Cheapest Illinois Car Insurance Rates in 2025 (Save Money With These 10 Companies!)

The cheapest Illinois car insurance rates start at just $18/month with Geico, making it one of the top choices alongside Erie and State Farm for affordability and comprehensive coverage. Compare rates and find the best policy to suit your needs and budget today without compromising quality.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

UPDATED: Oct 15, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 15, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage for Illinois

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 1,883 reviews

1,883 reviewsCompany Facts

Min. Coverage for Illinois

A.M. Best Rating

Complaint Level

Pros & Cons

1,883 reviews

1,883 reviews 18,155 reviews

18,155 reviewsCompany Facts

Min. Coverage for Illinois

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews

Discovering the cheapest Illinois car insurance rates is essential for savvy drivers looking to save. Geico stands out as the top pick overall with rates starting at just $18 for monthly car insurance rate, offering affordability without compromising on coverage. Alongside Geico, Erie and State Farm also shine for their competitive pricing and comprehensive policies.

Whether you’re prioritizing cost-effectiveness or comprehensive protection, comparing these top contenders will help you find the perfect fit for your insurance needs in Illinois. Don’t miss out on potential savings—start comparing today.

Our Top 10 Company Picks: Cheapest Illinois Car Insurance Rates

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $18 A++ Affordable Premiums Geico

#2 $22 A+ Competitive Rates Erie

#3 $25 B Good Driver State Farm

#4 $29 A Safe-Driving Discounts Liberty Mutual

#5 $33 A++ Extensive Coverage Travelers

#6 $34 A+ Online Services Progressive

#7 $35 A+ Multi-Policy Discount Nationwide

#8 $43 A Customer Service American Family

#9 $45 A Local Agents Farmers

#10 $67 A+ Many Discounts Allstate

Get the right car insurance at the best price — enter your ZIP code above to shop for coverage from the top insurers.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – Geico: Top Overall Pick

Pros

- Competitive Rates: Geico offers some of the lowest monthly rates in Illinois.

- Strong Financial Stability: Our examination of Geico car insurance review shows A++ rating by A.M. Best, indicating excellent financial strength.

- User-Friendly Online Tools: Geico provides easy-to-use online services for policy management.

Cons

- Limited Local Agents: Geico primarily operates online, which may not appeal to those preferring face-to-face interaction.

- Average Customer Service: Some customers report mixed experiences with Geico’s customer service.

#2 – Erie: Best for Competitive Rates

Pros

- Personalized Service: Erie Insurance is known for its personalized customer service.

- Excellent Coverage Options: Offers comprehensive coverage options at competitive rates.

- High Customer Satisfaction: According to our Erie car insurance review, Erie consistently ranks high in customer satisfaction surveys.

Cons

- Regional Availability: Erie Insurance is not available nationwide, limiting coverage options for some.

- Limited Online Tools: Compared to larger insurers, Erie’s online service offerings may be less robust.

#3 – State Farm: Best for Good Driver

Pros

- Bundling Policies: State Farm offers significant discounts for bundling multiple insurance policies.

- High Low-Mileage Discount: State Farm provides a substantial discount for low-mileage usage.

- Wide Coverage: The results of our State Farm car insurance review suggests State Farm offers various coverage options tailored for different driver needs.

Cons

- Limited Multi-Policy Discount: The multi-policy discount of State Farm is not as high compared to some competitors.

- Premium Costs: Despite discounts, State Farm’s premiums might still be relatively higher for certain coverage levels.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#4 – Liberty Mutual: Best for Safe-Driving Discounts

Pros

- Safe-Driver Incentives: Liberty Mutual offers substantial discounts for safe driving habits.

- Customizable Policies: Our Liberty Mutual car insurance review highlights Liberty Mutual offers provides options to tailor policies to individual needs.

- Wide Range of Coverage: Offers extensive coverage options for various types of drivers.

Cons

- Pricing Transparency: Some customers find Liberty Mutual’s pricing structure less transparent.

- Customer Service Challenges: Mixed reviews regarding Liberty Mutual’s customer service responsiveness.

#5 – Travelers: Best for Extensive Coverage

Pros

- Broad Coverage Options: Travelers provides extensive coverage options to suit different driver needs.

- Strong Financial Stability: According to our Travelers car insurance review, Travelers is rated A++ by A.M. Best, indicating top-tier financial strength.

- Flexible Payment Plans: Offers flexible payment plans to accommodate different budgeting needs.

Cons

- Higher Premiums: Travelers’ premiums may be higher compared to some other insurers.

- Complex Claims Process: Some customers find Travelers’ claims process more intricate than expected.

#6 – Progressive: Best for Online Services

Pros

- Advanced Online Tools: Progressive offers robust online services for policy management and claims.

- Variety of Discounts: Provides numerous discounts, including for bundling and safe driving.

- Strong Mobile App: Our Progressive car insurance review highlights Progressive’s mobile app is highly rated for ease of use and functionality.

Cons

- Pricing Fluctuations: Progressive’s rates can vary significantly based on personal factors and location.

- Customer Service Concerns: Mixed reviews regarding Progressive’s customer service quality.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#7 – Nationwide: Best for Multi-Policy Discount

Pros

- Generous Discounts: Nationwide offers substantial discounts for bundling multiple policies. Check out further information on Nationwide car insurance discounts for savings.

- Nationwide Availability: Available across the country, offering consistent coverage options.

- Solid Customer Service: Nationwide is known for its reliable customer service support.

Cons

- Average Premiums: Nationwide’s premiums may be moderate compared to some competitors.

- Limited Specialty Coverage: Some specialty coverage options may be less comprehensive than others.

#8 – American Family: Best for Customer Service

Pros

- Excellent Customer Service: American Family consistently receives high marks for customer service.

- Personalized Coverage: Offers customized policies to meet individual driver needs.

- Community Involvement: Our American Family car insurance review highlights the company’s involvement in community service and support initiatives.

Cons

- Limited Availability: American Family’s coverage may not be available in all states.

- Pricing Structure: Some customers find American Family’s pricing less competitive in certain regions.

#9 – Farmers: Best for Local Agents

Pros

- Personalized Attention: Farmers Insurance provides personalized service through local agents.

- Diverse Coverage Options: Offers a wide range of coverage options to meet various needs.

- Strong Claims Support: According to our Farmers car insurance review, Farmers is known for its efficient claims processing and support.

Cons

- Higher Premiums: Farmers’ premiums may be higher compared to some other insurers.

