Cheapest North Carolina Car Insurance Rates in 2025 (10 Most Affordable Companies)

The cheapest North Carolina car insurance rates are offered by Progressive, USAA, and Geico, with rates as low as $13 monthly. These top providers excel in affordability, discounts, and customer satisfaction, making them ideal for cost-effective coverage in North Carolina. Discover their features and benefits here.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Laura D. Adams

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Insurance & Finance Analyst

UPDATED: Jan 6, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jan 6, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

13,283 reviews

13,283 reviewsCompany Facts

Min. Coverage for North Carolina

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 6,589 reviews

6,589 reviewsCompany Facts

Min. Coverage for North Carolina

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage for North Carolina

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews

The cheapest North Carolina car insurance rates are offered by Progressive, USAA, and Geico. These top providers excel in affordability, extensive discounts, and strong customer satisfaction. Discover how these companies stand out in terms of coverage options, customer service, and pricing to find the best insurance policy for your needs.

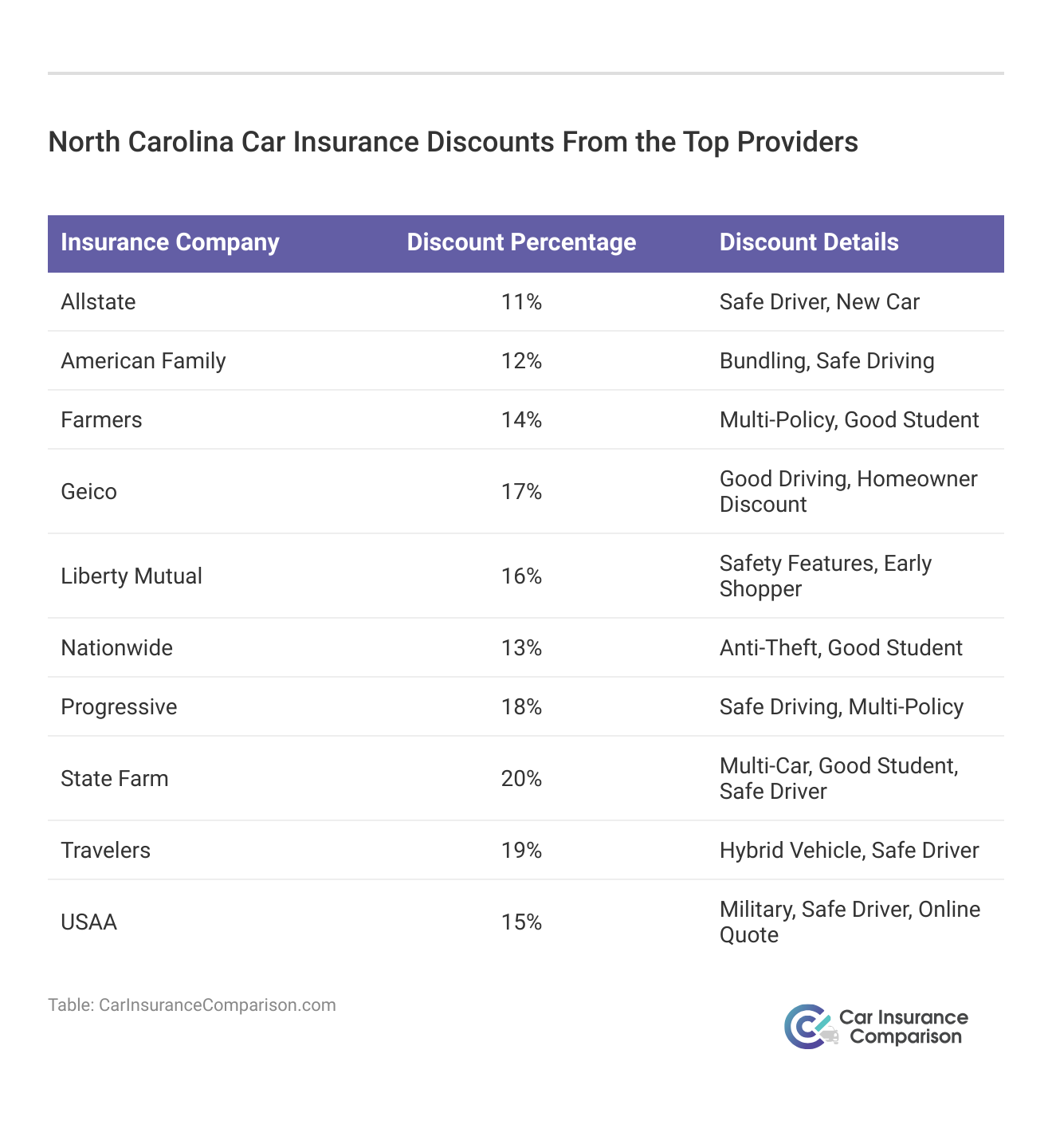

Understanding car insurance codes and laws is crucial for North Carolina drivers. The article also covers the various discounts available, such as safe driver and multi-policy discounts, to help you save even more. Additionally, it provides insights into the state’s insurance requirements and how to ensure you meet legal standards.

Our Top 10 Company Picks: Cheapest North Carolina Car Insurance Rates

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $13 A+ Online Convenience Progressive

#2 $18 A++ Military Savings USAA

#3 $29 A++ Cheap Rates Geico

#4 $32 B Many Discounts State Farm

#5 $35 A Student Savings American Family

#6 $35 A Customizable Polices Liberty Mutual

#7 $42 A Local Agents Farmers

#8 $42 A++ Accident Forgiveness Travelers

#9 $47 A+ Usage Discount Nationwide

#10 $72 A+ Add-on Coverages Allstate

- Compare North Carolina Car Insurance Rates

- Best Wake Forest, NC Car Insurance in 2025

- Best Troy, NC Car Insurance in 2025

- Best Sunset Beach, NC Car Insurance in 2025

- Best Reidsville, NC Car Insurance in 2025

- Best Maxton, NC Car Insurance in 2025

- Best Lincolnton, NC Car Insurance in 2025

- Best Leland, NC Car Insurance in 2025

- Best Kannapolis, NC Car Insurance in 2025

- Best Hillsborough, NC Car Insurance in 2025

- Best Grandy, NC Car Insurance in 2025

- Best Franklinton, NC Car Insurance in 2025

- Best Elkin, NC Car Insurance in 2025

- Best Camp Lejeune, NC Car Insurance in 2025

- Best Burgaw, NC Car Insurance in 2025

- Best Apex, NC Car Insurance in 2025

- Best Winston-Salem, NC Car Insurance in 2025

Ready to find cheaper car insurance coverage? Enter your ZIP code above to begin.

- Progressive offers the lowest rates at $13 per month

- Tailored coverage options for NC drivers’ specific needs

- Discounts and special programs catered to North Carolina residents

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – Progressive: Top Pick Overall

Pros

- Lowest Monthly Premiums: Progressive offers some of the most affordable car insurance rates in North Carolina, starting at just $13 per month. This makes it an excellent choice for drivers aiming to keep their insurance costs minimal without compromising essential coverage.

- Extensive Discount Opportunities: With numerous discount programs like the Snapshot program for safe driving and additional savings for bundling multiple policies, Progressive provides ample ways to lower rates for North Carolina policyholders. This flexibility is ideal for those looking to reduce insurance costs through various incentives.

- Customizable Coverage Options: Progressive allows North Carolina drivers to customize their coverage with options like roadside assistance and gap insurance. This flexibility ensures comprehensive protection while maintaining affordability, catering to a range of insurance needs. Delve into our evaluation of Progressive car insurance review.

Cons

- Inconsistent Customer Service: While Progressive is known for low rates in North Carolina, it has received mixed reviews for customer service, particularly in claims handling. This could impact overall satisfaction for those who value reliable support and efficient resolution of issues.

- Higher Costs for High-Risk Drivers: Progressive’s rates can be higher for drivers with a history of accidents or violations. This means that high-risk drivers in North Carolina may not benefit as much from the low starting premiums, potentially making it less cost-effective for individuals with poor driving records.

#2 – USAA: Best for Military Savings

Pros

- Exclusive Military Discounts: USAA offers a highly competitive rate of $18 per month for North Carolina drivers, with additional savings for military members and their families. This makes USAA an exceptional choice for those eligible, providing valuable discounts and tailored coverage.

- High Customer Satisfaction Ratings: USAA consistently ranks highly in customer satisfaction, especially for claims handling. For North Carolina drivers seeking both affordability and top-notch service, USAA’s strong reputation enhances the value of their low-cost insurance options.

- Competitive Pricing for Military Families: USAA’s pricing structure benefits military families significantly, often resulting in lower rates than many competitors in North Carolina. This focus on affordability for its target demographic makes it an attractive option for military members and veterans. Learn more in our USAA car insurance review.

Cons

- Membership Restrictions: USAA’s insurance services are restricted to military members, veterans, and their families, excluding the general public. This limitation means that non-eligible individuals in North Carolina cannot access their competitive rates, despite the benefits for qualifying drivers.

- Limited Physical Branches: With a limited number of physical locations in North Carolina, USAA may be less convenient for those who prefer in-person interactions. The lack of local branches could be a drawback for drivers who value face-to-face customer service.

#3 – Geico: Best for Cheap Rates

Pros

- Affordable Monthly Premiums: Geico provides some of the lowest monthly premiums in North Carolina, with rates starting at $29. This makes it an ideal choice for drivers looking to minimize their insurance expenses while receiving solid coverage.

- User-Friendly Online Tools: Geico’s well-rated website and mobile app offer a streamlined experience for managing policies and filing claims. This digital convenience is particularly beneficial for North Carolina drivers who prefer online interactions and efficient service.

- Diverse Coverage Options: Geico provides a wide range of coverage options, allowing North Carolina drivers to select protection levels that suit their needs. This versatility ensures that drivers can find the right balance between cost and coverage. Learn more in our Geico car insurance review.

Cons

- Limited Discounts for Certain Groups: While Geico offers competitive rates for drivers residing in North Carolina, it may not have as many discount options for specific groups compared to other insurers. This can be a disadvantage for drivers looking to maximize their savings through targeted discounts.

- Customer Service Variability: Geico’s customer service has received mixed reviews, with some customers reporting inconsistent experiences. This variability could affect overall satisfaction for North Carolina drivers who prioritize dependable support and effective problem resolution.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#4 – State Farm: Best for Many Discounts

Pros

- Strong Local Agent Network: State Farm’s $32 monthly rate comes with the benefit of a vast network of local agents across North Carolina, offering personalized support and guidance in navigating policy options.

