Cheapest California Car Insurance Rates in 2025 (Big Savings With These 10 Companies!)

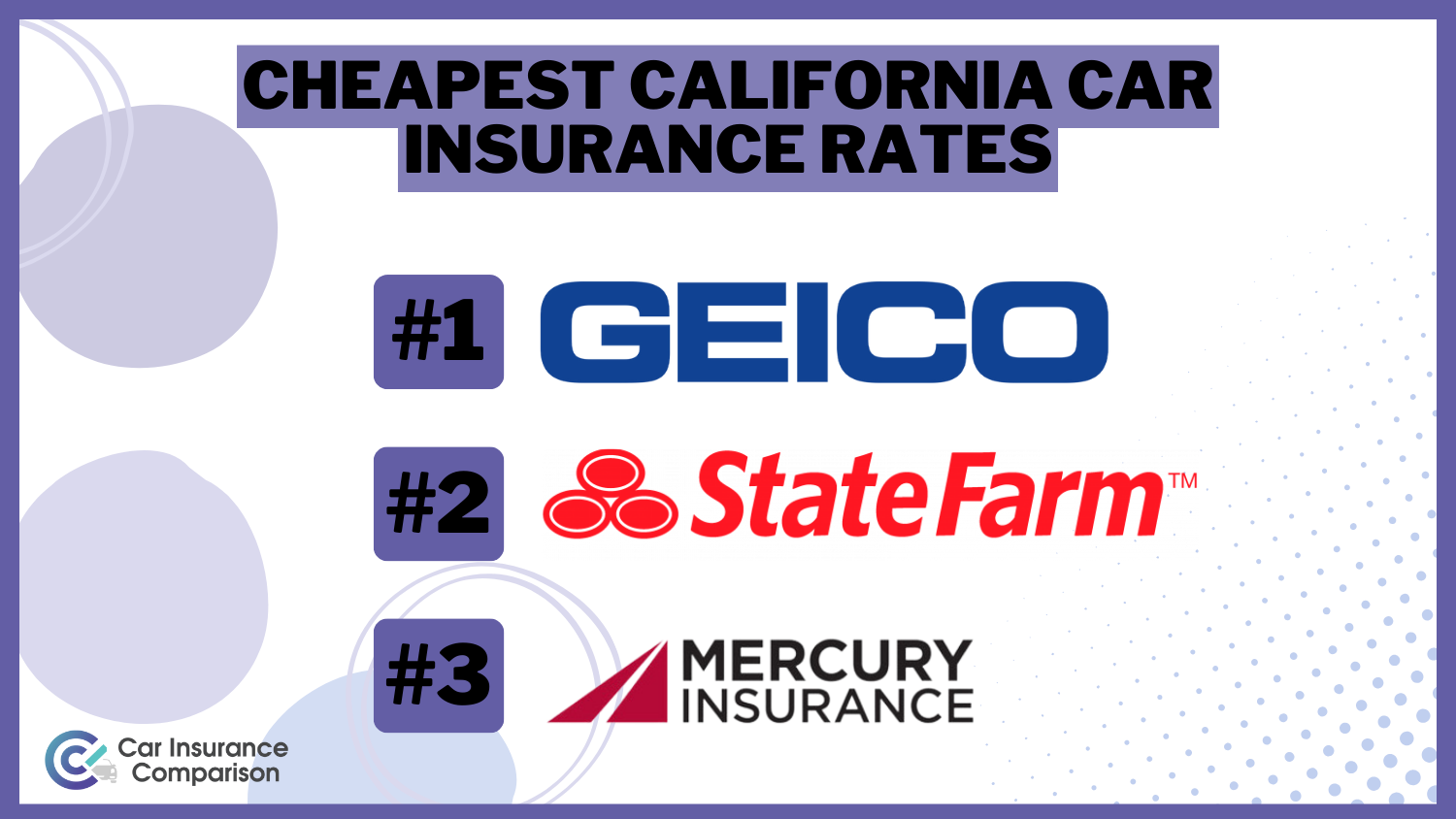

The cheapest California car insurance rates start at $33 per month, with Geico, State Farm, and Mercury offering the best options. These companies excel by providing affordable premiums, reliable customer service, and comprehensive coverage. For affordable insurance, these insurers are top choices.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

UPDATED: Nov 1, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Nov 1, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage for California

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 18,155 reviews

18,155 reviewsCompany Facts

Min. Coverage for California

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 675 reviews

675 reviewsCompany Facts

Min. Coverage for California

A.M. Best Rating

Complaint Level

Pros & Cons

675 reviews

675 reviews

The top pick overall for the cheapest California car insurance rates is Geico, followed by State Farm and Mercury. These companies stand out for their affordability, excellent coverage options, and customer satisfaction. Geico starts at $33 for monthly car insurance rate, making it the best choice for budget-conscious drivers.

State Farm provides competitive rates with comprehensive coverage options, and Mercury balances low rates with reliable service. This article explores why these providers lead the market, considering multiple factors such as price, coverage, and customer reviews. Discover how you can save on your car insurance without compromising on quality.

Our Top 10 Company Picks: Cheapest California Car Insurance Rates

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $33 A++ Online Convenience Geico

#2 $35 B Nationwide Availability State Farm

#3 $36 A Low Rates Mercury

#4 $40 A++ Discount Options Travelers

#5 $43 A+ Snapshot Program Progressive

#6 $46 A Membership Perks AAA

#7 $47 A+ Vanishing Deductible Nationwide

#8 $54 A Bundle Savings Farmers

#9 $65 A+ Safe Driver Allstate

#10 $70 A Coverage Options Liberty Mutual

Get the right car insurance at the best price — enter your ZIP code above to shop for coverage from the top insurers.

- Geico offers the best rates starting at $33 per month for California drivers

- State Farm and Mercury offer competitive California car insurance rates

- These providers balance affordability with excellent coverage

#1 – Geico: Top Overall Pick

Pros

- Online Convenience: Geico offers a seamless online platform for policy management and claims.

- Low Rates: Our examination of Geico car insurance review shows Geico is renowned for competitive pricing, making it affordable for many.

- Wide Coverage: Geico provides extensive coverage options tailored to different driver needs.

Cons

- Customer Service: Some customers report challenges with customer service responsiveness.

- Limited Local Agents: Geico primarily operates online, which may not suit those preferring face-to-face interaction.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#2 – State Farm: Best for Nationwide Availability

Pros

- Nationwide Availability: State Farm has a vast network, making it accessible across the country.

- Multi-Line Discounts: The results of our State Farm car insurance review suggests State Farm offers significant savings for bundling multiple insurance policies.

- Personalized Service: Customers value State Farm’s personalized agent relationships for advice and claims.

Cons

- Premium Costs: State Farm’s premiums can be higher compared to some competitors, even with discounts.

- Claims Processing: Occasional delays have been reported in the claims processing timeline.

#3 – Mercury: Best for Low Rates

Pros

- Affordable Premiums: Mercury is known for competitive pricing and low rates. Get Mercury car insurance quote online to know more about the costs.

- Good Customer Service: Customers often praise Mercury for its responsive and helpful customer service.

- Local Presence: Mercury has a strong local agent network, providing personalized support.

Cons

- Limited Coverage Options: Mercury may not offer as many specialized coverage options compared to larger insurers.

- Discounts: Some customers report fewer discount opportunities compared to other insurers.

#4 – Travelers: Best for Discount Options

Pros

- Discount Programs: Travelers offers various discount programs that can significantly reduce premiums.

- Strong Financial Strength: According to our Travelers car insurance review, Travelers boasts a top-tier A++ rating from A.M. Best, ensuring financial stability.

- Additional Benefits: Customers may enjoy additional perks like accident forgiveness and roadside assistance.

Cons

- Pricing Variability: Premiums may vary widely depending on location and specific coverage needs.

