Best Car Insurance for Foreigners in 2025 (Your Guide to the Top 10 Companies)

Compare rates from top insurers like Progressive, State Farm, and Allstate to find the best car insurance for foreigners. Secure tailored protection designed for international visitors and non-citizens, allowing them to drive confidently on U.S. roads while enjoying up to 20% discount.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

UPDATED: Mar 17, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 17, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Foreign Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Foreign Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage for Foreign Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews

Compare the best car insurance for foreigners, focusing on major competitors like Progressive, State Farm, and Allstate. Progressive, known for being the best car insurance option for foreigners, stands out in this guide due to its comprehensive coverage and competitive pricing, catering to both vehicle buyers and tourists seeking insurance.

Our Top 10 Company Picks: Best Car Insurance for Foreigners

| Company | Rank | Foreign Driver Discount | Multi-Car Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 10% | 15% | Comprehensive Coverage | Progressive | |

| #2 | 8% | 17% | Local Agents | State Farm | |

| #3 | 10% | 20% | Policy Options | Allstate | |

| #4 | 8% | 12% | Online Convenience | Liberty Mutual |

| #5 | 10% | 15% | 24/7 Support | Farmers | |

| #6 | 12% | 20% | Vanishing Deductible | Nationwide |

| #7 | 10% | 15% | Safe-Driving Discounts | Esurance | |

| #8 | 10% | 20% | Multi-Policy Discounts | Travelers | |

| #9 | 8% | 15% | Bundle Discounts | American Family | |

| #10 | 10% | 15% | Customizable Policies | Erie |

Explore our picks with finding reasonable car insurance rates to find the best fit for your requirements, get quotes, and start saving on your car insurance today.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

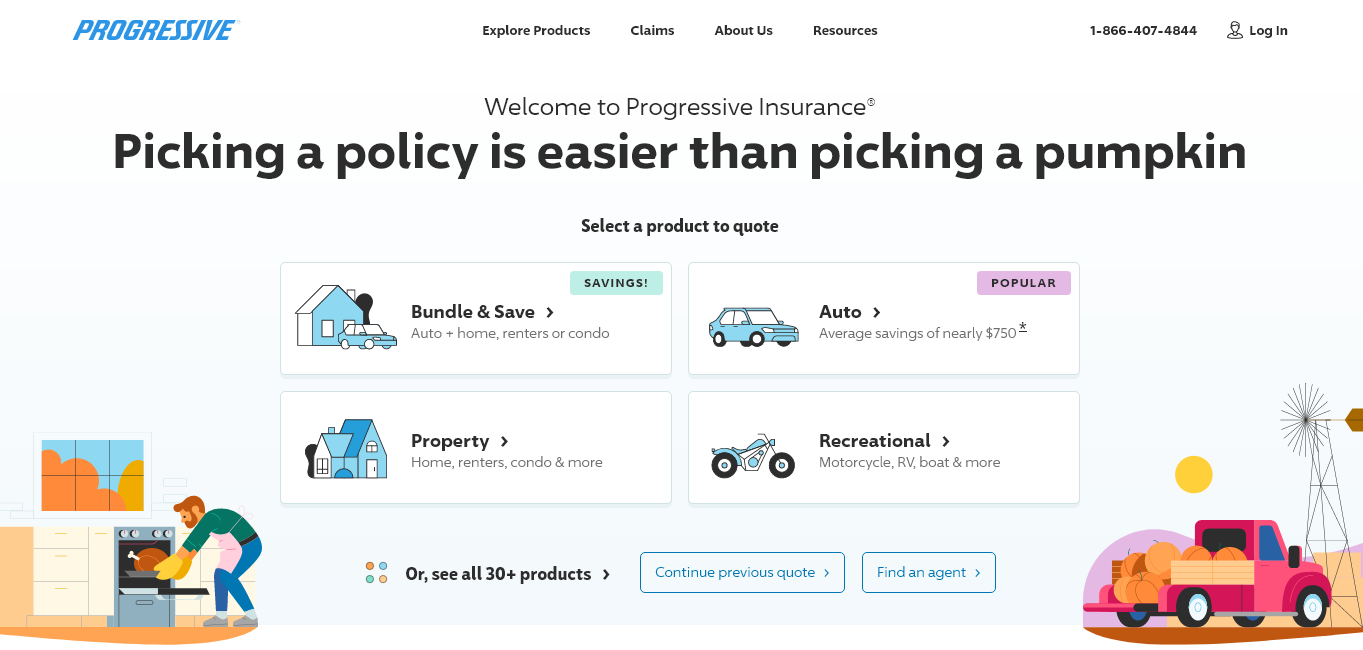

#1 – Progressive: Top Overall Pick

Pros

- Coverage Options: Progressive offers the best car insurance for foreigners with a wide range of coverage options, providing customers with the flexibility to tailor their policies to their specific needs.

- Competitive Foreign Driver Discount: Progressive provides a discount for foreign drivers, making their insurance offerings more accessible and affordable to international visitors. Explore further details about the company in our Progressive car insurance discount.

- Significant Multi-car Discount: Policyholders can benefit from substantial discounts when insuring multiple vehicles, potentially saving them a significant amount of money on their premiums.

Cons

- Customer Service Concerns: Some customers have reported issues with customer service, including delays and difficulty reaching representatives.

- Discount Limitations: The discount for foreign drivers is limited to 10%, which may be lower compared to some other providers.

#2 – State Farm: Best for Local Agents

Pros

- Extensive Network of Local Agents for Personalized Assistance: State Farm’s extensive agent network ensures personalized assistance, enhancing the customer experience. Learn more about the company by reading our State Farm car insurance review.

- Foreign Driver Discount Offered: State Farm provides a discount for foreign drivers, promoting inclusivity and making their insurance offerings more accessible to international visitors.

- Substantial Multi-car Discount Available: Policyholders can enjoy significant discounts when insuring multiple vehicles with State Farm, helping them save money on their premiums.

Cons

- Potentially Higher Rates: Some customers have reported relatively higher premium rates compared to other insurers.

- Limited Online Interaction: State Farm’s online interface may be less intuitive, and some services might require agent assistance.

#3 – Allstate: Best for Policy Options

Pros

- Range of Policy Options for Customization: Allstate offers a variety of policy options, allowing customers to customize their coverage according to their specific needs and preferences. Find additional insights about the company in our Allstate car insurance discounts.

- Foreign Driver Discount Provided: Allstate offers discounts for foreign drivers, making insurance more affordable and accessible to international visitors.

- Significant Multi-car Discount Available: Insuring multiple cars with Allstate can lead to substantial cost savings, significantly reducing premiums for policyholders.

Cons

- Premium Costs: Some policyholders find Allstate’s premiums relatively higher compared to other insurers.

- Claim Handling Concerns: There have been occasional reports of delays and complexities in the claims process.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#4 – Liberty Mutual: Best for Online Convenience

Pros

- Convenience of Online Platform for Policy Management: Liberty Mutual’s online platform offers convenient policy management for customers, providing flexibility and accessibility. Discover more about the company in our Liberty Mutual car insurance discounts.

