Cheapest Michigan Car Insurance Rates in 2025 (Save Big With These 10 Companies!)

For the cheapest Michigan car insurance rates, Geico, Progressive, and Travelers are the top picks, with rates starting at $47 per month. To find the best deals, consider comparing Michigan car insurance quotes. Discover how much does car insurance cost in Michigan and the factors affecting your premium.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

UPDATED: Jan 30, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jan 30, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage for Michigan

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 13,283 reviews

13,283 reviewsCompany Facts

Min. Coverage for Michigan

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 1,733 reviews

1,733 reviewsCompany Facts

Min. Coverage for Michigan

A.M. Best Rating

Complaint Level

1,733 reviews

1,733 reviews

Geico, Progressive, and Travelers are the top choices for the cheapest Michigan car insurance rates, starting at $47 per month. These providers stand out for their competitive pricing and customer service. Discover the average car insurance in Michigan and compare options to secure the best coverage tailored to your needs and budget.

Michigan drivers should compare car insurance rates due to some of the highest costs in the nation, largely from the no-fault car insurance system. High no-fault limits result in expensive premiums, making it essential to find the cheapest rates for car insurance.

Our Top 10 Company Picks: Cheapest Michigan Car Insurance Rates

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $47 A++ Affordable Rates Geico

#2 $73 A+ Competitive Rates Progressive

#6 $88 A++ Bundling Options Travelers

#4 $98 A Teen Discounts American Family

#5 $100 B Local Agents State Farm

#7 $124 A+ Vanishing Deductible Nationwide

#3 $145 A+ Customer Service Amica

#8 $161 A Policy Customization Farmers

#9 $195 A+ Drivewise Program Allstate

#10 $204 A Safe Driver Liberty Mutual

Find cheap car insurance quotes by entering your ZIP code above.

- Find the cheapest car insurance in Michigan to save money

- Comparing car insurance quotes helps lower costs

- Geico is the top choice for affordable coverage.

#1 – Geico: Top Overall Pick

- Compare Michigan Car Insurance Rates

- Best Troy, MI Car Insurance in 2025

- Best Swartz Creek, MI Car Insurance in 2025

- Best Southfield, MI Car Insurance in 2025

- Best Sandusky, MI Car Insurance in 2025

- Best Saginaw, MI Car Insurance in 2025

- Best Rhodes, MI Car Insurance in 2025

- Best Port Huron, MI Car Insurance in 2025

- Best Petoskey, MI Car Insurance in 2025

- Best Oak Park, MI Car Insurance in 2025

- Best Newaygo, MI Car Insurance in 2025

- Best Midland, MI Car Insurance in 2025

- Best Marquette, MI Car Insurance in 2025

- Best Lincoln Park, MI Car Insurance in 2025

- Best Jackson, MI Car Insurance in 2025

- Best Hazel Park, MI Car Insurance in 2025

- Best Grass Lake, MI Car Insurance in 2025

- Best Grand Haven, MI Car Insurance in 2025

- Best Garden City, MI Car Insurance in 2025

- Best Frankenmuth, MI Car Insurance in 2025

- Best Ferndale, MI Car Insurance in 2025

- Best Dearborn, MI Car Insurance in 2025

- Best Davison, MI Car Insurance in 2025

- Best Cheboygan, MI Car Insurance in 2025

- Best Bath, MI Car Insurance in 2025

- Best Atlanta, MI Car Insurance in 2025

- Best Ann Arbor, MI Car Insurance in 2025

- Best Algonac, MI Car Insurance in 2025

- Best Addison, MI Car Insurance in 2025

- Best Warren, MI Car Insurance in 2025

- Best Detroit, MI Car Insurance in 2025

Pros

- Competitive Rates: Geico offers the most competitive rates for car insurance in Michigan, with an average monthly premium of $47. This makes it an excellent option for budget-conscious drivers seeking affordable coverage. Learn more in our Geico car insurance review.

- Comprehensive Online Tools: Geico’s user-friendly website and mobile app allow Michigan drivers to manage their policies and access discounts effortlessly, contributing to their overall low cost of insurance.

- Significant Discount Opportunities: Geico provides substantial discount opportunities for Michigan drivers, including discounts for good driving records and vehicles with advanced safety features, which can further reduce the already low premiums.

Cons

- Limited Local Support: Geico’s primarily online and phone-based service may lack the personalized, face-to-face support available from insurers with a more extensive local presence in Michigan.

- Potential Coverage Limitations: Geico’s focus on offering lower rates may result in less comprehensive coverage options compared to some competitors, which could be a drawback for drivers needing extensive protection.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#2 – Progressive: Best for Competitive Rates

Pros

- Affordable Premiums: Progressive offers competitive rates for car insurance in Michigan, with an average monthly premium of $73. This makes it a cost-effective choice for many drivers. Delve into our evaluation of Progressive car insurance review.

- Discount Programs: Progressive’s Snapshot program rewards safe driving with additional discounts, which can help Michigan drivers save even more on their insurance premiums, making their rates more affordable.

- Flexible Coverage Options: Progressive provides a range of coverage options, including comprehensive and collision coverage, that align well with Michigan’s no-fault insurance system, ensuring drivers are adequately protected.

Cons

- Higher Rates for High-Risk Drivers: Drivers with poor credit scores or driving records might face higher rates with Progressive, which could offset the initial affordability for higher-risk drivers in Michigan.

- Limited Physical Locations: With fewer physical locations in Michigan, Progressive may offer less personalized service compared to insurers with a broader local agent network.

#3 – Travelers: Best for Bundling Options

Pros

- Affordable Premiums: Travelers offers relatively affordable car insurance in Michigan at $88, making it a viable option for drivers looking for reasonably priced coverage without compromising on quality.

- Extensive Coverage Options: Travelers provides comprehensive coverage options tailored to Michigan’s no-fault insurance requirements, including PIP and uninsured motorist coverage, ensuring broad protection for drivers.

- Discount Opportunities: Travelers offers various discounts, including those for safe driving and bundling policies, which can help Michigan drivers reduce their premiums and get better value for their insurance. See more details on our Travelers car insurance review.

Cons

- Higher Premiums Compared to Some Competitors: While $88 is competitive, Travelers’ premiums are higher than some other insurers like Geico and Progressive, which might be a consideration for budget-conscious drivers in Michigan.

- Possible Rate Increases: Travelers may adjust rates based on claim history and driving record, which can lead to higher costs over time, potentially impacting long-term affordability.

#4 – American Family: Best for Teen Discounts

Pros

- Reasonably Priced Coverage: As mentioned in our American Family car insurance review, American Family offers car insurance in Michigan at $98, which provides a good balance between cost and coverage, making it a solid choice for many drivers seeking reliable insurance.

- Comprehensive Coverage Options: American Family provides extensive coverage options, including comprehensive and collision coverage, which cater to Michigan’s insurance requirements and offer robust protection for drivers.

- Discount Opportunities: American Family offers various discounts, including multi-policy and safe driver discounts, helping Michigan drivers reduce their premiums and save on their insurance costs.

Cons

- Higher Premiums Compared to Some Insurers: At $98, American Family’s premiums are higher than Geico and Progressive, which might not be as appealing for drivers seeking the lowest possible rates.

- Limited Local Presence: American Family’s smaller local agent network in Michigan may result in less personalized service compared to insurers with a more extensive local presence.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#5 – State Farm: Best for Local Agents

Pros

- Affordable Rates: State Farm offers car insurance in Michigan at $100, providing competitive premiums that are relatively affordable for drivers while offering good value for coverage.

- Extensive Local Agent Network: State Farm’s large network of local agents in Michigan ensures personalized service and expert advice, helping drivers find the best insurance solutions tailored to their needs.

- Flexible Coverage Options: State Farm provides a range of coverage options suitable for Michigan’s no-fault insurance system, including comprehensive and collision coverage, which ensures thorough protection. Unlock details in our State Farm car insurance review.

Cons

- Potential Rate Increases: State Farm may increase premiums after policy renewals or claims, which could affect long-term affordability for Michigan drivers and potentially offset initial savings.

- Limited Discounts for High-Risk Drivers: Drivers with a history of accidents or traffic violations may not benefit as much from State Farm’s discount programs, leading to higher rates compared to some other insurers.

#6 – Nationwide: Best for Vanishing Deductible

Pros Best for

- Comprehensive Coverage at a Reasonable Price: Nationwide offers car insurance in Michigan at $124, providing a good balance of coverage and cost, making it a reliable choice for many drivers.

- Discount Programs: Nationwide provides various discount opportunities, including multi-policy and safe driver discounts, which can help Michigan drivers lower their premiums and get more value from their insurance.

- Strong Customer Service: Nationwide is known for its strong customer service, which can be beneficial for Michigan drivers seeking reliable support and assistance with their insurance needs. Check out insurance savings in our complete Nationwide car insurance discount.

Cons

- Higher Premiums Compared to Some Insurers: At $124, Nationwide’s premiums are higher than Geico, Progressive, and Travelers, which might be a consideration for those seeking the lowest rates.

- Potential for Rate Fluctuations: Nationwide may adjust rates based on driving history and claims, which could lead to increased premiums over time and impact long-term affordability.

#7 – Amica: Best for Customer Service

Pros

- Quality Coverage Options: Amica provides high-quality car insurance coverage in Michigan at $145, including comprehensive and collision coverage, which ensures robust protection for drivers in the state.

- Discount Opportunities: Amica offers various discounts, such as multi-policy and safe driver discounts, which can help Michigan drivers save on their insurance premiums and reduce overall costs.

- Strong Customer Satisfaction: Amica is known for its excellent customer service and satisfaction ratings, providing reliable support and a positive experience for Michigan drivers.

Cons

- Higher Premiums Compared to Many Competitors: With premiums at $145, Amica’s rates are higher than Geico, Progressive, and Travelers, which might not be as appealing for those looking for the most affordable insurance options. Compare quotes from Amica and learn more information on our page titled “How do you get an Amica Mutual car insurance quote online?“

- Limited Availability of Discounts: Some of Amica’s discount programs may not be available in all areas of Michigan, which could limit potential savings for drivers depending on their location.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#8 – Farmers: Best for Policy Customization

Pros

- Comprehensive Coverage Options: Farmers offers a wide range of coverage options at $161 in Michigan, including PIP and comprehensive coverage, which aligns well with the state’s no-fault insurance requirements.

- Discount Programs: Farmers provides various discount opportunities, such as safe driver and multi-policy discounts, which can help Michigan drivers reduce their premiums and save on insurance costs.

- Strong Local Presence: Farmers has a significant local agent network in Michigan, offering personalized service and expert advice to help drivers find the best insurance solutions for their needs. Learn more in our Farmers car insurance review.

Cons

- Higher Premiums Compared to Many Insurers: At $161, Farmers’ premiums are higher than Geico, Progressive, and Travelers, which might be less attractive for those seeking lower-cost insurance options.

- Possible Rate Increases: Farmers’ rates may increase based on driving history and claims, which could impact long-term affordability for Michigan drivers and affect overall cost savings.

#9 – Allstate: Best for Drivewise Program

Pros

- Wide Range of Coverage Options: Allstate offers comprehensive car insurance coverage in Michigan at $195, including options that cater to the state’s no-fault insurance requirements and provide extensive protection.

- Discount Opportunities: Allstate provides various discounts, such as multi-policy and safe driver discounts, which can help Michigan drivers reduce their premiums and save on their insurance costs.

- Extensive Local Agent Network: Allstate’s large network of local agents in Michigan ensures personalized service and expert guidance, helping drivers find the best insurance solutions tailored to their needs. Discover more about offerings in our Allstate car insurance review.

Cons

- Higher Premiums: At $195, Allstate’s premiums are higher than many other insurers, which might not be as appealing for drivers looking for the most affordable car insurance options in Michigan.

- Potential for Rate Increases: Allstate may adjust rates based on claims history and driving record, which could lead to higher premiums over time, impacting long-term affordability for Michigan drivers.

#10 – Liberty Mutual: Best for Safe Driver

Pros

- Extensive Coverage Options: Liberty Mutual provides a wide range of coverage options at $204 in Michigan, including comprehensive and collision coverage, which ensures robust protection for drivers.

- Discount Opportunities: Liberty Mutual offers various discount programs, such as multi-policy and safe driver discounts, which can help Michigan drivers lower their premiums and save on insurance costs.

- Strong Customer Service: Liberty Mutual is known for its strong customer service, providing reliable support and assistance to Michigan drivers, helping them navigate their insurance needs effectively. Learn more in our Liberty Mutual car insurance review.

Cons

- Highest Premiums: At $204, Liberty Mutual’s premiums are the highest among the listed insurers, which may not be ideal for drivers seeking the most cost-effective insurance options in Michigan.

- Potential Rate Fluctuations: Liberty Mutual’s rates may vary based on driving history and claims, which could lead to increased premiums over time and impact long-term affordability for Michigan drivers.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

The Best Car Insurance Companies in Michigan

All of the big-name companies operate in Michigan. This includes top pick Geico and the rest of the industry leaders such as Progressive and Travelers. In addition to national insurers, Michigan drivers can choose from homegrown companies too, including highly-rated Auto-Owners Insurance, which has its headquarters in Lansing.

The table will show you below compares monthly rates for minimum and full coverage car insurance in Michigan from various providers.

Michigan Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $195 $406

American Family $98 $204

Amica $145 $285

Farmers $161 $335

Geico $47 $99

Liberty Mutual $204 $424

Nationwide $124 $257

Progressive $73 $152

State Farm $100 $209

Travelers $88 $183

With so many insurance companies to choose from, it’s hard to figure out which one is right for you. You want a great rate, but you also want a company that will be there for you when you have a claim. Comparing them can be overwhelming.

