Compare Texas Car Insurance Rates [2024]

The average car insurance cost in Texas per month is $92. Texas car insurance requires a minimum of 30/60/25 in bodily injury and property damage, and PIP coverage. What city in Texas has the lowest car insurance rate? Grape Creek. The most expensive? Weslaco. Learn how to easily compare Texas car insurance rates.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Michael Leotta

Insurance Operations Specialist

Michael earned a degree in Business Management degree with an insurance focus, which led to a successful 25-year career in insurance claims operations and support. He possesses a high-level of business acumen across multiple areas of the insurance industry. Over the course of his career, he served in multiple roles supporting claims operations including: Claims Specialist, Claims Trainer, Claim Au...

Insurance Operations Specialist

UPDATED: Apr 23, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Apr 23, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Statistics Summary | Details |

|---|---|

| Road Miles | Total In State: 313,596 Vehicle Miles Driven: 258,122 Million |

| Vehicles | Registered in State: 21,477,692 Total Stolen: 67,485 |

| State Population (Current Estimate) | 28,701,845 |

| Most Popular Vehicle | Ford F150 |

| Percent of Uninsured Motorists | 14.10% State Rank: 16th |

| Total Driving Related Deaths | 2013-2022 Speeding Fatalities: 1,029 Drunk Driving Fatalities: 1,468 |

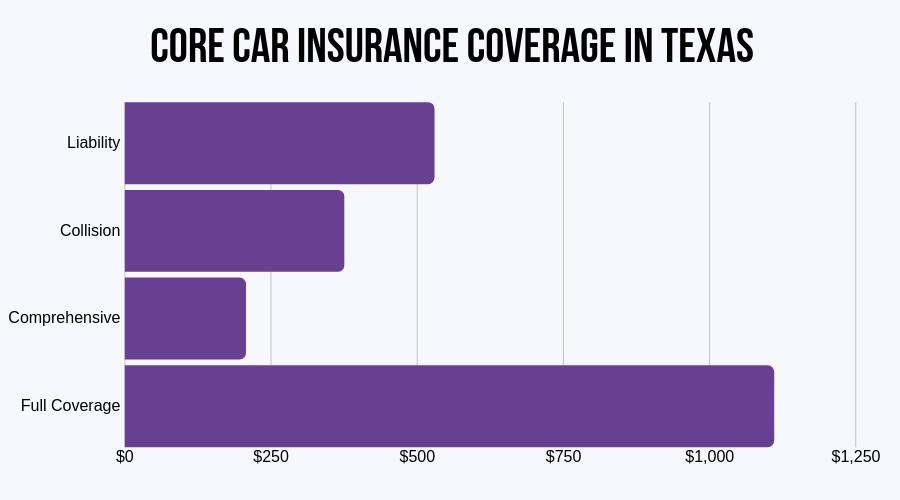

| Monthly Premiums | Liability: $44 Collision: $31 Comprehensive: $17 |

| Cheapest Provider | USAA |

There are many things that make a Texan smile every day, including barbecue, high school football, and cowboy boots. However, driving isn’t one of them. Why is that?

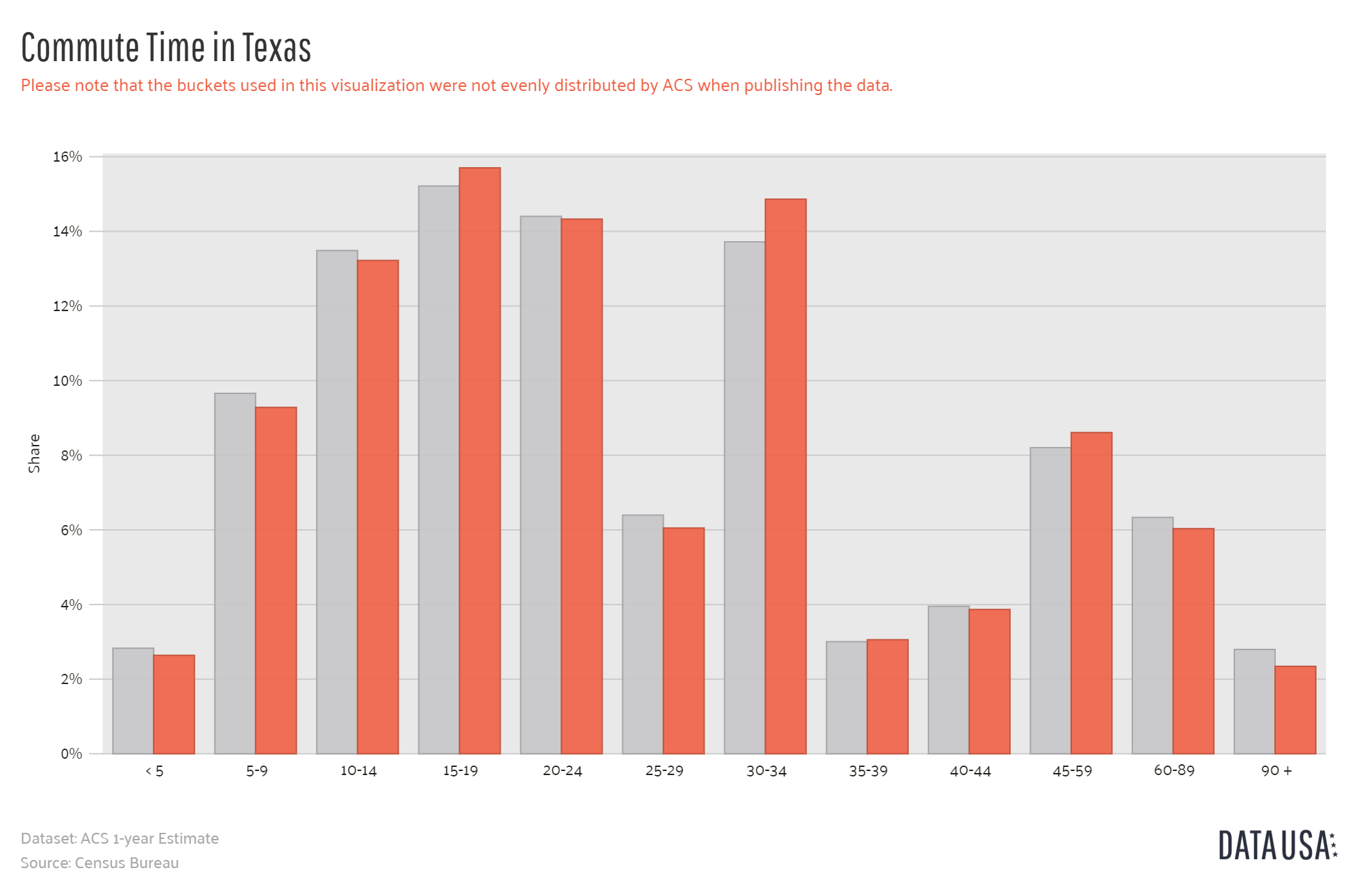

As per a new study, Houston, Dallas, Austin, and San Antonio are in the list of America’s most congested cities. On average, Houstonians spent 50 hours sitting idle in traffic.

Since there’s a massive population driving on those roads which increases the risk of accidents, knowing about the car insurance laws of your state and getting the right coverage would make your life peaceful. We really can’t do anything about traffic congestion in your city, however, we can enlighten you with a ton of information on car insurance.

You might be wondering:

- Is car insurance cheaper in Texas?

- Who has the best price on car insurance in Texas?

- What is the average cost of car insurance in Texas per month?

- Who has the best full-coverage car insurance in Texas?

- What car insurance is required by law in Texas?

We can answer all those questions and more. Let’s get started looking at the best car insurance companies for you and the best ways to compare Texas car insurance rates. Start comparing car insurance rates now using our FREE online tool above.

- Car Insurance Rates in Texas

- Compare Willis, TX Car Insurance Rates [2024]

- Compare Wichita Falls, TX Car Insurance Rates [2024]

- Compare Trenton, TX Car Insurance Rates [2024]

- Compare Tomball, TX Car Insurance Rates [2024]

- Compare Sugar Land, TX Car Insurance Rates [2024]

- Compare Snyder, TX Car Insurance Rates [2024]

- Compare Smithville, TX Car Insurance Rates [2024]

- Compare Paradise, TX Car Insurance Rates [2024]

- Compare Pampa, TX Car Insurance Rates [2024]

- Compare Nolanville, TX Car Insurance Rates [2024]

- Compare New Braunfels, TX Car Insurance Rates [2024]

- Compare Mexia, TX Car Insurance Rates [2024]

- Compare Mckinney, TX Car Insurance Rates [2024]

- Compare Mcallen, TX Car Insurance Rates [2024]

- Compare Madisonville, TX Car Insurance Rates [2024]

- Compare Lufkin, TX Car Insurance Rates [2024]

- Compare Live Oak, TX Car Insurance Rates [2024]

- Compare Lewisville, TX Car Insurance Rates [2024]

- Compare Kerens, TX Car Insurance Rates [2024]

- Compare Karnack, TX Car Insurance Rates [2024]

- Compare Jourdanton, TX Car Insurance Rates [2024]

- Compare Huntsville, TX Car Insurance Rates [2024]

- Compare Hochheim, TX Car Insurance Rates [2024]

- Compare Hawkins, TX Car Insurance Rates [2024]

- Compare Graham, TX Car Insurance Rates [2024]

- Compare Garden Ridge, TX Car Insurance Rates [2024]

- Compare Friendswood, TX Car Insurance Rates [2024]

- Compare Floresville, TX Car Insurance Rates [2024]

- Compare Edna, TX Car Insurance Rates [2024]

- Compare Edinburg, TX Car Insurance Rates [2024]

- Compare Eastland, TX Car Insurance Rates [2024]

- Compare Dickinson, TX Car Insurance Rates [2024]

- Compare Dallas, TX Car Insurance Rates [2024]

- Compare Cypress, TX Car Insurance Rates [2024]

- Compare Corpus Christi, TX Car Insurance Rates [2024]

- Compare Clifton, TX Car Insurance Rates [2024]

- Compare Cedar Hill, TX Car Insurance Rates [2024]

- Compare Carrollton, TX Car Insurance Rates [2024]

- Compare Canyon Lake, TX Car Insurance Rates [2024]

- Compare Caldwell, TX Car Insurance Rates [2024]

- Compare Brazoria, TX Car Insurance Rates [2024]

- Compare Bastrop, TX Car Insurance Rates [2024]

- Compare Austin, TX Car Insurance Rates [2024]

- Compare Andrews, TX Car Insurance Rates [2024]

- Compare Alba, TX Car Insurance Rates [2024]

- Compare Irving, TX Car Insurance Rates [2024]

- Compare San Antonio, TX Car Insurance Rates [2024]

- Compare Tyler, TX Car Insurance Rates [2024]

- Compare Fort Worth, TX Car Insurance Rates [2024]

- Best San Antonio, TX Car Insurance in 2024 (Your Guide to the Top 10 Companies)

- Compare Houston, TX Car Insurance Rates [2024]