- Affordable Monthly Premiums: State Farm offers competitive rates in North Carolina, with premiums starting at $32 per month. This affordability makes it a reliable choice for drivers seeking budget-friendly insurance without sacrificing coverage quality.

- Wide Range of Discounts: State Farm provides numerous discount opportunities, including those for safe driving, multi-policy bundling, and student discounts. These options can further reduce costs for North Carolina drivers who qualify for these savings. Unlock details in our State Farm car insurance review.

Cons

- Limited High-Risk Driver Options: State Farm’s rates may not be as favorable for high-risk drivers in North Carolina with a history of accidents or violations. This could lead to higher premiums for such individuals, making it less economical for drivers with problematic records.

- Less Competitive for Young Drivers: North Carolina’s young and inexperienced drivers may find State Farm’s rates higher compared to other insurers. Despite its overall affordability, State Farm may not be the best choice for younger drivers seeking the lowest possible rates.

#5 – American Family: Best for Student Savings

Pros

- Competitive Rates for Comprehensive Coverage: American Family offers rates starting at $35 per month in North Carolina, providing good value for drivers who want extensive coverage options. This balance of cost and coverage is appealing for those seeking protection beyond basic policies.

- Flexible Coverage Options: As mentioned in our American Family car insurance review, the company provides customizable coverage, including options like roadside assistance and rental car coverage. This flexibility allows North Carolina drivers to tailor their policies to their specific needs while maintaining affordable rates.

- Strong Regional Presence: With a solid reputation in North Carolina, American Family has a strong network of agents and services in the area. This regional presence ensures that drivers can access personalized support and local expertise.

Cons

- Higher Rates for Certain Demographics: American Family’s rates may be higher for specific groups, such as those with poor credit scores or high-risk driving records. This could result in less favorable premiums for some North Carolina drivers compared to other insurers.

- Limited National Discounts: American Family may not offer as many nationwide discount programs as some competitors. This could mean fewer savings opportunities for North Carolina drivers looking to maximize their discounts through various insurance incentives.

#6 – Liberty Mutual: Best for Customizable Polices

Pros

- Affordable Monthly Premiums: Liberty Mutual offers competitive insurance rates in North Carolina, starting at $35 per month. This affordability is combined with customizable coverage options, making it an attractive choice for drivers seeking both cost efficiency and flexibility.

- Wide Range of Coverage Choices: Liberty Mutual provides a broad selection of coverage options, including new car replacement and accident forgiveness. This extensive customization ensures that North Carolina drivers can tailor their policies to their specific needs while keeping costs manageable.

- Discount Programs: Liberty Mutual offers various discount programs, including savings for bundling multiple policies and for safe driving. These discounts can significantly reduce overall insurance costs for North Carolina drivers. Learn more in our Liberty Mutual car insurance review.

Cons

- Mixed Customer Service Reviews: Liberty Mutual has received varied feedback regarding its customer service, particularly in claims handling. North Carolina drivers might experience inconsistent support, which can impact overall satisfaction with the insurer.

- Potentially Higher Rates for Younger Drivers: Liberty Mutual’s premiums might be higher for younger drivers or those with limited driving experience. This could make it less economical for North Carolina’s younger or less experienced drivers compared to other insurance providers.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#7 – Farmers: Best for Local Agents

Pros

- Competitive Rates for Diverse Coverage: Farmers offers rates starting at $42 per month in North Carolina, with a wide range of coverage options. This allows drivers to select policies that suit their needs while keeping costs relatively low.

- Numerous Discount Opportunities: Farmers provides various discount programs, including savings for safe driving, multi-policy bundling, and membership affiliations. These discounts can help North Carolina drivers reduce their premiums and enhance the value of their insurance.

- Customizable Coverage Options: Farmers offers various coverage options, allowing North Carolina drivers to select policies tailored to their needs, which can be appealing for those looking for more than just the cheapest rates. Learn more in our Farmers car insurance review.

Cons

- Higher Premiums for High-Risk Drivers: Farmers may have higher premiums for drivers with poor credit scores or high-risk driving records. This could make it less cost-effective for North Carolina drivers with problematic histories.

- Less Competitive for Young Drivers: Rates for younger drivers may be higher with Farmers compared to some competitors. This can make it less attractive for North Carolina’s younger drivers who are seeking the most affordable insurance options.

#8 – Travelers: Best for Accident Forgiveness

Pros

- Affordable Premiums Starting at $42: Travelers provides competitive rates in North Carolina, with premiums beginning at $42 per month. This affordability, combined with additional coverage options, offers good value for drivers looking to balance cost and protection.

- Strong Bundle Discounts: Travelers offers significant savings for bundling auto insurance with other policies, such as home or renters insurance. This can lead to considerable overall savings for North Carolina drivers who need multiple types of coverage. See more details on our Travelers car insurance review.

- Wide Coverage Options: Travelers provides a diverse range of coverage options, including accident forgiveness and new car replacement. This variety allows North Carolina drivers to select policies that best meet their needs while benefiting from competitive rates.

Cons

- Inconsistent Customer Service: Travelers has received mixed reviews regarding customer service, particularly with claims processing. North Carolina drivers might experience variability in service quality, affecting overall satisfaction with the insurer.

- Potentially Higher Costs for High-Risk Drivers: Travelers’ rates may be less favorable for drivers with a history of accidents or poor credit. This could make it a less attractive option for high-risk drivers in North Carolina compared to other insurers.

#9 – Nationwide: Best for Usage Discount

Pros

- Competitive Rates Starting at $47: Nationwide offers competitive insurance rates in North Carolina, starting at $47 per month. This affordability is complemented by a range of coverage options tailored to meet various needs. Check out insurance savings in our complete Nationwide car insurance discount.

- Family-Friendly Coverage Options: Nationwide provides a variety of coverage options suitable for families, including discounts for adding multiple vehicles to a policy. This makes it an attractive choice for North Carolina families looking for comprehensive and cost-effective insurance solutions.

- Excellent Customer Service: Nationwide is known for its strong customer service and responsive claims handling. North Carolina drivers can expect reliable support and efficient resolution of issues, adding value to its competitive pricing.

Cons

- Higher Premiums for Single Drivers: While Nationwide offers good rates for families, single drivers may find its premiums higher compared to other insurers. This can make it less appealing for North Carolina drivers who do not require family-oriented coverage options.

- Limited Discount Programs for Certain Groups: Nationwide may offer fewer discount programs for specific demographics, such as young or high-risk drivers. This could result in higher overall costs for North Carolina drivers who do not benefit from its available discounts.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#10 – Allstate: Best for Add-on Coverages

Pros

- Comprehensive Coverage Options: Allstate offers extensive coverage options, including new car replacement and accident forgiveness, with rates starting at $72 per month in North Carolina. This wide range of options ensures robust protection for drivers seeking comprehensive coverage.

- Strong Regional Presence: Allstate has a significant presence in North Carolina, with many local agents available to provide personalized service and tailored insurance solutions. This regional support enhances the value of their comprehensive coverage options.

- Wide Range of Discounts: With various discounts for safe driving, bundling, and early signing, Allstate provides opportunities for North Carolina policyholders to reduce their overall costs despite higher premiums. Discover more about offerings in our Allstate car insurance review.

Cons

- Higher Premiums Compared to Competitors: Allstate’s starting premiums of $72 per month are higher than many competitors in North Carolina. This higher cost may be a disadvantage for drivers seeking the most affordable insurance options.

- Mixed Customer Service Feedback: Allstate has received varied reviews regarding its customer service, with some customers reporting issues with claims processing. This variability could affect overall satisfaction for North Carolina drivers prioritizing reliable support.

North Carolina Car Insurance Coverage and Rates

Speaking of food, North Carolina has a lot in terms of food firsts: Pepsi-Cola was first produced in New Bern in 1898; Golden Corral, a famous buffet restaurant chain, began and started in North Carolina in 1973, and the donut chain Krispy Kreme started in North Carolina.

North Carolina Car Insurance Monthly Rates by Coverage Level & Providers

Insurance Company Minimum Coverage Full Coverage

Allstate $72 $169

American Family $35 $82

Farmers $42 $99

Geico $29 $69

Liberty Mutual $35 $82

Nationwide $47 $111

Progressive $13 $32

State Farm $32 $77

Travelers $42 $99

USAA $18 $44

Before you go run out to buy a dozen delicious donuts, let’s go over the basic requirements of car insurance and what it will cost you in North Carolina.

North Carolina Minimum Coverage

It is great that most of the state is insured. But whether you are insured or not, it is important to know that you need, at the minimum, liability insurance. Liability car insurance covers you in the event you are in an accident and there is bodily injuries or property damage. It pays all the individuals involved.

North Carolina Car Insurance Minimum Coverage Requirements

| Coverages | Limits |

|---|---|

| Bodily Injury Liability | $30,000 per person and $60,000 per accident |

| Property Damage | $25,000 per accident |

| Uninsured/Underinsured Motorist | $30,000 per person and $60,000 per accident for bodily injury and $25,000 per accident for property damage |

North Carolina ranks 48th in the United States when it comes to people who are uninsured. This equates to 6.5% of the total state population that is not insured.

It is important to know North Carolina is an at-fault state. This means that the person who was at fault in the accident is the one who has to pay for any damage or injuries sustained.

Also, if you work or do business in North Carolina, it is important to know you must have liability insurance you have purchased in the state of North Carolina. Out-of-state policies will not be accepted as valid insurance policies.

The mandatory minimum you must carry in North Carolina according to North Carolina law G.S. 20-279.21 is listed in the table above, but to recap:

- $30,000 for injuries per person.

- $60,000 for total injuries per accident.

- $25,000 for property damage per accident.

This minimum liability coverage is known as 30/60/25.

Experts recommend if at all possible to purchase more than the minimum amount for your state.

Required Forms of Financial Responsibility in North Carolina

To drive in North Carolina, you must carry insurance and some form of financial responsibility.

According to North Carolina law G.S. 20-309, the following will serve as valid forms of financial responsibility in addition to insurance:

- A surety bond in the amount of $85,000 or more.

- Certificate of deposit of money or securities of $85,000 or more.

- Self-insurance (if you own/lease 26 cars or more).

Every time you operate a vehicle, you need to have, on hand, proof of insurance and/or financial responsibility.

If you let your insurance lapse, the North Carolina liability insurance law is heavily enforced. Insurance companies have to, by law, notify the state DMV if insurance is canceled or coverage lapses.

There is no grace period for insurance lapses in North Carolina.

Read More: Compare Best Car Insurance Companies That Don’t Report to the DMV When They Cancel a Customer

The penalties for letting your insurance lapse?

- First Time: $50 fine

- Second Time: $100 fine

- Subsequent Times: $150 fine

- Restoration Fee for License Plate: $50 fee

If you need to cancel your insurance, for any reason, make sure you follow the proper procedures. It’s much better than having to pay fines and fees.