We’ll help you make sense of all the information out there and narrow down your choices to the best car insurance companies in Michigan.

Read More: Best Full Coverage Car Insurance

Read on for company ratings, financial status, and rates based on multiple different factors including commute distance and credit score – so you can feel confident in your insurance company choice and get the cheapest car insurance premium.

Michigan Car Insurance Coverage and Rates

Michigan’s no-fault car insurance system is different from any other state, including coverage you won’t see elsewhere. It can be confusing, especially to new residents used to a fault system of insurance coverage.

We will take the complexity out of it and break it all down, discussing the types of coverage available in Michigan, how much you can expect to pay, and any car insurance coverage limits involved.

Learn More: Car Insurance Coverage Limits: Explained Simply

Here you will find details on all the required coverage for a Michigan auto insurance policy to comply with state laws, as well as what options are available to create a personal protection plan.

Michigan Minimum Insurance Coverage

Every driver in Michigan must be covered by a no-fault insurance policy that is made up of several parts. The system is designed to reduce lawsuits by having each individual’s insurance policy cover their own injury and damage costs regardless of who is at fault.

Remember, no-fault doesn’t mean no one is at fault. It just governs which insurance coverage is primary.

In addition to no-fault coverage, Michigan drivers must carry a basic amount of liability insurance, which serves as residual coverage in three main situations: if you are responsible for an accident causing serious injury or death, if you have an accident with an out-of-state driver in Michigan, or if you have an accident outside of Michigan. In these cases, you can be sued for damages, and your liability coverage will protect you.

Read More: Compare Liability Car Insurance: Rates, Discounts, & Requirements

There’s one more situation where you can sue another driver. Under the Limited Property Damage or “Mini-Tort” provision, if you are less than 50% at fault in an accident, you can recover up to $1,000 for property damage not covered by your policy, such as a deductible. On July 1, 2020, this amount increased to $3,000.

Here are the minimum limits you have to carry for both no-fault and liability coverage in Michigan. This table also reflects the new laws that went into effect on July 1, 2020, under the 2019 insurance reform bill. The biggest changes will be to PIP and liability limits.

- Personal Injury Protection (PIP): Previously, it provided unlimited coverage, with policies paying out all reasonable costs for injuries. The new minimums are $50,000 for drivers enrolled in Medicaid and $250,000 for all others.

- Personal Property Protection (PPI): The coverage remains unchanged at $1 million.

- Bodily Injury Liability: The previous limits were $20,000 per person and $40,000 per incident. The new limits are $50,000 per person and $100,000 per incident.

- Property Damage Liability: The coverage remains unchanged at $10,000 per incident.

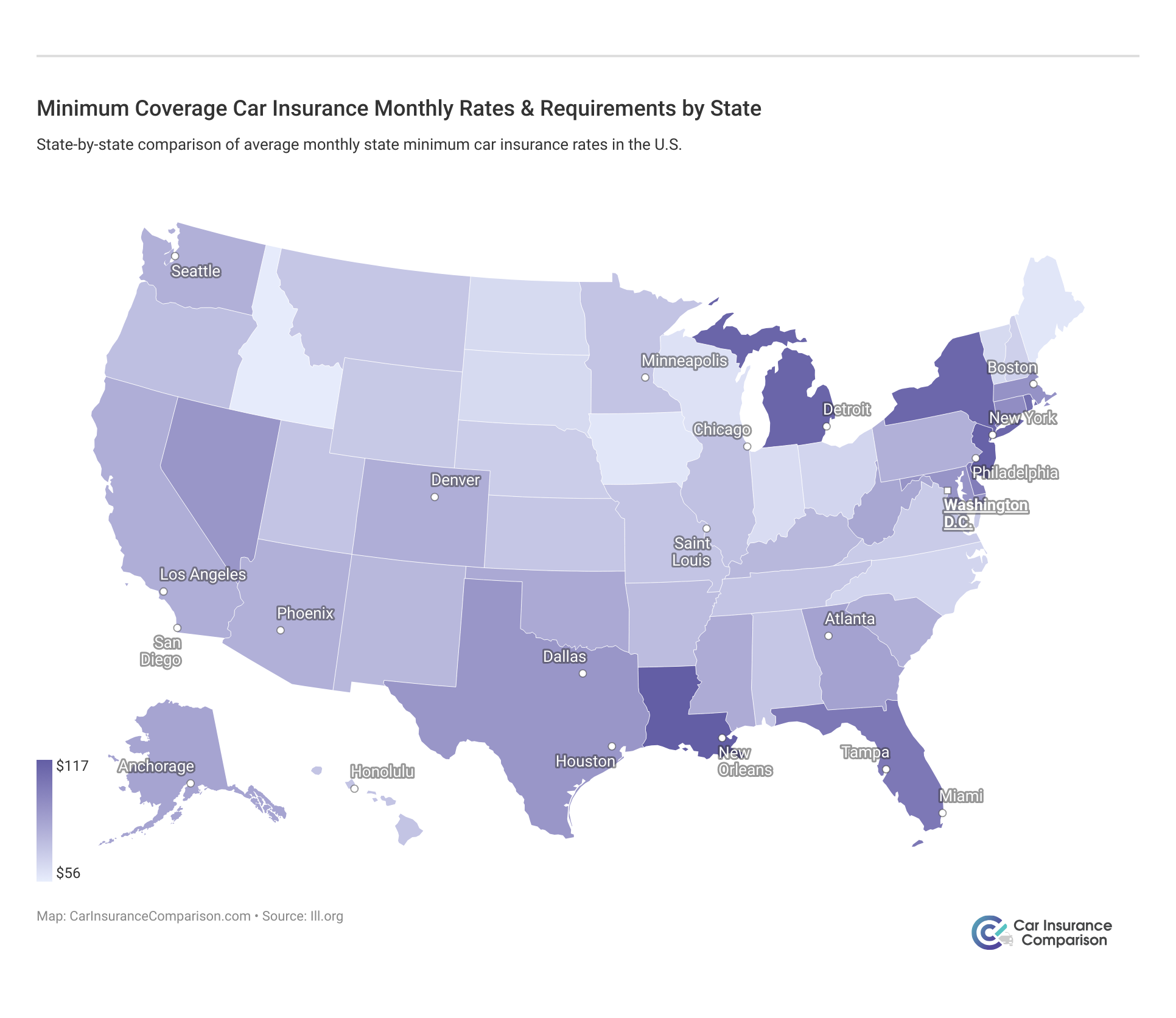

With the recent changes to Michigan’s insurance laws, drivers should review their coverage to ensure it meets the new minimums. Understanding these updates will help you stay compliant and adequately protected on the road. And here is a comparison chart of what minimum insurance costs are across the US.

Under the new PIP Choice law, Michigan drivers on Medicare can opt out of PIP coverage entirely, while other drivers can choose from several coverage levels: $50,000 (for Medicaid recipients), $250,000, $500,000, or unlimited coverage.

Forms of Financial Responsibility

In Michigan, the only acceptable form of financial responsibility is car insurance. With the exception of those with a fleet of 25 vehicles or more, in which case you can be self-insured, every driver must purchase the required policy. Up until the fall of 2018, drivers in Detroit could compare weekly car insurance and purchase a policy. It was good for just long enough to get the car registered, after which most drivers would let it lapse.

With this policy no longer available, drivers will only have the option of showing they are insured with a policy term of at least six months. Unfortunately, the change doesn’t mean much for the uninsured motorist rates since drivers can simply stop making installment payments at any time.

We’ll cover the penalties for driving without insurance later, but it’s definitely not worth breaking the law. Carry either a paper copy of your proof of insurance or be prepared to present it electronically. Since 2016, Michigan law has allowed the use of a smartphone or other electronic device to display proof of insurance on request.

Premiums as a Percentage of Income

We know the insurance rates in Michigan are really high, but how much of your income can you expect to spend?

In Michigan, the monthly per capita disposable income is $3,034 a month. That’s how much money is available to spend after taxes.

The average monthly car insurance premium is $112. That means Michigan residents spend an average of 3.71% of their income on car insurance. Not at all surprisingly, that places the state well above the national average of 2.37%.

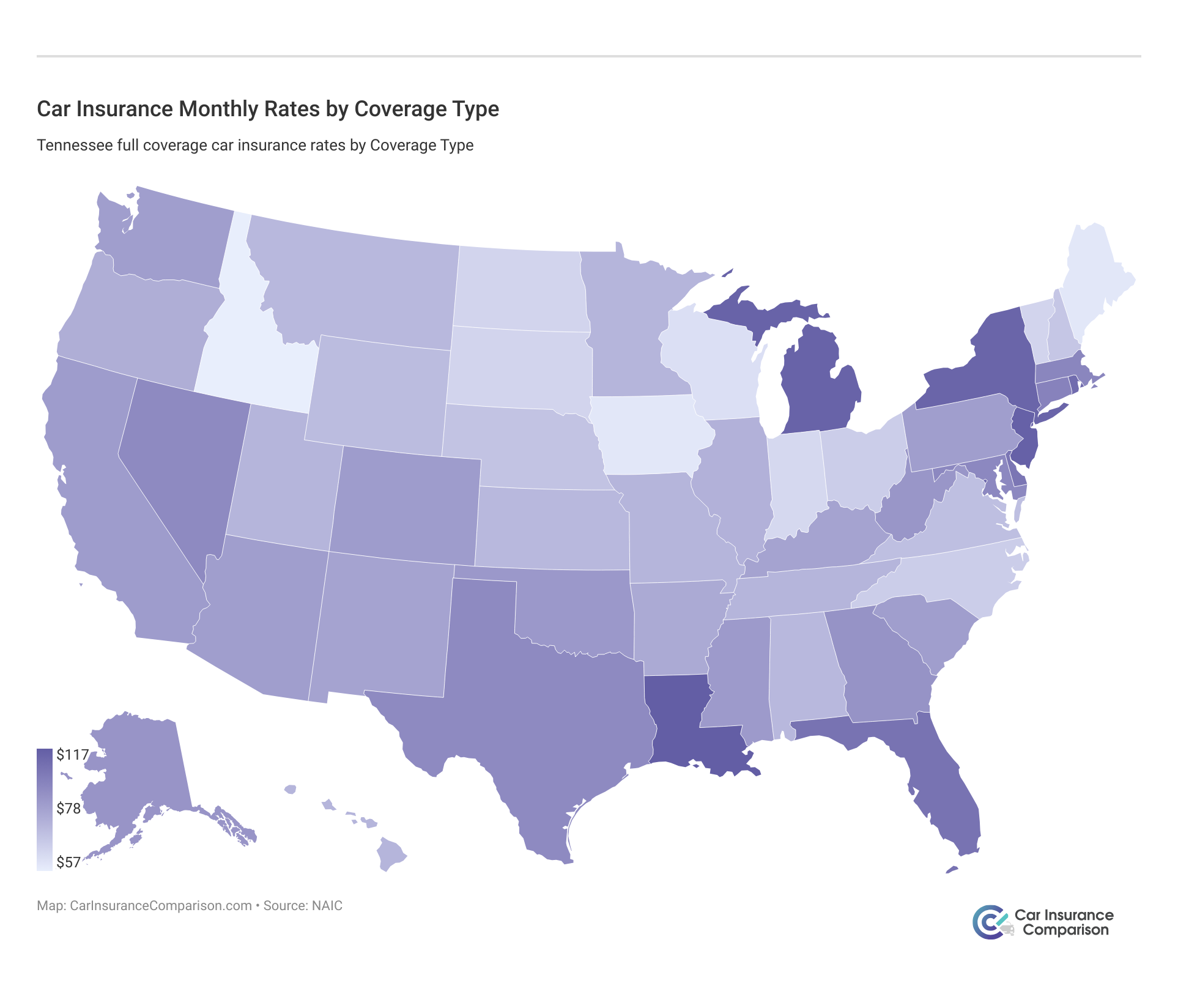

Average Monthly Car Insurance Rates in MI (Liability, Collision, Comprehensive)

Core coverage is the basics that make up a full coverage policy for Michigan drivers. Here’s a breakdown of what each of the three main parts of a car insurance policy costs on average in Michigan.

Michigan Car Insurance Cost by Coverage Type

| Coverage Type | Monthly Rates |

|---|---|

| Liability | $66 |

| Collision | $34 |

| Comprehensive | $13 |

| Full Coverage | $114 |

In Michigan, the average monthly rate for liability coverage is significantly higher, while collision and comprehensive coverage also contribute to increased overall costs. This results in a total that exceeds the national average.

As you can see, Michigan drivers are paying more than the national average across the board. This underscores the importance of shopping around for competitive rates and exploring various coverage options.

Additional Liability

Michigan requires both personal injury protection and personal liability as part of every legally acceptable insurance policy. There are still some options, however, for additional liability.

We’ll take a look at those options as well as how all of Michigan’s liability coverage is performing in terms of loss ratios.

Uninsured/underinsured motorist coverage is notable as an optional liability coverage given the fact that at 20%.

Michigan has the fourth-highest number of uninsured motorists in the nation.

Brad Larson LICENSED INSURANCE AGENT

You might be wondering why, with so much required no-fault coverage, you would still need to protect yourself from a motorist without insurance.

As noted above, there are situations in which you can still sue the at-fault driver in a crash. If that driver has no insurance and the accident involves serious injury or death, uninsured/underinsured coverage will pay additional costs.

