: Top Overall Pick

Pros

- High Discount Rates: AAA offers a 22% discount for vehicle marking, one of the highest in the industry.

- Strong Financial Rating: Rated ‘A’ by A.M. Best, indicating robust financial health. See more details on our AAA car insurance review.

- Comprehensive Security Features: AAA is known for its comprehensive security features that enhance vehicle safety.

Cons

- Availability: Discounts and features might vary by region, limiting accessibility for some customers.

- Cost: Premiums can be higher than average, especially without bundling other insurance products.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Allstate: Best for Vehicle Protection

Pros

- Substantial Vehicle Marking Discount: Allstate provides an 18% discount for VIN etching. Discover more about offerings in our Allstate car insurance review.

- Highest Financial Rating: Received an A+ rating from A.M. Best, ensuring excellent financial stability.

- Variety of Coverage Options: Offers a wide range of options that cater to different protection needs.

Cons

- Higher Premiums: Generally, premiums can be high compared to other insurers.

- Policy Restrictions: Certain discounts and coverages may not be available in all states.

#3 – Safeco: Best for Security Enhancement

Pros

- Generous Discounts: Offers a 20% discount for vehicle marking. Access comprehensive insights into our Safeco car insurance review.

- Excellent Financial Strength: Safeco holds an A+ rating from A.M. Best.

- Flexible Policies: Known for flexible policy options that suit various security needs.

Cons

- Customer Service: Some reports of less than satisfactory customer service experiences.

- Policy Cost: Premiums can be on the higher side without qualifying for multiple discounts.

#4 – State Farm: Best for Anti-Theft Measures

Pros

- Bundling Policies: State Farm offers significant discounts for bundling multiple insurance policies.

- High Low-Mileage Discount: Provides a substantial discount for low-mileage usage.

- Wide Coverage: Offers various coverage options tailored to different business needs. Unlock details in our State Farm car insurance review.

Cons

- Limited Multi-Policy Discount: The multi-policy discount is not as high compared to some competitors.

- Premium Costs: Despite discounts, premiums might still be relatively higher for certain coverage levels.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – The Hartford: Best for Theft Deterrence

Pros

- Competitive Vehicle Marking Discounts: The Hartford offers a 17% discount for vehicle marking.

- Strong Financial Standing: Holds an ‘A’ rating from A.M. Best, indicating good financial health.

- Focus on Theft Deterrence: Specializes in policies that focus on preventing theft. Discover insights in our The Hartford car insurance discounts.

Cons

- Niche Market Focus: May not offer as broad a range of general insurance products.

- Age Restrictions: Best benefits are often targeted to older, more mature customers.

#6 – Farmers: Best for Vehicle Security

Pros

- Dedicated Security Discounts: Offers a 12% discount on insurance for vehicles with security features like VIN etching.

- Robust Policy Options: Wide array of policy options catering to various security needs.

- Solid Financial Rating: Rated ‘A’ by A.M. Best. Learn more in our Farmers car insurance review.

Cons

- Higher Costs: Costs can be slightly higher, especially without discounts.

- Discount Limitations: Discounts and benefits might not be as competitive as other top insurers.

#7 – Nationwide: Best for Enhanced Safety

Pros

- Good Discount for Security Features: Provides a 14% discount for enhanced safety measures like vehicle marking.

- High Financial Stability: Nationwide has an A+ rating from A.M. Best. Check out insurance savings in our complete Nationwide car insurance discount.

- Broad Coverage: Offers extensive coverage options for a variety of needs.

Cons

- Premium Pricing: Premiums may be higher, affecting affordability.

- Complex Policy Offerings: Sometimes the variety of options can be overwhelming to new customers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Progressive: Best for Theft Protection

Pros

- Accessible Vehicle Marking Discounts: Offers a 10% discount for theft protection measures.

- Financially Strong: Maintains an A+ rating from A.M. Best. Delve into our evaluation of Progressive car insurance review.

- Innovative Tools: Known for innovative tools like the Snapshot program that can lead to additional savings.

Cons

- Varied Customer Satisfaction: Customer satisfaction can vary widely based on regional service levels.

- Rate Fluctuations: Premiums can vary after initial sign-up periods.

#9 – Erie: Best for Roadside Assistance

Pros

- High Vehicle Marking Discounts: Provides a 16% discount for vehicle marking. Learn more in our Erie car insurance review.

- Superior Service Ratings: Known for excellent customer service and quick claims response.

- Robust Roadside Assistance: Offers comprehensive roadside assistance as part of its packages.

Cons

- Limited Availability: Services are not available in all states.

- Premium Costs: These can be higher than some competitors, depending on coverage options.

#10 – Amica: Best for Excellent Service

Pros

- Good Discount for Vehicle Marking: Offers a 13% discount for VIN etching.

- Top-Tier Customer Service: Frequently rated highly for customer satisfaction and claims service.

- Financial Stability: Holds an A+ rating from A.M. Best. Unlock details in our “Amica vs. Progressive Car Insurance Comparison.”