- Coverage Limitations: Some policy options may have more restrictive coverage limits.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#10 – Allstate: Best for Many Discounts

Pros

- Wide Range of Discounts: Allstate offers numerous discounts, including for safe driving and bundling.

- Enhanced Coverage Options: Insights from our Allstate car insurance review shows Allstate provides additional coverage options beyond standard policies.

- Strong Digital Tools: Allstate’s digital tools and mobile app are highly rated for usability.

Cons

- Higher Premiums: Allstate’s premiums may be higher compared to some competitors.

- Customer Service Variability: Mixed reviews regarding the consistency of Allstate’s customer service.

Minimum Car Insurance Requirements in Illinois

Liability insurance coverage pays all individuals — drivers, passengers, pedestrians, bicyclists, etc — who are owed compensation for property damage and/or injuries resulting from a car accident that you or anyone under your policy causes.

Illinois is an “at-fault” accident state. This means, if you are the at-fault driver during an accident, you will be held liable for any personal injury or property claims.

As such, liability car insurance coverage is required in the state of Illinois at these minimum coverage amounts:

- $25,000 – to cover Injury or death per person in an accident you caused

- $50,000 – to cover total injuries or death per accident you caused

- $20,000 – to cover property damage per accident you caused

Illinois also requires all motorists to carry uninsured/underinsured motorist coverage.

The minimum requirements may not be enough coverage for you. You may wish to increase your liability coverage limits, and we’re also going to go over your additional coverage options so you can get all the protection you need.

Core Car Insurance Coverage in Illinois

How much does car insurance cost in Illinois? The above table outlines what the experts say. Expect car insurance rates in Illinois to be significantly higher for 2019 and on.

Illinois Car Insurance Monthly Rates by Coverage Type

| Coverage Type | Rate |

|---|---|

| Collision | $26 |

| Combined | $74 |

| Comprehensive | $11 |

| Liability | $37 |

Illinois has a mandatory insurance law for liability coverage and uninsured motorists coverage, but experts suggest drivers purchase more than what state law requires, especially when the state is an “at-fault” state like Illinois is.

Illinois Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $67 $176

American Family $43 $114

Erie $22 $58

Farmers $45 $117

Geico $18 $47

Liberty Mutual $29 $76

Nationwide $35 $93

Progressive $34 $89

State Farm $25 $64

Travelers $33 $87

You’re not required to purchase comprehensive or collision insurance. However, you will need to do so if you want your own damages to be covered after an accident or other incident involving your vehicle. An car insurance policy containing liability, comprehensive, and collision insurance is called full coverage car insurance. Let’s explore some of the most popular coverage options to add to a basic car insurance policy.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Additional Liability Coverage in Illinois

A loss ratio shows how much a company spends on claims to how much money they take in on premiums. For example, a loss ratio of 60% indicates that companies are spending $60 on claims out of every $100 earned in premiums. A loss ratio of over 100% means the company is losing money. If the loss ratio is too low, the company isn’t paying claims.

With loss ratios dropping, it is evident that Illinois residents are taking some advantage of valuable extras, but not quite as much as they should. Luckily, car insurance companies in Illinois are looking out for you. Every liability car insurance policy automatically includes uninsured motorist coverage (UIM) with limits EQUAL to the policy’s injury liability coverage.

Geico offers the best value with Illinois car insurance rates starting at just $18 per month, making it a top choice for affordability and comprehensive coverage.

Scott W. Johnson Licensed Insurance Agent

The State of Illinois expects drivers to cover themselves just as much as they cover others. Meaning, the more liability coverage you purchase, the more you are protected if hit by one of the nearly 5.5 million uninsured motorists driving around the state.

An alternative is to consider personal injury protection (PIP), otherwise known as no-fault car insurance, for medical bills incurred because of a wreck, regardless of who is at fault, who is driving, or who owns the vehicle.

Add-ons, Endorsements, and Riders

We know getting the complete coverage you need for an affordable price is your goal. Good news: there are lots of powerful but cheap extras you can add to your policy. Here’s a list of other useful coverage available to you in Illinois.

- Gap insurance

- Personal umbrella policy

- Rental car reimbursement coverage

- Mechanical breakdown insurance

- Non-owner car insurance

- Modified car insurance coverage

- Classic car insurance

- Pay-as-you-drive or usage-based insurance

We hope this list helps you find the right coverage additions to suit your needs. Remember, each option can offer valuable protection depending on your circumstances and budget.

Male vs. Female Monthly Car Insurance Rates in Illinois

Most people are under the impression that men pay higher car insurance rates than women. That is typically the case in the state of Illinois with a few instances otherwise. Our researchers came to a surprising conclusion. They learned that age and the actual insurance carrier seem to be the most significant contributing factors in cost variance.

Learn more information on our guide titled “Average Car Insurance Rates by Age and Gender.”

Illinois Farmers Insurance charges 17-year-olds over $683 more than their average $210 monthly premiums for insured individuals over 18. In contrast, USAA charges about $267 more monthly based on age. Younger drivers pay higher rates due to their limited driving experience. As drivers gain experience and skills improve, their rates decrease.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Highest and Lowest Rates by ZIP Code

Looking for cheap car insurance? What about the top-of-the-line? Search the table below which lists the lowest rates according to the ZIP code.

Illinois Car Insurance Monthly Rates in the Cheapest ZIP Codes by Provider

| ZIP Code | Monthly Rates | Allstate | American Family | Farmers | Geico | Safeco | Nationwide | Progressive | State Farm | Travelers | USAA |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 61443 | $233 | $371 | $283 | $326 | $214 | $170 | $166 | $241 | $165 | $182 | $210 |

| 61761 | $233 | $379 | $282 | $339 | $200 | $177 | $168 | $239 | $174 | $177 | $193 |

| 61261 | $233 | $390 | $300 | $327 | $198 | $168 | $166 | $229 | $166 | $178 | $210 |

| 61920 | $233 | $384 | $269 | $337 | $192 | $171 | $184 | $234 | $171 | $162 | $229 |

| 61270 | $234 | $390 | $294 | $329 | $198 | $168 | $166 | $229 | $166 | $187 | $210 |

| 61258 | $234 | $375 | $294 | $334 | $198 | $176 | $166 | $240 | $172 | $174 | $210 |

| 61274 | $234 | $375 | $297 | $319 | $214 | $174 | $166 | $239 | $161 | $185 | $210 |

| 61235 | $234 | $375 | $297 | $326 | $214 | $174 | $166 | $243 | $169 | $169 | $210 |

| 61234 | $235 | $375 | $297 | $334 | $214 | $175 | $166 | $246 | $167 | $167 | $210 |

