Cheapest South Carolina Car Insurance Rates in 2025 (10 Affordable Companies)

USAA, Geico, and State Farm are the top choices for the cheapest South Carolina car insurance rates, starting at $28 per month. Learn South Carolina car insurance requirements for bodily injury and property damage coverage and how to compare South Carolina car insurance rates to get the best deal.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Michael Leotta

Insurance Operations Specialist

Michael earned a degree in Business Management degree with an insurance focus, which led to a successful 25-year career in insurance claims operations and support. He possesses a high-level of business acumen across multiple areas of the insurance industry. Over the course of his career, he served in multiple roles supporting claims operations including: Claims Specialist, Claims Trainer, Claim Au...

Insurance Operations Specialist

UPDATED: Jan 6, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jan 6, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

6,589 reviews

6,589 reviewsCompany Facts

Min. Coverage for South Carolina

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage for South Carolina

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews

Company Facts

Min. Coverage for South Carolina

A.M. Best Rating

Complaint Level

Pros & Cons

Trying to find the cheapest South Carolina car insurance rates is difficult, yet top picks like USAA, Geico, and State Farm simplify it with affordable prices for as low as $28 per month.

Finding the cheapest South Carolina car insurance rates is essential for drivers looking to save money while meeting state requirements. However, driving its scenic roads requires car insurance.

Our Top 10 Company Picks: Cheapest South Carolina Car Insurance Rates

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $28 A++ Military Savings USAA

#2 $33 A++ Cheap Rates Geico

#3 $36 B Many Discounts State Farm

#4 $43 A++ Accident Forgiveness Travelers

#5 $43 A+ Online Convenience Progressive

#6 $49 A Student Savings American Family

#7 $50 A+ Usage Discount Nationwide

#8 $55 A+ Add-on Coverages Allstate

#9 $69 A Local Agents Farmers

#10 $76 A Customizable Polices Liberty Mutual

This guide helps you choose the best car insurance by covering types of coverage, minimum car insurance requirements by state, state laws, and top providers. Find cheap car insurance quotes by entering your ZIP code above.

- Compare providers for the cheapest South Carolina car insurance rates

- Meet South Carolina’s legal insurance requirements with the right coverage

- USAA offers top-rated, affordable insurance options

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – USAA: Top Pick Overall

Pros

- Exceptional Rates: USAA offers the lowest average rate of $28 for car insurance in South Carolina, making it an ideal choice for budget-conscious drivers seeking affordable coverage without sacrificing quality.

- Comprehensive Discounts: As mentioned in our USAA car insurance review, USAA provides various discounts such as for military affiliation, safe driving, and bundling, which contribute to their low premium rates, ensuring even greater savings on South Carolina car insurance.

- High Customer Satisfaction: Known for excellent customer service and high satisfaction ratings, USAA consistently ranks well in consumer surveys, reflecting their commitment to providing quality insurance at competitive rates in South Carolina.

Cons

- Eligibility Limitations: USAA’s car insurance is available only to military members, veterans, and their families, which limits accessibility for those outside this group, despite their exceptionally low rates in South Carolina.

- Limited Physical Presence: With fewer physical locations and agents compared to other insurers, USAA might offer less personal service and fewer in-person interactions, which could be a drawback for some South Carolina residents seeking hands-on support.

#2 – Geico: Best for Cheap Rates

Pros

- Affordable Rates: Geico offers competitive rates at an average of $33 for car insurance in South Carolina, making it a cost-effective option for drivers looking to save on their premiums while receiving comprehensive coverage.

- Discount Opportunities: Geico provides numerous discounts, including those for safe driving, multi-car policies, and military service, which help reduce overall costs and make their rates even more attractive in South Carolina.

- User-Friendly Services: With a highly-rated mobile app and online management system, Geico ensures easy access to policy management and claims filing, enhancing the convenience of their affordable insurance options in South Carolina. Learn more in our Geico car insurance review.

Cons

- Average Coverage Options: While Geico’s rates are low, their coverage options might be less extensive compared to some competitors, potentially leading to less customization in South Carolina car insurance policies.

- Customer Service Concerns: Some customers report less satisfactory experiences with Geico’s customer service, which can be a drawback if personalized service and support are important when managing your insurance needs in South Carolina.

#3 – State Farm: Best for Many Discounts

Pros

- Competitive Pricing: State Farm offers car insurance at an average rate of $36 in South Carolina, which is relatively affordable while providing a broad range of coverage options suited to various needs.

- Extensive Network of Agents: With a large network of local agents across South Carolina, State Farm provides accessible in-person service and personalized advice, enhancing the customer experience and support for insurance needs.

- Discount Programs: State Farm offers several discount programs, including those for safe driving, multiple policies, and good student discounts, contributing to lower insurance costs and making their rates attractive in South Carolina. Learn more in our State Farm car insurance review.

Cons

- Higher Rates Compared to Others: While State Farm’s rates are competitive, they are higher than some of the lowest options like USAA and Geico, which could be a consideration for those seeking the absolute cheapest car insurance in South Carolina.

- Mixed Customer Service Reviews: Some policyholders report mixed experiences with State Farm’s customer service, which may impact the overall satisfaction with their insurance coverage in South Carolina.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#4 – Travelers: Best for Accident Forgiveness

Pros

- Affordable Premiums: Travelers offers competitive car insurance rates averaging $43 in South Carolina, making it a budget-friendly option while still providing reliable coverage options.

- Broad Coverage Options: Travelers provides a range of coverage options and add-ons, such as roadside assistance and rental car reimbursement, allowing South Carolina drivers to tailor their insurance to meet specific needs.

- Discount Programs: Travelers offers various discounts, including those for multi-car policies and safe driving, which can help lower overall insurance costs and enhance affordability for South Carolina residents. See more details on our Travelers car insurance review.

Cons

- Higher Rates Than Some Competitors: Travelers’ average rate of $43 is higher than the lowest options such as USAA and Geico, which could be a disadvantage for those specifically seeking the cheapest car insurance in South Carolina.

- Customer Service Variability: Travelers’ customer service has received mixed reviews, which might affect the overall experience for South Carolina drivers seeking consistent and high-quality support.

#5 – Progressive: Best for Online Convenience

Pros

- Competitive Pricing: Progressive offers car insurance at an average rate of $43 in South Carolina, making it a cost-effective choice for drivers looking to balance affordability with comprehensive coverage.

- Customizable Policies: Progressive provides flexible policy options and additional coverage features, allowing South Carolina drivers to tailor their insurance to specific needs and preferences.

- Discount Opportunities: Progressive offers multiple discounts, such as for safe driving, bundling policies, and installing safety features in vehicles, which can help reduce overall insurance costs in South Carolina. Learn more about their availability in our Progressive car insurance review.

Cons

- Rate Variability: Progressive’s rates can vary significantly based on individual factors, which may result in higher premiums for some drivers in South Carolina compared to other low-cost options.

- Customer Service Issues: Some customers report issues with Progressive’s customer service, which may affect the overall satisfaction with managing claims and support in South Carolina.

#6 – American Family: Best for Student Savings

Pros

- Reasonable Rates:As mentioned in our American Family car insurance review, American Family offers car insurance at an average rate of $49 in South Carolina, providing a middle-ground option between the lowest and higher-priced insurance plans.

- Comprehensive Coverage: American Family provides a wide range of coverage options and add-ons, such as accident forgiveness and rental car reimbursement, catering to diverse insurance needs in South Carolina.

- Discount Programs: American Family offers various discounts, including those for bundling policies and safe driving, which can contribute to lowering insurance costs and making their rates more attractive.

Cons

- Higher Rates Than Some Competitors: At $49, American Family’s rates are higher than some of the cheapest options like USAA and Geico, which could be a drawback for those prioritizing the lowest possible premiums in South Carolina.

- Mixed Reviews on Customer Service: Some policyholders have reported less favorable experiences with American Family’s customer service, which might impact the overall satisfaction with their insurance services in South Carolina.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#7 – Nationwide: Best for Usage Discount

Pros

- Affordable Coverage: As outlined in our Nationwide car insurance discount, Nationwide offers car insurance at an average rate of $50 in South Carolina, providing relatively affordable coverage options with a good balance of cost and benefits.

- Comprehensive Policy Options: Nationwide provides a variety of coverage options, including customizable add-ons and accident forgiveness, allowing South Carolina drivers to tailor their insurance policies to their needs.

- Discount Opportunities: Nationwide offers multiple discounts, such as for safe driving, bundling policies, and having anti-theft devices, which can help reduce overall insurance costs for South Carolina residents.

Cons

- Higher Premiums Than Some Competitors: With an average rate of $50, Nationwide’s premiums are higher compared to the lowest options like USAA and Geico, which may not be ideal for those seeking the absolute cheapest rates in South Carolina.

- Customer Service Concerns: Nationwide has received mixed reviews regarding customer service, which could affect the overall experience for policyholders in South Carolina who value responsive and effective support.

#8 – Allstate: Best for Add-on Coverages

Pros

- Wide Range of Coverage: Allstate offers a comprehensive range of coverage options and additional features, such as accident forgiveness and safe driving bonuses, which cater to diverse needs in South Carolina.

- Discount Programs: Allstate provides various discount opportunities, including those for bundling policies, safe driving, and new vehicles, which can help reduce overall insurance costs for South Carolina drivers.

- Extensive Agent Network: With a large network of local agents, Allstate offers accessible in-person service and personalized advice, enhancing customer support and convenience in South Carolina. Learn more about their premiums in our Allstate car insurance review.

Cons

- Higher Average Rates: At an average rate of $55, Allstate’s premiums are higher compared to several competitors, which may be a consideration for those specifically looking for the cheapest car insurance options in South Carolina.

- Mixed Customer Satisfaction: Some customers report variable experiences with Allstate’s customer service, which might impact overall satisfaction with insurance coverage and support in South Carolina.

#9 – Farmers: Best for Local Agents

Pros

- Diverse Coverage Options: Farmers provides a wide range of coverage options and add-ons, such as roadside assistance and accident forgiveness, catering to various insurance needs for South Carolina drivers.

- Discount Opportunities: As outlined in our Farmers car insurance review, Farmers offers various discounts, including those for multi-car policies, safe driving, and bundling, which can help lower insurance premiums for residents in South Carolina.

- Local Agent Network: With a network of local agents, Farmers provides accessible in-person service and personalized support, enhancing customer experience for South Carolina drivers.

Cons

- Higher Premiums: Farmers’ average rate of $69 is significantly higher than several competitors, which may not be ideal for those seeking the most affordable car insurance options in South Carolina.

- Mixed Reviews on Customer Service: Some policyholders have reported less favorable experiences with Farmers’ customer service, which could impact overall satisfaction with managing claims and support in South Carolina.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#10 – Liberty Mutual: Best for Customizable Polices

Pros

- Comprehensive Coverage Options: Liberty Mutual offers a range of coverage options and add-ons, such as accident forgiveness and new car replacement, providing versatile insurance solutions for South Carolina drivers.

- Discount Programs: Liberty Mutual provides several discounts, including those for safe driving, multi-car policies, and bundling, which can contribute to reducing overall insurance costs for South Carolina residents.

- Customizable Policies: Liberty Mutual allows for a high degree of policy customization, enabling South Carolina drivers to tailor their insurance coverage to meet specific needs and preferences. Learn more in our Liberty Mutual car insurance review.

Cons

- Higher Average Rates: With an average rate of $76, Liberty Mutual’s premiums are the highest among the listed options, which may be a disadvantage for those seeking the most cost-effective car insurance in South Carolina.

- Customer Service Issues: Liberty Mutual has received mixed reviews regarding its customer service, which could impact the overall satisfaction with insurance coverage and support in South Carolina.

South Carolina Car Insurance Coverage and Rates

If you’re having a hard time understanding the different plans and types of car insurance, don’t feel overwhelmed. You’ve come to the right place.

The table below compares monthly rates for minimum and full coverage car insurance in SC from various providers.

South Carolina Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $55 $133

American Family $49 $118

Farmers $69 $166

Geico $33 $79

Liberty Mutual $76 $185

Nationwide $50 $118

Progressive $43 $105

State Farm $36 $88

Travelers $43 $105

USAA $28 $69

We want you to understand exactly what your plan covers (and what it doesn’t cover). After all, you are paying for it, right?

Hold on tight and keep reading to learn all about major insurance types and rates in South Carolina and in the surrounding states.

South Carolina Minimum Coverage

When you apply for a driver’s license (or renew your license) in the state of South Carolina, you must state either that you are an insured driver, or that you do not own a vehicle. What is no-fault car insurance and how does it work? This type of insurance helps pay for the costs of a car accident no matter who is at fault.

Because South Carolina is an at-fault state, state residents are required to carry liability auto insurance that meets at least the following minimums:

- $25,000 for bodily injury or death per person in an accident caused by the owner/driver of the insured vehicle

- $50,000 for total bodily injury or death liability per accident caused by the owner/driver of the insured vehicle

- $25,000 for property damage per accident caused by the owner/driver of the insured vehicle.