Michigan Liability Car Insurance Loss Ratio by Coverage Type

| Coverage Type | Michigan | U.S. Average |

|---|---|---|

| Uninsured/Underinsured Motorist | 73.90 | 67.33 |

| Personal Injury Protection | 68.14 | 69.50 |

Loss ratios tell us what companies are paying out in claims compared to the premiums they take in. A good loss ratio is neither too high (meaning the company is paying out too much in claims) nor too low (meaning they aren’t paying enough.

For both PIP and Uninsured or Underinsured Motorist coverage, Michigan is not far off from the national average.

Add-ons, Endorsements, and Riders

- Gap Insurance

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-As-You-Drive or Usage-Based Insurance

Currently, several insurance companies offer usage-based car insurance options in Michigan. They include Progressive, Allstate, and Esurance. These plans offer a discount for drivers who enroll in the program and have their driving habits recorded over time.

Discover the variety of car insurance discounts offered by top providers in Michigan to help you save on your premiums.

They’re a great choice for combating Michigan’s high rates, but a word of caution: Some companies can and will actually increase your rate if the information recorded shows risky driving habits. Progressive’s Snapshot program is one of these.

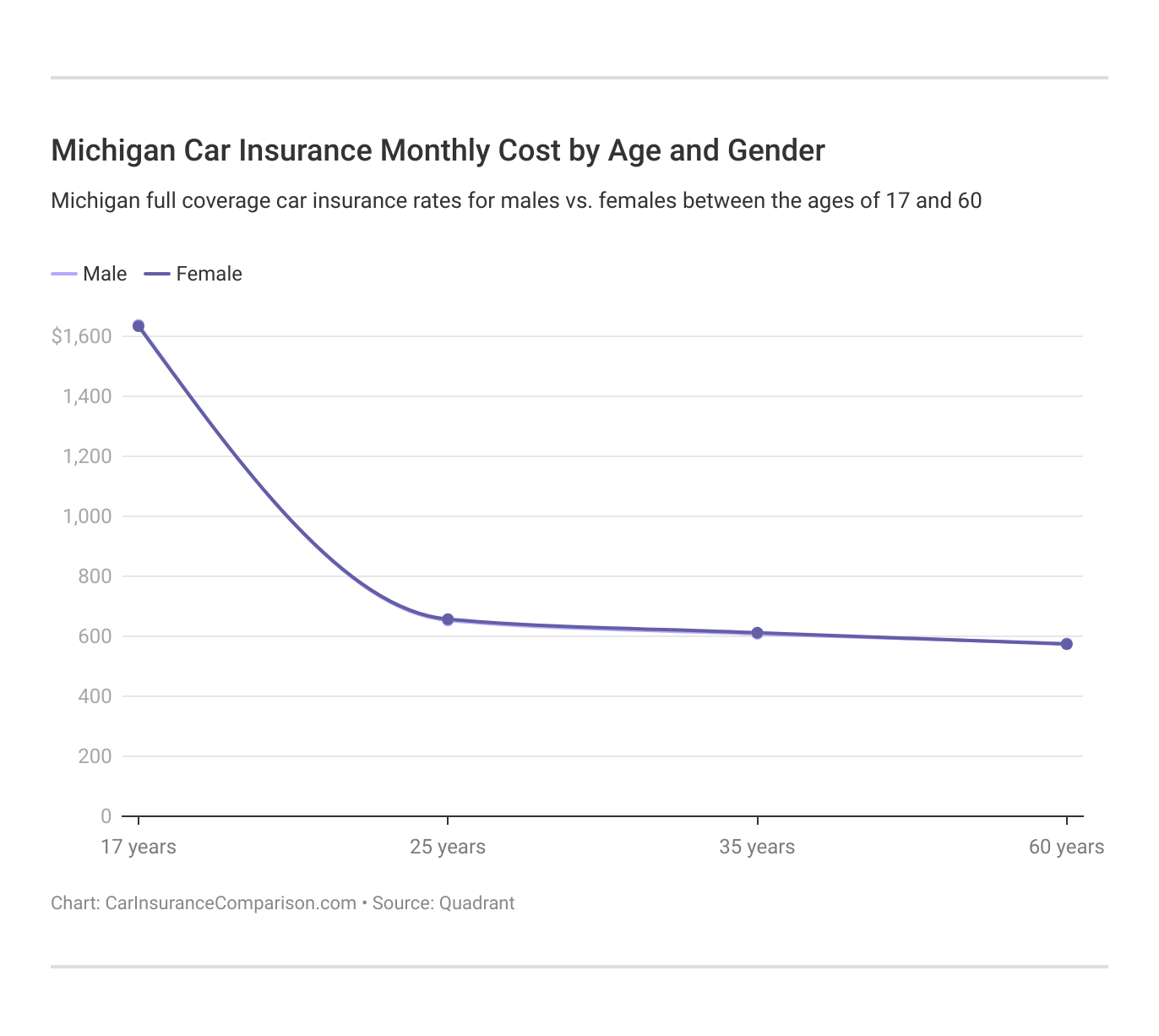

Michigan Car Insurance Monthly Rates by Age & Gender

As of July 1, 2020, Michigan’s new car insurance reform law removed gender and age from the allowable rating factors for car insurance rates. Here’s a look at the rates.

Michigan Car Insurance Monthly Rates by Age, Gender, & Provider

| Insurance Company | Age: 17 Male | Age: 17 Female | Age: 25 Male | Age: 25 Female | Age: 35 Male | Age: 35 Female | Age: 60 Male | Age: 60 Female |

|---|---|---|---|---|---|---|---|---|

| Allstate | $831 | $670 | $394 | $350 | $272 | $254 | $220 | $210 |

| American Family | $753 | $690 | $380 | $330 | $268 | $250 | $215 | $205 |

| Amica | $720 | $675 | $360 | $310 | $260 | $245 | $210 | $200 |

| Farmers | $966 | $753 | $393 | $350 | $272 | $255 | $220 | $210 |

| Geico | $531 | $453 | $282 | $240 | $209 | $196 | $180 | $170 |

| Liberty Mutual | $700 | $650 | $350 | $300 | $260 | $240 | $220 | $210 |

| Progressive | $775 | $664 | $348 | $300 | $259 | $245 | $215 | $205 |

| State Farm | $528 | $469 | $325 | $283 | $236 | $220 | $190 | $180 |

| The Hartford | $690 | $630 | $340 | $300 | $255 | $240 | $210 | $200 |

| USAA | $520 | $375 | $230 | $195 | $171 | $162 | $145 | $140 |

Age significantly affects monthly car insurance rates. Younger drivers, especially at 17, face much higher premiums due to inexperience, while drivers in their 35s or 60s enjoy lower costs because of safer driving records.

Seventeen-year-old drivers pay the highest rates due to inexperience, but by age 25, the cost drops dramatically. Decreases are much subtler from that point on.

This data illustrates the importance of shopping around – while some companies’ rates for a teen driver are astronomical, others charge a fraction of their counterparts’ premiums.

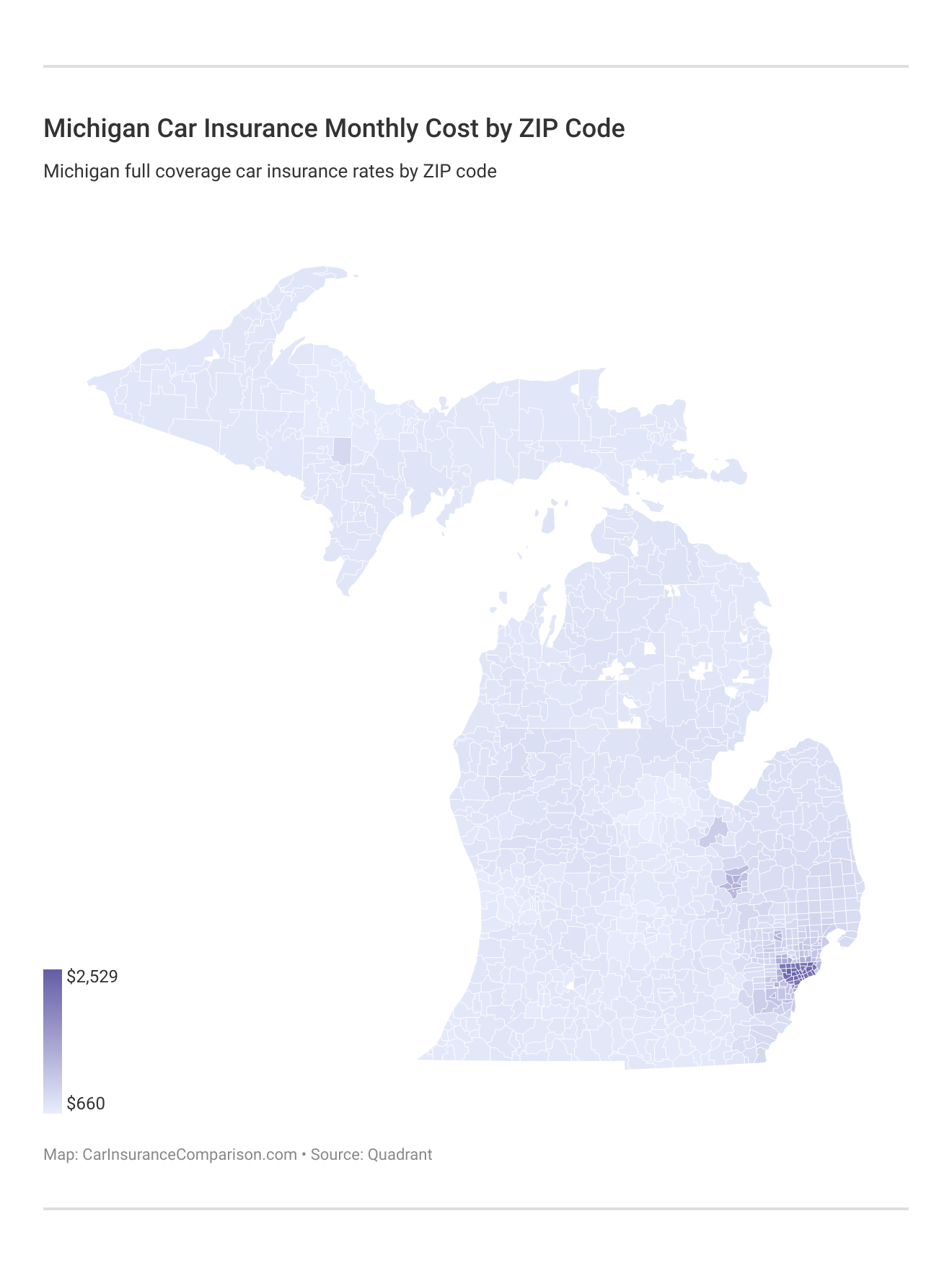

Cheapest Rates By Zip Code

Like other rating factors currently in use, your zip code will no longer have an impact on rates as of July 1, 2020. Currently, zip code is one of the determining factors in car insurance rates.

Take a look at the rates across Michigan by looking at the zip codes above. The most expensive zip codes are in Detroit, while the cheapest zip codes are in the central part of the state.

Highest and Lowest Rates By City

You can find the cheapest insurance rates for the big insurance companies by city. Typically, the highest rates are found in large cities and surrounding areas, such as Detroit and the metro area. Conversely, the lowest rates are found in smaller cities like St. Louis and Shepherd.

Although college towns might seem to have high rates due to the abundance of young drivers, many students are likely insured under a parent’s plan and rated based on their home zip code rather than the school. Note that as of July 1, 2020, location will no longer be a factor in determining rates.

How Much Auto Insurance Costs in Michigan

Explore auto insurance costs in Michigan across diverse cities like Addison, Frankenmuth, and Oak Park. Compare rates tailored to your city for informed coverage decisions.

Michigan Car Insurance Cost by City

Understanding car insurance costs in Michigan’s cities is crucial for making informed decisions. By comparing rates specific to your location, you can find the cheapest auto insurance in Michigan and best coverage options to fit your needs.

Michigan Car Insurance Companies’ Financial Ratings

AM Best gives insurance companies a letter grade based on their financial stability. Shown below are the ratings for each of the top ten companies in Michigan, all of which have earned either Excellent (A, A-) or Superior (A+, A++) ratings from AM Best.

A.M. Best Financial Strength Ratings From the Top Michigan Car Insurance Providers

| Insurance Company | A.M. Best |

|---|---|

| Allstate | A |

| CSAA | A |

| Geico | A++ |

| Liberty Mutual | A- |

| Nationwide | A+ |

| Progressive | A+ |

| State Farm | B |

| The Hartford | A+ |

| Travelers | A+ |

| USAA | A++ |

Also shown are the companies’ loss ratios, which if you’ll remember from above indicate how much a company is paying out in claims compared to how much it earns in premiums.

There’s definitely some concern with a couple of these companies, especially those reporting loss ratios of more than 100 percent. That means they’ve paid out more than they took in.

Big companies with a lot of business can absorb losses in one area better than a smaller company without a major impact on their bottom line. That explains why a huge company like Allstate can have a high loss ratio but hold on to a good AM Best rating.