Texas Car Insurance Coverage and Rates

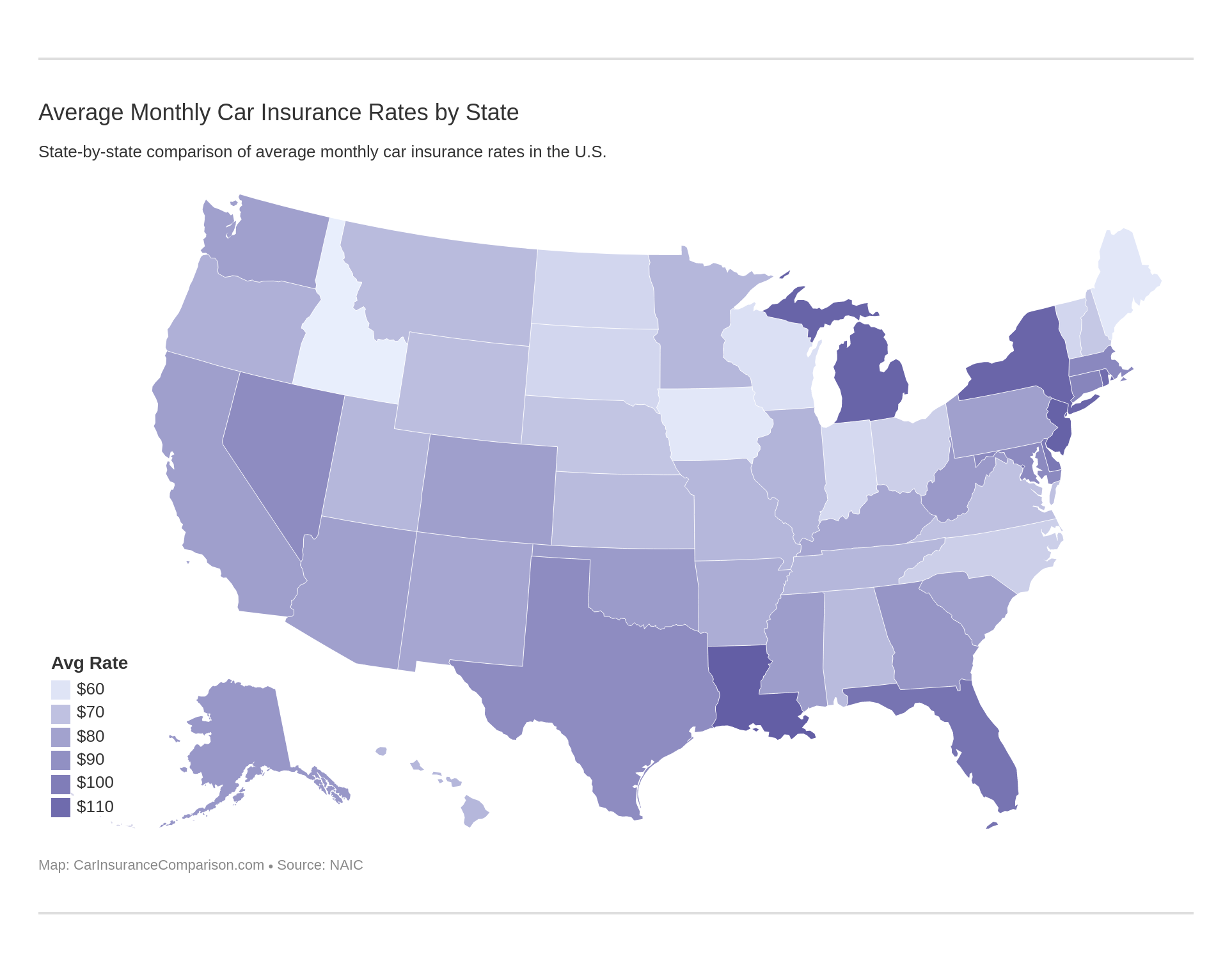

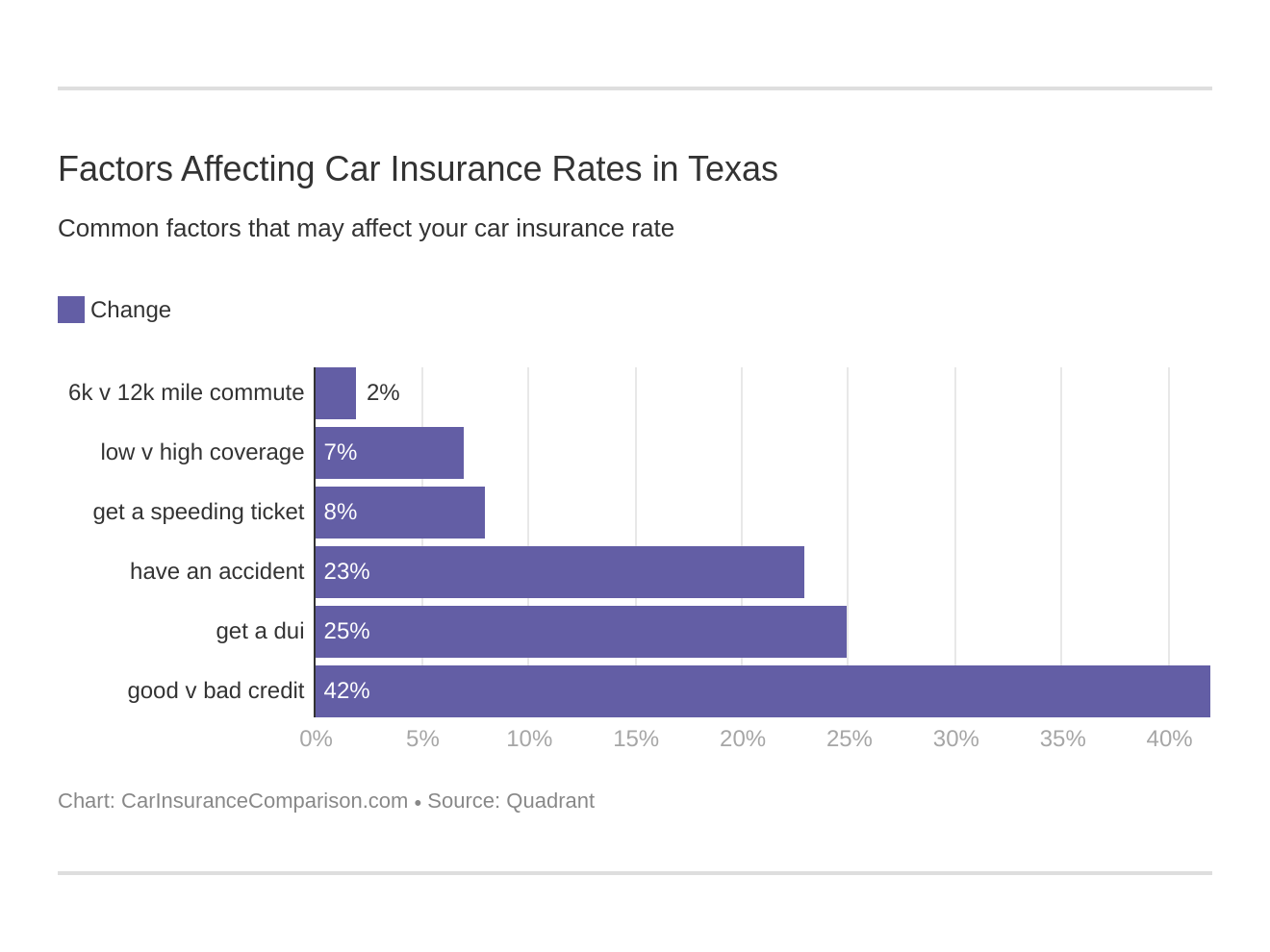

The premium that you pay to your insurer is calculated after taking into account many factors that might involve your age, marital status, driving record, your car’s make & model, the number of miles you drive, and even where you live.

If you don’t research the market for car insurance companies, you might end up buying an expensive policy or coverage that’s insufficient for you.

Don’t worry, we are experts in the field of auto insurance and have compiled a list of things to know before buying car insurance in Texas.

First and foremost, you must know about the minimum coverage requirements in your state. In Texas, it’s illegal to drive without insurance and you have to maintain coverage at all times.

Minimum Car Insurance Requirements in Texas

The laws in Texas require motorists to purchase minimum liability car insurance coverage of 30/60/25 to pay off any medical expenses or property damage costs to the other party in the event of an accident.

What do these coverage numbers mean?

- Medical expenses for personal injuries: Your policy should cover the other party’s personal injury expenses to the extent of $30,000 per person, with an overall limit of $60,000 per accident.

- Property Damage Expenses: In addition, the insurance policy should cover property damage costs up to $25,000 per accident.

Do remember: The minimum state-required coverage wouldn’t pay for your own personal injury expenses and property damage costs. Since Texas is an at-fault state, motorists have to pay damages to the other driver who wasn’t responsible for causing the accident.

You can also watch this short three-minute video to understand the minimum coverage requirements in Texas.

Please note: You should also consider adding coverage for collision insurance and medical payments to your policy so that your insurer settles the damages to your car or personal injury expenses if you’re the at-fault party in an accident.

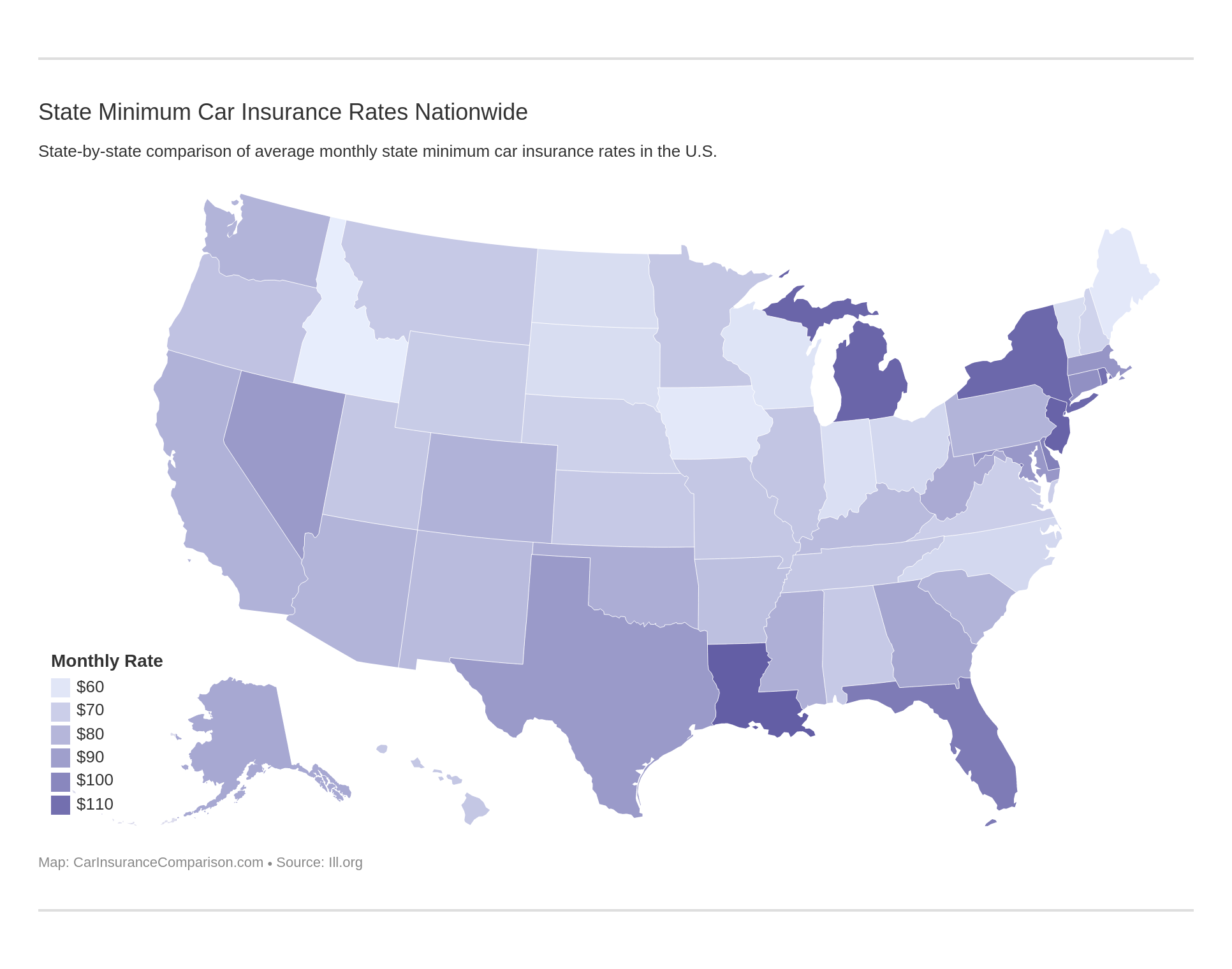

Also know that the cost of minimum coverage is not locked to the company, and similarly varies from state to state.

Required Forms of Financial Responsibility in Texas

If a motorist is involved in an accident, they become financially responsible for covering the damages caused as a result of the accident. By state laws, if you buy liability coverage in Texas, you can establish financial responsibility.

Texas follows a combination of tort and no-fault laws, which means if you’re the at fault party in an accident, you automatically become responsible to pay the financial cost of personal injury and property damage.

Apart from buying minimum liability coverage of 30/60/25, motorists in Texas have other options to prove financial responsibility. Always remember that the state-mandated minimum coverage wouldn’t be sufficient to pay for damages if you’re involved in a major accident.

Other forms of financial responsibility:

- A deposit of at least $55,000 as cashier’s check or cash to be held with a country judge

- A self-insurance certificate from the Texas Department of Public Safety

- A surety bond

These are some of the other alternatives to a car insurance policy in Texas. However, you can never estimate the financial costs that you may have to bear in case you’re involved in an accident, hence buying an insurance policy is more beneficial than the options mentioned above.

Premiums as Percentage of Income in Texas

How much is car insurance in Texas? In 2014, the monthly per capita disposable personal income in Texas was approximately $3,424 while the average monthly full coverage car insurance premium was $88.85.

On an average, Texans paid around 2.59% of their personal disposable income for car insurance premiums which was a little higher than the national average of 2.37%.

If you have a less-than-perfect driving record or you wish to buy additional coverage for your car, you might have to shell out more money for car insurance premiums in Texas.

Average Monthly Car Insurance Rates in TX (Liability, Collision, Comprehensive)

–>

The above chart would give you an idea of how much you can expect to pay for liability, collision insurance, and comprehensive car insurance coverage in Texas. Usually, the premiums for liability coverage are on the higher side, followed by collision and comprehensive coverage.

Now, you must be wondering what is collision and comprehensive coverage and why you need it.

Since your state law requires you to buy only the minimum liability coverage, you might not completely understand the significance of buying a collision or comprehensive coverage. But, those play an equally important role in paying off damages.

Collision coverage on car insurance pays for the cost of damage to your car when it collides with an object, such as a guardrail, building, or another vehicle. Comprehensive car insurance, on the other hand, covers the damages to your car caused by hailstorms, hurricanes, floods, earthquakes, etc.

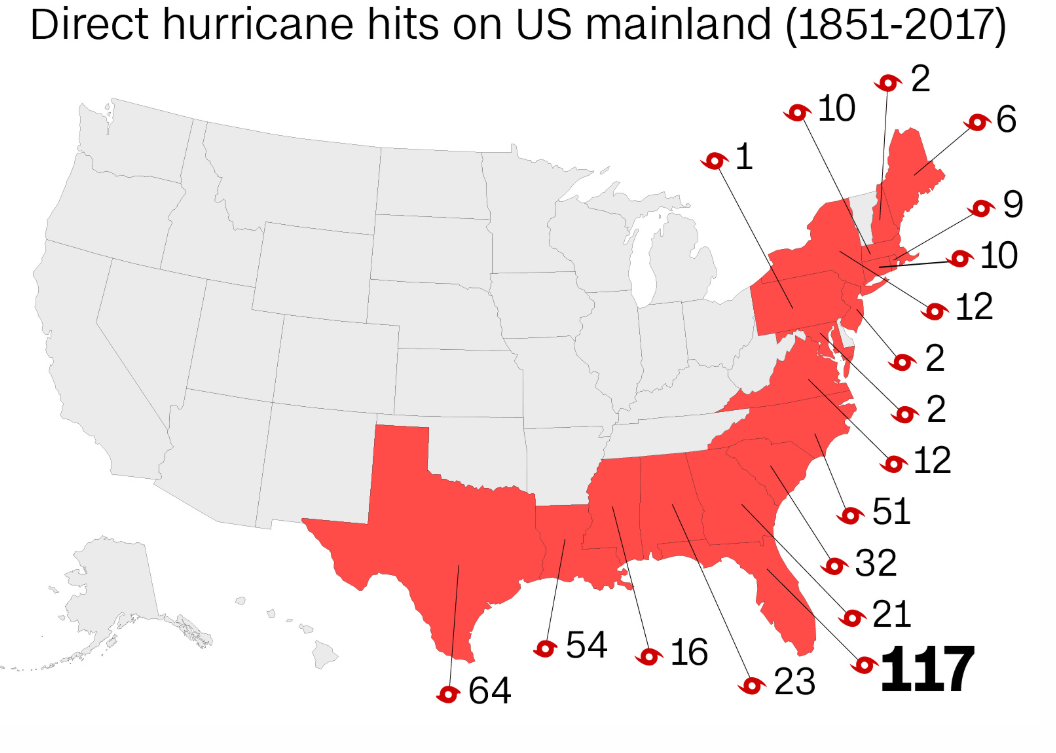

As per the Hurricane Research Division, Texas has witnessed the maximum number of hurricane landfalls after Florida on the US mainland during the 1851-2017 period.

Image source: CNN

Since Texas is exposed to the Gulf of Mexico coastline, it’s prone to hurricanes, and while you may not live in the coastal areas, your city/county might be impacted by heavy winds and tornadoes.