- Complex Policies: Travelers’ policy details can sometimes be intricate, requiring careful review.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#5 – Progressive: Best for Snapshot Program

Pros

- Usage-Based Insurance: Our Progressive car insurance review highlights Progressive’s Snapshot program rewards safe driving habits with potential premium reductions.

- Technology Integration: Progressive integrates advanced technology for easy online claims and policy management.

- Comprehensive Coverage: Progressive offers a wide range of coverage options tailored to various driver profiles.

Cons

- Rate Increases: Some customers have experienced unexpected rate hikes after initial policy periods.

- Customer Satisfaction: Progressive’s customer service ratings vary, with some customers reporting mixed experiences.

#6 – AAA: Best for Membership Perks

Pros

- Membership Benefits: AAA offers additional perks beyond insurance, including roadside assistance and travel discounts.

- Established Reputation: Based on our AAA car insurance review, AAA is well-regarded for reliability and longevity in the insurance industry.

- Local Support: AAA’s local clubs provide personalized service and support.

Cons

- Membership Required: To access insurance, customers must also be AAA members, which adds to the overall cost.

- Coverage Limits: AAA’s insurance coverage options may not be as customizable as some competitors’.

#7 – Nationwide: Best for Vanishing Deductible

Pros

- Vanishing Deductible: Nationwide’s program reduces deductibles for safe drivers over time.

- Nationwide Availability: Nationwide operates in all states, providing broad accessibility.

- Enhanced Coverage Options: Nationwide offers customizable policies with various add-ons. Check out further information on Nationwide car insurance discounts for savings.

Cons

- Premiums: Some customers find Nationwide’s premiums higher compared to other insurers.

- Claims Process: Occasionally, delays in claims processing have been reported by customers.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#8 – Farmers: Best for Bundle Savings

Pros

- Bundle Discounts: Farmers offers substantial savings for bundling multiple insurance policies.

- Local Agents: Farmers’ extensive network of local agents provides personalized service.

- Enhanced Coverage Options: According to our Farmers car insurance review, Farmers provides a wide range of coverage options to meet diverse needs.

Cons

- Customer Service: Farmers’ customer service satisfaction ratings can vary.

- Pricing Transparency: Some customers find Farmers’ pricing and discounts less transparent than expected.

#9 – Allstate: Best for Safe Drivers

Pros

- Safe Driving Rewards: Insights from our Allstate car insurance review shows Allstate rewards safe driving habits with potential premium discounts.

- Comprehensive Coverage: Allstate offers robust coverage options tailored to various needs.

- Digital Tools: Allstate’s mobile app and online platform facilitate easy policy management.

Cons

- Premium Costs: Allstate’s premiums may be higher than average, especially for high-risk drivers.

- Claims Handling: Customers have reported occasional delays and challenges in claims processing.

#10 – Liberty Mutual: Coverage Options

Pros

- Extensive Coverage: Liberty Mutual offers a wide range of coverage options to suit diverse needs.

- Online Tools: Liberty Mutual provides intuitive online tools for policy management and claims.

- Discounts: Our Liberty Mutual car insurance review highlights Liberty Mutual’s various discount opportunities are available to help reduce premium costs.

Cons

- Customer Service: Liberty Mutual’s customer service ratings vary, with some customers reporting dissatisfaction.

- Pricing Complexity: Understanding Liberty Mutual’s pricing structure and available discounts can be complex for some customers.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Minimum Car Insurance Requirements in California

While some states offer no-fault car insurance, California is a fault state (also commonly known as “tort”), meaning the person who is found to be responsible for causing the auto accident is also legally and financially responsible for any subsequent damages.

All drivers in California are required to carry minimum liability car insurance levels of 15/30/5 to satisfy basic overage. This means that car owners must carry the following minimum levels of liability insurance:

- $15,000 for bodily injury or death per person in an accident caused by the owner of the insured vehicle

- $30,000 for total bodily injury or death per accident caused by the owner of the insured vehicle

- $5,000 for property damage per accident caused by the owner of the insured vehicle

Discover more information for comparison with our guide titled “Compare No-Fault Car Insurance: Rates, Discounts, & Requirements.”

Drivers in California have the option to purchase Medical Payments Coverage (Med Pay) of at least $1,000 to cover medical expenses after a crash regardless of who caused the car crash. As long as you were not at fault in an automobile accident, insurance companies cannot raise your insurance rates for activating your insurance benefits, including Med Pay coverage.

The state of California does not require you to carry uninsured/underinsured motorist coverage, but it might not be a bad idea for you to add it to your base coverage.

California Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

AAA $46 $140

Allstate $65 $199

Farmers $54 $167

Geico $33 $101

Liberty Mutual $70 $216

Mercury $36 $108

Nationwide $47 $142

Progressive $43 $132

State Farm $35 $108

Travelers $40 $122

The onus is on each individual motorist on how much risk he or she is willing to assume. One must decide if the extra dozens of dollars a month he or she saves from foregoing uninsured/underinsured motorist coverage is worth the potential tens of thousands of dollars of personal liability to which one would be exposed in litigation in the case of an at-fault accident.

If a driver has substantial assets that he or she desires to protect, he or she should consider increasing his or her liability coverage. Experts advise that if you do choose to purchase liability coverage make sure to increase the limits to 100/300/50.

Next, we will explore how much money drivers in California spend on average on their car insurance. The amount you will actually pay will more than likely differ from these stated amounts; however, this data should serve as a helpful blueprint that you can apply to your current situation with confidence.

Compare California Car Insurance Rates as a Percentage of Income

The late comedian Fred Allen once bemoaned, “An income tax form is like a laundry list – either way, you lose your shirt.” This kidding-not-kidding joke captures America’s love-hate (and really only hate) relationship with income taxes because of how they affect one’s Disposable Personal Income (DPI), which is the amount of money left over after paying taxes.

California Car Insurance Premiums as a Percentage of Income

| Description | Data |

|---|---|

| Annual full coverage rates | $1,912 |

| Monthly full coverage rates | $159 |

| Average annual income | $79,000 |

| Monthly per capita disposable income | $3,665 |

| Percentage of income | 2.42% |

You are mandated by law to carry at least the basic liability coverage. Full coverage refers to an car insurance policy that includes liability, comprehensive car insurance, and collision car insurance. Here’s a peek at the average cost of each:

California Car Insurance vs. U.S. Average: Monthly Rates by Coverage Type

| Coverage Type | California Average | U.S. Average |

|---|---|---|

| Collision | $33 | $27 |

| Comprehensive | $8 | $12 |

| Minimum Coverage | $41 | $45 |

| Full Coverage | $82 | $84 |

Now that we have sorted through some data about car insurance costs to the individual consumer, let’s take a look at some important statistics about the insurance companies themselves.

Popular Add-ons for California Car Insurance

Just over 15 percent of drivers in California (15.2 percent to be precise) are driving without insurance, which ranks as the 12th highest percentage in the nation.

The California Department of Insurance has created the Automobile Insurance Information Guide as a thorough and useful reference for all the insurance enhancements available to you, complete with tips and tidbits on how to select from among the many options. Pay-by-the-mile car insurance plans offered by companies like Metromile are increasingly popular and available in the California Commonwealth.

Other Usage-Based Insurance programs (UBI) are active and available to drivers in California. Programs like SmartRide from Nationwide or Drive Safe & Save from State Farm offer discounts to drivers based on their driving acumen.

- Guaranteed auto protection (Gap)

- Personal umbrella policy

- Rental car reimbursement coverage

- Emergency roadside assistance

- Mechanical breakdown insurance

- Non-owner car insurance

- Modified car insurance coverage

- Classic car insurance

In addition to these add-ons, there are several more optional enhancements that you can explore to decide which ones may be right for you.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Compare California Car Insurance Rates by Gender

California boasts scores of leading men and leading ladies as permanent residents of the state. If you’re as curious as I am, you may catch yourself, from time to time, about the following question: Which group gets better car insurance quotes? California bros or California girls? Only one way to find out. Let’s take a look at the data. Learn more information on our guide titled “Average Car Insurance Rates by Age and Gender.”

