Best Car Insurance Companies in 2025 (Your Guide to the Top 10 Providers)

State Farm, Geico, and Progressive top the list of best car insurance companies, offering comprehensive plans starting at just $22 per month. Distinguished for their affordability, extensive coverage options, and exceptional customer service, these companies set the gold standard in the car insurance industry.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

UPDATED: Jan 11, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jan 11, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews

The top picks among the best car insurance companies are State Farm, Geico, and Progressive. These companies stand out for their robust coverage options.

Easily compare top car insurance companies online and find the best policy for you with our help. Everyone deserves the best coverage.

Chubb Car Insurance Monthly Rates vs. Top Competitors by Coverage Level

| Company | Rank | Monthly Rate | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $22 | A++ | Military Savings | USAA | |

| #2 | $30 | A++ | Safe Driving | Geico | |

| #3 | $33 | B | Personalized Service | State Farm | |

| #4 | $37 | A++ | Claims Service | Travelers | |

| #5 | $39 | A+ | Customer Service | Progressive | |

| #6 | $44 | A | Quick Claims Service | American Family | |

| #7 | $44 | A+ | SmartRide Program | Nationwide |

| #8 | $53 | A | Customizable Policies | Farmers | |

| #9 | $61 | A+ | Add-on Coverages | Allstate | |

| #10 | $68 | A | Add-on Coverage | Liberty Mutual |

It’s important to revisit your car insurance options, especially if it’s been years since you last checked. Updating your coverage with the best providers could be worthwhile.

Get the right car insurance at the best price — enter your ZIP code above to shop for coverage from the top insurers.

- State Farm leads as the top pick among the best car insurance companies

- Explore tailored coverage options that meet diverse driving needs and budgets

- Discover providers that offer superior claims service and customer support

- Car Insurance Company Comparison

- Esurance Car Insurance Review for 2025 [Rates, Discounts & More!]

- American Modern Car Insurance Review for 2025 [See Policies & Prices Here!]

- Ag Workers Mutual Car Insurance Review for 2025 [See if They’re a Good Fit]

- SafeAuto Car Insurance Review for 2025 [Expert Evaluation]

- Costco Car Insurance Review for 2025 [Comprehensive Overview]

- Cincinnati Insurance Car Insurance Review for 2025 [See if It’s a Good Fit]

- Shelter Car Insurance Review for 2025 [Honest Report]

- Anchor General Car Insurance Review for 2025 [Get the Facts Here]

- Horace Mann Car Insurance Review for 2025 [Comprehensive Overview]

- CURE Car Insurance Review for 2025 [See How Much You Can Save]

- GoAuto Car Insurance Review for 2025 [Trustworthy Evaluation]

- Freeway Car Insurance Review for 2025 [Unbiased Evaluation]

- NJM Car Insurance Review for 2025 [Unbiased Evaluation]

- Kemper Car Insurance Review for 2025 [Rates, Discounts, & Options]

- Lemonade Car Insurance Review for 2025 [Trustworthy Evaluation]

- Metromile Car Insurance Review for 2025 [What Customers Have to Say]

- State Auto Insurance Review for 2025 [Unbiased Evaluation]

- Chubb Car Insurance Review for 2025 (See If They’re a Good Fit)

- Hanover Car Insurance Review for 2025 [Trustworthy Evaluation]

- American Access Car Insurance Review for 2025 [Cost & Coverage]

- Nationwide Car Insurance Review for 2025 [Customer & Financial Ratings]

- Mile Auto Insurance Review for 2025 [Company Report]

- Amica Car Insurance Review for 2025 [See Their Cost & Ratings]

- Enterprise Rental Car Insurance Review [2025]

- National Rental Car Insurance Review [2025]

- Thrifty Rental Car Insurance Review [2025]

- Alamo Rental Car Insurance Review [2025]

- Esurance vs. Allstate Car Insurance Comparison [2025]

- Safeco RightTrack App Review: Compare Rates, Discounts, & Requirements [2025]

- Safeco Car Insurance Review [2025]

- Auto-Owners Car Insurance Review [2025]

- Cheap Car Insurance After an At-Fault Accident in 2025(Save Money With These 10 Providers!)

- Buying Car Insurance for Your New Car

- National General Car Insurance Review [2025]

- Erie Car Insurance Review [2025]

- Direct Auto Car Insurance Review [2025]

- Texas Farm Bureau Car Insurance Review for 2025 [See Ratings & Cost Here!]

- MCA Car Insurance Review [2025]

- A-Max Car Insurance Review [2025]

- Plymouth Rock Car Insurance Review [2025]

- Country-Wide Car Insurance Review [2025]

- Green Light Car Insurance Review [2025]

- Worst Car Insurance Companies in America (2025 Update)

- Travelers Car Insurance Review [2025]

- The Grange Car Insurance Review [2025]

- The General Car Insurance Review [2025]

- State Farm Car Insurance Review for 2025 [See if They’re a Good Fit]

- Magnum Car Insurance Review [2025]

- Dairyland Car Insurance Review [2025]

- Geico Defensive Driving Course Review: Compare Rates, Discounts, & Requirements [2025]

- Hippo Car Insurance Review [2025]

- Western General Car Insurance Review [2025]

- Rivian Car Insurance Review [2025]

- USAA GAP Insurance Review: Compare Rates, Discounts, & Requirements [2025]

- Allstate Drivewise Review: Compare Rates, Discounts, & Requirements [2025]

- Farmers Signal Review: Compare Rates, Discounts, & Requirements [2025]

- American Family Insurance KnowYourDrive Review: Compare Rates, Discounts, & Requirements [2025]

- Noblr Car Insurance Review [2025]

- Say Car Insurance Review [2025]

- Clearcover Car Insurance Review [2025]

- Allstate Car Insurance Review for 2025 [See Rates & Discounts Here]

- 21st Century vs. USAA Car Insurance Comparison [2025]

- AARP Auto Insurance Program from The Hartford Review: Compare Rates, Discounts, & Requirements [2025]

- Ameriprise vs. The Hanover Car Insurance Comparison [2025]

- Amica vs. The Hartford Car Insurance Comparison [2025]

- Ameriprise vs. USAA Car Insurance Comparison [2025]

- American Family vs. Safeco Car Insurance Comparison [2025]

- American Family vs. Safe Auto Car Insurance Comparison [2025]

- Allstate vs. The Hartford Car Insurance Comparison [2025]

- AAA vs. The Hartford Car Insurance Comparison [2025]

- AAA vs. Safeco Car Insurance Comparison [2025]

- Allstate vs. Safeco Car Insurance Comparison [2025]

- American Family vs. Country Financial Car Insurance Comparison [2025]

- American Family vs. Amica Car Insurance Comparison [2025]

- Progressive vs. Travelers Car Insurance Comparison [2025]

- Liberty Mutual vs. Travelers Car Insurance Comparison [2025]

- Farmers vs. Travelers Car Insurance Comparison [2025]

- Farmers vs. The Hartford Car Insurance Comparison [2025]

- Farmers vs. MetLife Car Insurance Comparison [2025]

- 21st Century vs. Amica Car Insurance Comparison [2025]

- Geico vs. The Hartford Car Insurance Comparison [2025]

- Geico vs. The General Car Insurance for 2025 [Compare Cost & Plans Here!]

- Geico vs. Liberty Mutual Car Insurance Comparison [2025]

- Liberty Mutual Car Insurance Review for 2025 [See Rates & Discounts Here]

- USAA Car Insurance Review for 2025 [Rates, Discounts, & Options]

- Root Car Insurance Review for 2025 [See Rates & Discounts Here]

- Progressive Car Insurance Review for 2025 [See if They’re a Good Fit]

- Farmers Car Insurance Review [2025]

- Geico Car Insurance Review for 2025 [See if They’re a Good Fit]

- AAA Car Insurance Review for 2025 (Uncover Rates and Discounts Here)

- Car Insurance Company Comparison: Head-to-Head Company Comparison [2025]

- American Family Car Insurance Review [2025]

- Prudential Car Insurance Review [2025]

- Gabi Car Insurance Review [2025]

- MAPFRE Car Insurance Review [2025]

- American Auto Shield Car Insurance Review [2025]

- Geico vs. AAA Car Insurance in 2025 [Compare Costs & Options!]

- Esurance vs. Geico vs. Progressive Car Insurance Comparison [2025]

- Auto Club Group Car Insurance Review [2025]

- Citizens Insurance Michigan Car Insurance Review [2025]

- Where to Find Car Insurance Company Reviews [2025]

- Compare Ford vs. Chevrolet Car Insurance Rates [2025]

- Nationwide Car Insurance Discounts [2025]

- EMC Car Insurance Review [2025]

- State Farm vs. Progressive Car Insurance Comparison [2025]

- Geico vs. Allstate Car Insurance Comparison [2025]

- Allstate vs. State Farm Car Insurance Comparison [2025]

- Kaiser Permanente Car Insurance Review [2025]

- Assurant Car Insurance Review [2025]

- Colonial Penn Car Insurance Review [2025]

- Aflac Car Insurance Review [2025]

- Blue Cross Blue Shield Car Insurance Review [2025]

- Humana Car Insurance Review [2025]

- United Healthcare Car Insurance Review [2025]

- Best Car Insurance Comparison Websites [2025]

- Viking Car Insurance Review [2025]

- Virginia Surety Car Insurance Review [2025]

- St. Paul Protective Car Insurance Review [2025]

- Compare Canadian vs. US Car Insurance: Rates, Discounts, & Requirements [2025]

- Truck Insurance Exchange Car Insurance Review [2025]

- Omaha Indemnity Car Insurance Review [2025]

- Mitsui Sumitomo Car Insurance Review [2025]

- Lyndon Car Insurance Review [2025]

- Mid Century Car Insurance Review [2025]

- MGA Car Insurance Review [2025]

- Mendakota Car Insurance Review [2025]

- Interinsurance Exchange Car Insurance Review [2025]

- GHS Car Insurance Review [2025]

- Germania Car Insurance Review [2025]

- Gateway Car Insurance Review [2025]

- Caterpillar Car Insurance Review [2025]

- Cumis Car Insurance Review [2025]

- American Standard Car Insurance Review [2025]

- BCS Insurance Car Insurance Review [2025]

- Central National Car Insurance Review [2025]

- AutoOne Car Insurance Review [2025]

- Advanta Car Insurance Review [2025]

- American Mercury Car Insurance Review [2025]

- American Interstate Car Insurance Review [2025]

- American Farmers Ranchers Car Insurance Review [2025]

- American Road Car Insurance Review [2025]

- Hertz Rental Car Insurance Review [2025]

- Wawanesa Car Insurance Review [2025]

- Direct Line Car Insurance Review [2025]

- Mountain Valley Indemnity Company Car Insurance Review [2025]

- AXA Car Insurance Review [2025]

- General Security National Insurance Company Car Insurance Review [2025]

- Everest Car Insurance Review [2025]

- American Alternative Insurance Corporation Car Insurance Review [2025]

- Economy Premier Assurance Car Insurance Review [2025]

- Aetna life Car Insurance Review [2025]

- Homesite Car Insurance Review [2025]

- Lloyds Car Insurance Review [2025]

- Massachusetts Bay Car Insurance Review [2025]

- Northern Assurance Car Insurance Review [2025]

- OneBeacon Car Insurance Review [2025]

- Essentia Car Insurance Review [2025]

- First National Car Insurance Review [2025]

- Amica vs. Progressive Car Insurance Comparison [2025]

- Progressive vs. USAA Car Insurance Comparison [2025]

- AAA vs. Nationwide Car Insurance Comparison [2025]

- AAA vs. Liberty Mutual Car Insurance Comparison [2025]

- State Farm vs. Liberty Mutual Car Insurance Comparison [2025]

- State Farm vs. AAA Car Insurance Comparison [2025]

- Amica vs. AAA Car Insurance in 2025 [Side-by-Side Comparison]

- Liberty Mutual vs. USAA Car Insurance Comparison [2025]

- Allstate vs. AAA Car Insurance Comparison [2025]

- Allstate vs. Nationwide Car Insurance Comparison [2025]

- Allstate vs. Amica Car Insurance Comparison [2025]

- Amica vs. Nationwide Car Insurance Comparison [2025]

- Esurance vs. Liberty Mutual Car Insurance Comparison [2025]

- Progressive vs. AAA Car Insurance Comparison [2025]

- Progressive vs. Farmers Car Insurance Comparison [2025]

- AAA vs. Farmers Car Insurance Comparison [2025]

- AAA vs. USAA Car Insurance Comparison [2025]

- AIS Car Insurance Review for 2025 [Ratings, Cost, & Complaints]

- Mercer Insurance Group Car Insurance Review [2025]

- Hagerty Car Insurance Review [2025]

- Esurance vs. Allstate Car Insurance Comparison [2025]

- Cheap Car Insurance After an At-Fault Accident in 2025(Save Money With These 10 Providers!)

