Cheap Car Insurance After a DUI in 2025 (Top 10 Low-Cost Companies)

State Farm, USAA, and Progressive stand out as top picks for cheap car insurance after a DUI, offering rates starting at just $45 per month. Despite DUI convictions, these companies provide affordable options, ensuring comprehensive protection for high-risk drivers on the road.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Michael Vereecke

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Commercial Lines Coverage Specialist

UPDATED: Jan 29, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jan 29, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Min. Coverage After a DUI

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage After a DUI

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage After a DUI

A.M. Best Rating

Complaint Level

Pros & Cons

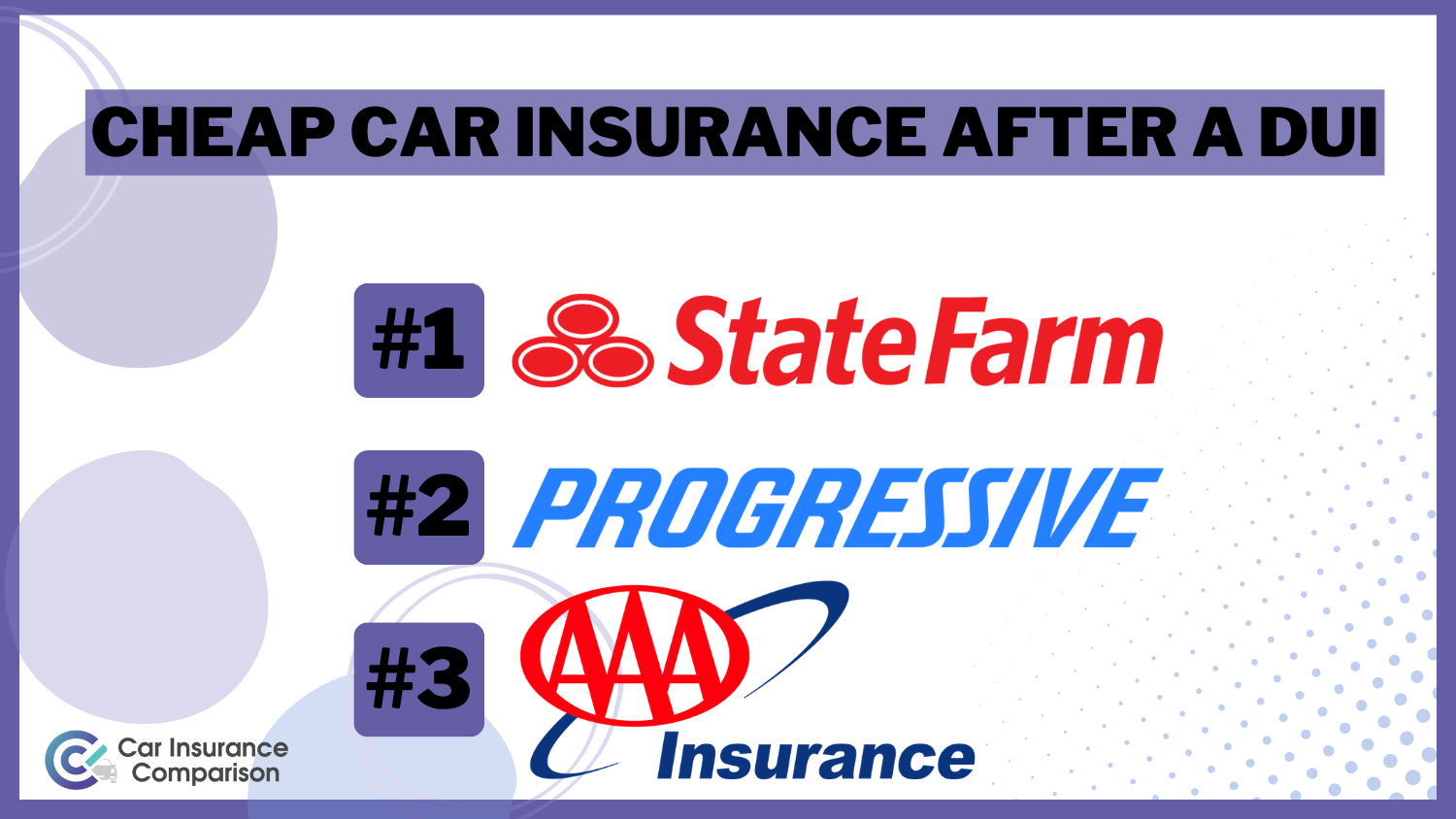

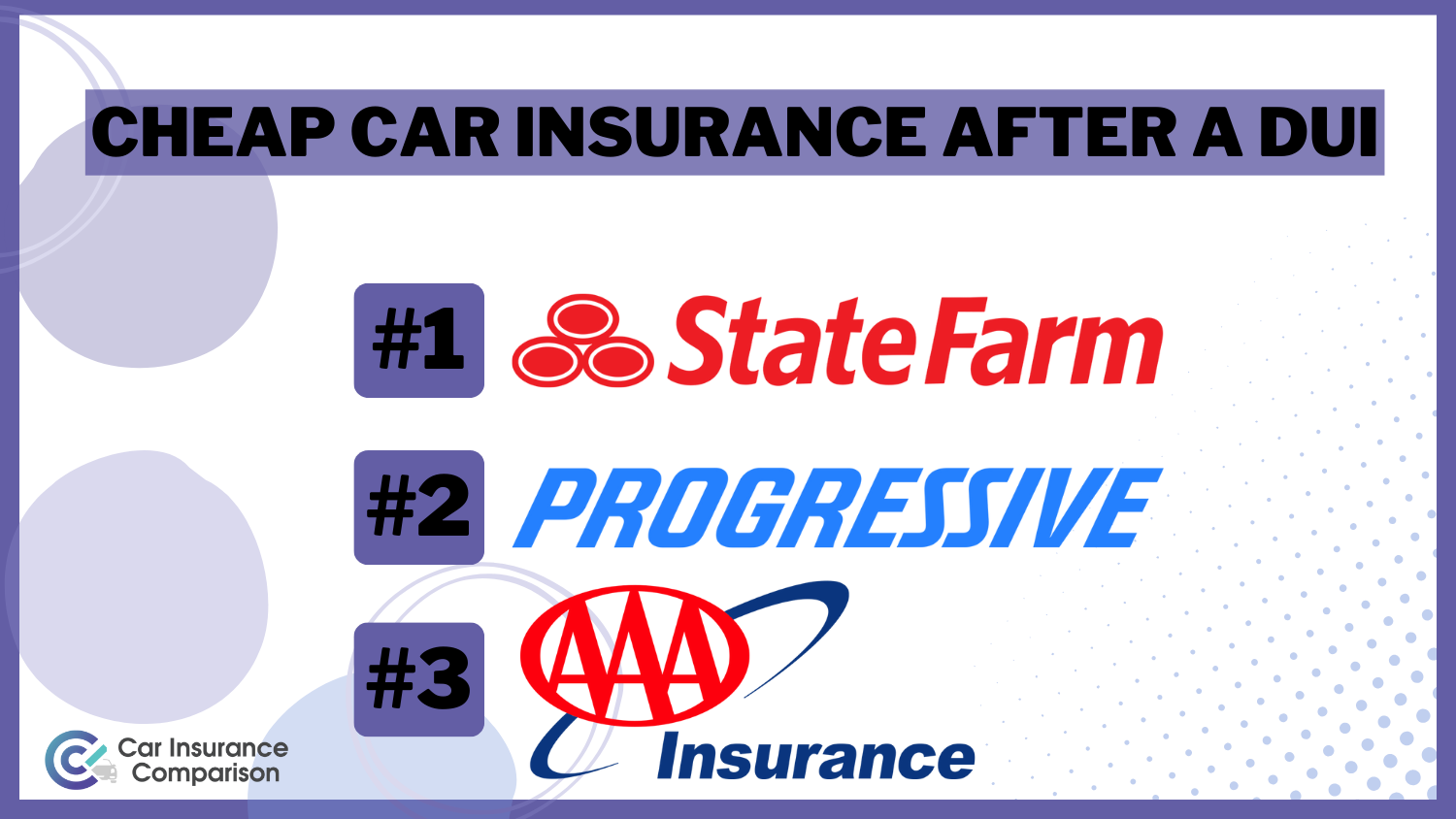

Our Top 10 Company Picks: Cheap Car Insurance After a DUI

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $45 A++ Many Discounts State Farm

#2 $52 A+ Online Convenience Progressive

#3 $57 A Local Agents AAA

#4 $73 A+ 24/7 Support Erie

#5 $73 A Student Savings American Family

#6 $74 A Local Agents Farmers

#7 $78 A++ Accident Forgiveness Travelers

#8 $90 A+ Usage Discount Nationwide

#9 $106 A+ Add-on Coverages Allstate

#10 $125 A Customizable Polices Liberty Mutual

DUI is a serious offense to insurance companies. Not only will the offense remain on your record for years, but finding affordable car insurance with DUI convictions becomes more difficult. However, companies like State Farm, Progressive, and AAA may offer affordable car insurance options for individuals with DUIs.