California Car Insurance Monthly Rates by Age, Gender, & Provider

| Insurance Company | Female (Age 17) | Male (Age 17) | Female (Age 25) | Male (Age 25) | Female (Age 35) | Male (Age 35) | Male (Age 60) | Female (Age 60) |

|---|---|---|---|---|---|---|---|---|

| Allstate | $675 | $849 | $312 | $343 | $243 | $244 | $177 | $179 |

| AMCO | $693 | $766 | $325 | $322 | $273 | $260 | $239 | $225 |

| Farmers | $722 | $1,182 | $268 | $299 | $226 | $226 | $204 | $204 |

| Geico | $452 | $461 | $214 | $219 | $149 | $149 | $140 | $140 |

| Liberty Mutual | $626 | $626 | $187 | $215 | $174 | $200 | $148 | $159 |

| Nationwide | $303 | $387 | $136 | $150 | $124 | $136 | $99 | $104 |

| Safeco | $418 | $446 | $216 | $218 | $192 | $181 | $179 | $173 |

| State Farm | $508 | $630 | $305 | $315 | $276 | $276 | $246 | $246 |

| Travelers | $431 | $492 | $271 | $265 | $208 | $201 | $184 | $182 |

| United Financial | $397 | $479 | $215 | $231 | $149 | $153 | $127 | $150 |

Here’s a look at the most expensive demographic rates in the Golden State. Where do you fit in the grand scheme of things? Which company is the best value for you and your family?

California Most Expensive Car Insurance Monthly Rates by Age, Gender, & Provider

| Insurance Company | Male (Age 17) | Female (Age 17) | Male (Age 25) | Female (Age 25) | Male (Age 35) | Female (Age 35) | Male (Age 60) | Female (Age 60) |

|---|---|---|---|---|---|---|---|---|

| Allstate | $698 | $698 | $229 | $229 | $208 | $208 | $192 | $192 |

| Geico | $370 | $427 | $149 | $172 | $148 | $171 | $139 | $161 |

| First Liberty | $965 | $965 | $420 | $420 | $331 | $331 | $303 | $303 |

| Nationwide | $446 | $446 | $178 | $178 | $159 | $159 | $151 | $151 |

| Progressive | $746 | $746 | $296 | $296 | $233 | $233 | $208 | $208 |

| State Farm | $495 | $495 | $155 | $155 | $140 | $140 | $124 | $124 |

| Travelers | $2,136 | $2,136 | $175 | $175 | $146 | $146 | $157 | $157 |

| USAA | $289 | $289 | $127 | $127 | $96 | $96 | $86 | $86 |

While you cannot ever put a price on independence, it’s if you’re an independent woman who is single and 17 in California, you’re going to pay over four times as much to be insured with USAA as a married 35-year-old woman.

Compare California Car Insurance Rates by Location

Which area has better car insurance rates, the Hollywood Hills or San Fernando Valley? East Bay or Palo Alto? La Jolla or Rancho Bernardo? Let’s find out by taking a look at the most expensive ZIP codes in California. Here is a chart with the most expensive average monthly premiums in California by ZIP code:

California Car Insurance Monthly Rates in the Most Expensive ZIP Codes by Provider

| ZIP Code | City | Monthly Rate | Most Expensive Company | Most Expensive Monthly Rate | Cheapest Company | Cheapest Monthly Rate |

|---|---|---|---|---|---|---|

| 90004 | Glendale | $507 | Allstate | $683 | USAA | $334 |

| 90005 | Glendale | $507 | Allstate | $683 | USAA | $334 |

| 90010 | Van Nuys | $506 | Allstate | $682 | USAA | $334 |

| 90017 | Van Nuys | $506 | Allstate | $681 | USAA | $352 |

| 90020 | Los Angeles | $505 | Allstate | $672 | USAA | $354 |

| 90027 | Los Angeles | $505 | Allstate | $668 | USAA | $354 |

| 90028 | Los Angeles | $504 | Allstate | $668 | Liberty Mutual | $368 |

| 90029 | Los Angeles | $504 | Beverly Hills | $527 | Allstate | $685 |

| 90038 | Los Angeles | $504 | Beverly Hills | $527 | Farmers | $686 |

| 90046 | Los Angeles | $504 | North Hollywood | $518 | Allstate | $690 |

| 90048 | Los Angeles | $503 | North Hollywood | $518 | Allstate | $690 |

| 90057 | Los Angeles | $503 | Los Angeles | $517 | Allstate | $697 |

| 90069 | Beverly Hills | $503 | Beverly Hills | $517 | Nationwide | $699 |

| 90077 | North Hollywood | $503 | Van Nuys | $517 | Nationwide | $701 |

| 90210 | Glendale | $501 | Los Angeles | $517 | Nationwide | $703 |

| 90211 | Glendale | $499 | Beverly Hills | $517 | Nationwide | $710 |

| 90212 | Los Angeles | $495 | Van Nuys | $517 | Nationwide | $711 |

| 91201 | Los Angeles | $494 | Los Angeles | $511 | Nationwide | $718 |

| 91203 | Los Angeles | $492 | Los Angeles | $511 | Nationwide | $721 |

| 91204 | Los Angeles | $491 | Glendale | $507 | Nationwide | $727 |

| 91205 | Los Angeles | $491 | Glendale | $507 | Nationwide | $728 |

| 91401 | Los Angeles | $490 | Van Nuys | $506 | Nationwide | $728 |

| 91405 | Los Angeles | $490 | Van Nuys | $506 | Nationwide | $732 |

| 91605 | West Hollywood | $487 | Los Angeles | $505 | Nationwide | $744 |

| 91606 | Glendale | $487 | Los Angeles | $505 | Nationwide | $760 |

Where does your hometown rank statewide? If it’s not on our list of the most expensive ZIP codes, below are the least expensive ZIP codes.

California Car Insurance Monthly Rates in the Cheapest ZIP Codes by Provider

| ZIP Code | City | Monthly Rate | Most Expensive Company | Most Expensive Monthly Rate | Cheapest Company | Cheapest Monthly Rate |

|---|---|---|---|---|---|---|

| 93401 | San Luis Obispo | $228 | Allstate | $291 | Progressive | $181 |

| 93402 | Los Osos | $235 | Nationwide | $284 | Liberty Mutual | $194 |

| 93420 | Arroyo Grande | $235 | Nationwide | $295 | Progressive | $165 |

| 93422 | Atascadero | $239 | Nationwide | $301 | Progressive | $172 |

| 93427 | Buellton | $234 | Allstate | $287 | Progressive | $187 |

| 93428 | Cambria | $231 | Nationwide | $283 | Progressive | $186 |

| 93430 | Cayucos | $238 | Nationwide | $288 | Liberty Mutual | $195 |

| 93432 | Creston | $239 | Farmers | $294 | Progressive | $187 |

| 93433 | Grover Beach | $236 | Nationwide | $313 | Liberty Mutual | $190 |

| 93436 | Lompoc | $237 | Nationwide | $295 | Geico | $194 |

| 93437 | Lompoc | $234 | Nationwide | $293 | Progressive | $175 |

| 93441 | Los Olivos | $237 | Nationwide | $300 | Progressive | $194 |

| 93442 | Morro Bay | $234 | Allstate | $283 | Progressive | $177 |

| 93444 | Nipomo | $237 | Nationwide | $291 | USAA | $192 |

| 93449 | Pismo Beach | $236 | Nationwide | $309 | Liberty Mutual | $190 |

| 93452 | San Simeon | $238 | Nationwide | $291 | Progressive | $192 |

| 93455 | Santa Maria | $240 | Nationwide | $296 | Geico | $194 |

| 93463 | Solvang | $238 | Allstate | $324 | Progressive | $176 |

| 93514 | Bishop | $236 | Allstate | $310 | Progressive | $162 |

| 96027 | Etna | $240 | Farmers | $340 | Progressive | $173 |

| 96032 | Fort Jones | $240 | Farmers | $361 | Progressive | $177 |

| 96064 | Montague | $237 | Farmers | $335 | Progressive | $164 |

| 96067 | Mount Shasta | $231 | Farmers | $336 | Progressive | $166 |

| 96094 | Weed | $229 | Farmers | $336 | Progressive | $167 |

| 96097 | Yreka | $237 | Farmers | $335 | Geico | $183 |

Check to see where your area falls in terms of affordability and cost of living compared to others across the state.