| 61238 | $235 | $375 | $294 | $319 | $214 | $180 | $166 | $259 | $162 | $173 | $210 |

| 61251 | $235 | $390 | $294 | $329 | $198 | $172 | $166 | $230 | $177 | $185 | $210 |

| 61277 | $235 | $389 | $294 | $329 | $198 | $176 | $166 | $239 | $169 | $182 | $210 |

| 61938 | $236 | $384 | $269 | $346 | $192 | $171 | $184 | $233 | $179 | $168 | $229 |

| 61254 | $236 | $375 | $297 | $319 | $214 | $175 | $166 | $249 | $167 | $185 | $210 |

| 61243 | $236 | $390 | $294 | $327 | $198 | $168 | $186 | $233 | $177 | $172 | $210 |

| 61401 | $236 | $358 | $283 | $333 | $200 | $172 | $217 | $239 | $166 | $170 | $220 |

| 61250 | $236 | $390 | $297 | $335 | $198 | $172 | $166 | $233 | $178 | $181 | $210 |

| 61379 | $237 | $375 | $297 | $338 | $214 | $166 | $186 | $246 | $169 | $177 | $197 |

| 61283 | $237 | $390 | $294 | $340 | $198 | $175 | $186 | $230 | $170 | $173 | $210 |

| 61233 | $237 | $375 | $294 | $336 | $214 | $180 | $166 | $245 | $172 | $176 | $210 |

| 61314 | $237 | $375 | $297 | $341 | $214 | $166 | $186 | $246 | $173 | $177 | $197 |

| 61322 | $237 | $375 | $294 | $337 | $214 | $167 | $186 | $249 | $168 | $186 | $197 |

| 61704 | $237 | $378 | $287 | $344 | $200 | $176 | $168 | $271 | $179 | $177 | $193 |

| 61726 | $237 | $378 | $282 | $336 | $214 | $175 | $204 | $258 | $159 | $166 | $203 |

| 61361 | $238 | $375 | $297 | $341 | $214 | $175 | $186 | $243 | $175 | $173 | $197 |

The table shows average monthly insurance rates from various companies across multiple ZIP codes, with USAA consistently offering the lowest rates and Allstate generally having the highest. Geico, Progressive, and Safeco typically have mid-range premiums, while State Farm and Travelers fall in between.

The average monthly rates are relatively stable across different ZIP codes, with slight variations in the premiums among different insurers. Now, compare those rates to the ones in the most expensive ZIP codes.

Illinois Car Insurance Monthly Rates in the Most Expensive ZIP Codes by Provider

| ZIP Code | Monthly Rate | Allstate | American Family | Farmers | Geico | Safeco | Nationwide | Progressive | State Farm | Travelers | USAA |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 60636 | $453 | $703 | $463 | $639 | $427 | $279 | $513 | $516 | $345 | $321 | $326 |

| 60623 | $449 | $735 | $458 | $625 | $431 | $280 | $478 | $554 | $327 | $318 | $282 |

| 60624 | $448 | $735 | $461 | $629 | $431 | $270 | $478 | $541 | $348 | $306 | $282 |

| 60651 | $447 | $714 | $461 | $629 | $431 | $280 | $478 | $563 | $335 | $317 | $261 |

| 60644 | $447 | $714 | $463 | $627 | $431 | $260 | $478 | $555 | $338 | $318 | $282 |

| 60621 | $444 | $686 | $464 | $629 | $427 | $270 | $513 | $493 | $324 | $304 | $326 |

| 60649 | $431 | $720 | $463 | $614 | $388 | $243 | $513 | $441 | $317 | $309 | $304 |

| 60620 | $430 | $685 | $458 | $615 | $388 | $262 | $513 | $478 | $297 | $308 | $293 |

| 60426 | $424 | $752 | $459 | $667 | $348 | $271 | $430 | $430 | $310 | $285 | $287 |

| 60639 | $424 | $676 | $451 | $571 | $431 | $258 | $478 | $482 | $303 | $303 | $282 |

| 60619 | $422 | $639 | $458 | $575 | $388 | $250 | $513 | $482 | $307 | $310 | $293 |

| 60637 | $421 | $639 | $442 | $574 | $411 | $250 | $513 | $458 | $311 | $303 | $304 |

| 60628 | $419 | $680 | $464 | $577 | $388 | $277 | $430 | $472 | $306 | $309 | $287 |

| 60609 | $415 | $556 | $458 | $554 | $448 | $268 | $513 | $424 | $295 | $306 | $326 |

| 60629 | $414 | $625 | $451 | $566 | $361 | $249 | $513 | $434 | $317 | $300 | $326 |

| 60653 | $414 | $550 | $461 | $562 | $399 | $254 | $513 | $457 | $310 | $308 | $326 |

| 60419 | $410 | $698 | $459 | $609 | $348 | $266 | $430 | $438 | $305 | $273 | $272 |

| 60428 | $409 | $752 | $419 | $621 | $348 | $252 | $430 | $401 | $302 | $280 | $287 |

| 60612 | $408 | $581 | $461 | $562 | $401 | $237 | $473 | $456 | $326 | $305 | $282 |

| 60409 | $406 | $703 | $459 | $609 | $348 | $247 | $430 | $424 | $297 | $269 | $272 |

| 60632 | $405 | $569 | $435 | $552 | $361 | $249 | $513 | $443 | $300 | $305 | $326 |

| 60617 | $402 | $639 | $463 | $566 | $388 | $249 | $430 | $409 | $296 | $306 | $272 |

| 60827 | $395 | $624 | $459 | $590 | $299 | $250 | $430 | $453 | $276 | $281 | $287 |

| 60652 | $394 | $622 | $435 | $547 | $361 | $240 | $513 | $391 | $279 | $285 | $262 |

| 60472 | $393 | $752 | $419 | $579 | $299 | $248 | $430 | $400 | $277 | $237 | $287 |

You can expect to pay almost twice as much for your car insurance if you live in the most expensive ZIP code compared to the least expensive. Delve more insights with our “Compare Car Insurance Rates by City.”

Insights Into Illinois Car Insurance Companies

What is the best car insurance in Illinois? Insurance carriers like State Farm car insurance, Allstate Insurance, and Geico are all vying for your business these days. Sometimes, it’s hard to know which ones actually come through on their promises. No need to worry, we’ve got you covered. Keep scrolling to find out who the 10 best providers are across the state. Ready to go? Let’s get this show on the road.

The 10 Largest Car Insurance Companies in Illinois and Their Financial Rating

In the table below are the 10 insurance companies in Illinois that are at the top of the market share. A loss ratio shows how much a company spends on claims to how much money they take in on premiums.