We are focusing on these facts so that you’re aware of the risks in your area and buy car insurance coverage accordingly. After a bad storm, nobody likes to hear from their insurer that damages from natural causes aren’t covered in the policy.

In case, you would like to know more about the different types of car insurance coverage, you can watch this quick four-minute video for a better understanding.

Additional Liability Coverage in Texas

| Loss Ratio | 2015 | 2014 | 2013 |

|---|---|---|---|

| Personal Injury Protection | 63.51% | 63.10% | 64.43% |

| Medical Payments | 64.37% | 72.93% | 64.31% |

| Uninsured/Underinsured Motorist | 70.62% | 67.04% | 64.26% |

An add-on state for no-fault law means that motorists are not required to buy first-party coverage, however, they have the option to choose medical payments or personal injury protection as an additional coverage to pay for their own damages if the at-fault party is unable to do so.

In 2015, around 14.1% motorists were uninsured in Texas, which made the lone star state number 16th in the list of US states with estimated percentage of uninsured motorists.

Add-ons, Endorsements, and Riders in Texas

Other than the basic liability and personal injury protection coverage, there are certain add-ons that reimburse the cost of repairs or damages in specific situations. You might want to take a look at these to rule out any major financial outlay in the future.

- GAP insurance

- Personal Umbrella Policy (PUP)

- Rental Car Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

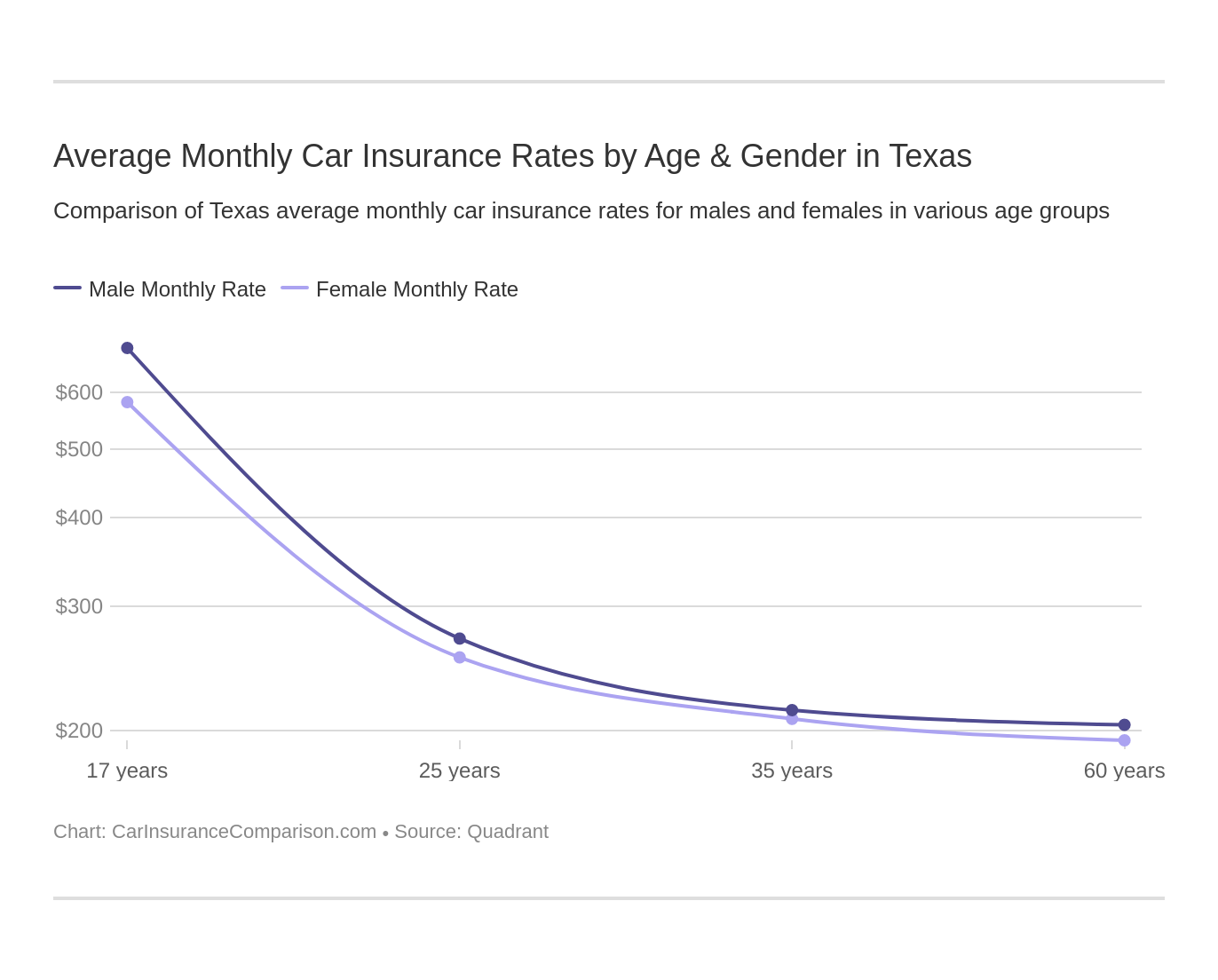

Average Monthly Car Insurance Rates by Age & Gender in TX

| Company | 16-Year-Old Male | 16-Year-Old Female | 25-Year-Old Male | 25-Year-Old Female | 30-Year-Old Male | 30-Year-Old Female | 60-Year-Old Male | 60-Year-Old Female |

|---|---|---|---|---|---|---|---|---|

| Allstate | $710 | $646 | $266 | $255 | $247 | $237 | $196 | $196 |

| Geico | $238 | $251 | $114 | $113 | $106 | $105 | $101 | $91 |

| Nationwide | $706 | $595 | $207 | $188 | $192 | $175 | $130 | $121 |

| Progressive | $1,016 | $993 | $164 | $160 | $153 | $149 | $112 | $109 |

| State Farm | $315 | $270 | $105 | $101 | $98 | $94 | $79 | $79 |

| USAA | $196 | $198 | $94 | $87 | $87 | $81 | $56 | $56 |

For different age groups, you can see the premium rates for males and females. On average, the rates for males are higher than for females across all age groups in Texas.

For males below 30, there’s a high probability that their insurance premiums would be higher than their female counterparts, especially in the 17-year-old category, as we can see in the table above. It can be difficult to find cheap car insurance for young male drivers.

But, after 30, insurance carriers look at many other factors (other than age & gender) to calculate insurance premiums and there’s a slight difference in rates between males and females.

Insurance Carrier Rank by Premium Rates in Texas

| Company | Demographic | Average Monthly Rate | Rank from Most to Least Expensive |

|---|---|---|---|

| Progressive | Single 16 Year Old Male | $967 | 1 |

| Allstate | Single 16 Year Old Male | $942 | 2 |

| Progressive | Single 16 Year Old Female | $867 | 3 |

| The General | Single 16 Year Old Male | $843 | 4 |

| Allstate | Single 16 Year Old Female | $780 | 5 |

| Nationwide | Single 16 Year Old Male | $735 | 6 |

| The General | Single 16 Year Old Female | $643 | 7 |

| Nationwide | Single 16 Year Old Female | $571 | 8 |

| State Farm | Single 16 Year Old Male | $511 | 9 |

| Geico | Single 16 Year Old Male | $459 | 10 |

| Geico | Single 16 Year Old Female | $442 | 11 |

| USAA | Single 16 Year Old Male | $402 | 12 |

| State Farm | Single 16 Year Old Female | $401 | 13 |

| The General | Single 25 Year Old Male | $399 | 14 |

| Allstate | Single 25 Year Old Male | $383 | 15 |

| USAA | Single 16 Year Old Female | $369 | 16 |

| Allstate | Single 25 Year Old Female | $368 | 17 |

| The General | Single 25 Year Old Female | $349 | 18 |

| Allstate | Married 30 Year Old Male | $300 | 19 |

| Allstate | Married 30 Year Old Female | $297 | 20 |

| Allstate | Married 60 Year Old Female | $293 | 21 |

| Allstate | Married 60 Year Old Male | $293 | 21 |

| The General | Married 30 Year Old Male | $271 | 23 |

| The General | Married 60 Year Old Male | $259 | 24 |

| Nationwide | Single 25 Year Old Male | $257 | 25 |

| Progressive | Single 25 Year Old Male | $250 | 26 |

| Progressive | Single 25 Year Old Female | $246 | 27 |

| The General | Married 30 Year Old Female | $243 | 28 |

| Nationwide | Single 25 Year Old Female | $238 | 29 |

| The General | Married 60 Year Old Female | $226 | 30 |

| Geico | Married 60 Year Old Male | $221 | 31 |

| Geico | Single 25 Year Old Female | $219 | 32 |

| Geico | Single 25 Year Old Male | $219 | 33 |

| Geico | Married 30 Year Old Male | $219 | 34 |

| Progressive | Married 30 Year Old Female | $208 | 35 |

| Nationwide | Married 30 Year Old Male | $206 | 36 |

| Geico | Married 30 Year Old Female | $203 | 37 |

| Nationwide | Married 30 Year Old Female | $203 | 38 |

| Progressive | Married 30 Year Old Male | $198 | 39 |

| Geico | Married 60 Year Old Female | $195 | 40 |

| USAA | Single 25 Year Old Male | $191 | 41 |

| Nationwide | Married 60 Year Old Male | $190 | 42 |

| Progressive | Married 60 Year Old Male | $189 | 43 |

| State Farm | Single 25 Year Old Male | $189 | 44 |

| Progressive | Married 60 Year Old Female | $185 | 45 |

| State Farm | Single 25 Year Old Female | $183 | 46 |

| Nationwide | Married 60 Year Old Female | $179 | 47 |

| USAA | Single 25 Year Old Female | $177 | 48 |

| State Farm | Married 30 Year Old Female | $168 | 49 |

| State Farm | Married 30 Year Old Male | $168 | 49 |

| State Farm | Married 60 Year Old Female | $150 | 51 |

| State Farm | Married 60 Year Old Male | $150 | 51 |

| USAA | Married 30 Year Old Male | $134 | 53 |

| USAA | Married 30 Year Old Female | $133 | 54 |

| USAA | Married 60 Year Old Female | $127 | 55 |

| USAA | Married 60 Year Old Male | $126 | 56 |

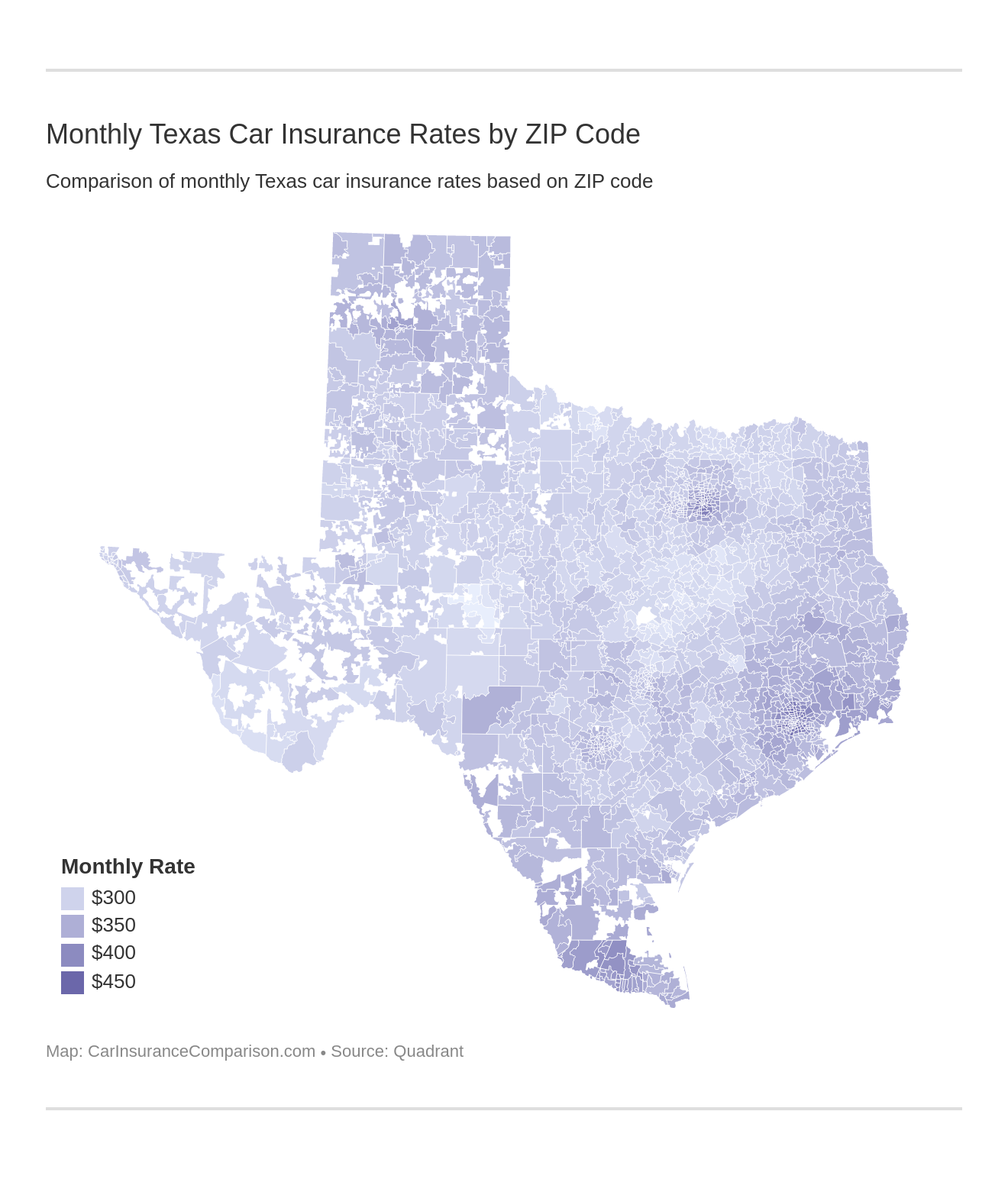

Most Expensive/Least Expensive Zip Codes by Premium Rates in Texas

Want to know how much insurance carriers are charging by zip code? Below are the most expensive zip codes in Texas.

