Cheapest Florida Car Insurance Rates in 2026 (Earn Savings With These 10 Companies!)

The cheapest Florida car insurance rates are offered by Geico, State Farm, and AAA, with rates as low as $30 per month. These companies stand out for their affordability, comprehensive coverage options, and strong customer satisfaction. Discover how they deliver the best value in car insurance while keeping costs low.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Dani Best

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Jeffrey Manola

Updated October 2024

Company Facts

Min. Coverage for Florida

A.M. Best Rating

Complaint Level

Pros & Cons

18,157 reviews

18,157 reviewsCompany Facts

Min. Coverage for Florida

A.M. Best Rating

Complaint Level

Pros & Cons

18,157 reviews

18,157 reviews

Company Facts

Min. Coverage for Florida

A.M. Best Rating

Complaint Level

Pros & Cons

Get the cheapest Florida car insurance rates with Geico, State Farm, and AAA, offering rates as low as $30 per month. Geico stands out for its extensive discounts and exceptional customer service. These companies excel in affordability, comprehensive coverage, and customer satisfaction.

Florida car insurance rates are among the highest in the country due to Florida car insurance regulations, a high percentage of uninsured drivers, and more high-risk drivers.

Our Top 10 Company Picks: Cheapest Florida Car Insurance Rates

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

![]()

#1 $30 A++ Good Drivers Geico

![]()

#2 $33 B Reliable Discounts State Farm

#6 $34 A Roadside Assistance AAA

#4 $51 A+ Snapshot Program Progressive

#5 $54 A Bundling Savings Liberty Mutual

#7 $56 A++ Hybrid Vehicles Travelers

#3 $61 A+ Safe Driving Allstate

#8 $63 A Teen Drivers American Family

#9 $76 A Personal Service Farmers

#10 $85 A++ Service Auto-Owners

To find affordable rates, seek discounts, maintain a clean driving record, and choose the right coverage. Comparing quotes is crucial for finding the cheapest Florida car insurance.

Read on to learn more and compare rates. Ready to find cheaper car insurance coverage? Enter your ZIP code above to begin.

- High Florida rates due to regulations and demographics

- Geico offers competitive rates and discounts

- Save with a clean record and discounts

- Compare Florida Car Insurance Rates

- Best Wesley Chapel, FL Car Insurance in 2026

- Best Waldo, FL Car Insurance in 2026

- Best Vero Beach, FL Car Insurance in 2026

- Best Venice, FL Car Insurance in 2026

- Best The Villages, FL Car Insurance in 2026

- Best Tavares, FL Car Insurance in 2026

- Best Tallahassee, FL Car Insurance in 2026

- Best Summerfield, FL Car Insurance in 2026

- Best Spring Hill, FL Car Insurance in 2026

- Best Sarasota, FL Car Insurance in 2026

- Best Santa Rosa Beach, FL Car Insurance in 2026

- Best Pompano Beach, FL Car Insurance in 2026

- Best Perry, FL Car Insurance in 2026

- Best Panama City Beach, FL Car Insurance in 2026

- Best Palm Beach Gardens, FL Car Insurance in 2026

- Best Ocoee, FL Car Insurance in 2026

- Best Ocala, FL Car Insurance in 2026

- Best North Fort Myers, FL Car Insurance in 2026

- Best Myakka City, FL Car Insurance in 2026

- Best Mount Dora, FL Car Insurance in 2026

- Best Milton, FL Car Insurance in 2026

- Best Melbourne, FL Car Insurance in 2026

- Best Lutz, FL Car Insurance in 2026

- Best Lynn Haven, FL Car Insurance in 2026

- Best Longwood, FL Car Insurance in 2026

- Best Lake Helen, FL Car Insurance in 2026

- Best Lady Lake, FL Car Insurance in 2026

- Best Kissimmee, FL Car Insurance in 2026

- Best Key Biscayne, FL Car Insurance in 2026

- Best Hollywood, FL Car Insurance in 2026

- Best Gulf Breeze, FL Car Insurance in 2026

- Best Fort Mc Coy, FL Car Insurance in 2026

- Best Englewood, FL Car Insurance in 2026

- Best Eglin Afb, FL Car Insurance in 2026

- Best Dunedin, FL Car Insurance in 2026

- Best Destin, FL Car Insurance in 2026

- Best Daytona Beach, FL Car Insurance in 2026

- Best Citra, FL Car Insurance in 2026

- Best Callaway, FL Car Insurance in 2026

- Best Callahan, FL Car Insurance in 2026

- Best Bushnell, FL Car Insurance in 2026

- Best Port St. Lucie, FL Car Insurance in 2026

- Best Cape Coral, FL Car Insurance in 2026

- Best Hialeah, FL Car Insurance in 2026

- Compare Male vs. Female Car Insurance Rates in Florida [2026]

- Best St. Petersburg, FL Car Insurance in 2026

#1 – Geico: Top Overall Pick

Pros

- Lowest Premium in Florida: Geico provides the most cost-effective car insurance rates in Florida at just $30 per month, making it the ideal choice for drivers prioritizing budget-friendly options without compromising basic coverage.

- Comprehensive Discount Programs: Geico offers various discounts that can further lower the already affordable Florida rates, including savings for safe driving, multi-vehicle policies, and bundling, enhancing overall value.

- Robust Financial Stability: Geico’s strong financial stability is supported by an A++ rating from A.M. Best, ensuring reliable claims payment and stability even with the lowest car insurance rates in Florida.

Cons

- Mixed Customer Service: Geico’s customer service has received mixed reviews, with some customers reporting less satisfactory experiences. This inconsistency may impact your overall satisfaction with their service. Learn more in our Geico car insurance review.

- Variable Claims Processing: There can be variability in how quickly and smoothly claims are processed, which may affect the overall customer experience and delay resolution of claims.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – State Farm: Best For Reliable Discounts

Pros

- Competitive Florida Rates: State Farm offers a highly competitive car insurance rate of $33 per month in Florida, providing an excellent balance between affordability and quality coverage for budget-conscious drivers.

- Wide Range of Discounts: State Farm provides extensive discount options, such as for safe driving and multi-policy bundling, which can help reduce the already low Florida rates and further enhance savings.

- Local Agent Accessibility: State Farm’s extensive network of local agents offers personalized service and tailored advice, which is beneficial for Florida drivers seeking assistance with their insurance needs while enjoying affordable rates. Unlock details in our State Farm car insurance review.

Cons

- Potential Rate Variability: State Farm’s rates may be higher for drivers with less favorable risk profiles, which could offset the savings for those with poor driving records, despite the competitive base rate of $33 in Florida.

- Inconsistent Agent Quality: Service quality can vary depending on the local agent, potentially affecting the overall experience and value of the Florida insurance rates provided.

#3 – AAA: Best For Roadside Assistance

Pros

- Affordable Florida Premiums: At $34 per month, AAA offers affordable car insurance rates in Florida, making it a cost-effective option while still providing essential coverage for drivers.