So, you may wonder how to find cheap car insurance for drivers with a DUI despite higher rates. Our free online comparison tool allows you to compare the cheapest companies for car insurance rates after a DUI.

- State Farm offers up to 15% discount for DUI car insurance

- Affordable coverage options tailored for DUI incidents

- Tailored solutions and comprehensive protection for high-risk drivers

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Cheapest Rates Overall: State Farm offers affordable auto insurance coverage in 48 U.S. states. Learn more in our State Farm car insurance review.

- SR-22 Insurance: By filing an SR-22, including non-owner SR-22, State Farm helps individuals with DUI convictions meet their legal obligations, especially when seeking car insurance after a DUI conviction.

- Financial Strength: State Farm’s insurance rating with A.M. Best of A+ (Superior) provides confidence in the company’s ability to fulfill claims.

Cons

- No Gap Insurance: While State Farm may lack gap insurance, its Payoff Protector provides financial protection if your car is ever totaled or stolen.

- Limited Online Tools: While State Farm continues to invest in digital technology, its online tools may not be as advanced as those of some competitors.

Pros

- Reputation and Reliability: AAA has a longstanding reputation for reliable customer service, providing peace of mind for drivers with a DUI on their record. Get more information in this AAA car insurance review.

- Discounts and Membership Benefits: Multi-policy or safe driver discounts, and membership perks such as roadside assistance can help offset the cost of insurance for drivers with a DUI.

- Customizable Coverage: For drivers with a DUI, having access to customizable coverage options can help ensure they have the protection they need without paying for unnecessary coverage.

Car Insurance Rates After a DUI Conviction

Various consequences come with drinking and driving — one of them is higher car insurance rates for as long as the DUI remains on your record. Living in one of the most dangerous states for drunk driving also increases your risk of getting into an accident and having to file a claim. Analyzing the average monthly DUI car insurance rates reveals distinct variations among top companies, impacting the average cost of insurance after a DUI.

DUI Car Insurance Monthly Rates by Provider & Coverage Level

Insurance Company Minimum Coverage Full Coverage

$81 $211

$152 $385

$104 $276

$60 $153

$105 $275

$178 $445

$129 $338

$75 $200

$65 $160

$112 $294

State Farm emerges with competitive rates, offering minimum coverage at $45 and full coverage at $112. Progressive follows closely, providing minimum coverage at $52 and full coverage at $140. Liberty Mutual, while presenting the highest rates, stands out for comprehensive coverage at $313/mo.

As we navigate the table, companies like Nationwide, Farmers, American Family, and Travelers showcase diverse pricing structures, catering to individuals’ budget constraints and coverage needs. This detailed overview equips readers with valuable insights for comparing and selecting the cheapest car insurance after a DUI.

State Farm emerges as the top choice for affordable post-DUI car insurance with competitive rates and personalized protection.

Brad Larson Licensed Insurance Agent

Driving under the influence of alcohol or drugs impairs your judgment, meaning you’re more likely to get involved in an accident. The National Highway Transportation and Safety Administration says drivers with a blood alcohol level of .08% or higher are four times more likely to get in an accident than sober drivers. A BAC of 0.15% or more increases the risk by 12 times.

You’ll generally see higher rates at renewal time when your insurance company checks your record again. Read more: How Long Does a Car Accident Stay on Your Insurance Record?

Car insurance rates can increase by about 75%, or over $ 1,000 a year. However, compared to other violations, rates only increase by 23% after a speeding ticket and 45% after an at-fault accident. You will incur higher rates and face other consequences depending on where you live, like fines, license suspension, or jail time. Here’s how to find cheap auto insurance after an accident.

How Much Rates Increase With Certain Companies After a DUI

Car insurance hikes after a DUI vary by insurance company. So, we looked at the average percentage increase for several companies based on DUI convictions.

The table below compares the average annual car insurance rates for drivers with a clean record versus drivers with a single DUI from some of the top companies.