| 25 Most Expensive Zip Codes | City | Average Monthly Rate by Zip Code | Most Expensive Company | Most Expensive Monthly Rate | Second Most Expensive Company | Second Most Expensive Monthly Rate | Cheapest Company | Cheapest Monthly Rate | Second Cheapest Company | Second Cheapest Monthly Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 78049 | Laredo | $462 | American Family | $945 | Progressive | $608 | USAA | $229 | State Farm | $257 |

| 78599 | Weslaco | $454 | American Family | $945 | Allstate | $519 | State Farm | $248 | USAA | $265 |

| 77036 | Houston | $453 | American Family | $755 | Allstate | $603 | USAA | $252 | State Farm | $300 |

| 77033 | Houston | $439 | American Family | $673 | Allstate | $608 | USAA | $252 | State Farm | $304 |

| 77072 | Houston | $437 | American Family | $752 | Allstate | $518 | USAA | $252 | State Farm | $290 |

| 75207 | Dallas | $435 | Allstate | $639 | Progressive | $614 | USAA | $245 | State Farm | $302 |

| 77053 | Houston | $432 | American Family | $674 | Allstate | $596 | USAA | $253 | State Farm | $295 |

| 77060 | Houston | $431 | American Family | $604 | Allstate | $563 | USAA | $253 | State Farm | $328 |

| 77067 | Houston | $431 | American Family | $616 | Allstate | $595 | USAA | $253 | State Farm | $330 |

| 77076 | Houston | $430 | Allstate | $608 | American Family | $580 | USAA | $251 | State Farm | $322 |

| 77091 | Houston | $430 | Allstate | $608 | American Family | $581 | USAA | $263 | State Farm | $314 |

| 77078 | Houston | $430 | Allstate | $613 | American Family | $601 | USAA | $263 | State Farm | $314 |

| 75242 | Dallas | $429 | Allstate | $652 | Progressive | $644 | USAA | $253 | Geico | $292 |

| 79430 | Lubbock | $429 | American Family | $945 | Progressive | $608 | USAA | $223 | State Farm | $242 |

| 77037 | Houston | $428 | Allstate | $608 | American Family | $545 | USAA | $253 | State Farm | $317 |

| 77022 | Houston | $426 | Allstate | $608 | American Family | $582 | USAA | $251 | State Farm | $326 |

| 77039 | Houston | $426 | American Family | $610 | Allstate | $564 | USAA | $251 | State Farm | $321 |

| 77081 | Houston | $426 | American Family | $649 | Allstate | $593 | USAA | $265 | State Farm | $282 |

| 77088 | Houston | $426 | American Family | $686 | Allstate | $549 | USAA | $263 | State Farm | $319 |

| 77016 | Houston | $426 | Allstate | $613 | American Family | $582 | USAA | $251 | State Farm | $315 |

| 77028 | Houston | $426 | Allstate | $639 | American Family | $576 | USAA | $263 | State Farm | $291 |

| 77093 | Houston | $425 | Allstate | $607 | American Family | $560 | USAA | $263 | State Farm | $320 |

| 77026 | Houston | $425 | Allstate | $613 | American Family | $585 | USAA | $263 | State Farm | $334 |

| 77050 | Houston | $425 | Allstate | $609 | American Family | $556 | USAA | $251 | State Farm | $314 |

| 75210 | Dallas | $425 | Allstate | $639 | American Family | $607 | USAA | $252 | State Farm | $297 |

The city of Laredo has the most expensive zip code. Now let’s see which cities have the cheapest zip codes.

| 25 Least Expensive Zip Codes | City | Average Monthly Rate by Zip Codes | Most Expensive Company | Most Expensive Monthly Rate | Second Most Expensive Company | Second Most Expensive Monthly Rate | Cheapest Company | Cheapest Monthly Rate | Second Cheapest Company | Second Cheapest Monthly Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 76901 | San Angelo | $263 | Allstate | $379 | American Family | $316 | USAA | $183 | State Farm | $202 |

| 76904 | San Angelo | $263 | Allstate | $379 | Progressive | $317 | USAA | $173 | State Farm | $200 |

| 76939 | Knickerbocker | $267 | Allstate | $379 | American Family | $322 | USAA | $174 | State Farm | $202 |

| 76306 | Wichita Falls | $268 | Allstate | $395 | American Family | $320 | USAA | $158 | State Farm | $210 |

| 76909 | San Angelo | $269 | Allstate | $379 | Progressive | $330 | USAA | $173 | State Farm | $202 |

| 76502 | Temple | $272 | Allstate | $403 | American Family | $324 | USAA | $186 | Geico | $223 |

| 76886 | Veribest | $272 | Allstate | $411 | American Family | $318 | USAA | $183 | State Farm | $202 |

| 76798 | Waco | $272 | Allstate | $428 | Progressive | $325 | Nationwide | $194 | USAA | $195 |

| 76712 | Woodway | $272 | Allstate | $429 | Progressive | $342 | Nationwide | $187 | USAA | $190 |

| 76908 | Goodfellow Afb | $273 | Allstate | $379 | American Family | $331 | USAA | $173 | State Farm | $203 |

| 75110 | Corsicana | $274 | Allstate | $410 | Progressive | $312 | USAA | $182 | Geico | $213 |

| 76354 | Burkburnett | $274 | Allstate | $408 | American Family | $322 | USAA | $172 | State Farm | $211 |

| 76543 | Killeen | $276 | Allstate | $411 | American Family | $344 | USAA | $186 | State Farm | $223 |

| 76309 | Wichita Falls | $276 | Allstate | $401 | American Family | $358 | USAA | $172 | Geico | $211 |

| 76706 | Waco | $277 | Allstate | $428 | American Family | $337 | Nationwide | $194 | USAA | $195 |

| 76905 | San Angelo | $277 | Allstate | $411 | Progressive | $348 | USAA | $174 | State Farm | $199 |

| 76903 | San Angelo | $278 | Allstate | $400 | American Family | $337 | USAA | $182 | State Farm | $202 |

| 76957 | Wall | $278 | Allstate | $379 | Progressive | $333 | USAA | $183 | State Farm | $202 |

| 76513 | Belton | $278 | Allstate | $428 | American Family | $316 | USAA | $182 | State Farm | $219 |

| 76564 | Pendleton | $278 | Allstate | $426 | American Family | $326 | USAA | $183 | State Farm | $222 |

| 76710 | Waco | $278 | Allstate | $427 | American Family | $322 | USAA | $190 | Geico | $223 |

| 76711 | Waco | $279 | Allstate | $429 | Progressive | $321 | USAA | $190 | Geico | $224 |

| 77881 | Wellborn | $279 | Allstate | $405 | Progressive | $329 | USAA | $183 | State Farm | $223 |

| 76311 | Sheppard Afb | $279 | Allstate | $415 | American Family | $354 | USAA | $158 | Geico | $211 |

| 76310 | Wichita Falls | $279 | Allstate | $413 | American Family | $357 | USAA | $172 | State Farm | $207 |

Most Expensive/Least Expensive Cities by Premium Rates in Texas

Now that we’ve looked at zip codes, let’s see which cities are the most expensive.

| Top 10 Most Expensive Cities | Average Monthly Rate by City | Most Expensive Company | Most Expensive Monthly Rate | Second Most Expensive Company | Second Most Expensive Monthly Rate | Cheapest Company | Cheapest Monthly Rate | Second Cheapest Company | Second Cheapest Monthly Rate |

|---|---|---|---|---|---|---|---|---|---|

| Weslaco | $454 | American Family | $945 | Allstate | $519 | State Farm | $248 | USAA | $265 |

| Texhoma | $441 | American Family | $945 | Progressive | $661 | USAA | $201 | State Farm | $205 |

| Aldine | $429 | American Family | $586 | Allstate | $578 | USAA | $252 | State Farm | $322 |

| Cockrell Hill | $400 | Allstate | $563 | American Family | $530 | USAA | $242 | State Farm | $311 |

| North Houston | $400 | Progressive | $608 | Allstate | $537 | USAA | $230 | State Farm | $279 |

| Houston | $398 | American Family | $571 | Allstate | $543 | USAA | $244 | State Farm | $289 |

| Garciasville | $397 | Progressive | $598 | Allstate | $575 | State Farm | $227 | USAA | $241 |

| South Houston | $396 | Allstate | $541 | American Family | $511 | USAA | $252 | State Farm | $278 |

| Galena Park | $395 | Allstate | $541 | American Family | $521 | USAA | $264 | State Farm | $282 |

| Linn | $394 | Progressive | $580 | Allstate | $512 | State Farm | $257 | USAA | $265 |

While Laredo had the most expensive zip code, it is not among the top ten most expensive cities.

| Top 10 Least Expensive Cities | Average Monthly Rate by City | Most Expensive Company | Most Expensive Monthly Rate | Second Most Expensive Company | Second Most Expensive Monthly Rate | Cheapest Company | Cheapest Monthly Rate | Second Cheapest Company | Second Cheapest Monthly Rate |

|---|---|---|---|---|---|---|---|---|---|

| Grape Creek | $263 | Allstate | $379 | American Family | $316 | USAA | $183 | State Farm | $202 |

| Knickerbocker | $267 | Allstate | $379 | American Family | $322 | USAA | $174 | State Farm | $202 |

| San Angelo | $272 | Allstate | $392 | Progressive | $333 | USAA | $176 | State Farm | $201 |

| Veribest | $272 | Allstate | $411 | American Family | $318 | USAA | $183 | State Farm | $202 |

| Goodfellow AFB | $273 | Allstate | $379 | American Family | $331 | USAA | $173 | State Farm | $203 |

| Burkburnett | $274 | Allstate | $408 | American Family | $322 | USAA | $172 | State Farm | $211 |

| Robinson | $277 | Allstate | $428 | American Family | $337 | Nationwide | $194 | USAA | $195 |

| Wall | $278 | Allstate | $379 | Progressive | $333 | USAA | $183 | State Farm | $202 |

| Belton | $278 | Allstate | $428 | American Family | $316 | USAA | $182 | State Farm | $219 |

| Pendleton | $278 | Allstate | $426 | American Family | $326 | USAA | $183 | State Farm | $222 |

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Best Car Insurance Companies in Texas

There are some insurance companies that charge exorbitant premiums whereas there are others who charge a fraction of that amount, assuming that you keep all factors for premium calculations constant.

Which one should you choose? And, what factors should you consider before buying an insurance policy?

Should premium rates be the determining factor in your decision-making process? Or, should you consider the financial ratings and customer reviews of your insurance carrier?

We have answers to all those queries and much more in the section ahead to help you learn how to compare car insurance rates.

Financial Ratings of Leading Insurance Carriers in Texas

| Insurance Company | A.M. Best Rating |

|---|---|

| State Farm Group | A++ |

| Geico | A++ |

| Allstate Insurance Group | A+ |

| Progressive Group | A+ |

| Farmers Insurance Group | A |

| USAA Group | A++ |

| Liberty Mutual Group | A |

| Texas Farm Bureau Mutual Group | A |

| Consumers County Mutual Insurance Co | NR |

| Nationwide Corp Group | A+ |

Every insurance company is rated by credit rating agencies that assess the long-term financial viability of an insurer so that they are able to meet their obligations with respect to claim settlement.

We are using AM Best ratings to give you an idea about the creditworthiness of the insurance providers in Texas, as it’s one of the first companies to evaluate the credit quality of institutions in America.

When it comes to claim settlement, having coverage from a reliable and creditworthy insurance company helps in faster responses and settlement of claims.

Car Insurance Companies with Best Customer Ratings in Texas

Communication in the digital era happens at supersonic speed. If you’re not satisfied with an insurance provider, you would immediately tweet about it or send a WhatsApp message to most of your friends.

A recent study found that negative reviews sway almost 86% of the customers. Also, a majority (90%) of the respondents said that their purchase decision was influenced by positive reviews of a specific brand.

Customer service and engagement have become a focal point of most insurance companies these days because that’s what differentiates them from the others in the market.

And, before making a purchase decision, you must look at the customer ratings of insurance providers as market research companies use every parameter available to gauge the satisfaction levels among consumers.

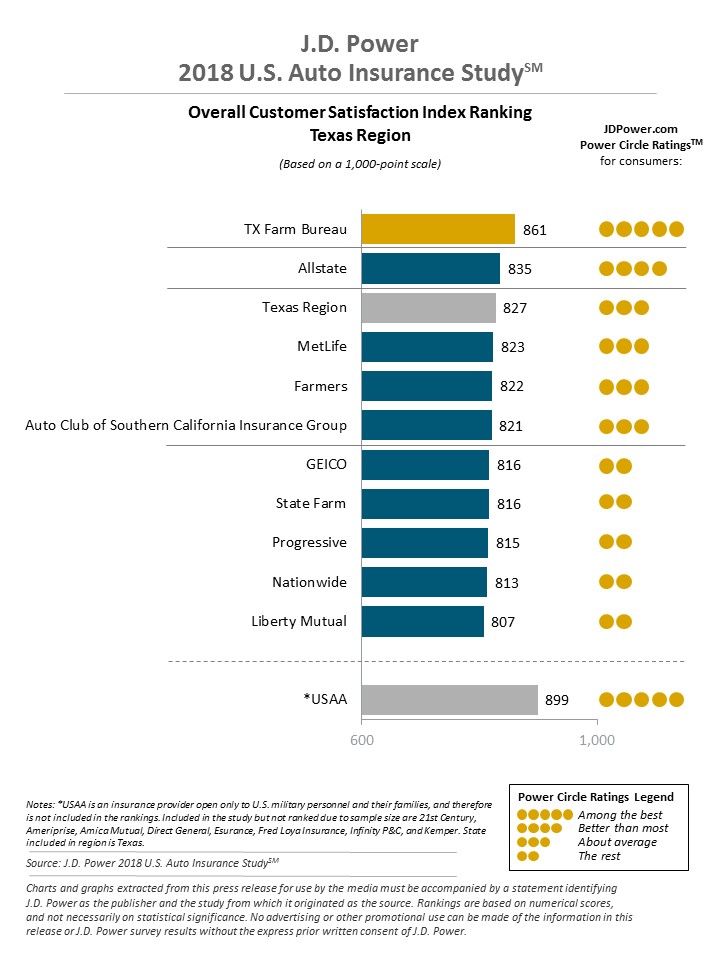

As per a study by J.D. Power in 2018, Texas Farm Bureau was the highest-ranked brand amongst auto insurance companies in Texas. J.D. Power’s study assessed customer satisfaction on five factors; interaction, policy offerings, price, billing process & policy information, and claims.