- Added Membership Benefits: AAA membership includes additional perks such as roadside assistance and travel discounts, which enhance the overall value of the insurance policy and contribute to savings for Florida drivers.

- Strong Customer Service: AAA is known for reliable customer service and 24/7 support, ensuring that policyholders receive assistance whenever needed, which complements the competitive insurance rates in Florida. Read more in our AAA car insurance review.

Cons

- Membership Fee Requirement: To access the competitive rates and benefits, AAA requires a membership fee, which could add to the overall cost for drivers seeking the cheapest Florida car insurance.

- Coverage Limitations: Coverage options might be more limited compared to other insurers, potentially affecting drivers’ ability to customize their policy despite the competitive rates offered in Florida.

#4 – Progressive: Best For Snapshot Program

Pros

- Snapshot Program Savings: Progressive’s Snapshot program offers personalized discounts based on driving habits, which can reduce premiums further from the base rate of $51 in Florida for safe drivers.

- Flexible Policy Options: Progressive provides a range of coverage options, allowing drivers to tailor their policies to their specific needs while benefiting from relatively affordable Florida car insurance rates.

- Solid Financial Ratings: With an A+ rating from A.M. Best, Progressive offers financial stability, ensuring reliable claims payments and support for policyholders even with its mid-range Florida rates.

Cons

- Increased Rates Post-Accident: Premiums can rise substantially after an accident or violation, potentially making Progressive less cost-effective for drivers with less-than-perfect driving records.

- Average Customer Service: Progressive’s customer service has received mixed reviews, with some customers reporting challenges in claims processing and overall service experience, which may impact user satisfaction. Delve into our evaluation of Progressive car insurance review.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Liberty Mutual: Best For Bundling Savings

Pros

- Variety of Coverage Options: The insurer provides a wide range of coverage options, including unique policies like identity theft protection, which enhances the value of insurance beyond the base rate of $54 in Florida.

- Good Financial Stability: Liberty Mutual’s A rating from A.M. Best reflects strong financial stability, ensuring reliable claims handling and support even with mid-range car insurance rates in Florida.

- Bundling Savings: As mentioned in our Liberty Mutual car insurance review, Liberty Mutual offers significant discounts for bundling auto and home insurance policies, which can lower overall costs and provide greater savings for customers with multiple insurance needs.

Cons

- Higher Premiums: Starting at $54 per month, Liberty Mutual’s rates are higher compared to other options, making it less appealing for drivers seeking the absolute lowest Florida car insurance rates.

- Customer Service Issues: Some customers have reported challenges with Liberty Mutual’s customer service and claims process, which could affect the overall satisfaction despite the competitive rates.

#6 – Travelers: Best For Hybrid Vehicles

Pros

- Hybrid Vehicle Discounts: Travelers offers special discounts for hybrid vehicles, which can be a significant benefit for eco-conscious Florida drivers looking to save on insurance costs.

- Customizable Coverage Options: Travelers provides a range of customizable coverage options, allowing drivers to tailor their policies to their needs while benefiting from their relatively competitive rates in Florida.

- High Financial Strength: With an A++ rating from A.M. Best, Travelers ensures financial reliability and stable claims payments, supporting their value proposition despite the mid-range Florida rates.

Cons

- Regional Availability Limitations: Travelers might not be available in all areas, which can limit options for some Florida drivers seeking their competitive rates and coverage options.

- Higher Rates for Some Drivers: Travelers’ rates starting at $56 may be higher for certain drivers, making it less attractive for those primarily focused on finding the lowest insurance rates in Florida. See more details on our Travelers car insurance review.

#7 – Allstate: Best For Safe Driving

Pros

- Drivewise Discount Program: Allstate’s Drivewise program offers significant discounts for safe driving behavior, which can reduce the premium from the starting rate of $61 in Florida for responsible drivers.

- Extensive Agent Network: Allstate’s broad network of local agents provides personalized support and advice, which can be beneficial for managing insurance policies and getting assistance despite the higher rates in Florida.

- Comprehensive Coverage Options: Allstate offers a wide array of coverage options, allowing Florida drivers to customize their policies to their specific needs while receiving value beyond the base rate. Discover more in our Allstate car insurance review.

Cons

- Higher Premium Costs: Allstate’s base rate of $61 per month is higher compared to many competitors, which might not be ideal for drivers focused on obtaining the lowest Florida car insurance rates.

- Inconsistent Customer Service: Some policyholders have reported inconsistent experiences with Allstate’s customer service, which could impact overall satisfaction despite the comprehensive coverage options.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – American Family: Best For Teen Drivers

Pros

- Discounts for Teen Drivers: American Family offers discounts for teen drivers with good academic performance, which can help families save on insurance costs while paying the starting rate of $63 in Florida.

- Loyalty Rewards: The insurer provides rewards for long-term customers, contributing to additional savings and enhancing the overall value of insurance policies for Florida residents.

- Community Engagement: American Family’s active involvement in community initiatives can add to its positive reputation and trustworthiness, adding value to their insurance offerings despite the higher rates.

Cons

- Availability Limitations: American Family’s coverage might not be available in all Florida regions, potentially limiting access for some drivers seeking their competitive rates and benefits.

- Higher Premiums Compared to Competitors: With rates starting at $63 per month, American Family may be less attractive for those primarily seeking the lowest Florida car insurance rates. Learn more about their rates in our American Family car insurance review.

#9 – Farmers: Best For Personal Service

Pros

- Personalized Service Through Local Agents: Farmers provides tailored service through a network of local agents, offering personalized insurance solutions that complement their competitive rates in Florida. Learn more in our Farmers car insurance review.

- Additional Coverage Options: Farmers offers various additional coverage options, such as umbrella insurance, enhancing the overall protection and value of their policies despite the higher rates.

- Stable Financial Rating: With an A rating from A.M. Best, Farmers ensures financial stability and reliable claims handling, supporting its insurance offerings even with the higher Florida rates.

Cons

- Higher Premiums: Starting at $76 per month, Farmers’ rates are significantly higher compared to many competitors, making it less appealing for drivers focused on finding the cheapest Florida car insurance rates.

- Potential Issues with Claims Processing: Some customers report challenges with the claims process, which could impact the overall satisfaction with Farmers’ insurance despite the personalized service and coverage options.

#10 – Auto-Owners: Best For Service

Pros

- Exceptional Customer Service: Auto-Owners is known for its high-quality customer service and efficient claims handling, providing a positive experience even with its higher Florida car insurance rates.

- Strong Financial Strength: With an A++ rating from A.M. Best, Auto-Owners offers superior financial stability, ensuring reliable claims payments and support despite the higher premiums.

- Specialized Coverage Options: The insurer provides specialized coverage options, including classic car insurance, catering to diverse needs and adding value to its insurance offerings in Florida.

Cons

- Higher Premiums: Auto-Owners’ rates starting at $85 per month are among the highest compared to other insurers, making it less competitive for those seeking the lowest Florida car insurance rates.