But what does liability coverage mean and what does it cover? Simply put, you are liable or at fault for any damages that occur because of an accident you caused.

These damages include covering the costs of medical bills to anyone who is injured because of the accident, as well as covering the costs of vehicle damages and property damages.

If the accident costs exceed your insurance coverage, you must pay the remaining damages yourself.

Brad Larson LICENSED INSURANCE AGENT

Keep in mind that minimum liability car insurance does not cover anything that happens to you or your vehicle at the time of the accident if it was caused by you or the person driving your car. Who is covered by minimum liability insurance?

- A family member or friend that is driving your car at the time of the accident

- Any person who was given permission to drive your car at the time of the accident

- It is likely to cover you if you are driving a rental car at the time of the accident. Compare rental car insurance to get better rates.

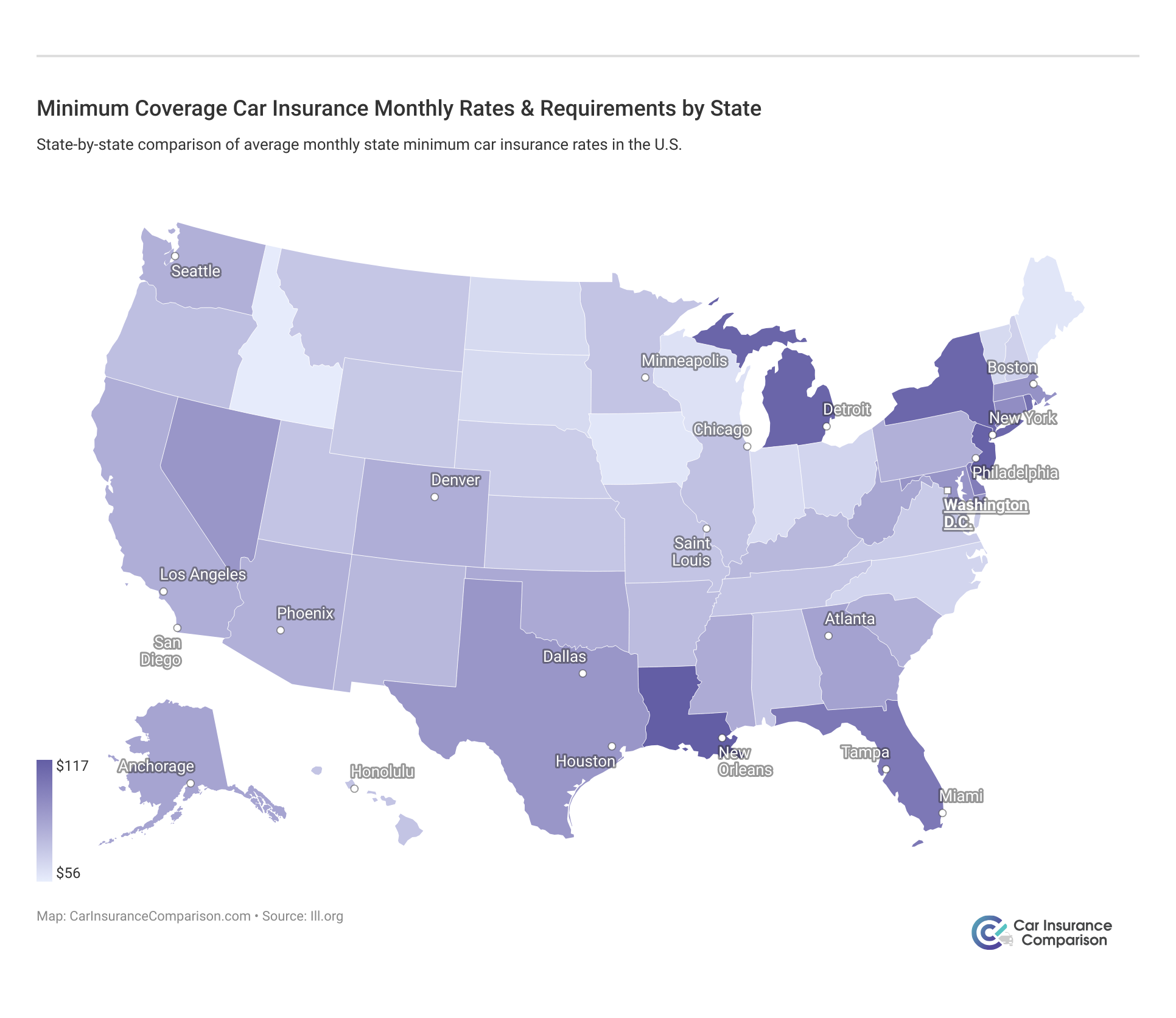

Minimum coverage is the cheapest option when it comes to car insurance, but it is not the same across the nation. Take a look.

Just remember if you’re worried about being held responsible for more than the minimum liability coverage, it might be a good idea to purchase a plan with better insurance.

Forms of Financial Responsibility

Proof of insurance proves financial responsibility, and by law, South Carolina drivers must be able to prove financial responsibility at all times. Vehicle owners must maintain proof of insurance at all times and must give a copy to any law enforcement officer demanding to see it. Acceptable forms of proof of insurance are:

- Liability Insurance ID Card

- Valid Binder (temporary form of insurance card)

- Copy of the car’s current insurance policy

Verifying Your Insurance

The South Carolina DMV will verify your insurance when you register or renew the tags on your vehicle. If your policy is not valid or cannot be found, your license and registration will be suspended and you may need to pay a $400 fee to reinstate your driving privileges.

Don’t want to lose your license and have to pay fees left and right? Make sure you keep your proof of insurance on your person and in your vehicle at all times.

Premiums as a Percentage of Income

The monthly average amount that residents pay for car insurance in South Carolina is $78.

So South Carolina rates are roughly $40 lower than the average. Of course, if you add more coverage to your insurance plan, your rates are sure to go up in price. It’s good to compare South Carolina’s rates to the states with the highest car insurance rates.

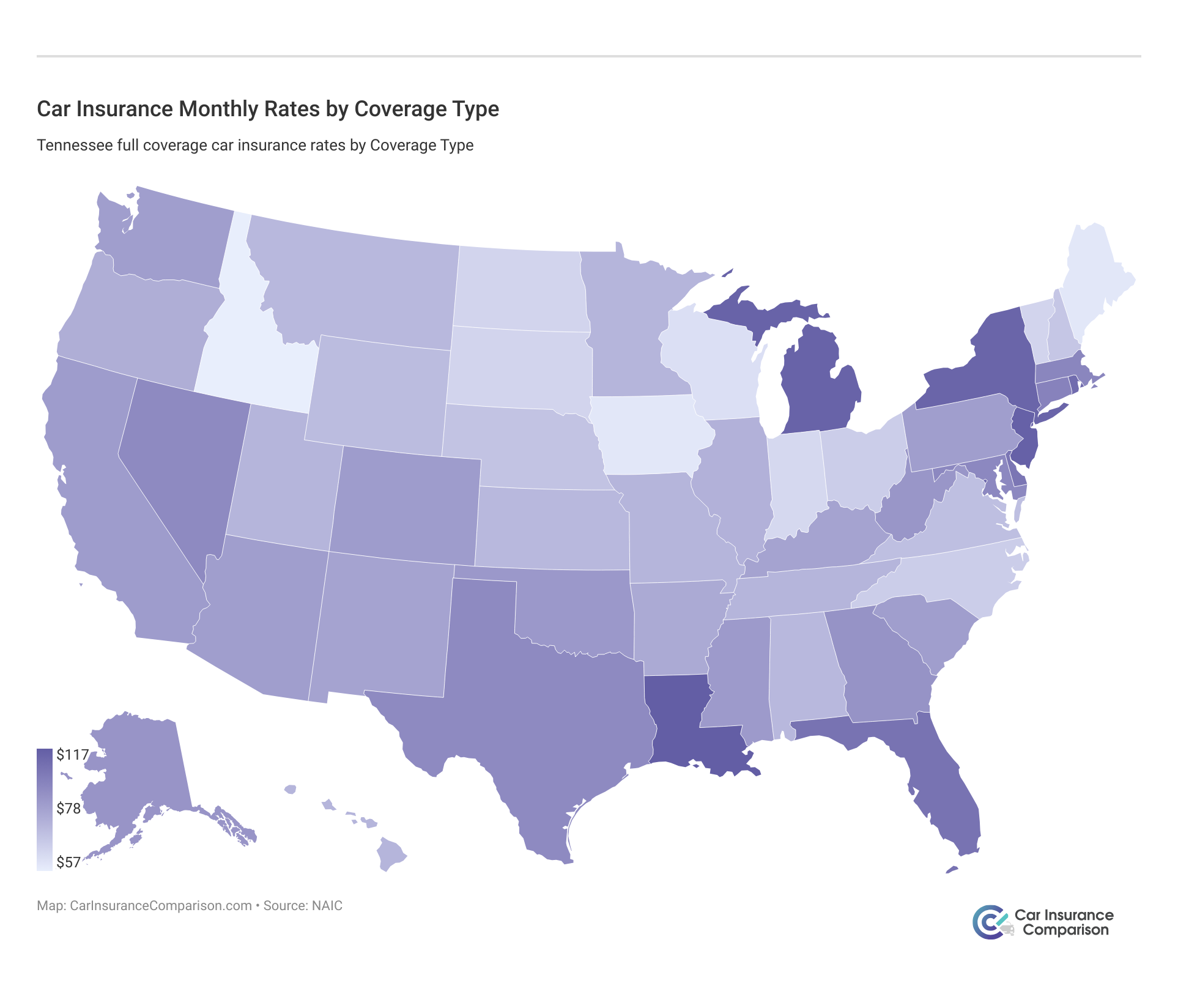

Average Monthly Car Insurance Rates in SC (Liability, Collision, Comprehensive)

What is the average cost of car insurance in South Carolina? Below is a table showing South Carolina’s car insurance rates by type: liability, collision, comprehensive, and combined.

South Carolina Car Insurance Rates by Coverage Type

| Coverage Type | Monthly Cost |

|---|---|

| Comprehensive | $44 |

| Collision | $22 |

| Minimum Coverage | $15 |

| Full Coverage | $81 |

Remember, this data was pulled from 2015, and rates may be higher for 2019. Sometimes it’s best to have additional insurance on top of the required insurance for your state in case of a bad accident. Where you live also affects your rates, especially from state to state.

Still have no idea what you’re doing? Don’t worry. Next, we will help you understand some additional coverage types, and why they are important. Be aware that these types can be added to any basic car insurance plan.

Additional Liability Coverage

The table below shows that in 2014, about 84% of medical bill claims were covered by the person’s insurance company and almost 74% of uninsured/underinsured claims were also covered.

South Carolina Liability Car Insurance Loss Ratio by Coverage Type

| Loss Ratio | 2021 | 2022 | 2023 |

|---|---|---|---|

| Medical Payments (MedPay) | 84% | 90% | 89% |

| Unisured/Underinsured Motorist Coverage (UUM) | 74% | 72% | 69% |

This is called a loss ratio. Car insurance companies who aren’t covering enough claims may be scamming you out of paying too much towards your yearly premium rate. But, companies who are covering too many claims, run the risk of bankrupting themselves.

That being said, car insurance companies who pay about 60-85% of claims are good companies to invest in when it comes to making sure your claim will be covered appropriately. The table above shows that South Carolina has good rates for claims being covered.

For Example:

If you are paying $120 a month towards your premium, about 84% of that money is going towards covering claims — whether you or someone else with your car insurance company has been in an accident.

Although these types of additional liability coverage plans are not required in the state of South Carolina, you might decide that adding some extra padding to your plan is a good idea.

Approximately 9.4% of motorists in South Carolina are uninsured. South Carolina is ranked 37th in the state for uninsured drivers.

But what does this frightening fact mean for you? Almost 10% of drivers will not be able to pay for damages in accidents that they cause. Most of these accidents caused by uninsured drivers will cause the driver to go bankrupt, leaving you vulnerable to covering the costs of damages yourself.

Also, be sure to find a company that doesn’t have super high (over 90%) or super low (under 60%) loss ratios. Read about how to calculate total loss for car insurance for more information on this topic.

Add-Ons, Endorsements, and Riders

We’ve already made it crystal clear that having just the required amount of car insurance isn’t always the smartest idea. But are there any other factors to consider? How do you know what other scenarios your plan should cover?

Below is a list of some of the most cost-effective insurance coverage out there. Pay attention, This list is extremely important and will help you save money when an accident occurs.

- Guaranteed Auto Protection (Gap)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Road Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Low-Mileage Discount

- Pay-as-you-go Car Insurance

Just like with additional liability coverage, these add-on car insurance coverage options can be added separately to your existing policy, or all at once, giving you the option to customize your plan.