Another one, wondering what the most expensive city for car insurance is?

California Car Insurance Monthly Rates in the Most Expensive Cities by Provider

| City | Monthly Rate | Most Expensive Company | Most Expensive Monthly Rate | Cheapest Company | Cheapest Monthly Rate |

|---|---|---|---|---|---|

| Beverly Hills | $516 | Nationwide | $701 | USAA | $284 |

| Van Nuys | $491 | Allstate | $695 | USAA | $287 |

| Tarzana | $483 | Allstate | $685 | USAA | $289 |

| North Hollywood | $481 | Nationwide | $681 | USAA | $299 |

| Encino | $479 | Nationwide | $670 | USAA | $302 |

| Valley Village | $477 | Farmers | $665 | USAA | $313 |

| Panorama City | $475 | Allstate | $662 | USAA | $313 |

| Studio City | $471 | Farmers | $662 | USAA | $313 |

| Reseda | $466 | Allstate | $660 | USAA | $320 |

| Sherman Oaks | $464 | Farmers | $652 | USAA | $366 |

One of the most famous cities in California, Beverly Hills is also the most expensive city for car insurance. Now let’s see which cities offer cheap car insurance in California. Delve more insights with our “Compare Car Insurance Rates by City.”

California Car Insurance Monthly Rates in the Cheapest Cities by Provider

| City | Monthly Rate | Most Expensive Company | Most Expensive Monthly Rate | Cheapest Company | Cheapest Monthly Rate |

|---|---|---|---|---|---|

| Los Ranchos | $228 | Farmers | $336 | Progressive | $165 |

| Weed | $229 | Farmers | $336 | Progressive | $166 |

| Cambria | $231 | Nationwide | $309 | Progressive | $167 |

| Mount Shasta | $231 | Nationwide | $295 | Progressive | $175 |

| Buellton | $234 | Nationwide | $293 | Progressive | $177 |

| Morro Bay | $234 | Allstate | $291 | Progressive | $181 |

| Vandenberg AFB | $234 | Allstate | $287 | Progressive | $186 |

| Arroyo Grande | $235 | Nationwide | $284 | Progressive | $187 |

| Los Osos | $235 | Nationwide | $283 | Liberty Mutual | $190 |

| Pismo Beach | $236 | Allstate | $283 | Liberty Mutual | $194 |

Check to see where your city is in terms of affordability and cost of living compared to others across the state.

The Best Car Insurance Companies in California

Choosing the correct car insurance coverage for your budget is an important decision. That decision can become even more difficult to make when you try to compare and contrast the hundreds of different companies vying for your business. How can you possibly do enough research on each one to feel good about your choice? Well, this is how we do it.

We have combed through all the data and have extrapolated the information that is most helpful to you in making your choice of the best car insurance company for you. You should seriously take into account the public reputation and perception of any company from which you’re considering purchasing car insurance.

Geico stands out as the top choice for California car insurance with rates starting at just $33 per month, offering unbeatable affordability and comprehensive coverage options.

Brad Larson Licensed Insurance Agent

An insurer’s public reputation can be a clear indication of the kind of rates it offers to its consumers. We’ll show how the largest companies rate in the areas of financial stability and customer satisfaction. Obtain more knowledge with our “Where to Find Car Insurance Company Reviews.”

AM Best is a credit rating agency. It evaluates insurance companies and grades them based on their financial stability. The table below shows the ten largest insurance companies in California.

Top 10 California Car Insurance Companies by Premiums Written & Financial Strength

| Rank | Insurance Company | Premiums Written | A.M. Best |

|---|---|---|---|

| #1 | State Farm | $3,910,351 | B |

| #2 | Farmers | $3,158,814 | A |

| #3 | Geico | $2,502,854 | A++ |

| #4 | Allstate | $2,446,564 | A+ |

| #5 | Auto Club | $2,312,230 | A- |

| #6 | Mercury | $2,095,531 | A+ |

| #7 | CSAA | $1,950,257 | A |

| #8 | USAA | $1,218,792 | A++ |

| #9 | Progressive | $1,147,186 | A+ |

| #10 | Liberty Mutual | $929,058 | A |

This table is measured by direct premiums written with their AM Best rating.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Largest Car Insurance Companies in California

This table gives a representation of the car insurance companies with the largest market share in California. AAA Northern California, Nevada & Utah Insurance Exchange (Auto Club Enterprises) holds a significant market share in California’s car insurance sector, ranking among the top providers.

Top 10 California Car Insurance Companies by Market Share

| Rank | Insurance Company | Market Share | Premiums Written |

|---|---|---|---|

| #1 | State Farm | 14.34% | $3,910,351 |

| #2 | Farmers | 11.59% | $3,158,814 |

| #3 | Geico | 9.18% | $2,502,854 |

| #4 | Allstate | 8.97% | $2,446,564 |

| #5 | Auto Club | 8.48% | $2,312,230 |

| #6 | Mercury | 7.69% | $2,095,531 |

| #7 | CSAA | 7.15% | $1,950,257 |

| #8 | United Services | 4.47% | $1,218,792 |

| #9 | Progressive | 4.21% | $1,147,186 |

| #10 | Liberty Mutual | 3.41% | $929,058 |

Mercury General Corporation follows closely, contributing substantially to the competitive landscape. CSAA Insurance Group and United Services Automobile Association (USAA) also maintain substantial market presence, underscoring their popularity and trust among consumers. Progressive and Liberty Mutual round out the list of top insurers, reflecting their growing influence in the state’s insurance market.

Learn more about CSAA Car Insurance Review.

Complaint Ratios of the Largest California Car Insurance Companies

Among the 770 car insurance companies registered in California, 99 are locally based, while 671 originate from outside the state. These statistics highlight a diverse market landscape where both local and national insurers compete. The data on customer complaints from major insurers underscores the importance of customer service in the highly competitive California insurance market.

California Car Insurance Customer Complaints by Provider

| Insurance Company | 2021 | 2022 | 2023 | Total |

|---|---|---|---|---|

| AAA | 150 | 200 | 210 | 560 |

| Allstate | 320 | 400 | 420 | 1,140 |

| Farmers | 200 | 270 | 290 | 760 |

| Geico | 308 | 382 | 410 | 1,100 |

| Liberty Mutual | 190 | 250 | 270 | 710 |

| Mercury | 220 | 295 | 310 | 825 |

| Nationwide | 180 | 240 | 265 | 685 |

| Progressive | 325 | 400 | 435 | 1,160 |

| State Farm | 275 | 360 | 389 | 1,024 |

| Travelers | 180 | 230 | 250 | 660 |

Check out more information on our “Interinsurance Exchange Car Insurance Review.”

Understanding complaint ratios helps consumers make informed decisions when choosing their insurance providers. Comparing complaint trends over multiple years provides insights into how insurers manage customer satisfaction and service quality over time.

Compare California Car Insurance Rates by Commute

When comparing car insurance rates for different companies based on commute distances and annual mileage, clear patterns emerge. Geico and USAA offer the most competitive rates across both short and long commutes.