Top 10 Illinois Car Insurance Companies by Market Share

| Rank | Insurance Company | Market Share |

|---|---|---|

| #1 | State Farm | 32% |

| #2 | Allstate | 12% |

| #3 | Country Insurance & Financial Service | 7% |

| #4 | Progressive | 6% |

| #5 | Geico | 6% |

| #6 | American Family | 4% |

| #7 | Farmers | 4% |

| #8 | Liberty Mutual | 3% |

| #9 | Travelers | 2% |

| #10 | USAA | 2% |

AM Best gives insurance companies financial ratings. A good score means they are highly likely to stay solvent and have the ability to pay customer claims.

Top 10 Illinois Car Insurance Companies by Financial Strength

| Rank | Insurance Company | A.M. Best |

|---|---|---|

| #1 | Allstate | A+ |

| #2 | American Family | A |

| #3 | Country Financial | A+ |

| #4 | Farmers | A |

| #5 | Geico | A++ |

| #6 | Liberty Mutual | A |

| #7 | Progressive | A+ |

| #8 | State Farm | B |

| #9 | Travelers | A++ |

| #10 | USAA | A++ |

Besides premiums, one of the other components that should factor into your decision when picking an insurance carrier is customer ratings. Want to find out what customers really think about the top Illinois car insurance carriers?

Companies With Best Ratings

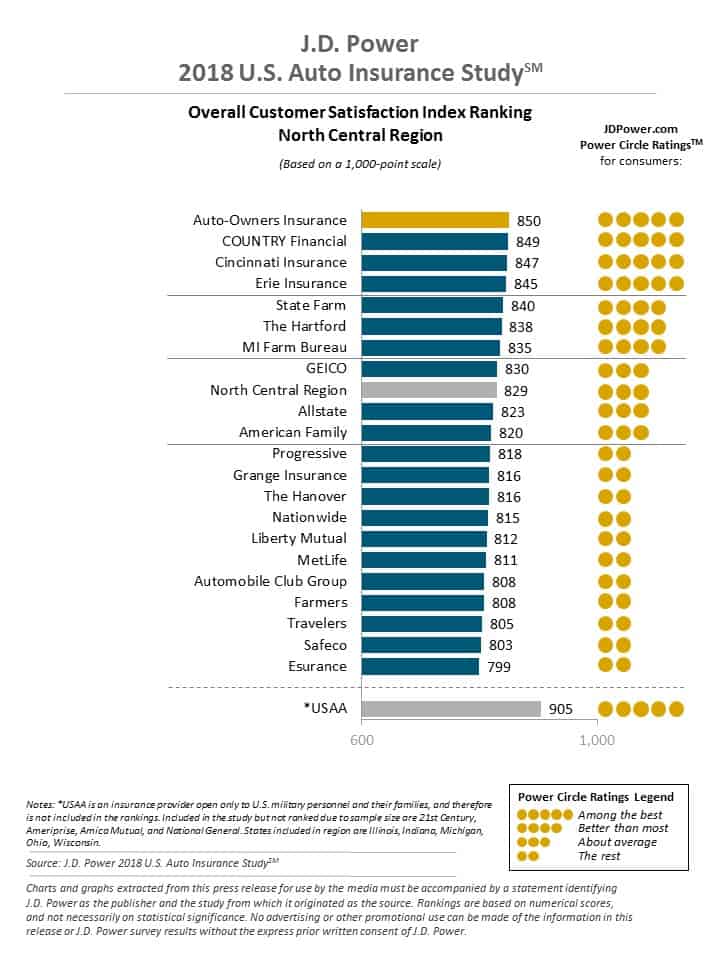

Illinois falls into the North Central Region for the 2018 J.D. Power car insurance study. The top insurance companies of Illinois are sprinkled throughout the customer satisfaction ratings provided by this trusted source.

Weigh the good against the bad by looking at complaints as well as accolades.

Car Insurance Company Complaints

The complaint index of each company calculates how much larger a company’s share of complaints is compared to its share of profits across the state. Companies that have a complaint index higher than one are worse than the average insurer in Illinois, and those with an index below one are better than average.

Illinois Car Insurance Customer Complaint Ratio by Provider

| Insurance Company | Complaint Ratio |

|---|---|

| AAA | 29% |

| Allied | 34% |

| Allstate | 18% |

| American Access | 160% |

| American Alliance | 430% |

| American Family | 22% |

| American Freedom | 424% |

| Ameriprise | 58% |

| Auto Owners | 35% |

| Bristol West | 49% |

| Country Financial | 6% |

| Direct Auto | 585% |

| Elephant | 117% |

| Erie | 21% |

| Esurance | 29% |

| Falcon | 336% |

| Farmers | 13% |

| First Acceptance | 146% |

| First Chicago | 175% |

| Founders | 328% |

| Fred Loya | 163% |

| Geico | 23% |

| Hanover | 1% |

| Hartford | 26% |

| Liberty Mutual | 32% |

| Lighthouse Casualty | 495% |

| Mendota Insurance | 68% |

| MetLife | 18% |

| Nationwide | 4% |

| Progressive | 21% |

| Safe Auto | 52% |

| SafeCo | 0.12 |

| Safeway | 148% |

| Standard Fire | 14% |

| Standard Mutual | 24% |

| State Farm | 13% |

| Stonegate | 376% |

| Unique Insurance | 318% |

| United Equitable | 634% |

| USAA | 19% |

Bear in mind, some complaints are based on general customer satisfaction from Illinois vehicle insurance reviews, so factor that into your final decision.

Car Insurance Rates by Provider in Illinois

We know that rates are one of the biggest factors that impact your choices in Illinois car insurance. The below chart shows ten of the top carriers in the state, along with their average rates compared to the overall state average.

Illinois Car Insurance vs. State Average: Monthly Rates by Coverage Type

| Insurance Company | Monthly Rate | State Average |

|---|---|---|

| Allstate | $432 | $159 |

| American Family | $317 | $45 |

| Farmers | $381 | $109 |

| Geico | $230 | -$42 |

| Nationwide | $252 | -$21 |

| Progressive | $293 | $21 |

| Safeco | $189 | -$83 |

| State Farm | $194 | -$79 |

| Travelers | $207 | -$66 |

| USAA | $231 | -$42 |

Our researchers discovered that Allstate charges the most in average premiums, with Illinois Farmers Insurance coming in at 2nd place for the highest monthly rates. Meanwhile, Safeco comes in number one for the lowest average rates. Keep in mind when you’re reviewing the cheapest car insurance companies that USAA only insures military personnel and their immediate families.