- Limited Regional Availability: Auto-Owners may not be available in all Florida areas, potentially limiting access for drivers who want to take advantage of their higher service standards and specialized coverage. Learn more info in our Auto-Owners car insurance review.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

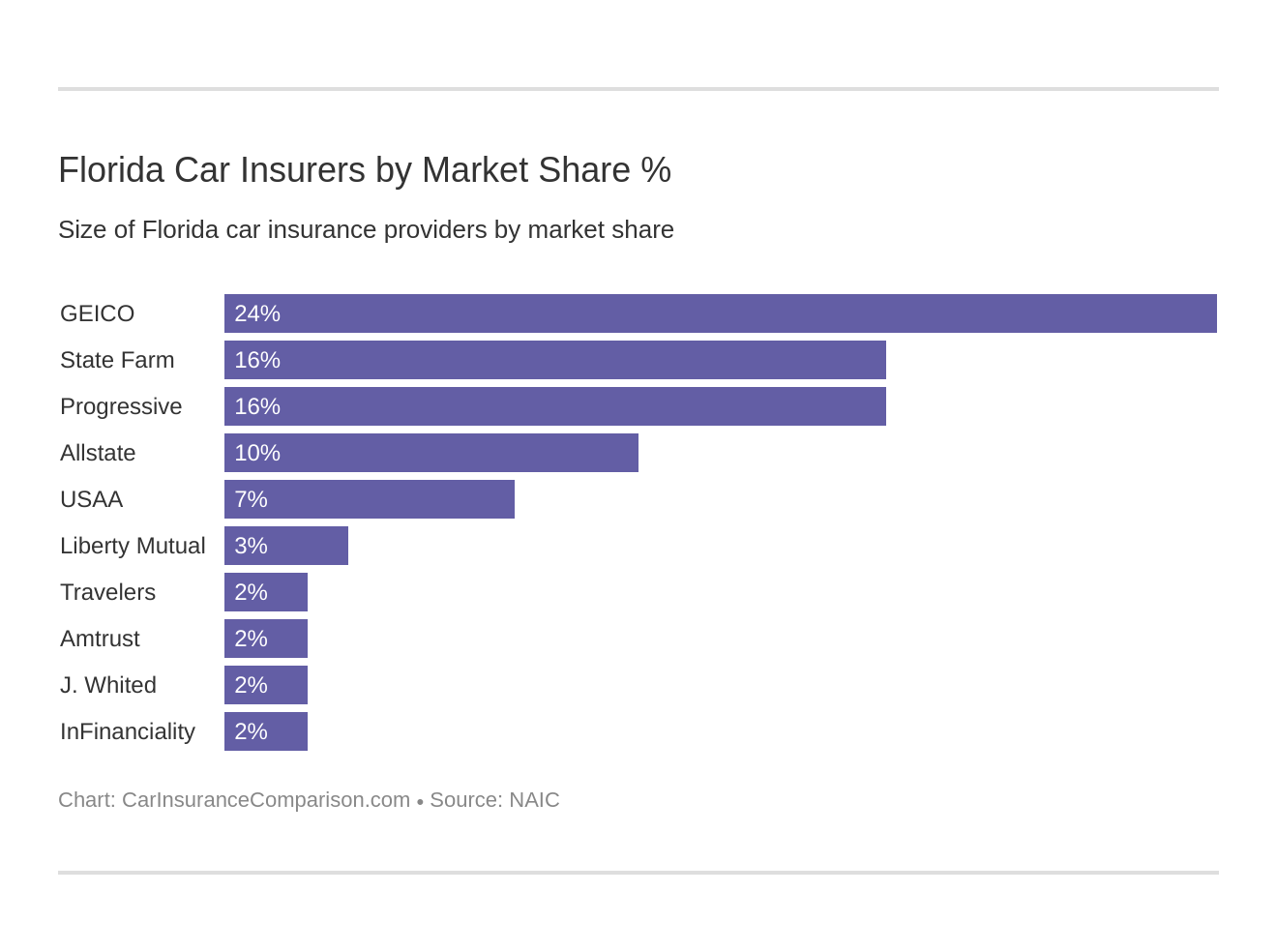

Florida Car Insurance Companies

Getting an auto insurance policy only to realize your friend or relative found a better deal with a more economical provider can be frustrating, to say the least.

Florida Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

AAA $34 $103

Allstate $61 $183

American Family $63 $188

Auto-Owners $85 $175

Farmers $76 $227

Geico $30 $89

Liberty Mutual $54 $161

Progressive $51 $153

State Farm $33 $99

Travelers $56 $166

Don’t despair. If you’re currently browsing or in the market for a new provider, we provide the right insight you need to know to make the right decision. We’ll help you find the best provider in Florida to meet your needs.

Florida Commute Rates

As you can see, Progressive car insurance review and Nationwide car insurance don’t change the price based on the annual mileage.

Florida Minimum Coverage Car Insurance Monthly Rates by Annual Mileage

| Insurance Company | 6,000 Miles | 12,000 Miles |

|---|---|---|

| AAA | $35 | $38 |

| Allstate | $50 | $53 |

| American Family | $34 | $37 |

| Auto-Owners | $27 | $30 |

| Farmers | $28 | $31 |

| Geico | $26 | $26 |

| Liberty Mutual | $36 | $39 |

| Nationwide | $30 | $30 |

| Progressive | $39 | $39 |

| State Farm | $23 | $24 |

| Travelers | $32 | $35 |

| USAA | $20 | $20 |

Allstate is already the most expensive option of the big providers in the state, and they’ll charge more for the longer commute.

Monthly Rates by Coverage Level in Florida

Explore the monthly car insurance rates in Florida based on different coverage levels. Understanding these rates can help you choose the most appropriate coverage for your needs. Selecting the right coverage level is essential for balancing cost and protection.

Monthly Rates by Credit History in Florida

Credit rating makes a huge impact on rates. Of the large companies in our research, State Farm car insurance is the lowest-priced insurance in Florida available to the general public, and Geico car insurance rates are competitive with State Farms for individuals with good credit. See table below:

Florida Minimum Coverage Car Insurance Monthly Rates by Credit Score

| Insurance Company | Poor Credit | Fair Credit | Good Credit |

|---|---|---|---|

| AAA | $113 | $98 | $83 |

| Allstate | $105 | $90 | $75 |

| American Family | $103 | $88 | $73 |

| Auto-Owners | $93 | $78 | $63 |

| Farmers | $98 | $83 | $68 |

| Geico | $100 | $85 | $70 |

| Liberty Mutual | $110 | $95 | $80 |

| Nationwide | $115 | $100 | $85 |

| Progressive | $120 | $105 | $90 |

| State Farm | $95 | $80 | $65 |

| Travelers | $108 | $93 | $78 |

| USAA | $90 | $75 | $60 |

Those with fair or poor credit may do better to consider State Farm over Geico. You’ll only know which company offers you the best rate by comparing quotes for your unique situation.