Companies With the Best Ratings

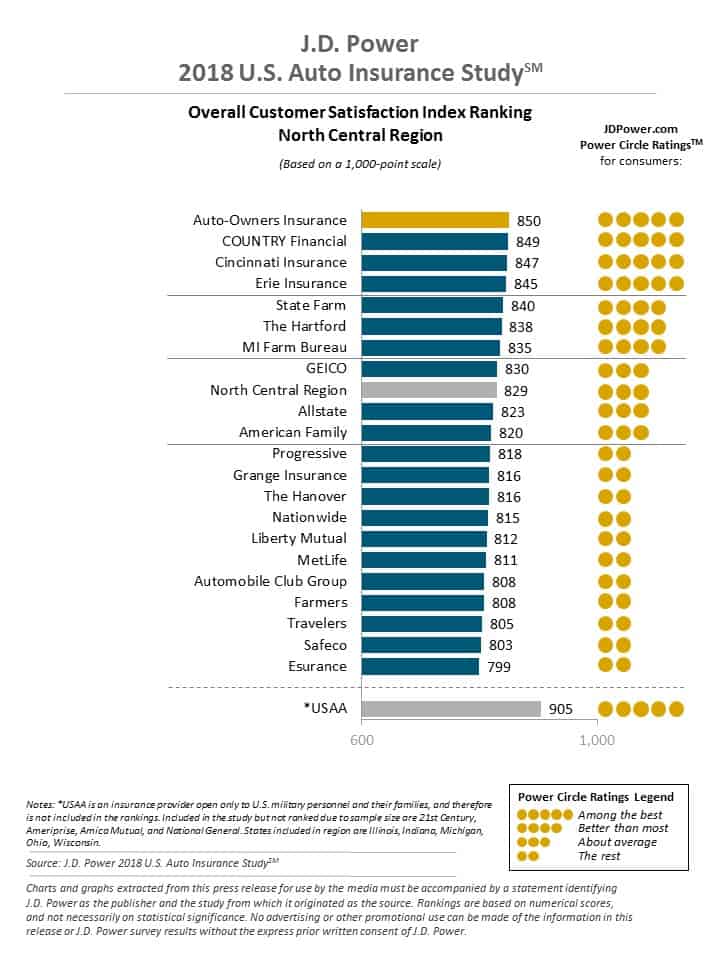

Financial ratings are just the beginning. JD Power ratings tell us how a company is performing in terms of customer satisfaction. The company uses a five-factor survey to rate companies overall.

The ratings above tell us that local company Auto-Owners takes the top spot for the region, with the exception of USAA. The small print explains that JD Power rates USAA, but doesn’t rank them due to their eligibility requirements.

Both State Farm and Michigan Farm Bureau ranked above the regional average.

Read More: Auto Owners Car Insurance Review

Michigan Car Insurance Companies With the Most Customer Complaints

Which companies have the most complaints in Michigan? We gathered complaints data for the top ten companies in the state.

Pay special attention to the complaint ratio. That tells us how many complaints there were per $1 million in premiums written. A company that writes a lot of policies may well have a complaint number that looks high, but their ratio will actually be a lot lower than their competitors.

Insurance Companies in Michigan with the Most Customer Complaints

| NAIC # | Insurance Company | Premiums | Total Complaints | Complaint Index |

|---|---|---|---|---|

| 25178 | State Farm | $1.2 billion | 150 | 12.1 |

| 19232 | Allstate | $1 billion | 120 | 11.5 |

| 35882 | Geico | $800 million | 95 | 11.3 |

| 25143 | Progressive | $700 million | 85 | 10.8 |

| 21628 | American Family | $600 million | 72 | 10.3 |

| 37478 | Hartford | $500 million | 68 | 9.7 |

| 25941 | USAA | $300 million | 45 | 8.9 |

| 42919 | Liberty Mutual | $300 million | 40 | 8.6 |

| 13692 | Nationwide | $300 million | 35 | 8.4 |

| 24147 | Farmers | $300 million | 30 | 8.2 |

State Farm has the highest number of complaints, but one of the lowest ratios because they sell more insurance in Michigan than any other company. The ratio tells us more than the number alone.

Of the top 10, Liberty Mutual has the highest complaint ratio in Michigan.

Cheapest Car Insurance Rate in Michigan

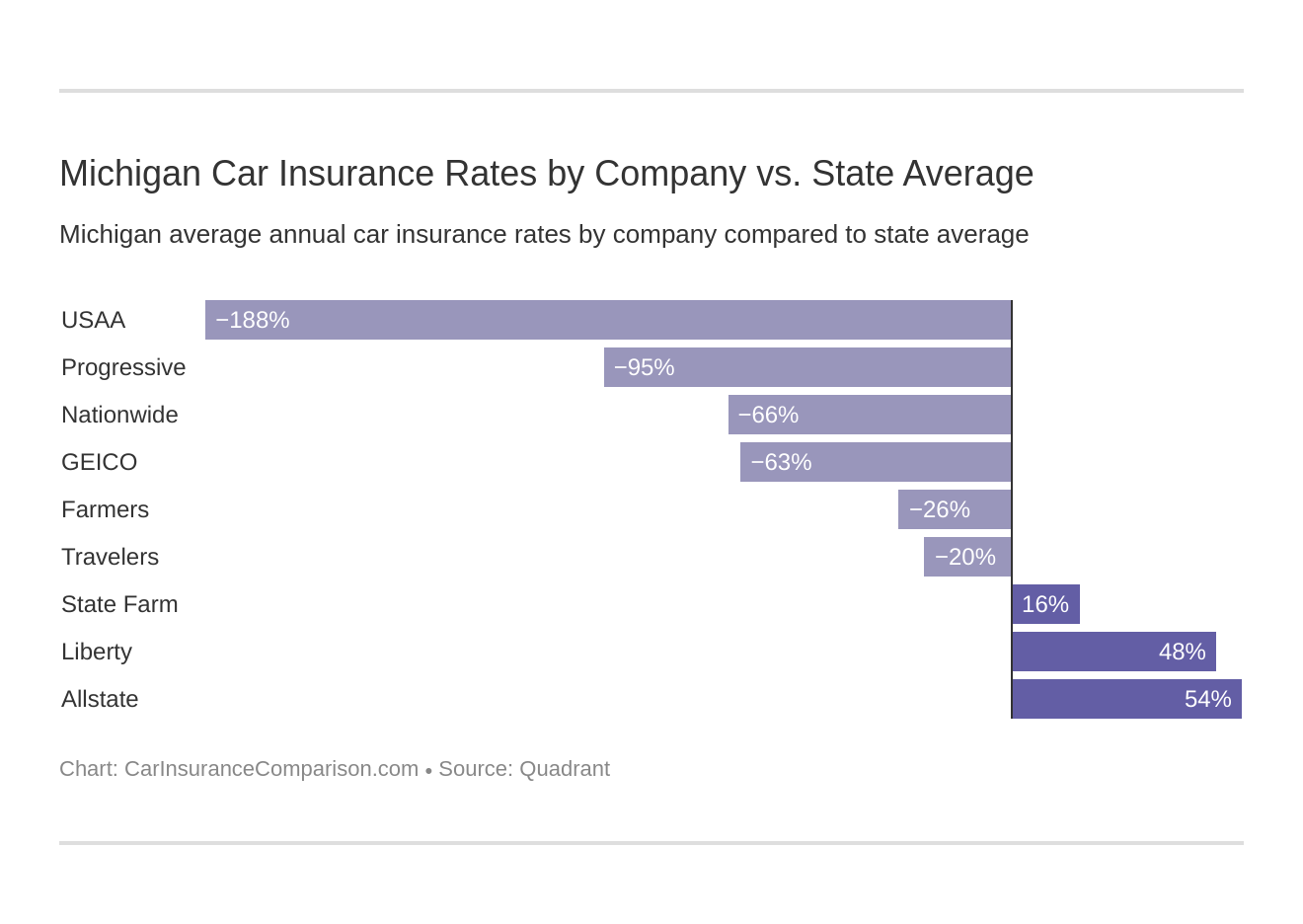

Now the big question: which company is the cheapest in Michigan? We’ve ranked the top ten largest companies based on their rates below.

USAA is far and away the option for cheap insurance in Michigan, with rates around 188% below average. Unfortunately, they aren’t open to everyone. You need a military connection to get coverage through USAA, and they offer a quiz to determine eligibility. You can learn more by looking at our USAA car insurance review.

Progressive, the next cheapest option, comes in at more than 94% below the state average and is open to everyone, which is good news. Learn more by looking at our recent Progressive car insurance review.

Somewhat surprising is the fact that State Farm came in above the average but still holds onto the top spot for market share. Learn more in our State Farm insurance review.

Commute Distance Rates by Company

Commute distance is a factor in car insurance rates, but it may not be as big a difference as you might think. Some companies don’t increase rates at all with a longer commute, while at others the difference is minor.

Check out the rates for several top companies using two difference daily commutes and annual mileage estimates.

Michigan Full Coverage Car Insurance Monthly Rates by Annual Mileage & Provider

| Insurance Company | 6,000 Miles | 12,000 Miles |

|---|---|---|

| Allstate | $155 | $170 |

| American Family | $160 | $175 |

| Farmers | $170 | $185 |

| Geico | $120 | $135 |

| Liberty Mutual | $145 | $160 |

| Progressive | $125 | $140 |

| State Farm | $115 | $130 |

| USAA | $105 | $120 |

| U.S. Average | $118 | $124 |

Comparing insurance rates based on daily commutes and mileage can lead to significant savings. Evaluating different scenarios helps you choose the most cost-effective coverage for your driving habits.

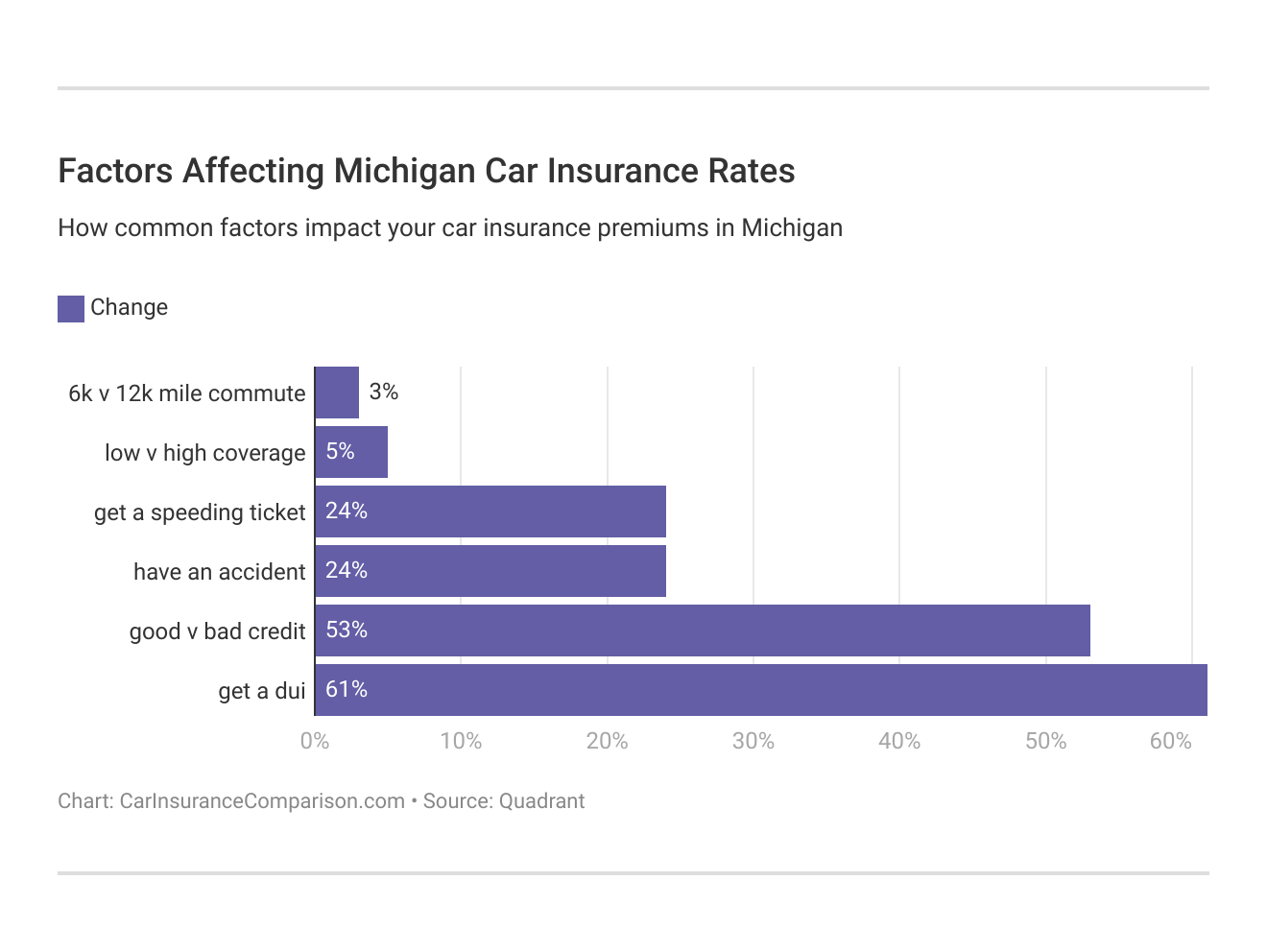

Credit History Rates by Company

What car insurance companies don’t use credit ratings? The use of credit scores in insurance rating has long been a contentious issue. Take a look at how your credit score can impact rates with different companies under current law.