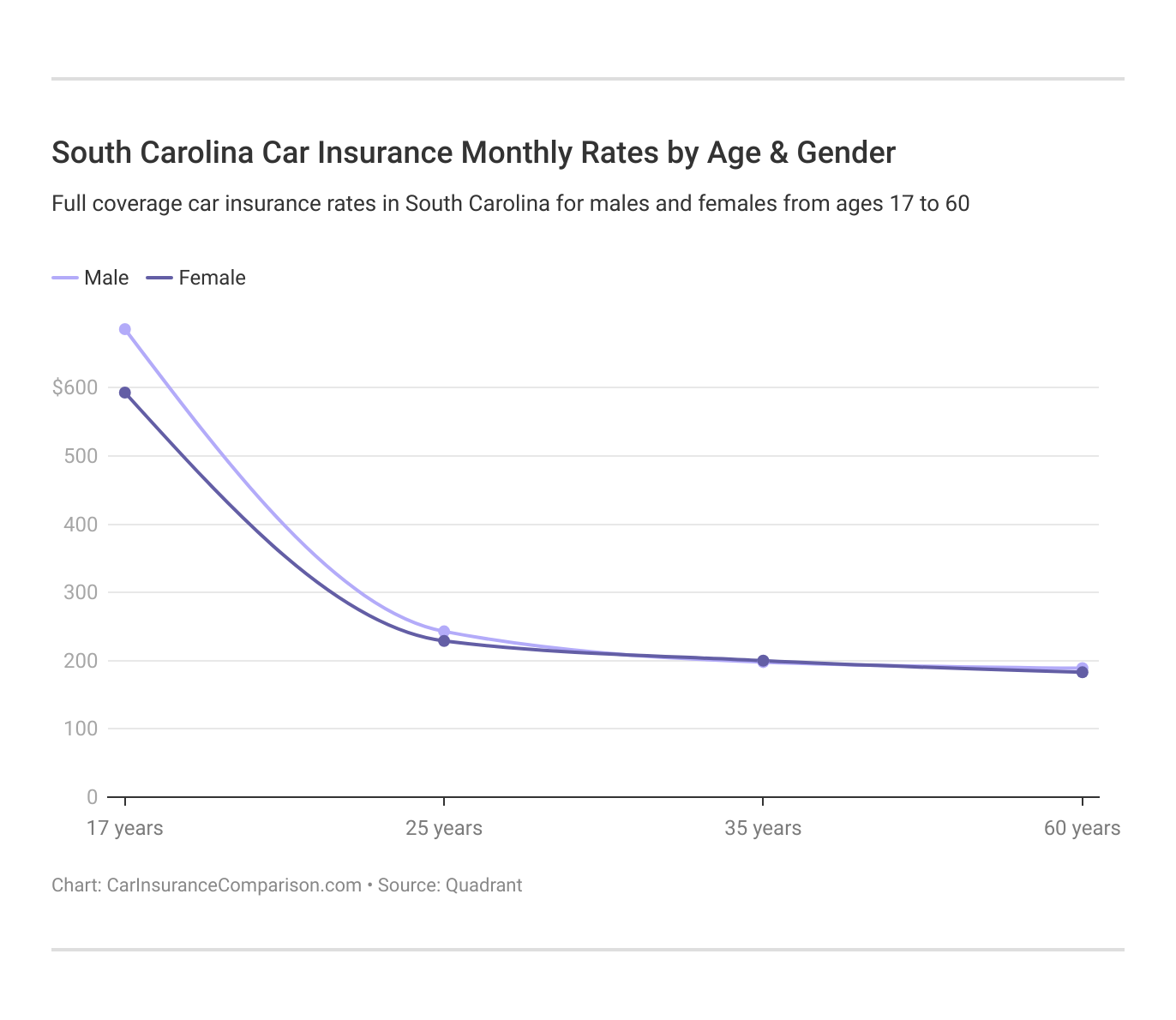

Average Monthly Car Insurance Rates by Age & Gender in SC

Did you know that things like your age, gender, what you do for work, and if you’re married or single can influence your car insurance rate?

As you can see, the younger you are, the higher the rate you’ll pay. Males are often associated with being reckless drivers, so more than likely they will pay more for car insurance than females do.

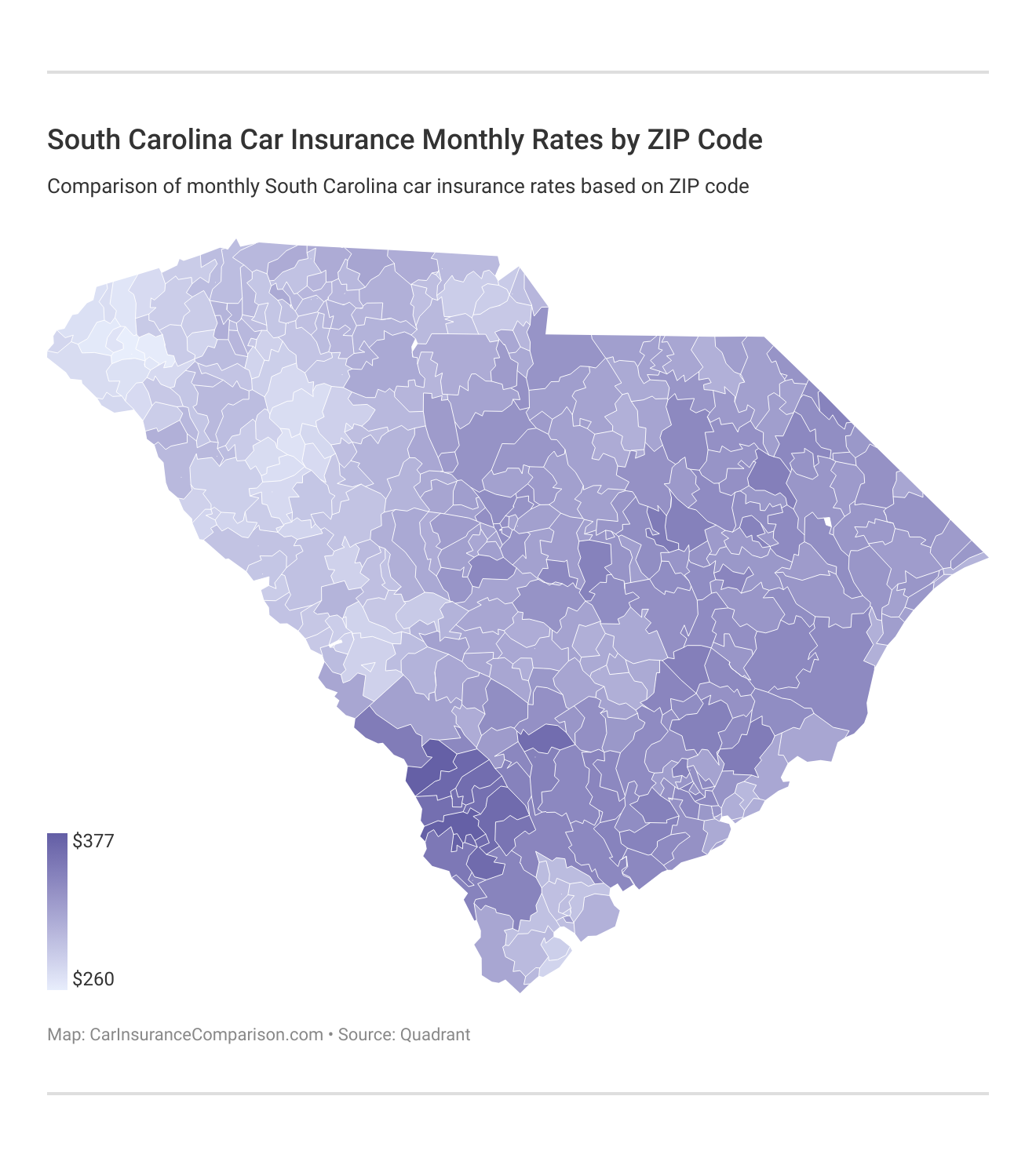

Highest and Lowest Insurance Rates by ZIP Codes

If you live in a big city, your rate might be higher than someone who lives in the country, or vice versa. See if you can find your ZIP code in the chart or lists below.

Knowing the typical rates for your specific ZIP code can help you find the best and most affordable coverage to meet your needs.

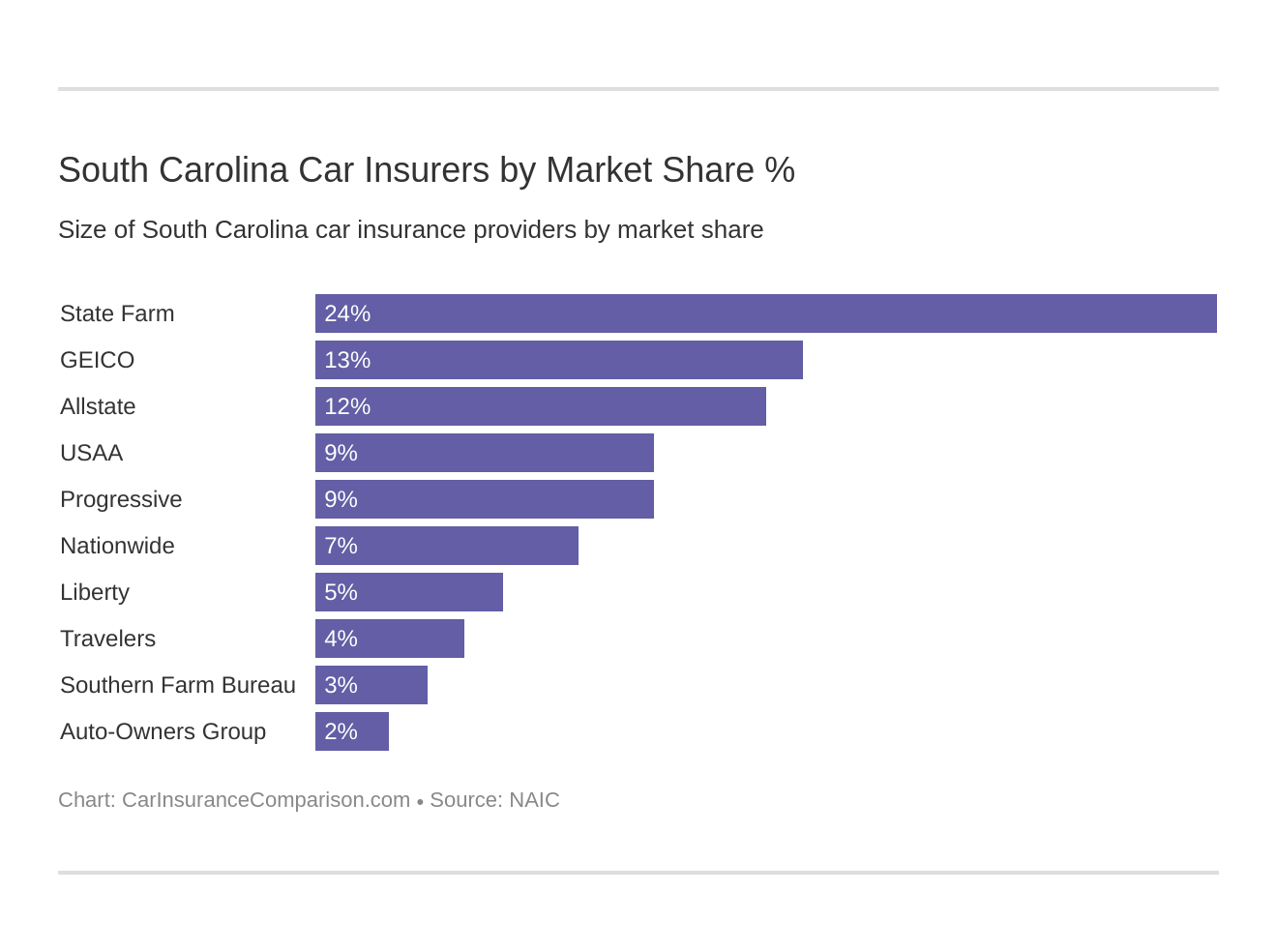

Best South Carolina Car Insurance Companies

Now that we’ve touched on different types of car insurance, it’s time to start discussing how to find a good car insurance company, and why and how that company will meet your needs in the long run.

But sometimes it’s a full-time job just to research all of the different car insurance companies out there, and that’s exactly why we took some of the guesswork out of it for you.

Picking one of the largest companies can be a good choice. Take a look at some of the dominant ones in South Carolina above. This will help you find the best car insurance companies in your area

Stay tuned as we hit company ratings, complaints, and more.

The Largest Companies’ Financial Ratings

What is an AM Best Rating?

According to Insure.com, an AM Best Rating is an independent opinion based on a company’s financial strength and ability to meet its ongoing insurance policy and contract obligations. Here is a complete table of financial ratings for some of the largest companies in the state of South Carolina.