The insurance practice business consultant at the firm, Robert Lajdziak, also noted that “Cost is not the sole indicator of customer satisfaction in the auto insurance industry. Low prices may attract new customers, but it’s service that keeps them. The auto insurers that increase customer satisfaction across all facets of the customer experience make the price just one part of the overall relationship.”

Efforts made by insurance companies, especially in improving interactions through digital channels, have enhanced the overall level of customer satisfaction.

Read more:

Customer Complaints Data of Leading Insurers in Texas

| Insurance Company | Number of Complaints (2017) |

|---|---|

| State Farm Group | 1482 |

| Geico | 333 |

| Allstate Insurance Group | 163 |

| Progressive Group | 120 |

| Farmers Insurance Group | 0 |

| USAA Group | 296 |

| Liberty Mutual Group | 222 |

| Texas Farm Bureau Mutual Group | 3 |

| Consumers County Mutual Insurance Co | 5 |

| Nationwide Corp Group | 25 |

Now that you have seen the financial ratings and customer satisfaction reviews of insurance companies in Texas, you should also know about the number of complaints against these companies.

Even though some companies manage to get an excellent financial rating, their complaints data tell another story. A high number of complaints mean that customers aren’t satisfied with the overall services of an insurer, irrespective of its ability to settle claims.

We can see that Texas Farm Bureau Mutual Group has a negligible number of complaints and also bagged the trophy for highest customer satisfaction in the J.D. Power study.

Premium Rates of Insurance Companies in Texas

After sharing details of leading insurance providers, their ratings, customer reviews, and complaints data, it’s time to take a look at the premiums offered by different providers in Texas. For many consumers, premium rates are the determining factor behind their purchase decision.

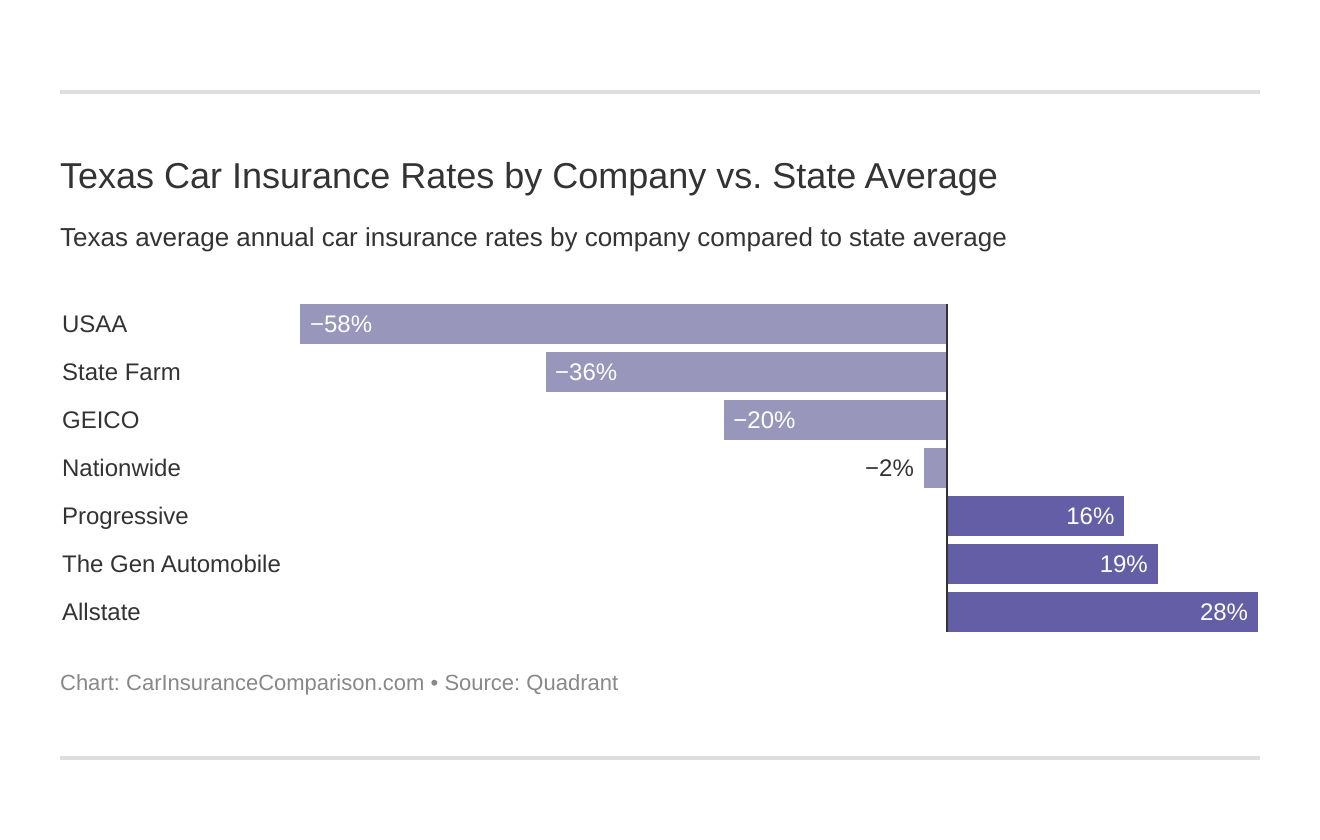

| Company | Average Monthly Premiums | Compared to State Average (+/-) | Percentage Change (+/-) |

|---|---|---|---|

| Allstate | $457 | $130 | 28.38% |

| The Gen | $404 | $77 | 18.99% |

| Geico | $272 | -$55 | -20.38% |

| Nationwide | $322 | -$5 | -1.57% |

| Progressive | $389 | $61 | 15.79% |

| State Farm | $240 | -$87 | -36.40% |

| USAA | $207 | -$120 | -57.88% |

How Much Auto Insurance Costs in Texas

Explore car insurance costs in various Texas cities, including Alba, Austin, Carrollton, Houston, McAllen, and San Antonio. This concise citywise comparison provides insights into factors influencing car insurance rates, helping you make informed decisions about coverage tailored to your specific location.

Insurance Premiums by Commute Rate in Texas

| Insurance Company | Commute And Monthly Mileage | Monthly Average |

|---|---|---|

| Allstate | 25 Miles Commute 1000 Monthly Mileage | $468 |

| Allstate | 10 Miles Commute 500 Monthly Mileage | $446 |

| American Family | 10 Miles Commute 500 Monthly Mileage | $404 |

| American Family | 25 Miles Commute 1000 Monthly Mileage | $404 |

| Progressive | 10 Miles Commute 500 Monthly Mileage | $389 |

| Progressive | 25 Miles Commute 1000 Monthly Mileage | $389 |

| Nationwide | 10 Miles Commute 500 Monthly Mileage | $322 |

| Nationwide | 25 Miles Commute 1000 Monthly Mileage | $322 |

| Geico | 25 Miles Commute 1000 Monthly Mileage | $277 |

| Geico | 10 Miles Commute 500 Monthly Mileage | $267 |

| State Farm | 10 Miles Commute 500 Monthly Mileage | $240 |

| State Farm | 25 Miles Commute 1000 Monthly Mileage | $240 |

| USAA | 25 Miles Commute 1000 Monthly Mileage | $210 |

| USAA | 10 Miles Commute 500 Monthly Mileage | $205 |

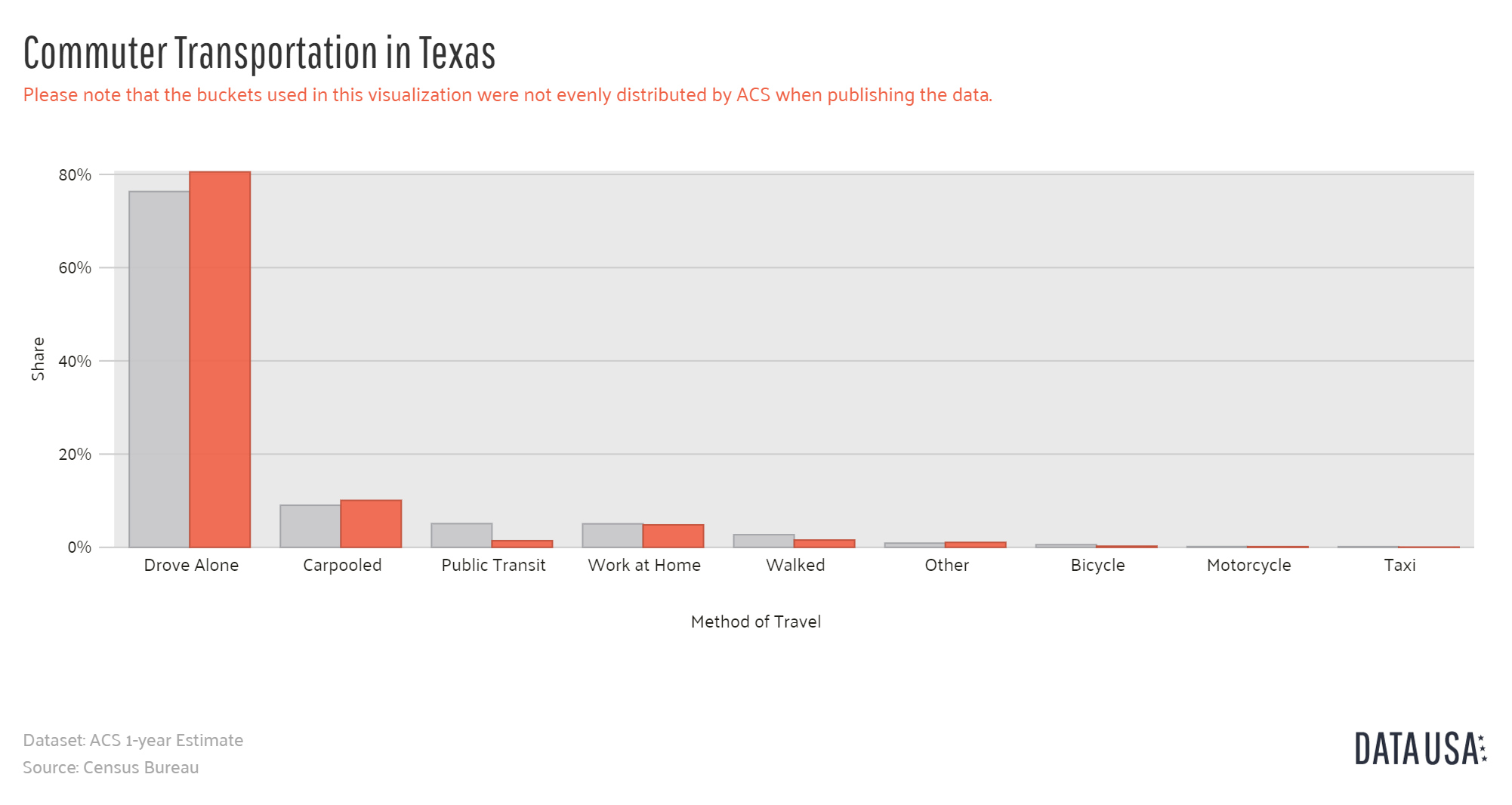

While in Texas the premium rates offered by most of the insurance providers do not vary significantly depending on annual mileage, it’s always a good idea to check for low mileage discounts when you’re seeking quotes.

Since different people have different needs, the miles they drive on a daily basis usually make them more/less vulnerable to risks on the road.

If you drive less than 10,000 miles, you’re less prone to accidents on the road because of low exposure to traffic. Hence, it’s recommended to accurately estimate your annual mileage for a cheaper quote.

Another way to reduce your premiums is usage-based car insurance wherein your insurer would install a telematics device in your car and calculate premiums based on your driving behavior.

Insurance Premiums by Different Coverage Levels in Texas

| Insurance Company | Coverage Type | Monthly Average |

|---|---|---|

| Allstate | High | $471 |

| Allstate | Medium | $453 |

| Allstate | Low | $447 |

| American Family | High | $446 |

| Progressive | High | $410 |

| American Family | Medium | $389 |

| Progressive | Medium | $387 |

| American Family | Low | $376 |

| Progressive | Low | $369 |

| Nationwide | Low | $347 |

| Nationwide | High | $311 |

| Nationwide | Medium | $308 |

| Geico | High | $290 |

| Geico | Medium | $268 |

| Geico | Low | $258 |

| State Farm | High | $253 |

| State Farm | Medium | $239 |

| State Farm | Low | $227 |

| USAA | High | $215 |

| USAA | Medium | $206 |

| USAA | Low | $200 |

Insurance Premiums by Credit History in Texas

Do you want to know how much your credit history impacts your insurance premiums?

| Insurance Company | Credit History | Monthly Average |

|---|---|---|

| Allstate | Poor | $581 |

| Allstate | Fair | $426 |

| Allstate | Good | $364 |

| Geico | Poor | $420 |

| Geico | Fair | $238 |

| Geico | Good | $159 |

| Nationwide | Poor | $387 |

| Nationwide | Fair | $310 |

| Nationwide | Good | $270 |

| Progressive | Poor | $438 |

| Progressive | Fair | $378 |

| Progressive | Good | $350 |

| American Family | Poor | $556 |

| American Family | Fair | $350 |

| American Family | Good | $306 |

| State Farm | Poor | $340 |

| State Farm | Fair | $212 |

| State Farm | Good | $169 |

| USAA | Poor | $305 |

| USAA | Fair | $176 |

| USAA | Good | $141 |

Data shows that insurance carriers significantly raise the premium rates if motorists have a poor credit rating. Those with a good credit history are charged much lower premiums than those who have a fair and poor credit history.

As per the State of Credit survey, the average vantage score for Texas was 656, which is amongst the top 10 states with the lowest vantage scores. Texas also tops the list of states with the highest average late payment rate.

Vantage score is consumer credit scoring system that rates the debt paying ability of consumers in the range of 300 to 850, and was developed in the year 2006 as a competition of FICO.