Monthly Rates by Driving History in Florida

Understanding how your driving history affects car insurance rates is crucial. This section compares monthly rates from various insurance companies in Florida based on different driving records, including clean records, speeding violations, accidents, and DUIs.

Florida Minimum Coverage Car Insurance Monthly Rates by Driving Record

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| AAA | $73 | $88 | $103 | $133 |

| Allstate | $92 | $100 | $121 | $116 |

| American Family | $60 | $75 | $90 | $115 |

| Auto-Owners | $50 | $65 | $80 | $105 |

| Farmers | $55 | $70 | $85 | $110 |

| Geico | $45 | $78 | $62 | $97 |

| Liberty Mutual | $81 | $105 | $99 | $142 |

| Nationwide | $52 | $60 | $72 | $108 |

| Progressive | $77 | $118 | $139 | $104 |

| State Farm | $50 | $54 | $58 | $54 |

| Travelers | $66 | $80 | $95 | $128 |

| USAA | $24 | $26 | $30 | $43 |

By examining how different driving histories impact insurance rates, you can better understand which providers offer the most favorable pricing based on your record. Use this information to make an informed choice and potentially save on your premiums.

This table reveals some interesting and surprising information. I’ll highlight a few things:

- State Farm is the most forgiving of bad history and charges less than $300 more monthly for a DUI on record than for a clean record

- Most people assume a DUI will make rates rise more than any other infraction, however, Progressive increases rates more for a speeding violation than for a DUI conviction, and State Farm increases rates equally for a speeding violation and a DUI conviction

- Liberty Mutual, Nationwide, and Geico increase rates more for a speeding violation than for an accident.

Use this information to understand how different infractions can impact your insurance rates and choose the best provider based on your driving history.

Number of Car Insurance Companies in Florida

Compare how various car insurance companies’ rates in Florida stack up against the state average. This section provides a comparison of average annual rates, helping you identify which companies offer more competitive pricing.

For those seeking affordable car insurance, comparing these rates to the state average reveals which companies provide the most cost-effective options. By choosing wisely, you can ensure you’re getting the best value for your coverage in Florida.

Compare Florida Car Insurance Rates

When you think of Florida, perhaps Disney, South Beach, The Miami Heat, or its warm, comfortable climate with bright sunshine springs to mind.

U.S. News & World Report ranked a series of Florida cities within the top 50 of its “125 Best Places to Live in the USA.” While there are many advantages of living in Florida, knowing what types of car insurance policies are available to you is one of the most important aspects for peace of mind.

Minimum Florida Car Insurance Requirements

While Florida insurance laws state that you must maintain the Personal Injury Protection (PIP) insurance and Property Damage Liability (PDL) coverage throughout the licensing and registration of your vehicle, you’ll be happy to know that the coverage is broad.

For instance, in the event of an automobile crash, not only will PIP cover you and your vehicle, but also covers:

- Your child

- Members of your household

- Passengers who don’t have PIP Insurance (only if they don’t own a vehicle)

- If you are injured in someone else’s vehicle

- If, as a pedestrian or bicyclist, you’re struck by a vehicle

- If your child is injured on a school bus

Florida is a “no-fault” insurance state, which means that drivers are required to carry coverage that will pay for their own medical bills regardless of who was at fault in the accident. You can see below how the minimum rates compare across the country.

In Florida, minimum coverage for car insurance includes personal injury protection (PIP) and property damage liability (PDL):

- $10,000 to cover personal injury protection (PIP)

- $10,000 to cover property damage liability (PDL)

Bodily Injury Liability (BI) coverage is not required to drive in the state of Florida. In fact, they are the only state without that requirement. Many insurance companies will not sell a liability car insurance policy without minimum bodily injury limits, though.

Read More: Compare School Bus Insurance Rates

What Forms are Required With Florida Car Insurance

You must have the minimum insurance coverage in Florida; it’s the law. So, when it comes to actually proving that you have auto insurance and financial responsibility in Florida, you must present one of the following documents every time you operate your vehicle :

- The insurance ID card provided by your insurance company

- Your insurance policy

- Certificate of self-insurance

- Form E, Uniform Motor Carrier Bodily Injury and Property Damage Liability

- Insurance policy binder

- A surety bond or combination of surety bond and insurance policy

To comply with Florida’s insurance requirements, always carry one of the accepted documents to prove your coverage and financial responsibility. This ensures you meet legal obligations and avoid potential penalties while driving.

Some of the most common times when you proof of insurance and financial responsibility are:

- You are asked by a police officer (such as when you are pulled over)

- You register your vehicle

- You are getting or reinstating your license

- You didn’t abide by or failed to maintain financial responsibility penalties

In the event that you don’t show proof of your Florida car insurance regulations when requested, the penalties can be stiff for driving without insurance.

For instance, the law states that your driving privileges, registration, and license plate could be suspended for up to three years or until proof of insurance is shown; or you can be given a license reinstatement fine of between $150 to $500.

Compare Florida Car Insurance Rates as Percentage of Income

The monthly per capita disposable personal income (DPI) in Florida was $3,350, which represents the total amount of money available for individuals to spend (or save) after taxes have been paid.

The average cost for full coverage car insurance premiums is $238 per month, representing 3.15% of the average resident’s DPI. That percentage puts Florida as the fourth most expensive state for insurance when compared to income.

Additional Liability Coverage in Florida

Are you wondering what the relevance of a loss ratio is? Maybe you’re wondering what a loss ratio is? Here’s your answer:

A loss ratio demonstrates the amount paid in claims to the amount earned in premiums. A loss ratio of 75% indicates that insurance companies paid $75 on claims for every $100 earned.

Florida Car Insurance Loss Ratio by Coverage Type

| Loss Ratio | 2021 | 2022 | 2023 |

|---|---|---|---|

| Medical Payments (MedPay) | 74% | 73% | 81% |

| Personal Injury Protection | 75% | 62% | 76% |

| Uninsured/Underinsured Motorist | 73% | 80% | 86% |

A loss ratio matters because it shows the financial health of that insurance product and indicates whether the rates will need to raise, lower, or stay the same for the insurance companies to maintain financial stability.

The loss ratios listed above are in a healthy range but demonstrate a rising trend which means rates are likely to increase.

Uninsured/Underinsured Motorist coverage is optional in Florida, but they’re still important to have. Why?

In 2015, 13% of motorists (or approximately one in eight drivers) in the US were uninsured, and a whopping 26.7% of motorists were uninsured in Florida – the highest in the U.S.

Add-ons, Endorsements, and Riders in Florida

We understand that getting the complete coverage you need for an affordable price is your goal while at the same time finding all the required coverage you need.

The good news is that there are a plethora of powerful but reasonable extras you can add to your policy in Florida. Here’s a list of useful coverage available to you in Florida:

- Collision Insurance

- Comprehensive Insurance

- Gap Insurance

- Personal Umbrella Policy (pup)

- Rental Car Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-As-You-Go Insurance

After all, an unfortunate accident is an experience everyone wants to avoid, but when it does happen, the additional coverage can make for an easier (and sometimes less expensive) outcome.