Michigan Full Coverage Car Insurance Monthly Rates by Credit Score & Provider

| Insurance Company | Bad Credit | Fair Credit | Good Credit |

|---|---|---|---|

| Allstate | $275 | $210 | $170 |

| American Family | $265 | $200 | $165 |

| Farmers | $290 | $220 | $180 |

| Geico | $250 | $190 | $150 |

| Liberty Mutual | $285 | $215 | $175 |

| Metromile | $270 | $200 | $160 |

| Nationwide | $260 | $195 | $155 |

| Progressive | $280 | $210 | $170 |

| State Farm | $240 | $185 | $145 |

| Travelers | $265 | $205 | $160 |

| USAA | $220 | $175 | $135 |

| U.S. Average | $210 | $140 | $115 |

Credit scores significantly impact monthly insurance rates, with poor credit resulting in much higher premiums. From July 1, 2020, Michigan drivers will no longer have their credit scores used to determine insurance rates.

Driving Record Rates by Company

This is the big one – your driving record. Few things have as big an impact on car insurance rates as tickets, accidents, and major violations such as a DUI.

Do all car insurance companies check your driving records? You bet. As of July 1, 2020, driving record will be one of the only rating factors on which insurance companies can base rates.

But the good news is that not every company rates these things the same way, so no matter what’s on your record you can still shop around a better deal. Here’s an idea of what top companies charge based on different driving records with common violations.

Michigan Full Coverage Car Insurance Monthly Rates by Driving Record & Provider

| Insurance Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| Allstate | $180 | $220 | $300 | $240 |

| American Family | $175 | $215 | $295 | $235 |

| Amica | $170 | $210 | $280 | $230 |

| Farmers | $185 | $225 | $305 | $245 |

| Geico | $150 | $190 | $250 | $200 |

| Liberty Mutual | $175 | $215 | $295 | $235 |

| Progressive | $160 | $200 | $299 | $214 |

| State Farm | $140 | $180 | $270 | $190 |

| The Hartford | $170 | $210 | $280 | $230 |

| USAA | $130 | $170 | $287 | $160 |

With most companies, a DUI will have the biggest impact on your rates, but that’s not always the case. A few companies charge less for a DUI than for an accident, again highlighting why comparing rates from multiple companies is a must.

Read More: What are the DUI insurance laws in Michigan?

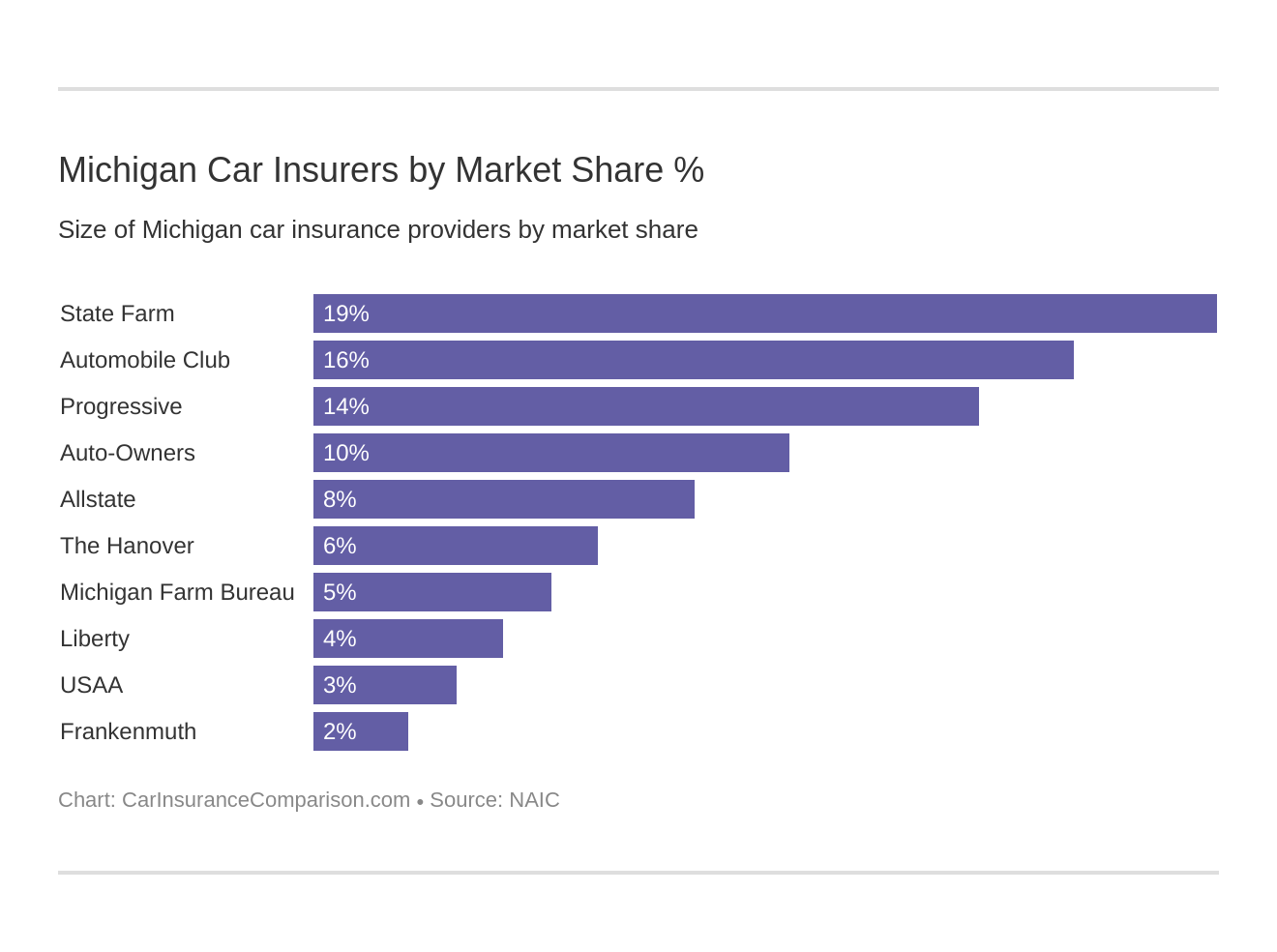

Largest Car Insurance Companies in Michigan

The top three biggest car insurance companies in Michigan are not that far off from each other in terms of market share. State Farm holds onto the lead by about three percent.

State Farm leads the market in Michigan, with a slight edge over competitors. Local companies like Frankenmuth and Michigan Farm Bureau also offer competitive monthly rates.

Number of Insurers by State

Michigan has 65 domestic insurance companies operating in the state, domestic meaning that the company is incorporated in Michigan. There are also 786 foreign insurance companies that are also licensed to do business in Michigan – to be clear, this means that these companies are incorporated in other states, not other countries.

Michigan drivers have more domestic insurers to choose from than many states, and that includes the fourth largest insurer in the state, Auto-Owners.

Michigan Car Insurance Laws

There are a lot of laws on the books governing vehicles and drivers on Michigan’s roads. Understanding all of the laws and keeping up with the changes that seem to happen all the time is confusing and time-consuming. It would be a lot easier to simply have the must-know laws outlined in a straightforward format, without all the legal jargon, right?

We agree, so we’ve gathered all the basic laws you need to know right here. Included below are laws regarding car insurance, vehicle and driver licensing, and the rules you need to know when you’re on the road.

Car Insurance Laws

You know you need car insurance on the road, and we have already covered the basics of required and optional coverage. But read on, because there’s more you need to know.

The Michigan Legislature handles the creation and changes to all of the laws related to vehicles. The current state of car insurance premiums in Michigan has made reform a big topic for legislators.

Michigan finally passed car insurance reform and it was signed into law in June of 2019. This sweeping change is intended to reduce rates for most drivers.

High-Risk Insurance

High-risk drivers are those with a driving record or other issue that makes it difficult to qualify for insurance coverage. Michigan operates the Michigan Automobile Insurance Placement Facility (MAIPF) to help drivers who have been unable to get coverage on the open market.

This plan is a last resort and only for drivers whose record has caused them to be turned down for coverage.

This type of insurance pool exists to see that drivers can get the legal minimum coverage they need even with a driving record that makes insurance companies slam the door. Drivers are assigned to an insurance company, spreading the risk around to the various insurers in the state.

While the pool will get you covered and will keep rates within a certain state maximum, you can bet this coverage won’t be cheap. The goal should be to clean up your driving record and get on a standard policy as soon as possible.

Low-Cost Insurance

There is currently no state plan in place to assist low-income families with their car insurance costs. The last attempt to create a low-income option, Senate Bill 288, was defeated in the house back in 2015.

Windshield Coverage

There are a few laws on the books in Michigan regarding how broken windshield car insurance is handled.

First, you have the right to choose your own repair shop, but you may be required to pay the difference in price if you choose to do so.

Second, insurance companies do have the right to use aftermarket parts in windshield repair. They have to explicitly include it in the estimate, however.

When you bundle, you don’t have to pick 😉 #NFLDraft pic.twitter.com/LL0aBcY0Dm

— GEICO (@GEICO) April 27, 2023

While companies can offer you a specific windshield replacement and repair coverage option on your policy, they’re not required to do so. The coverage is otherwise considered part of the comprehensive portion of the policy and is subject to that deductible.

Automobile Insurance Fraud in Michigan

Michigan’s unlimited no-fault injury benefits have made the state a target for car insurance fraud.

Fraud costs insurance companies millions, in turn contributing to Michigan’s already high insurance costs. The Michigan Department of Insurance and Financial Services estimates that between $5.6-77 billion in buildup claims were paid out in 2012, with 15% of claims showing signs of possible fraud. They also estimate a loss of about $29 billion a year to car insurance companies.

Insurance fraud, including lying about, concealing, or omitting information relating to a claim, is illegal in Michigan.

Insurance fraud is a felony carrying a sentence of up to five years and fines of up to $50,000, along with restitution and other civil penalties.

The 2019 car insurance reform law included the creation of a new anti-fraud unit to investigate fraudulent activities in the insurance industry.

Statute of Limitations

The statute of limitations in Michigan for both bodily injury and property damage claims is three years. After this time limit, you can no longer make a claim or file a lawsuit.

Michigan Specific Laws

No discussion of driving in Michigan is complete without a mention of the Michigan Left. Essentially a U-turn, the Michigan Left was created in 1960 in order to reduce the traffic making left turns at major intersections. Rather than turning left right at the intersections, drivers go past it, make a U-turn, and then come back to the intersection to make a right turn.

Drivers are required to follow the Michigan Left laws at intersections where they are present rather than making a standard left turn. While other cities are picking up on the idea of the Michigan Left, and giving it new names such as the “Thru-Turn”, the practice remains Michigan-born and unusual anywhere else.

Vehicle Licensing Laws

Licensing for drivers and vehicles is handled by the office of the Michigan Secretary of State. Let’s take a look at some of the pertinent laws.

Penalties for Driving Without Insurance

Michigan has a high number of uninsured drivers on the road, but it’s illegal and can result in fines and even jail time. The law is unusual in that you can be fined simply for failing to provide proof of insurance when asked by an officer, even if you do actually have insurance.

That means that the thing you don’t want to leave home without in Michigan isn’t your American Express card – although you might need that to pay the fine – it’s your proof of insurance. What does an auto insurance certificate look like? Make sure you know before you leave the house next time.

Driving without insurance is a misdemeanor and carries possible penalties of:

- $200-$400 in fines

- Up to one year in jail

- License suspension of up to 30 days, or until you provide proof of insurance

- $25-$125 reinstatement fee

Proof of insurance can be provided in the form of a paper copy of your insurance card or policy, or in electronic format on your phone or tablet. Michigan also allows police to run your license plate through a database to determine whether you have insurance on record, which means they may already know you’re uninsured when they pull you over.

Proof of insurance can still save the day though; since insurance companies are only required to submit policy information on the first and 15th of each month, a policy taken out in between might not show up, so be prepared to show proof.

Teen Driver Laws

Michigan’s Graduated Driver Licensing (GDL) system helps ensure safety for teen drivers by introducing restrictions as they gain skills. The Level 1 Learner’s License, available at 14 years and 9 months, requires completion of Segment 1 driver education and a vision test.

Teens can drive only with a licensed adult over 21, and cell phone use is prohibited.

At 16, teens can obtain a Level 2 Intermediate License after completing Segment 2 education, holding the Level 1 license for six months, and passing a driving test with 50 hours of practice (10 at night). Restrictions include no cell phone use, no driving between 10 p.m. and 5 a.m. without an adult, and only one passenger under 21 unless they are family.

The final step is the Level 3 Full License at 17, which requires holding the Level 2 license for six months, with no restrictions. Parents can revoke driving permission until the teen turns 18. Looking for car insurance for your teen driver? Compare rates on our website.

Older Driver License Renewal Procedures

Michigan law requires all drivers to renew their licenses every four years, regardless of age. Similarly, all ages are permitted to renew either online or by mail every second renewal. There are no renewal laws specific to seniors in Michigan, but you may be able to find over age 55 car insurance discounts.

New Residents

Need advice on handling car insurance when moving to another state? Are you new to Michigan? You’ll need to get a Michigan license right away, which you can do at any Secretary of State office. If you have a current license from another state that is valid or has been expired for less than four years, you won’t need to take a written test, but a vision test will be required.

Make sure to bring your current license along with proof of legal presence in the United States and your Social Security Number. Drivers from another country with temporary status in the United States can be issued a temporary license. Finally, you will need to pay the $25 fee to get your new Michigan license and pose for your new license photo.

License Renewal Procedures

The same license renewal procedures apply to all licensed Michigan drivers. License renewal is done every four years, and every second time (or every eight years) it has to be handled in person. The one caveat is that only U.S. Citizens can renew online.

Each in-person renewal will require a vision test. You’ll need to bring any prescription eyewear to the visit and of course be prepared to pay the fee. Can you get car insurance with an expired license? Yes, but getting coverage may be more complex than if you simply renewed your license first.