- Worst Car Insurance Companies in America (2025 Update)

- Geico Defensive Driving Course Review: Compare Rates, Discounts, & Requirements [2025]

- USAA GAP Insurance Review: Compare Rates, Discounts, & Requirements [2025]

- Farmers Signal Review: Compare Rates, Discounts, & Requirements [2025]

- American Family Insurance KnowYourDrive Review: Compare Rates, Discounts, & Requirements [2025]

- 21st Century vs. USAA Car Insurance Comparison [2025]

- Ameriprise vs. The Hanover Car Insurance Comparison [2025]

- Amica vs. The Hartford Car Insurance Comparison [2025]

- Ameriprise vs. USAA Car Insurance Comparison [2025]

- American Family vs. Safeco Car Insurance Comparison [2025]

- American Family vs. Safe Auto Car Insurance Comparison [2025]

- Allstate vs. The Hartford Car Insurance Comparison [2025]

- AAA vs. The Hartford Car Insurance Comparison [2025]

- AAA vs. Safeco Car Insurance Comparison [2025]

- Allstate vs. Safeco Car Insurance Comparison [2025]

- American Family vs. Country Financial Car Insurance Comparison [2025]

- American Family vs. Amica Car Insurance Comparison [2025]

- Progressive vs. Travelers Car Insurance Comparison [2025]

- Liberty Mutual vs. Travelers Car Insurance Comparison [2025]

- Farmers vs. Travelers Car Insurance Comparison [2025]

- Farmers vs. The Hartford Car Insurance Comparison [2025]

- Farmers vs. MetLife Car Insurance Comparison [2025]

- 21st Century vs. Amica Car Insurance Comparison [2025]

- Geico vs. The Hartford Car Insurance Comparison [2025]

- Geico vs. The General Car Insurance for 2025 [Compare Cost & Plans Here!]

- Geico vs. Liberty Mutual Car Insurance Comparison [2025]

- Car Insurance Company Comparison: Head-to-Head Company Comparison [2025]

- Geico vs. AAA Car Insurance in 2025 [Compare Costs & Options!]

- Esurance vs. Geico vs. Progressive Car Insurance Comparison [2025]

- Compare Ford vs. Chevrolet Car Insurance Rates [2025]

- Nationwide Car Insurance Discounts [2025]

- State Farm vs. Progressive Car Insurance Comparison [2025]

- Geico vs. Allstate Car Insurance Comparison [2025]

- Allstate vs. State Farm Car Insurance Comparison [2025]

- Compare Canadian vs. US Car Insurance: Rates, Discounts, & Requirements [2025]

- Amica vs. Progressive Car Insurance Comparison [2025]

- Progressive vs. USAA Car Insurance Comparison [2025]

- AAA vs. Nationwide Car Insurance Comparison [2025]

- AAA vs. Liberty Mutual Car Insurance Comparison [2025]

- State Farm vs. Liberty Mutual Car Insurance Comparison [2025]

- State Farm vs. AAA Car Insurance Comparison [2025]

- Amica vs. AAA Car Insurance in 2025 [Side-by-Side Comparison]

- Liberty Mutual vs. USAA Car Insurance Comparison [2025]

- Allstate vs. AAA Car Insurance Comparison [2025]

- Allstate vs. Nationwide Car Insurance Comparison [2025]

- Allstate vs. Amica Car Insurance Comparison [2025]

- Amica vs. Nationwide Car Insurance Comparison [2025]

- Esurance vs. Liberty Mutual Car Insurance Comparison [2025]

- Progressive vs. AAA Car Insurance Comparison [2025]

- Progressive vs. Farmers Car Insurance Comparison [2025]

- AAA vs. Farmers Car Insurance Comparison [2025]

- AAA vs. USAA Car Insurance Comparison [2025]

- Best Car Insurance by Coverage Type

- Best Personal Accident Insurance in 2025 (Compare the Top 10 Companies)

- Best Full Coverage Car Insurance in 2025 (Top 10 Companies Ranked)

- 10 Best Car Insurance Companies for Drivers With Speeding Tickets in 2025

- 10 Best Commercial Car Insurance Companies in 2025

- Best Tesla Car Insurance Rates in 2025 (Compare The Top 10 Companies)

- 8 Best Car Insurance Companies That Accept Felons in 2025

- 10 Best Car Insurance Companies That Accept Cash App in 2025

- Best Car Insurance for Company Vehicles in 2025 (Top 10 Providers)

- Best Car Insurance Companies That Offer Cash Back in 2025 (Top 10 Providers)

- 10 Best Car Insurance Companies That Accept Suspended Licenses in 2025

- Best Car Insurance Companies That Don’t Report to the DMV in 2025 (Top 10 Providers)

- Best Car Insurance Companies That Cover OEM Parts in 2025 (Top 10 Providers)

- Cheap Car Insurance Companies That Insure Salvage Title Vehicles in 2025 (Top 10 Providers)

- Best Car Insurance Companies That Offer Agreed Value in 2025 (Top 10 Providers)

- 10 Best Car Insurance Companies for DUI Offenders in 2025

- Best Car Insurance for Married Couples on Separate Policies in 2025 (Top 10 Providers)

- 10 Best Companies That Insure Cars With Blown Airbags in 2025

- Cheap Car Insurance Companies That Beat Quotes in 2025 (10 Most Affordable Providers)

- Best Car Insurance for Modified Cars in 2025 (Your Guide to the Top 10 Companies)

- Best Car Insurance for Multiple Accidents in 2025 (Top 10 Providers)

- Best Insurance for Car Rental Businesses in 2025 (Top 10 Providers)

- Best Car Insurance Companies That Only Look Back 3 Years in 2025 (Top 10 Picks)

- Best Car Insurance for Unlicensed Drivers in 2025 (Top 10 Providers)

- 10 Best Car Insurance Companies That Allow Spouse Exclusions in 2025

- Best Car Insurance Companies for Financed Cars in 2025

- 10 Best Car Insurance Companies for High-Risk Drivers in 2025

- Best Car Insurance for High-Risk Drivers in 2025 (Top 8 Companies Ranked)

- Car Subscription Services: A Comprehensive Guide [2025]

- Compare Car Insurance for Business Leases: Rates, Discounts, & Requirements [2025]

- 10 Best Classic Car Insurance Companies in 2025

- What are private-passenger car insurance companies?

- 10 Best Car Insurance Companies for Families in 2025

- 10 Best Car Insurance Companies in Canada for 2025

- Traits of the Worst Car Insurance Companies

- 10 Best Car Insurance Companies in 2025

- Best Car Insurance for Car Dealerships in 2025 (Top 10 Companies Ranked)

- Best Car Insurance Companies That Don’t Use Credit Scores in 2025 (Top 10 Providers)

- What is the best car insurance?

- Compare the Best Car Insurance Companies

- Best Car Insurance by Occupation

- Cheap Car Insurance for Pilots and Navigators in 2025 (Top 10 Affordable Companies)

- Best Car Insurance for Pharmacists in 2025 (Top 10 Companies)

- How Occupation Affects Car Insurance Rates (Education, Discounts, & Rates)

- Cheap Taxi Car Insurance in 2025 (Top 10 Companies)

- Best Car Insurance for Home-Care Worker in 2025 (Top 10 Companies)

- Best Car Insurance for Diplomats in 2025 (Top 10 Companies)

- Best Car Insurance for Emergency Service Workers in 2025 (Top 10 Companies)

- Can I get car insurance without having a job?

- Best Car Insurance for Social Workers in 2025 (Top 10 Companies)

- Best Car Insurance for Doctors in 2025 (Top 10 Companies)

- Best Car Insurance for Accountants in 2025 (Top 10 Companies)

- Best Car Insurance When Self-Employed in 2025 (Top 10 Companies)

- Best Car Insurance for Security and Prison Workers in 2025 (Top 10 Companies)

- Best Car Insurance for Drivers Without a College Degree in 2024 (Top 10 Companies)

- Best Car Insurance for Church Employees in 2025 (Top 10 Companies)

- Best Car Insurance for Customer Service Occupations in 2025 (Top 10 Companies)

- Best Car Insurance for Healthcare Workers in 2025 (Top 10 Companies)

- Best Car Insurance for Managers and Directors in 2025 (Top 10 Companies)

- Best Car Insurance for Nannies in 2025 (Top 10 Companies)

- Best Car Insurance for Real Estate Agents in 2025 (Top 10 Companies)

- Best Car Insurance for Engineers in 2025 (Top 10 Companies)

- Best Car Insurance for Homemakers in 2025 (We Suggest These 10 Companies)

- Best Car Insurance for Scientists in 2025 (Top 10 Companies)

- Best Car Insurance for Students in 2025 (Top 10 Companies)

- Best Car Insurance for Unemployed Drivers in 2025 (Top 10 Companies)

- Best Car Insurance for Driving Instructors in 2025 (Top 10 Companies)

- Best Car Insurance for Independent Contractors in 2025 (Top 10 Companies)

- Best Car Insurance for Union Members in 2025 (Top 10 Companies)

- Cheap Car Insurance for Pilots and Navigators in 2025 (Top 10 Affordable Companies)

- Best Car Insurance for Pharmacists in 2025 (Top 10 Companies)

- How Occupation Affects Car Insurance Rates (Education, Discounts, & Rates)

- Cheap Taxi Car Insurance in 2025 (Top 10 Companies)

- Best Car Insurance for Home-Care Worker in 2025 (Top 10 Companies)

- Best Car Insurance for Diplomats in 2025 (Top 10 Companies)

- Best Car Insurance for Emergency Service Workers in 2025 (Top 10 Companies)

- Can I get car insurance without having a job?

- Best Car Insurance for Social Workers in 2025 (Top 10 Companies)

- Best Car Insurance for Doctors in 2025 (Top 10 Companies)

- Best Car Insurance for Accountants in 2025 (Top 10 Companies)

- Best Car Insurance When Self-Employed in 2025 (Top 10 Companies)

- Best Car Insurance for Security and Prison Workers in 2025 (Top 10 Companies)

- Best Car Insurance for Drivers Without a College Degree in 2024 (Top 10 Companies)

- Best Car Insurance for Church Employees in 2025 (Top 10 Companies)

- Best Car Insurance for Customer Service Occupations in 2025 (Top 10 Companies)

- Best Car Insurance for Healthcare Workers in 2025 (Top 10 Companies)

- Best Car Insurance for Managers and Directors in 2025 (Top 10 Companies)

- Best Car Insurance for Nannies in 2025 (Top 10 Companies)

- Best Car Insurance for Real Estate Agents in 2025 (Top 10 Companies)

- Best Car Insurance for Engineers in 2025 (Top 10 Companies)

- Best Car Insurance for Homemakers in 2025 (We Suggest These 10 Companies)

- Best Car Insurance for Scientists in 2025 (Top 10 Companies)

- Best Car Insurance for Students in 2025 (Top 10 Companies)

- Best Car Insurance for Unemployed Drivers in 2025 (Top 10 Companies)

- Best Car Insurance for Driving Instructors in 2025 (Top 10 Companies)

- Best Car Insurance for Independent Contractors in 2025 (Top 10 Companies)

- Best Car Insurance for Union Members in 2025 (Top 10 Companies)

- Best Car Insurance for Hobbyists

- Best Track Day Car Insurance in 2025 (Top 10 Companies)

- The Best Classic Car Auctions [2025]

- Best Vehicle Shipping Insurance in 2025 (Top 10 Companies)

- Best Car Insurance for Road Trips in 2025 (Top 10 Companies)

- Insurance Auto Auction: Explained Simply

- Best Car Insurance for Natural Disasters in 2025 (Your Guide to the Top 10 Companies)

- How to Handle Car Insurance When Moving Out of State in 2025 [6 Easy Steps to Follow]

- Best Track Day Car Insurance in 2025 (Top 10 Companies)

- The Best Classic Car Auctions [2025]

- Best Vehicle Shipping Insurance in 2025 (Top 10 Companies)

- Best Car Insurance for Road Trips in 2025 (Top 10 Companies)

- Insurance Auto Auction: Explained Simply

- Best Car Insurance for Natural Disasters in 2025 (Your Guide to the Top 10 Companies)

- How to Handle Car Insurance When Moving Out of State in 2025 [6 Easy Steps to Follow]

- Best Car Insurance by Vehicle

- Cheap Car Insurance for a Second Car in 2025 (Earn Savings With These 10 Companies!)