Learn more information about Safeco with our guide titled “Safeco Car Insurance Review.”

Commute Rates

The table below compares the rates of top carriers in the state against average commute times. Interestingly enough, Allstate comes out with the highest premium for annual mileage while Liberty Mutual and USAA compete for the lowest premium for annual mileage.

Illinois Car Insurance Monthly Rates by Annual Mileage & Provider

| Insurance Company | 6,000 Miles | 12,000 Miles |

|---|---|---|

| Allstate | $155 | $160 |

| American Family | $130 | $135 |

| Farmers | $180 | $185 |

| Geico | $110 | $115 |

| Liberty Mutual | $145 | $150 |

| Nationwide | $120 | $125 |

| Progressive | $140 | $145 |

| State Farm | $100 | $105 |

| Travelers | $125 | $130 |

| USAA | $105 | $110 |

These rates reflect how each company prices insurance based on commute distances and annual mileage. Always consider both factors when choosing your insurance provider to ensure you get the best coverage at the most competitive rates.

Credit History Rates

According to a study conducted by Experian, the average resident of Illinois has a credit card VantageScore of 683 and around 3.14 credit cards in their name. The average Illinois consumer has a credit card balance of $6,410.

Illinois Car Insurance Monthly Rates by Credit History & Provider

| Insurance Company | Poor Credit | Fair Credit | Good Credit |

|---|---|---|---|

| Allstate | $551 | $397 | $347 |

| American Family | $422 | $287 | $242 |

| Farmers | $433 | $364 | $346 |

| Geico | $370 | $181 | $141 |

| Liberty Mutual | $267 | $167 | $133 |

| Nationwide | $301 | $242 | $212 |

| Progressive | $334 | $283 | $262 |

| State Farm | $282 | $169 | $131 |

| Travelers | $252 | $203 | $165 |

| USAA | $307 | $211 | $174 |

If you think that your credit card debt and car insurance rates have no correlation, think again. Insurance carriers run credit checks on their insureds to assess the likelihood of them filing a claim at any point. If your credit score doesn’t meet their standards, you might just see a spike in your rates regardless of whether you’ve had an accident or not.

Driving Record Rates

As you’ll see in the table below, your driving history is one of the car insurance factors that affect your premiums.

If you look at the rates listed for American Family, for example, you’ll notice that the rate difference for a clean record versus one DUI is nearly $2,500 premium jump, while State Farm increases by as little as $200 from a clean driving record to having one DUI.

Illinois Full Coverage Car Insurance Monthly Rates by Driving Record & Provider

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| Allstate | $309 | $406 | $525 | $488 |

| American Family | $233 | $264 | $331 | $440 |

| Farmers | $322 | $383 | $415 | $405 |

| Geico | $165 | $203 | $232 | $321 |

| Liberty Mutual | $158 | $179 | $223 | $196 |

| Nationwide | $203 | $233 | $262 | $309 |

| Progressive | $242 | $305 | $358 | $268 |

| State Farm | $177 | $194 | $211 | $194 |

| Travelers | $164 | $206 | $215 | $240 |

| USAA | $164 | $198 | $236 | $324 |

Liberty Mutual and Safe Farm offer the cheapest car insurance rates for those with a speeding violation in their driving history. Those with poor credit scores or a bad driving record should make sure to ask about insurance discounts when getting a quote.

Most major insurers offer a wide variety of discounts, such as student discounts, the safe driver discount, multi-policy discount, and defensive driving course discount. Additionally, some insurers provide discounts for installing anti-theft devices or maintaining good grades in school.

Often, finding the most affordable rates comes down to which companies offer the best discounts for your personal situation. Make sure to get car insurance quotes from multiple companies before making a decision.

Compare Car Insurance Rates in Illinois

Uncover the spectrum of car insurance rates across Illinois, from Aurora to Chicago to Rockford.

Illinois Car Insurance Cost by City

Gain valuable insights into the factors influencing premiums and find the best coverage for your needs.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

High-Risk Insurance

For drivers with a history of accidents or traffic violations, they may find themselves unable to purchase coverage from an car insurance carrier. This is where a type known as high-risk car insurance comes into play. Check out the best car insurance for high-risk drivers.

But, don’t fret. If you are having trouble finding a car insurance carrier, you may apply for insurance through the Illinois Automobile Insurance Plan (ILAIP).

You must verify that you have tried and failed to get reasonable rates within 60 days of serving your sentence.

Windshield Coverage

While some states mandate a waived deductible for windshield repairs, and others specify the use of only manufacturer replacement parts, Illinois does permit replacement with aftermarket parts with written notice; however, you may refuse, but you will pay the difference in the quote. Discover more information on our “What states have full glass coverage?”

There is no law that mandates insurance companies in Illinois to offer a zero deductible with comprehensive car insurance coverage, but it is an option. If windshield coverage is something you desire, you will need to have comprehensive car insurance and you will have to carefully examine how the different insurance providers handle windshield claims.

Automobile Insurance Fraud in Illinois

Insurance fraud is a criminal offense in the state of Illinois, occurring when an individual attempt to deceive an insurer to receive benefits or payouts they are not qualified to obtain. These frauds undergo car insurance claim investigation.

In Illinois, there are five ways in which insurance fraud is committed:

- Knowingly obtains, attempts to obtain, or causes to be obtained;

- By deception, control over the property of an insurance company, or self-insured entity;

- By the making of a false claim; or

- By causing a false claim to be made on any policy of insurance issued by an insurance company;

- Intending to deprive an insurance company or self-insured entity permanently of the use and benefit of that property.

The state of Illinois has a fraud bureau, but it does not apply to automobile insurance.

- Class A misdemeanor if the value in question is $300 or under, punishable by as much as one year’s imprisonment and/or a $2,500 fine

- Class 3 felony if the value in question is over $300, punishable by as much as five years imprisonment and/or a $10,000 fine

- Class 2 felony if the value in question is over $10,000 but less than $100,000, punishable by as much as 7 years imprisonment

- Class 1 felony if the value in question is over $100,000, punishable by as much as 15 years imprisonment

The state of Illinois has a fraud bureau, but it does not apply to automobile insurance. Simply put, don’t commit insurance fraud, and you’re good to go.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Vehicle Licensing Laws in Illinois

Now, we all know that you can’t drive a car without a license. Let’s find out what mandatory vehicle licensing laws are in Illinois. Unlock insights with our guide “What to Do If You Can’t Find Your Car Registration.”