- Discount Tailored for Foreign Drivers Offered: Liberty Mutual offers a discount specifically designed for foreign drivers, promoting inclusivity and affordability for international visitors.

- Substantial Multi-car Discount Available: Policyholders can benefit from notable discounts when insuring multiple vehicles with Liberty Mutual, helping them save money on their premiums.

Cons

- Higher Premiums for Some: Premiums may be relatively higher for certain demographics or regions.

- Limited Agent Interaction: Customers who prefer in-person agent interactions might find Liberty Mutual’s approach less extensive.

#5 – Farmers: Best for 24/7 Support

Pros

- 24/7 Customer Support Available: Farmers offers 24/7 support for enhanced convenience. Explore our Delve deeper into the company’s profile in our Farmers car insurance review.

- Discount for Foreign Drivers Provided: Farmers offers a discount for foreign drivers, enhancing affordability and accessibility for international visitors.

- Substantial Multi-car Discount Available: Insuring multiple vehicles with Farmers under one policy can lead to significant premium savings, helping policyholders reduce costs.

Cons

- Premiums Variation: Premium rates may vary significantly based on factors such as location and driving history.

- Policy Options Complexity: The abundance of policy options might be overwhelming for customers seeking simplicity.

#6 – Nationwide: Best for Vanishing Deductible

Pros

- Discount Specifically Designed for Foreign Drivers: Nationwide’s vanishing deductible promotes safe driving by reducing deductibles over time. Gain a deeper understanding of the company from our Nationwide car insurance discounts.

- Substantial Multi-car Discount Available: Insuring multiple vehicles with Nationwide significantly reduces premiums for policyholders.

- Vanishing Deductible Feature Rewards safe Driving: Nationwide’s vanishing deductible rewards safe driving, encouraging good habits.

Cons

- Limited Availability: Nationwide’s services may not be available in all states, potentially limiting choices for some customers.

- Policy Costs: Premium rates might be perceived as relatively higher compared to some competitors.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#7 – Esurance: Best for Safe–Driving Discounts

Pros

- Discount Aimed at Foreign Drivers for Affordability: Nationwide’s vanishing deductible rewards safe driving with reduced deductibles, incentivizing good driving habits. Find out more about the company by delving into our how do you get an Esurance car insurance quote?

- Additional Discounts for Safe Driving Habits: Esurance offers extra discounts for safe driving, rewarding policyholders and helping them save on premiums.

- Substantial Multi-car Discount Available: Insuring multiple vehicles with Esurance can save policyholders on premiums, offering cost-effective coverage.

Cons

- Customer Service Concerns: Some customers have reported dissatisfaction with customer service responsiveness.

- Policy Options Complexity: The variety of policy options may be overwhelming for customers seeking simplicity.

#8 – Travelers: Best for Multi–Policy Discounts

Pros

- Discount Specifically Tailored for Foreign Drivers: Travelers provides a discount tailored for foreign drivers, improving affordability and accessibility for international visitors. Uncover more about the company’s background in our Travelers car insurance review.

- Substantial Multi-Policy Discounts Available: Bundling home and auto policies with Travelers saves policyholders money.

- User-Friendly Online Platform for Policy Management: Travelers’ online platform provides convenience and flexibility for managing insurance policies.

Cons

- Premium Costs: Some policyholders may find Travelers’ premiums relatively higher compared to other insurers.

- Discount Limitations: Availability and eligibility for certain discounts may be subject to specific conditions.

#9 – American Family: Best for Embracing Bundle Savings

Pros

- Discount for Foreign Drivers Offered: American Family extends a discount aimed at foreign drivers, contributing to increased affordability and making their insurance offerings more accessible to international visitors. Find out more about the company by delving into our American Family car insurance review.

- Significant Multi-car Discount Available: Insuring multiple vehicles with American Family can save on premiums, reducing overall insurance costs for policyholders.

- Bundle Discounts for Combining Policies like home and auto: American Family offers bundle discounts for combining policies like home and auto, saving policyholders money.

Cons

- Limited Availability: American Family’s services may be limited to specific regions, potentially restricting choices.

- Policy Costs: Some policyholders may perceive American Family’s premium rates as relatively higher.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#10 – Erie: Best for Customizable Policies

Pros

- Discount Catering to Foreign Drivers for Affordability: Erie provides a discount for foreign drivers, enhancing affordability and accessibility for international visitors.

- Significant Multi-car Discount Available: Insuring multiple vehicles with Erie can save on premiums, reducing overall insurance costs for policyholders.

- Flexibility in Customizing Policies according to individual preferences: Erie offers customizable policies, allowing customers to tailor coverage to their needs. Gain a deeper understanding of the company from our Erie car insurance review.

Cons

- Regional Availability: Erie’s services may be limited to specific regions, potentially restricting choices for some customers.

- Limited Online Presence: The online platform may lack some features found with larger insurers.