Negligent Operator Points System

Michigan uses a points system to monitor drivers for violations of the law. Points range between two and six depending on the offense.

Here’s a sampling of points:

- Two Points: minor moving violations such as speeding 10 mph or less over the limit, refusing a breathalyzer Under 21), open alcohol

- Three Points: careless driving, speeding 11-15 mph over, failure to obey traffic lights or stop signs, failure to stop at a railroad crossing

- Four Points: Drag racing, driving while visibly impaired, speeding 16 mph or more over the limit, any BAC while under 21

- Six Points: felony involving the use of a motor vehicle (such as manslaughter), driving under the influence, reckless driving, fleeing or evading a police officer

Michigan’s points system ensures that drivers are held accountable for their actions on the road. Accumulating 12 points can lead to license suspension, so it’s crucial to drive responsibly and adhere to traffic laws.

Rules of the Road

Before you hit the road in Michigan, make sure you brush up on these important rules of the road.

Fault vs. No-Fault

Michigan is a no-fault state, as we have already covered in previous sections. In fact, the state has some of the most comprehensive no-fault laws in the country.

Michigan is the only no-fault state where injury benefits under PIP are unlimited. This will change in July of 2020 when new laws go into effect and lower PIP limit choices are available..

The new laws that go into effect on July 1, 2020, will allow drivers to sue for excess medical benefits. This is a change from the current law that allows lawsuits only under very specific circumstances.

Seat Belt and Car Seat Laws

Do seat belt laws impact my car insurance? Absolutely, but it varies based on where you live in the country. In Michigan, all passengers (and the driver) over the age of 16 are required by law to wear a seat belt. The fine for failure to do so starts at $25.

Michigan’s child restraint laws apply to children 15 and under. Kids under four must be in the rear seat if available, while those 8 and under, or under 4 feet, 9 inches tall, must use a car seat or booster. Children 8 to 15 at least 57 inches tall must wear a seat belt.

Violating these laws incurs a minimum $10 fine. Additionally, anyone under 18 cannot ride in a truck’s cargo area unless the vehicle is moving at 16 mph or less.

Keep Right and Move Over Laws

In Michigan, drivers must keep to the right except in a few situations: when passing another vehicle on the left, making a left turn, in heavy traffic, or on a freeway with more than three lanes. Additionally, drivers are required to move over, or if that’s not possible, slow down when passing a stopped emergency vehicle displaying lights.

Speed Limits

Understanding Michigan’s speed limits is essential for safe driving and avoiding fines. Different limits apply to passenger vehicles and trucks, so it’s important to know the rules for each.

Passenger Vehicles:

- 70/75 mph where designated on rural interstates for passenger vehicles.

- 70 mph on urban interstates for passenger vehicles.

- 70 mph on other limited access roads for passenger vehicles.

- 55 mph on other roads for passenger vehicles.

Trucks:

- 65 mph on rural interstates for trucks.

- 70 mph on urban interstates for trucks.

- 70 mph on other limited access roads for trucks.

- 55 mph on other roads for trucks.

By adhering to Michigan’s speed limits, you can prevent costly speeding tickets and contribute to road safety. Always stay aware of posted signs and adjust your speed accordingly.

Ridesharing

Michigan has a lot of laws that regulate the ridesharing industry. These include requirements that all drivers for services like Uber and Lyft pass background checks and have their vehicles inspected regularly. They also place limits on the driving record of anyone driving for a rideshare company.

When it comes to rideshare car insurance, Michigan law requires rideshare drivers to have $1 million in liability when carrying a passenger, and $50,000 in liability when in between rides but still working for the company. How does the Michigan no-fault law work with rideshare passengers? In the event of an accident, the passenger’s own PIP coverage will be the primary coverage.

Only in a situation where the passenger doesn’t have any other source of coverage will the rideshare driver or company be responsible for this coverage. Currently, only Farmers and State Farm offer specific ridesharing insurance endorsements in Michigan.

Automation on the Road

Michigan is home to so many of the nation’s car companies that it’s no surprise they are at the forefront of autonomous vehicle laws. It’s legal in Michigan to test and deploy autonomous vehicles, but the operator must be licensed and liability insurance is required (you can compare liability car insurance on our website).

Safety Laws

Some of the laws in Michigan are designed to help keep everyone safe on the road by ensuring drivers are in control at all times.

OWI Laws

In Michigan, driving while impaired is legally known as Operating While Intoxicated (OWI). The legal blood alcohol limit (BAC) in the state is 0.08%. There are serious penalties for an OWI conviction.

Michigan DUI Offenses

| Offense | Suspension | Fine | Incarceration | Penalties |

|---|---|---|---|---|

| 1st | 6 months (restricted license possible after 30 days) | $100-$500 | 5 days to one year, or 30-90 hours of community service | 6 points, possible interlock device |

| 2nd | 1 year (5 years if previous within 7 years) | $200-$1,000, plus $1,000 fee | 30 days to 1 year (48 hours in jail/workhouse) | 6 points, license plate confiscated, and vehicle immobilized 60-90 days or forfeited |

| 3rd | 1 year (5 years if previous within 7 years) | $500-$5,000, plus $1,000 fee | 1-5 years | 6 points, license plate confiscated, vehicle immobilized 1-3 years or forfeited, and possible registration denial or forfeiture |

OWI convictions in Michigan carry severe penalties, including license suspensions, hefty fines, and possible incarceration. It’s crucial for drivers to understand these consequences and make responsible choices to avoid impaired driving.

Marijuana-Impaired Driving Laws

Marijuana is now legal in Michigan, but driving after use is not. Although there is an expectation that the rules may change in the future, currently there no allowable legal amount of THC in the bloodstream of a driver; violators will be subject to OWI penalties. Police can also arrest you based on a field sobriety test, much like with alcohol.

It’s worth noting that it’s also illegal to smoke marijuana while driving and even to have a passenger in the vehicle smoking marijuana while driving, so leave it at home.

Distracted Driving Laws

There is no statewide handheld cell phone ban in Michigan, with the exception of drivers on a Level 1 or Level 2 graduated license. Two cities – Detroit and Troy – have enacted their own ban on handheld cell phone use while driving, so be aware when you cross city limits. Texting while driving is illegal for all drivers, and cell phone ticket car insurance rates may burn a hole in your wallet.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Must-Know Facts About Michigan

What does it look like on Michigan’s roads when it comes to safety and traffic? There’s a lot of information out there, and it can be hard to make sense of the news stories and statistics to understand what’s a real concern and what might be exaggerated. Wouldn’t it be a lot easier to have all the relevant information neatly organized for you in an easy-to-read format?

Below you will find just that; all the details of the risks on the road in one place. You’ll get the statistics of vehicle theft, crashes, underage drinking, and what the commute looks like for Michigan drivers too right here.

Vehicle Theft in Michigan

Vehicle theft remains a significant concern in Michigan, with certain models being targeted more frequently than others. The Chevy Impala tops the list, followed by several other popular vehicles.

Top 10 Michigan Car Thefts by Model in 2024

| Make & Model | Year | Total Thefts |

|---|---|---|

| Ford Pickup (Full-Size) | 2006 | 386 |

| Chevrolet Pickup (Full-Size) | 2004 | 325 |

| Honda Civic | 2000 | 278 |

| Honda Accord | 1997 | 272 |

| Hyundai Sonata | 2013 | 251 |

| Hyundai Elantra | 2017 | 241 |

| Kia Optima | 2015 | 230 |

| Toyota Camry | 2021 | 219 |

| GMC Pickup (Full-Size) | 2018 | 211 |

| Honda CR-V | 2001 | 203 |

Vehicle theft in Michigan is a significant concern, with the Chevy Impala topping the list. It’s crucial for owners of these commonly stolen models to take extra precautions to protect their vehicles.

Read More: Compare Pontiac Car Insurance Rates

Dangers on the Road in Michigan

Next, you’ll find details on some of the conditions that cause the most fatal accidents in Michigan. A total of 1,030 lives were lost in vehicle crashes in Michigan in 2017. What causes these crashes? Common factors include weather, speeding, and alcohol use.

Fatal Crashes by Weather Condition and Light Conditions

This data highlights the impact of weather and light conditions on fatal crashes in Michigan. Understanding these factors can help in assessing risks and improving safety measures on the road.

Fatal Crash in Michigan by Weather Condition & Light Condition

| Weather Condition | Daylight | Dark, but Lit | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 413 | 140 | 195 | 30 | 2 | 780 |

| Rain | 29 | 27 | 27 | 3 | 0 | 86 |

| Snow/Sleet | 22 | 8 | 14 | 4 | 0 | 48 |

| Other | 7 | 6 | 7 | 1 | 0 | 21 |

| Unknown | 0 | 0 | 2 | 0 | 2 | 4 |

| Total | 471 | 181 | 245 | 38 | 4 | 939 |

Normal weather conditions account for the majority of fatal crashes, especially during daylight hours. Adverse weather like rain and snow significantly increases the risk, emphasizing the importance of cautious driving in such conditions.

Fatality Rates by County

Explore the table below to see the number of fatal car crashes reported across various counties in Michigan. This information provides insight into regional safety trends and highlights areas where fatalities have occurred over the past three years.

Michigan Car Crash Fatalities by County

| County Name | Total Fatalities (2021) | Total Fatalities (2022) | Total Fatalities (2023) |

|---|---|---|---|

| Alcona | 2 | 3 | 2 |

| Alger | 1 | 1 | 0 |

| Allegan | 20 | 18 | 22 |

| Alpena | 5 | 4 | 6 |

| Antrim | 3 | 5 | 4 |

| Arenac | 4 | 2 | 3 |

| Baraga | 1 | 0 | 1 |

| Barry | 8 | 7 | 9 |

| Bay | 14 | 12 | 13 |

| Benzie | 2 | 3 | 2 |

| Berrien | 25 | 27 | 26 |

| Branch | 7 | 6 | 8 |

| Calhoun | 18 | 19 | 21 |

| Cass | 10 | 9 | 11 |

| Charlevoix | 2 | 3 | 4 |

| Cheboygan | 4 | 3 | 3 |

| Chippewa | 5 | 6 | 4 |

| Clare | 4 | 5 | 6 |

| Clinton | 7 | 9 | 10 |

| Crawford | 3 | 2 | 4 |

| Delta | 6 | 5 | 6 |

| Dickinson | 3 | 2 | 3 |

| Eaton | 14 | 13 | 15 |

| Emmet | 5 | 4 | 5 |

| Genesee | 45 | 48 | 50 |

| Gladwin | 2 | 3 | 4 |

| Gogebic | 1 | 2 | 1 |

| Grand Traverse | 10 | 9 | 11 |

| Gratiot | 6 | 5 | 7 |

| Hillsdale | 5 | 6 | 7 |

| Houghton | 2 | 1 | 3 |

| Huron | 4 | 3 | 4 |

| Ingham | 20 | 18 | 22 |

| Ionia | 9 | 8 | 10 |

| Iosco | 3 | 2 | 3 |

| Iron | 1 | 1 | 2 |

| Isabella | 6 | 7 | 8 |

| Jackson | 21 | 23 | 24 |

| Kalamazoo | 27 | 26 | 28 |

| Kalkaska | 3 | 2 | 4 |

| Kent | 56 | 54 | 57 |

| Keweenaw | 0 | 0 | 1 |

| Lake | 2 | 3 | 2 |

| Lapeer | 12 | 13 | 14 |

| Leelanau | 2 | 1 | 3 |

| Lenawee | 14 | 13 | 15 |

| Livingston | 17 | 16 | 19 |

| Luce | 1 | 0 | 1 |

| Mackinac | 2 | 1 | 2 |

| Macomb | 59 | 58 | 61 |

| Manistee | 3 | 4 | 5 |

| Marquette | 8 | 7 | 9 |

| Mason | 4 | 3 | 4 |

| Mecosta | 6 | 5 | 7 |

| Menominee | 2 | 1 | 2 |

| Midland | 8 | 7 | 9 |

| Missaukee | 2 | 3 | 3 |

| Monroe | 16 | 15 | 17 |

| Montcalm | 12 | 11 | 14 |

| Montmorency | 1 | 1 | 2 |

| Muskegon | 25 | 23 | 26 |

| Newaygo | 10 | 9 | 11 |

| Oakland | 63 | 61 | 65 |

| Oceana | 4 | 3 | 4 |

| Ogemaw | 3 | 2 | 3 |

| Ontonagon | 0 | 0 | 1 |

| Osceola | 4 | 3 | 4 |

| Oscoda | 1 | 2 | 1 |

| Otsego | 3 | 4 | 4 |

| Ottawa | 19 | 18 | 20 |

| Presque Isle | 1 | 1 | 2 |

| Roscommon | 2 | 3 | 3 |

| Saginaw | 22 | 21 | 23 |

| Sanilac | 5 | 4 | 6 |

| Schoolcraft | 1 | 1 | 1 |

| Shiawassee | 8 | 7 | 9 |

| St. Clair | 16 | 15 | 17 |

| St. Joseph | 11 | 10 | 12 |

| Tuscola | 6 | 5 | 7 |

| Van Buren | 13 | 12 | 14 |

| Washtenaw | 24 | 22 | 26 |

| Wayne | 178 | 180 | 190 |

| Wexford | 5 | 4 | 6 |

Fatal accident rates vary significantly across Michigan counties, with some areas experiencing higher fatalities than others. It’s crucial for drivers to stay vigilant and prioritize safety regardless of their location.

Traffic Fatalities Urban Vs. Rural

402 of the fatalities in Michigan occurred in rural areas.