Premiums as Percentage of Income in North Carolina

In 2017, the average monthly disposable income was $3,099.

What is disposable income? That is the amount you have left to spend after you have taken care of your necessary expenses and after taxes have been paid.

The average monthly cost of car insurance in North Carolina is $76.28, which is about 2.2% of your total disposable income.

If you live in North Carolina, your monthly disposable income, on average, totals about $292.92. On average, a full coverage premium will deduct about $64 out of your total monthly income.

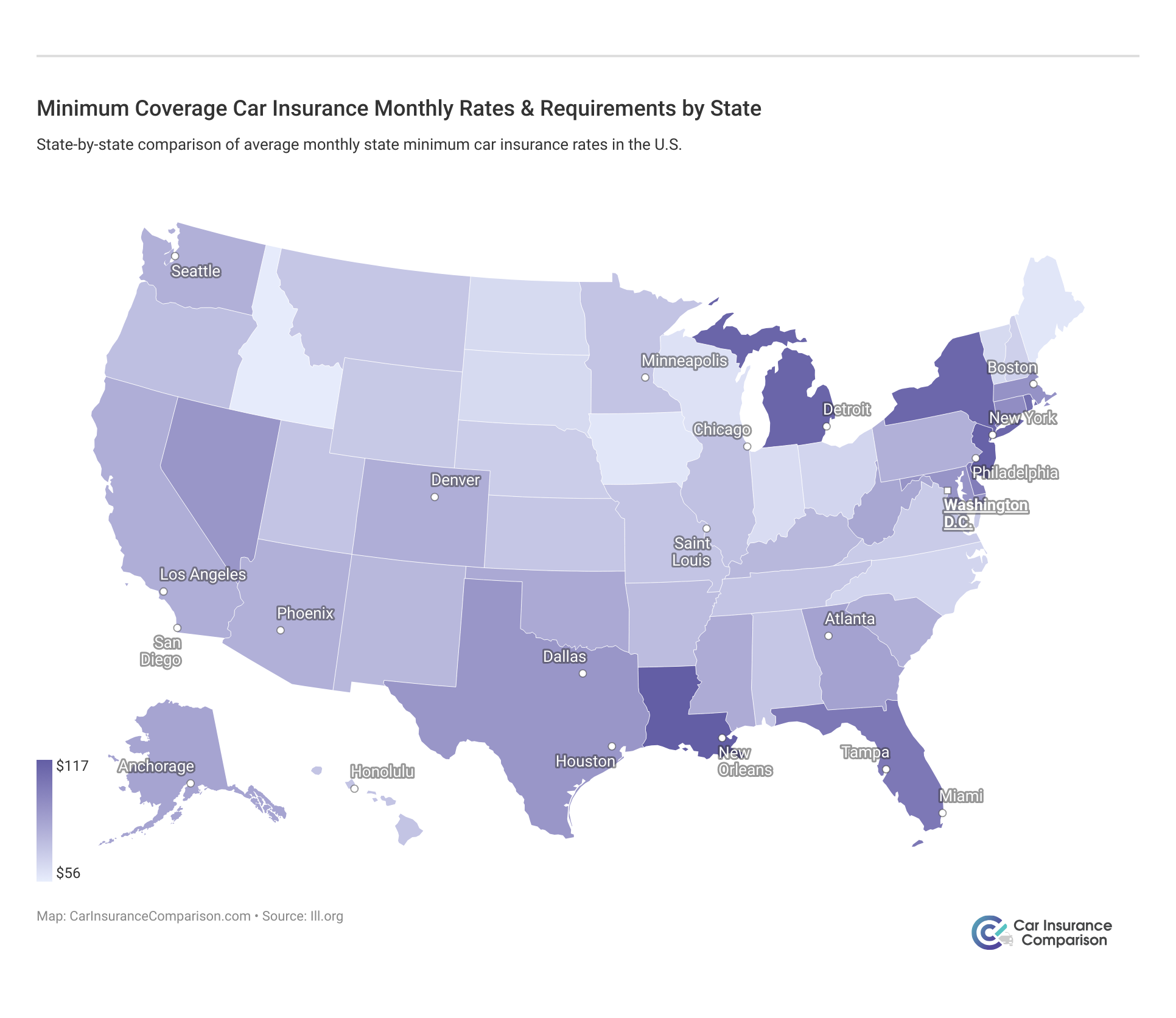

Why is full coverage so low in North Carolina?

According to a study cited on the Charlotte Observer, North Carolina (as of 2018) is the least expensive state to buy car insurance in, as its residents pay 41% less monthly than the national average of $811. Find out which states have the highest car insurance rates before moving.

The study lists three potential reasons for low car insurance:

- North Carolina is mostly rural, which means less crime, cheaper cost of living, and fewer accidents. This drives insurance rates lower.

- The Commissioner of Insurance, Wayne Goodwin, is responsible for capping car insurance rates. Insurance firms compete with one another by offering rates lower than the state cap.

- Because of this competition, more than 2,000 different auto insurance discounts are offered by North Carolina auto insurance companies, an amount the study calls “uncharacteristically high.”

American Consumer Credit Counseling suggests saving 20% of every paycheck. With North Carolina’s DPI, that is a whopping $585 each month. How much are you putting aside for savings?

Full Coverage Monthly Car Insurance Rates in NC

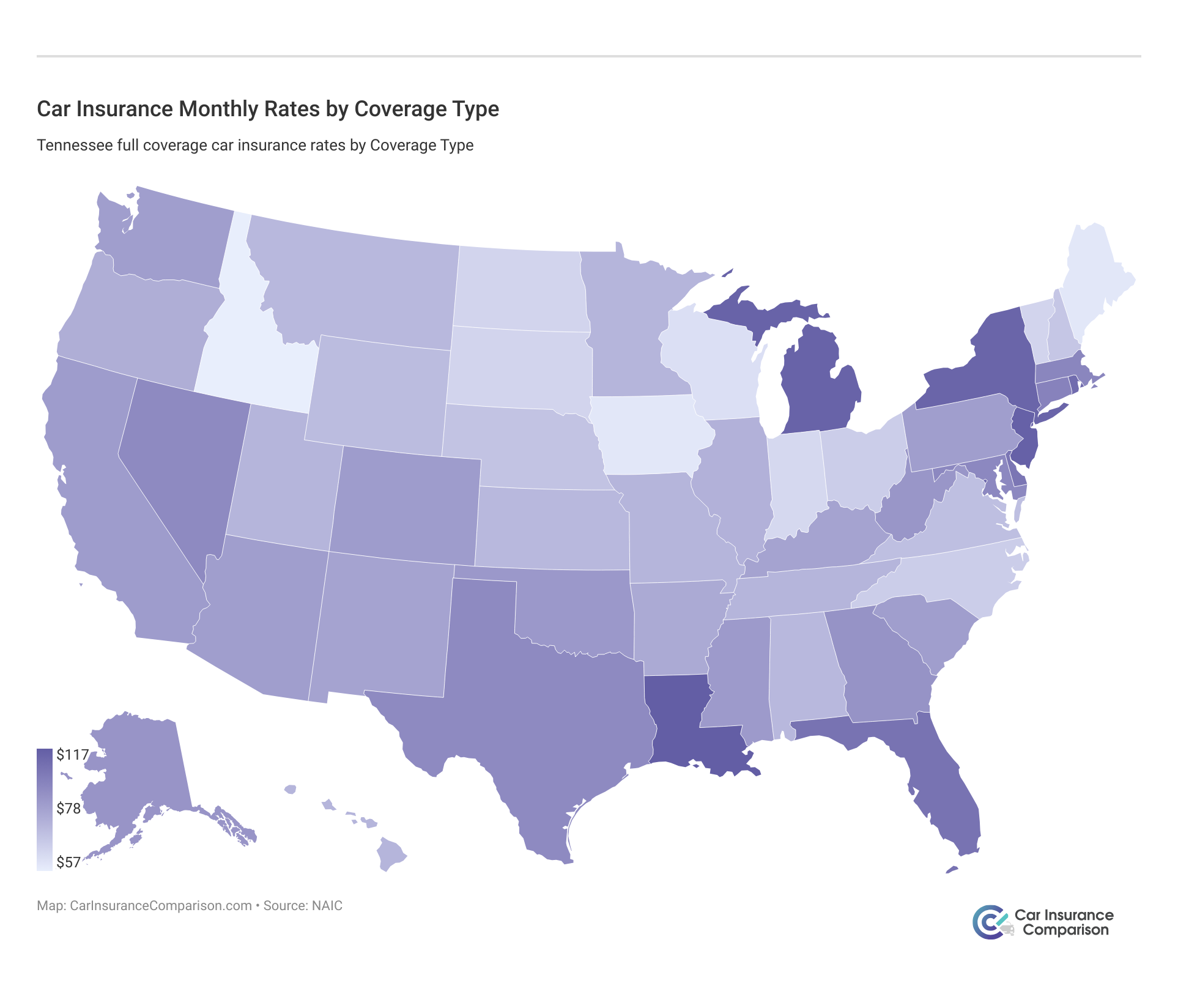

To provide a clearer picture, we have developed an interactive map that allows you to explore full coverage car insurance monthly rates across different states and coverage types. By simply hovering your mouse over each state, you can access detailed information about the insurance costs specific to that region.

The map reveals significant variations in monthly rates for full coverage car insurance across different states. For instance, states with higher population densities or higher rates of traffic incidents may have higher insurance costs. Conversely, states with fewer traffic incidents or lower population densities might offer more affordable rates. Understanding these differences can help you budget better and choose the most cost-effective insurance plan for your needs.

Add-ons, Endorsements, and Riders

Getting complete coverage at an affordable price is your main goal when it comes to car insurance, right?

Here’s a list of useful coverage available to you in North Carolina:

- Guaranteed Auto Protection (Gap)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance, such as towing

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-as-You-Drive or Usage-Based Insurance

Good news: there are lots of powerful but cheap extras you can add to your policy.