California Full Coverage Car Insurance Monthly Rates by Annual Mileage & Provider

| Insurance Company | 6,000 Miles | 12,000 Miles |

|---|---|---|

| Allstate | $341 | $415 |

| Farmers | $378 | $433 |

| Geico | $218 | $263 |

| Liberty Mutual | $232 | $274 |

| Nationwide | $342 | $433 |

| Progressive | $216 | $260 |

| State Farm | $337 | $363 |

| Travelers | $251 | $307 |

| USAA | $207 | $242 |

Progressive also stands out with similarly low car insurance premiums. Liberty Mutual and Travelers provide mid-range options, showing affordable rates but slightly higher than Geico and Progressive.

Conversely, Farmers, Nationwide, and State Farm exhibit higher premiums, especially noticeable for longer commutes and higher annual mileage, indicating their rates increase significantly with more extensive use. Allstate consistently shows the highest premiums among the listed insurers, suggesting it might be less competitive for both short and long commutes with higher annual mileage.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Compare California Car Insurance Rates by Coverage Level, Driving Record, and Demographic

In examining monthly insurance premiums across different coverage levels, several major companies stand out. Geico offers the lowest rates across the board. Progressive closely follows with competitive pricing. USAA also proves affordable consistently lower than most competitors. Conversely, Farmers and Nationwide command higher premiums across their coverage tier.

These variations highlight the significant pricing diversity in the insurance market, influenced by factors such as coverage levels, company policies, and customer demographics. Accumulating points on your license will have a negative impact on your car insurance rates. How severely depends on the company. Each company uses its own underwriting metrics when assessing risk.

California Full Coverage Car Insurance Monthly Rates by Driving Record & Provider

| Insurance Company | Clean Record | One Ticket | One Ticket | One DUI |

|---|---|---|---|---|

| Allstate | $227 | $299 | $383 | $602 |

| Farmers | $308 | $417 | $419 | $522 |

| Geico | $168 | $209 | $260 | $326 |

| Liberty Mutual | $220 | $233 | $294 | $265 |

| Nationwide | $271 | $347 | $347 | $587 |

| Progressive | $155 | $224 | $264 | $307 |

| State Farm | $250 | $290 | $298 | $563 |

| Travelers | $186 | $274 | $304 | $353 |

| USAA | $149 | $163 | $222 | $364 |

The table above shows how best car insurance companies in California price various driving infractions.

A single 25-year-old male will pay more on average with USAA, compared to what a 17-year-old single male would pay with the same company. Focus on the company that best suits your specific circumstance. The only way to ensure that you’re getting the best quotes for your specific circumstance is to compare rates from multiple carriers.

Another way to keep your rates low is to be a good driver. Being a good driver entails knowing the rules of the road and adhering to them. We’ll review the traffic laws in California so that you can keep a 24-karat driving record.

Unearth the disparities in car insurance rates across various cities in California.

California Car Insurance Cost by City

Delve into the premiums of Alpine, Marin City, Salinas, and beyond to make informed decisions about your coverage. Start optimizing your insurance plan today.

How to Get High-Risk Insurance in California

The SR-22 form must be filed by drivers who have committed violations or have multiple infractions, as well as uninsured drivers and others. If your license has been revoked or suspended, you may need to file an SR-22 to have it reinstated.

SR-22 car insurance may be required after committing the following infractions in California:

- A DUI or wet-reckless suspension/revocation

- Being involved in an accident when you were uninsured

- Having your driving privileges suspended/revoked by DMV because it declared you a negligent operator (you may be declared a negligent operator if you obtain too many points on your driving record within a specific timeframe)

Traffic violations in California are broken down into one-point violations and two-point violations. Here is a list of some common infractions that can earn you points in the state of California:

- DUI/alcoholic beverage or any drug: 2 points

- Speed contest/aiding or abetting: 2 points

- Reckless driving/injury: 2 points

- Driving while suspended or revoked: 2 points

- Speed/too fast or over the speed limit: 1 point

- Disobedience to law enforcement officer: 1 point

- Following too close: 1 point

- Erratic driving/suddenly changing speeds: 1 point

Racking up too many points on your driving record will cause your premiums to skyrocket.

Windshield Coverage in California

California has no specific laws requiring insurance companies to offer special glass coverage or no-deductible windshield replacement. Your insurance company may require you to use a specific repair shop in order to receive coverage. As a consumer, you have the right to choose a repair vendor, but you may be required to pay the difference in the quote. Discover more information on our “What states have full glass coverage?”

Aftermarket parts are allowed to be used by insurance companies with written notice to the consumer and at least equal in terms of fit, quality, performance, and warranty as the OEM. For a detailed summary of windshield and glass coverage in California, click here.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Insurance Fraud in California

Insurance fraud is the second-largest economic crime in America. Premium rates are raised dramatically by insurance companies and passed on to consumers in attempts to combat fraud. There are two classifications of fraud and these undergo car insurance claim investigation:

- Hard Fraud: A purposefully fabricated claim or accident

- Soft Fraud: A misrepresentation of information to the insurance company

Soft fraud is more common than hard fraud. Twenty to 40 percent of consumers admitted to lying to their insurer about one of the following:

- Number of annual miles driven

- Number of drivers in the household

- How the vehicle would be used

Insurance fraud is a crime no matter how you slice it. Even the “little, white lie” you tell to get a lower rate can lead to harmful consequences. That kind of willful misrepresentation of facts is called known as “rate evasion” and it is a $16 billion annual expense to car insurers.

If you suspect insurance fraud or have been the victim of fraud, you can contact the California Department of Insurance to report such activity.

Vehicle Licensing Laws in California

California’s DMV has an online portal where residents can perform tasks such as renewing their registrations and drivers’ licenses, updating or changing their address, and retrieving their driving history. Vehicle registration and insurance information can be easily accessed through the state database. Unlock insights with our guide “What to Do If You Can’t Find Your Car Registration.”

Teen Driver Laws in California

The State of California DMV wants to ensure that all teenage drivers are equipped with all the tools and resources to be safe and knowledgeable behind the wheel.

Here are California’s requirements for obtaining a driver’s license.

California Teen Driver Requirements to Get a Driver’s License

| Requirements | Period |

|---|---|

| Mandatory holding period | 6 months |

| Minimum supervised driving time | 50 hours; 10 at night |

| Minimum age | 16 years old |

There are also some additional restrictions for teen drivers in California. In addition to these restrictions, teen drivers in California are also required to have their provisional driver’s license for at least six months before applying for a full driver’s license.

California Teen Driver Restrictions

| Restrictions | Period |

|---|---|

| Driving | Prohibited from 11 p.m. to 5 a.m. |

| Passengers | Under 20 years old - prohibited (unless immediate family) |

The State of California DMV wants to ensure that all teenage drivers are equipped with all the tools and resources to be safe and knowledgeable behind the wheel. These are California’s requirements for obtaining a driver’s license. Additionally, there are specific restrictions for teen drivers to promote safety on the road. Expand your knowledge with our guide “Compare Teen Driver Car Insurance Rates.”

Cell Phone Use Laws in California

Does a cell phone ticket affect car insurance rates? California does not take cellphone use behind the wheel lightly.

California Cell Phone Use Laws

| Age | Enforcement Type | Laws |

|---|---|---|

| All drivers | Primary enforcement | Handheld use and texting banned |

| Drivers under 18 | Secondary enforcement | All use banned |

It was one of the first six states in America to adopt a comprehensive texting ban.

License Renewal Procedure for Older Drivers in California

In California, elderly drivers must get their licenses renewed every five years, just like every other driver in the general population.

- Elderly drivers in California must get their licenses renewed every five years just like every other driver in the general population.

- Senior drivers must show proof of adequate vision at every renewal once they reach age 70; while the general population must only do so when renewing in person.

- Senior drivers 70 and older are not permitted to renew online or by mail; while the general population is only permitted to do so for two consecutive renewals.