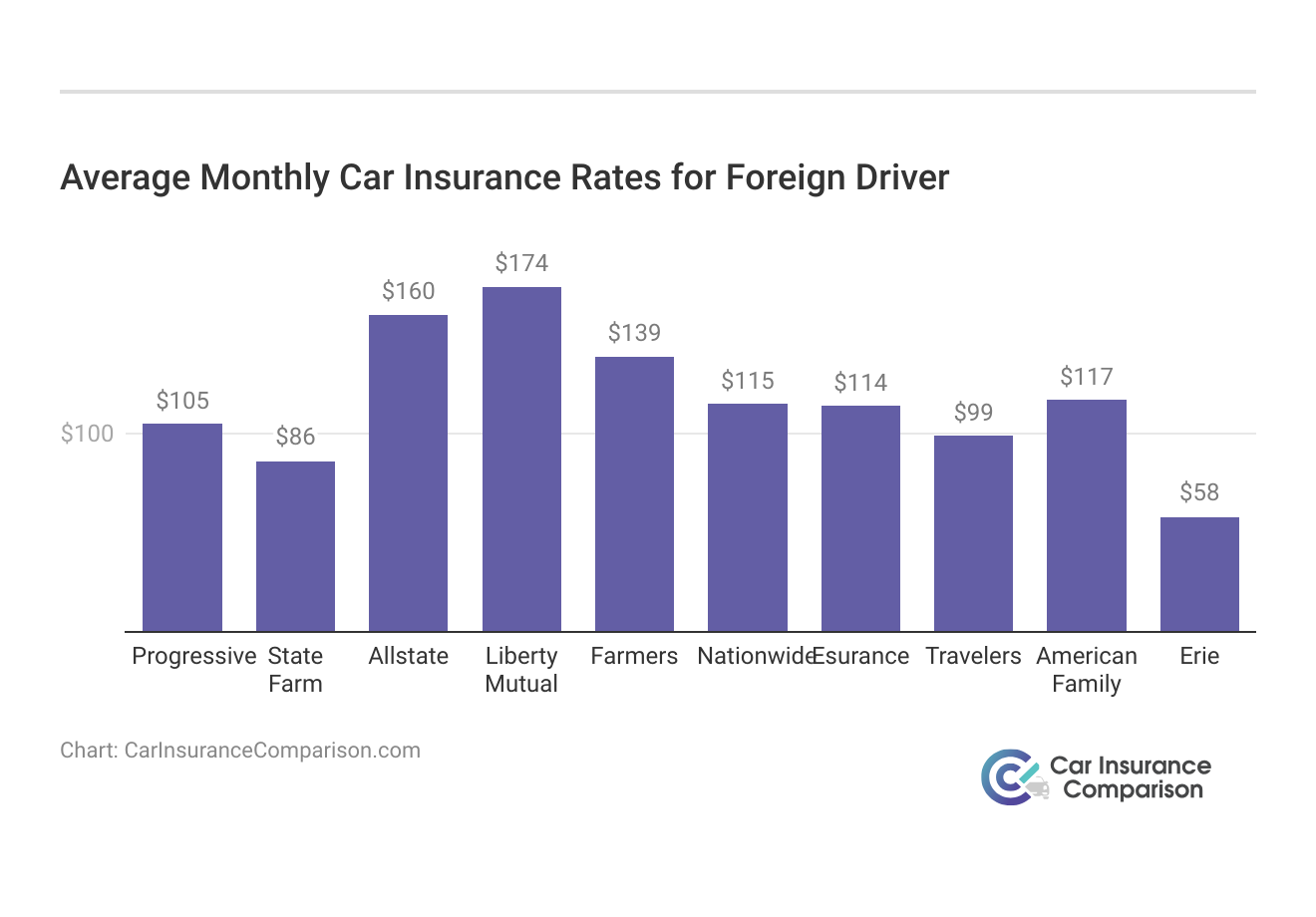

Top Car Insurance Rates for Foreigners

Navigating the complexities of car insurance can be particularly daunting for foreign drivers. Understanding the intricacies of coverage options and pricing can prove challenging, especially when presented with a multitude of insurance providers.

Foreign Drivers Car Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $61 | $160 | |

| $44 | $117 | |

| $22 | $58 |

| $46 | $114 | |

| $44 | $139 | |

| $68 | $174 |

| $44 | $115 |

| $39 | $105 | |

| $33 | $86 | |

| $37 | $99 |

To shed light on this matter, we have compiled a comparative overview of average monthly car insurance rates for foreign drivers across various insurance companies.

This data aims to provide clarity and aid in informed decision-making for those seeking insurance coverage while residing in a foreign country. From minimum coverage to full coverage options, we present a comprehensive breakdown of rates offered by prominent insurance providers. Compare international car Insurance: rates, discounts, & requirements.

Do I Need Car Insurance as a Foreign Driver

The minimum car insurance required by each state varies, but in most states, car owners are required to have liability car insurance coverage in place. This coverage protects the occupants in the other vehicle if a car accident occurs and you are at fault.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Which Companies Offer Car Insurance for Foreign Drivers

While many auto insurance providers cater primarily to domestic drivers, there are companies that recognize the unique needs of international visitors or individuals without a US address. Understanding which companies offer coverage to foreign drivers is essential for those seeking to comply with legal requirements and protect themselves financially while driving in the US.

Among the select few insurers that extend coverage to foreign drivers are Farmers and Progressive. These companies have tailored policies designed to accommodate the needs of international drivers, providing a pathway to obtain the necessary coverage without the requirement of a US address.

Read more: Does car insurance cover relatives with international driving permits?

Does a Foreign Driver’s License Work in the US

How do I Shop for USA Car Insurance

Shopping for car insurance in the USA as a visitor may seem daunting, but with the right approach, it can be manageable and cost-effective. Starting the process early can save you time and money. This guide outlines steps to effectively shop for car insurance during your visit, ensuring you have the coverage you need.

- Start Researching Insurance Options Online Before Your Trip: Begin researching insurance companies online before your trip to confirm they offer coverage for USA visitors.

- Obtain Multiple Insurance Quotes for Comparison: Obtain quotes from at least three insurance companies to compare prices.

- Verify State Licensing with Insurance Department: Verify that the insurance company is licensed in the state you plan to visit by contacting the Insurance Department of that state.

- Check Financial Ratings and Complaint Histories of Insurance Companies: Check the financial rating and complaint information of the insurance companies through resources like the National Association of Insurance Commissioners, A.M. Best, or Standard and Poor’s.

- Prioritize Coverage for International Drivers: Consider the basics when looking for auto insurance for international driver license for foreigners in USA, including coverage for international drivers.

- Choose Companies with High Customer Service Ratings: Choose Companies with High Customer Service Ratings: Look for insurance companies with good customer service ratings, as this is important in case of filing a claim.

- Know Your Vehicle Details for Accurate Coverage Quotes: Have information about the make and model of the vehicle you plan to buy to get a quote for coverage.

- Consider Rental Car Insurance Options: For rental cars, most rental companies offer insurance, so you may not need to seek coverage from an external provider.

By following these steps, you can find suitable car insurance coverage for your visit to the USA.

Read more: How do I get car insurance when moving to the USA?

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Can you Buy a Car in the USA as a Foreigner

For the sale to be a legal one, both parties are required to go to the local office of the state motor vehicle bureau. They must sign documents to affirm the sale and register the new ownership of the vehicle.

With their range of options tailored to different needs, you can drive with confidence knowing you’re protected wherever you go. Don’t let unexpected mishaps derail your journey; choose Progressive for peace of mind on the road.

Can you Get Tourist Car Insurance in the USA

- Understand Insurance Laws Before Your US Vacation: Tourists driving on vacation in the USA need to be aware of the ramifications of insurance law before they leave.

- Ensure Legal Insurance Coverage: It is illegal to operate a vehicle without some form of insurance coverage that meets local legal requirements.

- Know How Liability and Physical Damage Insurance Work: Liability car insurance usually follows the person purchasing the insurance but physical damage coverage on the vehicle itself stays with the individual vehicle.

Insurance regulations in the United States are complex and change from state to state. You may be wondering if your existing car insurance will extend to driving in the USA. The answer to this varies, as it depends on your insurer and if the limits apply to US insurance laws.

One thing that is always the same, though, is that every state requires that drivers carry insurance when driving. Tourists driving on vacation in the US need to be aware of the ramifications of insurance law before they leave.

For example, required car insurance California for foreigners may be different than what is required in Florida.

How can I Save on my Car Insurance Policy in the US

Consult your own automobile insurance company to determine if your insurance applies to a rental vehicle or one that you borrow from a friend or relative.

Many people want to know they can add a foreigner to their car insurance or if a foreigner can drive their car. You can add someone to your car insurance for a week.