A.M. Best Financial Strength Ratings From the Top South Carolina Car Insurance Providers

| Insurance Company | A.M. Best |

|---|---|

| Allstate | A+ |

| Auto-Owners | A++ |

| Farm Bureau | A+ |

| Geico | A++ |

| Liberty Mutual | A |

| Nationwide | A+ |

| Progressive | A+ |

| State Farm | B |

| Travelers | A++ |

| USAA | A++ |

As you can see, all of these companies have a pretty good loss ratio. USSA Group is slightly high at 92% , but overall, none of these companies are at risk of going bankrupt.

Companies With the Most Complaints in South Carolina

Take a good look at the data below. This is a list showing company complaints versus total complaints against the top ten car insurance companies in South Carolina.

South Carolina Customer Complaints: NAIC Score by Car Insurance Provider

| Insurance Company | Complaint Ratio | Total Complaints |

|---|---|---|

| State Farm | 0.44 | 1482 |

| Geico | 0.01 | 6 |

| Allstate | 0.50 | 163 |

| USAA | 0.00 | 2 |

| Progressive | 0.75 | 120 |

| Nationwide | 0.28 | 25 |

| Liberty Mutual | 0.01 | 6 |

| Travelers | 0.01 | 2 |

| Southern Farm Bureau | 0.00 | 3 |

| Auto-Owners | 0.53 | 31 |

Remember that there can be invalid complaints. It does not mean a company is a bad company just because it may receive complaints every once in a while.

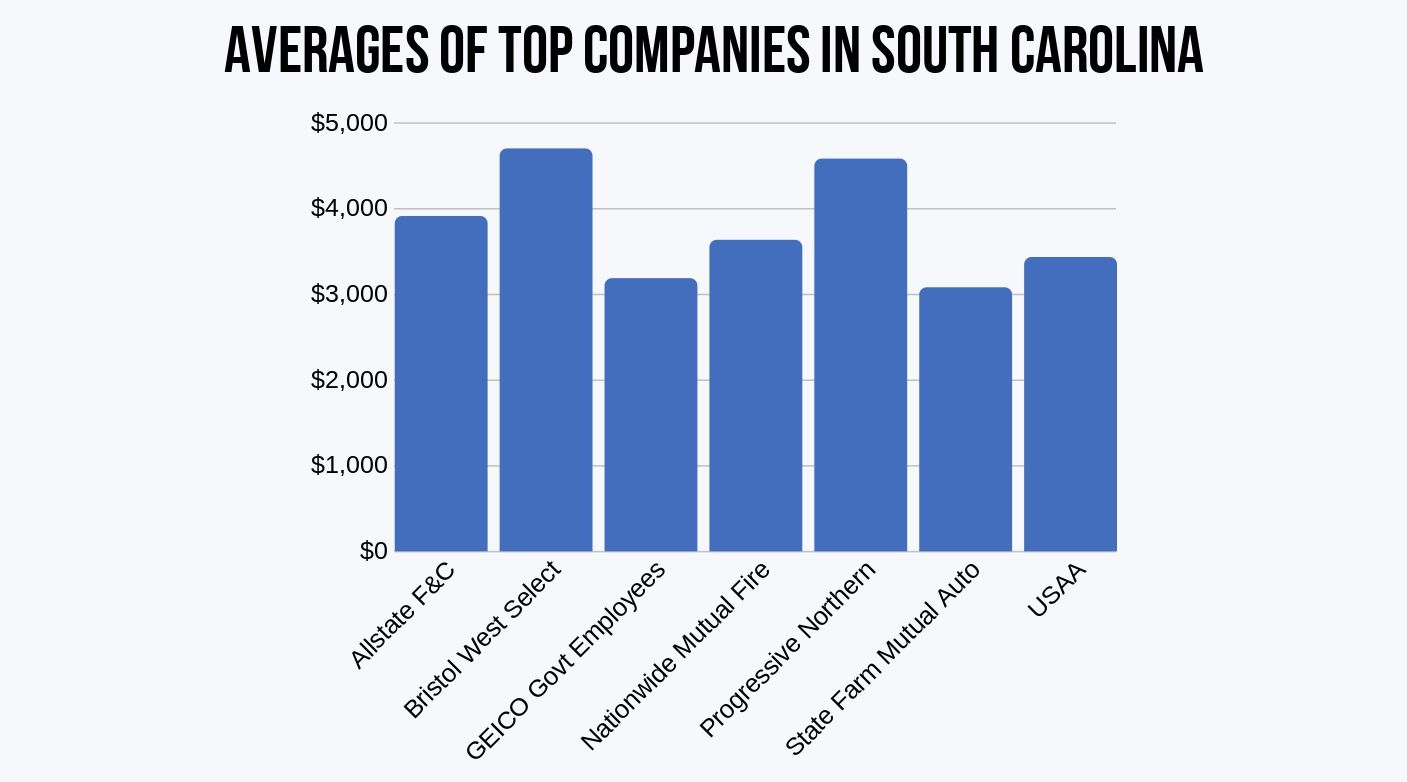

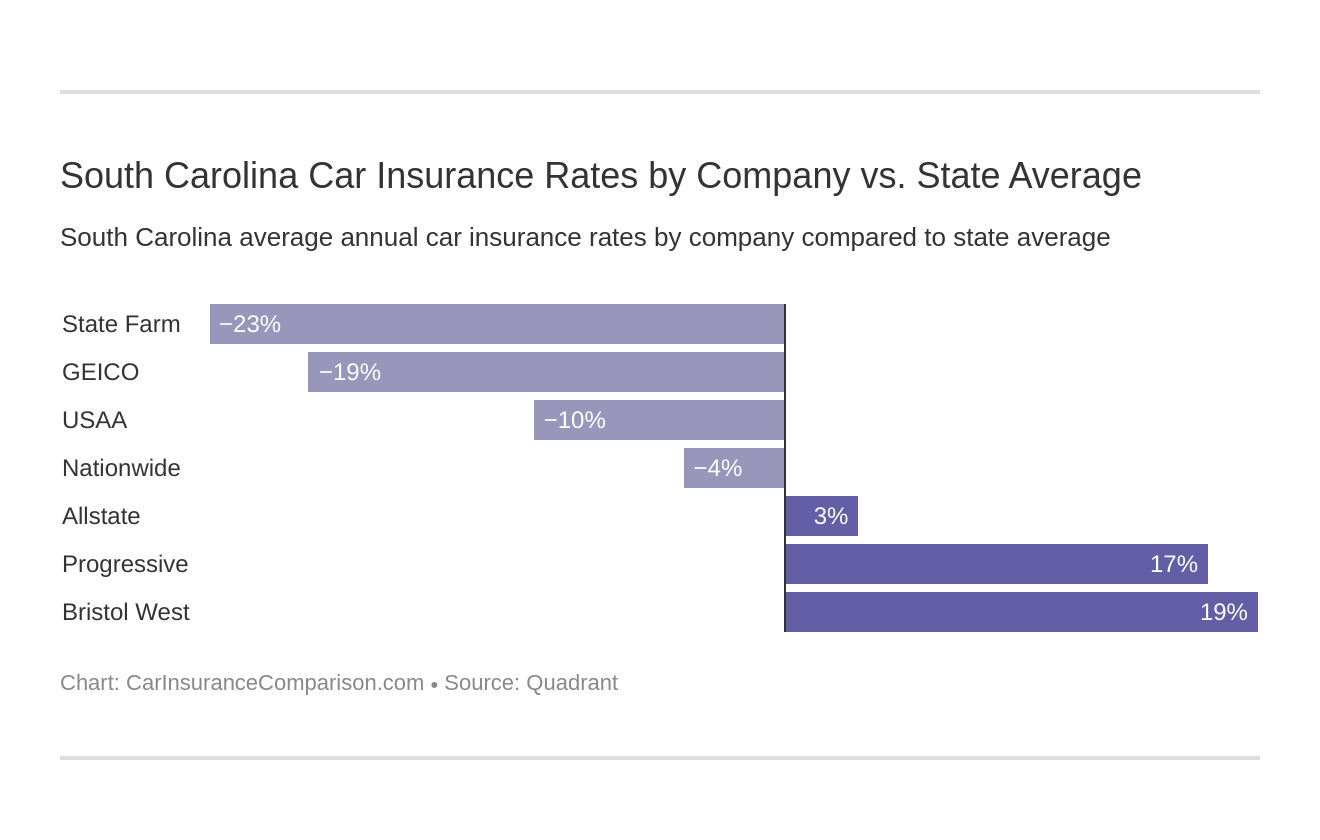

Cheapest Car Insurance in South Carolina

Discover the most affordable car insurance providers in South Carolina to help you save on your premiums.

This information helps South Carolina car owners identify the most affordable insurance options, allowing them to save money on their premiums.

If you take a look at how Bristol West Select compares to Geico, you can see that Geico costs 36% less. That’s almost $2,000 less.

Cost of Commutes by Traveler

For some people, how many miles they drive a day can affect their insurance rate. Buying car insurance by the mile can help.

South Carolina Full Coverage Car Insurance Monthly Rates by Annual Mileage

| Insurance Company | 6,000 Miles | 12,000 Miles |

|---|---|---|

| Farmers | $125 | $140 |

| Progressive | $115 | $130 |

| Allstate | $135 | $150 |

| Nationwide | $120 | $135 |

| USAA | $110 | $125 |

| Geico | $105 | $120 |

| State Farm | $130 | $145 |

| U.S. Average | $118 | $124 |

Most companies add around $100 more per year if you average 25 miles of driving a day. But, Allstate adds just under $200 to their yearly premium. Still, commute times are among the smallest factors to affect your rates. Take a look.

Understanding that commute times have minimal impact on insurance rates can help car owners prioritize more influential factors when seeking to lower their premiums.

Credit History Rates

Can a good or bad credit history affect my car insurance rate? You betcha bottom dollar it can. If you have really bad credit, you are likely going to pay a few thousand dollars more a year for your car insurance premium.

South Carolina Full Coverage Car Insurance Monthly Rates by Credit Score & Provider

| Insurance Company | Bad Credit | Fair Credit | Good Credit |

|---|---|---|---|

| Allstate | $210 | $180 | $150 |

| Farmers | $220 | $190 | $160 |

| Geico | $200 | $170 | $140 |

| Geico | $200 | $170 | $140 |

| Nationwide | $215 | $185 | $155 |

| Progressive | $225 | $195 | $165 |

| State Farm | $205 | $175 | $145 |

| USAA | $190 | $160 | $130 |

If you have great credit, generally you’ll pay less for car insurance. It’s that simple. According to The Balance Magazine, the average credit score for South Carolina residents in 2017 was 657.

One other important factor that may impact your insurance rate even more than your credit score is your driving record.

Read More: Do all car insurance companies check your driving records?

Driving Record Rates

Explore how different driving records impact your car insurance rates across various providers, helping drivers understand how violations and accidents affect premiums.

South Carolina Full Coverage Car Insurance Monthly Rates by Driving Record & Provider

| Insurance Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| Allstate | $150 | $200 | $250 | $180 |

| American Family | $140 | $190 | $240 | $170 |

| Amica | $135 | $185 | $235 | $165 |

| Farmers | $160 | $210 | $260 | $190 |

| Geico | $120 | $170 | $220 | $150 |

| Liberty Mutual | $155 | $205 | $255 | $185 |

| Progressive | $145 | $195 | $245 | $175 |

| State Farm | $130 | $180 | $230 | $160 |

| The Hartford | $145 | $195 | $245 | $175 |

| USAA | $125 | $175 | $225 | $155 |

As you can see, if you have had a DUI or even one speeding violation, your rates can dramatically increase. But if you’re a clean driver, your rates are likely to be on the lower end of the spectrum.

How Much Auto Insurance Costs in South Carolina

Discover the varying landscape of auto insurance expenses in South Carolina by examining rates in cities such as Anderson, Bluffton, Charleston, Florence, Hollywood, Pickens, Santee, and Wallace.

South Carolina Car Insurance Cost by City

This city wide comparison offers insights into the factors impacting car insurance rates, aiding you in making well-informed decisions for tailored coverage.

Number of Insurers in South Carolina

What is the difference between licensed and foreign insurance? South Carolina has its own set of laws that it abides by; these are called domestic laws.

Number of South Carolina Car Insurance Companies

| Summary | Foreign | Totals |

|---|---|---|

| 19 | 993 | 1012 |

Foreign insurance is created under the laws of any other state in America. Domestic insurance is insurance that is created under South Carolina law.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

South Carolina State Laws

Have you ever been traveling through an unfamiliar state and gotten pulled over because you didn’t obey a traffic law? Usually, if you’re a good driver, you don’t disregard traffic laws on purpose. However, just because you’re unaware of the state laws doesn’t mean you’re going to get off with just a warning.

But what are some of the state driving laws in South Carolina?

Keep scrolling to learn more about South Carolina state laws.