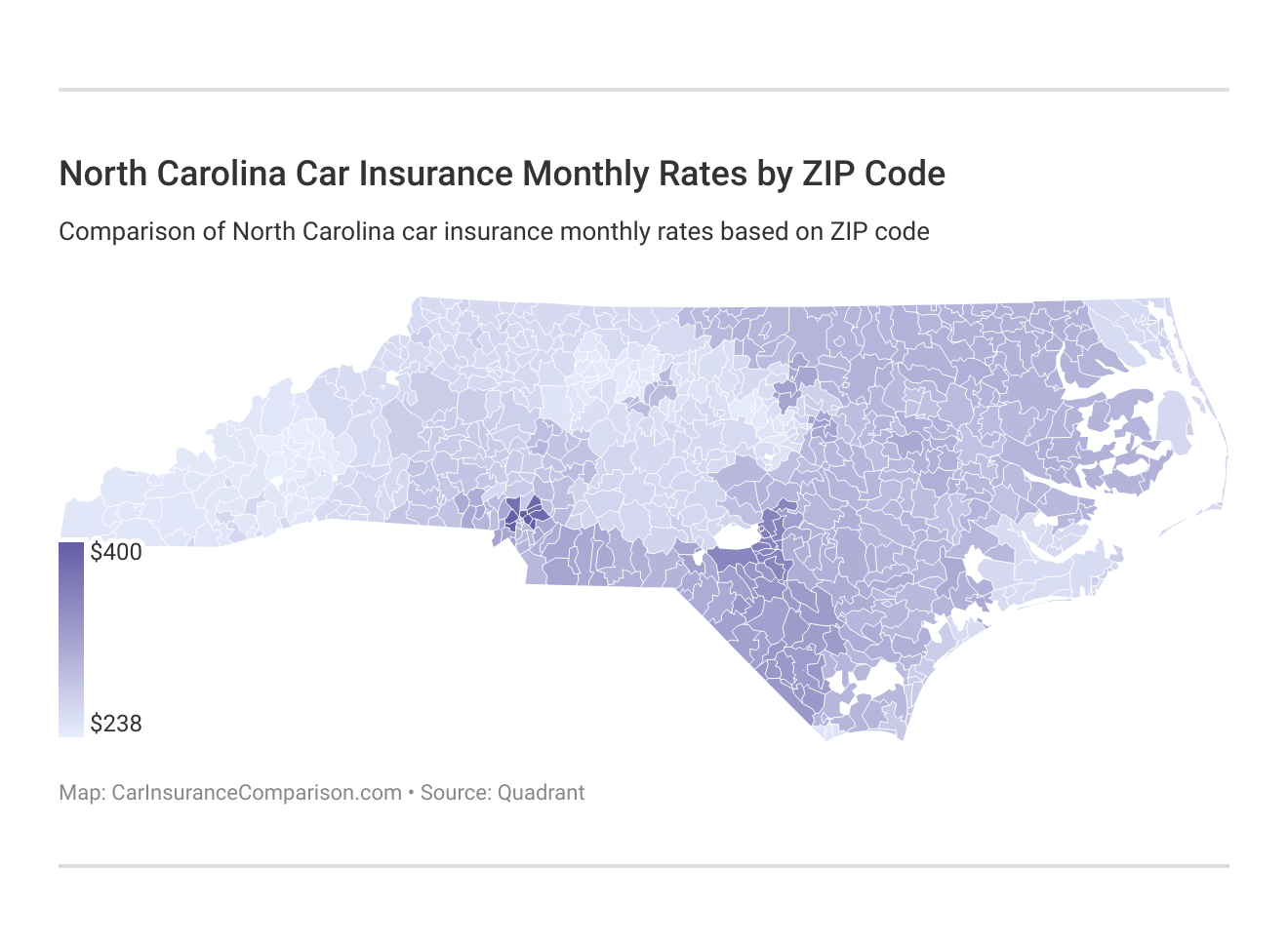

North Carolina Car Insurance Rates by ZIP Code

Check the table and chart below to see if your ZIP code is among the most expensive or cheapest ZIP codes.

Knowing the car insurance rates by city can help you better understand regional cost differences and choose a city with more affordable premiums if you’re considering a move.

This information is essential for managing your car insurance expenses effectively.

North Carolina Car Insurance Costs

Understanding the most expensive ZIP codes for car insurance in North Carolina can help you better manage your insurance costs.

North Carolina Monthly Car Insurance Rates by City

| City | Rates |

|---|---|

| Alexander | $238 |

| Candler | $239 |

| Leicester | $239 |

| Weaverville | $239 |

| Swannanoa | $240 |

| Barnardsville | $240 |

| Black Mountain | $241 |

| Arden | $241 |

| Carrboro | $242 |

| Kernersville | $242 |

By analyzing the most expensive ZIP codes for car insurance, you can identify areas where premiums are higher and consider options for more affordable coverage.

Best North Carolina Car Insurance Companies

There are a lot of car insurance providers out there, and it can be a pain to try and navigate who is the best, and who you can trust.

So let us help you.

Find out who the best providers are, and why, in the state of North Carolina. See table below:

A.M. Best Financial Strength Ratings From the Top North Carolina Car Insurance Providers

| Insurance Company | A.M. Best |

|---|---|

| Allstate | A+ |

| Erie | A+ |

| Geico | A++ |

| Liberty Mutual | A |

| Nationwide | A+ |

| Farm Bureau | A |

| Progressive | A+ |

| State Farm | B |

| USAA | A++ |

Sometimes it’s more important to know what people say about these companies instead of the financial data. You’re the customer, after all, and you need to be treated well.

Read on to find out about customer reviews.

Companies With the Most Complaints in North Carolina

Every business gets a bad review every now and then. It’s only natural.

But when there are multiple bad reviews and complaints, it’s wise to pay attention.

Here are the companies in North Carolina that customers believe are the worst and have the most complaints, with number one being the company that has the most complaints:

- MAPFRE North America

- MetLife Auto & Home

- Mercury General

- Progressive Insurance

- Liberty Mutual

- Nationwide

- Allstate

- Farmers Insurance

- Geico

- State Farm

Read More: MAPFRE Car Insurance Review

The information above was gathered from Consumer Reports regarding the state of North Carolina in 2018 and cited on the Charlotte, North Carolina website for WSOC-TV.

North Carolina has your back if you need to file a complaint. Go to the Insurance Complaints Website to file a complaint.

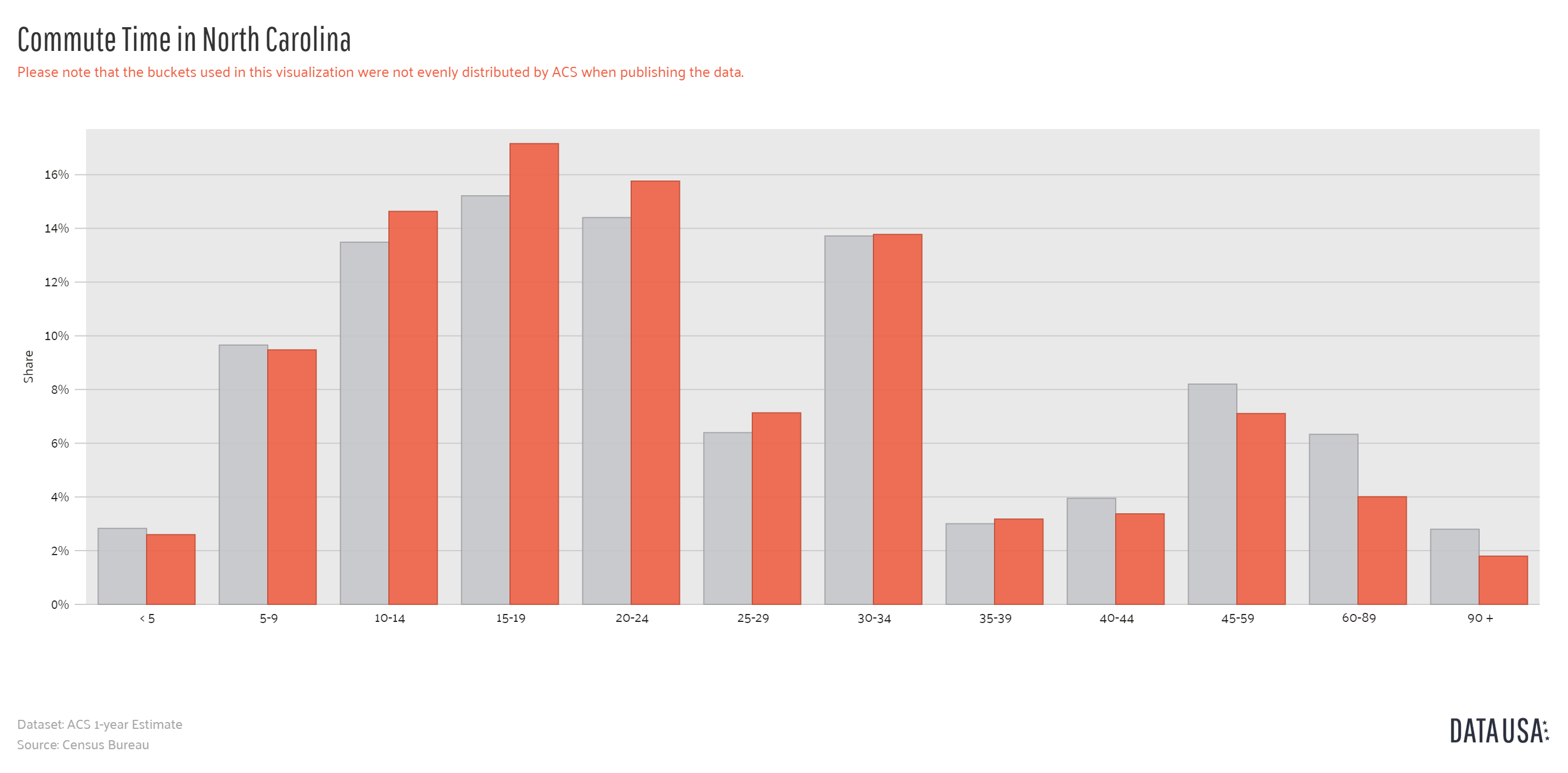

Commute Rates in North Carolina

The cost of car insurance can vary depending on your commute distance and annual mileage. The table below shows the monthly rates from different insurance companies in North Carolina for various commute distances and annual mileage.

North Carolina Minimum Coverage Car Insurance Monthly Rates by Annual Mileage

| Insurance Company | 6,000 Miles | 12,000 Miles |

|---|---|---|

| Allstate | $61 | $72 |

| American Family | $35 | $44 |

| Farmers | $53 | $42 |

| Geico | $30 | $29 |

| Liberty Mutual | $67 | $35 |

| Progressive | $39 | $13 |

| State Farm | $33 | $32 |

| USAA | $22 | $18 |

| U.S. Average | $118 | $124 |

Liberty Mutual consistently offers the cheapest rates regardless of your commute length. Understanding these rates can help you choose the most cost-effective car insurance based on your driving habits and mileage in North Carolina.