Below are several ways of obtaining vehicle insurance for a rental or loaner vehicle:

- Car Insurance for New Drivers: Rely on liability insurance from your own automobile policy.

- Check Credit Card Rental Insurance Benefits: Obtain insurance on a rental vehicle through your credit card (some companies offer insurance as one of their benefits).

- Buy Physical Damage Coverage from Rental Agency: Purchase physical damage coverage for the vehicle itself from the rental agency.

- Get Added as a Driver to a Friend or Family Member’s Policy: Request the friend or family member you are borrowing the car from add you as a driver to their insurance policy for a specific vehicle.

- Consider Short-Term Car Insurance for Comprehensive Coverage: Purchase a short-term car insurance policy to provide liability and physical damage coverage for you.

As we’ve already noted, US residents can temporarily add you to their policy if they plan to lend you one of their vehicles to drive while you’re in the country.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

What Car Insurance Should I Get for Short-Term/Long-Term Visits

Shop for the best liability-only car insurance with our free quote comparison tool. Enter your ZIP code to begin.

Can Foreign Nationals Drive in the US

Individuals driving in the United States must have a valid driver’s license. Since each state has differing regulations, contact that state’s motor vehicle department to ascertain its requirements.

USA.gov states that an International Driving Permit (IDP) is often required in addition to a valid license from your own country to acquire a driver’s license from the state.

The United States does not issue International Driving Permits for non-residents, so it is necessary to contact that country’s driver’s license issuing entity or motoring association.

Renting a vehicle in the United States requires a driver’s license, so you’ll need to obtain an IDP and possibly a temporary license in the state(s) you plan to visit (this is typically important if your stay is a long one).

One driver’s license from a single state will ordinarily be enough for your entire visit. So if you need car insurance but have a Chinese license, or need car insurance with an Indian driving license, you will first need to get a USA driver’s temporary license. To learn more, check out our best car insurance for international visa holders in the US.

Finding cheap car insurance quotes is easy. Just enter your ZIP code into our free comparison tool to instantly compare quotes near you.

Where to Get Car Insurance as a Foreign Driver

Things to do to acquire car insurance in the USA for foreign drivers:

- Familiarize Yourself with US Road Rules: Learn US rules of the road; any Department of Motor Vehicles can offer you this information

- Secure Necessary Driving Documentation: An IDP is required, as well as a license from your country of residence; you may also need a temporary US driver’s license if you plan an extended stay

- Research Insurance Companies Specializing in Foreigner Coverage: Look online for insurance companies that specialize in car insurance in the USA for foreigners

- Gather Insurance Quotes and Information: Contact insurance companies and collect information and quotes on the cost of this insurance

For example, ask about Geico car insurance and foreign licenses or Progressive car insurance for international students in the USA to get help on specialized car insurance. It will be slightly more difficult for you to find the right car insurance as a foreign driver because not all companies offer this option, and at a reasonable price.

Progressive is one of the few larger companies to offer this option, and at a fairly reasonable rate. You may also have luck finding insurance with smaller companies, like Dairyland insurance, Hallmark, and Assurance America.

Speaking to an independent agent would be a good idea in this situation. They can provide personalized guidance, evaluate different insurance options, and help you understand the nuances of each policy. With their expertise, they can identify why Progressive stands out as the best car insurance for foreigners that best fits your specific circumstances.

Taking the time to consult with an agent can save you both time and money, ensuring you get the coverage you need without overpaying.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

How Much Car Insurance You Need in the United States

Each state has its own laws for required limits of liability (recall we listed these in a previous section). Go through this checklist to determine what coverage you need:

- Bodily Injury Liability: Coverage for your legal liability should you be responsible for an accident; recommended limits of liability are typically $100,000 per person and $300,000 per accident

- Property Damage Liability: Coverage for legal liability for property damage to others if you are responsible for an accident; $50,000 is the recommended limit for this type of coverage

- Underinsured and Uninsured Motorist Coverage: Pays for injury to you and your passengers if you’re in an accident involving someone without insurance; most people are responsible, but about 13% of US drivers are currently uninsured.

These amounts may be higher than the minimum requirement but are recommended in order to ensure you have appropriate protection.

This table breaks down the penalties for driving without insurance in each state. Search for your state in the box below.

Penalties for Driving Without Car Insurance by State

| State | 1st Offense | 2nd Offense |

|---|---|---|

| Alabama | Fine: Up to $500; registration suspension with $200 reinstatement fee | Fine: Up to $1,000 and/or six-month license suspension; $400 reinstatement fee with four-month registration suspension |

| Alaska | License suspension for 90 days | License suspension for one year |

| Arizona | Fine: $500 (or more); license/registration/license plate suspension for three months | Fine: $750 (or more within 36 months); license/registration/license plate suspension for six months |

| Arkansas | Fine: $50 to $250; suspended registration/no plates until proof of coverage plus $20 reinstatement fee; the court may order impoundment | Fine: $250 to $500 fine — minimum fine mandatory; suspended registration/no plates until proof of coverage plus $20 reinstatement fee. The court may order impoundment. |

| California | Fine: $100-$200 plus penalty assessments. The court may order impoundment | Fine: $200-$500 within three years plus penalty assessments. The court may order impoundment |

| Colorado | Fine: $500 minimum fine; 4 points against your license; license suspension until you can show proof to the DMV that you are insured. Courts may add up to 40 hours community service | $1,000 minimum fine and license suspension for 4 months; 4 points against your license. Courts may add up to 40 hours of community service |

| Connecticut | Fine: $100-$1000; suspended registration/license for one month (show proof of insurance) with $175 reinstatement fee | Fine: $100-$1000; suspended registration/license for six months (show proof of insurance) with $175 reinstatement fee |

| Delaware | Fine: $1500 minimum fine; license/privilege suspension for six months | Fine: $3000 minimum fine within three years; license/privilege suspension for six months |

| Florida | Suspension of license and registration until reinstatement fee is paid and non-cancelable coverage is secured; $150 fee for first reinstatement | Suspension of license and registration until reinstatement fee is paid and non-cancelable coverage is secured; $250 fee for the second reinstatement |

| Georgia | Suspended registration with a $25 lapse fee and $60 reinstatement fee. Pay any other registration fees and vehicle ad valorem taxes due | Within five years: Suspended registration with $25 lapse fee and $60 reinstatement fee. Pay any other registration fees and vehicle ad valorem taxes due |

| Hawaii | Fine: $500 fine or community service granted by the judge. Either license suspension for three months or a required nonrefundable insurance policy in force for six months | Fine: $1500 minimum fine within five years; either license suspension for one year or a required non-refundable insurance policy in force for six months |

| Idaho | Fine: $75; license suspension until financial proof. No reinstatement fee. | Fine: $1000 maximum fine within five years and/or no more than six months in jail; license suspension until financial proof. No reinstatement fee. |