Car Insurance Laws

We’ve already said that South Carolina requires every driver to have car insurance. According to the NAIC, regarding rate filings, filings under 7% are filed and used, and over 7% are prior approval. Regarding form filings, prior approval (60-day deemer).

File and use filings mean that rates must be filed with the state insurance department prior to their use. Prior approval filings are filings that must be filed and approved by the state insurance department before they can be used.

South Carolina state law requires everyone to have minimum liability coverage.

Fun Fact:

There is no deductible for windshields for private passenger vehicles if you have comprehensive insurance. So the next time you’re driving down the road and a rock smashes into your windshield and it needs to be replaced, don’t worry — South Carolina state law says that you don’t have to pay to cover the cost of that cracked or broken windshield.

Read More: Does car insurance cover broken car windows?

Next, we will cover high-risk car insurance and what it means to have high-risk insurance.

High-Risk Insurance

No one wants to pay a higher car insurance premium, but sometimes, you can’t always get what you want. You can’t always get what you want especially if you have been in a car accident.

South Carolina drivers who have been convicted of serious violations, such as a DUI, or who have had their licenses suspended may be required to file an SR-22 with their insurance.

Scan the list below for a few reasons that you might have to have high-risk insurance.

- Conviction of DUI/DWI

- Driving while uninsured

- A traffic violation that results in a fatality or serious injury

- A high number of points on your driving record

- A high-risk car (sports cars, etc.)

- Being over 70 years old

It doesn’t happen all the time, but if you are required to have high-risk insurance, some companies may not want to insure you. Read more about high-risk car insurance for more information.

Low-Cost Insurance

If you really, really want low-cost insurance, be a great driver. Avoid car accidents and don’t drink and drive. It’s pretty self-explanatory.

There are ways to lower your car insurance rate other than just being a great driver. Discover the variety of car insurance discounts offered by top providers in South Carolina to help you save on your premiums.

But wait, There are ways to save even more. Shopping around, comparing rates, and asking for a price match with other companies are all great ways to save.

Automobile Insurance Fraud in South Carolina

Insurance fraud by definition according to the Insurance Information Institute is a deliberate deception perpetrated against or by an insurance company or agent for the purpose of financial gain.

Read More: Can you legally use a different address to get cheaper car insurance?

Just like every other state in America, insurance fraud is illegal in the state of South Carolina. But how do you commit insurance fraud?

- Making a false claim

- Faking an accident

- Adding more damage to a legitimate claim

Still wondering what not to do when it comes to insurance fraud? Watch this short video about insurance fraud fails.

Using a fake address for cheap car insurance is an example of insurance fraud. Insurance fraud in South Carolina is considered a felony and can be punishable by jail time.

Statute of Limitations

Statute of limitations means that there is a certain amount of time to file a charge against someone or something — or in this case, a claim. If you forget to file a claim or don’t file it within that statute of limitations, you will not receive money from your insurance company.

In South Carolina, a person has just three years to file a claim for property damage and/or personal injury.

Specific Driving Laws

Section 38-59-10 in the South Carolina code of laws says that when an insurer under an insurance policy requires written proof of loss after the notice of the loss has been given by the insured or beneficiary, the insurer or its representative shall furnish a blank to be used for that purpose.

If the forms are not furnished within 20 days after the receipt of the notice, the claimant is considered to have complied with the requirements of the policy as to proof of loss upon submitting within the time fixed in the policy for filing proofs of loss written proof covering the occurrence, character, and extent of the loss for which claim is made.

The 20-day period after notice of loss to furnish forms applies to all types of insurance unless a lesser time period is specifically provided by law.

Vehicle Licensing Laws

Since all drivers are required to have car insurance in South Carolina, there are serious penalties for driving without car insurance.

Penalties for Driving Without Insurance

As you can see, if you drive without insurance, you may end up in prison for 30 days without warning. Take a look at the data below:

South Carolina Penalties for Driving Without Insurance

| Offense | Penalty |

|---|---|

| 1st Offense | Fine: $100-$200 or 30-day imprisonment; failure to surrender registration and plates when insurance lapses; license/registration suspended until proof of insurance plus $200 reinstatement fee |

| Second Offense | Fine: $200 and/or 30-day imprisonment — within 10 years; license/registration suspended until proof of insurance plus $200 reinstatement fee |

If you do have insurance, (and we hope you do by now) you need to provide proof of insurance at all times. Some acceptable forms of proof of insurance are:

- Valid, current insurance card

- Copy of your car’s current insurance policy

- Valid insurance binder (this is a temporary form of insurance)

If you fail to surrender your registration and plates to a law enforcement officer and your insurance policy lapses, your license and registration will also be suspended until you show valid proof of insurance and pay a $200 reinstatement fee.

Teen Driver Laws

To get a learners license in South Carolina, you must be at least 15 years old. Take a look at the table below for more license requirements.

South Carolina License Requirements

| Data | Requirement |

|---|---|

| Mandatory Holding Period | 6 Months |

| Minimum Supervised Driving Time | 40 hours, ten of those hours must be at night |

| Minimum Age | 15, 6 Months |

Finding young drivers car insurance requires comparing rates online as it can be difficult to find. Teens in South Carolina with restricted licenses must also follow the requirements listed below.

South Carolina Restricted License Requirements & Time

| Requirements | Time |

|---|---|

| Nighttime Restrictions | 6 p.m.-6 a.m. EST; 8 p.m.-6 a.m. EDT |

| Passenger restrictions (family members excepted unless noted otherwise) | no more than 2 passengers younger than 21 unless transporting students to and from school |

| Minimum Age at Which Restriction May be Lifted | Age |

| Nighttime Restrictions | 12 months and age 17 if intermediate license has been held for at least 6 months (min. age: 16, 6 mos.) |

| Passenger restrictions | 12 months and age 17 if intermediate license has been held for at least 6 months (min. age: 16, 6 mos.) |

In South Carolina, nighttime driving and passenger restrictions apply until drivers with intermediate licenses turn 17, after holding the license for a year.

Driver’s License Renewal Procedures

In South Carolina, it doesn’t matter if you’re 19 or 90 when you’re renewing your license — everyone young or old must renew their license every eight years and must show adequate proof of vision at the time of renewal.

South Carolina drivers are permitted to renew their license online or through the mail.

New Residents

If you want to drive that beautiful South Carolina shoreline and you just moved from another state to South Carolina, you have to get car South Carolina car insurance. If you remember, South Carolina requires you to have the following minimum insurance coverage:

- $25,000 for bodily injury or death per person

- $50,000 for total bodily injury or death per accident

- $25,000 for property damage per accident

If you want to stay with the same car insurance company that you had in the state you moved from, you can absolutely do that — unless they won’t insure you in South Carolina.

Negligent Drivers

Reckless or negligent driving in South Carolina is defined as driving in a way that shows a willful or wanton disregard for the safety of persons or property. For a first violation, a motorist faces up to 30 days in jail or $25 to $200 in fines. Reckless driving is a misdemeanor in South Carolina. The penalties for a conviction are:

- First offense. Motorists convicted of a first reckless driving offense face up to 30 days in jail or $25 to $200 in fines.

- Repeat offense. In addition to the first-offense penalties (see above), anyone convicted of a second or subsequent reckless driving offense within a five-year period is looking at a three-month license suspension.

A reckless driving conviction will also add six demerit points to a motorist’s driving record. Don’t forget that a bad driving record will increase your car insurance rates.

South Carolina’s Rules of the Road

Just like we mentioned above, if you don’t know driving laws in the specific state you’re driving in, you are at risk of being pulled over and given a citation.

Keep reading to learn more about South Carolina’s rules of the road.

Fault vs. No Fault

South Carolina is an at-fault state. This means that when you cause an accident, you are the one who is responsible for covering the costs of damages and medical bills that result from that accident.

It is recommended that you purchase more than the minimum amount of insurance required as medical bills and car repair costs can add up very quickly.

You can also read about no-fault car insurance for more explanations on the difference between fault vs. no-fault insurance.

Seat Belt and Car Seat Laws

Don’t be a dummy and drive without a seat belt. It takes two seconds to pull that buckle across your chest and the reward for doing so could be saving your life.

South Carolina Seat Belt Laws

| Law | Data |

|---|---|

| Effective Since | July 1st, 1989 |

| Primary Enforcement | yes, effective December 9th, 2005 |

| Age/Seats Applicable | 8+ years in all seats |

| 1st Offense Max Fine | $25 |

South Carolina wants your child to be safe, so pay attention to these car sear laws and don’t put your child in harm’s way.

South Carolina Car Seat Laws

| Type | Age |

|---|---|

| Rear-Facing Child Restraint | Younger than 2 years in rear-facing child restraint until exceeding manufacturer height/weight limit |

| Forward-Facing Child Restraint | Children younger than 2 who outgrow rear-facing system and children 2 and older must be in forward-facing restraint with harness until exceeding manufacturer height/weight limit |

| Child Booster Seat | Children 4 and older who outgrow forward-facing child restraint must be in belt positioning booster using lap/shoulder belts until child is at least 8 years or at least 57 inches |

| Preference for Rear Seat | 7 years and younger must be in the rear seat if available |

| Adult Belt Permissible | 8 years or at least 57 inches tall if (1) lap belt fits across hips and thighs, not abdomen (2) shoulder belt crosses center of chest and not neck (3) knees bend over seat edge when sitting up straight with his/her back firmly against seat back |

Will insurance cover me if I am riding in the bed of a pick-up truck at the time of an accident? Keep in mind that you will not be covered if:

- You are 15 or older

- You are 15 and younger when an adult is present

- Your child is belted

- If you are riding during a parade

- If you are riding during an emergency situation

- For agricultural activities

- Hunting

- If your vehicle was operated in your county at the time of the accident

- If your vehicle has a secured metal tailgate and operated at less than 36 mph at the time of accident

Understanding the specifics of what your car insurance covers is crucial for ensuring you’re adequately protected. South Carolina’s laws have particular stipulations regarding coverage in specific scenarios, so it’s essential to be aware of these exceptions.

Keep Right and Move Over Laws

South Carolina state law says to keep right if you want to drive slower than the traffic around you. Basically, if you want to drive slow or you need to drive slow, just stay in the right lane.

The state law also says to reduce your speed and vacate the lane closest to stationary emergency vehicles. These vehicles include but are not limited to:

- Tow trucks

- Recovery vehicles

- Ambulances

- Utility service vehicles

Remember to be cautious of workers on the side of the road and you should not have a problem following this law.

Speed Limits

Usually, if you’re going to get a ticket, it’s going to be a speeding ticket. Look at the box below to learn about South Carolina speed limit laws.

South Carolina Speed Limit Laws

| Road Type | Speed Limit |

|---|---|

| Rural Interstates | 70 mph |

| Urban Interstates | 70 mph |

| Other Limited Access Roads | 60 mph |

| Other Roads | 55 mph |

Read about the best car insurance companies for people with speeding tickets for more information.

Ridesharing

If you are interested in getting a job driving for ridesharing companies like Uber or Lyft, you’ll need to have ridesharing insurance to protect you in case of an accident.

Geico is one car insurance company that provides ridesharing insurance.

Automation on the Road

Right now, there aren’t any laws against managing automated vehicles in the state of South Carolina.

Safety Laws

Every state has its own set of safety laws. Keep reading to find out what the safety laws are the South Carolina.

DUI Laws

In 2018, South Carolina was ranked 2nd in the nation for drunk driving fatalities. SafeWise reports that there were 7.98 drunk driving-related deaths per 100,000 people in 2018.

South Carolina DUI Laws

| DUI Offense | DUI Limit |

|---|---|

| BAC Limit | 0.08 |

| High BAC Limit | 0.16 |

| Criminal Status | 1st serious misdemeanor, 2nd aggravated misdemeanor, and 3rd+ class D felony |

| Look Back Period | 10 Years |

Because of this data, South Carolina has strict laws against drunk driving. South Carolina’s laws have particular stipulations regarding coverage in specific scenarios, so it’s essential to be aware of these exceptions.

South Carolina DUI Offenses

| Penalty | Time | Jail | Fine |

|---|---|---|---|

| First Offense | 6 Months | 48 Hours - 30 Days | $400 minimum ($992 with assessments and surcharges) |

| Second Offense | 1 Year | 5 Days - 1 Year | $2,100-$5,100 ($10,744.50 with assessments and surcharges) |

| Third Offense | minimum 2 years. 4 years if within 5 years of 1st offense | 60 days - 3 years | $3800 - $6300 ($13,234.50 with assessments and surcharges) |

| Fourth Offense | permanent | 1-5 years | – |

Don’t drink and drive. Doing so could cost you your license, jail time, money, your own life, or someone else’s. By staying informed and making educated decisions, you can secure the best and most affordable insurance for your needs.

Marijuana-Impaired Driving Laws

Currently, there are no laws against doing marijuana while driving. However, that doesn’t mean you can’t be held responsible for driving under the influence of marijuana.

The state of South Carolina can charge you for impaired driving which could lead to fines, jail time, and more.