- The Best Small Car Safety Ratings for 2025

- Compare 1980s Vehicle Insurance Rates [2025]

- Best Affordable Classic Cars

- Compare Car Insurance Rates for WW2 Vehicles [2025]

- Best Low-Mileage Car Insurance in 2025 (Your Guide to the Top 10 Providers)

- Cheap Classic Car Insurance Without a Garage in 2025 (10 Most Affordable Companies)

- Cheap Car Insurance for Wheelchair-Accessible Vehicles in 2025 (Save Big With These 10 Companies!)

- Does car insurance cover engine failure?

- Car Insurance for Electric Cars

- Best Rally Car Insurance in 2025 (Find the Top 10 Companies Here!)

- Cheap Insurance for Car Auctions in 2025 (Cash Savings With These 8 Companies!)

- Why do you need GAP insurance for a leased car?

- Cheap Car Insurance for Older Vehicles in 2025 (Save Money With These 8 Companies)

- Cheap Car Insurance for a Second Car in 2025 (Earn Savings With These 10 Companies!)

- The Best Small Car Safety Ratings for 2025

- Compare 1980s Vehicle Insurance Rates [2025]

- Best Affordable Classic Cars

- Compare Car Insurance Rates for WW2 Vehicles [2025]

- Best Low-Mileage Car Insurance in 2025 (Your Guide to the Top 10 Providers)

- Cheap Classic Car Insurance Without a Garage in 2025 (10 Most Affordable Companies)

- Cheap Car Insurance for Wheelchair-Accessible Vehicles in 2025 (Save Big With These 10 Companies!)

- Does car insurance cover engine failure?

- Car Insurance for Electric Cars

- Best Rally Car Insurance in 2025 (Find the Top 10 Companies Here!)

- Cheap Insurance for Car Auctions in 2025 (Cash Savings With These 8 Companies!)

- Why do you need GAP insurance for a leased car?

- Cheap Car Insurance for Older Vehicles in 2025 (Save Money With These 8 Companies)

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

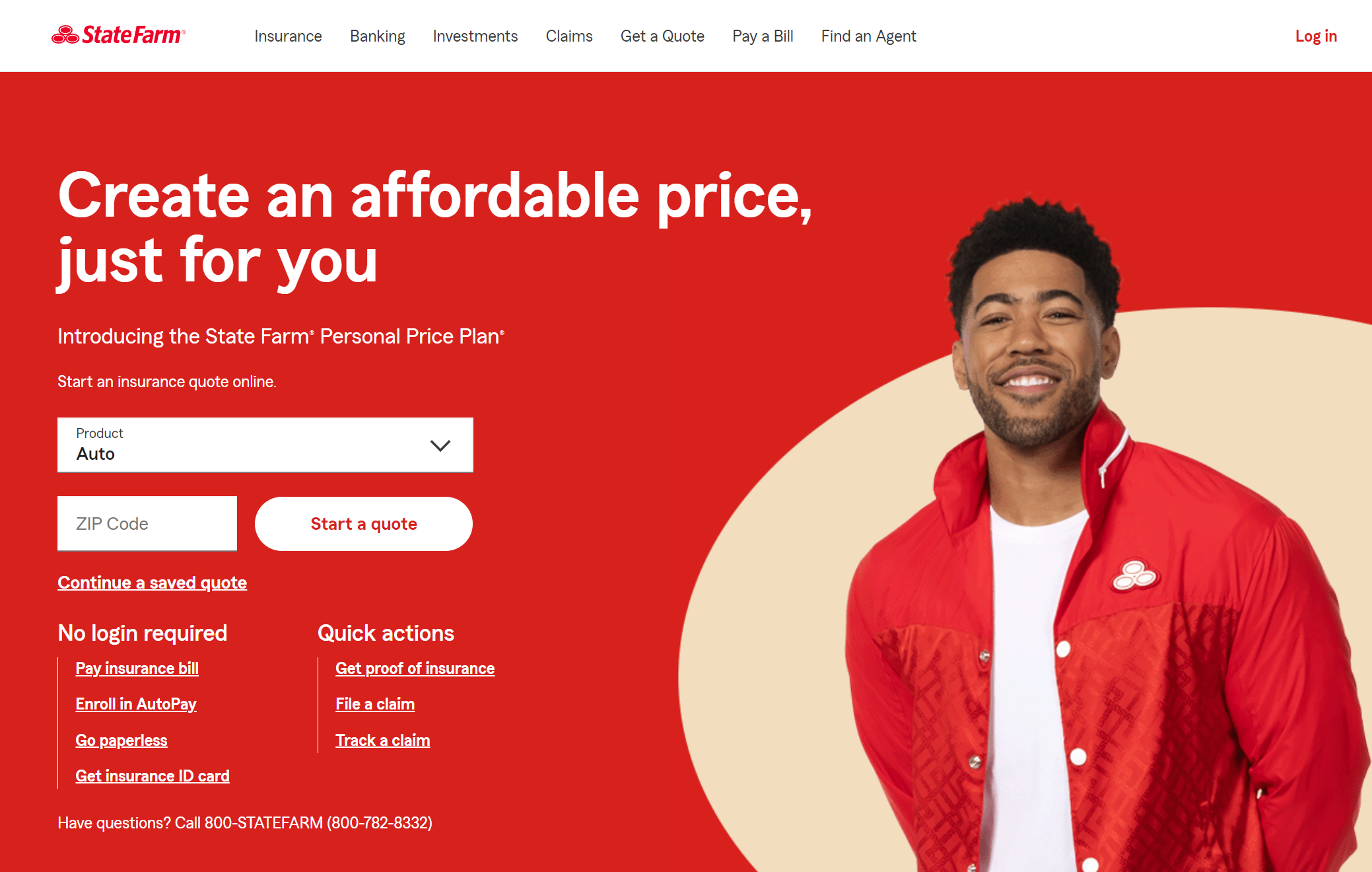

#1 – State Farm: Top Overall Pick

Pros

- Bundling Policies: State Farm offers significant discounts for bundling multiple insurance policies. Learn more in our State farm car insurance review.

- High Low-Mileage Discount: State Farm provides a substantial discount for low-mileage usage.

- Wide Coverage: State Farm offers various coverage options tailored for different business needs.

Cons

- Limited Multi-Policy Discount: The multi-policy discount of State Farm is not as high compared to some competitors.

- Premium Costs: Despite discounts, State Farm’s premiums might still be relatively higher for certain coverage levels.

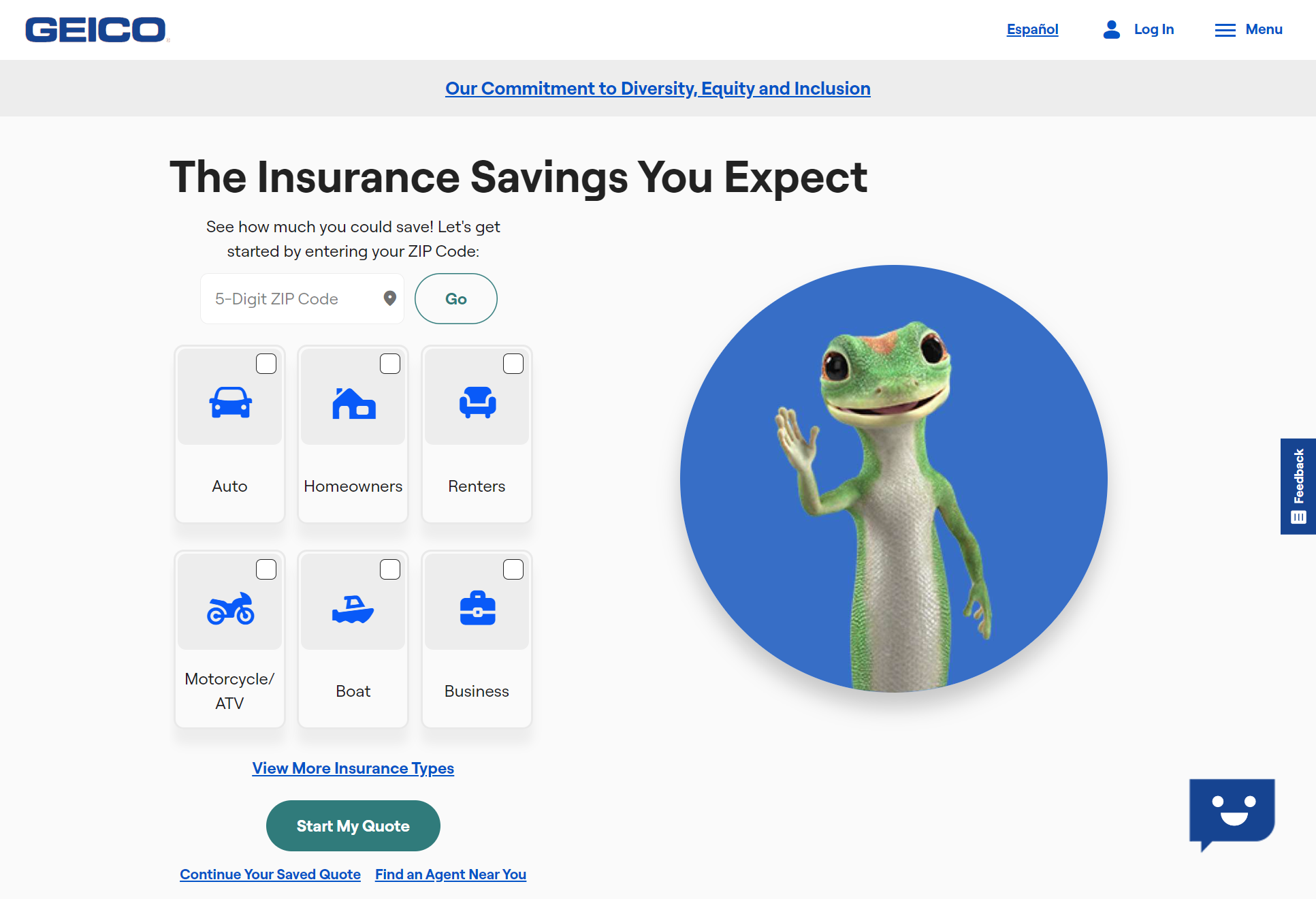

#2 – Geico: Best for Coverage Options

Pros

- High Safe Driving Discount: Geico offers a 24% discount for safe drivers, one of the highest in the industry.

- Extensive Coverage Options: Provides a wide range of coverage types, including mechanical breakdown insurance.

- Fast Claims Process: Known for a quick and efficient claims resolution process. See more details on our Geico car insurance review.

Cons

- Customer Service Variability: Customer service quality can vary significantly by region.

- Pricing Fluctuations: Some customers report inconsistent pricing at renewal.

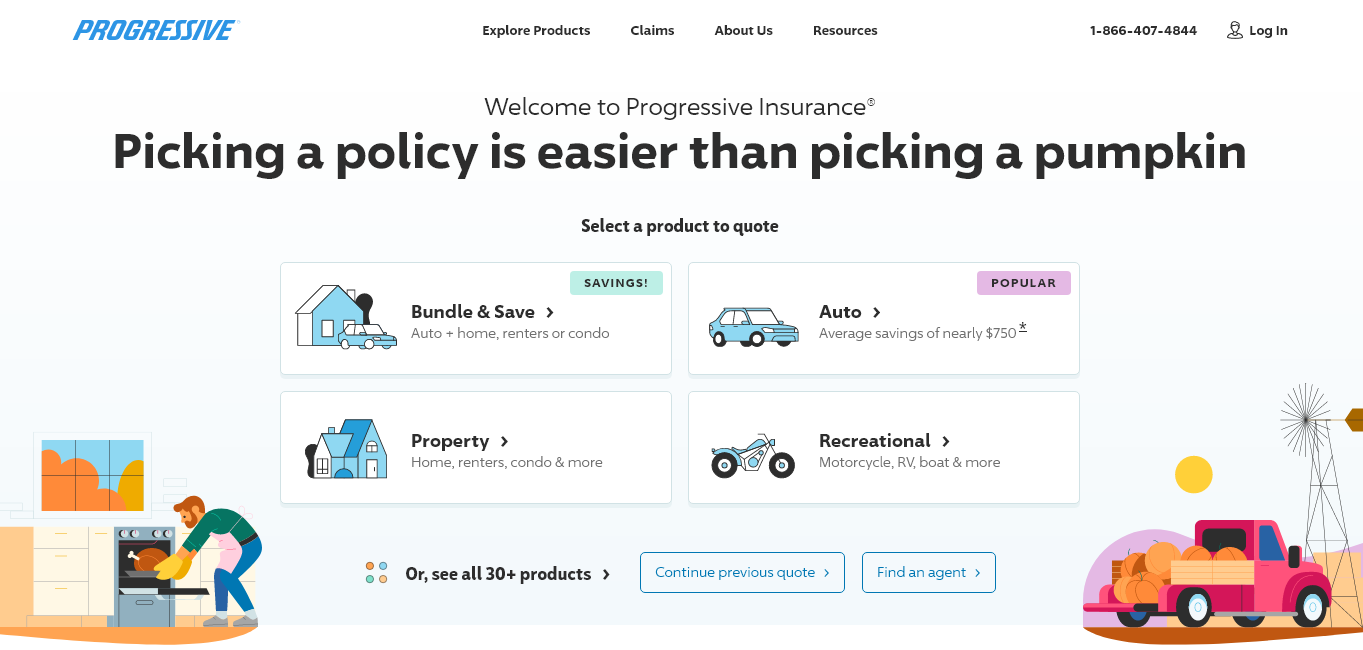

#3 – Progressive: Best for Customer Service

Pros

- Highest Safe Driving Discount: Progressive leads with a 28% discount for safe driving.