Full Coverage DUI Car Insurance Monthly Rates vs. Clean Record

When comparing DUI rates, look at the total cost rather than the surcharge. For example, State Farm car insurance with a DUI will come with a 30% increase after a conviction. Overall, DUI rates for full coverage are $112 monthly on average. On the other hand, Progressive increases rates at a similar percentage, but you’ll pay $140 a month on average.

So, even though the accident wasn’t your fault, you still drove under the influence of alcohol, and your insurer assumes you could do so again. Although rates won’t be as low as before, it is possible to find cheap auto insurance for DUI drivers. However, it may take some searching on your part.

You should also read about “DUI vs. DWI: What is the Difference?” Understanding these two violations might help you get better insurance rates.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

How Long a DUI Impacts Your Car Insurance Rates

Since insurance companies view a DUI as a significant violation, expect higher car insurance rates for around three to five years. The amount of time your rates stay high depends on various factors:

- Amount of Time the DUI is on Record: Since the blemish on your motor vehicle record prompts the rate increase, your rates will remain high if the violation still appears on your record.

- State Insurance Laws: Your state insurance laws affect how long you’ll pay higher rates after a DUI. For example, insurers in North Carolina can hike them for three years, whereas Massachusetts insurance companies can increase rates for five years. Compare Massachusetts car insurance rates for more information.

- Other Variables: There are other ways a DUI can impact your rates. For example, California may drop your DUI surcharge, but you can’t qualify for a 20% good driver discount for 10 years after the DUI, impacting the search for the cheapest car insurance DUI California. Compare California car insurance rates to get a better idea of how much you could end up paying.

Understanding the duration of the impact of a DUI on your car insurance rates is crucial for planning and budgeting. Factors such as the length of time the DUI remains on your record, state insurance laws, and other variables all play a role in determining how long you’ll pay higher rates.

You’ll still see your car insurance rates hike if you didn’t cause an accident but were driving under the influence. Once the DUI conviction appears on your motor record, insurers will reflect that in your rates.

Michelle Robbins Licensed Insurance Agent

By comparing rates and understanding the specific regulations in your state, you can gain insight into the duration and extent of the impact on your insurance premiums. This knowledge empowers you to make informed decisions and potentially mitigate the financial consequences of a DUI conviction.

Read more: What Are the DUI Insurance Laws in Massachusetts?

There are many consequences to drinking and driving, including higher rates, so expect your DUI to impact rates for several years.

When renewing your car insurance policy, insurance companies generally request your driving record from the state department of motor vehicles, and this record will reflect any DUIs, speeding tickets, and moving violations. Unless your renewal is upcoming, you could save up for your anticipated rate increase since they don’t find out about a DUI immediately.

However, if you need to file an SR-22 form — a certificate several states require after a DUI to prove you carry minimum car insurance — your insurer will find out sooner about your DUI. Your DUI won’t instantly increase rates since insurance companies can’t increase rates mid-policy. So, you’ll typically see the increase at policy renewal (For more information, read our “Can I Change my Car Insurance Company Mid-Policy?“).

SR-22 Insurance

An SR-22 car insurance is a certificate your state requires and is filed by your insurance company, proving you carry your state’s required car insurance coverage.

Some states like Florida and Virginia have stricter insurance requirements than the SR-22, known as an FR-44 car insurance, and are used for more severe driving offenses, which results in higher liability coverage requirements.

You won’t need to file an SR-22 unless you receive notice from a judge or the state ordering the certificate. Below is a list of common reasons a driver might need to file an SR-22:

- DUI Conviction

- Reckless Driving Violations

- Several Traffic Violations in a Short Period

- Several Car Accidents in a Short Period

- Caught Driving Without Insurance

- Restricted or Suspended License

- Failure to Pay Child Support

Alongside higher rates, SR-22 filers should expect to pay a filing fee between $15 and $50, though some states may charge more.

Read more: Compare Car Insurance Rates After a Suspended License

The Best DUI Insurance Companies

So, what is the best DUI insurance company for you? As you’ve learned, DUI insurance rates vary substantially depending on what company you use and what state you live in.

However, some national insurance companies increase rates less significantly after a DUI conviction than others.

Overall, State Farm car insurance company underwrites the cheapest car insurance for DUIs, on average. Plus, State Farm also offers SR-22 insurance if you speak directly with an agent.