Cons

- Limited Reach: Not as widely available as some larger insurers.

- Higher Premiums: Premium rates can be higher, particularly without bundling other insurance products.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Comparative Monthly Rates for VIN Etching Car Insurance Discounts

The following table illustrates the monthly car insurance rates provided by various companies for vehicles equipped with VIN etching discounts. This anti-theft feature can help reduce premiums, reflecting in the cost differences between full and minimum coverage options.

Car Insurance Monthly Rates by Coverage Level & Top Providers for VIN Etching Discounts

Insurance Company Minimum Coverage Full Coverage

AAA $40 $85

Allstate $45 $90

Amica $40 $83

Erie $44 $89

Farmers $41 $87

Nationwide $43 $86

Progressive $37 $84

Safeco $38 $80

State Farm $42 $88

The Hartford $39 $82

AAA offers full coverage at $85 and minimum coverage at $40, making it a competitive choice for those seeking substantial protection. Allstate follows closely with full coverage priced at $90 and minimum at $45. Safeco presents a lower-end rate with full coverage at $80 and a minimum of $38, one of the lowest in this selection.

State Farm and Hartford provide moderate rates, $88 and $82 for full coverage, respectively, demonstrating a balance between cost and comprehensive coverage. On the more affordable side, Progressive offers the lowest minimum coverage rate at $37.

Meanwhile, Erie and Amica showcase slightly higher rates, with Erie charging $89 for full coverage and Amica at $83. Each company offers distinct pricing, enabling consumers to choose based on their coverage needs and budget constraints.

Read more: Compare Comprehensive Car Insurance: Rates, Discounts, & Requirements

What Is a VIN and What Does It Do

Car insurance companies will reward you for having both active and passive anti-theft devices on your car. A passive anti-theft measure is doing something to your vehicle that makes it more difficult, if not impossible, for a thief to sell your car after they steal it.

In the case of VIN etching, the Vehicle Identification Number is etched into several windows of your car so that if the VIN plate is removed there is still an identifying VIN on the windows.

VIN etching doesn’t have to stop there, either. Some people go so far as to have VIN etchings done on their engine, gas tank, and more so that a thief would literally have to replace all of the parts in order to sell the car somewhere else. Because this isn’t cost-effective, the thief either is unable to sell the vehicle or tries to sell it anyway and is caught.

In the case of VIN etching in the window, all or some of your windows are etched with the VIN of your vehicle below the seal line. In order for a thief to see it, he or she would have to remove each of your windows which most thieves aren’t willing to do.

Yet, your willingness to take this step can help keep your vehicle from being stolen because a car dealership has the equipment on hand to remove and replace a window to determine whether or not it has been stolen before they make a purchase. This makes it difficult for the thief to do business. There are several ways to get VIN etching done on your vehicle, including:

- Dealer: In many cases, when you purchase a new vehicle, the dealer will offer a certain number of VIN etchings for free as part of the purchase. Some dealers will charge you a small fee and some dealers will charge a huge fee. It just depends on where you buy the car.

- Factory: If you don’t buy a car off of the lot because you have one made custom, you can request the etching be done at the factory and skip the middleman, so to speak.

- Independent: If you want to get VIN etching on a vehicle you already own, you can hire someone to do it.

You should talk to several insurance companies to ensure that you get the most savings from whatever anti-theft measures you take, both passive and active. If an insurance company doesn’t offer a discount for passive measures, consider finding another company to work with.

What Is the Effect of VIN Etching on Your Car’s Value

Another important point to consider is that VIN etching may be a selling point for you when you trade your car in, but it can decrease a car’s value if a criminal tries to re-sell the vehicle after stealing it from you. Criminals understand that their reward for stealing a car with VIN etching is reduced, and they often prefer to target vehicles that do not have this feature. Discover insights in our “Does car insurance cover stolen items?”

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Why Do Auto Insurance Companies Offer a VIN Etching Discount

Many car insurance companies offer a considerable discount for vehicles with anti-theft features, and this includes VIN etching. When a vehicle has anti-theft features, it is less likely to be stolen.

Therefore, the insurance company has less risk associated with insuring the vehicle. A VIN etching auto insurance discount is a way for the insurance company to pass along savings when your vehicle has ample features that deter criminal activity.

How Can You Find a VIN Etching Discount

While many auto insurance companies offer a VIN etching discount, not all providers do. If you want to find a provider that offers this money-saving discount, consider exploring the options online.

Many providers advertise or publish their discounts online, and your online research may give you a good indication of which providers to reach out to when you want to save money through this discount. However, this is just one of several factors to consider when you are looking for a new car insurance provider.

Can I Get VIN Etchings Done on My Older Vehicle

You can get VIN etchings done at any time. However, you need to understand that if you do this on your own, you are going to have to pay to have this done and it probably won’t be cheap. Removing the windows from your car to do a window VIN etching will be costly, as will finding a specialist to do VIN etchings on your car parts.