Distracted Driving Laws

Sometimes, texting or talking on your cell phone while driving can be worse than drunk driving. Be aware of whether you live in one of the most dangerous states for drunk driving. While it’s not illegal to talk on the phone while driving, it is illegal to text while driving.

South Carolina Cell Phone Use Laws While Driving

| Law | Details |

|---|---|

| Hand held ban | No |

| Young driver cell phone ban | No |

| Texting ban | All drivers |

| Enforcement | Primary |

What is primary enforcement? If a police officer suspects that you are texting while driving, he or she has every right to pull you over.

South Carolina Can’t Miss Facts

We’ve covered state driving laws in depth, but now it’s time to jump into some of the most-known driving facts in South Carolina.

Similar to other states, South Carolina has unique driving risks. Knowing these risks will help keep you protected while driving along those gorgeous Carolina shorelines.

Up next we will cover everything you need to know about car theft, EMS response time, and more.

Vehicle Theft in South Carolina

Obviously, certain cars are more valuable than others, so some cars are more likely to be stolen than others.

If your car is stolen, your insurance may cover the cost of replacing it. Learning how cars are stolen is important to protect your vehicle from theft. Below is a list of the top 10 most stolen cars in South Carolina.

Top 10 South Carolina Car Thefts by Model

| Make & Model | Year | Total Thefts |

|---|---|---|

| Honda Civic | 2000 | 1057 |

| Honda Accord | 1997 | 1045 |

| Hyundai Elantra | 2017 | 1023 |

| Ford F-150 | 2020 | 926 |

| Hyundai Sonata | 2013 | 904 |

| Chevrolet Silverado 1500 | 2020 | 861 |

| GMC Pickup | 2005 | 811 |

| Kia Optima | 2015 | 611 |

| Honda CR-V | 2001 | 566 |

| Toyota Camry | 2021 | 547 |

Read More: Compare Honda vs. Ford Car Insurance Rates

According to this list, Ford pickups are the most stolen car in South Carolina. But did you know that where you live can affect whether or not your car is at risk of being stolen? Scan this list from the FBI to see how many thefts happened in your city in 2013.

South Carolina Car Thefts by City

| City | Total |

|---|---|

| Abbeville | 8 |

| Aiken | 58 |

| Allendale | 7 |

| Anderson | 140 |

| Andrews | 8 |

| Aynor | 1 |

| Bamberg | 5 |

| Barnwell | 4 |

| Batesburg-Leesville | 13 |

| Beaufort | 19 |

| Belton | 21 |

| Bennettsville | 5 |

| Bishopville | 14 |

| Blacksburg | 4 |

| Blackville | 8 |

| Bluffton | 18 |

| Burnettown | 4 |

| Camden | 15 |

| Central | 9 |

| Chapin | 1 |

| Charleston | 162 |

| Cheraw | 11 |

| Chesnee | 1 |

| Chester | 12 |

| Chesterfield | 0 |

| Clemson | 50 |

| Clinton | 13 |

| Clover | 6 |

| Columbia | 791 |

| Conway | 42 |

| Cottageville | 1 |

| Coward | 1 |

| Cowpens | 4 |

| Darlington | 13 |

| Denmark | 13 |

| Dillon | 31 |

| Due West | 1 |

| Duncan | 5 |

| Easley | 60 |

| Edgefield | 4 |

| Edisto Beach | 1 |

| Ehrhardt | 0 |

| Elgin | 4 |

| Estill | 1 |

| Florence | 104 |

| Folly Beach | 7 |

| Forest Acres | 24 |

| Fort Lawn | 1 |

| Fort Mill | 2 |

| Fountain Inn | 9 |

| Gaffney | 27 |

| Gaston | 9 |

| Georgetown | 18 |

| Goose Creek | 49 |

| Great Falls | 5 |

| Greenville | 211 |

| Greenwood | 30 |

| Greer | 50 |

| Hampton | 6 |

| Hanahan | 30 |

| Hardeeville | 16 |

| Harleyville | 3 |

| Hartsville | 33 |

| Hemingway | 0 |

| Holly Hill | 12 |

| Honea Path | 8 |

| Inman | 2 |

| Irmo | 14 |

| Isle of Palms | 5 |

| Jackson | 2 |

| Johnsonville | 1 |

| Johnston | 5 |

| Kingstree | 16 |

| Lake City | 20 |

| Lake View | 0 |

| Lamar | 1 |

| Lancaster | 13 |

| Landrum | 2 |

| Latta | 5 |

| Laurens | 14 |

| Lexington | 13 |

| Liberty | 9 |

| Loris | 4 |

| Lyman | 0 |

| Lynchburg | 0 |

| Manning | 16 |

| Marion | 26 |

| Mauldin | 33 |

| McBee | 0 |

| McColl | 1 |

| McCormick | 7 |

| Moncks Corner | 35 |

| Mount Pleasant | 64 |

| Mullins | 10 |

| Myrtle Beach | 470 |

| Newberry | 8 |

| New Ellenton | 2 |

| Nichols | 0 |

| North | 0 |

| North Augusta | 26 |

| North Charleston | 503 |

| North Myrtle Beach | 136 |

| Orangeburg | 50 |

| Pacolet | 6 |

| Pageland | 9 |

| Pelion | 1 |

| Pickens | 14 |

| Port Royal | 13 |

| Prosperity | 0 |

| Ridgeland | 7 |

| Rock Hill | 121 |

| Salley | 2 |

| Saluda | 3 |

| Santee | 8 |

| Scranton | 0 |

| Seneca | 11 |

| Spartanburg | 118 |

| Springdale | 16 |

| St. George | 9 |

| St. Matthews | 9 |

| Sullivans Island | 1 |

| Summerton | 2 |

| Summerville | 87 |

| Sumter | 128 |

| Surfside Beach | 18 |

| Swansea | 3 |

| Tega Cay | 1 |

| Travelers Rest | 10 |

| Turbeville | 1 |

| Union | 6 |

| Wagener | 4 |

| Walhalla | 4 |

| Walterboro | 14 |

| Ware Shoals | 10 |

| Wellford | 5 |

| West Columbia | 40 |

| Westminster | 5 |

| West Pelzer | 7 |

| West Union | 2 |

| Whitmire | 1 |

| Williamston | 10 |

| Williston | 6 |

| Winnsboro | 6 |

| Woodruff | 5 |

| York | 11 |

When searching for the cheapest South Carolina car insurance rates, always compare multiple providers and consider all aspects of coverage, including special circumstances like riding in a pick-up truck bed, the implications of DUI offenses, and the risk of car thefts in different cities.

Dangers on the Road in South Carolina

When it comes to road safety, South Carolina faces unique challenges due to its diverse geography and weather conditions. Understanding the risks and dangers on the road can help residents and visitors alike take necessary precautions.

https://docs.google.com/spreadsheets/d/16KgECYF0-vI-xYjKgBaDLzIcwMjhU82_1ZMZhBE36CA/edit#gid=759204855

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 376 | 94 | 326 | 31 | 0 | 827 |

| Rain | 32 | 8 | 42 | 6 | 0 | 88 |

| Snow/Sleet | 1 | 0 | 0 | 0 | 0 | 1 |

| Other | 2 | 1 | 2 | 3 | 0 | 8 |

| Unknown | 0 | 0 | 0 | 0 | 0 | 0 |

| TOTAL | 411 | 103 | 370 | 40 | 0 | 924 |

In 2017, there were 988 traffic fatalities in South Carolina. Some of those fatalities were caused by inclement weather. By examining this data, we aim to shed light on the critical areas that need improvement to enhance road safety for all.

Fatality Rates by County

Table below shows the monthly fatality rates per county in South Carolina from 2013 to 2017, revealing significant variations in fatalities per 100,000 population across different regions.

Top 10 South Carolina Car Crash Fatalities by County

| County Name | Total Fatalities (2021) | Total Fatalities (2022) | Total Fatalities (2023) |

|---|---|---|---|

| Abbeville | 6 | 4 | 8 |

| Aiken | 26 | 37 | 39 |

| Allendale | 4 | 2 | 4 |

| Anderson | 32 | 57 | 44 |

| Bamberg | 4 | 7 | 4 |

| Barnwell | 5 | 5 | 8 |

| Beaufort | 17 | 30 | 26 |

| Berkeley | 36 | 34 | 34 |

| Calhoun | 10 | 10 | 7 |

| Charleston | 64 | 54 | 71 |

| Cherokee | 17 | 5 | 20 |

| Chester | 17 | 18 | 15 |

| Chesterfield | 16 | 9 | 12 |

| Clarendon | 17 | 21 | 19 |

| Colleton | 21 | 24 | 18 |

| Darlington | 25 | 24 | 15 |

| Dillon | 7 | 11 | 9 |

| Dorchester | 32 | 32 | 17 |

| Edgefield | 2 | 3 | 4 |

| Fairfield | 7 | 10 | 13 |

| Florence | 38 | 29 | 32 |

| Georgetown | 18 | 6 | 15 |

| Greenville | 73 | 87 | 74 |

| Greenwood | 11 | 12 | 10 |

| Hampton | 7 | 1 | 4 |

| Horry | 81 | 70 | 67 |

| Jasper | 15 | 25 | 11 |

| Kershaw | 18 | 18 | 19 |

| Lancaster | 15 | 14 | 18 |

| Laurens | 22 | 21 | 29 |

| Lee | 8 | 5 | 5 |

| Lexington | 46 | 43 | 47 |

| Marion | 11 | 9 | 8 |

| Marlboro | 9 | 9 | 8 |

| Mccormick | 3 | 4 | 4 |

| Newberry | 7 | 6 | 7 |

| Oconee | 13 | 11 | 18 |

| Orangeburg | 31 | 30 | 28 |

| Pickens | 16 | 19 | 20 |

| Richland | 45 | 69 | 52 |

| Saluda | 0 | 1 | 7 |

| Spartanburg | 75 | 54 | 51 |

| Sumter | 20 | 20 | 18 |

| Union | 6 | 7 | 6 |

| Williamsburg | 8 | 17 | 15 |

| York | 18 | 36 | 28 |

The data reveals varied fatality rates across South Carolina counties from 2013 to 2017, highlighting the need for targeted traffic safety measures.

Traffic Fatalities

Traffic fatality rates in rural areas are significantly higher than they are in urban areas. In South Carolina, there is a noticeable difference in fatality rates between rural and urban areas, as well as among different types of vehicles involved in these accidents.

South Carolina Traffic Fatalities by Area Type

| Type | Total |

|---|---|

| Rural | 687 |

| Urban | 301 |

Rural areas consistently show higher traffic fatalities compared to urban areas across the years, indicating ongoing challenges in rural road safety.

Road type may be a major cause of accidents, however, vehicle type can also be a major cause. This section breaks down traffic fatalities by person type, highlighting the significant role vehicle type plays in these tragic events.

South Carolina Traffic Fatalities by Person Type

| Type | Total |

|---|---|

| Light Truck - Pickup | 116 |

| Light Truck - Utility | 133 |

| Light Truck - Van | 18 |

| Large Truck | 17 |

| Bus | 1 |

| Non-Occupants | 6 |

If you check the list below, you’ll see that speeding results in many accidents, especially in accidents involving fatalities.

South Carolina Traffic Fatalities by Crash Type

| Type | Total |

|---|---|

| Total Fatalities (All Crashes)* | 988 |

| Single Vehicle | 569 |

| Involving a Large Truck | 90 |

| Involving Speeding | 416 |

| Involving a Rollover | 234 |

| Involving a Roadway Departure | 575 |

| Involving an Intersection (or Intersection Related) | 173 |

Speeding remains a significant factor in fatal accidents across South Carolina, highlighting the need for increased road safety measures.

Fatalities Involving Speeding by County

Explore the impact of speeding-related fatalities across South Carolina counties, revealing regional safety disparities and emphasizing the need for targeted prevention measures.