Compare Florida Car Insurance Rates by Age and Gender

Understanding how car insurance rates vary by age and gender can help you make informed decisions when choosing a policy.

This section provides a comparison of rates from various insurance companies for different demographic groups in Florida.

Read More: Compare Male vs. Female Car Insurance Rates in Florida

Florida Minimum Coverage Car Insurance Monthly Rates by Age & Gender

| Insurance Company | Age: 17 Male | Age: 17 Female | Age: 25 Male | Age: 25 Female | Age: 35 Male | Age: 35 Female | Age: 60 Male | Age: 60 Female |

|---|---|---|---|---|---|---|---|---|

| Allied | $80 | $75 | $50 | $48 | $39 | $38 | $34 | $33 |

| Allstate | $125 | $115 | $34 | $34 | $63 | $61 | $29 | $29 |

| American Family | $110 | $100 | $40 | $34 | $53 | $50 | $29 | $29 |

| Farmers | $115 | $105 | $49 | $47 | $58 | $55 | $36 | $34 |

| Geico | $90 | $85 | $18 | $18 | $33 | $32 | $13 | $13 |

| Liberty Mutual | $135 | $125 | $34 | $28 | $65 | $63 | $26 | $26 |

| Nationwide | $95 | $90 | $21 | $20 | $43 | $41 | $16 | $16 |

| Progressive | $105 | $100 | $33 | $35 | $48 | $45 | $25 | $23 |

| State Farm | $100 | $95 | $20 | $19 | $38 | $36 | $15 | $15 |

| USAA | $85 | $80 | $11 | $11 | $25 | $24 | $8 | $8 |

Car insurance rates can differ significantly based on age and gender. Use this comparison to find the best rates and coverage options that suit your demographic profile, ensuring you get the best value for your insurance needs.

Secure Your Ride With the Best Rates in Florida: Compare Car Insurance in Your City

Easily compare car insurance rates across various cities in Florida. This section provides a comprehensive list of cities and their respective insurance costs, helping you find the best rates for your needs.

Florida Car Insurance Cost by City

Finding the right car insurance at the best rate can make a significant difference in your budget. Use this comparison to secure the most affordable and suitable coverage in your Florida city.

Laws and Florida Car Insurance

Laws regarding auto insurance differ from state to state. Florida insurance laws are detailed and you must realize and understand the common auto insurance laws to avoid unexpected fines.

The old saying, “ignorance of the law is no excuse” rings true and certainly applies in the state of Florida.

So keep reading to learn all about Florida’s specific laws.

Florida’s Car Insurance Laws

There are many Florida car insurance laws that apply to you, whether you’re a senior citizen, young adult, or a late teen who just passed the driver education course and examinations.

High-Risk Insurance in Florida

We said before that Florida is the only state that doesn’t require bodily injury liability coverage. If, however, you have caused an accident that caused bodily injury to another party, you will be required to carry full liability car insurance coverage.

People that have a DUI on their record and let their insurance lapse will be required to file an FR-44 insurance form. This form filing requires that the driver carry increased limits on their policy:

- $100,000: Bodily injury liability per person

- $300,000: Total bodily injury liability per accident

- $50,000: Property damage liability per accident

Read More: Compare FR-44 Insurance: Rates, Discounts, & Requirements

If you’ve committed offenses that require an SR-22 car insurance certification, you will have to purchase bodily injury liability (BIL) car insurance on top of the state’s basic car insurance requirements.

The list of Florida Insurance laws is an extensive one and it’s always best to know the regulations to make sure you’re always on the right side of the insurance laws.

You have to carry the SR-22 for three years if:

- You have been in a car accident that causes injuries or property damage.

- Your driver’s license has been suspended due to excessive traffic violation points.

- Your driver’s license has been habitually revoked.

Should you be found guilty of driving without car insurance, you may have to carry a six-month SR-22 for up to two years. which cannot be canceled. This also means that have to pay your whole premium each time before you renew your policy.

Florida’s Windshield and Glass Repair Laws

Whether you’re an urban dweller who commonly commutes on the interstate or you travel to and from the country on the back roads, sooner or later you may get a crack windshield.

Gravel, dirt, or other debris kick-up and hit windshields all the time, and when you hit a big one that causes some real damage you should know how you stand with your insurance company when it comes to broken windshields car insurance.

The good news is that if you have comprehensive insurance, there is no deductible per Florida Statute 627.7288. Insurance companies don’t have to use OEM parts, but replacement parts need to be the same fit, quality, and performance.

The Statute of Limitations in Florida

Understanding the statute of limitations is really not that difficult to comprehend and you certainly don’t require three years of law school to determine its premise.

Basically, the statute of limitations is a state law that sets a limit on the amount of time to file a lawsuit.

The statute of limitations for personal injury is four years.

Automobile Insurance Fraud in Florida

False and fraudulent insurance claims are a crime in the State of Florida and are punishable as provided in subsection (11) if that person has the intent to injure, defraud, or deceive any insure.

Florida Car Insurance Fraud

| Insurance Fraud | Yes/No |

|---|---|

| Insurance Fraud Classified as a Crime | Yes |

| Immunity Statues | Yes |

| Fraud Bureau | Yes |

| Mandatory Insurer Fraud Plan | Yes |

| Mandatory Auto Photo Inspection | No |

Florida takes insurance fraud very seriously, implementing strict penalties and preventive measures to protect consumers and insurers alike. By being aware of these regulations, you can help prevent fraud and ensure a fair and trustworthy insurance system in the state.

Florida’s Vehicle Licensing Laws

To drive a car, you have to have a license. Keep reading to find out what Florida’s mandatory licensing laws are. It’s also pertinent to remember Florida’s license renewal procedures.

Under Florida law, residents 80 years old and older are required to renew their licenses every six years while the general population must renew every eight years. Here are some additional specifics for new drivers, the general population, and seniors.

Penalties for Driving Without Insurance

You must carry proof of insurance whenever you are driving anywhere in the U.S.. Suffice to say, driving without insurance in Florida can have severe penalties.

Florida Car Insurance Driving Without Insurance Penalties

| Offense | Penalty |

|---|---|

| First Offense | Suspension of license and registration until reinstatement fee is paid and non-cancelable coverage is secured; $150 fee for first reinstatement |

| Second Offense | Suspension of license and registration until reinstatement fee is paid and non-cancelable coverage is secured; $250 fee for second reinstatement |

Driving without insurance in Florida can lead to significant fines and suspension of your driving privileges. Always ensure you have adequate coverage and carry proof of insurance to avoid these penalties and drive legally and safely.

Teen Driver Laws in Florida

Not all teen driving regulations are the same from state to state. Here’s what new drivers need to know in Florida. These laws are designed to ensure the safety of young drivers and help them gain the necessary experience before driving independently.