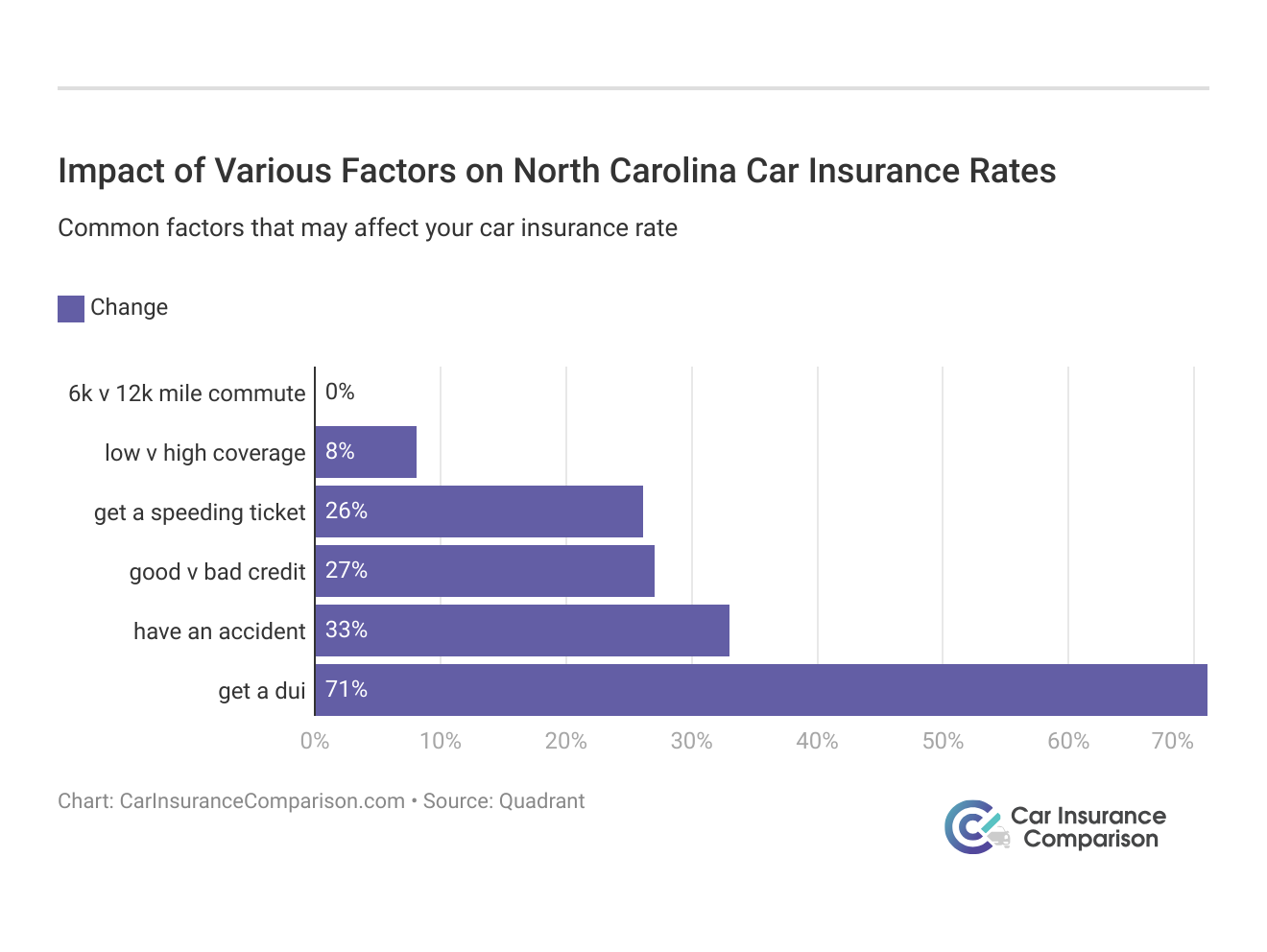

North Carolina Auto Insurance Rates

In North Carolina, the lengthy of your commute has a very negligible effect on your car insurance rates.

Compared to some of the other more dramatic factors, it’s not even something companies consider.

Credit History Rates in North Carolina

In North Carolina, your credit history can work for you or against you when it comes to purchasing insurance.

North Carolina Full Coverage Car Insurance Monthly Rates by Credit Score & Provider

| Insurance Company | Bad Credit | Fair Credit | Good Credit |

|---|---|---|---|

| Allstate | $275 | $215 | $150 |

| American Family | $250 | $200 | $140 |

| Farmers | $280 | $220 | $160 |

| Geico | $240 | $180 | $120 |

| Liberty Mutual | $310 | $250 | $190 |

| Metromile | $220 | $170 | $130 |

| Nationwide | $260 | $200 | $140 |

| Progressive | $260 | $200 | $150 |

| State Farm | $230 | $180 | $130 |

| Travelers | $290 | $230 | $170 |

| USAA | $210 | $160 | $120 |

| U.S. Average | $115 | $140 | $210 |

Liberty Mutual has the best rates, no matter your credit history. If you have good credit overall, Progressive has the best rates. Read our Progressive car insurance review for more information.

Driving Record Rates in North Carolina

Much like with credit, your driving record can work for you or against you in North Carolina.

North Carolina Full Coverage Car Insurance Monthly Rates by Driving Record

| Insurance Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| AAA | $102 | $137 | $289 | $120 |

| Allstate | $148 | $228 | $382 | $168 |

| American Family | $135 | $192 | $354 | $150 |

| Farmers | $169 | $237 | $413 | $175 |

| Geico | $110 | $208 | $301 | $145 |

| Liberty Mutual | $183 | $246 | $428 | $200 |

| Nationwide | $120 | $237 | $350 | $170 |

| Progressive | $126 | $151 | $226 | $80 |

| State Farm | $104 | $141 | $314 | $82 |

| The Hartford | $145 | $195 | $378 | $158 |

| Travelers | $120 | $158 | $340 | $130 |

| U.S. Average | $119 | $172 | $173 | $147 |

Progressive has the best rates for a clean driving record.

Accidents happen, and it seems like Progressive has the best rates if you have minimal speeding violations or minimal accidents.

Number of Insurers in North Carolina: Domestic vs. Foreign

What in the world do domestic and foreign insurers mean?

The difference is simple.

Domestic means that the insurer is based in-state, or it may be an insurance company only available in the state of North Carolina.

Foreign means it is based out of state, or a company such as Geico that is available in multiple states.

In North Carolina, there are 56 domestic insurers and 855 foreign insurers.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Laws in North Carolina

To keep rates on car insurance low, it helps to know the laws in North Carolina.

Never fear. This guide will help you with knowing all the facts.

North Carolina’s Car Insurance Laws

Each state can have different rules and different laws, so it helps to read up on all of them.

To stay in the know, read up on the North Carolina laws here. The sections below get a little more detailed.

North Carolina’s Windshield & Glass Repair Laws

Oh no. The unthinkable has happened. That tiny crack in your windshield is starting to become a big one.

Are insurers required to pay for windshield repairs? It looks like from research, yes, they are.

You can choose where the repairs are done, and the insurance company must use aftermarket parts that are equal to the original parts they are replacing. By law G.S. 58-3-180, “it is a violation for an automobile repair facility or parts person to place a nonoriginal crash repair part, nonoriginal windshield, or nonoriginal auto glass on a motor vehicle and to submit an invoice for an original repair part.”

When we aren’t saving you buckets of money, we’re designing new (family-friendly) buckets of popcorn! Which is your fave? Pop off in the comments. pic.twitter.com/f3utdI5AcO

— Progressive (@progressive) July 12, 2024

High-Risk Insurance in North Carolina

North Carolina high-risk insurance is for people who have had past driving violations or no experience behind the wheel, or poor credit. Car insurance premiums will be high as a result.

From research, it looks like insurance rates will either increase or decrease according to the North Carolina Safe Driver Incentive Plan.

Low-Cost Insurance in North Carolina

The Safe Driver Incentive Plan is the easiest way to get low-cost auto insurance in North Carolina. Be a safe driver, and enjoy the discounts.

More information on the SDIP is down below.

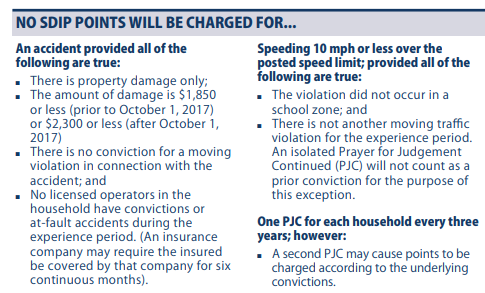

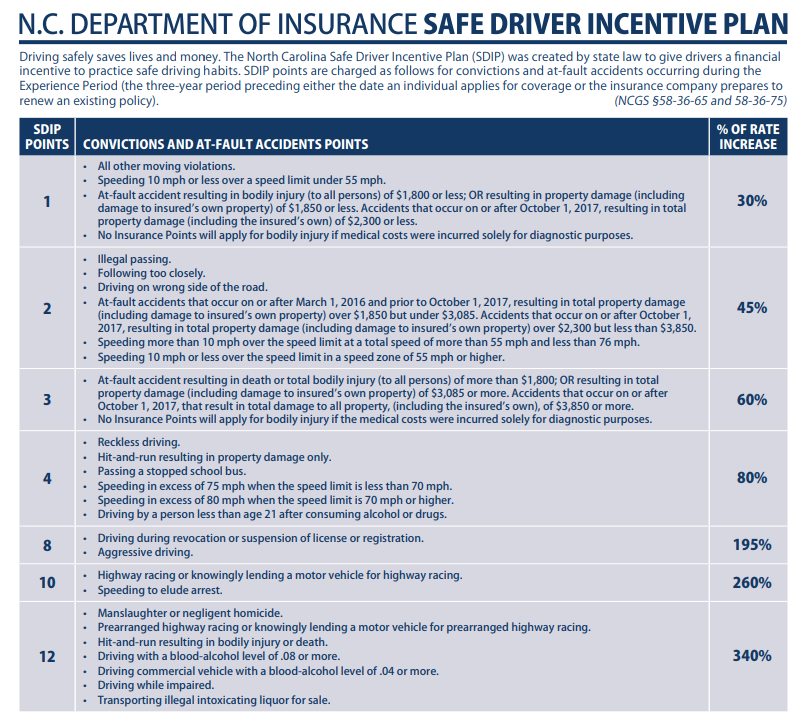

North Carolina Safe Driver Incentive Plan (SDIP)

It pays to be a safe driver in North Carolina.

The North Carolina Safe Driver Incentive Plan (SDIP) is, according to the North Carolina Department of Insurance,

a financial incentive to practice safe driving habits. SDIP points are charged as follows for convictions and at-fault accidents occurring during the

Experience Period (the three-year period preceding either the date an individual applies for coverage or the insurance company prepares to

renew an existing policy).