| Illinois | Fine: minimum of $500; License plate suspension until $100 reinstatement fee and insurance proof | Fine: minimum of $1,000; License plate suspension for four months; $100 reinstatement fee and insurance proof |

| Indiana | License/registration suspension for 90 days to one year | Within three years: license/registration suspension for one year |

| Iowa | Fine: $500 if in an accident; Otherwise, fine: $250; community service in lieu of fine. Possible citation/warning if pulled over plus removal of plates and registration possible when pulled over without insurance and reissued upon payment of fine or completed community service, proof of insurance, and $15 fee; possible impoundment when pulled over | NA |

| Kansas | Fine: $300 to $1000 and/or confinement in jail up to six months; license/registration suspension; reinstatement fee: $100 | Fine: $800 to $2500 within three years; license/registration suspension; reinstatement fee: $300 if revoked within previous year, otherwise $100 |

| Kentucky | Fine: $500 to $1000 fine and/or sentenced up to 90 days in jail; license plates and registration revoked for one year or until proof of insurance is shown | Within five years: 180 days in jail and/or $1000 to $2500; license plates and registration revoked for one year or until proof of insurance is shown |

| Louisiana | Fine: $500 to $1000; If in a car accident, fine plus registration revoked and driving privileges suspended for 180 days | NA |

| Maine | Fine: $100 to $500; suspension of license and registration until proof of insurance | NA |

| Maryland | Lose license plates and vehicle registration privileges; pay uninsured motorist penalty fees for each lapse of insurance — $150 for the first 30 days, $7 for each day thereafter; Pay a restoration fee of up to $25 for a vehicle's registration | NA |

| Massachusetts | Fine: $500 to $5000 fine and/or imprisonment for one year or less | Within six years: License/driving privileges suspended for one year |

| Michigan | Fine: $200 to $500 fine and/or imprisonment for one year or less; license suspension for 30 days or until proof of insurance; $25 service fee to Secretary of State | NA |

| Minnesota | Fine: $200 to $1000 (or community service) and/or imprisonment for up to 90 days; License and registration revoked for no more than 12 months | NA |

| Mississippi | Fine: $1000; driving privileges suspended for one year or until proof of insurance | NA |

| Missouri | Four points against driving record; the driver may be supervised; suspended until proof of insurance with $20 reinstatement fee | Four points against driving record; the driver may be supervised; suspended for 90 days with $200 reinstatement fee |

| Montana | Fine: $250 to $500 fine and/or imprisonment for no more than 10 days | Fine: $350 and/or imprisonment for no more than 10 days — within 5 years; license and registration revoked until proof of insurance and payment of reinstatement fees within 90 days |

| Nebraska | License and registration suspension; reinstatement fee of $50 for each; proof of insurance to remain on file for three years | NA |

| Nevada | Fine: $250 to $1,000 depending on the length of lapse; registration suspension — until payment of reinstatement fee and, depending on circumstances, an SR-22 (proof of financial responsibility) if lapsed more than 90 days; reinstatement fee: $250 | Fine: $500 to $1000 depending on the length of lapse; registration suspension — until payment of reinstatement fee and, depending on circumstances, SR-22 (proof of financial responsibility) if lapsed more than 90 days; Reinstatement fee: $500 |

| New Hampshire | Not a mandatory insurance state. Proof of insurance may be required as the result of a conviction, crash involvement, or administrative action. If you are required to file proof of insurance and vehicles are registered in your name, you will be required to file an Owner’s SR-22 Certificate of Insurance. | NA |

| New Jersey | Fine: $300 to $1000; license suspension for one year; pay surcharges for three years in the amount of $250 per year | Fine: up to $5000; two-year license suspension; 14-day, mandatory jail term, and an additional mandatory 30 days of community service |

| New Mexico | Fine: up to $300 and/or imprisoned for 90 days; license suspension | NA |

| New York | Fine: up to $1500 if involved in accident plus $750 civil penalty; license and registration suspension – revoked for one year; suspension of the license if without insurance for 90 days; suspension lasts as long as registration suspension; Suspension of registration: equal to time without insurance or pays $8/day up to thirty days for which financial security was not in effect, $10/day from the thirty-first to the sixtieth day $12/day from the sixtieth to the ninetieth day and proof of security is provided. Or for the same time as the vehicle was operated without insurance. | NA |

| North Carolina | Fine: $50; registration suspension until proof of financial responsibility but 30-day suspension if in a car accident or knowingly driving without insurance; $50 restoration fee plus license plate fee | Fine: $100 within three years; registration suspension until proof of financial responsibility but 30-day suspension if in a car accident or knowingly driving without insurance; $50 restoration fee plus license plate fee |

| North Dakota | Fine: up to $1500 and/or 30 days in prison; 14 points against license plus suspension; Proof of insurance must be provided for one year; license with a notation requiring that person keep proof of liability insurance on file with the department. The fee for this license is $50, and the fee to remove this notation is $50. | Fine: up to $1500 and/or 30 days in prison; 14 points against license plus suspension; license plates impounded until proof of insurance (provided for one year) plus $20 reinstatement fee; license with a notation requiring that person keep proof of liability insurance on file with the department. The fee for this license is $50 and the fee to remove this notation is $50. |

| Ohio | License/plates/registration suspension until requirements are met and $100 reinstatement fee is paid; maintain special high-risk coverage on file with the BMV for three to five years; If involved in an accident without insurance: all above penalties and a security suspension for two-plus years and an indefinite judgment suspension (until all damages are satisfied) | License/plates/registration suspension for one year; $300 reinstatement fee; maintain special high-risk coverage on file with the BMV for three or five years; if involved in an accident without insurance: all above penalties and a security suspension for two-plus years and an indefinite judgment suspension (until all damages are satisfied) |

| Oklahoma | Fine: $250; jail time up to 30 days; license suspension with $275 reinstatement fee. Police can seize license plates and assign temporary plates and liability insurance — in effect for 10 days and can also impound the vehicle. The cost of the temporary coverage is added to the administrative fee and any fines paid for plates to be returned. If the car impounded, the owner must also pay towing and storage fees. | NA |

| Oregon | Fine: $130-$1000 ($260 is the presumptive fine); If involved in an accident — at least a one-year license suspension; proof of financial responsibility required for three years | NA |

| Pennsylvania | Registration suspended for three months (unless lapse was for less than 31 days and the vehicle not operated during that time); $88 restoration fee plus proof of insurance required to get it back; $500 civil penalty fee is optional in lieu of registration suspension plus $88 restoration fee — can only use this option once within a 12-month period | NA |

| Rhode Island | Fine: $100 to $500; license and registration suspension up to three months; reinstatement fee: $30 to $50 | Fine: $500; license and registration suspension up to six months; reinstatement fee: $30 to $50 |

| South Carolina | Fine: $100-$200 or 30-day imprisonment; failure to surrender registration and plates when insurance lapses; license/registration suspended until proof of insurance plus $200 reinstatement fee | Fine: $200 and/or 30-day imprisonment — within 10 years; license/registration suspended until proof of insurance plus $200 reinstatement fee |