Car Insurance Premiums by Driving Record in Texas

| Insurance Company | Driving Record | Monthly Average |

|---|---|---|

| Allstate | With 1 DUI | $570 |

| Allstate | With 1 Accident | $547 |

| Allstate | With 1 Speeding Violation | $356 |

| Allstate | Clean Record | $356 |

| Nationwide | With 1 DUI | $415 |

| Nationwide | With 1 Accident | $279 |

| Nationwide | With 1 Speeding Violation | $316 |

| Nationwide | Clean Record | $279 |

| American Family | With 1 DUI | $411 |

| American Family | With 1 Accident | $469 |

| American Family | With 1 Speeding Violation | $368 |

| American Family | Clean Record | $368 |

| Progressive | With 1 DUI | $396 |

| Progressive | With 1 Accident | $438 |

| Progressive | With 1 Speeding Violation | $382 |

| Progressive | Clean Record | $339 |

| Geico | With 1 DUI | $255 |

| Geico | With 1 Accident | $304 |

| Geico | With 1 Speeding Violation | $298 |

| Geico | Clean Record | $231 |

| State Farm | With 1 DUI | $289 |

| State Farm | With 1 Accident | $245 |

| State Farm | With 1 Speeding Violation | $213 |

| State Farm | Clean Record | $213 |

| USAA | With 1 DUI | $269 |

| USAA | With 1 Accident | $228 |

| USAA | With 1 Speeding Violation | $178 |

| USAA | Clean Record | $155 |

Driving under the influence (of alcohol or other substances) is considered graver than accidents and speeding violations, and those with DUI records are penalized with higher premiums. Car insurance after a DUI is usually the most expensive.

In the year 2016, Texas witnessed the highest number of fatalities resulting from alcohol-impaired driving with the death toll reaching at 1,438.

Alcohol-impaired driving can also lead to serious injuries that might result in repercussions for life, hence motorists should refrain from driving under the influence altogether.

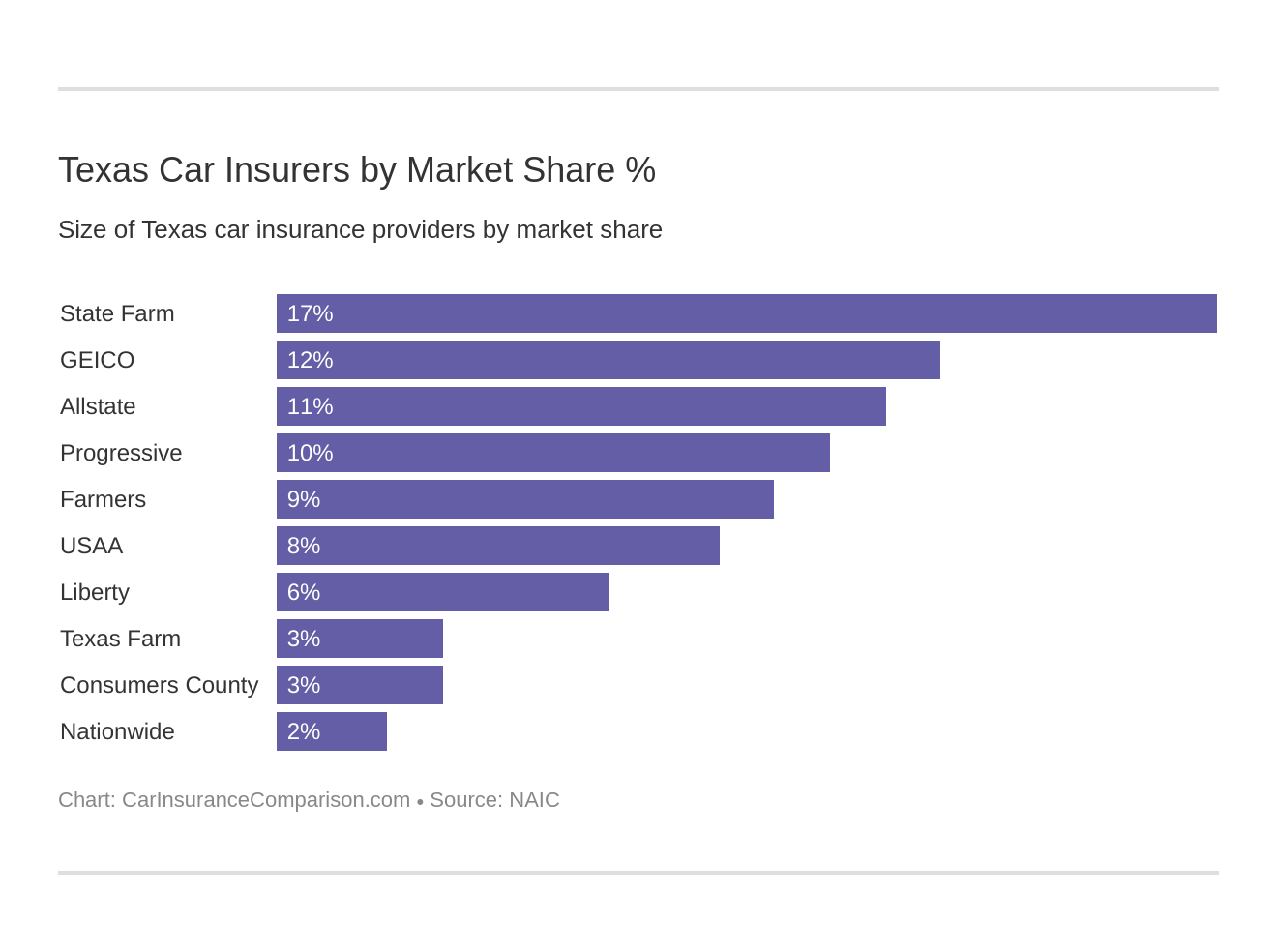

Leading Car Insurance Companies in Texas

| Insurance Company | Direct Written Premiums | Loss Ratio | Market Share |

|---|---|---|---|

| State Farm Group | $3,563,120 | 78.29% | 16.83% |

| Geico | $2,637,489 | 88.18% | 12.46% |

| Allstate Insurance Group | $2,362,584 | 66.19% | 11.16% |

| Progressive Group | $2,041,345 | 68.91% | 9.64% |

| Farmers Insurance Group | $1,842,735 | 66.07% | 8.70% |

| USAA Group | $1,712,949 | 88.30% | 8.09% |

| Liberty Mutual Group | $1,195,735 | 83.96% | 5.65% |

| Texas Farm Bureau Mutual Group | $693,004 | 77.31% | 3.27% |

| Consumers County Mutual Insurance Co | $541,825 | 86.45% | 2.56% |

| Nationwide Corp Group | $473,342 | 65.53% | 2.24% |

Number of Car Insurance Companies in Texas

| Type of Insurer | Number of Insurers |

|---|---|

| Domestic | 199 |

| Foreign | 937 |

Laws in Texas

State laws considerably influence auto insurance requirements in every state as the state determines the minimum amount of liability coverage, insurer rates approval, tort laws, etc.

Knowing about the laws related to your car insurance would help you make a more informed decision in buying coverage. It also can help you in seeking discounts or optional coverage to meet your needs.

Car Insurance Laws in Texas

At times, you might wonder why car insurance is mandatory in your state, especially when you have to pay high premiums.

The mandatory law was established more than a century ago when people started getting involved in car accidents, some of whom were unable to pay the financial cost incurred in the process.

The main purpose of car insurance laws was to protect everyone driving on the roads. Without the collective pool of premiums, it would be impossible for individuals to bear the financial cost of personal injury and property damage in fatal crashes.

Let’s look at some of the car insurance laws in place today.

Windshield Coverage Laws in Texas

If you regularly drive on unpaved roads or pass through terrains where there’s a high probability of getting hit by cobbles and pebbles on the windshield, you should know the windshield coverage laws in your state.

In Texas, there aren’t any laws specific to windshields, however, repairs are allowed from any vendor provided the material used is of similar quality.

Do make sure that you ask your insurer about broken windshield car insurance in your policy as windshield replacement can cost a lot, depending on the car.

Read more: Does car insurance cover broken car windows?

High-Risk Insurance in Texas

When states establish laws to protect motorists/pedestrians on the road, they also have to create separate rules for high-risk car insurance for drivers who have a history of bad driving behavior.

A motorist is considered a high-risk driver if they have been involved in multiple accidents/speeding violations. When an insurer realizes that a person’s driving behavior may cause significant cost outlay in future, they label these drivers as high-risk.

Because of their driving behavior, high-risk drivers are at times ineligible to obtain car insurance from the traditional market. To offer coverage to these drivers, the state has established a program for them, known as the Texas Automobile Insurance Plan Association (TAIPA).

Who’s eligible for this program?

Motorists in Texas who can prove that they were denied insurance coverage by at least two carriers within a period of 60 days can apply for coverage under TAIPA.

How does the Texas Automobile Insurance Plan Association work?

The TAIPA operates like an association wherein member companies licensed to do business in Texas form part of a pool that would provide coverage. Motorists who are accepted into the program are placed in that pool and are allocated an insurer according to the annual quota of insurers.

How is the annual quota decided?

To keep the process fair and avoid undue burden on any insurance company, each insurer has to offer coverage to a specific percentage of high-risk drivers depending on their market share in Texas.

Though the TAIPA program is a boon for high-risk drivers, the rates tend to be on the higher side for basic coverage and enable motorists to meet the state minimum liability requirement only. Recently, the rates were revised for both personal and commercial auto insurance.

Automobile Insurance Fraud in Texas

Motorists buy coverage with the hope that, in the unfortunate event of an accident, the repair and injury costs would be settled by their insurance company. However, there are some motorists who try to find a loophole in the system to make some quick money and commit insurance fraud.

In 2017, the Texas fraud unit received 7,756 reports of motor vehicle insurance fraud which accounted for around 61.52% of the overall insurance fraud reports.

The data indicates that motor vehicle insurance fraud is quite rampant in Texas. That’s why there’s a penalty for insurance fraud, which increases with the value claimed.

- When the claim amount is less than $50: Anything lower than $50 is considered a “Class C” misdemeanor, carrying a fine of $500.

- When the claim amount is more than $200,000: As the value is high, the penalty is also severe with fines up to $10,000 and/or jail time of five to 99 years.

Let’s look at some of the most common types of auto insurance fraud:

- Staging an accident or car theft with the motive to get money from the insurance claim settlement

- Claiming a higher amount than the cost of repair after an accident from the insurer

- Sharing incorrect residential address information with the insurer to get a cheaper premium quote

Beware: On the other end of the spectrum, you can also be scammed after an accident. Here’s a short video on how to avoid scams post a crash.

Statute of Limitations in Texas

The statute of limitations defines a time limit from the date of an accident to bring a lawsuit against the at-fault party. Beyond this limit, the state law wouldn’t allow you to go to the court with your grievance.

In Texas, you have two years from the time of the accident to file a lawsuit for both personal injury and property damage.

Texas Lemon Law

We are happy to inform you that if you have been facing repeated problems with your newly purchased or leased car, the Texas Lemon Law offers a redressal system for its replacement or repair.

Which vehicles are eligible under this law?

If you have bought or leased a new motor vehicle that has developed a defect causing continuous problems in its use, then you can apply for relief under the law, provided you have given the manufacturer a reasonable opportunity to repair the defect.

Please note: You have to submit a $35 fee with the Lemon Law complaint form.

Vehicle Licensing Laws in Texas

To get a cheap premium quote, you must have an impeccable driving record. And, to maintain a good driving record, you have to follow the licensing laws in your state so that you don’t receive any tickets.

Penalties for Driving Without Car Insurance in Texas

Auto insurance is expensive, but if you happen to be involved in an accident, the financial costs of personal injury and property damage can burn a deep hole in your pocket. Despite that fact, some motorists tend to avoid buying insurance coverage.

Driving without insurance poses an extremely serious threat to others on the road, and the state of Texas has established TexasSure program to initiate automatic verification of insurance.

TexasSure is a motor vehicle insurance verification program that allows law enforcement officers to access a central database that connects vehicle license plate, VIN number, and the liability insurance policy. Law officers can easily verify whether you have coverage now.

In Texas, around 20% of motorists are driving without any insurance coverage. To reduce the number of uninsured motorists on roads, Texas levies heavy penalties.

First Offense: When you’re caught without insurance for the first time, you would be fined in the range of $175 to $350. In addition, you would have to pay an additional surcharge of $250 annually towards your driver’s license fee for the next three years.

Subsequent Offenses: For repeat offenders, the fines can range from $350 to $1,000 along with the chance of license revocation and vehicle impoundment.

Teen Driver Laws in Texas

When it comes to premium rates, teenagers have to pay the maximum because of the obvious risks involved with their driving behavior. On top of that, if teens get involved in accidents or speeding violations, their premiums increase further.

As teenagers, it’s important to closely keep track of driving laws in your state.

Learner’s License: To be eligible for a learner’s permit, you must be at least 15 or older. A permit is issued to only those who satisfactorily complete the classroom phase of a driver’s education course.

| Restriction | Details |

|---|---|

| Mandatory Holding Period | 6 months |

| Supervised Driving Time | 30 hours, with at least 10 hours of nighttime driving |

| Required Tests | Driver's knowledge test, vision test and a sign recognition test |

Provisional/Intermediate License: Teens can apply for a provisional license if they have satisfied the requirements under the learner’s permit.

| Restriction | Details |

|---|---|

| Nighttime Restrictions | Midnight to 5 a.m, unless accompanied with a parent/guardian |

| Passenger Restrictions | One person at a time under 21 who isn't a family member |

| Required Tests | Road test and certified driver's education course |

Unrestricted License: At 18, teens who have successfully held a provisional license can apply for a full license.

To ensure that your children follow the law, you can write a Texas Parent-Teen Driving Agreement. This agreement outlines specific rules that teens need to follow while driving as well as the consequences of anything on the contrary.

Driver License Renewal Procedure in Texas

Renewing your driving license as per the renewal cycle of your state would save you unnecessary hassles with law enforcement since you aren’t allowed to drive with an expired license.

In Texas, you have to renew your license every six years if you’re aged between 18-84. For residents older than 84, you’re required to renew your license every two years.

Texans can renew their license within a year before it’s supposed to expire and up to two years after the expiration of the license. However, if two years have elapsed since expiration, you aren’t eligible for renewal and have to apply for a new license.

Renewing your license every six years might seem like a big task to you, but the state of Texas has made the renewal procedure quite smooth.

Renewals by phone, mail, or online: If you’re below 79, you can renew your license by phone, mail, or online. Drivers under 18 and older than 79 are required to renew their licenses in person at a Texas DPS office.

Let’s look at the license renewal fee in Texas.

| Age | Fee |

|---|---|

| Below 18 | $6 |

| Between 18 to 84 | $25 |

| Above 85 | $9 |

Rules of the Road in Texas

If you want to keep your auto premiums low, you need to abide by the rules of the road so that you can avoid tickets, speeding violations, and accidents.

Don’t worry, we aren’t asking you to take out the driver’s handbook. In this section, we are listing the basic rules you need to follow on the road.