Penalties for Driving Without Insurance

- First Offense – Fine: $500 minimum; License plate suspension until $100 reinstatement fee and insurance proof

- Second Offense – Fine: $1,000 minimum; License plate suspension for four months; $100 reinstatement fee and insurance proof

Teen Driver Laws

In Illinois, enrollment in the Graduated Driver Licensing (GDL) program is required to help teen drivers gradually get more comfortable driving. The program has been in effect since 2008.

Illinois Teen Driver Laws and Restrictions

| Licensing Laws | Age Restrictions | Passenger Restrictions | Time Restrictions |

|---|---|---|---|

| Learner's Permit | 15 years | First 12 months: max 1 passenger under 20 (family exception) | 10 P.M. Sun.-Thur., 11 P.M. Fri.-Sat., ends 6 A.M. |

| Provisional License | 15 years; 9 months holding period; 50 hours supervised driving time, 10 of which must be at night | 12 months or until 18 (min. age: 17) | Until age 18 |

| Full License | 16 years | NA | NA |

In fact, Illinois has cut teen driving deaths in half since beginning the GDL. In the first year of the program alone, the death rate was reduced by 67%. In addition, any 18-20 year old who did not take driver’s education in school (new residents, for example) must complete a 6-hour adult driver education course.

Older Driver and General Population License Renewal Procedure

Understanding the renewal procedures for driver’s licenses can vary based on age and local regulations. Below are the details for the general population and older adults:

Illinois Older Driver and General Population Renewal Procedures

| Renewal Procedures | General Population | Older Population |

|---|---|---|

| License renewal cycle | 4 years | 2 years for people 81 - 86; 1 year for people 87 and older |

| Mail or online renewal permitted | both, every other renewal | not permitted 75 and older |

| Proof of adequate vision required at renewal | when renewing in person | 75 and older, every renewal |

This structure provides a clear introduction to the topic and a summary of the key points discussed.

New Residents

Here is a list of action items important for all new residents of Illinois:

- The Office of the Illinois Secretary of State handles all matters related to vehicle licensing.

- Visit a Secretary of State location, turn over all other state licenses, provide identification documents, and have your photo taken.

- Pass the vision screening, written and/or driving exams, and pay your fees.

- A 90-day, paper driver’s license will be provided, and expect the real deal in the mail within 15 business days.

- Drivers under the age of 21 must complete a six-hour adult driver education course before obtaining a driver’s license.

Rules of the Road in Illinois

Knowing the driving laws of Illinois is important to keep your insurance rates down. Let’s take a look at some of Illinois’ traffic laws and your car insurance. Are you ready?

Fault vs. No-Fault

The first thing to know is that Illinois follows a traditional fault-based system when it comes to financial responsibility for losses stemming from a crash: that includes car accident injuries, lost income, vehicle damage, and so on.

Keep Right and Move Over Laws

Illinois law states that you should use the left lane for only passing and turning left with five exceptions. When it comes to moving over, the law says “If it’s flashing, move over.” Previous to January 1, 2017, the Move Over law – now known as “Scott’s Law,” only applied to emergency vehicles. Now the law applies to all vehicles with flashing lights including commercial vehicles.

“Scott’s Law” was named after Lieutenant Scott Gillen of the Chicago Fire Department who was struck and killed by an intoxicated driver while assisting at a crash on the Dan Ryan Expressway.

Speed Limits

The Willis Tower elevator has a need for speed going 18 mph to the 103rd floor, but Illinois keeps drivers at a safe speed of 55 mph on its urban interstates. Maximum posted speed limits are 70 mph on rural interstates, 65 mph on limited access roads, and 55 mph on all other roads.

However, Cook, DuPage, Kane, Lake, Madison, McHenry, St. Clair, and Will Counties have enacted a local ordinance setting the maximum large truck speed limit of 60 mph outside of urban districts and 55 mph inside urban districts.

Seat Belt, Car Seat, and Cargo Area Laws

Seat belt use in Illinois is primarily enforced and requires anyone in the front seat to be at least 8 years old with a fine of $25 if violated. 2019 child safety seat laws in Illinois require that children younger than 2 years old be in a rear-facing child restraint unless the child weighs 40 or more pounds or is 40 or more inches tall. Effective June 1, 2019, children seven years and younger will be required to be in a child safety seat.

An adult belt is permissible for children 8-15 years old and over 40 pounds with no preference for the rear seat. Currently, there is no Illinois state law that regulates transporting people in the cargo areas of pick-up trucks.

Ridesharing

Rideshare services like Uber and Lyft mandate that all their drivers carry personal car insurance policies that align with or exceed the minimum coverages dictated by state law. Drivers rarely carry their own commercial insurance coverage; however, nine companies provide rideshare car insurance in Illinois.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Safety Laws in Illinois

But wait, there’s more. Let’s dig deeper into the safety laws in Illinois to protect you on the open road. Drive safely to avail of potential safe driver car insurance discounts.

DUI Laws

Illinois DUI laws are strict compared to most states.

Illinois Car Insurance DUI Laws

| Laws | Facts |

|---|---|

| Name of Offense | Driving Under the Influence (DUI) |

| BAC Limit | .08% |

| High BAC Limit | .16% |

| Criminal Status by Offense | 1st-2nd class a misdemeanor, 3rd-4th class 2 felony, 5th class 1 felony, 6th+ class x felony |

| Look Back Period/Washout Period | 10 years |

| 1st Offense Penalties | Term |

| License revoked | 1 year |

| Jail time | No minimum, but up to 1 year |

| Fine | $500-$2,500 |

| Others | Before driving privileges restored, must complete substance evaluation and treatment program +high-risk auo insurance for 3 years. |

| 2nd Offense Penalties | Term |

| License revoked | 5 year min for 2nd conviction in 20 years |

| Jail time | Mandatory 5 days up to 1 year or 240 hours community service |

| Fine | $1,250 to $2500 |

| 3rd Offense Penalties | Term |

| License revoked | Min 10 years + suspension of vehicle registration |

| Jail time | 90 days minimum. Possible 3-7 years |

| Fine | $2,500 up to $25,000 |

| 4th Offense Penalties | Term |

| License revoked | For life + suspension of vehicle registration |

| Jail time | Possible 4-15 years |

| Fine | Up to $25,000 |

| 5th Offense Penalties | Term |

| Jail time | Imprisonment of 6-30 years with fines up to $25,000 |

| 6th Offense Penalties | Term |

| 6th Offense | Same as 5th offense |

| Mandatory Interlock | All offenders |

The only other states more strict are South Carolina and Florida.