Florida Young Driver Licensing System

| Licensing System | Requirements |

|---|---|

| To get a learners license you must: | Be a minimum age of 15 |

| Before getting a license or restricted license you must: | Be a minimum age of 16 Have a minimum supervised driving time of 50 hours (10 of which must be at night) Have a mandatory holding period of 12 months |

| Restrictions during intermediate or restricted license stage: | 11 p.m.-6 a.m. for 16 year-olds; 1 a.m.-5 a.m. for 17 year-olds Passenger restrictions: None |

| Minimum age at which restrictions may be lifted: | 18 years-old |

Understanding and adhering to teen driver laws in Florida is crucial for the safety and development of young drivers. These regulations help ensure that teens gain adequate driving experience under supervised conditions, promoting safer driving habits.

License Renewal Procedures for Older Drivers in Florida

It’s not uncommon to see license renewal procedures with different requirements for older residents than for the general population. Here are some tables to help you easily see what is required.

Florida Car Insurance License Renewal Procedures

| Renewal Cycle | Period |

|---|---|

| General Population | 8 years |

| Older Population | 6 years for people 80 and older |

Knowing the specific license renewal procedures for older drivers helps ensure that all drivers meet the necessary requirements and maintain their driving privileges. These regulations are in place to promote road safety and accommodate the needs of older drivers.

Vision requirements are an essential part of maintaining driving safety. The following table outlines the proof of adequate vision requirements for both the general population and older residents in Florida.

Florida Car Insurance Proof of Adequate Vision Requirements

| Proof | Requirement |

|---|---|

| General population | When renewing in person |

| Older population | 80-years-old and older, every renewal |

Ensuring that you meet the vision requirements for your age group helps maintain safety on the roads. Regular vision checks and adhering to these requirements can prevent accidents and ensure that all drivers have the necessary visual acuity to drive safely.

Vehicle registration is a mandatory process for all drivers. The following table details the registration requirements for both the general population and older residents in Florida.

Florida Car Insurance Registration Requirements

| Registration | Requirement |

|---|---|

| General population | Both, every other renewal |

| Older population | Both, every other renewal |

Staying up-to-date with vehicle registration requirements ensures that your vehicle is legally registered and roadworthy. Regular registration renewals are crucial for maintaining compliance with Florida’s vehicle laws and ensuring a smooth driving experience.

New Residents or People Visiting Florida

If you’re new to Florida or just visiting, there are specific requirements for vehicle registration and driving licenses you need to be aware of. These regulations ensure that all vehicles on Florida roads are properly documented and insured.

To register a vehicle, the Vehicle identification number (VIN) must be physically inspected and verified by one of the following:

- A law enforcement officer from any state.

- A licensed Florida or out of state motor vehicle dealer.

- A Florida DMV Compliance Examiner/Inspector, DMV or tax collector employee.

- A notary public commissioned by the state of Florida.

- Provost Marshal or a commissioned officer in active military service, with a rank of 2nd Lieutenant or higher or an LNC, “Legalman, Chief Petty Officer, E-7”

A vehicle must be registered within 30 days of the owner doing any of the following:

- Becoming Employed

- Placing Children in Public School

- Establishing Residency

If you have a valid out-of-state license, you will likely be able to apply for and receive a Florida driver license without taking a driving or written test.

When you bundle, you don’t have to pick 😉 #NFLDraft pic.twitter.com/LL0aBcY0Dm

— GEICO (@GEICO) April 27, 2023

Understanding these requirements ensures a smooth transition for new residents and visitors in Florida. Registering your vehicle and obtaining a Florida driver license promptly helps you avoid fines and ensures compliance with state laws, making your stay in Florida hassle-free.

Snowbirds

Maybe you’re one of the million snowbirds who escape the cold weather up north to winter in Florida. There are some things you need to know:

- If you intend to use your vehicle for 90 days or more (consecutive or not) in Florida you must register your car in Florida.

- If your car is registered in Florida, you will have to get insurance from Florida that meets minimum requirements.

- You do not need to get a Florida driver’s license unless you spend seven or more months of the year in Florida.

For snowbirds, understanding these rules helps ensure that your time in Florida is enjoyable and legally compliant. By adhering to the vehicle registration and insurance requirements, you can enjoy the warm weather without any legal concerns, making your winter stay in Florida as pleasant as possible.

Florida Rules of the Road

Whether you’re a resident or just passing through, it’s important to know the rules of the road. Take a peek at this basic rundown to make sure you are following the law.

Fault vs. No-Fault

Florida is a no-fault state, which means your own PIP coverage will pay for your injuries regardless of who caused the accident. Whoever causes the crash will still be liable for property damage.

Impaired-Driving Laws in Florida

There can’t be enough enforcement or education when it comes to the dangerous, reckless practice of drinking and driving.

Florida Speed Limits by Road Type

| Offense | Penalties |

|---|---|

| 1st Offense | 180 days - 1 year; Fine: $500-$1000 (High BAC/minor: $1000-$2000); Jail: 8 hours - 6 months (High BAC/minor: up to 9 months); Other: Car impounded 10 days, 50 hours community service or $10 per hour fine |

| 2nd Offense | 5 years (within 5 years), 180 days - 1 year (over 6 years); Fine: $1000-$2000 (High BAC/minor: $2000-$4000); Jail: Up to 9 months (High BAC/minor: up to 12 months); Other: Car impounded 30 days (within 5 years) |

| 3rd Offense | 10 years; Fine: $2000-$5000 (High BAC/minor: $4000 min); Jail: Mandatory 30 days (High BAC/minor: up to 12 months); Other: Car impounded 90 days (within 10 years) |

| 4th Offense | Permanent; Fine: $2000 min; Jail: Up to 5 years |

| BAC Limit | 0.08% |

| Criminal Status | 1st and 2nd: misdemeanors; 3rd+: felonies |

| Offense Name | DUI |

| High BAC Limit | 0.15% |

| Look Back Period | 10 years (1st-3rd); Lifetime (4th+) |

| Mandatory Interlock | Repeat offenders |

Understanding the penalties for DUI offenses in Florida can help you avoid severe consequences and stay compliant with the law. Adhering to these guidelines is crucial for maintaining your driving privileges and ensuring road safety.

Like many states, Florida DUI laws are very strict if found guilty.

Speed Limits in Florida

Knowing the speed limit in Florida (for new residents or if you are just passing through) is something you need to be aware of before its too late and you see two red lights flashing in your rearview mirror. Here is a simple breakdown of the speed limits in Florida.

Florida Speed Limits by Road Type

| Road Type | Speed Limit |

|---|---|

| Rural Interstates | 70 mph |

| Urban Interstates | 65 mph |

| Other limited access roads | 70 mph |

| Other roads | 65 mph |

Adhering to Florida’s speed limits is essential for safe driving and avoiding fines. Always stay informed about the speed limits for different road types to ensure a smooth journey.

Child Safety Seat Laws in Florida

Child safety laws are some of the most important laws to adhere to and regulations are in strict force in Florida to ensure the utmost safety.