Fault vs No-Fault

Texas follows the tort law according to which insurance companies try to find at fault party in the event of an accident before providing coverage.

In an at-fault state, if you’re involved in an accident caused by the other party, you would be compensated for personal injury and property damage costs by their insurer.

Seat Belt Laws in Texas

Do you know that seat belts can improve the chance of survival by 50% in the event of a fatal crash?

The seat belt laws in Texas require drivers and all passengers of a motor vehicle to wear seat belts, failing which they might be fined in the range of $25-$250.

Read more: Do seat belt laws impact my car insurance?

Car Seat Laws for Children in Texas

The safety of children is of paramount importance on the road as they are incapable of protecting themselves in a crash. That’s why children are required to be buckled up in a car seat for maximum protection.

Let’s look at the guidelines for child seats.

| Phase | Guideline |

|---|---|

| Birth-2 years | All children below the age of two are required to ride inside a rear-facing seat |

| 2-4 years | Once the child turns two, he/she can ride in a forward facing seat as long as recommended by the seat manufacturer (check for weight & height labels on the seat) |

| 4-10 years | Children can ride in a booster seat once they are 4 years old and weigh 40+ pounds |

| Beyond 10 years | Once children outgrow their booster seat (around 10-12 years old), they are allowed to use the adult safety belt, provided it fits them perfectly |

Another thing to consider about children in Texas: The Lone Star State tragically sees more child fatalities from heat strokes in cars than any other state in the nation.

Move Over Laws in Texas

The law requires motorists to reduce their speed if they’re approaching a stationary emergency vehicle (which includes Texas DMV vehicles and tow trucks) and vacate the lane next to the stationary vehicle.

Speed Limits in Texas

The maximum posted limit of rural and urban interstates in Texas is 75 mph, however, some segments of highways have a speed limit of 80 or 85 mph the fastest highway in America.

We took a look at the NHSTA statistics from 2005-2010 for fatal crashes in the counties where this highway is before the change and tallied up the totals.

Here are the most recent available stats for Texas driving fatalities by county before the new 85 mph highway in Texas:

| TX County | Travis | Caldwell | Guadalupe | Totals |

| 2010 | 78 | 15 | 8 | 101 |

| 2009 | 95 | 12 | 18 | 125 |

| 2008 | 92 | 9 | 13 | 114 |

| 2007 | 94 | 12 | 16 | 122 |

| 2006 | 103 | 3 | 12 | 118 |

| 580 |

Now compare that to the most recent data below.

What do higher speed limits mean?

Only one thing can be sure: accidents at higher speeds will cause greater damage, and the chances of surviving an accident decrease as the traveling speed goes up.

Cars just aren’t built to withstand crashes upwards of 90 miles per hour.

When traveling at such high speeds, drivers have just a split second to make quick decisions (especially with wild hogs roaming the area). It is important to maintain safe following distances and adjust your speed according to the visibility conditions.

Ridesharing Laws in Texas

In 2017, the state of Texas established statewide rideshare car insurance standards through House Bill 100 for ridesharing companies as there were clashes over local ordinances that varied from city to city.

The new ordinance aims to protect the interest of riders and requires drivers to undergo criminal background checks annually, carry the minimum auto insurance coverage and be barred from driving if found on the sex offenders registry.

The mandatory liability insurance for these motor vehicles is $1 million to cover expenses from bodily injury and property damage in total for each incident, while the vehicle is engaged for a ride.

Automation on the Road in Texas

The state of Texas is making efforts to be ahead of everyone in the autonomous vehicles arena. Apart from allowing full deployment of automated vehicles, state officials are also forming a Connected and Autonomous Vehicle (CAV) Task Force for testing self-driving cars.

Safety Laws in Texas

Multitasking isn’t easy and even more so when you are distracted by way of texting/talking on the phone or under the influence of alcohol/marijuana. The ill effects of alcohol consumption or excessive usage of mobile phones is a topic in itself, but here we would focus on the safety laws in Texas.

DUI Laws in Texas

In the state of Texas, the official term for driving after the consumption of alcohol is DWI or driving while intoxicated.

The law prohibits driving a motor vehicle with a blood alcohol level (BAC) of .08% or more. Commercial drivers (including school bus drivers) are considered drunk when their BAC is more than .04%.

Beware: Drivers under the age of 21 aren’t allowed to drive a motor vehicle with any trace of alcohol in their system. Texas has a zero-tolerance policy for underage drinking and driving.

Texas penalizes heavily for DWI and the fines/jail time increases with the number of offenses.

- First Offense: First-time offenders can be fined up to $2,000 and face the possibility of jail time from three days to six months as well. In addition, their license can also be suspended for a period of up to 12 months.

- Second Offense: If you’re caught the second time, you may be fined up to $4,000 and face jail time from a month to a year. You can also lose your driver’s license for up to two years.

- Third Offense: For a third time, the fines increase substantially to $10,000 and you would have to spend time in prison for a period of two to 10 years. Also, you might lose driving rights for up to two years.

Distracted Driving Laws in Texas

Although driving while talking or texting on a hand-held phone is less dangerous than DWI, it still distracts you from the road and might lead to accidents.

Cellphone usage law: The state of Texas has imposed a texting ban for all motorists while driving. The use of hand-held phones is completely banned for drivers under the age of 18, and adults aren’t allowed to use cellphones around school zones during school time.

Texas Can’t-Miss Facts

With the end of the previous section, we know that you have learned about the car insurance laws of your state in detail. We are sure that the information provided above would help you in getting the right insurance coverage.

Now, we just want to share some facts about Texas related to the most popular vehicle for theft, fatality rates, commute rates of different cities, etc.

Vehicle Theft in Texas

| Rank | Make and Model | Year of Vehicle | Stolen |

|---|---|---|---|

| 1 | Ford Pickup (Full Size) | 2006 | 7,897 |

| 2 | Chevrolet Pickup (Full Size) | 2004 | 6,158 |

| 3 | Dodge Pickup (Full Size) | 2004 | 2,898 |

| 4 | Honda Accord | 1997 | 1,626 |

| 5 | GMC Pickup (Full Size) | 2015 | 1,450 |

| 6 | Honda Civic | 2000 | 1,371 |

| 7 | Chevrolet Tahoe | 2004 | 1,148 |

| 8 | Toyota Camry | 2014 | 1,030 |

| 9 | Nissan Altima | 2012 | 957 |

| 10 | Chevrolet Impala | 2007 | 898 |

You can also search for the number of vehicle thefts in your city using the following table.