These regulations aim to ensure road safety by maintaining stringent requirements for senior drivers in California.

Licensing Procedure for New Residents in California

All new residents and first-time driver’s license applicants must visit a DMV office in person and present proof of California residency. New residents must register any out-of-state vehicles within 20 days of establishing residency.

California Real ID

California is currently under review for federal REAL ID compliance. You may visit the California DMV to apply for a federal-compliant REAL ID card or a federal non-compliant one. As of October 1, 2020, anyone wishing to board an airplane or enter a federal facility must have a REAL ID-compliant form of identification.

The Rules of the Road in California

Let’s take a look at some of California’s traffic laws and your car insurance.

Keep Right and Move Over Laws

California law requires that you keep right if driving slower than the average speed of traffic around you.

California released an updated memo to its “Move Over” law on July 11, 2011. The California DMV, the California Highway Patrol, and the California Department of Transportation (Caltrans) teamed up to form the legislation and launch a statewide media campaign that implores motorists to move over when safe to do so or slow down when they see amber flashing lights on Caltrans vehicles.

Speed Limits, Seat Belts and Car Seat Laws in California

The speed limits on different types of roadways in California vary significantly. Rural interstates allow for the highest safe speed to drive a car, with a limit of 70 mph for general traffic and 55 mph for trucks. Urban interstates have slightly lower limits at 65 mph for regular vehicles and the same 55 mph limit for trucks.

Other limited access roads, similar to rural interstates, also permit speeds of up to 70 mph. Meanwhile, on other roads categorized differently, the speed limit reduces to 65 mph across the board.

California Speed Limit Laws

| Type of Roadway | Speed Limit |

|---|---|

| Rural interstates | 70 mph |

| Rural interstates (Trucks) | 55 mph |

| Urban interstates | 65 mph |

| Urban interstates (Trucks) | 55 mph |

| Other limited access roads | 70 mph |

| Other roads | 65 mph |

California’s safety belt laws have been in effect since January 1, 1986, and are enforced as a primary offense. This means law enforcement can stop and ticket drivers solely for not wearing a seatbelt. The law applies to all passengers aged 16 and older in every seating position within the vehicle. For a first offense, the fine starts at $20 plus additional fees.

California Seat Belt Laws

| Laws | Facts |

|---|---|

| Effective date | January 1, 1986 |

| Primary enforcement | Yes |

| Age/seats applicable | 16+ years old in all seats |

| First offense fine | $20 plus fees |

Regarding child seat laws in California, they are structured to ensure safety based on age, weight, and height criteria. Children under 2 years old or weighing under 40 lbs, and under 40″ tall, must use a rear-facing seat. For children aged 2 to 7 years old and between 40″ to 57″ tall, a forward-facing seat is appropriate.

California Child Seat Laws

| Laws | Facts |

|---|---|

| Car seat required | Children 7 years old and under |

| Rear-facing seat required | Children who are: - under 2 years old - under 40 lbs - under 40" tall |

| Forward-facing seat allowed | Children who are: - 2 to 7 years old - 40" to 57" tall |

| Booster seat allowed | Children over 40 lbs. |

| Adult seat belt allowed | Children who are: - 8 to 15 years old - at least 57" tall |

| Rear seats required | Children who are: - 7 years and under - under 57" tall |

| First offense fine | $100 plus fees |

Once children exceed 40 lbs, they can transition to a booster seat until they meet the height requirement of at least 57″ tall or reach the age of 8. Beyond these stages, children must use adult seat belts until they turn 16. Failure to comply with these regulations incurs a fine of $100 plus additional fees.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Companies That Provide Ridesharing Protection in California

The following companies offer ridesharing protection in California:

- Allstate

- Farmers

- Liberty Mutual

- Mercury

- Metlife

- Metromile

- State Farm

- USAA

The California government recently passed a new bill (AB 5) that will classify the majority of rideshare drivers as employees rather than contractors. This isn’t exactly great news, as it means rideshare driving will turn into more of a job than a way to earn extra cash.

Access new insights with our guide “How do you get a metromile car insurance quote online?”

Automation on the Roads in California

California’s regulatory framework for autonomous vehicles emphasizes innovation while addressing safety and financial concerns. The state allows full deployment of autonomous vehicles on public roads without requiring operators to obtain a specialized license for such vehicles.

Unlike some jurisdictions, California does not mandate the physical presence of an operator inside the vehicle during autonomous operation, reflecting confidence in the reliability of autonomous systems. A significant aspect of California’s regulations is the requirement for autonomous vehicles to maintain liability car insurance coverage of $5 million.

California Autonomous Vehicle Laws

| Laws | Facts |

|---|---|

| Driving allowed | Full deployment |

| Operator license required | Not addressed |

| Operator required to be in the vehicle | No |

| Liability insurance required | $5 million |

This mandate aims to ensure adequate financial protection against potential accidents or damages involving autonomous vehicles. By imposing this high coverage requirement, California seeks to mitigate risks associated with autonomous technology and uphold public safety standards.

Overall, California’s approach encourages the advancement of autonomous vehicle technology while prioritizing safety and financial responsibility. The regulations support innovation in the automotive industry while establishing stringent measures to address potential liabilities, thereby shaping a progressive environment for autonomous vehicle development and deployment.

DUI Laws in California

The Blood-Alcohol Content (BAC) limit in California is 0.08 percent; the High BAC limit is between 0.15 to 0.20 percent. For a DUI offense, penalties may include a license revocation of 4 to 10 months, 96 hours to 6 months of jail time, fines ranging from $390 to $3,600, and vehicle impoundment for up to 6 months.

If convicted, you face severe penalties including a revoked license for over 2 years, up to 1 year in jail, fines up to $4,000, and a vehicle impoundment for up to 1 year. Additional requirements include attending DUI programs, installing a mandatory ignition interlock device, paying a $125 reinstatement fee, securing SR-22 insurance, and completing 52 hours of counseling along with extensive probation and monitoring.

California DUI Laws

| Laws | Facts |

|---|---|

| Name of offenseName of Offense | Driving Under the Influence (DUI) |

| BAC Limit | .08 |

| High BAC limit | .15 to .20+ |

| Criminal status | Non-injury DUI = misdemeanor Fourth+ DUI = felony |

| Look-back period | 10 years |

| 1st Offense Penalties | Term |

| License revoked | 4 to 10 months |

| Jail time | 96 hours to 6 months |

| Fine | $390 to $3,600 |

| Vehicle impounded | Up to 6 months |

| DUI program | 3 months of alcohol & drug education |

| Community service | Determined in court |

| Mandatory ignition interlock device | Yes - in 4 counties |

| Required to get license reinstated | $125 fee SR-22 insurance counseling |

| Probation | 3 to 5 years |

| 2nd Offense Penalties | Term |

| License revoked | 2+ years |

| Jail time | Up to 1 year |

| Fine | Up to $4,000 |

| Vehicle impounded | Up to 1 year |

| DUI program | 12 hour alcohol & drug education 1.5 year Multi-Offender Program |

| Community service | Determined in court |

| Mandatory ignition interlock device | Yes - can't drive anywhere without it |

| Required to get license reinstated | $125 fee SR-22 insurance 52 hours counseling 6 hours re-entry monitoring 12 month bi-weekly interviews |

| Probation | 3 to 5 years |

| 3rd Offense Penalties | Term |

| License revoked | 3+ years |

| Jail time | Up to 16 months |

| Fine | Up to $18,000 |

| Vehicle impounded | Up to 1 year |

| DUI program | 12-hour alcohol & drug education 2.5 year multi-offender program |

| Community service | Up to 300 hours |

| Mandatory ignition interlock device | Yes - can't drive anywhere without it |

| Required to get license reinstated | $125 fee SR-22 insurance Regular interviews & monitoring 78 hrs Counseling Habitual Offender Status |

| Probation | 3 to 5 years |

| 4th Offense Penalties | Term |

| License revoked | 4+ years Possibly permanent |

| Jail time | Up to 16 months in state prison |

| Fine | Up to $18,000 |

| Vehicle impounded | Up to 1 year |

| DUI program | 12-hour alcohol & drug education 2.5 year multi-offender program |

| Community service | Up to 300 hours |

| Mandatory ignition interlock device | Yes - can't drive anywhere without it |

| Required to get license reinstated | $125 fee SR-22 insurance Regular interviews & monitoring 78 hrs Counseling Habitual Offender Status |

| Probation | 3 to 5 years |

The penalties for a DUI conviction are severe and may include a license revocation for over three years, up to 16 months in jail, fines reaching $18,000, vehicle impoundment for up to a year, mandatory DUI education programs, extensive community service, and the installation of an ignition interlock device.