- Children from birth to age three must be secured in a federally approved child safety seat

- Children ages four and five may be secured in a federally approved child safety seat or a booster seat

If you fail to abide by this law you can face a fine of $60 for a first offense.

Another thing to consider regarding children in Florida: The Sunshine State tragically sees more child fatalities from heat strokes in cars than almost any other state in the nation.

Move Over and Keep Right Laws

Florida has what is called a Move Over law that requires you to move over for law enforcement, emergency, utility service, towing and even wrecker vehicles.

If it’s difficult or you can’t move over slow to a speed of 20 mph less than the posted speed limit. In the event of a posted speed limit of 20 mph slow to a speed a five mph.

Know Florida's Move Over and Keep Right laws for safer driving and smoother traffic.

Brandon Frady LICENSED INSURANCE AGENT

Florida’s keep right laws require slower traffic to keep right and drivers to yield to faster vehicles. This helps maintain smooth traffic flow and minimizes congestion on the road.

For example: If you’re on a four-lane highway driving in the left lane and a vehicle moving faster than you is behind you, you must move over to the right lane and let them pass.

Distracted Driving

One of the common issues that have become more prominent since the dawn of smartphones is distracted driving while talking or texting while at the wheel. Florida, like most states, has enacted laws limiting the use of handheld devices when driving.

Florida Cell Phone Use Laws While Driving

| Laws | Details |

|---|---|

| Hand-held ban | Yes |

| Young drivers all cellphone ban | No |

| Texting ban | Yes - all drivers |

| Enforcement | Primary |

Effective October 1st, 2019, the Florida Department of Highway Safety and Motor Vehicles (FLHSMV) says cellphones can “only be used in a hands-free manner when driving in a designated school crossing, school zone, or active work zone area.”

Enforcement for texting while driving is also now a primary offense (effective since July 1st, 2019).

The FLHSMV says that if drivers text while driving, they face the following penalties.

- 1st Violation: Non-moving offense (no points added to driver’s record).

- 2nd Violation: Moving violation (three points added to driver’s record).

So put the phone down in the car, as Florida is strengthening its laws on distracted driving.

Ridesharing in Florida

Ridesharing services in Florida are one of the most common forms of transportation. Lyft and Uber are the most popular. Uber and Lyft drivers who have the app on must be carrying the following rideshare insurance limits.

- $50,000 of bodily injury coverage per person

- $100,000 of bodily injury coverage per accident

- $25,000 of property damage liability coverage per accident

Once you have a passenger, you need to be covered by the company’s third-party liability insurance policy, with at least one million dollars coverage for bodily injury and property damage.

Automation on the Roads in Florida

Florida allows autonomous vehicles in the state, but the laws specify the person who activated the autonomous technology shall be considered the “operator” regardless of whether that person is in the vehicle or not.

Owners (typically this would be a corporate entity) must provide proof of five million dollars proof on insurance or surety bond to the Florida Department of Highway Safety and Motor Vehicles when testing an autonomous vehicle.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

These Facts Might Raise Your Eyebrow

Staying informed is crucial for protecting yourself, your passengers, and your vehicle. This section provides essential data and insights into various aspects of vehicle safety and insurance in Florida.

Florida Statistics Summary

| Statistics | Details |

|---|---|

| Miles of Roadway | 122,391 |

| Vehicle Miles Driven Annually | 201 billion |

| Vehicles | Registered in State: 14.9 million Total Stolen: 42,579 |

| State Population | 20.9 million |

| Most Popular Vehicle | Toyota Corolla |

| Uninsured Motorists | 26.7% State Rank: 1st |

| Driving Fatalities | 2017 Speeding: 299 Drunk Driving: 839 |

| Annual Insurance Costs | Liability: $857.64 Collision: $282.96 Comprehensive: $116.53 Combined: $1257.13 |

| Cheapest Provider | USAA |

Knowledge is your best defense on the road. Use this information to make informed decisions and stay safe while driving in Florida.

Vehicle Theft in Florida

Here are the top stolen cars in the state of Florida. Understanding which vehicles are most targeted can help you take preventive measures.

Top 10 Florida Car Thefts by Model

| Make & Model | Year | Total Thefts |

|---|---|---|

| Ford Pickup (Full Size) | 2021 | 2,030 |

| Honda Accord | 2020 | 1,003 |

| Nissan Altima | 2020 | 1,000 |

| Chevrolet Pickup (Full Size) | 2021 | 992 |

| Toyota Camry | 2019 | 898 |

| Toyota Corolla | 2019 | 887 |

| Honda Civic | 2018 | 772 |

| Dodge Charger | 2021 | 639 |

| Honda CR-V | 2020 | 580 |

| Hyundai Sonata | 2019 | 577 |

Vehicle theft is a significant issue in Florida. Stay vigilant and implement security measures to protect your vehicle from becoming a target.

Road Danger in Florida

The best way to stay out of danger on the road is to drive defensively and be aware of common issues in your state.

Fatalities by Person Type

This section provides statistics on traffic fatalities in Florida, broken down by person type. Understanding these figures can help identify the most vulnerable road users.

Florida Traffic Fatalities by Person Type

| Type | Total |

|---|---|

| Bicyclist and Other Cyclist Fatalities | 123 |

| Motorcyclist Fatalities | 590 |

| Passenger Vehicle Occupant Fatalities (All Seat Positions) | 1,009 |

| Pedestrian Fatalities | 654 |

| Traffic Fatalities | 3,112 |

Awareness of fatality statistics by person type can inform better safety practices. Protect yourself and others by driving responsibly.

Fatalities by Crash Type

Explore the different types of crashes that result in fatalities in Florida. This data highlights the most common and deadly crash scenarios.

Florida Traffic Fatalities by Crash Type

| Type | Total |

|---|---|

| Involving a Large Truck | 292 |

| Involving a Roadway Departure | 1,122 |

| Involving a Rollover | 538 |

| Involving an Intersection (or Intersection Related) | 1,134 |

| Involving Speeding | 299 |

| Single Vehicle | 1,622 |

Recognizing the types of crashes that lead to fatalities can help you avoid risky situations and adopt safer driving habits. Stay informed and drive cautiously.

Fatalities Rates in the Largest Cities

This section details traffic fatality rates in the largest cities of Florida. Understanding these rates can help you gauge the safety of different urban areas.

Florida Traffic Fatalities by City

| City Name | Total Fatalities (2021) | Total Fatalities (2022) | Total Fatalities (2023) |

|---|---|---|---|

| Cape Coral | 35 | 38 | 40 |

| Fort Lauderdale | 42 | 44 | 46 |

| Hialeah | 29 | 31 | 33 |

| Hollywood | 25 | 27 | 29 |

| Jacksonville | 120 | 125 | 130 |

| Miami | 100 | 105 | 110 |

| Orlando | 78 | 81 | 85 |

| Pembroke Pines | 20 | 22 | 24 |

| Port St. Lucie | 18 | 19 | 21 |

| St. Petersburg | 45 | 47 | 50 |

| Tallahassee | 30 | 32 | 34 |

| Tampa | 55 | 58 | 60 |

Being aware of fatality rates in various cities can guide you in making safer travel decisions. Prioritize safety and stay informed about the risks in your area.