- Loyalty Rewards: Offers benefits like small accident forgiveness as part of its loyalty rewards program.

- Flexible Policies: Provides flexibility in customizing policies and choosing payment schedules. More information is available about this provider in our Progressive car insurance ieview.

Cons

- Higher Rates for Riskier Drivers: Rates can be significantly higher for high-risk drivers.

- Inconsistent Agent Experiences: Experiences can vary depending on the agent or representative.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

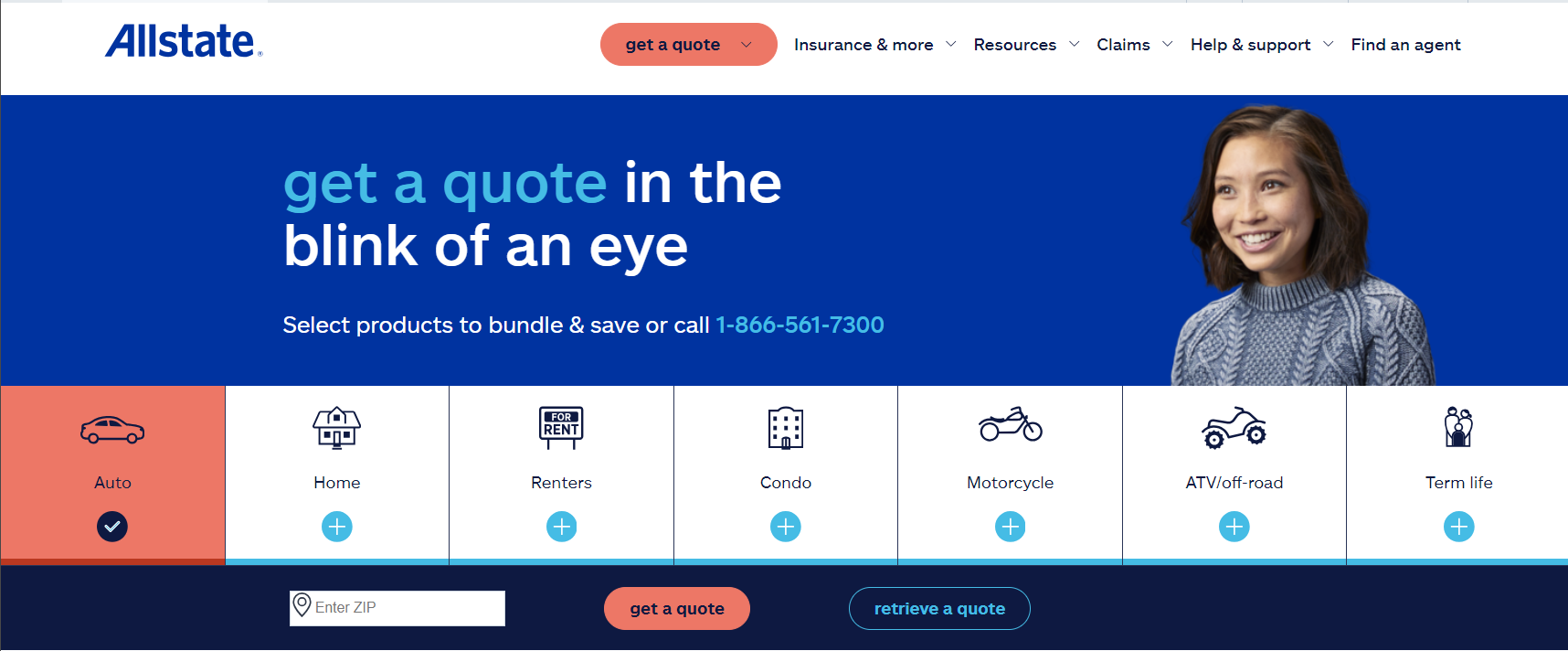

#4 – Allstate: Best for Add-on Coverages

Pros

- Multiple Add-Ons: Allstate offers several unique add-ons, such as new car replacement and custom equipment coverage. Read up on the Progressive car insurance review.

- Safe Driving Club: Rewards safe drivers with discounts and other benefits through its Safe Driving Club.

- Effective Online Tools: Provides robust online tools and apps for policy management.

Cons

- Higher Premiums: Tends to have higher premiums compared to competitors.

- Complex Policy Options: Some customers find policy options and add-ons complex and difficult to understand.

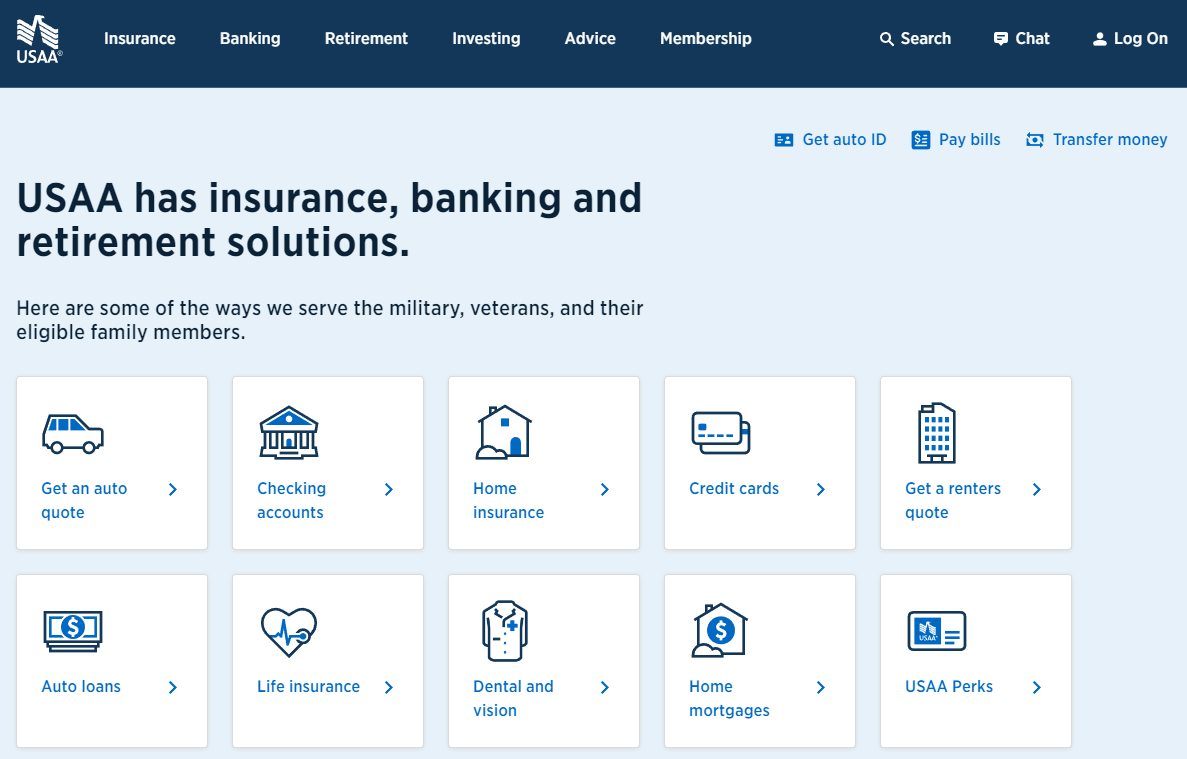

#5 – USAA: Best for Military Savings

Pros

- Dedicated to Military: Tailored services and discounts specifically for military members and their families. Check out insurance savings in our complete USAA car insurance review.

- Consistently High Ratings: USAA regularly receives high marks for customer service and claims satisfaction.

- Comprehensive Coverage: Offers comprehensive coverage that often exceeds competitors at similar or lower rates.

Cons

- Limited Availability: Only available to military members, veterans, and their families.

- Fewer Physical Locations: Limited physical branches which may affect those preferring in-person service.

#6 – Liberty Mutual: Best for Add-on Coverage

Pros

- Customizable Add-Ons: Offers extensive add-on options, including accident forgiveness and lifetime repair guarantee.

- Diverse Discounts: Provides a wide array of discounts, such as for hybrid/electric cars and good students.

- Strong Global Presence: Extensive support network and services available globally. Discover more about offerings in our Liberty Mutual car insurance review.

Cons

- Variable Customer Satisfaction: Customer satisfaction ratings can be inconsistent across different regions.

- Pricing Above Average: Some customers report higher than average pricing.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#7 – Nationwide: Best for SmartRide Program

Pros

- SmartRide Discount: Offers discounts for safe driving through its telematics-based SmartRide program.

- Wide Range of Products: Provides a broad range of insurance products, making it easy to bundle services.

- Strong Financial Stability: Maintains a strong financial status with high ratings from A.M. Best. Access comprehensive insights into our Nationwide car insurance discounts.

Cons

- Customer Service Issues: Some policyholders report less than satisfactory experiences with customer service.

- Claims Process: The claims process can sometimes be slower compared to industry leaders.

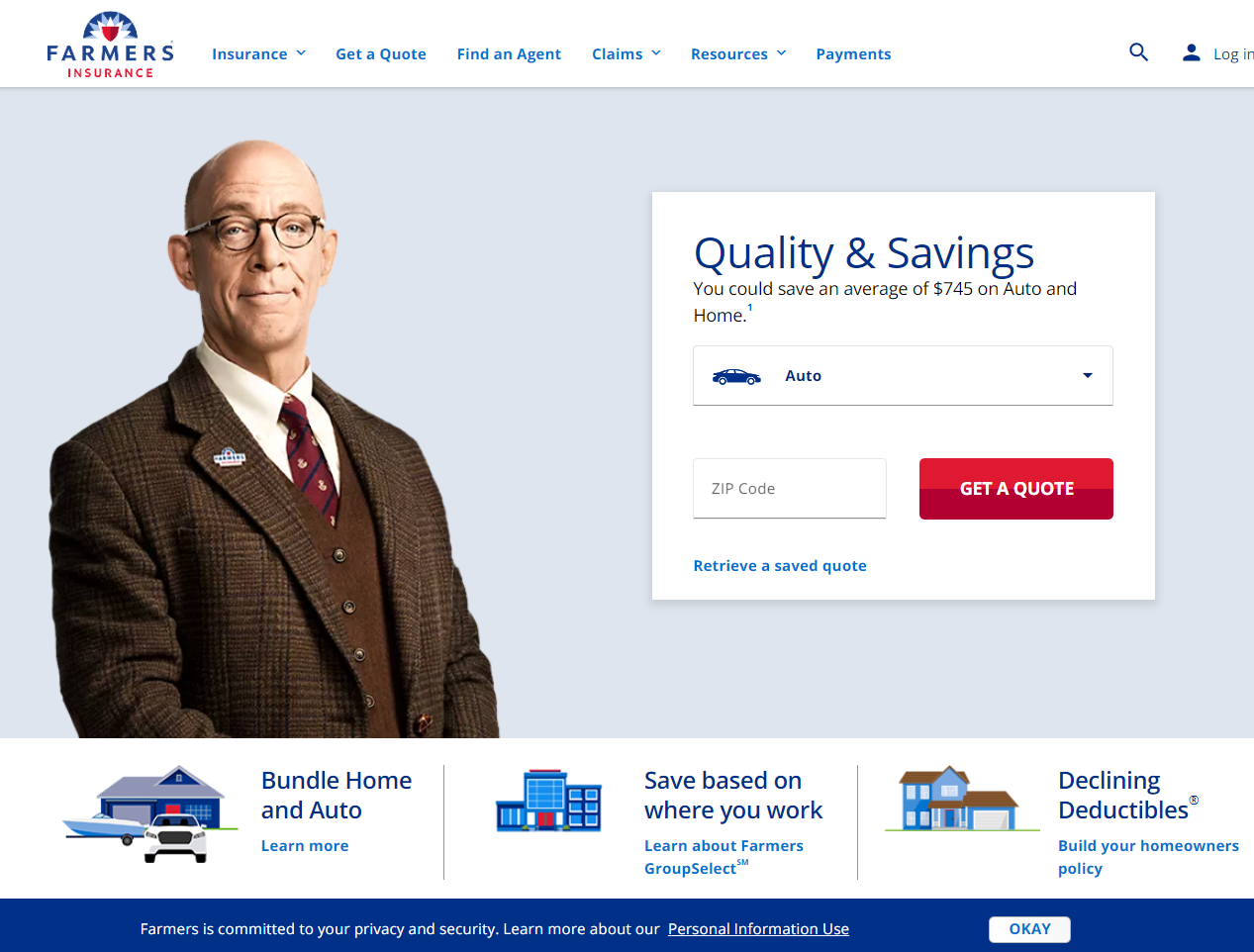

#8 – Farmers: Best for Customizable Policies

Pros

- Highly Customizable Policies: Allows extensive customization of policies to fit individual needs.