624 fatalities happened in urban areas. That’s pretty common; in most states, fatal accidents are more frequent in urban than rural areas.

Fatalities by Person Type

This table provides numbers on the type of person involved in fatal crashes; occupants of vehicles, pedestrians, motorcyclists, and cyclists.

Michigan Traffic Fatalities by Person Type in 2024

| Type | Total |

|---|---|

| Traffic | 1030 |

| Passenger Vehicle Occupant | 696 |

| Motorcycles | 150 |

| Pedestrian | 156 |

| Bicyclist and other Cyclist | 21 |

Fatal crashes in Michigan predominantly involve passenger vehicle occupants, but motorcyclists and pedestrians also account for a significant number of fatalities. Bicyclists and other cyclists make up a smaller yet notable portion of these tragic incidents.

Fatalities by Crash Type

Around half of the fatal crashes in Michigan were single-vehicle accidents, and just under half involved a roadway departure.

Michigan Traffic Fatalities by Crash Type in 2024

| Type | Total |

|---|---|

| Single Vehicle | 519 |

| Involving a Large Truck | 88 |

| Involving Speeding | 241 |

| Involving a Rollover | 224 |

| Involving a Roadway Departure | 429 |

| Involving an Intersection (or Intersection Related) | 268 |

Single-vehicle accidents and roadway departures account for a significant portion of fatal crashes in Michigan. Speeding, intersections, and rollovers also contribute notably to these incidents.

Fatalities Involving Speeding by top 10 Counties

Discover how speeding contributed to fatal car crashes across Michigan’s counties with the data provided below. This table highlights the number of fatalities linked to speeding over the past three years in the top counties.

Michigan Speeding Fatalities by County

| County | Total Fatalities (2021) | Total Fatalities (2022) | Total Fatalities (2023) |

|---|---|---|---|

| Alcona | 1 | 1 | 0 |

| Alger | 0 | 0 | 0 |

| Allegan | 5 | 6 | 7 |

| Alpena | 1 | 2 | 1 |

| Antrim | 2 | 2 | 1 |

| Arenac | 1 | 1 | 1 |

| Baraga | 0 | 0 | 0 |

| Barry | 4 | 4 | 5 |

| Bay | 4 | 5 | 6 |

| Benzie | 1 | 1 | 1 |

| Berrien | 8 | 7 | 8 |

| Branch | 2 | 2 | 3 |

| Calhoun | 6 | 7 | 8 |

| Cass | 4 | 4 | 5 |

| Charlevoix | 1 | 1 | 1 |

| Cheboygan | 1 | 1 | 1 |

| Chippewa | 2 | 2 | 2 |

| Clare | 2 | 2 | 3 |

| Clinton | 3 | 3 | 3 |

| Crawford | 1 | 1 | 1 |

| Delta | 2 | 2 | 2 |

| Dickinson | 1 | 1 | 1 |

| Eaton | 5 | 5 | 5 |

| Emmet | 2 | 2 | 2 |

| Genesee | 12 | 13 | 14 |

| Gladwin | 1 | 1 | 1 |

| Gogebic | 0 | 0 | 0 |

| Grand Traverse | 4 | 4 | 4 |

| Gratiot | 2 | 2 | 2 |

| Hillsdale | 2 | 2 | 2 |

| Houghton | 1 | 1 | 1 |

| Huron | 1 | 1 | 1 |

| Ingham | 7 | 7 | 7 |

| Ionia | 3 | 3 | 3 |

| Iosco | 1 | 1 | 1 |

| Iron | 0 | 0 | 0 |

| Isabella | 3 | 3 | 3 |

| Jackson | 7 | 7 | 8 |

| Kalamazoo | 9 | 9 | 10 |

| Kalkaska | 1 | 1 | 1 |

| Kent | 18 | 18 | 19 |

| Keweenaw | 0 | 0 | 0 |

| Lake | 1 | 1 | 1 |

| Lapeer | 5 | 5 | 6 |

| Leelanau | 1 | 1 | 1 |

| Lenawee | 5 | 5 | 5 |

| Livingston | 6 | 6 | 7 |

| Luce | 0 | 0 | 0 |

| Mackinac | 1 | 1 | 1 |

| Macomb | 21 | 22 | 23 |

| Manistee | 1 | 1 | 1 |

| Marquette | 3 | 3 | 3 |

| Mason | 1 | 1 | 1 |

| Mecosta | 2 | 2 | 2 |

| Menominee | 0 | 0 | 0 |

| Midland | 3 | 3 | 3 |

| Missaukee | 1 | 1 | 1 |

| Monroe | 6 | 6 | 7 |

| Montcalm | 4 | 4 | 4 |

| Montmorency | 0 | 0 | 0 |

| Muskegon | 9 | 9 | 9 |

| Newaygo | 3 | 3 | 3 |

| Oakland | 21 | 21 | 22 |

| Oceana | 1 | 1 | 1 |

| Ogemaw | 1 | 1 | 1 |

| Ontonagon | 0 | 0 | 0 |

| Osceola | 1 | 1 | 1 |

| Oscoda | 0 | 0 | 0 |

| Otsego | 1 | 1 | 1 |

| Ottawa | 6 | 6 | 6 |

| Presque Isle | 0 | 0 | 0 |

| Roscommon | 1 | 1 | 1 |

| Saginaw | 7 | 7 | 8 |

| Sanilac | 2 | 2 | 2 |

| Schoolcraft | 0 | 0 | 0 |

| Shiawassee | 3 | 3 | 3 |

| St. Clair | 6 | 6 | 6 |

| St. Joseph | 4 | 4 | 4 |

| Tuscola | 2 | 2 | 2 |

| Van Buren | 4 | 4 | 5 |

| Washtenaw | 7 | 7 | 8 |

| Wayne | 65 | 67 | 68 |

| Wexford | 1 | 1 | 1 |

Speeding-related fatalities in Michigan vary widely by county, with some counties reporting no such incidents. Notably, Cass County experienced the highest number of speeding-related fatalities.

Fatalities in Crashes Involving an Alcohol-Impaired Driver (BAC = .08+) by County

Examine the impact of driving under the influence (DUI) on fatal accidents across Michigan’s counties. The following table presents data on DUI-related fatalities from 2021 to 2023, offering insight into the extent of this critical issue.

Michigan DUI Fatalities by County

| County | Total Fatalities (2021) | Total Fatalities (2022) | Total Fatalities (2023) |

|---|---|---|---|

| Alcona | 1 | 2 | 1 |

| Alger | 0 | 1 | 0 |

| Allegan | 6 | 5 | 7 |

| Alpena | 2 | 1 | 2 |

| Antrim | 1 | 2 | 1 |

| Arenac | 2 | 1 | 2 |

| Baraga | 0 | 0 | 0 |

| Barry | 3 | 4 | 3 |

| Bay | 5 | 4 | 5 |

| Benzie | 1 | 1 | 1 |

| Berrien | 7 | 8 | 9 |

| Branch | 3 | 2 | 3 |

| Calhoun | 8 | 7 | 8 |

| Cass | 4 | 4 | 4 |

| Charlevoix | 1 | 1 | 1 |

| Cheboygan | 1 | 2 | 1 |

| Chippewa | 2 | 2 | 1 |

| Clare | 3 | 2 | 2 |

| Clinton | 3 | 3 | 3 |

| Crawford | 1 | 1 | 1 |

| Delta | 2 | 2 | 1 |

| Dickinson | 1 | 1 | 1 |

| Eaton | 4 | 5 | 4 |

| Emmet | 2 | 2 | 2 |

| Genesee | 13 | 14 | 15 |

| Gladwin | 1 | 1 | 1 |

| Gogebic | 0 | 0 | 0 |

| Grand Traverse | 5 | 4 | 5 |

| Gratiot | 2 | 2 | 2 |

| Hillsdale | 3 | 2 | 3 |

| Houghton | 1 | 1 | 1 |

| Huron | 1 | 1 | 1 |

| Ingham | 8 | 7 | 8 |

| Ionia | 3 | 3 | 4 |

| Iosco | 1 | 1 | 1 |

| Iron | 0 | 0 | 0 |

| Isabella | 3 | 3 | 4 |

| Jackson | 7 | 8 | 9 |

| Kalamazoo | 10 | 10 | 11 |

| Kalkaska | 1 | 1 | 1 |

| Kent | 19 | 20 | 21 |

| Keweenaw | 0 | 0 | 0 |

| Lake | 1 | 1 | 1 |

| Lapeer | 6 | 6 | 6 |

| Leelanau | 1 | 1 | 1 |

| Lenawee | 6 | 5 | 6 |

| Livingston | 7 | 7 | 8 |

| Luce | 0 | 0 | 0 |

| Mackinac | 1 | 1 | 1 |

| Macomb | 22 | 23 | 24 |

| Manistee | 1 | 1 | 1 |

| Marquette | 3 | 3 | 3 |

| Mason | 1 | 1 | 1 |

| Mecosta | 2 | 2 | 2 |

| Menominee | 0 | 0 | 0 |

| Midland | 3 | 3 | 3 |

| Missaukee | 1 | 1 | 1 |

| Monroe | 6 | 6 | 7 |

| Montcalm | 4 | 4 | 4 |

| Montmorency | 0 | 0 | 0 |

| Muskegon | 10 | 10 | 10 |

| Newaygo | 3 | 3 | 3 |

| Oakland | 22 | 22 | 23 |

| Oceana | 1 | 1 | 1 |

| Ogemaw | 1 | 1 | 1 |

| Ontonagon | 0 | 0 | 0 |

| Osceola | 1 | 1 | 1 |

| Oscoda | 0 | 0 | 0 |

| Otsego | 1 | 1 | 1 |

| Ottawa | 6 | 6 | 6 |

| Presque Isle | 0 | 0 | 0 |

| Roscommon | 1 | 1 | 1 |

| Saginaw | 8 | 8 | 8 |

| Sanilac | 2 | 2 | 2 |

| Schoolcraft | 0 | 0 | 0 |

| Shiawassee | 3 | 3 | 3 |

| St. Clair | 6 | 6 | 6 |

| St. Joseph | 4 | 4 | 4 |

| Tuscola | 2 | 2 | 2 |

| Van Buren | 5 | 5 | 5 |

| Washtenaw | 8 | 8 | 9 |

| Wayne | 68 | 69 | 70 |

| Wexford | 1 | 1 | 1 |

Genesee County reported the highest number of fatalities involving alcohol-impaired drivers. Many counties recorded zero fatalities, highlighting significant regional variations in impaired driving incidents.

Teen Drinking and Driving

Michigan’s teen drunk driving arrest fatality count falls right about the national average. The number of arrests, however, is on the high side, which indicates that law enforcement is catching teens under the influence before a tragedy can happen. The high number of arrests also signals that teen drinking and driving may be a more common problem in Michigan than in some other states.

EMS Response Time

Emergency Medical Services (EMS) response times vary significantly between urban and rural areas in Michigan. The following data highlights the average times from notification to arrival for both types of locations, illustrating the quicker response in urban settings.

Michigan EMS Response Time

| Location | Notification | Arrival |

|---|---|---|

| Rural | 2.67 | 10.41 |

| Urban | 2.01 | 5.44 |

EMS response times are generally faster in urban areas compared to rural settings. This difference underscores the challenges faced in emergency response in less populated regions.

Transportation

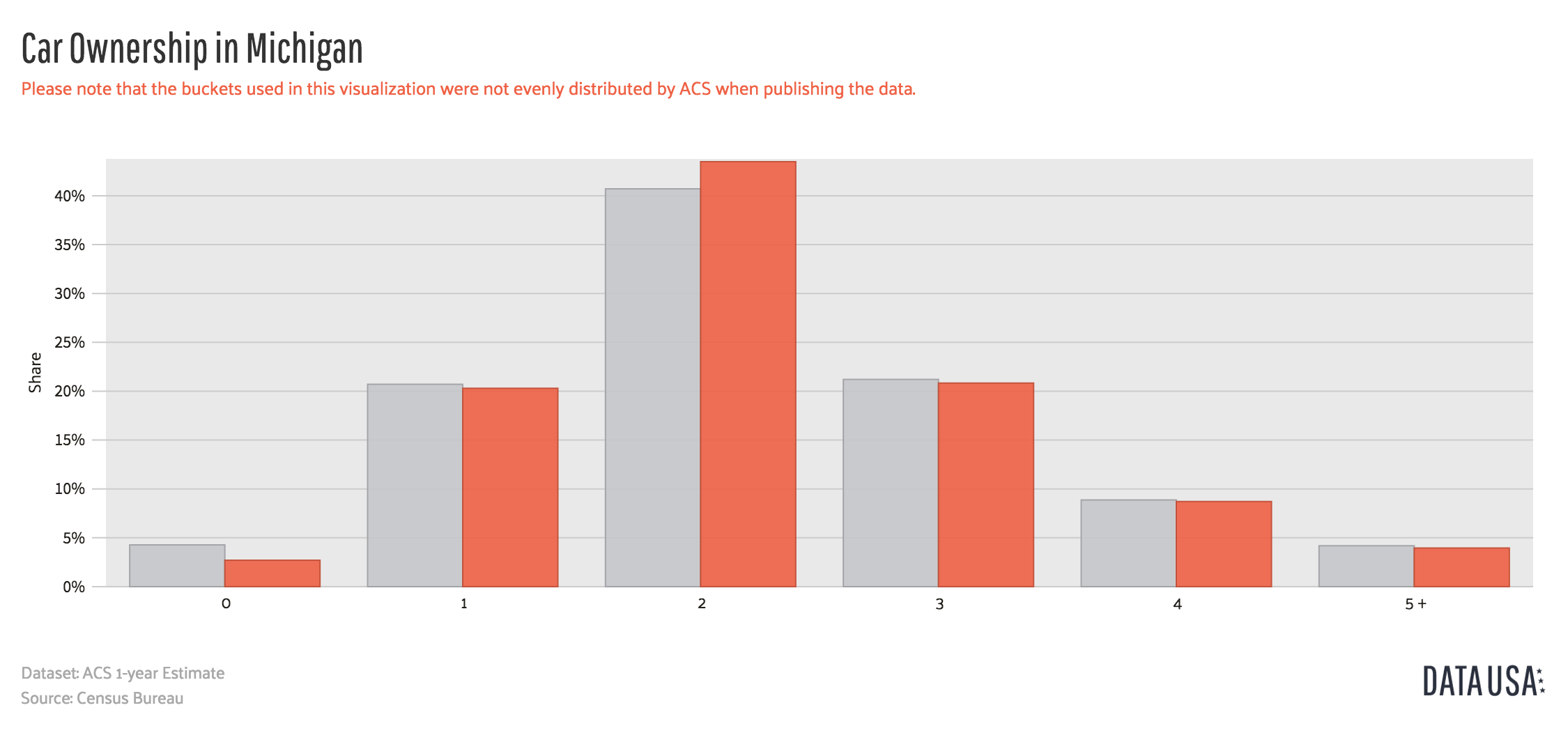

It’s home to Motor City, so it’s no wonder there are a lot of cars in Michigan. Next, we will look at car and commuter statistics.