If you drive safely, you save money.

However, if you rack up the points, your insurance rates will go up.

Automobile Insurance Fraud in North Carolina

“Insurance Fraud: Recognize it. Report it. Protect yourself.”

The Department of Insurance in North Carolina is charged with protecting its customers from insurance fraud.

10% of all insurance claims involving some degree of fraud — totaling nearly $120 billion per year lost.

The Department of Insurance warns you to be on the lookout for the most common types of insurance schemes in North Carolina:

- Automobile repair fraud.

- Staged automobile accidents.

- Fraudulent billing of customers for medical services.

- Property claims adjusting.

- Property repair.

- Using your address for their claim

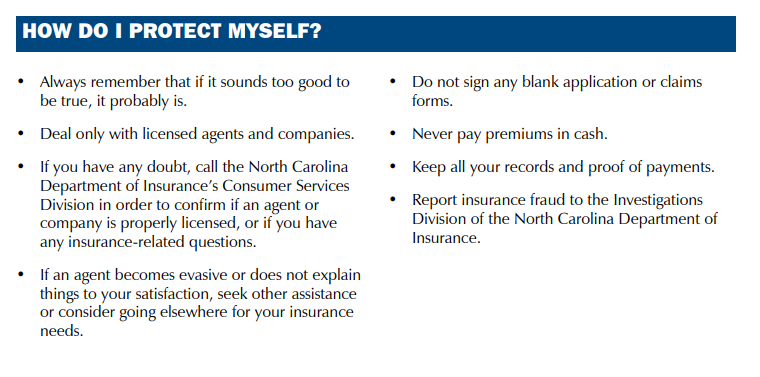

The DOI is there to help you. However, they also want you to be proactive. How can you protect yourself?

The Statute of Limitations in North Carolina

If you are in any kind of accident, you have until the day of the accident to a set amount of time to file charges or file a claim. This length of time is known as the statute of limitations. It protects both you and the other party by giving each of you a set amount of time to bring charges forth.

In North Carolina, the statute of limitations is three years for either personal injury or property damage cases.

North Carolina’s Vehicle Licensing Laws

To be able to operate a vehicle in the state of North Carolina, you must have insurance, and also a license. Keep on reading to find out more about the specifics and the rules of the road.

Penalties for Driving Without Insurance

The penalties for driving without insurance are steep.

- First Offense: $50 civil penalty; license/registration suspended for 30 days and $50 reinstatement fee; 45-day probation.

- Second Offense: $100 civil penalty; license/registration suspended for 30 days and $50 reinstatement fee; 45-day probation.

- Third and Subsequent Offenses: $150 civil penalty; license/registration suspended for 30 days and $50 reinstatement fee; 45-day probation.

Remember that you must have the required insurance and/or forms of financial responsibility in your vehicle at all times.

Read More: What is the penalty for driving without insurance in North Carolina?

Teen Driver Laws in North Carolina

If you are the parent of a teen driver, or if you’re a teen driver yourself, it is important to know that a teen cannot get a full-fledged license right off the bat. If you are between the ages of 15-17, you go through a process called graduated licensing.

What is graduated licensing?

It is a series of strict requirement teens must follow before they can receive a full driver’s license.

What are those requirements? Find out in the table below.

Teen Driving Laws in North Carolina

| Teen Driving Laws | Requirements #1 | Requirements #2 | Requirements #3 |

|---|---|---|---|

| To get a learners license you must: | Have a minimum age of 15. | Pass a driver's education course. | Receive a driver's eligibility and a driver's education certificate. |

| Before getting a license or restricted license you must: | Have a minimum age of 16. | Have a mandatory holding period of 12 months | Have 60 hours of supervised driving time. 10 hours must be at night;. |

| Restrictions | Nighttime restrictions from 9 p.m. to 5 a.m. | No more than one passenger younger than 21. | - |

Important to know: if you are younger than 18, you are banned from using a cellphone to talk or text. The texting ban is primarily enforced for all drivers, no matter your age. Texting and driving statistics show why texting bans are in place.

Older Driver Laws in North Carolina

The rules for older drivers in North Carolina? Pretty straightforward.

- Older Population License Renewal: Five years for people 66 years and older

- Proof of vision required: every renewal.

- Mail or online renewal permitted: Yes, for every other renewal.

You can save yourself a trip to the DMV every five years by renewing online. Now that’s what I call convenience.

New Residents of North Carolina

Moving to North Carolina?

You must register and title your vehicle, as well as get a North Carolina license, within 60 days of moving to the state.

You should also familiarize yourself with the North Carolina driver’s handbook since every state is different with their laws and regulations. Updating your insurance when moving out of state can be daunting if you don’t educate yourself on the process.

License Renewal Procedures in North Carolina

When it comes to renewing your license, you must have a current or expired license with you at the time of renewal. If you do not have these, you must present two forms of identification.

The North Carolina DMV will make sure to send you a renewal card 60 days before your license expires, but you can renew your license 180 days before its expiration date.

Good news. If you don’t have a restriction on your driver’s license and if you have a Class C driver’s license, you can renew online.

North Carolina REAL ID

Federal agencies endorse what is known as the REAL ID Act, which requires you to have a REAL ID U.S. Passport or another federally approved ID to board flights or enter federal buildings.

In North Carolina, a REAL ID is optional and not required to drive, but it is recommended if you fly a lot in the United States.

Here is what you need if you want to apply for a REAL ID in North Carolina.

Rules of the Road in North Carolina

It is important to know the rules of the road so you can be a responsible driver in the state of North Carolina. Read on to find out more…

Fault vs. No-Fault

Remember, North Carolina is an at-fault state.

This means that the person who was at fault in the accident is the one who has to pay for any damage or injuries sustained.

Seat Belts and Car Seat Laws

North Carolina takes seat belt and car seat laws VERY seriously, as they are primarily enforced. This means if a police officer sees you not wearing your seat belt or doesn’t see a child in a car seat, they will stop you.

If your child is 7 years old or younger and less than 80 pounds, they must be in a car seat. If your child is 4 years old or younger and less than 40 pounds, they must be in the rear seat.

A $25 fine applies if you are not wearing your seat belt or if your child is not in a car seat. Seat belt laws also affect car insurance.

Keep Right and Move Over Laws

In North Carolina, the laws are as follows:

State law requires drivers approaching a stationary emergency vehicle displaying flashing lights, including towing and recovery vehicles, traveling in the same direction, to vacate the lane closest if safe and possible to do so, or slow to a safe speed. Also included in the law are utility vehicles, municipal vehicles, and road maintenance vehicles.

If you are in the left lane, slow driving is not allowed if you are traveling under the speed

Speed Limits

In North Carolina, the speed limit is 70 miles per hour on rural interstates, urban interstates, and other limited access roads. All other roads have a limit of 55 miles per hour.

Ridesharing

Share the Ride.

In North Carolina, you can quickly find commute partners with the use of their website.

Automation

When it comes to automated vehicles, North Carolina is one of 12 states that have authorized the full deployment of automated vehicles.

Other important pieces of information to know:

- Depending on the level of automation, an operator may or may not need to be licensed.

- An autonomous vehicle in North Carolina does not require an operator.

- Autonomous vehicles in North Carolina do require liability insurance.

Safety Laws in North Carolina

DWI Laws

North Carolina’s DWI Laws are some of the strictest in the United States.

You are considered Driving While Intoxicated if you have a BAC of .08 or higher (if you are 21 or older) or .04 if you are a commercial driver. Younger than 21, any BAC is considered Driving While Intoxicated.

The higher your BAC, the more severe your penalties will be.

Michelle Robbins LICENSED INSURANCE AGENT

With a DWI offense, you have to deal with a driver’s license suspension (handled separately by the DMV), and your criminal case, depending on what “level” of DWI you are charged with.

Here are the levels explained:

- Level V: $200 fine, a minimum jail sentence of 24 hours and a maximum of 60 days.

- Level IV : $500 fine, a minimum jail sentence of 48 hours and a maximum of 120 days.

- Level III : $1,000 fine, a minimum jail sentence of 72 hours and a maximum of six months.

- Level II: $2,000 fine, a minimum jail sentence of seven days and a maximum of one year.

- Level I: $4,000 fine, a minimum jail sentence of 30 days and a maximum of two years.

A DWI turns into a felony if the following is found out:

- Three DWI Convictions within the past seven years.

- Serious injury caused while driving.

- Death caused while driving.

The penalty is a minimum of one year in state prison.

Marijuana-Impaired Driving Laws

There is no marijuana-specific law in the state of North Carolina, but it doesn’t mean you won’t get in trouble for driving under the influence.

Distracted Driving Laws

When it comes to distracted driving, the laws are as follows, according to AAA:

Text messaging and emailing while driving are prohibited for all drivers. Limited learner’s permit and provisional driver’s license holders, and drivers under 18, are prohibited from all cell phone use. School bus drivers are not permitted to use cell phones.

However, in 2018, 123 deaths were attributed to distracted driving. With this in mind, North Carolina lawmakers are now pushing for the Hands-Free NC Act.

Read More: Compare School Bus Insurance Rates

North Carolina Can’t-Miss Facts

Speaking of food, North Carolina has a lot in terms of food firsts: Pepsi-Cola was first produced in New Bern in 1898; Golden Corral, a famous buffet restaurant chain, began and started in North Carolina in 1973, and the donut chain Krispy Kreme started in North Carolina.

So many new pieces of information and facts. But we’re not done yet.

Let’s continue with the guide…

Vehicle Theft in North Carolina

Vehicle theft is definitely an annoyance, and it can be attributed to the type of car you own. Here are the top 10 vehicles stolen in the state of North Carolina:

Top 10 North Carolina Car Thefts by Model

| Make & Model | Year | Total Thefts |

|---|---|---|

| Ford F-150 | 2020 | 615 |

| Hyundai Elantra | 2019 | 590 |

| Chevrolet Silverado 1500 | 2021 | 578 |

| Honda Civic | 2018 | 555 |

| Hyundai Sonata | 2020 | 530 |

| Kia Optima | 2019 | 510 |

| Honda Accord | 2020 | 490 |

| Toyota Camry | 2021 | 475 |

| GMC Sierra 1500 | 2021 | 450 |

| Honda CR-V | 2020 | 425 |

The Honda Accord takes over the number one spot for the most stolen vehicle.

Dangers on the Road in North Carolina

The best way to stay out of danger on the roads is to drive defensively and be aware of common issues in North Carolina.

Fatal Crashes by Weather Condition and Light Condition

Weather and the time of day can contribute to traffic fatalities.