- Proactive Claims Service: Known for proactive management and resolution of claims. Delve into our evaluation of Farmers car insurance review.

- Innovative Home Coverage: Offers unique home insurance options that can be bundled with auto for savings.

Cons

- Higher Cost: Generally more expensive than some other competitors.

- Complexity in Policy Management: Some users find managing their policies through online portals to be complex.

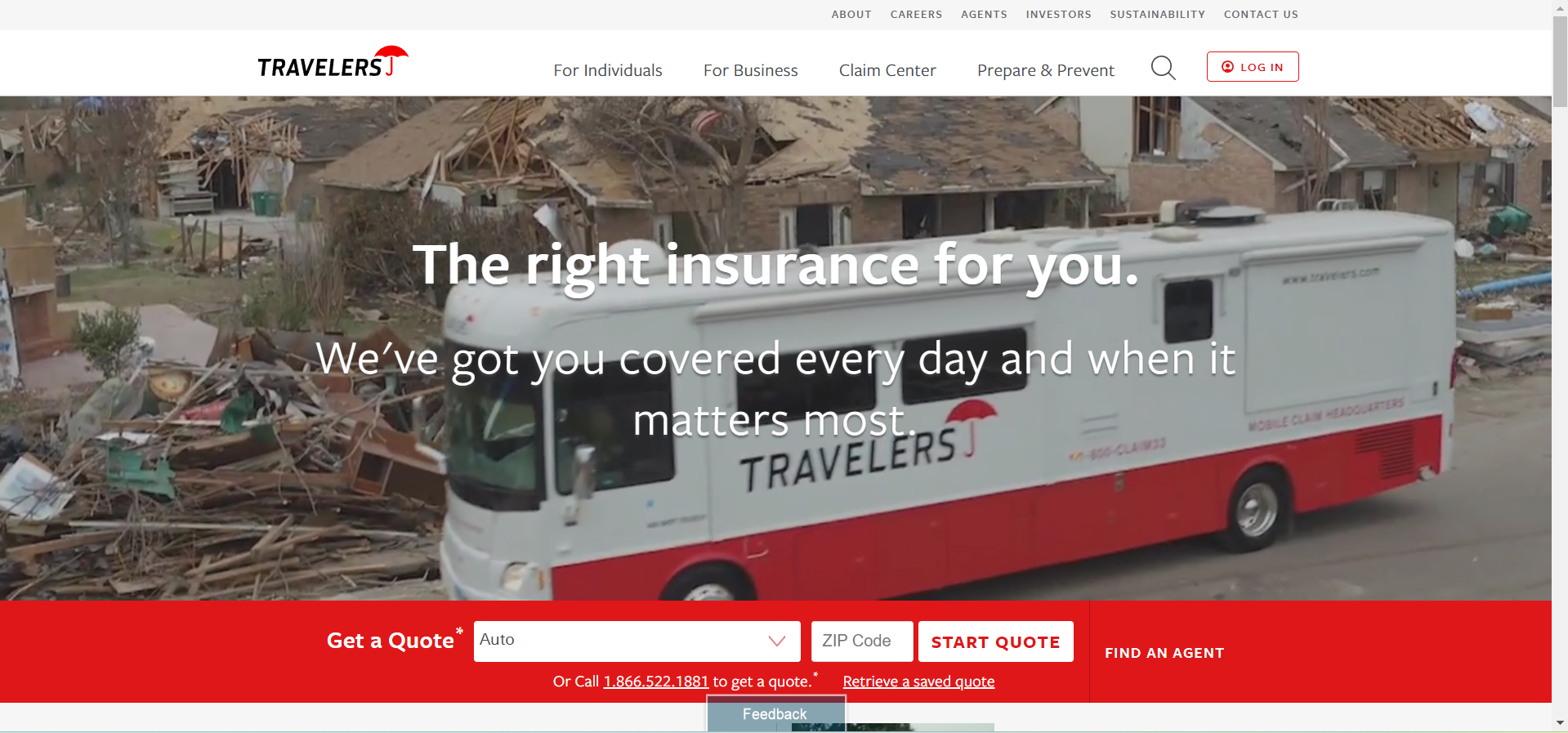

#9 – Travelers: Best for Comprehensive Coverage

Pros

- Broad Coverage Options: Offers some of the most comprehensive coverage options available. Unlock details in our Travelers car insurance review.

- Green Home Discount: Provides discounts for certified green homes and hybrid/electric vehicles.

- Excellent Risk Assessment Tools: Offers superior risk assessment tools to tailor coverage needs accurately.

Cons

- Higher Premiums for Some Policies: Premiums can be on the higher side for certain policies.

- Limited Discount Opportunities: Fewer discount options compared to other top insurers.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

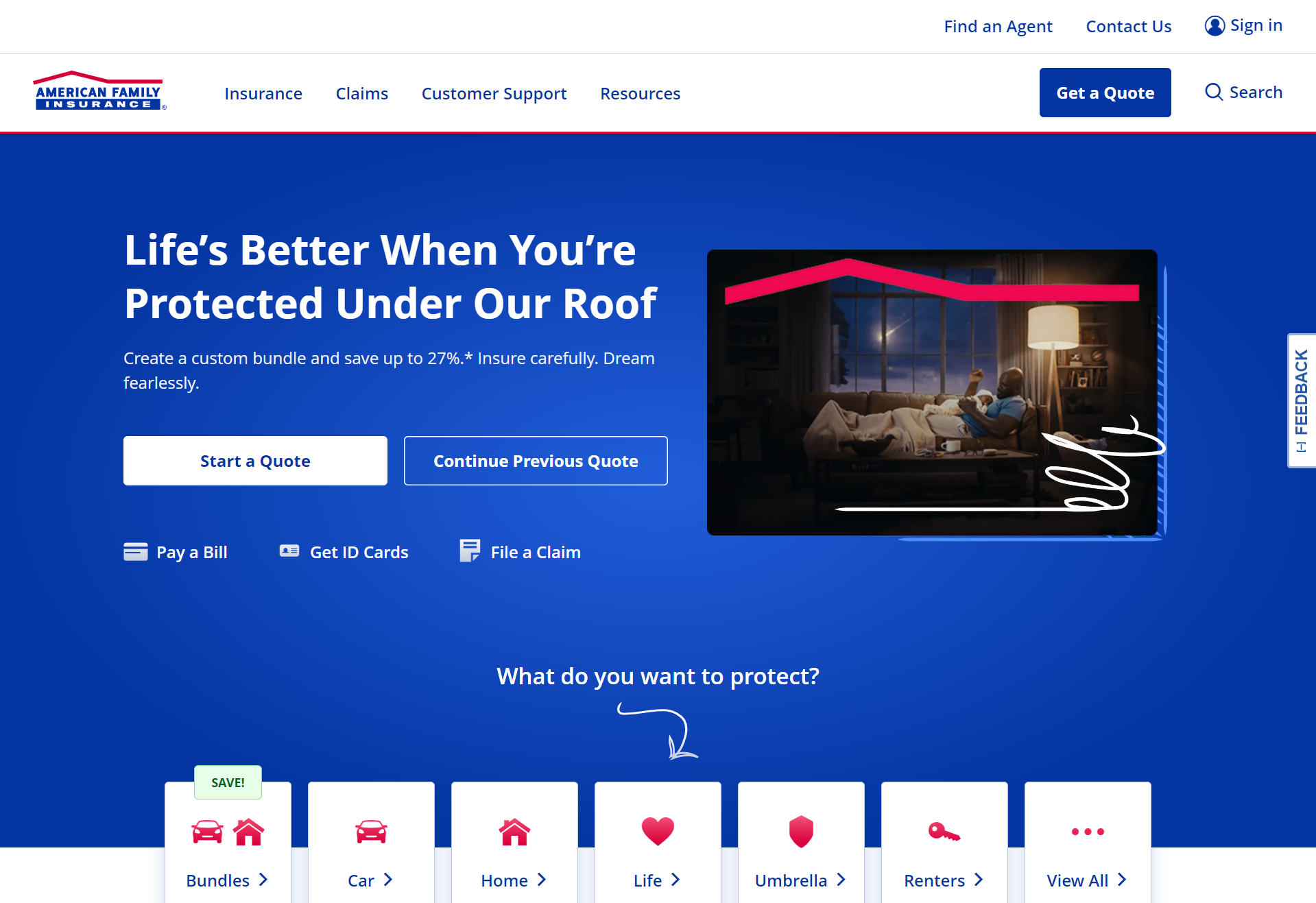

#10 – American Family: Best for Claims Service

Pros

- Focused on Claims Satisfaction: Emphasizes superior claims service and quick resolution. Discover insights in our American Family car insurance review.

- Bundling Options: Offers significant discounts for bundling auto with other types of insurance.

- Diverse Policy Offerings: Wide range of policy options catering to diverse customer needs.

Cons

- Geographical Limitations: Not available in all states, which can limit availability for some customers.

- Premium Variability: Some customers report variability in premium rates at renewal time.

Comparative Monthly Rates for Leading Car Insurers

When assessing car insurance options, it’s essential to consider the monthly rates for both minimum and full coverage across various providers. The table below illustrates a comparison among top insurers, showing a significant range in pricing for both types of coverage. Learn more in our “Compare Monthly Car Insurance: Rates, Discounts, & Requirements.”

Car Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $61 | $160 |

| American Family | $44 | $117 |

| Farmers | $53 | $139 |

| Geico | $30 | $80 |

| Liberty Mutual | $68 | $174 |

| Nationwide | $44 | $115 |

| Progressive | $39 | $105 |

| State Farm | $33 | $86 |

| Travelers | $37 | $99 |

| USAA | $22 | $59 |

Allstate, Liberty Mutual, and USAA present varying rates with Allstate charging $61 for minimum coverage and $160 for full coverage, positioning it at a higher pricing bracket.

On the other end, USAA offers the most competitive rates at $22 for minimum and $59 for full coverage, particularly favorable for military families.

Geico also stands out with remarkably low rates of $30 for minimum and $80 for full coverage, making it an appealing choice for budget-conscious consumers. Each company’s rates reflect their unique value propositions, catering to different segments of the market based on coverage needs and financial flexibility.

Compare the Best Car Insurance Companies in the Nation

You’ve seen the commercials: mayhem, disasters, flying pigs.

Flying pigs? Yep, according to Farmers

We’ve seen it and covered it.

What about your neighbors? Are you really in good hands? I haven’t seen any cavemen lately, but can I really save 15% with a ten-minute phone call?

Maybe. But which is actually the best? What are the 10 best insurance companies? We’ve got the complete buyer’s guide to who’s the best.

Check our car insurance comparison chart below to see how the biggest auto insurance companies measure up in four core categories: availability and rates, financial stability, reputation, and best company for you.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Car Insurance Comparison Chart

Here’s one important fact: the top 10 car insurance companies are licensed to operate in all 50 states except for American Family, Nationwide, and Travelers. Be sure and check out our company reviews if you are considering one of the companies above to see if it is available in your state.

The table below includes a list of the top 10 auto insurance companies, their average annual rate on a national scale compared to the national average, and their cheapest insured vehicle.