Marijuana-Impaired Driving Laws

Illinois currently has a marijuana-specific impaired driving law that restricts blood toxicity levels to be no more than five nanograms of THC per se.

Distracted Driving Laws

The state of Illinois currently has tough laws regarding hand-held device usage, cellphone usage, and texting. Illinois has an all driver ban on any handheld device. They even clarify no blue-tooth conversations for those under 19 with an “all cell phone ban” and it is primarily enforced.

Lawmakers keep it simple. It’s “10 and 2” for you, Illinois residents. Primary enforcement means that you don’t have to be pulled over for anything else to get a citation for using any type of communication device.

Risky/Harmful Driving Behavior

The best way to stay safe while driving is to always keep your eyes on the road and stay aware of common risky driving issues in your state. We’ve compiled a list of all driving-related car accidents and fatalities in Illinois. Let’s delve into this a bit further.

Fatalities by Person Type

Below is a table illustrating the number of fatalities categorized by different types of individuals involved in traffic incidents:

Illinois Traffic Fatality by Person Type

| Person Type | Number |

|---|---|

| Motorcyclists | 162 |

| Nonoccupants | 179 |

| Occupants | 756 |

This table provides insights into the number of fatalities among various categories of individuals involved in traffic incidents.

Fatalities by Crash Type

Here is a breakdown of traffic crash types along with the corresponding number of fatalities:

Illinois Traffic Fatality by Crash Type

| Crash Type | Number |

|---|---|

| Large Truck | 149 |

| Roadway Departure | 535 |

| Rollover | 235 |

| Intersection | 340 |

| Speeding | 462 |

| Single Vehicle | 579 |

This table provides details on fatalities associated with different types of traffic crashes.

Five-Year Trend by County

Below is a table showing the number of traffic fatalities in various counties for the years 2019 to 2023:

Illinois Five-Year Trend for Top 10 Counties

| County | 2019 | 2020 | 2021 | 2022 | 2023 |

|---|---|---|---|---|---|

| Cook | 247 | 260 | 275 | 280 | 290 |

| Dupage | 45 | 50 | 52 | 55 | 60 |

| Kane | 40 | 42 | 45 | 48 | 50 |

| Kankakee | 25 | 28 | 30 | 32 | 33 |

| Lake | 60 | 65 | 68 | 70 | 72 |

| Madison | 35 | 38 | 40 | 42 | 44 |

| Mchenry | 30 | 32 | 34 | 35 | 37 |

| St. Clair | 38 | 40 | 42 | 44 | 45 |

| Will | 50 | 55 | 58 | 60 | 63 |

| Winnebago | 25 | 27 | 29 | 30 | 32 |

| Total: Top Ten Counties | 595 | 637 | 673 | 696 | 726 |

| Total: All Other Counties | 615 | 663 | 700 | 724 | 750 |

This table provides an overview of traffic fatalities in selected counties over a five-year period.

Fatalities Involving Speeding by County

Below is a table showing the number of speeding-related fatalities in various counties from 2014 to 2023, along with the corresponding rates per 100,000 population:

Counties in Illinois With the Most Speeding Deaths

| County | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

|---|---|---|---|---|---|---|---|---|---|---|

| Cook | 35 | 40 | 42 | 45 | 50 | 48 | 52 | 55 | 57 | 60 |

| Dupage | 15 | 18 | 20 | 22 | 25 | 24 | 26 | 28 | 30 | 32 |

| Kane | 10 | 12 | 15 | 17 | 20 | 19 | 21 | 23 | 25 | 27 |

| Kankakee | 8 | 10 | 11 | 12 | 13 | 13 | 14 | 15 | 16 | 17 |

| Lake | 20 | 22 | 24 | 26 | 28 | 29 | 31 | 33 | 34 | 36 |

| Madison | 12 | 14 | 15 | 16 | 18 | 17 | 19 | 20 | 21 | 23 |

| McHenry | 9 | 11 | 13 | 14 | 16 | 15 | 17 | 18 | 19 | 20 |

| St. Clair | 10 | 12 | 13 | 14 | 16 | 15 | 17 | 18 | 19 | 21 |

| Vermilion | 7 | 8 | 9 | 10 | 11 | 10 | 12 | 13 | 14 | 15 |

| Will | 18 | 20 | 22 | 24 | 26 | 25 | 27 | 29 | 30 | 32 |

| Total: Top Ten Counties | 144 | 167 | 184 | 200 | 223 | 215 | 236 | 252 | 265 | 283 |

| Total: All Other Counties | 256 | 295 | 316 | 340 | 377 | 365 | 404 | 432 | 455 | 485 |

This table provides details on speeding-related fatalities in various counties over a five-year period.

Fatalities in Crashes Involving an Alcohol-Impaired Driver by County

This table provides data on DUI-related fatalities in several counties over a five-year period, along with the corresponding rates per 100,000 population.

Illinois Fatalities in Crashes Involving Alcohol by County

| County Name | DUI 2019 | DUI 2020 | DUI 2021 | DUI 2022 | DUI 2023 | DUI 2019 per 100k | DUI 2020 per 100k | DUI 2021 per 100k | DUI 2022 per 100k | DUI 2023 per 100k |

|---|---|---|---|---|---|---|---|---|---|---|

| Cook | 128 | 140 | 135 | 130 | 125 | 5 | 5 | 5 | 5 | 5 |

| Dupage | 36 | 38 | 40 | 37 | 35 | 4 | 4 | 4 | 4 | 4 |

| Kane | 28 | 30 | 32 | 30 | 28 | 5 | 6 | 6 | 6 | 5 |

| Kankakee | 12 | 14 | 15 | 14 | 13 | 6 | 8 | 8 | 8 | 7 |

| La Salle | 15 | 16 | 18 | 17 | 16 | 7 | 7 | 8 | 8 | 7 |

| Lake | 40 | 42 | 45 | 43 | 42 | 6 | 6 | 6 | 6 | 6 |

| Madison | 22 | 24 | 26 | 25 | 23 | 6 | 7 | 8 | 7 | 7 |

| McHenry | 16 | 18 | 20 | 19 | 18 | 5 | 6 | 6 | 6 | 6 |

| St. Clair | 20 | 22 | 24 | 22 | 21 | 7 | 8 | 9 | 8 | 7 |

| Will | 35 | 37 | 40 | 38 | 37 | 5 | 5 | 6 | 5 | 5 |

This table highlights DUI-related fatalities and rates across multiple counties, providing insight into the impact of DUI incidents over the specified years.