North Carolina Traffic Fatalities by Weather Condition

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 619 | 132 | 384 | 47 | 2 | 1,184 |

| Rain | 38 | 18 | 31 | 7 | 0 | 94 |

| Snow/Sleet | 4 | 1 | 2 | 2 | 0 | 9 |

In normal weather conditions, during the day, North Carolina had 619 traffic fatalities.

There were fatalities in other instances, but remember to always keep your eye on the road.

Fatalities (All Crashes) by County

Examining traffic fatalities by county can provide insights into regional safety trends and highlight areas needing improvement. The table below details the number of fatalities from all crashes across various counties in North Carolina over a five-year period.

North Carolina Car Crash Fatalities by County

| County | Total Fatalities (2021) | Total Fatalities (2022) | Total Fatalities (2023) |

|---|---|---|---|

| Alamance | 35 | 40 | 42 |

| Alexander | 10 | 12 | 13 |

| Alleghany | 5 | 4 | 6 |

| Anson | 14 | 15 | 17 |

| Ashe | 8 | 10 | 9 |

| Avery | 6 | 8 | 7 |

| Beaufort | 20 | 22 | 21 |

| Bertie | 18 | 19 | 18 |

| Bladen | 15 | 17 | 19 |

| Brunswick | 38 | 42 | 45 |

| Buncombe | 44 | 46 | 48 |

| Burke | 21 | 24 | 26 |

| Cabarrus | 30 | 35 | 37 |

| Caldwell | 20 | 22 | 24 |

| Camden | 5 | 6 | 6 |

| Carteret | 18 | 20 | 21 |

| Caswell | 14 | 15 | 16 |

| Catawba | 32 | 34 | 35 |

| Chatham | 20 | 22 | 23 |

| Cherokee | 15 | 17 | 18 |

| Chowan | 10 | 12 | 13 |

| Clay | 5 | 6 | 7 |

| Cleveland | 25 | 28 | 30 |

| Columbus | 22 | 24 | 25 |

| Craven | 24 | 26 | 27 |

| Cumberland | 50 | 55 | 58 |

| Currituck | 8 | 10 | 11 |

| Dare | 12 | 14 | 15 |

| Davidson | 35 | 38 | 40 |

| Davie | 10 | 11 | 12 |

| Duplin | 18 | 20 | 21 |

| Durham | 45 | 48 | 50 |

| Edgecombe | 22 | 24 | 26 |

| Forsyth | 50 | 54 | 57 |

| Franklin | 18 | 20 | 21 |

| Gaston | 38 | 42 | 45 |

| Gates | 6 | 7 | 7 |

| Graham | 5 | 6 | 7 |

| Granville | 15 | 17 | 18 |

| Greene | 8 | 10 | 11 |

| Guilford | 55 | 60 | 63 |

| Halifax | 20 | 22 | 23 |

| Harnett | 30 | 33 | 35 |

| Haywood | 12 | 14 | 15 |

| Henderson | 18 | 20 | 21 |

| Hertford | 10 | 12 | 13 |

| Hoke | 15 | 17 | 18 |

| Hyde | 4 | 5 | 6 |

| Iredell | 32 | 35 | 37 |

| Jackson | 10 | 12 | 13 |

| Johnston | 38 | 42 | 45 |

| Jones | 5 | 6 | 7 |

| Lee | 15 | 17 | 18 |

| Lenoir | 18 | 20 | 21 |

| Lincoln | 20 | 22 | 23 |

| Macon | 10 | 12 | 13 |

| Madison | 5 | 6 | 7 |

| Martin | 10 | 11 | 12 |

| Mcdowell | 14 | 16 | 17 |

| Mecklenburg | 90 | 98 | 105 |

| Mitchell | 5 | 6 | 7 |

| Montgomery | 10 | 11 | 12 |

| Moore | 20 | 22 | 23 |

| Nash | 25 | 28 | 30 |

| New Hanover | 30 | 33 | 35 |

| Northampton | 12 | 14 | 15 |

| Onslow | 38 | 42 | 45 |

| Orange | 20 | 22 | 23 |

| Pamlico | 5 | 6 | 7 |

| Pasquotank | 10 | 12 | 13 |

| Pender | 15 | 17 | 18 |

| Perquimans | 5 | 6 | 7 |

| Person | 15 | 17 | 18 |

| Pitt | 30 | 33 | 35 |

| Polk | 5 | 6 | 7 |

| Randolph | 32 | 35 | 37 |

| Richmond | 15 | 17 | 18 |

| Robeson | 50 | 55 | 58 |

| Rockingham | 20 | 22 | 23 |

| Rowan | 35 | 38 | 40 |

| Rutherford | 20 | 22 | 23 |

| Sampson | 20 | 22 | 23 |

| Scotland | 15 | 17 | 18 |

| Stanly | 18 | 20 | 21 |

| Stokes | 12 | 14 | 15 |

| Surry | 20 | 22 | 23 |

| Swain | 8 | 10 | 11 |

| Transylvania | 8 | 9 | 10 |

| Tyrrell | 3 | 4 | 5 |

| Union | 35 | 38 | 40 |

| Vance | 18 | 20 | 21 |

| Wake | 90 | 98 | 105 |

| Warren | 10 | 12 | 13 |

| Washington | 5 | 6 | 7 |

| Watauga | 10 | 12 | 13 |

| Wayne | 30 | 33 | 35 |

| Wilkes | 15 | 17 | 18 |

| Wilson | 20 | 22 | 23 |

| Yadkin | 12 | 14 | 15 |

| Yancey | 5 | 6 | 7 |

This data illustrates the fatalities over the course of five years, helping to identify trends and areas for targeted interventions.

Traffic Fatalities: Rural vs. Urban

The table below shows a ten-year trend of traffic fatalities in rural and urban areas in North Carolina.

North Carolina Traffic Fatalities by Location

| Region Type | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|---|---|---|

| Rural | 1,010 | 964 | 945 | 835 | 901 | 861 | 896 | 910 | 902 | 903 |

| Urban | 418 | 349 | 375 | 394 | 398 | 426 | 388 | 468 | 543 | 509 |

Interestingly, rural areas have a lot more traffic fatalities than in urban areas. This may be due to the fact that North Carolina is mainly a rural state.

Fatalities by Person Type

This shows the fatalities over the course of five years.

North Carolina Traffic Fatalities by Person Type

| Type | Total |

|---|---|

| Bicyclist and Other Cyclist | 34 |

| Bus | 5 |

| Large Truck | 84 |

| Light Truck - Other | 26 |

| Light Truck - Pickup | 210 |

| Light Truck - Utility | 158 |

| Light Truck - Van | 45 |

| Motorcyclists | 180 |

| Passenger Car | 490 |

| Pedestrian | 240 |

Passenger cars, motorcyclists, and pedestrians have a high rate of fatalities in this five-year timespan.

Fatalities by Crash Type

Different types of crashes result in varying fatality rates. The table below breaks down traffic fatalities by crash type in North Carolina over the past five years.

North Carolina Traffic Fatalities by Crash Type

| Type | Total |

|---|---|

| Intersection | 265 |

| Large Truck | 84 |

| Roadway Departure | 510 |

| Rollover | 95 |

| Single Vehicle | 320 |

| Speeding | 430 |

This shows the fatalities over the course of five years.

Five-Year Trend for the Top 10 Counties in North Carolina

Analyzing the five-year trend of traffic fatalities in the top ten counties can help identify patterns and areas for improvement. The table below provides this data for North Carolina.

North Carolina Traffic Fatalities by County

| County | 2019 | 2020 | 2021 | 2022 | 2023 |

|---|---|---|---|---|---|

| Buncombe County | 35 | 29 | 36 | 25 | 32 |

| Cumberland County | 53 | 40 | 43 | 43 | 43 |

| Durham County | 25 | 26 | 25 | 22 | 31 |

| Forsyth County | 27 | 34 | 40 | 42 | 42 |

| Guilford County | 44 | 57 | 57 | 59 | 66 |

| Harnett County | 27 | 23 | 23 | 22 | 34 |

| Johnston County | 28 | 36 | 27 | 34 | 32 |

| Mecklenburg County | 67 | 69 | 80 | 103 | 114 |

| Robeson County | 42 | 32 | 53 | 38 | 53 |

| Wake County | 73 | 63 | 65 | 81 | 53 |

This five-year trend provides insights into the traffic fatality rates in the top ten counties in North Carolina.

Teen Drinking and Driving

Remember, the DWI Laws in North Carolina are some of the strictest in the United States.

Here are some of the sobering facts about drunk driving in North Carolina, and here are the facts when it comes to teens:

North Carolina Teens Drinking and Driving Statistics

| Facts | Details |

|---|---|

| Alcohol-Impaired Driving Fatalities Per one million people | 1.5 |

| Higher/Lower Than National Average (1.2) | Higher |

| DUI Arrests (Under 18 years old) | 201 |

| DUI Arrests (Under 18 years old) Total Per Million People | 87.44 |

North Carolina has stricter DWI laws, but teen drinking and driving remains a significant concern, emphasizing the need for continued education and enforcement.

EMS Response Time: Rural vs. Urban

The response times in both rural and urban areas are excellent.

North Carolina EMS Response Times by Location

| Region Types | Time of Crash to EMS Notification | EMS Notification to EMS Arrival | EMS Arrival at Scene to Hospital Arrival | Time of Crash to Hospital Arrival |

|---|---|---|---|---|

| Rural | 6 minutes | 10 minutes | 41 minutes | 48 minutes |

| Urban | 3 minutes | 8 minutes | 29 minutes | 37 minutes |

Both areas take under an hour from the time of the crash to hospital arrival.