| South Dakota | Fine: $100 and/or 30 days imprisonment; license suspension for 30 days to one year; filing proof of insurance (SR-22) with the state for three years from the date of conviction. Failure to file proof will result in the suspension of vehicle registration, license plates, and driver license. | NA |

| Tennessee | Pay $25 coverage failure fee within 30 days of notice; if not paid, then an additional $100 coverage failure fee with suspension or revocation of registration plus reinstatement fee of no more than $25 | NA |

| Texas | Fine: $175 to $350 fine; plus, pay up to a $250 surcharge every year for three years (may be reduced with certain requirements) | Fine: $350 to $1000; pay up to a $250 surcharge every year for three years (may be reduced with certain requirements); suspend the driver's license and vehicle registrations of the person unless the person files and maintains evidence of financial responsibility with the department until the second anniversary of the date of the subsequent conviction; Impoundment: for 180 days and cannot apply for the release of the car without evidence of financial responsibility and an impoundment fee of $15/day. |

| Utah | Fine: $400; license suspension until proof of insurance (maintained for three years) and $100 reinstatement fee | Fine: $1000 — with three years; license suspension until proof of insurance (maintained for three years) and $100 reinstatement fee |

| Vermont | Fine: up to $500; license suspended until proof of insurance | NA |

| Virginia | Fine: may pay $500 Uninsured Motorists Vehicle fee to drive without insurance at your own risk. If this fee is not paid in lieu of insurance, all driving and vehicle registration privileges will be suspended until a $500 statutory fee is paid, proof of insurance is filed for three years, and a reinstatement fee (if applicable) is paid | NA |

| Washington | Fine: Up to $250 or more | NA |

| West Virginia | Fine: $200 to $5000; license suspended for 30 days with reinstatement fees, unless there's proof of insurance and $200 penalty fee | Fine: $200-$5000 fine and/or 15 days to one year in jail — within five years; license suspended for 90 days and registration revoked until proof of insurance |

| Wisconsin | Fine: up to $500 | NA |

| Wyoming | Fine: up to $750 fine and up to six months in jail | NA |

In this comprehensive guide, we delve into the penalties imposed by each state for driving without car insurance. From fines to license suspensions and other legal repercussions, we explore the consequences drivers may face for failing to maintain proper insurance coverage.

Read more:

- Citizens Insurance Michigan Car Insurance Review

- What is the penalty for driving without insurance in Hawaii?

- What is the penalty for driving without insurance in New Mexico?

State-by-State Minimum Car Insurance Requirements

Understanding these minimum liability requirements is crucial for drivers to ensure they are adequately covered and compliant with the law. Here’s a concise breakdown of the minimum liability car insurance requirements by state.

Car Insurance Minimum Liability Requirements by State

| State | Coverages | Limits |

|---|---|---|

| Alabama | Bodily injury and property damage liablity | 25/50/25 |

| Alaska | Bodily injury and property damage liablity | 50/100/25 |

| Arizona | Bodily injury and property damage liablity | 15/30/10 |

| Arkansas | Bodily injury, property damage liablity, and personal injury protection | 25/50/25 |

| California | Bodily injury and property damage liablity | 15/30/5 |

| Colorado | Bodily injury and property damage liablity | 25/50/15 |

| Connecticut | Bodily injury, property damage liablity, and uninsured motorist/underinsured motorist | 25/50/20 |

| Delaware | Bodily injury, property damage liablity, and personal injury protection | 25/50/10 |

| District of Columbia | Bodily injury, property damage liablity, and Uninsured Motorist | 25/50/10 |

| Florida | Property damage liablity, and personal injury protection | 10/20/10 |

| Georgia | Bodily injury and property damage liablity | 25/50/25 |

| Hawaii | Bodily injury, property damage liablity, and personal injury protection | 20/40/10 |

| Idaho | Bodily injury and property damage liablity | 25/50/15 |

| Illinois | Bodily injury, property damage liablity, and uninsured motorist/underinsured motorist | 25/50/20 |

| Indiana | Bodily injury and property damage liablity | 25/50/25 |

| Iowa | Bodily injury and property damage liablity | 20/40/15 |

| Kansas | Bodily injury, property damage liablity, and personal injury protection | 25/50/25 |

| Kentucky | Bodily injury, property damage liablity, personal injury protection, and uninsured motorist/underinsured motorist | 25/50/25 |

| Louisiana | Bodily injury and property damage liablity | 15/30/25 |

| Maine | Bodily injury, property damage liablity, uninsured motorist/underinsured motorist, and MedPay | 50/100/25 |

| Maryland | Bodily injury, property damage liablity, personal injury protection, and uninsured motorist/underinsured motorist | 30/60/15 |

| Massachusetts | Bodily injury, property damage liablity, and personal injury protection | 20/40/5 |

| Michigan | Bodily injury, property damage liablity, and personal injury protection | 20/40/10 |

| Minnesota | Bodily injury, property damage liablity, personal injury protection, and uninsured motorist/underinsured motorist | 30/60/10 |

| Mississippi | Bodily injury and property damage liablity | 25/50/25 |

| Missouri | Bodily injury, property damage liablity, and Uninsured Motorist | 25/50/25 |

| Montana | Bodily injury and property damage liablity | 25/50/20 |

| Nebraska | Bodily injury, property damage liablity, and uninsured motorist/underinsured motorist | 25/50/25 |

| Nevada | Bodily injury and property damage liablity | 25/50/20 |

| New Hampshire | Financial responsibility (None required) | 25/50/25 |

| New Jersey | Bodily injury, property damage liablity, personal injury protection, and uninsured motorist/underinsured motorist | 15/30/5 |

| New Mexico | Bodily injury and property damage liablity | 25/50/10 |

| New York | Bodily injury, property damage liablity, personal injury protection, and uninsured motorist/underinsured motorist | 25/50/10 |

| North Carolina | Bodily injury, property damage liablity, and uninsured motorist/underinsured motorist | 30/60/25 |

| North Dakota | Bodily injury, property damage liablity, personal injury protection, and uninsured motorist/underinsured motorist | 25/50/25 |

| Ohio | Bodily injury and property damage liablity | 25/50/25 |

| Oklahoma | Bodily injury and property damage liablity | 25/50/25 |

| Oregon | Bodily injury, property damage liablity, personal injury protection, and uninsured motorist/underinsured motorist | 25/50/20 |

| Pennsylvania | Bodily injury, property damage liablity, and personal injury protection | 15/30/5 |

| Rhode Island | Bodily injury and property damage liablity | 25/50/25 |

| South Carolina | Bodily injury, property damage liablity, and uninsured motorist/underinsured motorist | 25/50/25 |

| South Dakota | Bodily injury, property damage liablity, and uninsured motorist/underinsured motorist | 25/50/25 |

| Tennessee | Bodily injury and property damage liablity | 25/50/15 |

| Texas | Bodily injury, property damage liablity, and personal injury protection | 30/60/25 |

| Utah | Bodily injury, property damage liablity, and personal injury protection | 25/65/15 |

| Vermont | Bodily injury, property damage liablity, and uninsured motorist/underinsured motorist | 25/50/10 |

| Virginia | Bodily injury, property damage liablity, and uninsured motorist/underinsured motorist | 25/50/20 |

| Washington | Bodily injury and property damage liablity | 25/50/10 |

| West Virginia | Bodily injury, property damage liablity, and uninsured motorist/underinsured motorist | 25/50/25 |

| Wisconsin | Bodily injury, property damage liablity, uninsured motorist, and MedPay | 25/50/10 |

| Wyoming | Bodily injury and property damage liablity | 25/50/20 |

Understanding minimum car insurance requirements by state is essential for ensuring you’re adequately covered and compliant with the law. Below is a brief overview of these requirements across various states.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Demystifying Minimum Car Insurance Abbreviations