South Carolina Speeding Fatalities by County

| County Name | Total Fatalities (2021) | Total Fatalities (2022) | Total Fatalities (2023) |

|---|---|---|---|

| Abbeville | 2 | 4 | 6 |

| Aiken | 7 | 20 | 20 |

| Allendale | 1 | 0 | 0 |

| Anderson | 13 | 21 | 17 |

| Bamberg | 3 | 2 | 0 |

| Barnwell | 3 | 2 | 3 |

| Beaufort | 8 | 6 | 10 |

| Berkeley | 12 | 15 | 15 |

| Calhoun | 5 | 4 | 6 |

| Charleston | 23 | 19 | 26 |

| Cherokee | 7 | 3 | 7 |

| Chester | 9 | 7 | 3 |

| Chesterfield | 5 | 3 | 6 |

| Clarendon | 7 | 10 | 12 |

| Colleton | 6 | 7 | 7 |

| Darlington | 10 | 13 | 8 |

| Dillon | 4 | 6 | 7 |

| Dorchester | 9 | 11 | 8 |

| Edgefield | 0 | 2 | 4 |

| Fairfield | 3 | 5 | 5 |

| Florence | 21 | 12 | 13 |

| Georgetown | 5 | 2 | 6 |

| Greenville | 14 | 22 | 14 |

| Greenwood | 5 | 5 | 4 |

| Hampton | 2 | 0 | 1 |

| Horry | 21 | 15 | 26 |

| Jasper | 7 | 13 | 6 |

| Kershaw | 9 | 7 | 7 |

| Lancaster | 3 | 4 | 5 |

| Laurens | 15 | 16 | 17 |

| Lee | 3 | 3 | 3 |

| Lexington | 13 | 14 | 16 |

| Marion | 7 | 4 | 5 |

| Marlboro | 6 | 3 | 6 |

| Mccormick | 1 | 3 | 1 |

| Newberry | 7 | 1 | 6 |

| Oconee | 5 | 2 | 8 |

| Orangeburg | 13 | 15 | 16 |

| Pickens | 4 | 5 | 12 |

| Richland | 14 | 29 | 23 |

| Saluda | 0 | 1 | 2 |

| Spartanburg | 35 | 15 | 21 |

| Sumter | 5 | 9 | 9 |

| Union | 5 | 7 | 4 |

| Williamsburg | 3 | 10 | 6 |

| York | 6 | 16 | 9 |

Speeding-related fatalities vary significantly across counties in South Carolina, highlighting localized challenges and the need for targeted safety measures to reduce these incidents effectively.

Fatalities in Crashes Involving an Alcohol-Impaired Driver

Driving under the influence of alcohol remains a persistent and dangerous issue on South Carolina’s roads. Alcohol-impaired driving not only endangers the driver but also poses a significant threat to passengers, other motorists, and pedestrians.

South Carolina DUI Fatalities by County

| County Name | Total Fatalities (2021) | Total Fatalities (2022) | Total Fatalities (2023) |

|---|---|---|---|

| Abbeville | 2 | 1 | 0 |

| Aiken | 10 | 13 | 8 |

| Allendale | 0 | 0 | 1 |

| Anderson | 8 | 14 | 20 |

| Bamberg | 2 | 1 | 0 |

| Barnwell | 4 | 3 | 4 |

| Beaufort | 3 | 10 | 8 |

| Berkeley | 10 | 12 | 11 |

| Calhoun | 2 | 2 | 2 |

| Charleston | 15 | 21 | 18 |

| Cherokee | 4 | 1 | 7 |

| Chester | 3 | 8 | 7 |

| Chesterfield | 9 | 3 | 4 |

| Clarendon | 6 | 6 | 5 |

| Colleton | 10 | 8 | 6 |

| Darlington | 10 | 9 | 4 |

| Dillon | 2 | 5 | 2 |

| Dorchester | 11 | 8 | 7 |

| Edgefield | 0 | 1 | 0 |

| Fairfield | 0 | 5 | 3 |

| Florence | 10 | 11 | 15 |

| Georgetown | 4 | 0 | 3 |

| Greenville | 24 | 26 | 21 |

| Greenwood | 6 | 3 | 5 |

| Hampton | 2 | 0 | 0 |

| Horry | 23 | 19 | 18 |

| Jasper | 3 | 6 | 3 |

| Kershaw | 5 | 8 | 6 |

| Lancaster | 4 | 5 | 4 |

| Laurens | 5 | 8 | 11 |

| Lee | 6 | 3 | 3 |

| Lexington | 22 | 20 | 21 |

| Marion | 4 | 3 | 1 |

| Marlboro | 1 | 1 | 1 |

| Mccormick | 0 | 2 | 0 |

| Newberry | 1 | 3 | 3 |

| Oconee | 4 | 4 | 7 |

| Orangeburg | 9 | 11 | 11 |

| Pickens | 7 | 3 | 8 |

| Richland | 16 | 24 | 16 |

| Saluda | 0 | 1 | 1 |

| Spartanburg | 24 | 17 | 14 |

| Sumter | 4 | 10 | 6 |

| Union | 4 | 1 | 2 |

| Williamsburg | 2 | 11 | 4 |

| York | 7 | 11 | 13 |

Alcohol-impaired driving remains a significant contributor to fatal crashes in South Carolina’s counties. By understanding the prevalence of DUI-related fatalities, we can better advocate for effective measures to reduce impaired driving and enhance road safety across the state.

Teen Drinking and Driving

Teenage driving fatalities aren’t uncommon because inexperienced drivers tend to have accidents more often. But what is even more depressing is the number of teenage fatalities caused by drinking and driving.

South Carolina Underaged Drinking Arrests

| Metric | Number |

|---|---|

| Number of Under 18 DUI Arrests | 90 |

| Total Per One Million People | 82 |

Teenage drinking and driving is a pressing issue, evident from the high rate of under 18 DUI arrests in South Carolina.

EMS Response Time

Prompt EMS response times are crucial for ensuring the best possible outcomes in emergency situations. This table compares EMS notification and arrival times between rural and urban areas in South Carolina.

South Carolina EMS Response Time

| Location | Notification | Arrival |

|---|---|---|

| Rural | 8.04 min | 11.85 min |

| Urban | 6.78 min | 8.26 min |

The data clearly shows that urban areas benefit from quicker EMS response times compared to rural areas. This disparity underscores the need for improved emergency services in rural communities.

Transportation in South Carolina

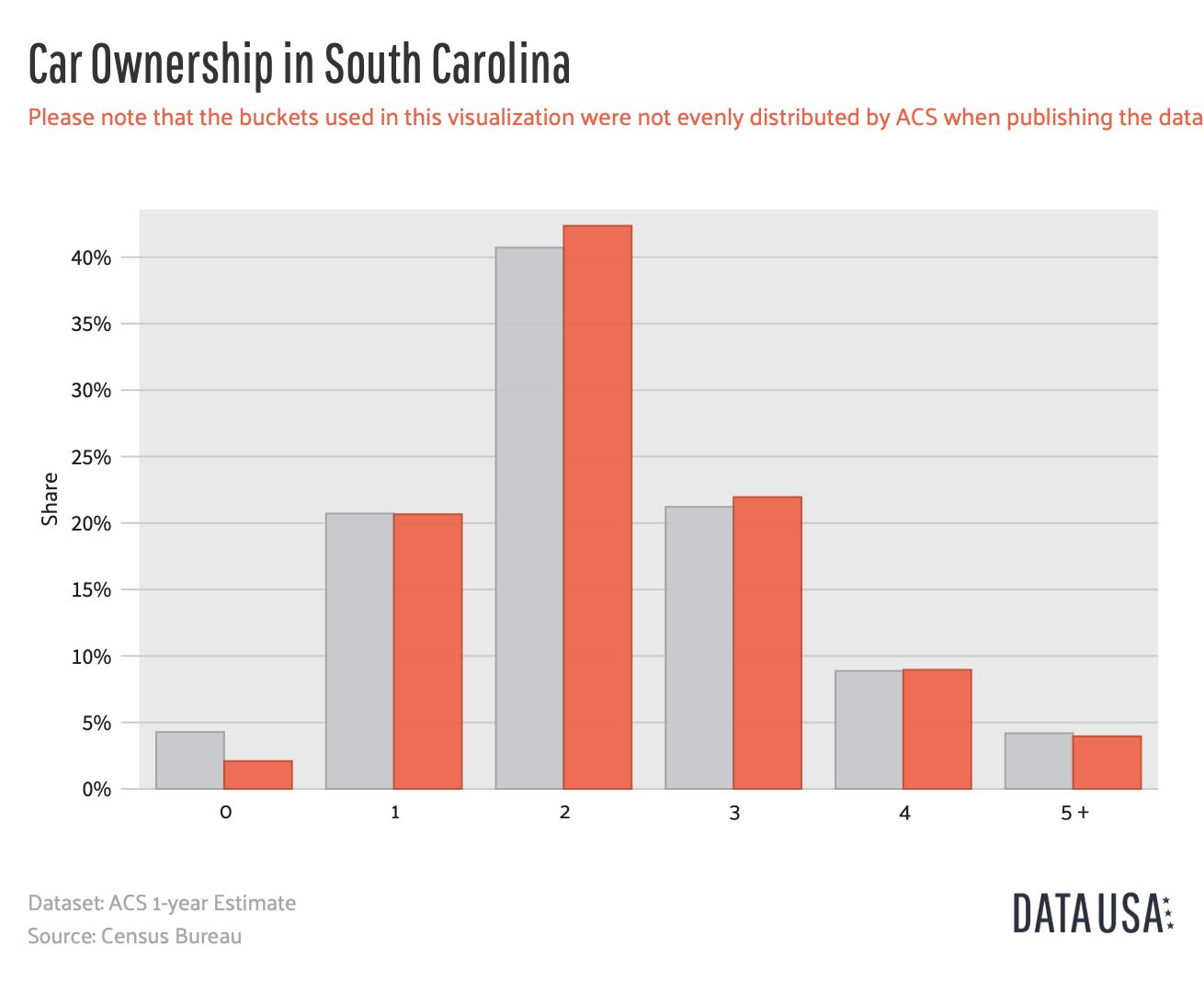

Have you ever wondered how many cars your neighbors own?

The average number of cars owned in South Carolina per household is two.

Car Ownership

Car ownership is a significant aspect of daily life in South Carolina, influencing transportation patterns and economic activities. The following chart illustrates the distribution of car ownership among households in the state.

South Carolina’s car ownership data reflects trends that align closely with the national average, showcasing a robust presence of vehicles among its residents.

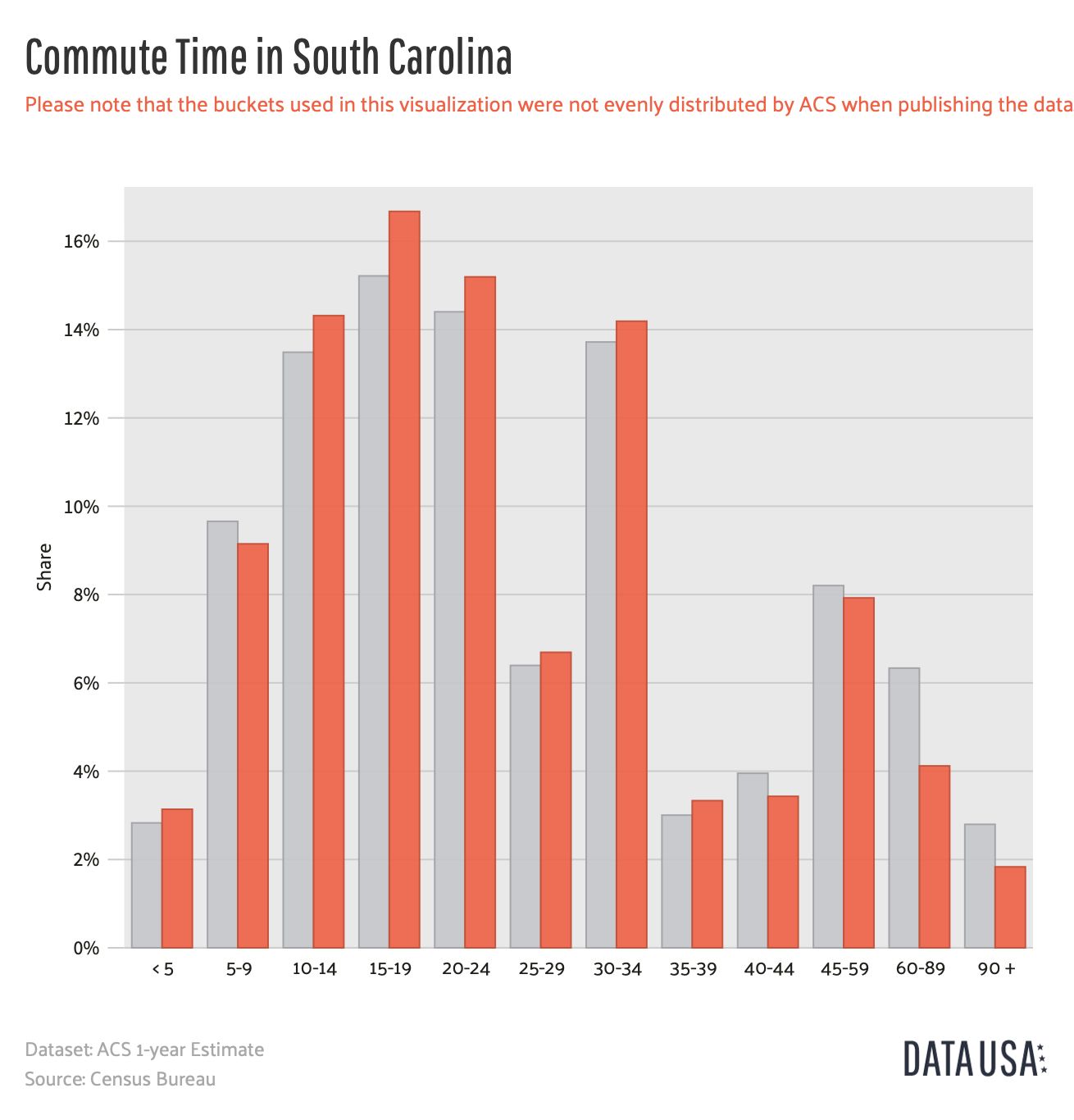

Commute Time

Commute times in South Carolina vary widely depending on urbanization, with major cities like Charleston and Columbia experiencing heavier traffic during peak hours, contrasting with shorter commute times in more rural areas of the state.