Top 10 Car Insurance Companies by Availability, Average Annual Rates, and Cheapest Car to Insure/strong>

| Insurance Company | Availability | Monthly Rates | Percent Higher/Lower Than Average | Cheapest Car to Insure |

|---|---|---|---|---|

| All 50 States and D.C. | $378 | 23.82% (Higher) | 2015 Toyota RAV-4 | |

| 19 States | $308 | 1.03% (Higher) | 2015 Honda Civic | |

| All 50 States and D.C. | $326 | 6.75% (Higher) | 2015 Toyota RAV-4 | |

| All 50 States and D.C. | $256 | -16.04% (Lower) | 2015 Toyota RAV-4 | |

| All 50 States and D.C. | $441 | 44.65% (Higher) | 2015 Toyota RAV-4 |

| 46 States and D.C. | $266 | -12.94% (Lower) | 2018 Toyota RAV-4 |

| All 50 States and D.C. | $328 | 7.5% (Higher) | 2015 Toyota RAV-4 | |

| All 50 States and D.C. | $228 | -25.39% (Higher) | 2015 Honda Civic | |

| 42 States and D.C. | $311 | 1.87% (Higher) | 2015 Ford F-150 | |

| All 50 States and D.C. | $207 | -32% (Lower) | 2015 Honda Civic |

Read more:

- Liberty Mutual vs. USAA Car Insurance Comparison

- American Family vs. Safeco Car Insurance Comparison

- American Family vs. Safe Auto Car Insurance Comparison

- Amica vs. Nationwide Car Insurance Comparison

- Allstate vs. Safeco Car Insurance Comparison

- Allstate vs. State Farm Car Insurance Comparison

- Allstate vs. The Hartford Car Insurance Comparison

- AAA vs. Nationwide Car Insurance Comparison

- Geico vs. AAA Car Insurance Comparison

- Liberty Mutual vs. Travelers Car Insurance Comparison

- Progressive vs. Travelers Car Insurance Comparison

- State Farm vs. Liberty Mutual Car Insurance Comparison

- Compare Best Car Insurance Companies That Only Look Back Three Years

- Farmers vs. MetLife Car Insurance Comparison

- Farmers vs. The Hartford Car Insurance Comparison

- Farmers vs. Travelers Car Insurance Comparison

Although the table shows USAA and State Farm have the lowest premiums, that doesn’t necessarily mean you should choose one of them as your provider without doing further research.

USAA has the lowest prices, but the company provides insurance for military personnel and their family members only. If you’re looking for car insurance discounts for military members, USAA may be the best option for you.

If you aren’t affiliated with the military, State Farm may be your next choice. But again, our research has shown that location and carrier, not price, are the most important factors when deciding on an insurance company.

Other factors, such as the laws in your state, marital status, and credit history, also play a role in the cost of your rates. We will cover all of these factors in this article.

For the best car insurance companies by claim settlement ratio, keep reading.

Compare the Best Car Insurance Companies by Financial Ratings

The future financial stability of a company can often be judged by its historic financial stability, especially in comparison to its top competitors. Also, third-party entities such as A.M. Best use an intricate algorithm to rate and predict the financial stability of a company.

The National Association of Insurance Commissioners (NAIC) releases an annual report that examines the financial stability of all car insurance companies. Here’s what you should look for:

- Direct Premiums Written: The total dollar amount in premiums received by an insurance company without any adjustments.

- Market Share: Indicates the degree (in percent) of market concentration in a line of business.

- Loss Ratio: A percent that represents the amount paid out on claims against what a company earns in premiums.

The table below shows these three figures for the top 10 companies in the car insurance market for 2018 and indicates whether they’re rising (↑), falling (↓), or remaining steady (~) based on NAIC data from 2015 through 2018.

Top 10 Car Insurance Companies by A.M. Best Rating, Market Share, & Loss Ratio

| Insurance Company | A.M. Best | Premiums Written | Market Share | Loss Ratio |

|---|---|---|---|---|

| A+ | $22.7 billion (↑) | 9.19% (↓) | 56% (↓) | |

| A | $4.7 billion (↑) | 1.9% (↑) | 69% (~) | |

| A | $10.5 billion (↑) | 4.26% (↓) | 61% (~) | |

| A++ | $33.1 billion (↑) | 13.41% (↑) | 71% (~) | |

| A | $11.8 billion (↑) | 4.77% (↓) | 62% (~) |

| A+ | $6.7 billion (↓) | 2.73% (↓) | 58% (↓) |

| A+ | $27.1 billion (↑) | 10.97% (↑) | 62% (~) | |

| B | $41.9 billion (↑) | 17.01% (↓) | 63% (↓) | |

| A++ | $4.7 billion (↑) | 1.9% (↑) | 60% (~) | |

| A++ | $14.5 billion (↑) | 5.87% (↑) | 77% (~) |

Because loss ratios can fluctuate from year to year, the safest bet is if they stay in the 60-to-70% range. A loss ratio (or claim settlement ratio) lower than 60% shows the company is not paying out on enough claims. A loss ratio above 70% shows the company may be losing money, which long term can mean an increase in rates.

Read more:

Compare the Best Car Insurance Companies by Reputation

Saving money is nice, but what happens when you need to file a car insurance claim? When you’re looking for the best-rated car insurance companies, you certainly don’t want to rely on a company with a bad reputation when it comes to customer service.

When choosing (or changing) car insurance providers, it’s essential to examine the satisfaction of new customers and established customers who file a claim. Luckily, J.D. Power collects data on both.

J.D. Power is a well-known go-to source for customer ratings of all sorts. Over 40,000 participants complete their comprehensive surveys.

We share data here from two of their annual reviews: the U.S. Auto Claims Satisfaction Study and the Insurance Shopping Study. J.D. Power uses Power Circle Ratings. These ratings are calculated based on the range between the highest score and the lowest score (per survey item) and place a company in that range with one to five circles.

Five circles = among the best; one circle = the rest. J.D. Power may assign one or more power circles to any company; however, they publicly announce and publish only those ratings that are two power circles or higher.

More circles of trust are shown to mean a higher level of customer satisfaction, which is suitable for everyone, including Greg.

This table shows J.D. Power Circles (and translates them) awarded in two categories: satisfaction of new customers and satisfaction of customers that file a claim. J.D. Power awards Power Circles in many other categories as well.

Read more:

- Car Insurance Companies With the Worst Customer Satisfaction

- Truck Insurance Exchange Car Insurance Review

Top 10 Car Insurance Companies by J.D. Power Ratings: Shopping, Claims, and Complaint Ratio

| Insurance Company | Shopping Satisfaction | Claims Satisfaction | Complaint Ratio vs. Average (1.00) |

|---|---|---|---|

| 862/1,000 | 869/1,000 | 1.10 (Higher) | |

| 854/1,000 | 887/1,000 | 0.98 (Lower) | |

| 841/1,000 | 872/1,000 | 1.12 (Higher) | |

| 853/1,000 | 885/1,000 | 1.03 (Higher) | |

| 837/1,000 | 872/1,000 | 1.20 (Higher) |

| 848/1,000 | 882/1,000 | 1.00 (Average) |

| 841/1,000 | 859/1,000 | 1.15 (Higher) | |

| 866/1,000 | 878/1,000 | 0.95 (Lower) | |

| 849/1,000 | 879/1,000 | 1.05 (Higher) | |

| 890/1,000 | 897/1,000 | 0.85 (Lower) |

The NAIC tracks official complaints about how car insurance companies do business. This agency calculates a complaint ratio for each company and compares it to the collective national complaint ratio.

The complaint ratio is determined by looking at the number of complaints per year per $1 million of premium earned by the total in annual premiums. In 2018, the collective national complaint ratio was 1.15; a rate lower than 1.15 is good, and one higher than 1.15 is not so good.

For example, USAA has some of the best rates in the country, and J.D. Power awarded them five Power Circles on handling claims. However, they have one of the highest complaint ratios, squeaking in right under the collective national complaint ratio of 1.15.

Progressive is in a similar situation, except J.D. Power awarded them three Power Circles on handling claims, though they are among the lowest in complaint ratio out of the top 10 companies.

Besides J.D. Power and NAIC, here are three other agencies that provide customer satisfaction ratings to help you choose the best company for your specific needs.

- Consumer Reports

- Better Business Bureau

- Consumer Affairs

Read more: Consumer Reports Car Insurance Recommendations

Take a few minutes to research companies you’re considering by using tools like these to get online quotes before you make a decision.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Finding the Best Car Insurance Company for You

Who has what you need?

We’ve looked at several factors that are crucial to choosing the best company for your insurance needs, and they are undoubtedly important.

But there are also things we can’t control when shopping around for auto insurance.

Like where you live, whether you drive an older vehicle, if you have multiple cars, or even if you have kids. If you want to learn more about the company, head to our “Is it cheaper to purchase car insurance online?.”

So let’s take a look at our list of the most important factors to consider when comparing car insurance companies.

Factors to Consider When Comparing Car Insurance Companies

You want to find a place that offers competitive prices and great service. But sometimes, it boils down to dollars and cents. Are there ways you can save money?

Check out this table, where we’ve listed each company and the total number of car insurance discounts. We’ve also listed the highest percent discount, our opinion of what kind of customer it’s best for, and a link to our company review.

As you can see, depending on what you’re looking for, some companies may be a better fit than others.

How to Choose the Best Car Insurance Companies

There are many options when it comes to choosing car insurance. Here are some key questions to consider before getting a quote:

- Do I want to conduct business with an agent, a broker, directly with the provider, online, a national company, or a local company?

- What is the financial stability of each company, and what is their position for the future when it comes to market share, loss ratios, and third-party rankings?

- Which company offers the best discounts and rates for my situation and needs?

- How satisfied are customers of each company with its service and claims process?

- How many and what types of complaints have customers issued against each company?

We’ll spend a little time discussing some of these questions in greater detail in the next few sections. (For more information, read our “Should I buy car insurance through a broker or direct from the company?”).

Car Insurance Buying Options

We know cost is a huge factor in determining which company to choose. But let’s look at your personal preference: Do you conduct business online? Do you prefer to let your fingers do the walking? Or do you like to meet with someone in person?

Each of the top 10 companies varies in the services they provide through their agents, website, and mobile app. Some companies have more strengths in their agents, while others are almost entirely web or app-based. Some of these services include:

- Finding and contacting an agent

- Purchasing a policy

- Filing a claim

- Tracking a claim

- Paying or modifying your bill

- Storing electronic proof of insurance

- Accessing app chat or 24/7 phone services

- Requesting roadside assistance

J.D. Power provides ratings of company services such as agents, call-center representatives, and websites. Take a look at these ratings and see if they meet your needs.

Depending on what you’re looking for, different companies are more successful in some areas than others, as shown by the J.D. Power Circle ratings.

Read more: Best Car Insurance Comparison Websites

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

How Your Situation Affects Car Insurance Rates

When obtaining a quote from a car insurance company, the company will ask you a series of personal questions, which will be used to help determine the cost of your rates.

Insurance companies claim statistics show drivers with some of these characteristics as lower risk, but the numbers also make assumptions that are not always true about individual drivers.

In most states, there are nine factors that affect car insurance rates.

- Where You Live: States (and sometimes cities) have specific laws about car insurance. Your state of residence is the most significant factor in determining your rate.

- Age: Insurance companies assume that, with more driving experience and maturity, we become safer drivers.

- Gender: In some cases, rates for males are higher than for females because of the assumption that men are more adventurous and willing to take risks.

- Marital Status / Homeownership: Insurance companies consider being married and owning a home both signs of stability and responsibility, so they assume that married homeowners carry less risk.

- Level of Education: Similar to marital status and homeownership, the assumption is that people with higher levels of education will also be more responsible and safer.

- Vehicle Year, Make, and Model: What you choose to drive makes a huge difference in your rate based on safety ratings, cost of repairs, and, sometimes, the amount of damage your vehicle can do to another car if in an accident.

- Credit Score: Along with education, marital status, and homeownership, your credit score can reflect how responsible you are.

- Driving Record: If you have a history of speeding tickets, accidents, or DUIs, you are considered a risky driver and will pay higher rates in most cases.

- Commute Distance: If you drive more, you statistically increase your chances of getting in an accident.

Okay, some of these factors make sense, but some of them may make you feel a little uncomfortable.

The good news is some states have outlawed some of the more discriminatory methods in calculating rates.

Here are a few examples:

- Determining rates based on gender has been outlawed in California, Hawaii, Massachusetts, Montana, Pennsylvania, North Carolina, and parts of Michigan.

- Montana was one of the first states (1985) to outlaw determining rates based on gender and marital status.

- California, Massachusetts, and Hawaii have outlawed using consumer credit information to determine rates.

- A recent law in Michigan prohibits insurance companies from determining rates based on anything but driving record, age, the vehicle you choose to operate, and possibly location.

Given this decision in Michigan, it may not be long before other states pass such legislation.

Read more: Massachusetts Bay Car Insurance Review

Car Insurance Discounts

Got discounts? How do you know unless you ask?

Companies offer discounts of up to 40% if you answer “yes” to specific questions. Be sure and ask your provider what car insurance discounts are available to you.