Traffic Fatalities: Rural vs. Urban

Compare traffic fatalities on rural and urban roadways in Florida. This data reveals the differences in safety between these two types of environments.

Florida Traffic Fatalities by Area Type

| Type | Total |

|---|---|

| Rural | 969 |

| Urban | 1,434 |

Understanding the disparity in fatality rates between rural and urban areas can help you take appropriate precautions. Drive safely, regardless of your location.

Fatalities Involving a DUI by County

This section examines fatalities in crashes involving alcohol-impaired drivers by county in Florida. It underscores the severe impact of DUI on road safety.

Top 10 Florida DUI Fatalities by County

| County Name | Total Fatalities (2021) | Total Fatalities (2022) | Total Fatalities (2023) |

|---|---|---|---|

| Miami-Dade | 50 | 52 | 55 |

| Hillsborough | 45 | 47 | 50 |

| Broward | 40 | 42 | 45 |

| Palm Beach | 40 | 42 | 45 |

| Duval | 35 | 37 | 40 |

| Orange | 35 | 37 | 40 |

| Brevard | 25 | 27 | 29 |

| Pinellas | 25 | 27 | 29 |

| Escambia | 20 | 22 | 24 |

Driving under the influence remains a leading cause of fatal accidents. Stay responsible and never drive while impaired to protect yourself and others.

Fatalities Involving Speeding by County

Explore the fatalities involving speeding by county in Florida. This data highlights the dangers of speeding and its impact on road safety.

Top 10 Florida Speeding Fatalities by County

| County Name | Total Fatalities (2021) | Total Fatalities (2022) | Total Fatalities (2023) |

|---|---|---|---|

| Miami-Dade | 55 | 57 | 60 |

| Hillsborough | 50 | 52 | 55 |

| Broward | 45 | 47 | 50 |

| Palm Beach | 45 | 47 | 50 |

| Duval | 40 | 42 | 45 |

| Orange | 40 | 42 | 45 |

| Brevard | 30 | 32 | 34 |

| Pinellas | 30 | 32 | 34 |

| Escambia | 25 | 27 | 29 |

| Lee | 25 | 27 | 29 |

Speeding significantly increases the risk of fatal accidents. Always adhere to speed limits and drive at safe speeds to ensure everyone’s safety.

Five-year Fatality Trends in the Top-10 Counties

Analyze the five-year trend of traffic fatalities in the top 10 counties in Florida. This data provides insights into how fatality rates have changed over time in these regions.

Florida Car Crash Fatalities by County

| County Name | Total Fatalities (2021) | Total Fatalities (2022) | Total Fatalities (2023) |

|---|---|---|---|

| Miami-Dade | 348 | 359 | 372 |

| Broward | 283 | 298 | 310 |

| Hillsborough | 235 | 242 | 256 |

| Orange | 204 | 216 | 229 |

| Palm Beach | 227 | 235 | 240 |

| Duval | 185 | 192 | 203 |

| Volusia | 158 | 163 | 170 |

| Pinellas | 145 | 150 | 160 |

| Lee | 148 | 154 | 161 |

| Polk | 160 | 165 | 172 |

Monitoring long-term trends in traffic fatalities can guide efforts to improve road safety. Stay informed about your county’s statistics to contribute to a safer community.

Teens and Drunk Driving

Teen drunk driving is a critical issue in Florida, where alcohol-impaired driving fatalities among teens are higher than the national average. The state has seen 109 DUI arrests for individuals under 18, with a rate of 26 arrests per million people.

Florida Teens and Drunk Driving Statistics

| Teens and Drunk Driving | Stats |

|---|---|

| Alcohol-Impaired Driving Fatalities Per one million people | 2 |

| Higher/Lower Than National Average (1.2) | Higher |

| DUI Arrests (Under 18 years old) | 109 |

| DUI Arrests (Under 18 years old) Total Per Million People | 26 |

Teen drunk driving can have devastating consequences. Parents and guardians must take this issue seriously and promote responsible driving habits among young drivers.

Top Cities for Traffic Congestion

Discover the top four cities in Florida with the highest traffic congestion. This section details the hours spent in congestion and the associated costs per driver.

Florida Traffic Congestion by City

| City | Hours | Cost |

|---|---|---|

| Jacksonville | 60 hours | $70 |

| Miami | 105 hours | $123 |

| Orlando | 74 hours | $86 |

| Tampa | 87 hours | $101 |

Florida’s major cities face significant traffic congestion, with Miami topping the list at 105 hours per year. The associated costs for drivers vary, with Jacksonville being the least expensive at $70, and Miami the most costly at $123.

By entering your ZIP code below, you can get instant car insurance quotes from top providers.

Frequently Asked Questions

How do car insurance rates vary by age and gender in Florida?

Car insurance rates can vary based on age and gender. Comparing quotes can help you find the best rates.

What add-ons, endorsements, and riders are available in Florida?

Available options include collision, comprehensive, gap insurance, personal umbrella policy, rental car reimbursement, emergency roadside assistance, mechanical breakdown insurance, non-owner car insurance, modified car coverage, classic car insurance, and pay-as-you-go insurance.

Read More: Understanding Your Car Insurance Policy (Complete Guide)

Can additional liability coverage be added in Florida?

Yes, additional liability coverage can be added to your car insurance policy.

Take the first step toward cheaper car insurance rates. Enter your ZIP code below to see how much you could save.

What are the average monthly car insurance rates in Florida?

Average monthly rates are $71.47 for liability, $23.58 for collision, $9.71 for comprehensive, and $104.76 combined.

Are there any discounts available for Florida car insurance?

Yes, discounts are available for safe driving, multiple policies, anti-theft devices, good grades, and defensive driving courses. Check with your provider for eligibility.

Does my credit score affect my car insurance rates in Florida?

Yes, your credit score can impact your car insurance rates as insurers often consider credit history when determining premiums.

Read More: Good Credit Car Insurance Discounts

What is the minimum car insurance coverage required in Florida?

Florida law requires a minimum of $10,000 in Personal Injury Protection (PIP) and $10,000 in Property Damage Liability (PDL) coverage.

How does Florida’s no-fault insurance system work?

Under Florida’s no-fault system, your insurance pays for your medical expenses and certain other losses, regardless of who is at fault in an accident, up to the limits of your PIP coverage.

Read More: Compare No-Fault Car Insurance

Can I get insurance coverage for a leased car in Florida?

Yes, you can get insurance coverage for a leased car in Florida. Most leasing companies require full coverage, including liability, collision, and comprehensive insurance.

How do I file a car insurance claim in Florida?

To file a car insurance claim, contact your insurance company as soon as possible after an accident or loss. Provide all necessary information, including the details of the incident, and cooperate fully with the claims adjuster.

Find cheap car insurance quotes by entering your ZIP code below.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.