Progressive car insurance company also sells reasonably priced car insurance to people with a DUI. According to the company website, Progressive increases rates by a countrywide average of 13% after your first conviction.

If you have multiple DUIs or other traffic citations on your record, you may also look into the non-standard insurer, The General car insurance company. Often, non-standard companies offer very basic policies to high-risk drivers lacking the bells and whistles that traditional insurers provide.

Fortunately, that’s not the case with The General. This company provides customers with a user-friendly mobile app, competitive rates, and even includes SR-22 forms with your policy if one is required. It’s also worth looking into the smaller, regional car insurance companies active near where you live.

So, ultimately, to secure the best DUI insurance rates for you, compare quotes online from the best companies in your region, including companies offering high-risk car insurance.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

How to Save on Car Insurance After a DUI

Though a DUI can cause car insurance rates to skyrocket, there are ways for policyholders to save on coverage. Below are ways to find lower rates with a DUI on your record:

- Look for Car Insurance Discounts. Though you’ll likely lose your good driver discount, insurers offer various car insurance discounts, like pay-in-full, multi-vehicle, and multi-policy. Speak with an insurance company representative about eligible discounts to get the best rate possible

- Exhibit Safe Driving. Insurance companies will take note if you maintain a clean record, avoiding accidents and moving violations. While it takes time to see lower rates, your insurer will eventually move you back into the low-risk category

- Shop Around. The best way to save on car insurance is to compare car insurance quotes from various insurance companies. After your rates increase due to a DUI, compare your new rate to others to find the cheapest rate.

It’s important to shop around for rates because some companies charge less or are more forgiving of DUIs than others. For example, while one company might increase rates by 50% each year for five years, another may only increase them by 50% the first year and 20% the last four years.

Also, be sure to ask about additional discounts when renewing your policy. You could also consider participating in usage-based insurance, a telematics program that monitors your driving and gives you a discount if you practice safe driving. Finding the best car insurance after a DUI varies by driver, so compare insurance quotes for DUI drivers from multiple companies to find the best deal.

How Insurance Companies Find Out About DUIs

Your insurance company most likely will learn about your DUI conviction from your local DMV or by re-checking your driving history. To maintain proper rates, insurance companies check your driving record at various points throughout your time as a customer.

Another way companies learn about DUIs is if you’re required to file an SR-22 form. In some states, you need to file an SR-22 to reinstate your license. Usually, your car insurance company files that form with your state’s DMV on your behalf.

It’s not worth hiding your DUI from your car insurance company. If you do, the company may not renew your policy at the end of your term. If that leads to a coverage lapse, your insurance rates increase even more. We recommend telling your insurance company about your DUI as soon as possible to allow you time to plan and evaluate your options.

Read more: Compare Car Insurance Rates After a DUI as a Minor

Case Studies From the Top Insurance Companies for DUI drivers

Navigating insurance coverage after a DUI conviction can be a daunting task. However, these case studies offer insights on how top insurers handle such situations.

- Case Study #1 – Progressive: Mark, 35, with a DUI, checks Progressive for coverage. Despite the conviction, Progressive offers competitive rates: $52 for minimum coverage and $140 for full coverage. Progressive’s customizable policies suit Mark’s budget, showing their commitment to affordable car insurance post-DUI. Explore more about Compare Car Insurance Rates After a Conviction.

- Case Study #2 – State Farm: Sarah, 28, with a recent DUI, chooses State Farm. She gets minimum coverage at $45 and full coverage at $112. State Farm’s tailored approach ensures coverage suits individual needs post-DUI without compromising quality.

- Case Study #3 – Allstate: Alex, 40, with a DUI history, considers Allstate for comprehensive coverage. Despite higher rates, Allstate’s extensive options offer Alex full coverage at $270, making it a top choice for post-DUI insurance needs.

Despite the challenges, these DUI insurers prioritize affordability, customization, and comprehensive protection, ensuring that high-risk drivers can find suitable coverage options tailored to their specific circumstances.

Some check at intervals, while others re-run your information at the time of your policy renewal. Your insurance company will find out about any DUI convictions at this time.

Daniel Walker Licensed Insurance Agent

By learning from these case studies, individuals with DUI convictions can make informed decisions and find suitable coverage options tailored to their specific circumstances.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Compare Car Insurance Rates After a DUI

Insurance companies take DUI convictions seriously, hiking rates an average of 75% for convicted drivers. However, there are many ways to save on car insurance after a DUI, like comparing auto insurance quotes, utilizing discounts, and driving safely.