Laws and discounts vary by state and company, and we’ll spend some time looking at various discounts offered by the top 10 carriers in the nation.

Top Car Insurance Companies in the Nation

Which company has the best reputation and is inside your circle of trust? Who’s the best of the best? What is the highest-rated auto insurance company?

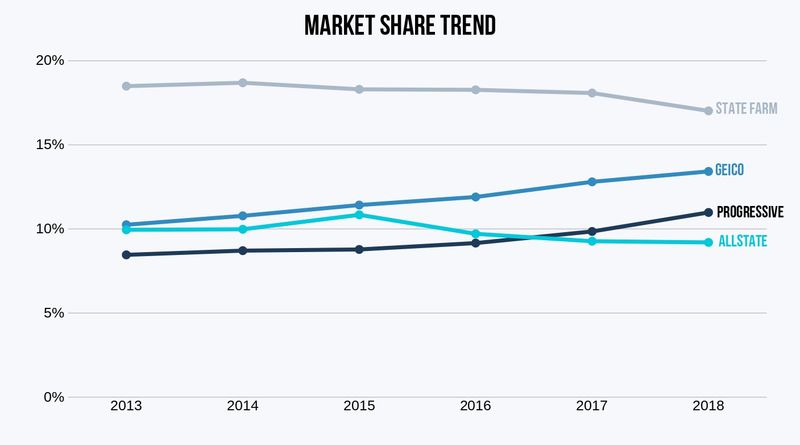

Four companies (Allstate, Geico, Progressive, and State Farm) have dominated the car insurance industry for the past 15 years. They are the top car insurance companies by market share. We researched NAIC’s website from 2004 onward and discovered an important fact:

In 15 years, these companies have gained a 10% market share, and now control over half of the market share for the entire car insurance industry.

Comparing market share in 2004 and market share in 2018 shows who was and continues to be the best.

Top Four Car Insurance Companies by 15-Year Market Share Comparison

| Insurance Company | 2004 Market Share (in percent) | 2018 Market Share (in percent) | Growth / Decline (in percent) |

|---|---|---|---|

| 10.21% | 9.19% | -1.02% | |

| 5.49% | 13.41% | 0.0792 | |

| 7.12% | 10.97% | 0.0385 | |

| 18.52% | 17.01% | -1.51% | |

| TOTAL Market Share of Top Four | 41.34% | 50.58% | 0.0924 |

Geico has shown the largest growth over this period, with over seven percent. Progressive has also shown an impressive growth spurt with just under four percent of the market. While State Farm and Allstate have lost market share with decreases of over one percent.

But, when you look at the period between 2013 and 2018, Geico is closing the gap in market share with State Farm, while Progressive continues to gain market share over Geico. Take a look at this chart for a visual representation of growth and rankings.

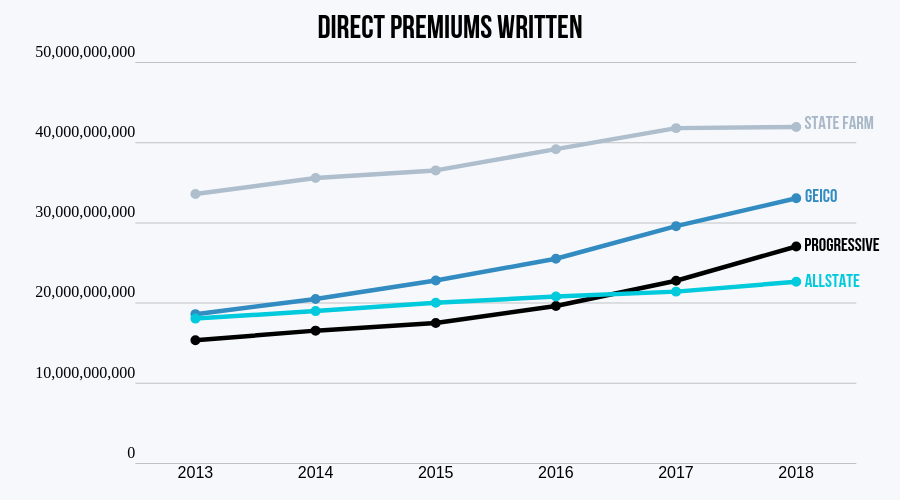

Currently, based on 2018 financials, State Farm is still in the lead in total direct premiums written. Allstate hasn’t lost any of its market shares but continues to trail behind Geico and Progressive in the current five-year growth trend. This chart visually represents the direct premiums written by the four companies over the same five-year period.

What sets these industry leaders apart from one another? There are a few key differences:

- State Farm is a mutual company owned by its customers, all shouldering risks and rewards equally.

- Geico offers internet-based policies dealing directly with customers, and they also partner with investors.

- Progressive offers both agents and internet-based policies.

- Allstate offers only an agent-based model.

It’s hard to say which business model is the best of the best, but, as the consumer, you have choices. Your individual needs and preferences will ultimately determine the best company for you. Compare the Best Car Insurance Companies by Region

If you plan to move a state or two over, up, or down, these tables may be helpful. Sometimes when moving out of state (even within the same region), your current carrier may not have the best rates.

In some cases, neighboring states have such cheaper car insurance, it may be more feasible to move there and commute to work or ride the subway.

We’ve broken down the 50 states into regions so you can take a quick look at the average rate of your current (or future) insurance provider.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Average Car Insurance Rates by Company in the Midwest

We’ll start with the Midwest. Take a look at this table to see the average annual rates by state.

Top 10 Car Insurance Companies in the Midwest by Rate

| State |  |  | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Illinois | $434 | $318 | $384 | $232 | $190 | $226 | $295 | $195 | $208 | $231 |

| Indiana | $332 | $307 | $286 | $188 | $482 | $275 | $325 | $201 | $283 | $136 |

| Iowa | $247 | $252 | $203 | $191 | $368 | $228 | $200 | $185 | $452 | $154 |

| Kansas | $334 | $179 | $309 | $268 | $399 | $206 | $345 | $227 | $362 | $199 |

| Michigan | $1,909 | $1,100 | $709 | $536 | $1,667 | $527 | $447 | $1,047 | $731 | $302 |

| Minnesota | $378 | $293 | $261 | $292 | $1,130 | $244 | $350 | $172 | $320 | $238 |

| Missouri | $341 | $274 | $359 | $240 | $377 | $189 | $285 | $224 | $299 | $210 |

| Nebraska | $267 | $185 | $333 | $320 | $520 | $217 | $313 | $203 | $280 | $194 |

| North Dakota | $389 | $318 | $258 | $222 | $1,071 | $213 | $302 | $213 | $348 | $167 |

| Ohio | $266 | $126 | $285 | $156 | $369 | $275 | $286 | $209 | $261 | $123 |

| South Dakota | $394 | $337 | $314 | $245 | $626 | $228 | $313 | $192 | $275 | $185 |

| Wisconsin | $405 | $126 | $315 | $327 | $563 | $435 | $261 | $199 | $325 | $248 |

| U.S. Average | $475 | $247 | $335 | $268 | $647 | $272 | $307 | $272 | $383 | $200 |

Liberty Mutual has the overall highest average rate of $7,762 per year. In the Midwest, Michigan car insurance has the highest rates, where coverage by Allstate tops out at just under $23,000.

Read more: Compare Vermont Car Insurance Rates

Average Car Insurance Rates by Company in the Northeast

Next, we’ll look at the Northeast. This table outlines average annual rates by state.

Top 10 Car Insurance Companies in the Northeast by Rate

| State |  |  | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Connecticut | $486 | $346 | $256 | $607 | $306 | $410 | $248 | $500 | $266 |

| Maine | $306 | $231 | $235 | $361 | $250 | $304 | $183 | $188 | $161 |

| Massachusetts | $226 | $210 | $126 | $362 | $280 | $320 | $113 | $295 | $122 |

| New Hampshire | $227 | $191 | $135 | $704 | $208 | $225 | $182 | $256 | $159 |

| New Jersey | $476 | $635 | $230 | $564 | $420 | $331 | $627 | $355 | $300 |

| New York | $395 | $310 | $202 | $545 | $334 | $314 | $374 | $382 | $313 |

| Pennsylvania | $332 | $290 | $217 | $505 | $233 | $371 | $229 | $654 | $149 |

| Rhode Island | $413 | $341 | $467 | $515 | $367 | $436 | $201 | $576 | $360 |

| Vermont | $266 | $211 | $183 | $302 | $177 | $435 | $365 | $210 | $159 |

| U.S. Average | $347 | $433 | $228 | $496 | $271 | $349 | $280 | $421 | $211 |

Read more: Compare New Hampshire Car Insurance Rates

Liberty Mutual has the overall highest rate of $5,952 per year. In the northeast, New Jersey car insurance has the highest rates, where coverage by State Farm leads the way with a yearly rate of $7,527.

Average Car Insurance Rates by Company in the Southeast

This table includes average annual rates for states in the Southeast part of the country.

Top 10 Car Insurance Companies in the Southeast by Rate

| State |  |  | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Alabama | $225 | $198 | $239 | $212 | $181 | $218 | $155 | $205 | $177 |

| Arkansas | $183 | $198 | $150 | $125 | $125 | $203 | $172 | $120 | $72 |

| Delaware | $326 | $301 | $311 | $410 | $315 | $348 | $372 | $310 | $194 |

| Florida | $260 | $240 | $315 | $290 | $250 | $330 | $283 | $270 | $238 |

| Georgia | $265 | $248 | $248 | $275 | $215 | $250 | $282 | $220 | $263 |

| Kentucky | $310 | $290 | $386 | $315 | $280 | $310 | $280 | $290 | $241 |

| Louisiana | $340 | $330 | $513 | $335 | $310 | $380 | $382 | $360 | $363 |

| Maryland | $285 | $290 | $319 | $310 | $270 | $341 | $330 | $310 | $229 |

| Mississippi | $230 | $220 | $341 | $225 | $210 | $230 | $248 | $220 | $171 |

| North Carolina | $170 | $160 | $245 | $182 | $160 | $199 | $257 | $261 | $200 |

| South Carolina | $190 | $185 | $265 | $210 | $175 | $215 | $256 | $240 | $285 |

| Tennessee | $220 | $210 | $274 | $240 | $225 | $230 | $220 | $228 | $228 |

| Virginia | $175 | $165 | $172 | $160 | $140 | $208 | $189 | $150 | $155 |

| West Virginia | $210 | $190 | $177 | $244 | $215 | $180 | $177 | $180 | $165 |

| U.S. Average | $200 | $198 | $292 | $235 | $220 | $275 | $279 | $250 | $222 |

Again, Liberty Mutual has the highest overall rate of $6,879 per year. In the southeast, Delaware car insurance has the highest rates, where coverage by Liberty Mutual tops out at $18,360.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Average Car Insurance Rates by Company in the Southwest

Take a look at this table for average annual rates for states in the Southwest. Learn more in our “How do you get competitive quotes for car insurance?.”

Top 10 Car Insurance Companies in the Southwest by Rate

| State |  |  | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Arizona | $4,904 | Data Not Available | $5,000 | $2,265 | Data Not Available | $3,496 | $3,578 | $4,756 | $3,085 | $3,084 |

| New Mexico | $4,201 | Data Not Available | $4,316 | $4,458 | Data Not Available | $3,514 | $3,119 | $2,341 | Data Not Available | $2,297 |

| Oklahoma | $3,719 | Data Not Available | $4,142 | $3,437 | $6,875 | Data Not Available | $4,832 | $2,817 | Data Not Available | $3,174 |

| Texas | $5,485 | $4,849 | Data Not Available | $3,263 | Data Not Available | $3,868 | $4,665 | $2,880 | Data Not Available | $2,488 |

| AVERAGE | $4,577 | $4,849 | $4,486 | $3,356 | $6,875 | $3,626 | $4,048 | $3,198 | $3,085 | $2,761 |

Liberty Mutual has the highest overall rate of $6,874 per year, followed by American Family, whose average rate is $4,849.

Average Car Insurance Rates by Company in the West

Finally, we’ll look at average annual rates for states in the Western part of the country.