Learn further insights with our guide title “DWI vs. DUI: What Is the Difference?”

If convicted, you could face severe penalties, including up to 16 months in state prison, fines up to $18,000, and the possibility of a revoked license for 4 or more years, potentially permanently. Additional consequences include mandatory DUI programs, community service, an ignition interlock device requirement, probation for 3 to 5 years, and significant fees and monitoring for license reinstatement.

California’s DUI laws are stringent, with escalating penalties for multiple offenses, including hefty fines, license revocation, mandatory education programs, and potential imprisonment. It’s crucial for drivers to understand these consequences and the legal limits to avoid serious legal repercussions.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Risky and Harmful Driving Behavior in California

For your information, we’ve compiled a list of all driving-related car accidents and fatalities in California.

Fatalities by County, Rural vs. Urban, and by Demographic

Between 2019 and 2023, Alameda County saw a fluctuating trend in speeding deaths, peaking at 33 in 2019 and reaching 32 in 2023. Fresno County experienced an overall increase, with deaths rising from 26 in 2019 to 51 in 2023. Kern County had a significant rise, especially from 2020 to 2022, reaching 49 deaths before slightly decreasing to 45 in 2023. Los Angeles County consistently had the highest numbers, peaking at 308 in 2022, then dropping to 214 in 2023.

Counties in California With the Most Speeding Deaths

| County | 2019 | 2020 | 2021 | 2022 | 2023 |

|---|---|---|---|---|---|

| Alameda | 33 | 24 | 27 | 25 | 32 |

| Fresno | 26 | 24 | 22 | 44 | 51 |

| Kern | 32 | 27 | 40 | 49 | 45 |

| Los Angeles | 245 | 240 | 231 | 308 | 214 |

| Orange | 62 | 56 | 51 | 53 | 60 |

| Riverside | 66 | 93 | 87 | 95 | 84 |

| Sacramento | 40 | 35 | 42 | 56 | 53 |

| San Bernardino | 92 | 90 | 82 | 72 | 88 |

| San Diego | 67 | 71 | 75 | 76 | 78 |

| San Joaquin | 36 | 26 | 34 | 36 | 35 |

Orange County maintained a relatively steady trend, with a slight increase to 60 in 2023. Riverside County saw a substantial rise from 66 in 2019 to 95 in 2022 before slightly decreasing to 84 in 2023. Sacramento County’s deaths increased from 40 in 2019 to 56 in 2022, then decreased to 53 in 2023.

San Bernardino County’s numbers fluctuated, peaking at 92 in 2019, with a dip to 72 in 2022, and rising again to 88 in 2023. San Diego County had a gradual increase, reaching 78 in 2023. San Joaquin County’s figures remained relatively stable, with slight variations, ending at 35 in 2023.

California Traffic Fatalities Ten-Year Tread by Roadway Type

| Roadway Type | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

|---|---|---|---|---|---|---|---|---|---|---|

| Rural | 226 | 227 | 200 | 211 | 209 | 232 | 223 | 262 | 301 | 306 |

| Urban | 79 | 66 | 59 | 61 | 66 | 69 | 69 | 70 | 78 | 82 |

Examining fatalities by person type reveals motorcyclists consistently facing high risks, with numbers exceeding 500 annually from 2014 to 2016, while pedestrians and passenger car occupants also experienced significant fatalities, highlighting broader safety concerns beyond just speeding.

California Traffic Deaths by Person Type

| Person Type | 2019 | 2020 | 2021 | 2022 | 2023 |

|---|---|---|---|---|---|

| Motorcyclists | 463 | 522 | 494 | 576 | 529 |

| Pedestrians | 734 | 709 | 819 | 933 | 858 |

| Bicyclists | 147 | 129 | 136 | 155 | 124 |

| Passenger car occupants | 1,098 | 1,066 | 1,170 | 1,357 | 1,269 |

| Pickup truck occupants | 239 | 209 | 294 | 278 | 279 |

| Utility truck occupants | 241 | 271 | 288 | 307 | 336 |

| Van occupants | 67 | 79 | 88 | 88 | 84 |

| Large truck occupants | 38 | 33 | 32 | 48 | 53 |

| Bus occupants | 11 | 17 | 1 | 20 | 3 |

| State Total | 3,107 | 3,102 | 3,387 | 3,837 | 3,602 |

Overall, these data points illustrate the complex landscape of traffic safety in California, emphasizing the need for targeted interventions to reduce fatalities across different transportation modes and geographic settings.

EMS Response Rime

In California, the efficiency of Emergency Medical Services (EMS) is critical in saving lives and ensuring timely medical intervention. When a crash occurs, the clock starts ticking: it takes approximately 5 minutes and 5 seconds from the time of the crash to notify EMS. Once notified, EMS responds swiftly, with an average of 4 minutes and 7 seconds elapsing before they arrive on the scene.

EMS Response and Transport Times in California

| Description | Time |

|---|---|

| Time of crash to EMS notification | 5 minutes 5 seconds |

| Notification to EMS arrival | 4 minutes 7 seconds |

| EMS arrival to hospital arrival | 21 minutes 24 seconds |

| Time of crash to hospital arrival | 35 minutes |

Once EMS personnel arrive, they work swiftly to stabilize patients and transport them to the hospital, with an average transit time of 21 minutes and 24 seconds. This means that from the moment of the crash to the patient’s arrival at the hospital, approximately 35 minutes pass on average.

This timeline underscores the coordinated efforts of EMS teams and the importance of rapid response and transport in emergency situations across California.

Case Studies: California Car Insurance Rates

In this section, we present several case studies illustrating how different insurance solutions have addressed specific client needs effectively.

- Case Study 1 – Comprehensive Coverage for Small Business Owners: A small bakery in California faced a significant financial setback due to fire damage. Their comprehensive insurance policy not only covered the property damage but also compensated for lost revenue during the restoration period.

- Case Study 2 – Personalized Car Insurance for Family Security: A young family in Texas needed an auto insurance policy that offered ample coverage for multiple drivers and vehicles. Their insurer tailored a package with enhanced liability limits and added uninsured motorist coverage to ensure protection against unforeseen accidents.

- Case Study 3 – Cyber Insurance Mitigating Business Risks: A tech startup in New York suffered a data breach, compromising sensitive customer information. Their cyber insurance policy helped cover legal fees, notification costs, and provided funds for credit monitoring services, restoring customer trust and compliance with data protection regulations.

These case studies demonstrate the versatility and importance of choosing the right insurance solutions tailored to specific needs. Whether it’s protecting physical assets, ensuring comprehensive liability coverage, or safeguarding against cyber risks, the right insurance strategy can mitigate financial losses and provide peace of mind.

Geico emerges as the top choice for California drivers seeking affordable premiums, robust coverage options, and streamlined online services.

Scott W. Johnson Licensed Insurance Agent

For businesses and individuals alike, understanding their unique risks and selecting appropriate insurance coverage is crucial for long-term security and stability.