Deciphering the minimum liability insurance requirements for each state can be overwhelming, with various abbreviations and coverage types to consider. To streamline the process, we’ve outlined the meanings of key abbreviations commonly found in car insurance policies, making it easier to understand the minimum coverage needed in each state.

Car Insurance Abbreviations: Minimum Liability Coverage Types

| Abbreviation | Meaning |

|---|---|

| BI | Bodily Injury |

| PD | Property Damage Liability |

| PIP | Personal Injury Protection |

| UM | Uninsured Motorist |

| UIM | Underinsured Motorist |

Decoding the abbreviations used in minimum car insurance requirements can be confusing. To simplify things, we’ve defined key terms you’ll encounter in insurance policies, helping you grasp the coverage needed in each state.

For additional information, read our compare liability car Insurance: rates, discounts, & requirements.

Physical Damage Protection

While not legally required to drive in the US, physical damage coverage for the vehicle you are driving is important to protect you from damage. This coverage consists of comprehensive car insurance and collision insurance. Comprehensive insurance covers wind, hail, flood, theft, glass damage, vandalism, and animal damage, among other things, but only for your vehicle. A deductible applies to this coverage.

Collision insurance covers damage to your vehicle in the event of a collision with another car or another object. A deductible applies to this coverage. Rental companies typically offer physical damage coverage for the vehicle you are renting (usually for an additional charge). Read the contract carefully to determine the extent of this coverage. You may save money if you shop at different rental agencies and compare prices.

If you are a US citizen, it is relatively easy to acquire insurance that will cover your responsibilities when driving in another state. Foreign nationals and individuals living within the parameters of a visa need to acquire a valid driver’s license in their state.

Can Non-US Citizens Get Car Insurance

Read this step-by-step guide and learn how to get insurance when you are not a resident.

Step 1: Obtaining an IDP

You need to check to see which licenses are recognized and which are not. If you are not a foreign national of a country like Mexico or Canada, you will need to apply for an IDP regardless of your foreign driving experience. Read our compare undocumented immigrant car insurance rates for more information.

To obtain an International Driving Permit (IDP), follow these steps:

-

Check Eligibility: Ensure you meet the eligibility criteria to apply for an IDP. Typically, you must be at least 18 years old and possess a valid driver’s license issued by your home country.

-

Visit an Authorized Agency: IDPs are typically issued by automobile associations or similar organizations authorized by your country’s government. Visit their website or contact them to find out where you can apply.

-

Prepare Required Documents: You’ll usually need to provide a completed application form, your valid driver’s license, passport-sized photographs, proof of identity (e.g., passport), and an application fee.

-

Submit Your Application: Visit the authorized agency in person or apply online if that option is available. Ensure all required documents are included with your application.

-

Pay the Fee: Pay the application fee, which varies depending on your country and the agency you’re applying through.

-

Receive Your IDP: Once your application is processed and approved, you’ll receive your IDP. It’s usually issued on the spot if you apply in person, but if you apply online, it will be sent to your provided address.

-

Check Validity and Restrictions: Be aware of the validity period and any restrictions associated with your IDP. It’s typically valid for one year from the date of issue and allows you to drive in over 150 countries.

-

Travel with Your IDP: Always carry your IDP along with your valid driver’s license when driving in a foreign country. The IDP serves as a translation of your license and is recognized as a legal document in many countries.

Read more:

- Compare Mexican Car Insurance: Rates, Discounts, & Requirements

- Compare Car Insurance for Traveling in Canada: Rates, Discounts, & Requirements

- Compare the Best Car Insurance Companies in Canada

International Driving Permit

How to Apply for an IDP

Planning to drive abroad? You’ll likely need an International Driving Permit (IDP) to ensure smooth travels. This essential document translates your native driver’s license into multiple languages, allowing you to drive legally in over 150 countries. In this guide, we’ll walk you through the simple steps to apply for an IDP, ensuring you’re well-prepared for your international driving adventures.

- Contact a Local Travel Agency or Automobile Association: Reach out to a local travel agency or automobile association in your country that is authorized to issue IDPs. They can provide you with the necessary application forms and guidance on the application process.

- Prepare Required Documents: Gather the documents required for the application, such as an application.

- Fill out the Application Form: Complete the application form accurately and legibly, providing all the required information.

- Submit the Application: Submit your completed application form, along with the necessary documents and any applicable fees, to the issuing authority. This may be done in person or by mail, depending on the procedures of the issuing organization.

- Wait for Processing: Allow sufficient time for the processing of your application. Processing times may vary depending on the issuing authority and other factors, so it’s advisable to apply well in advance of your planned trip.

- Receive your IDP. Once your application is approved, you will receive your International Driving Permit. Ensure that all the information on the IDP is accurate and matches your native driver’s license.

- Use your IDP Responsibly: Carry your IDP along with your native driver’s license whenever you drive in a foreign country. Remember that the IDP is valid for a limited period, typically up to 12 months, so be mindful of its expiration date.

Step 2: Knowing What Documents You Need

If you are renting a car, applying for an IDP, applying for a US driver’s license, or applying for car insurance, you are going to need several different documents.

Rental car agencies will require both your IDP and your foreign license. If you’re applying for a US driver’s license as a foreign resident, the documents that you need may vary from state to state, but in most cases, you are required to show you:

- Foreign license

- Immigration documents

- Passport

- Proof of social security number

- Proof of your duration of stay in the US

- Proof of residency

- Proof of valid car insurance (when you own a personal vehicle)

The documents required to apply for your car insurance are extremely important. Failing to bring the right documents with you could be the difference between being eligible or ineligible for coverage.

Documents you should have before leaving your home country include:

- IDP

- Copy of out-of-country license

- Abstract of your driving record translated into English

- Letter of experience from a prior insurance company showing the initial date of inception

- Claims history letter detailing claim dates and payout amounts

Without these documents, you may still be able to find a company that will insure you, but without the right documents, you are going to pay a huge sum for your protection.