In some cases, the person may need to remove some engine parts, which will mean that there will be steep labor costs involved. If you already own your vehicle, consider a tracking device, which is getting more and more affordable as an anti-theft option. You should compare the cost of VIN etching on your older vehicle to other anti-theft measures to see what will fit best in your budget.

If you have an accident that requires you to get a new window, that is the best time to get an etching done. Some window companies will do it for only a couple of extra dollars, which your insurance company may pay for anyway.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What Are Some Other Ways to Deter Auto Theft

Deterring auto theft is understandably a top goal, and these are a few steps that you can take to reduce the chance that your car will be targeted by criminals:

- Always lock the doors, and secure the vehicle properly.

- Purchase a vehicle with an anti-theft security system.

- Install a GPS tracking system in your vehicle.

- Park in public, highly visible places.

- Avoid placing valuable items in open view inside the car.

Drivers will generally experience financial loss when their car is stolen. After all, you likely will need to pay your insurance deductible when you file a claim, and you may even have to pay off the remainder of your car loan if you are currently upside down with your financing.

Learn more by reading our guide: Common Ways Cars Are Stolen

What Can You Do if Your Car Is Stolen

If your vehicle is stolen, you should contact law enforcement officials as soon as possible so that they can file a police report and start looking for your car. After you have a copy of the police report, contact your auto insurance provider to file a claim.

The insurer often will ask you for a copy of the police report to confirm the theft. In some cases, a stolen car may be located, but you may also start looking for a new car to buy while you wait. Unlock details in our “Anti-Theft Car Insurance Discounts.”

Many vehicles are stolen each year, and a policy provides you with a convenient way to cover most of your financial loss associated with this type of event. See more details on our “What to Do if Your Car Keys Are Stolen.”

When you are updating your coverage, remember that only comprehensive auto coverage will pay benefits on a vehicle theft event.

Drivers can easily shop online today to compare rates that include a VIN etching discount, and you should also make plans to continue to shop for new rates every six months. By taking this step, you can keep your coverage updated and identify potential ways to save money on your auto coverage.

Compare quotes by entering your zip code below. Find the best rate for the coverage you need.

Frequently Asked Questions

What is VIN etching and how does it work?

VIN etching involves etching the Vehicle Identification Number (VIN) into the windows of a car as an anti-theft measure. This helps identify the vehicle even if the VIN plate is removed, making it less attractive to thieves. VIN etching can also be done on other parts of the vehicle, such as the engine or gas tank.

To find out more, explore our guide titled “The Top 5 Car Insurance Companies.”

Does VIN etching affect the value of a car?

While VIN etching can be a selling point when trading in a car, it may decrease the vehicle’s value if a criminal tries to resell it after stealing it from you. Criminals prefer to target vehicles without VIN etching because it reduces their potential reward.

How does VIN etching qualify for car insurance discounts?

Car insurance companies offer discounts for vehicles with active and passive anti-theft devices. VIN etching is considered a passive anti-theft measure. By etching the VIN into the windows, the car becomes less desirable to thieves, reducing the risk of theft. As a result, insurance companies may offer discounts on car insurance rates, often up to 10%.

By entering your ZIP code below, you can get instant car insurance quotes from top providers.

Are VIN etching insurance discounts available for all vehicles?

VIN etching insurance discounts are typically available for most vehicles. However, it’s recommended to check with your insurance company to ensure they offer this discount. Different insurance companies may have varying policies regarding anti-theft device discounts, so it’s advisable to compare quotes from multiple insurers to find the best savings.

Can I get VIN etchings done on my older vehicle?

Yes, you can get VIN etchings done on older vehicles. However, it’s important to note that the process may be more expensive compared to newer vehicles. Removing windows or etching other parts of the car may require additional labor costs. It’s advisable to compare the cost of VIN etching to other anti-theft measures to determine the best option for your budget.

To learn more, explore our comprehensive resource on “What is the minimum amount of liability car insurance coverage required?“

What is car etching and how does it work?

Car etching involves engraving the Vehicle Identification Number (VIN) on the windows of a vehicle to deter theft and facilitate recovery if stolen.

Does VIN etching lower insurance costs?

Yes, VIN etching can lower insurance costs as many insurers offer discounts for vehicles with this anti-theft feature.

What is etch insurance and what does it cover?

Etch insurance is a type of coverage that provides benefits if your car is stolen and not recovered. It often relates to the VIN etching on your vehicle.

How can I use an etching expressions coupon code?

An etching expressions coupon code can be used at checkout on their website to receive a discount on customized glass etching services.

For additional details, explore our comprehensive resource titled “Car Insurance Discounts: Compare the Best Discounts.”

How do I know if my car has VIN etching?

Check the lower corners of all windows in your vehicle; if you see the VIN engraved, your car has VIN etching.

Is window etching mandatory in NJ?

What is a VIN discount and how do I get it?

What is the typical cost of VIN etching?

How much is the VIN etching insurance discount?

Where can I find a VIN etching kit at AutoZone?

Does VIN etching help?

Who typically has the cheapest car insurance?

How do I know if my car has VIN etching?

What are discount rates in insurance?

Which insurance company offers the most discounts?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.