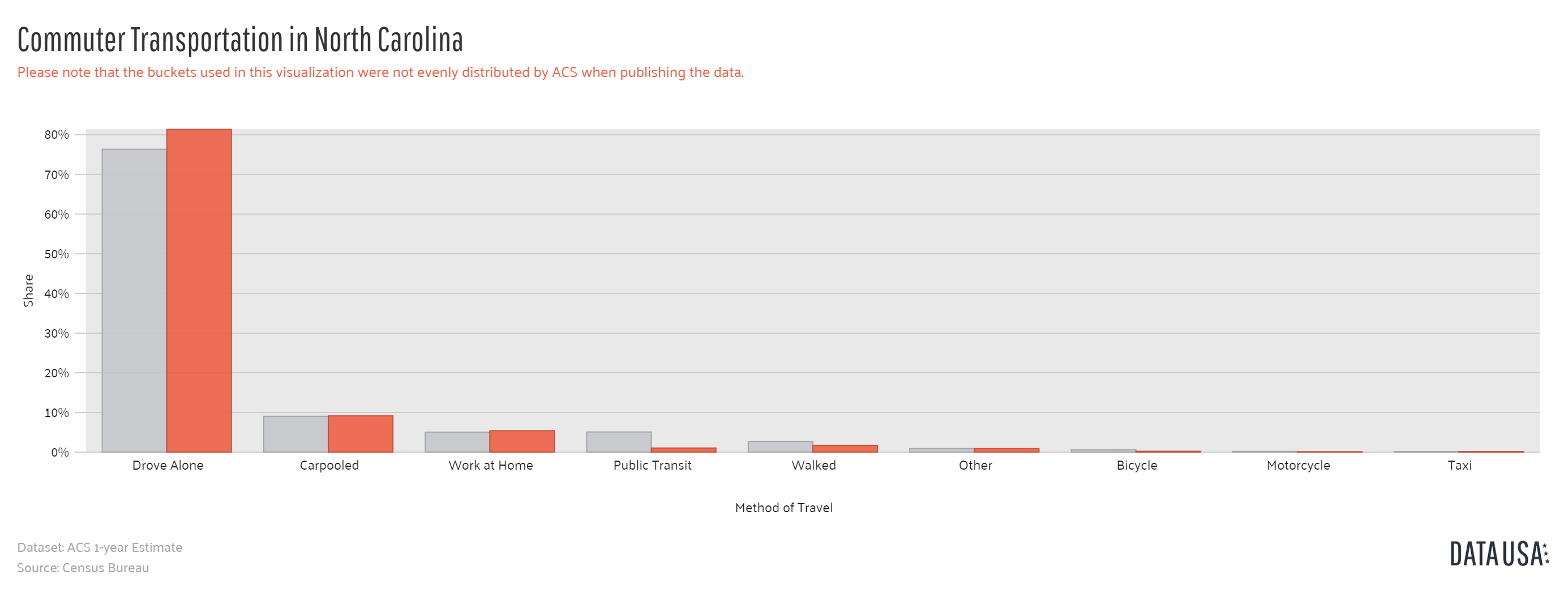

Transportation

If you live in Arizona, chances are you live in a two-car (or more.) household, drive alone to work, and spend a hefty amount of your day commuting.

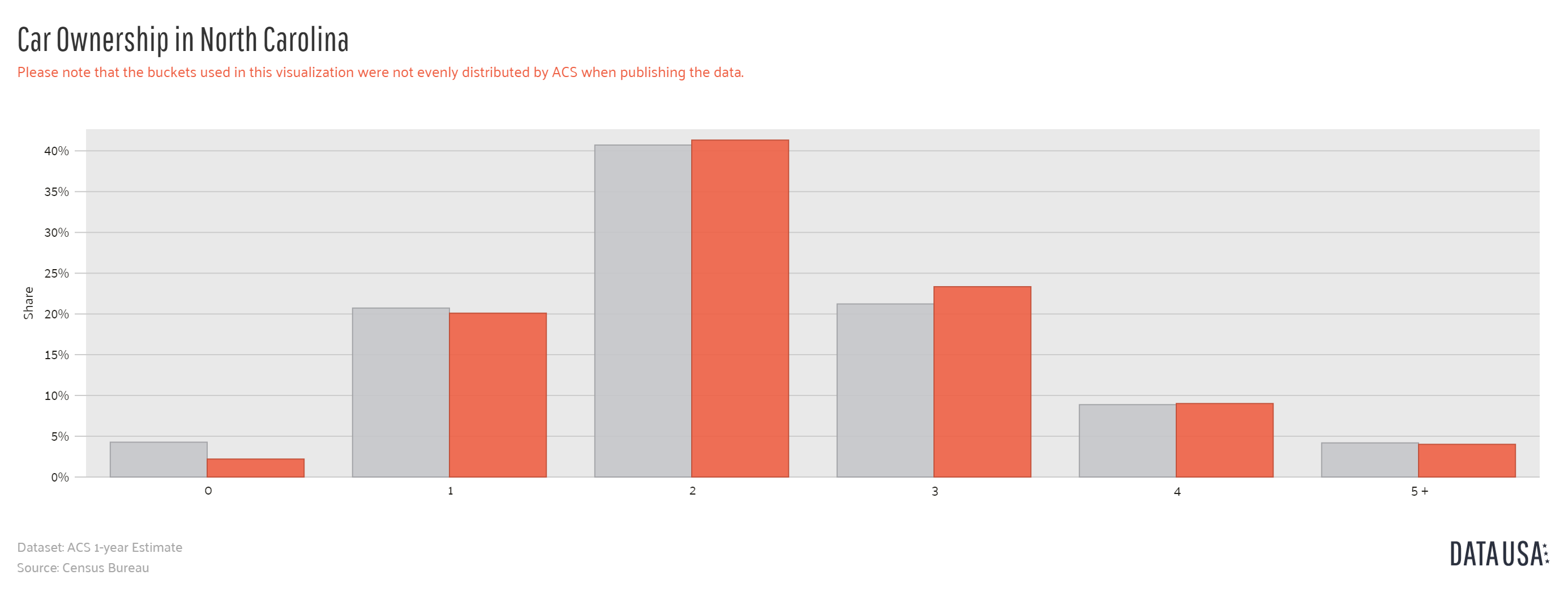

Car Ownership

Most people in North Carolina live in a two-car household.

With an average commute time of 23.1 minutes, North Carolina ranks above the national average.

1.8% of North Carolina residents report a super-commute, which is spending 90 minutes or more of your time commuting.

86.1% of the workforce report driving in to work alone. 9.2% carpool, and 5.4% work at home.

Top Cities for Traffic Congestion

By the year 2040, North Carolina’s population looks to increase by 3 million, according to North Carolina DOT (as cited by WRAL). This is why the DOT is gathering data from North Carolina residents so it can better plan for the future.

When it comes to traffic, only two North Carolina cities are the worst: Greensboro and Charlotte rank 209th and 91st, respectively, for the worst traffic in the WORLD, according to the INRIX Global Traffic scorecard. Greensboro residents lose 43 hours a week (almost totaling two days) to congestion, whereas Charlotte residents lose 95 hours a week. That’s a total of almost four days.

And according to experts, congestion in Charlotte is likely to only get worse.

In Greensboro, drivers see an increase of 9% extra travel time. This amounts to minutes extra minutes per day and 33 extra hours per year. When it’s morning traffic, drivers see an increase of 11% extra travel time, and in the evenings, drivers see an increase of 17% extra travel time.

Highways seem a bit easier to travel on, as they see a 2% increased as opposed to non-highways, which see a 17% increase.

In Charlotte, drivers see an increase of 17% extra travel time. This amounts to 23 extra minutes per day and 90 extra hours per year. When it’s morning traffic, drivers see an increase of 28% extra travel time, and in the evenings, this increase nearly DOUBLES at 48%.

Highways seem a bit easier to travel on, as they see an 8% increased as opposed to non-highways, which see a 27% increase.

Let’s break this down even further into several other factors: traffic index, time index, and inefficiency index:

- Traffic Index: Time consumed in traffic.

- Time Index: the average time, one-way, that is spent in a commute.

- Inefficiency Index: estimation of “inefficiencies”, such as people driving a car instead of carpooling or taking public transport. Remember, you need car insurance when carpooling.

These factors are not listed for Greensboro, but they are for Charlotte.

- Traffic Index: 183.17 hours.

- Time Index (in minutes): 38.02 minutes.

- Inefficiency Index: 222.03 hours.

We hope this guide about car insurance and the rules/laws in North Carolina has helped you.

Don’t waste another minute. Start comparison shopping car insurance rates today.

Frequently Asked Questions

How can I compare car insurance quotes in North Carolina?

To compare car insurance quotes in North Carolina, start by gathering information about your vehicle, including make, model, and year, and prepare personal details like your driver’s license number and driving history.

Read More: Finding Free Car Insurance Quotes Online

What factors influence car insurance rates in North Carolina?

Several factors influence car insurance rates in North Carolina, including age, gender, marital status, driving record, claims history, vehicle type and safety features, annual mileage, credit history, ZIP code, chosen coverage limits, and deductibles.

Find cheap car insurance quotes by entering your ZIP code below.

Are there any specific car insurance requirements in North Carolina?

North Carolina requires specific car insurance coverage, including $30,000 bodily injury liability per person, $60,000 bodily injury liability per accident, $25,000 property damage liability, and uninsured/underinsured motorist coverage with the same minimum limits.

What additional coverage options should I consider in North Carolina?

In addition to mandatory coverage, consider optional coverage like collision (for vehicle damage from collisions), comprehensive (for non-collision incidents like theft or vandalism), medical payments (for accident-related medical expenses), and rental car reimbursement (to cover rental costs during vehicle repairs).

Read More: Compare Liability Car Insurance: Rates, Discounts, & Requirements

How can I lower my car insurance premiums in North Carolina?

To potentially lower car insurance premiums in North Carolina, maintain a clean driving record, bundle policies, inquire about discounts (such as for safe driving or multi-policy), consider higher deductibles (if financially feasible), install safety features in your vehicle, and compare quotes from different insurers to ensure competitive rates.

What should I do if I’m involved in a car accident in North Carolina?

If you’re involved in a car accident in North Carolina, first ensure safety and seek medical help if needed. Exchange information with the other driver(s) involved, including insurance details. Report the accident to local law enforcement if there are injuries, deaths, or property damage exceeding $1,000. Notify your insurance company promptly to start the claims process.

Are there penalties for driving without insurance in North Carolina?

Yes, driving without insurance in North Carolina can result in fines, license suspension, and potentially a requirement to obtain expensive high-risk insurance (SR-22). The penalties escalate with repeated offenses, highlighting the importance of maintaining proper insurance coverage.

Can my insurance policy be canceled or non-renewed in North Carolina?

Yes, insurance companies in North Carolina can cancel your policy or choose not to renew it under certain circumstances. Common reasons include non-payment of premiums, misrepresentation of information, or a significant increase in risk (such as a poor driving record). Your insurer must provide notice before canceling or non-renewing your policy.

How can I file a complaint against an insurance company in North Carolina?

If you have a complaint against an insurance company in North Carolina, you can file it with the North Carolina Department of Insurance (NCDOI). They have a Consumer Services Division that handles complaints and can provide guidance on how to resolve issues with your insurer.

Read More: How do you contest the amount of a car insurance payout?

Does my credit score affect my car insurance rates in North Carolina?

Yes, your credit history can impact your car insurance rates in North Carolina. Insurers often use credit-based insurance scores to assess risk and determine premiums. Maintaining a good credit score can help lower your insurance costs, while a poor score may result in higher rates.

By entering your ZIP code below, you can get instant car insurance quotes from top providers.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Laura D. Adams

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Insurance & Finance Analyst

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.