Step 3: Obtaining Affordable Auto Insurance Rates

Now that you can legally drive in the country and have all the documents you need to get insurance, you can shop the market. One of the best ways to save money on your car insurance in the US is to shop around. This will help you with finding the cheapest car insurance quotes for international drivers.

As a resident non-citizen, you can still compare rates, you just need to be more aware of the company’s requirements. There will be limitations surrounding which companies will extend coverage to you and how you will be classified as a driver.

Keep reading to learn more about some considerations to keep in mind as you shop around. Progressive is often considered the best car insurance for foreigners, offering competitive rates and excellent customer service. Their wide range of coverage options can cater to various needs, whether you’re a student, a seasoned traveler, or a new driver in a foreign country.

Understanding your options and comparing different plans can help you make an informed decision that not only provides the protection you need but also fits your budget. Don’t rush into a decision; take the time to explore and find the right insurance solution for your international adventures.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

How to Get Car Insurance With an International Driver’s Permit

Having an IDP license or a newly issued driver’s license can affect your rates when you choose a company that will not give you prior experience credits.

If you are classified as a new driver because your permit or license was recently issued, you will pay rates similar to those offered to teenage drivers.

How do you handle a car insurance policy when moving out of state? It’s essential to understand that while buying car insurance as a resident can seem daunting, it doesn’t have to be difficult. Especially since teens pay nearly double the rate of the average driver, finding companies willing to offer experience credits becomes crucial.

Tips on How to Buy Car Insurance for Foreign Drivers

There are some things to consider when you are looking for auto insurance as a foreign driver.

A few tips are:

- Assess Your Daily Car Needs: Figure out if you need a car daily. If you are somewhere that offers public transportation, you might not need a car. You can always rent a car for those road trips you want to take.

- Evaluate Necessary Insurance Coverage: Consider the coverage you need. Although you want to make sure you meet your state minimum requirements, you might want to add additional coverages. The last thing you want is to have to pay out of pocket for damages to your vehicle.

- Obtaining a US Driver’s License for Long-Term Stays: If you’re going to be in the US for more than a year, you might want to get a US driver’s license. This will help you find car insurance when you need it.

There are a lot of factors to look at when you’re looking for car insurance and don’t live in the US Asking questions and shopping around will ensure you can find the coverage you need.

For additional information, read our: Car Insurance for New Drivers.

Case Studies in Obtaining Car Insurance for Foreign Drivers in the USA

Navigating car insurance in the USA as a foreign driver can be challenging. In these case studies, we explore real-life experiences of tourists, students, and residents who faced unique hurdles and found solutions to secure suitable coverage.

- Case Study #1 – Maria’s Journey as a Tourist Driver: Maria, a tourist in the USA, wanted to buy a car for her stay but struggled to find insurance without a U.S. license. After research, she found Progressive offers coverage for foreign drivers.

- Case Study #2 – James’s Experience Renting a Car: James, a foreign visitor to the USA, rented a car with the agency’s insurance. He later found out that U.S. companies like Farmers and Progressive offer insurance for international drivers, realizing he could have found a more cost-effective option independently.

- Case Study #3 – Emily’s Dilemma with Foreign License: Emily, a non-U.S. resident with a foreign license, struggled to find affordable car insurance. While some big companies like Liberty Mutual and Nationwide offered coverage, rates were high.

- Case Study #4 – Alex’s Strategy for Cost Savings: Alex, a budget-conscious foreign driver in the U.S., compared quotes from companies like Esurance and Travelers. Using the competitive market, he found affordable coverage that met his needs without sacrificing quality.

- Case Study #5 – Sarah’s Seamless Transition to U.S. Roads: Sarah, an international student in the USA, followed an article’s guide to get car insurance for her new vehicle. She got an International Driving Permit, applied for a U.S. license, and secured coverage with Allstate, making her transition to U.S. driving smooth and legal.

For additional information, read our: Can you get U.S. Car Insurance With a Canadian License?

Frequently Asked Questions

Can foreign drivers find affordable car insurance in the USA?

Yes, foreign drivers can find cheap car insurance for foreign drivers in the USA by comparing rates from different insurance companies. It’s essential to research insurance providers that offer coverage to foreign drivers and obtain quotes to find the best rates.

Check out our car insurance comparison for further details.

Can international drivers find affordable car insurance in the USA?

Yes, international drivers can find cheap car insurance for international drivers in the USA by comparing rates from different insurance companies. It’s essential to research insurance providers that offer coverage to international drivers and obtain quotes to find the best rates.

Can international drivers find affordable car insurance in the USA with a foreign license?

Can international drivers obtain car insurance from Geico with a foreign driver license?

Yes, international drivers can obtain Geico foreign driver license car insurance in the USA. Geico offers insurance options specifically designed for individuals with foreign driver licenses. By contacting Geico and exploring their policies, international drivers can find suitable coverage tailored to their needs.

Can foreign drivers obtain car insurance from Progressive with a foreign license?

Yes, foreign drivers can obtain Progressive car insurance foreign license in the USA. Progressive offers insurance options specifically tailored to individuals with foreign licenses. By contacting Progressive and exploring their policies, foreign drivers can find suitable coverage that meets their needs. Explore our how do you get Progressive car insurance quotes online? to learn more.

Is tourist car insurance available for visitors to the USA?

Yes, tourist car insurance is available for visitors to the USA. This type of insurance provides coverage for individuals who are visiting the country and need temporary car insurance for their stay. By exploring options offered by various insurance providers, tourists can find suitable coverage that meets their needs while complying with legal requirements.

Can international drivers obtain US auto insurance for international drivers?

Yes, international drivers can obtain US auto insurance for international drivers in the USA. Certain insurance providers offer specialized policies designed to cater to the needs of international drivers. By researching and contacting insurance companies that offer such coverage, international drivers can find suitable insurance options for their time in the USA.

Get the right car insurance at the best price — enter your ZIP code to shop for coverage from the top insurers.

Can foreign drivers purchase car insurance in USA for foreign drivers?

Yes, foreign drivers can purchase car insurance in USA for foreign drivers. Several insurance companies offer policies specifically tailored to the needs of foreign drivers visiting or residing in the USA. By researching and comparing quotes from different insurers, foreign drivers can find the coverage that best suits their requirements and legal obligations while driving in the USA.

Can foreigners obtain USA car insurance for foreigners?

Yes, international car insurance USA is available for drivers in the USA. Several insurance companies offer specialized policies designed to cater to the needs of international drivers visiting or residing in the USA. By researching and comparing quotes from different insurers, drivers can find the coverage that best suits their requirements and legal obligations while driving in the USA.

Dive into our compare Canadian vs. US car insurance: rates, discounts, & requirements for comprehensive details.

How can I Save on my Car Insurance Policy in the US?

To save on car insurance in the US, compare quotes, bundle policies, maintain a good driving record, raise your deductible, and ask about available discounts.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.