EMS Response Time

Understanding response times in fatal crashes is crucial for evaluating emergency medical services (EMS) efficiency. Here are the response time metrics for rural and urban fatal crashes:

Rural vs. Urban EMS Response and Transport Times in Illinois

| Type of Crash | Time of Crash to EMS Notification | EMS Notification to EMS Arrival | EMS Arrival at Scene to Hospital Arrival | Time of Crash to Hospital Arrival |

|---|---|---|---|---|

| Rural | 2 | 10 | 53 | 57 |

| Urban | 8 | 1 | NA | NA |

These figures highlight the time intervals involved in responding to fatal crashes in both rural and urban settings, crucial for assessing emergency response effectiveness.

Case Studies in Illinois Car Insurance Rates

Understanding how different factors influence car insurance rates in Illinois can help drivers make informed decisions. Below are case studies highlighting varying scenarios and their impact on insurance costs.

- Case Study 1 – Young Driver in Chicago: High Rates Despite Discounts: In Chicago, a 22-year-old student with a clean driving record sought affordable insurance. Despite qualifying for student and good driver discounts, premiums remained high due to the city’s dense traffic and high accident rates.

- Case Study 2 – Family in Suburban Aurora: Savings with Bundling: A family of four in Aurora bundled their home and car insurance policies with Geico, saving over $42 monthly. Living in a low-crime area and having multiple vehicles insured contributed to lower premiums. Check out the best companies for bundling home and car insurance.

- Case Study 3 – Senior Driver in Rockford: Tailored Coverage for Peace of Mind: A retired senior in Rockford opted for State Farm’s comprehensive coverage, including roadside assistance and higher liability limits. Although premiums were slightly higher, the added peace of mind and local agent support were invaluable.

These case studies illustrate how diverse factors such as location, age, and policy bundling can significantly impact car insurance rates in Illinois.

Geico stands out as the top choice for Illinois car insurance, offering comprehensive coverage and competitive pricing.

Brad Larson Licensed Insurance Agent

By understanding these dynamics and exploring different options, drivers can effectively manage costs while ensuring adequate coverage.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Conclusion: Key Considerations for Illinois Drivers

Navigating the landscape of car insurance in Illinois involves balancing affordability with comprehensive coverage tailored to individual needs. Geico emerges as a standout choice for its competitive rates appealing to budget-conscious drivers. State Farm and Erie also shine for their robust coverage options and customer satisfaction.

Whether prioritizing cost-effectiveness, bundling policies, availing car insurance discounts or selecting tailored coverage, Illinois residents have ample choices to ensure they meet state requirements without overspending. Drivers should secure the best policy that aligns with their financial goals. Our free quote comparison tool allows you to shop for quotes from the top providers near you by entering your ZIP code below.

Frequently Asked Questions

What are the minimum car insurance requirements in Illinois?

In Illinois, the minimum car insurance requirements include liability coverage with limits of 25/50/25. This means you need at least $25,000 in bodily injury liability coverage per person, $50,000 in bodily injury liability coverage per accident, and $25,000 in property damage liability coverage.

What is the best car insurance in Illinois?

The best car insurance companies in Illinois can vary depending on individual needs and preferences. However, some of the top insurance providers in the state include State Farm, Allstate, Geico, and Liberty Mutual. It’s recommended to compare quotes from multiple companies to find the best coverage and rates for your specific situation.

How much does car insurance cost per month in Illinois?

The average cost of car insurance in Illinois is around $37 per month. However, it’s important to note that individual rates can vary based on factors such as your age, driving history, coverage options, and the insurance company you choose. See if you’re getting the best deal on car insurance by entering your ZIP code below.

What additional coverage options are available for car insurance in Illinois?

In addition to the minimum liability coverage, you can consider adding additional coverage options to your car insurance policy in Illinois. Some common additional coverage options include comprehensive coverage, collision coverage, uninsured/underinsured motorist coverage, medical payments coverage, and roadside assistance.

How does your driving record and credit history affect car insurance rates in Illinois?

Your car insurance rates in Illinois can be influenced by your driving record and credit history. Insurance companies typically factor in past accidents, tickets, and violations when setting rates. They also assess credit scores to gauge claim likelihood. A clean driving record and good credit can lead to lower premiums, whereas accidents or poor credit may increase costs.

If you have good credit, you may qualify for a good credit discount.

Who is the cheapest car insurance in Illinois?

Geico offers the best value with Illinois car insurance rates starting at just $18 per month, making it a top choice for affordability and comprehensive coverage.

What is premium insurance?

An insurance premium represents the regular payment made, typically monthly or annually, to maintain an active insurance policy. The amount you pay is influenced by various factors such as risk assessment, coverage level, and other specifics pertinent to the type of insurance policy in question. It’s important to note that these principles may not apply universally across all types of life insurance products.

What type of car insurance is cheapest?

Typically, comprehensive car insurance tends to be the most affordable option, although actual costs can vary based on individual circumstances.

How much of an umbrella policy do I need?

To determine the appropriate amount of umbrella insurance coverage, calculate the total value of your property, savings, and investments. Next, assess the liability coverage provided by your current insurance policies. Purchase sufficient umbrella insurance to bridge any gaps in coverage.

What is Illinois minimum car insurance?

To comply with the law, you must have liability insurance with at least the following coverage amounts: $25,000 for injury or death of one person in an accident, $50,000 for injury or death of multiple people in an accident, and $20,000 for property damage to another person’s property.

Why is insurance in Illinois so expensive?

The cost of car body labor has significantly increased, and insurance companies are experiencing higher claim volumes compared to pre-pandemic levels. Increased mobility and travel post-pandemic have led insurers to raise rates to cover these elevated costs. Obtain more information with our guide titled “How do you file a car insurance claim?”

Is Illinois a no-fault state?

Illinois operates under a fault or tort system for car accident claims, where the driver found responsible for the accident is liable for covering the damages incurred by the injured party.

Does Illinois require insurance?

Illinois law mandates that all motor vehicles registered and operated within the state must have liability insurance. This insurance covers costs related to property damage or injuries caused to others in the event of an accident. Trailers, however, are exempt from this requirement. Our free online comparison tool below allows you to compare cheap car insurance quotes instantly — just enter your ZIP code to get started.

Is car insurance higher in Chicago?

Chicago car insurance rates tend to be elevated due to its status as one of the largest cities in the U.S. However, there are opportunities to save money with a bit of research.

What is the lowest form of car insurance?

Liability insurance tends to be the most affordable type of car insurance. It exclusively covers bodily injuries and property damage for others if you’re responsible for an accident. It does not include coverage for your own vehicle damage or personal injury expenses.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.