A DUI can remain on your record for three to five years, and you may be required to file an SR-22 form proving you carry the required car insurance coverages. In addition, you could face fines, filing fees, or even jail time.

Enter your ZIP code to compare quotes from multiple insurance companies offering cheap DUI insurance.

Frequently Asked Questions

What is the average cost of insurance after a DUI conviction?

The average cost of insurance after a DUI conviction can vary depending on several factors, including your location, driving history, and the insurance company you choose. On average, you can expect your rates to increase by about 75% or more after a DUI.

How does a DUI impact your car insurance?

A DUI conviction almost always leads to higher insurance rates and may make it harder to get coverage.

Our free online comparison tool below allows you to compare cheap car insurance quotes instantly — just enter your ZIP code to get started.

What’s the best car insurance after a DUI?

If you have a DUI on your record, State Farm is the best car insurance company, with an average monthly rate of $112. Progressive comes in second, charging an average of $140 monthly for a full coverage policy.

However, the best insurance companies for DUIs may vary since insurers consider various unique factors when setting rates. Finding the best insurance with DUI requires comparing quotes from multiple companies specializing in providing coverage to high-risk drivers.

Compare auto insurance quotes with DUI to find the company to fit your needs and budget.

How much does a DUI increase your car insurance rates?

The U.S. average for full coverage car insurance after a DUI conviction is $209, accounting for a 75% increase.

Insurance companies take DUI convictions seriously, so if you have a DUI, expect your insurer to consider you high risk. High-risk means you’re more likely to cost the company money after an accident or filing a claim.

What is an SR-22 certificate?

An SR-22 is a certificate the state requires you to obtain after certain violations. It’s not an insurance policy but a document proving you carry the required insurance coverages for your state.

Is there a trick to get cheap DUI insurance rates?

While there isn’t a trick to lowering your DUI insurance rates, there are proven tips you can take to decrease DUI insurance costs. For example, comparison shopping and asking for discounts could lead to lower rates.

Find out if you can get car insurance if your spouse has a DUI/DWI.

How long does a DUI affect your insurance?

Typically, a DUI affects your rates for three years, but in some states like California, it stays on your record for 10 years.

How long does a DUI stay on your insurance in Connecticut?

A DUI conviction typically remains on your driving record for 10 years in Connecticut. During this time, insurance companies may consider you a high-risk driver, which can result in significantly higher insurance premiums.

Ready to shop around for the best car insurance company? Enter your ZIP code below and see which one offers the coverage you need.

How much is insurance with a DUI in Florida?

Car insurance premiums after a DUI in Florida average $152 per month, but rates can vary among insurers.

How can I find affordable car insurance with a DUI?

Finding affordable car insurance with a DUI may seem challenging, but it’s not impossible. Start by comparing quotes from multiple insurance companies specializing in providing coverage to drivers with DUIs. Look for companies that offer discounts for safe driving or completion of a defensive driving course.

What is the best auto insurance for DUI drivers?

The best auto insurance for DUI drivers will depend on individual circumstances and preferences. However, companies like State Farm, Progressive, and Allstate are known for offering competitive rates and comprehensive coverage options for drivers with DUI convictions, making them reliable options for auto insurance for DUI offenders.

What does DUI mean in insurance?

There is no specific insurance policy called DUI insurance, but it refers to car insurance for drivers with a DUI conviction.

Where can I find cheap car insurance for DUI offenders?

If you’re a DUI offender looking for cheap car insurance, consider comparing quotes from non-standard insurance companies that specialize in providing coverage to high-risk drivers. Additionally, some standard insurance companies may offer more affordable rates if you take steps to demonstrate responsible driving behavior. Finding cheap insurance for DUI offenders requires thorough research and comparison to secure the best rates possible.

How can I get insurance after a DUI accident?

Getting car insurance after a DUI accident may require some effort, but it’s possible. Start by researching insurance companies that offer coverage to drivers with DUIs and request quotes from multiple providers. Be prepared for higher rates initially, but over time, as you demonstrate responsible driving behavior, you may be able to lower your premiums.

What is the best car insurance for DUI offenders in Florida?

The best car insurance for DUI drivers in Florida is offered by companies like State Farm and Progressive.

Get more information on the Florida DUI insurance laws.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Michael Vereecke

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Commercial Lines Coverage Specialist

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.