Car Ownership

In Michigan, households with a single vehicle outnumber those with two vehicles by a significant margin, reflecting a trend towards minimal car ownership. Approximately 50% of households own just one car, while only about 25% have two.

Interestingly, the number of three-car households is nearly equal to those with just one car, indicating that while many families opt for a single vehicle, a substantial portion also embraces the convenience of having three. This dynamic highlights varying preferences for car ownership based on factors like lifestyle, commuting needs, and economic considerations.

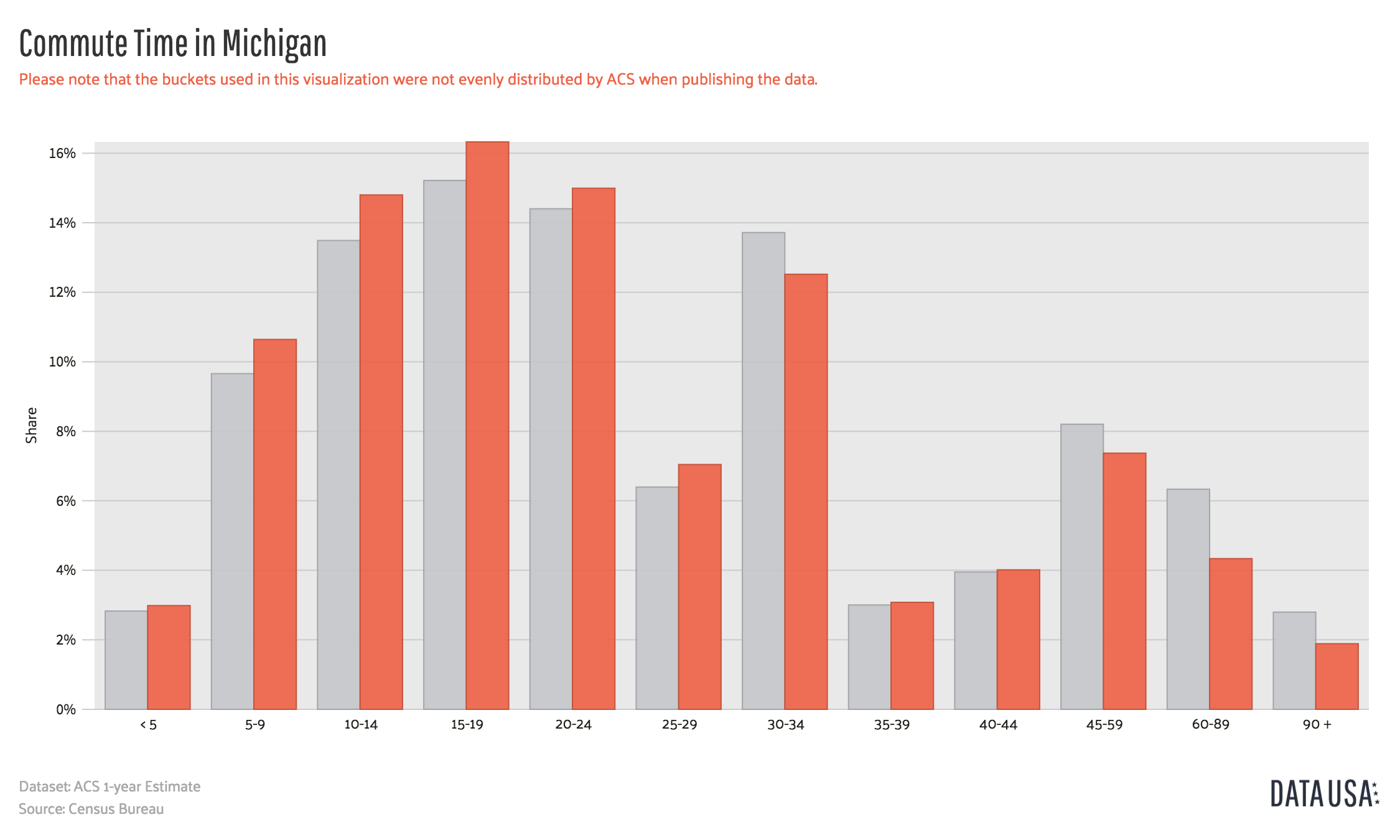

Commute Time

It may not be comforting when you are stuck in traffic, but Michigan actually has a slightly lower average commute time as 23.5 minutes than the national average of 25.3.

This efficiency may be attributed to a mix of urban planning and transportation options available, allowing residents to navigate their daily routes more effectively. Additionally, factors such as remote work opportunities and flexible schedules could also contribute to reduced congestion during peak hours.

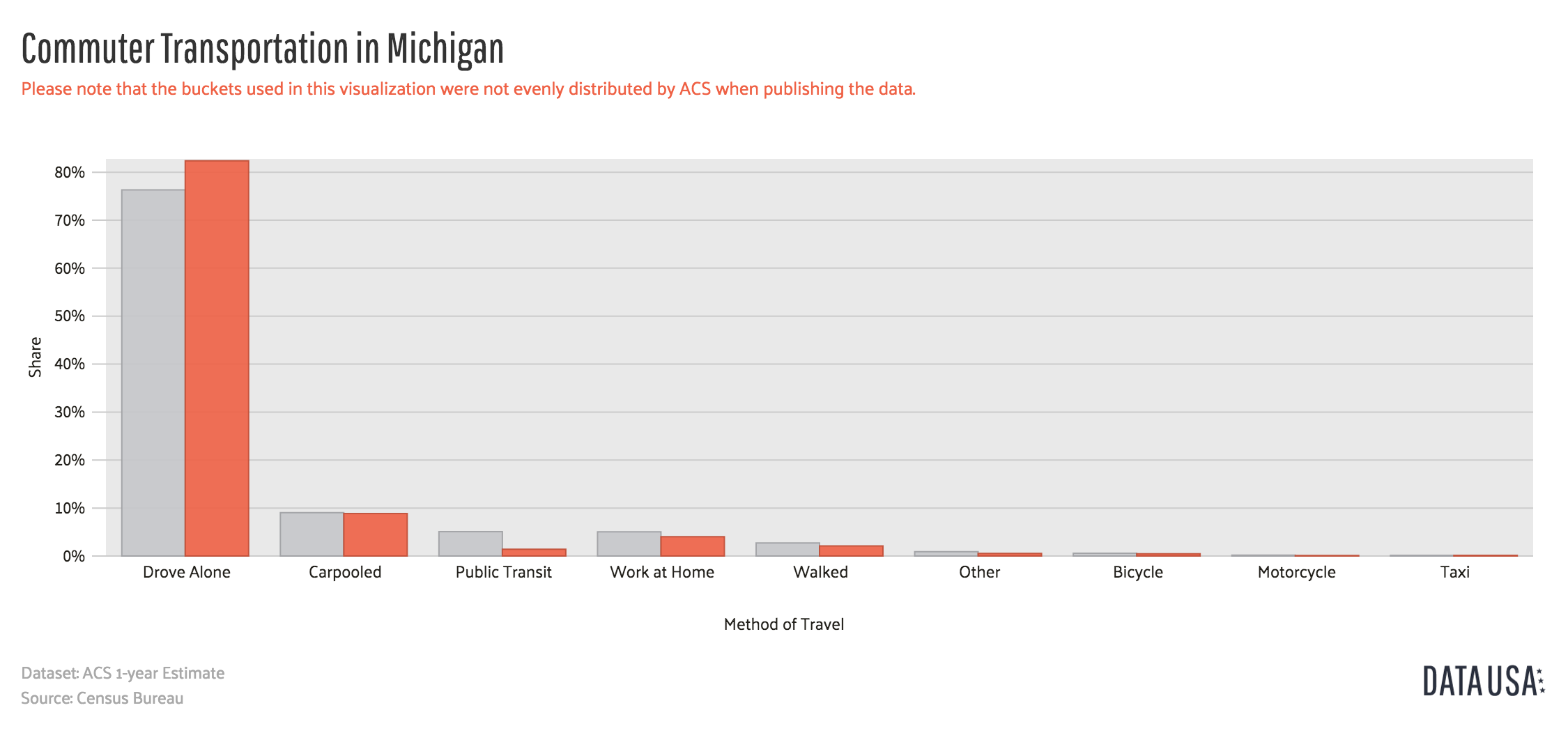

Commuter Transportation

In Michigan, a significant majority of drivers, over 80%, opt for solo commutes in their personal vehicles. This preference reflects the state’s sprawling layout and often limited public transportation options, making car travel more convenient for many.

Additionally, commuting alone allows for flexibility in schedules and routes, catering to individual preferences. While some cities offer ride-sharing or public transit, the comfort and control of personal vehicles remain the favored choice for most Michigan commuters.

Top Cities for Traffic Congestion

The biggest city in Michigan, Detroit ranks as the 27th most congested city in North America and the 146th in the world.

According to data from Inrix, drivers in Detroit spend an average of 66 minutes in congested traffic each day.TomTom data shows that Detroit drivers have an extra 16% of travel time on average. Travel time increases by 23% during morning peak traffic and 41% during evening peak traffic. On highways, the increase is about 11%, while on non-highways, it’s an increase of 19% .

Extra travel time adds up to 20 minutes per day for a total of 76 hours each year.

After that long commute, you probably don’t want to spend much time shopping around for cheap Michigan car insurance, so let us make it easy. Enter your zip code below to compare Michigan car insurance rates now.

Finding affordable car insurance doesn’t have to be a challenge. Enter your ZIP code below into our free comparison tool to find the lowest prices in your area.

Frequently Asked Questions

How does car insurance in Michigan compare to other states?

Car insurance in Michigan tends to be higher compared to many other states in the United States. This is primarily due to Michigan’s unique no-fault insurance system, which requires drivers to carry Personal Injury Protection (PIP) coverage. The of medical benefits and unlimited lifetime PIP coverage significantly contributes to the higher premiums in the state.

Can drivers opt out of PIP coverage?

Yes, under the PIP Choice law, certain drivers, like those on Medicare, can opt out of PIP coverage, while others can select from various coverage levels.

Read More: What are the pros and cons of PIP insurance?

Which car insurance is cheapest?

The cheapest car insurance typically depends on factors such as your driving history, vehicle type, and location. For many drivers in Michigan, companies like Geico and Progressive frequently provide some of the lowest rates available.

Which insurance companies provide car insurance coverage in Michigan?

There are various insurance companies that offer car insurance coverage in Michigan. Some popular options include State Farm, Progressive, GEICO, Allstate, and Auto-Owners Insurance. It’s recommended to research and compare car insurance quotes from different providers to find the best coverage and for your needs.

Take the first step toward cheaper car insurance rates. Enter your ZIP code below to see how much you could save.

How to get the best car insurance rates in Michigan?

To find affordable car insurance in Michigan, consider the following tips:

- Shop around and compare car insurance quote from multiple insurance providers.

- Maintain a clean driving record and avoid traffic violations.

- Consider raising your deductibles, but make sure you can afford the out-of-pocket costs in case of a claim.

- Inquire about available discounts, such as multi-policy discounts, good student discounts, or discounts for safety features in your vehicle.

- Bundle your car insurance with other policies, such as home or renters insurance, for potential savings.

Are there penalties for not having car insurance in Michigan?

Yes, driving without insurance can result in fines, points on your driving record, and potential vehicle registration issues. See how much you’ll pay for car insurance by entering your ZIP code below into our free comparison tool.

What types of coverage are recommended for car insurance in Michigan?

Michigan requires drivers to carry certain minimum coverages, including:

- Personal Injury Protection (PIP): Provides coverage for medical expenses, lost wages, and other related costs resulting from an accident, regardless of fault. Michigan offers unlimited lifetime PIP coverage.

- Property Protection Insurance (PPI): Covers up to $1 million in property damage to buildings and other structures in Michigan caused by your vehicle.

- Bodily Injury and Property Damage Liability: Minimum required coverage for injuries and damages you cause to others in an accident.

Read More: Compare Personal Liability and Property Damage (PLPD) Car Insurance