| City | Motor Stolen |

|---|---|

| Abernathy | 0 |

| Abilene | 254 |

| Addison | 62 |

| Alamo | 81 |

| Alamo Heights | 5 |

| Alice | 43 |

| Allen | 50 |

| Alton | 33 |

| Alvarado | 10 |

| Alvin | 38 |

| Amarillo | 695 |

| Andrews | 27 |

| Angleton | 16 |

| Anna | 5 |

| Anson | 0 |

| Anthony | 2 |

| Aransas Pass | 21 |

| Arcola | 8 |

| Argyle | 2 |

| Arlington | 940 |

| Arp | 0 |

| Atlanta | 4 |

| Aubrey | 1 |

| Austin | 2,169 |

| Azle | 19 |

| Baird | 0 |

| Balch Springs | 136 |

| Balcones Heights | 30 |

| Ballinger | 2 |

| Bangs | 2 |

| Bastrop | 32 |

| Bay City | 9 |

| Bayou Vista | 0 |

| Baytown | 364 |

| Beaumont | 283 |

| Bedford | 66 |

| Bee Cave | 4 |

| Beeville | 15 |

| Bellaire | 12 |

| Bellmead | 43 |

| Bellville | 4 |

| Belton | 8 |

| Benbrook | 30 |

| Bertram | 0 |

| Beverly Hills | 6 |

| Big Sandy | 0 |

| Big Spring | 51 |

| Bishop | 1 |

| Blanco | 0 |

| Blue Mound | 2 |

| Boerne | 19 |

| Bogata | 4 |

| Bonham | 4 |

| Borger | 43 |

| Bovina | 0 |

| Bowie | 8 |

| Brady | 3 |

| Brazoria | 6 |

| Breckenridge | 5 |

| Brenham | 12 |

| Bridge City | 4 |

| Brookshire | 7 |

| Brookside Village | 1 |

| Brownfield | 7 |

| Brownsville | 257 |

| Brownwood | 26 |

| Bryan | 89 |

| Buda | 14 |

| Bullard | 1 |

| Bulverde | 2 |

| Burkburnett | 8 |

| Burleson | 55 |

| Burnet | 8 |

| Cactus | 4 |

| Caddo Mills | 4 |

| Caldwell | 2 |

| Calvert | 1 |

| Cameron | 1 |

| Canyon | 7 |

| Carrollton | 206 |

| Carthage | 12 |

| Castle Hills | 9 |

| Castroville | 1 |

| Cedar Hill | 70 |

| Cedar Park | 28 |

| Celina | 1 |

| Center | 13 |

| Chillicothe | 1 |

| Cibolo | 8 |

| Cisco | 3 |

| Clarksville | 1 |

| Cleburne | 43 |

| Cleveland | 46 |

| Clifton | 0 |

| Clint | 1 |

| Clyde | 2 |

| Cockrell Hill | 12 |

| Coleman | 4 |

| College Station | 48 |

| Colleyville | 4 |

| Collinsville | 0 |

| Colorado City | 3 |

| Columbus | 7 |

| Comanche | 0 |

| Combes | 3 |

| Commerce | 13 |

| Conroe | 105 |

| Converse | 23 |

| Coppell | 30 |

| Copperas Cove | 21 |

| Corinth | 13 |

| Corpus Christi | 487 |

| Corrigan | 3 |

| Corsicana | 27 |

| Crandall | 5 |

| Crane | 2 |

| Crockett | 5 |

| Crosbyton | 0 |

| Crowell | 0 |

| Crowley | 15 |

| Cuero | 5 |

| Cumby | 3 |

| Daingerfield | 2 |

| Dalhart | 4 |

| Dallas | 7,384 |

| Dalworthington Gardens | 10 |

| Danbury | 0 |

| Dayton | 27 |

| Decatur | 14 |

| De Kalb | 3 |

| De Leon | 1 |

| Del Rio | 17 |

| Denison | 53 |

| Denton | 102 |

| Denver City | 7 |

| Desoto | 78 |

| Diboll | 1 |

| Dickinson | 40 |

| Dilley | 5 |

| Dimmitt | 11 |

| Donna | 74 |

| Double Oak | 1 |

| Driscoll | 0 |

| Dublin | 3 |

| Dumas | 15 |

| Duncanville | 144 |

| Eagle Pass | 11 |

| Early | 0 |

| Eastland | 4 |

| East Mountain | 1 |

| Edcouch | 1 |

| Edinburg | 255 |

| Edna | 2 |

| El Campo | 9 |

| Electra | 2 |

| Elgin | 11 |

| El Paso | 794 |

| Elsa | 16 |

| Ennis | 22 |

| Euless | 139 |

| Everman | 9 |

| Fairfield | 2 |

| Fair Oaks Ranch | 2 |

| Falfurrias | 0 |

| Farmers Branch | 106 |

| Farmersville | 4 |

| Farwell | 1 |

| Ferris | 4 |

| Flatonia | 2 |

| Florence | 0 |

| Floresville | 14 |

| Flower Mound | 21 |

| Floydada | 2 |

| Forney | 33 |

| Fort Stockton | 6 |

| Fort Worth | 2,399 |

| Frankston | 1 |

| Fredericksburg | 3 |

| Freeport | 24 |

| Freer | 2 |

| Friendswood | 17 |

| Friona | 1 |

| Frisco | 58 |

| Fulton | 2 |

| Gainesville | 59 |

| Galena Park | 27 |

| Galveston | 189 |

| Garden Ridge | 0 |

| Garland | 647 |

| Gatesville | 13 |

| Georgetown | 32 |

| Giddings | 3 |

| Gilmer | 11 |

| Gladewater | 18 |

| Glenn Heights | 13 |

| Godley | 0 |

| Gonzales | 5 |

| Gorman | 2 |

| Graham | 14 |

| Granbury | 13 |

| Grand Prairie | 590 |

| Grand Saline | 0 |

| Granger | 0 |

| Granite Shoals | 9 |

| Grapeland | 0 |

| Grapevine | 102 |

| Greenville | 65 |

| Gregory | 3 |

| Groesbeck | 3 |

| Groves | 29 |

| Gun Barrel City | 15 |

| Hale Center | 1 |

| Hallettsville | 4 |

| Hallsville | 2 |

| Haltom City | 121 |

| Hamlin | 2 |

| Harker Heights | 37 |

| Harlingen | 76 |

| Haskell | 1 |

| Hawkins | 4 |

| Hawley | 2 |

| Hearne | 2 |

| Heath | 1 |

| Hedwig Village | 14 |

| Helotes | 3 |

| Hemphill | 4 |

| Hempstead | 13 |

| Henderson | 25 |

| Hereford | 18 |

| Hewitt | 7 |

| Hickory Creek | 9 |

| Highland Park | 11 |

| Highland Village | 1 |

| Hill Country Village | 3 |

| Hillsboro | 11 |

| Hitchcock | 23 |

| Hollywood Park | 1 |

| Hondo | 6 |

| Hooks | 1 |

| Horizon City | 20 |

| Horseshoe Bay | 6 |

| Houston | 13,595 |

| Howe | 2 |

| Hubbard | 2 |

| Hudson | 0 |

| Hughes Springs | 1 |

| Humble | 112 |

| Huntington | 2 |

| Huntsville | 39 |

| Hurst | 56 |

| Hutchins | 28 |

| Hutto | 5 |

| Idalou | 1 |

| Ingleside | 21 |

| Ingram | 2 |

| Iowa Park | 1 |

| Irving | 594 |

| Jacksboro | 3 |

| Jacksonville | 12 |

| Jamaica Beach | 0 |

| Jarrell | 1 |

| Jasper | 1 |

| Jefferson | 2 |

| Jersey Village | 16 |

| Johnson City | 0 |

| Jones Creek | 0 |

| Jonestown | 1 |

| Joshua | 8 |

| Jourdanton | 0 |

| Junction | 0 |

| Karnes City | 1 |

| Katy | 29 |

| Kaufman | 7 |

| Keene | 6 |

| Keller | 2 |

| Kenedy | 3 |

| Kennedale | 20 |

| Kermit | 6 |

| Kerrville | 24 |

| Kilgore | 34 |

| Killeen | 206 |

| Kingsville | 24 |

| Kirby | 20 |

| Kirbyville | 3 |

| Kountze | 1 |

| Kress | 0 |

| Kyle | 32 |

| Lacy-Lakeview | 14 |

| La Feria | 0 |

| Lago Vista | 0 |

| La Grange | 7 |

| La Grulla | 0 |

| Laguna Vista | 2 |

| La Joya | 0 |

| Lake Dallas | 12 |

| Lake Jackson | 19 |

| Lakeside | 2 |

| Lakeview, Harris County | 3 |

| Lakeway | 10 |

| Lake Worth | 16 |

| La Marque | 51 |

| Lamesa | 20 |

| Lampasas | 6 |

| Lancaster | 152 |

| La Porte | 43 |

| Laredo | 372 |

| La Vernia | 0 |

| La Villa | 1 |

| Lavon | 0 |

| League City | 56 |

| Leander | 15 |

| Leon Valley | 65 |

| Levelland | 24 |

| Lewisville | 299 |

| Lexington | 0 |

| Liberty | 14 |

| Lindale | 9 |

| Linden | 1 |

| Little Elm | 13 |

| Littlefield | 3 |

| Live Oak | 52 |

| Livingston | 10 |

| Llano | 5 |

| Lockhart | 12 |

| Lone Star | 2 |

| Longview | 200 |

| Lorena | 2 |

| Lorenzo | 0 |

| Los Fresnos | 5 |

| Lubbock | 846 |

| Luling | 5 |

| Lumberton | 5 |

| Lyford | 4 |

| Lytle | 4 |

| Madisonville | 9 |

| Magnolia | 3 |

| Malakoff | 5 |

| Manor | 5 |

| Mansfield | 49 |

| Manvel | 12 |

| Marble Falls | 9 |

| Marlin | 3 |

| Marshall | 44 |

| Martindale | 1 |

| Mathis | 6 |

| McAllen | 236 |

| McGregor | 2 |

| McKinney | 129 |

| Meadows Place | 10 |

| Melissa | 4 |

| Memorial Villages | 6 |

| Memphis | 2 |

| Mercedes | 41 |

| Meridian | 0 |

| Merkel | 2 |

| Mesquite | 766 |

| Mexia | 3 |

| Midland | 164 |

| Midlothian | 16 |

| Mineola | 3 |

| Mineral Wells | 41 |

| Mission | 177 |

| Missouri City | 76 |

| Monahans | 1 |

| Mont Belvieu | 25 |

| Montgomery | 1 |

| Morgans Point Resort | 0 |

| Moulton | 0 |

| Mount Pleasant | 20 |

| Muleshoe | 2 |

| Munday | 1 |

| Murphy | 0 |

| Mustang Ridge | 2 |

| Nacogdoches | 41 |

| Naples | 1 |

| Nash | 3 |

| Nassau Bay | 6 |

| Navasota | 23 |

| Nederland | 32 |

| Needville | 1 |

| New Boston | 7 |

| New Braunfels | 129 |

| Nocona | 3 |

| Nolanville | 0 |

| Northlake | 3 |

| North Richland Hills | 78 |

| Oak Ridge | 0 |

| Odessa | 463 |

| O'Donnell | 2 |

| Olmos Park | 4 |

| Olney | 1 |

| Olton | 0 |

| Omaha | 1 |

| Onalaska | 6 |

| Orange | 42 |

| Orange Grove | 0 |

| Overton | 1 |

| Ovilla | 1 |

| Oyster Creek | 4 |

| Paducah | 0 |

| Palacios | 7 |

| Palestine | 49 |

| Palmer | 0 |

| Palmhurst | 1 |

| Palm Valley | 1 |

| Palmview | 17 |

| Pampa | 38 |

| Panhandle | 1 |

| Pantego | 3 |

| Paris | 39 |

| Parker | 0 |

| Pasadena | 510 |

| Pearland | 100 |

| Pearsall | 3 |

| Pecos | 9 |

| Penitas | 7 |

| Perryton | 12 |

| Pflugerville | 31 |

| Pharr | 120 |

| Pilot Point | 2 |

| Pittsburg | 4 |

| Plainview | 25 |

| Plano | 256 |

| Pleasanton | 33 |

| Ponder | 0 |

| Port Aransas | 38 |

| Port Arthur | 127 |

| Port Isabel | 5 |

| Portland | 12 |

| Port Neches | 20 |

| Poteet | 10 |

| Poth | 2 |

| Pottsboro | 2 |

| Premont | 1 |

| Presidio | 1 |

| Primera | 2 |

| Princeton | 7 |

| Progreso | 7 |

| Prosper | 3 |

| Queen City | 1 |

| Quitman | 3 |

| Ralls | 0 |

| Rancho Viejo | 0 |

| Ranger | 5 |

| Ransom Canyon | 0 |

| Raymondville | 6 |

| Red Oak | 23 |

| Refugio | 1 |

| Reno | 0 |

| Richardson | 151 |

| Richland Hills | 23 |

| Richmond | 13 |

| Riesel | 0 |

| Rio Grande City | 47 |

| Rio Hondo | 0 |

| River Oaks | 6 |

| Roanoke | 8 |

| Robinson | 7 |

| Robstown | 17 |

| Rockdale | 6 |

| Rockport | 23 |

| Rockwall | 63 |

| Rollingwood | 0 |

| Roma | 22 |

| Roman Forest | 1 |

| Roscoe | 0 |

| Rosenberg | 47 |

| Round Rock | 45 |

| Rowlett | 37 |

| Royse City | 7 |

| Runaway Bay | 0 |

| Sabinal | 0 |

| Sachse | 10 |

| Salado | 0 |

| San Angelo | 185 |

| San Antonio | 6,577 |

| San Augustine | 3 |

| San Diego | 0 |

| Sanger | 13 |

| San Juan | 58 |

| San Marcos | 149 |

| San Saba | 2 |

| Sansom Park Village | 13 |

| Santa Anna | 1 |

| Santa Fe | 20 |

| Santa Rosa | 3 |

| Schertz | 23 |

| Schulenburg | 4 |

| Seabrook | 15 |

| Seagoville | 73 |

| Seagraves | 4 |

| Sealy | 4 |

| Seguin | 26 |

| Selma | 24 |

| Seminole | 7 |

| Seven Points | 3 |

| Seymour | 2 |

| Shallowater | 0 |

| Shamrock | 2 |

| Shavano Park | 1 |

| Shenandoah | 11 |

| Sherman | 46 |

| Silsbee | 5 |

| Sinton | 11 |

| Slaton | 1 |

| Smithville | 2 |

| Snyder | 21 |

| Socorro | 46 |

| Somerset | 6 |

| Sonora | 2 |

| Sour Lake | 2 |

| South Houston | 175 |

| Southlake | 13 |

| Southmayd | 4 |

| South Padre Island | 21 |

| Southside Place | 0 |

| Spearman | 1 |

| Splendora | 3 |

| Springtown | 3 |

| Spring Valley | 6 |

| Spur | 1 |

| Stafford | 79 |

| Stagecoach | 0 |

| Stamford | 6 |

| Stanton | 1 |

| Stephenville | 18 |

| Stratford | 0 |

| Sugar Land | 46 |

| Sullivan City | 0 |

| Sulphur Springs | 10 |

| Sunrise Beach Village | 0 |

| Sunset Valley | 0 |

| Sweeny | 2 |

| Sweetwater | 25 |

| Taft | 3 |

| Tatum | 1 |

| Taylor | 7 |

| Terrell | 43 |

| Terrell Hills | 5 |

| Texarkana | 105 |

| Texas City | 93 |

| The Colony | 35 |

| Thorndale | 1 |

| Thrall | 0 |

| Three Rivers | 2 |

| Tioga | 0 |

| Tomball | 24 |

| Tool | 3 |

| Trinity | 4 |

| Trophy Club | 4 |

| Troy | 1 |

| Tulia | 0 |

| Tye | 2 |

| Tyler | 180 |

| Universal City | 33 |

| University Park | 17 |

| Uvalde | 20 |

| Valley Mills | 0 |

| Van | 0 |

| Van Alstyne | 2 |

| Venus | 2 |

| Vernon | 21 |

| Victoria | 64 |

| Vidor | 47 |

| Waco | 163 |

| Waelder | 0 |

| Wake Village | 1 |

| Waller | 4 |

| Wallis | 3 |

| Watauga | 20 |

| Waxahachie | 41 |

| Weatherford | 22 |

| Webster | 61 |

| Weimar | 1 |

| Weslaco | 117 |

| West | 1 |

| West Columbia | 3 |

| West Orange | 8 |

| Westover Hills | 1 |

| West Tawakoni | 0 |

| Westworth | 6 |

| Wharton | 13 |

| Whitehouse | 7 |

| White Oak | 3 |

| Whitesboro | 3 |

| White Settlement | 38 |

| Whitewright | 3 |

| Whitney | 0 |

| Wichita Falls | 286 |

| Willow Park | 4 |

| Wills Point | 1 |

| Wilmer | 11 |

| Windcrest | 18 |

| Wink | 0 |

| Winnsboro | 3 |

| Winters | 1 |

| Wolfforth | 1 |

| Woodbranch | 0 |

| Woodville | 0 |

| Woodway | 2 |

| Wortham | 2 |

| Wylie | 18 |

| Yoakum | 7 |

| Yorktown | 1 |

Dangers on the Road in Texas

Despite how safely we drive on the roads, there would be some reckless driving by others leading to fatal crashes. In the next section, we would look at the crash data by city and the reasons behind it.

Fatal Crashes by Weather Conditions in Texas

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 1,316 | 664 | 930 | 94 | 8 | 3,012 |

| Rain | 91 | 53 | 85 | 9 | 0 | 238 |

| Snow/Sleet | 9 | 0 | 1 | 0 | 0 | 10 |

| Other | 17 | 18 | 32 | 4 | 0 | 71 |

| Unknown | 3 | 0 | 3 | 0 | 6 | 12 |

| TOTAL | 1,436 | 735 | 1,051 | 107 | 14 | 3,343 |

Traffic Fatalities by Road Type in Texas

| Road Type | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|---|---|---|

| Rural | 1,761 | 1,652 | 1,462 | 1,464 | 1,696 | 1,663 | 1,780 | 1,622 | 1,590 | 1,504 |

| Urban | 1,629 | 1,437 | 1,546 | 1,582 | 1,711 | 1,726 | 1,750 | 1,948 | 2,205 | 2,205 |

| Unknown | 86 | 15 | 15 | 8 | 1 | 0 | 6 | 12 | 2 | 13 |

| Total | 3,476 | 3,104 | 3,023 | 3,054 | 3,408 | 3,389 | 3,536 | 3,582 | 3,797 | 3,722 |

Fatalities by Person Type in Texas

| Person Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Passenger Car | 1,067 | 1,137 | 1,171 | 1,219 | 1,252 |

| Light Truck - Pickup | 606 | 693 | 626 | 636 | 588 |

| Light Truck - Utility | 441 | 480 | 483 | 441 | 457 |

| Light Truck - Van | 95 | 87 | 88 | 87 | 64 |

| Light Truck - Other | 1 | 1 | 1 | 11 | 8 |

| Large Truck | 111 | 114 | 100 | 109 | 129 |

| Bus | 7 | 2 | 17 | 10 | 16 |

| Other/Unknown Occupants | 23 | 21 | 23 | 27 | 31 |

| Total Occupants | 2,351 | 2,535 | 2,509 | 2,540 | 2,545 |

| Total Motorcyclists | 493 | 451 | 452 | 495 | 490 |

| Pedestrian | 480 | 479 | 549 | 675 | 607 |

| Bicyclist and Other Cyclist | 48 | 50 | 52 | 65 | 59 |

| Other/Unknown Nonoccupants | 17 | 21 | 20 | 22 | 21 |

| Total Nonoccupants | 545 | 550 | 621 | 762 | 687 |

| Total | 3,389 | 3,536 | 3,582 | 3,797 | 3,722 |

Fatalities by Crash Type in Texas

| Crash Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Total Fatalities (All Crashes) | 3,389 | 3,536 | 3,582 | 3,797 | 3,722 |

| Single Vehicle | 1,815 | 1,913 | 1,848 | 1,982 | 1,914 |

| Involving a Large Truck | 535 | 553 | 567 | 558 | 649 |

| Involving Speeding | 1,181 | 1,277 | 1,125 | 1,076 | 1,029 |

| Involving a Rollover | 1,011 | 1,091 | 983 | 1,020 | 942 |

| Involving a Roadway Departure | 1,836 | 1,912 | 1,800 | 1,860 | 1,832 |

| Involving an Intersection (or Intersection Related) | 668 | 667 | 709 | 719 | 724 |

Fatalities Trend for the Top 10 Counties of Texas

| Rank | Texas Counties by 2017 Ranking | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|

| 1 | Harris County | 369 | 417 | 391 | 447 | 456 |

| 2 | Dallas County | 225 | 238 | 259 | 315 | 282 |

| 3 | Tarrant County | 144 | 145 | 157 | 167 | 180 |

| 4 | Bexar County | 189 | 184 | 189 | 226 | 164 |

| 5 | Travis County | 112 | 95 | 145 | 120 | 120 |

| 6 | Collin County | 41 | 47 | 37 | 50 | 68 |

| 7 | Hidalgo County | 65 | 65 | 67 | 75 | 60 |

| 8 | El Paso County | 60 | 66 | 62 | 81 | 58 |

| 9 | Bell County | 36 | 34 | 40 | 42 | 57 |

| 10 | Montgomery County | 51 | 53 | 60 | 76 | 54 |

| - | Total | 1,326 | 1,358 | 1,445 | 1,614 | 1,499 |

DWI Arrests in Texas

| Age | Arrests (2016) | Rank |

|---|---|---|

| Under 18 | 421 | 34 |

| 18 years and older | 67,950 | 31 |

The number of alcohol-impaired driving arrests is on the higher side in Texas, especially for adults older than 18. Another number to be concerned about is the fatality rate per 100,000 people in Texas, which is much higher at 1.9 than the national average of 1.2.

EMS Response Time in Texas

| Type of Road | Time of Crash to EMS Notification (in minutes) | EMS Notification to EMS Arrival (in minutes) | EMS Arrival at Scene to Hospital Arrival (in minutes) | Time of Crash to Hospital Arrival (in minutes) |

|---|---|---|---|---|

| Urban | 4.47 | 8.17 | 27.42 | 38.65 |

| Rural | 10.93 | 16.28 | 43.22 | 63.38 |