The chart illustrates that a significant portion of South Carolina residents have commutes ranging from 10 to 34 minutes, with a noticeable peak in the 20-24 minute range.

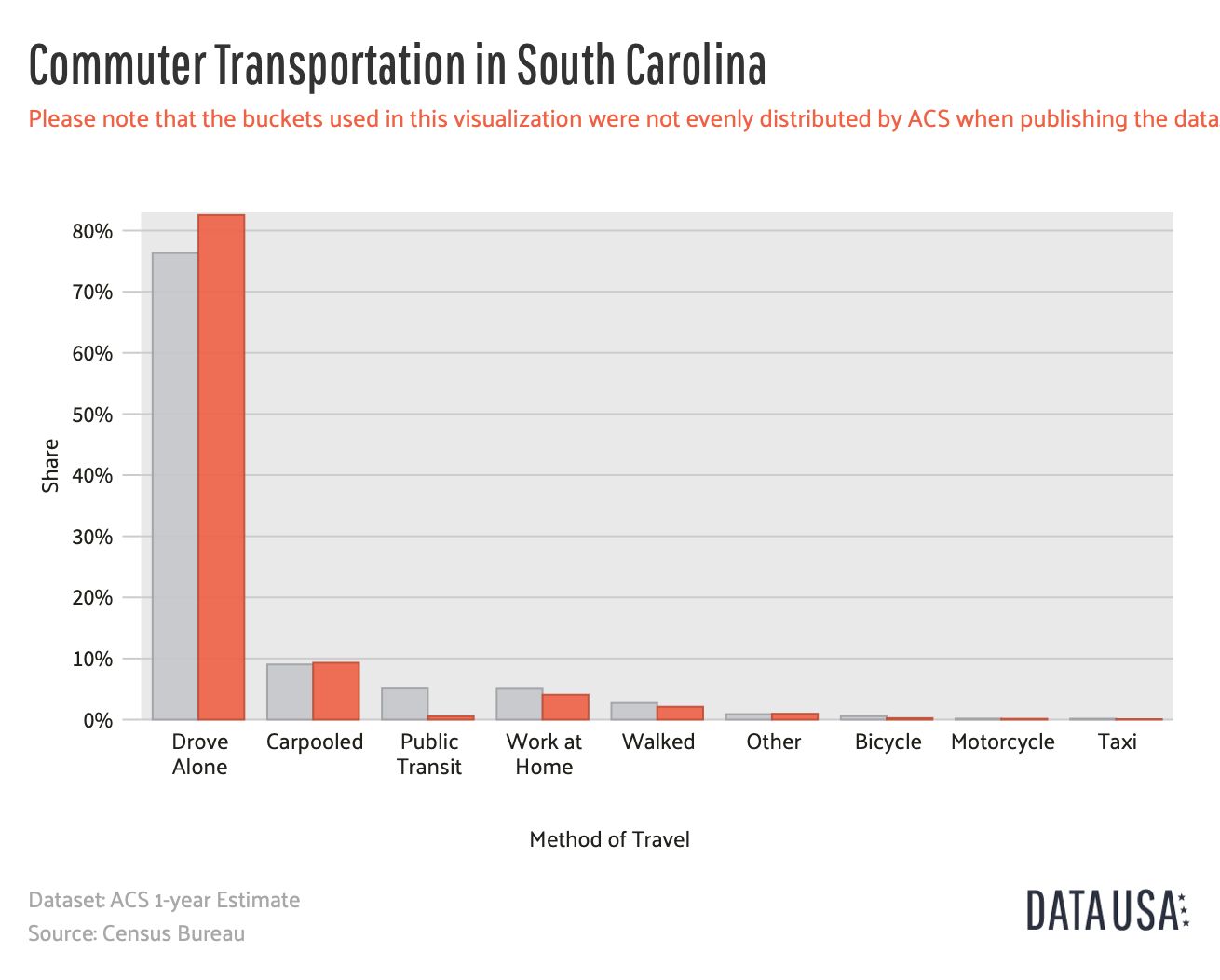

Commuter Transportation

Commuter transportation in South Carolina primarily relies on personal vehicles due to limited public transit options outside major urban centers.

This reliance underscores the need for infrastructure development to support more sustainable and efficient commuting solutions across the state.

Worst Cities in South Carolina for Traffic Congestion

Charleston, South Carolina is one of the worst cities in the United States for traffic congestion. According to TomTom, you should give yourself an extra 29 minutes a day if you’re traveling to or from Charleston. At 29 minutes a day, that’s over 100 hours a year.

South Carolina Traffic Congestion Percentage

| Congestion Level | Percentage |

|---|---|

| Morning Peak | 35% |

| Evening Peak | 59% |

| Highways | 16% |

| Non-highways | 30% |

| Average Extra Travel Time | 25% |

In this post, we’ve covered types of car insurance, car insurance rates, and South Carolina driving laws. Now that you have all the information you need to purchase car insurance, you can start to compare South Carolina car insurance rates for yourself and your family and find the best plan out there to fit your specific needs.

See how much you’ll pay for car insurance by entering your ZIP code below into our free comparison tool.

Frequently Asked Questions

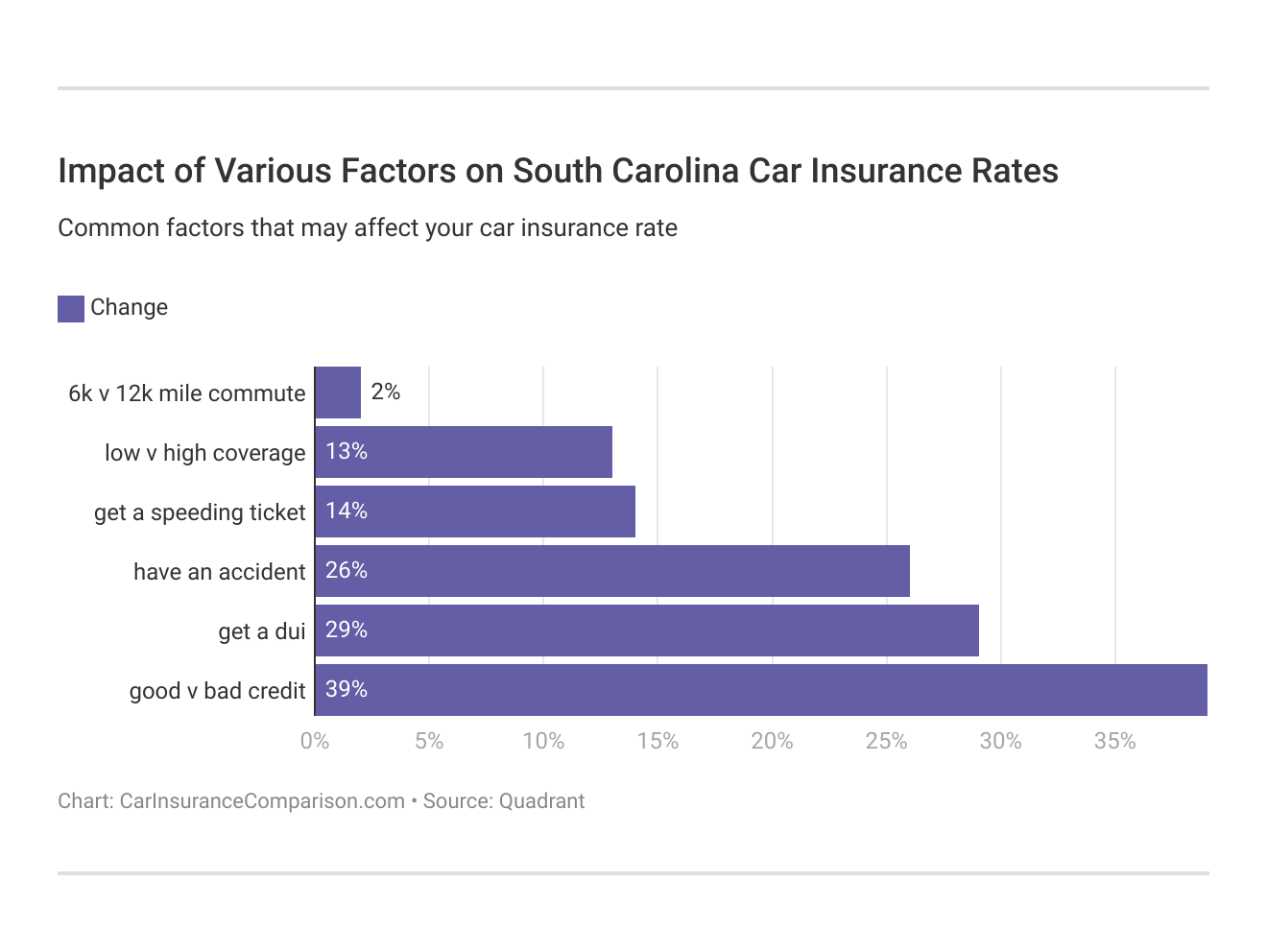

What factors affect car insurance rates in South Carolina?

Common factors that affect car insurance rates include your driving record, age, gender, marital status, type of vehicle you drive, your credit history, and the coverage options you choose. Additionally, factors like the location where you live in South Carolina and the frequency of car thefts and accidents in that area can impact insurance rates.

What is the best way to compare car insurance rates in South Carolina?

You can contact individual insurance companies directly and request quotes. Additionally, you can use online comparison tools, such as ours, that provide multiple quotes from different insurers. These tools typically require you to provide some personal information and details about your vehicle and driving history to generate accurate quotes.

Are car insurance rates higher in South Carolina compared to other states?

Car insurance rates can vary from state to state, and South Carolina may have different rates compared to other states. Insurance companies consider factors like state regulations, population density, crime rates, and accident statistics when determining rates for a specific area. Find cheap car insurance quotes by entering your ZIP code below.

Are there any discounts available for car insurance in South Carolina?

Yes, many insurance companies offer various discounts that can help you save on car insurance in South Carolina. Common discounts include safe driver discounts, multi-policy discounts (if you have multiple policies with the same insurer), good student discounts, low-mileage discounts, and discounts for having safety features installed in your vehicle.

What are the consequences of driving without car insurance in South Carolina?

Driving without insurance in South Carolina can result in fines, license suspension, and a $550 uninsured motorist fee. You must prove continuous insurance coverage for three years to regain your license and registration.

Is it necessary to have full coverage car insurance in South Carolina?

Full coverage car insurance is not legally required in South Carolina. However, if you have a loan or lease on your vehicle, your lender or leasing company may require you to have comprehensive and collision coverage. Even if it’s not mandatory, having full coverage can provide added protection for your vehicle in case of accidents, theft, or other covered events.

What should I do if I can’t afford car insurance in South Carolina?

If you’re having difficulty affording car insurance in South Carolina, there are options you can explore. First, consider adjusting your coverage limits or deductibles to lower your premium. You can also reach out to insurance companies to inquire about any available discounts or payment plans that could make the insurance more affordable.

Additionally, some states offer low-cost or subsidized insurance programs for individuals with limited incomes. Contact your state’s insurance department or a local insurance agent to inquire about such programs in South Carolina.

How can I find the cheapest car insurance rates in South Carolina?

To find the cheapest South Carolina auto insurance cost, compare quotes from multiple insurance companies. Look for discounts you may qualify for, such as safe driver discounts, bundling policies, or discounts for having a good credit score.

What coverage options should I consider to get affordable car insurance in South Carolina?

To get cheap car insurance in South Carolina, consider opting for liability coverage that meets the state’s minimum requirements, along with comprehensive and collision coverage if your vehicle is newer or of higher value. Increasing your deductible can also lower your premium.

Does my credit score affect my car insurance rates in South Carolina?

Yes, your credit score can affect your car insurance rates in South Carolina. Insurers often use credit-based insurance scores to assess risk, with lower scores potentially leading to higher premiums. Maintaining a good credit score can help you secure lower insurance rates.

By entering your ZIP code below, you can get instant car insurance quotes from top providers.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Michael Leotta

Insurance Operations Specialist

Michael earned a degree in Business Management degree with an insurance focus, which led to a successful 25-year career in insurance claims operations and support. He possesses a high-level of business acumen across multiple areas of the insurance industry. Over the course of his career, he served in multiple roles supporting claims operations including: Claims Specialist, Claims Trainer, Claim Au...

Insurance Operations Specialist

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.