Final Thoughts on Affordable Car Insurance in California

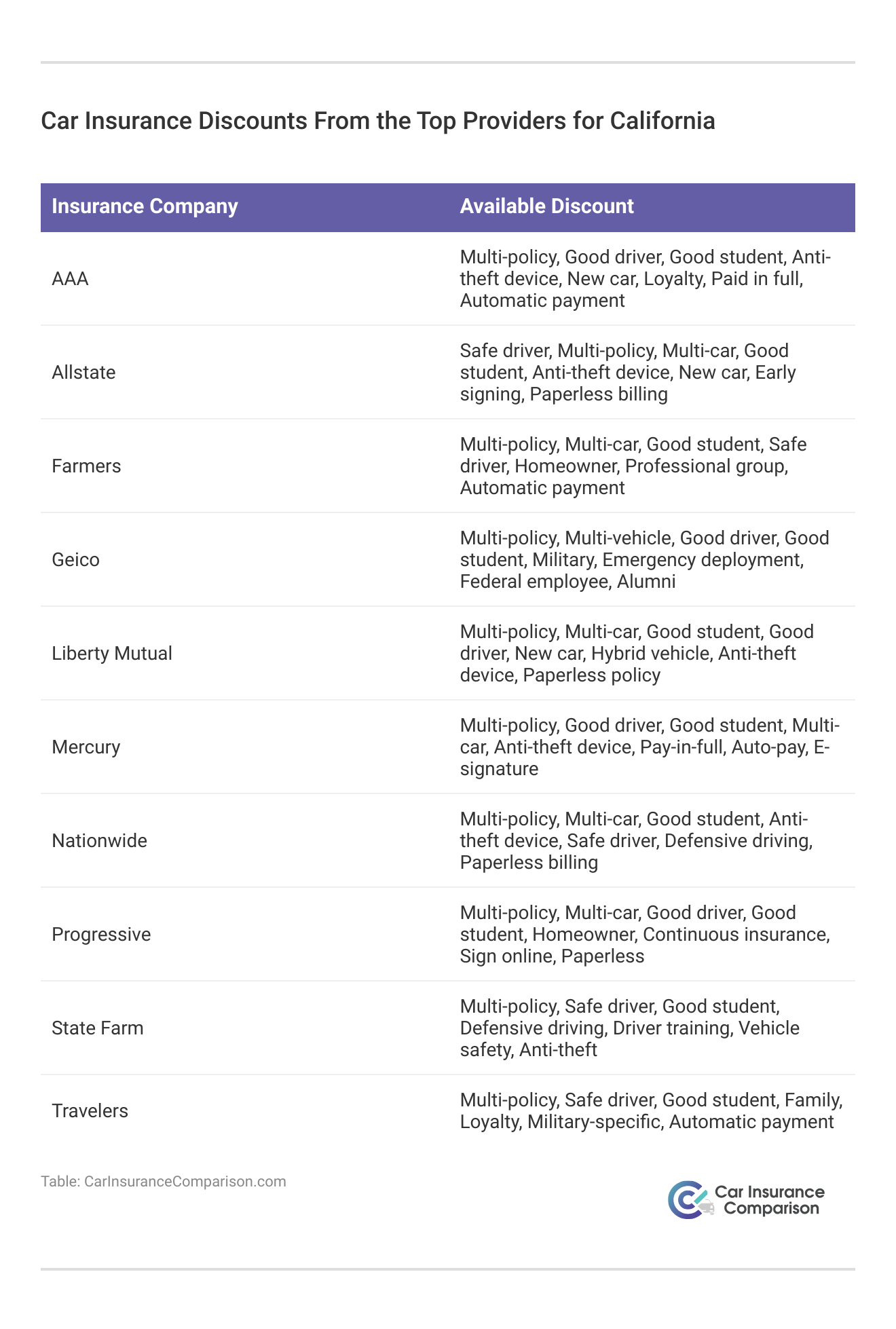

In conclusion, California drivers have a variety of options for affordable and reliable car insurance, with Geico, State Farm, and Mercury leading the market. Each of these insurers offers competitive rates and comprehensive coverage, making them suitable choices for diverse needs. It’s essential for drivers to consider factors such as customer service, coverage options, and car insurance discounts when selecting an insurer.

By comparing rates and evaluating personal needs, California residents can secure the best possible car insurance coverage. Ultimately, finding the right policy ensures both financial protection and peace of mind on the road. Our free quote comparison tool allows you to shop for quotes from the top providers near you by entering your ZIP code below.

Frequently Asked Questions

Why is it so hard to get insurance in California?

California’s stringent regulation of insurance companies, including their oversight of rate increases, has prompted several insurers to withdraw from the state. This trend contributes to the growing difficulty in securing insurance policies in California.

What affects car insurance premiums in California?

Factors such as driving record, demographics, and comparing car insurance by coverage type can impact your insurance rates.

Are there additional coverage options in California?

While not required, it’s recommended to consider adding medical payments coverage and uninsured/underinsured motorist coverage to your policy. See if you’re getting the best deal on car insurance by entering your ZIP code below.

What are the car insurance laws in California?

California has specific laws regarding car insurance. It’s important to be familiar with these rules to maintain a good driving record, but memorizing all the statutes is not necessary.

Why is California car insurance so expensive?

Although California car insurance rates match the national average, they’re higher than you might expect. The main culprits behind California’s car insurance rates are dense traffic, a high number of accidents and fatalities, and increased car theft rates. Expand your knowledge with our guide “Does car insurance cover stolen items?”

Is California a no-fault state?

California is an at-fault state, which means the person who causes an accident is financially responsible for bodily injury and property damage they cause.

Which car insurance companies in California have the cheapest rates?

Rates depend on a variety of factors, but the companies with the cheapest California car insurance quotes tend to be Geico, Mercury, and Progressive.

How much is minimum car insurance in California?

California mandates that drivers maintain a minimum level of car insurance coverage, which includes bodily injury liability coverage of at least $15,000 per person and $30,000 per accident as well as property damage liability coverage of at least $5,000. Access more insights with our “Minimum Car Insurance Requirements by State.”

What is the cheapest car insurance in California?

Geico stands out as the top choice for California car insurance with rates starting at just $33 per month, offering unbeatable affordability and comprehensive coverage options.

At what age is car insurance cheapest?

Experienced drivers tend to file fewer accident claims, making them cheaper to insure. At Progressive, the average premium for drivers decreases significantly between the ages of 19 and 34. From 34 to 75, the premium generally stabilizes or decreases slightly. However, at age 75, the average premium begins to rise again.

Is California car insurance high?

In California, full coverage car insurance costs an average of about $222 per month, while the state minimum coverage is approximately $54 per month. Nationally, the average monthly cost for full coverage is around $193, and for minimum coverage, it is about $53, making car insurance in California generally more expensive than the national average.

What type of car insurance is the cheapest?

Generally, fully comprehensive insurance tends to be the least expensive option, although costs vary based on individual circumstances.

What is the lowest form of car insurance?

Liability insurance is typically the least expensive type of car insurance. This is because it only covers expenses related to bodily injuries and property damage sustained by others when you are responsible for an accident. It does not cover damages to your own vehicle or costs related to your injuries.

What kind of car insurance is mandatory in California?

The law mandates that you must have car liability insurance. However, for those with low incomes, affording the premium can be challenging. California offers a program designed to assist. This program helps good drivers who meet the income criteria obtain insurance. Delve into related insights with our “Compare Personal Liability and Property Damage (PLPD) Car Insurance.”

What is free insurance in California called?

Medi-Cal is California’s Medicaid program, offering public health insurance that provides free or low-cost medical services to children and adults with limited income and resources.

Which category of car insurance is best?

Comprehensive car insurance offers the most extensive coverage available. Our free online comparison tool below allows you to compare cheap car insurance quotes instantly — just enter your ZIP code to get started.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.