Top 10 Car Insurance Companies in the West by Rate

| State |  |  | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Alaska | $262 | $346 | $410 | $240 | $441 | $331 | $255 | $186 | $368 | $2,454 |

| California | $378 | $465 | $417 | $240 | $253 | $388 | $237 | $350 | $279 | $2,694 |

| Colorado | $461 | $346 | $441 | $258 | $233 | $312 | $353 | $273 | $390 | $3,339 |

| Hawaii | $181 | $249 | $397 | $280 | $266 | $196 | $213 | $181 | $87 | $1,189 |

| Idaho | $341 | $346 | $264 | $231 | $192 | $253 | $187 | $156 | $269 | $1,878 |

| Montana | $389 | $288 | $326 | $300 | $111 | $290 | $361 | $201 | $415 | $2,032 |

| Nevada | $448 | $346 | $466 | $305 | $517 | $290 | $339 | $483 | $447 | $3,069 |

| Oregon | $397 | $346 | $313 | $268 | $361 | $265 | $302 | $228 | $241 | $2,587 |

| Utah | $297 | $346 | $326 | $247 | $361 | $249 | $319 | $387 | $410 | $2,491 |

| Washington | $295 | $346 | $247 | $214 | $333 | $177 | $267 | $208 | $397 | $2,262 |

| Wyoming | $364 | $298 | $256 | $291 | $166 | $266 | $367 | $192 | $420 | $2,780 |

| U.S. Average | $347 | $346 | $345 | $261 | $294 | $270 | $298 | $250 | $309 | $2,434 |

Allstate has the highest overall rate of $4,161 per year. In the west, Nevada car insurance has the highest rates where coverage from Liberty Mutual leads the way at $6,202.

Compare the Best Car Insurance Companies by State

The state in which you live has a huge influence on your rate. Every state is different, and it usually has a lot to do with the laws. For example, one dividing factor between 11 states and the remaining 39 is whether or not their laws are at-fault-based or no-fault-based.

Typically, no-fault states require drivers to purchase a certain amount of personal injury protection coverage (PIP), which is elective in most at-fault states.

Michigan has just passed historic legislation to overhaul its insurance systems completely. To read more about the insurance laws in your state, be sure and check out our comprehensive state guides linked in the table below.

Car Insurance Guides by State

Next, we’ll discuss insurance companies by rates.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Best Car Insurance Companies by Rates

It’s not just laws that can affect your rates. Many companies offer cheaper options, and some even advertise, “to pick and choose only the coverage you need.” Delve into our evaluation of “Does a negligent driving ticket affect car insurance rates?”

The following sections and tables show national-level rates for the top 10 auto insurance providers based on various demographics.

Compare the Best Car Insurance Rates by Gender

Some states have outlawed car insurance rates based on gender, and other states now require a non-binary category when drivers obtain a quote. Discover insights in our “Average Car Insurance Rates by Age and Genderr.”

We have removed teenage drivers from this table since their age more heavily influences their rates rather than their gender.

Top 10 Car Insurance Companies: Monthly Rates by Gender

| Insurance Company | Female | Male |

|---|---|---|

| $162 | $160 | |

| $115 | $117 | |

| $139 | $139 | |

| $80 | $80 | |

| $171 | $174 |

| $113 | $115 |

| $112 | $105 | |

| $86 | $86 | |

| $98 | $99 | |

| $59 | $59 | |

| U.S. Average | $119 | $119 |

The numbers don’t lie: on average, males pay an average of an extra $80 per year for the same coverage as female drivers do.

Compare the Best Car Insurance Rates by Relationship Status

There is a difference in the cost of married car insurance vs. single car insurance.

We have removed teenage drivers from the table below since their age more heavily influences their rates rather than their marital status.

Top 10 Car Insurance Companies: Monthly Rates by Age & Gender

| Age & Gender |  |  | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| 16-Year-Old Female | $448 | $305 | $597 | $220 | $626 | $303 | $591 | $229 | $530 | $180 |

| 16-Year-Old Male | $519 | $414 | $629 | $254 | $626 | $387 | $662 | $284 | $740 | $203 |

| 25-Year-Old Female | $181 | $124 | $172 | $97 | $187 | $136 | $141 | $101 | $107 | $80 |

| 25-Year-Old Male | $190 | $147 | $180 | $93 | $215 | $150 | $146 | $111 | $116 | $85 |

| 35-Year-Old Female | $263 | $263 | $213 | $192 | $317 | $197 | $191 | $173 | $182 | $129 |

| 35-Year-Old Male | $260 | $260 | $213 | $193 | $321 | $199 | $181 | $173 | $183 | $128 |

| 60-Year-Old Female | $150 | $104 | $120 | $73 | $148 | $99 | $92 | $76 | $148 | $53 |

| 60-Year-Old Male | $154 | $105 | $128 | $74 | $159 | $104 | $95 | $76 | $159 | $53 |

Female drivers pay more for car insurance, based on this data. Not all companies provide a discount for marital status, while Geico and State Farm have similar rates.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Compare the Best Car Insurance Rates for New Drivers

Teen car insurance is often expensive. Take a look at this table to see the average rates for teenagers and young adults.

Top 10 Car Insurance Companies: Monthly Rates for Teens and Young Adults

| Insurance Company | 17-Year-Old Female | 17-Year-Old Male | 24-Year-Old Female | 24-Year-Old Male |

|---|---|---|---|---|

| $448 | $519 | $181 | $190 | |

| $305 | $414 | $124 | $147 | |

| $597 | $629 | $172 | $180 | |

| $220 | $254 | $97 | $93 | |

| $626 | $626 | $187 | $215 |

| $303 | $387 | $136 | $150 |

| $591 | $662 | $141 | $146 | |

| $229 | $284 | $101 | $111 | |

| $530 | $740 | $107 | $116 | |

| $180 | $203 | $80 | $85 | |

| U.S. Average | $403 | $472 | $133 | $143 |

If you have teen drivers in your household, Geico offers the least expensive coverage at $5,966 per year. Liberty Mutual charges nearly double that rate, so if the cost is a major deal-breaker, then they may not be the best choice.

Compare the Best Car Insurance Rates for Adults Ages 20 to 30

This table provides data on average rates for drivers in their 20s and 30s by company. See more details on our “Compare Texas Car Insurance Rates.”

Top 10 Car Insurance Companies: Monthly Rates for Drivers in Their 20s and 30s

| Insurance Company | 25-Year-Old Female | 25-Year-Old Male | 34-Year-Old Female | 34-Year-Old Male |

|---|---|---|---|---|

| $181 | $190 | $161 | $170 | |

| $124 | $147 | $111 | $129 | |

| $172 | $180 | $152 | $159 | |

| $97 | $93 | $85 | $82 | |

| $187 | $215 | $166 | $190 |

| $136 | $150 | $118 | $127 |

| $141 | $146 | $124 | $129 | |

| $101 | $111 | $89 | $98 | |

| $107 | $116 | $95 | $103 | |

| $80 | $85 | $71 | $76 | |

| U.S. Average | $133 | $143 | $117 | $113 |

Nationally, Geico, Travelers, and USAA (military-affiliated only) charge the least for covering single drivers in their mid-20s to mid-30s. Liberty Mutual has the highest rates at $4,231 per year.

Compare the Best Car Insurance Rates for Adults Ages 40 to 50

In this table, we outline the average annual rates for drivers between their mid-30s and mid-50s by company. Take a look.

Top 10 Car Insurance Companies: Monthly Rates for Drivers in Their 40s and 50s

| Insurance Company | 45-Year-Old Female | 45-Year-Old Male | 59-Year-Old Female | 59-Year-Old Male |

|---|---|---|---|---|

| $162 | $160 | $150 | $154 | |

| $115 | $117 | $104 | $105 | |

| $139 | $139 | $120 | $128 | |

| $80 | $80 | $73 | $74 | |

| $171 | $174 | $148 | $159 |

| $113 | $115 | $99 | $104 |

| $112 | $105 | $92 | $95 | |

| $86 | $86 | $76 | $76 | |

| $98 | $99 | $89 | $90 | |

| $59 | $59 | $53 | $53 | |

| U.S. Average | $114 | $113 | $100 | $104 |

Liberty Mutual charges more than $1,400 more than average for married drivers in this age range.

More information is available about this provider in our “Understanding Your Car Insurance Policy.”

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Compare the Best Car Insurance Rates by Adults in Their 60s

Take a look at this table for average annual rates for drivers in their 60s by company. Check out insurance savings in our complete “Car Insurance Policyholder: Explained Simply.”

Top 10 Car Insurance Companies: Monthly Rates for Drivers in their 60s

| Insurance Company | 65-Year-Old Female | 65-Year-Old Male |

|---|---|---|

| $158 | $157 | |

| $113 | $114 | |

| $136 | $136 | |

| $78 | $77 | |

| $167 | $170 |

| $111 | $112 |

| $109 | $103 | |

| $84 | $83 | |

| $96 | $97 | |

| $58 | $57 | |

| U.S. Average | $111 | $110 |

Nationally, American Family and State Farm charge the least for covering drivers 60 and older.

Compare the Best Car Insurance Rates by Vehicle Type

Different vehicle types can mean differing insurance rates. Take a look at this table to see what we mean.

Top 10 Car Insurance Companies: Monthly Rates by Vehicle Type

| Insurance Company | Used Sedan | New Sedan | Used SUV | New SUV | Used Truck | New Truck |

|---|---|---|---|---|---|---|

| $396 | $448 | $360 | $412 | $369 | $458 | |

| $265 | $310 | $277 | $291 | $287 | $291 | |

| $367 | $398 | $311 | $314 | $341 | $366 | |

| $258 | $278 | $258 | $278 | $258 | $278 | |

| $489 | $557 | $485 | $520 | $486 | $499 |

| $296 | $280 | $293 | $277 | $298 | $281 |

| $369 | $377 | $304 | $311 | $326 | $330 | |

| $252 | $266 | $269 | $285 | $267 | $291 | |

| $368 | $388 | $365 | $392 | $335 | $368 | |

| $201 | $202 | $205 | $211 | $213 | $238 | |

| U.S. Average | $326 | $351 | $313 | $329 | $318 | $340 |

In all cases, a new sedan will cost you more for car insurance than a used model. The same goes for SUVs, except for Nationwide, which charges less for a used model. One could expect to pay higher premiums for their older or antique car insurance.

Compare the Best Car Insurance Rates by Credit Score

Who has the best rates for car insurance based on credit score? If you’re below 600, then companies may want you to pay more.

Check out the table below to see where your number lands for good, fair, and bad credit.

Top 10 Car Insurance Companies: Monthly Rates by Credit Score

| Insurance Company | Good Credit | Fair Credit | Poor Credit |

|---|---|---|---|

| $110 | $130 | $150 | |

| $105 | $125 | $145 | |

| $115 | $135 | $155 | |

| $95 | $115 | $135 | |

| $100 | $120 | $140 |

| $102 | $122 | $142 |

| $98 | $118 | $138 | |

| $90 | $110 | $130 | |

| $112 | $132 | $152 | |

| $85 | $105 | $125 | |

| U.S. Average | $101 | $121 | $141 |

Liberty Mutual charges more than double for car insurance for customers who have poor credit versus those with good credit. Read more: Compare Taxi Cab Insurance Rates

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Compare the Best Car Insurance Rates by Driving History

If there’s one factor that insurance companies can use in determining rates that is non-discriminatory, it’s your driving record. Car insurance with a bad driving record will cost more. Finding the best car insurance companies after an accident requires a little more work, but it can be done.

The table below shows how much your rates can go up with just one speeding ticket, as well as rates for several other infractions.

Top 10 Car Insurance Companies: Monthly Rates by Driving Record

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| 160 | 188 | 225 | 270 | |

| 117 | 136 | 176 | 194 | |

| 139 | 173 | 198 | 193 | |

| 80 | 106 | 132 | 216 | |

| 174 | 212 | 234 | 313 |

| 115 | 137 | 161 | 237 |

| 105 | 140 | 186 | 140 | |

| 86 | 96 | 102 | 112 | |

| 99 | 134 | 139 | 206 | |

| 59 | 67 | 78 | 108 | |

| U.S. Average | $113 | $139 | $163 | $199 |

Read more:

- Geico Defensive Driving Course Review: Compare Rates, Discounts, & Requirements

- Geico DriveEasy Review: Compare Rates, Discounts, & Requirements

Speed trap? Not only will you have to pay for the ticket, but there’s a good chance you’re trapped into paying more for your insurance. Progressive charges over $600 more for drivers who have a speeding ticket than those with a clean record.

More difficult to find are the best car insurance companies after a DUI. Some car insurance companies won’t work with you after a DUI conviction, and you’ll definitely see higher rates. However, it’s integral to compare rates after a DUI, or you’ll likely overpay for your coverage.

Compare the Best Car Insurance Rates by Commute

In the case of commute distance, a shorter commute is considered 10 miles or 6,000 miles per year. A long commute is considered 25 miles or 12,000 miles per year.

Top 10 Car Insurance Companies: Monthly Rates by Annual Mileage

| Insurance Company | 6,000 Miles | 12,000 Miles |

|---|---|---|

| $403 | $411 | |

| $283 | $290 | |

| $348 | $351 | |

| $264 | $272 | |

| $500 | $513 |

| $286 | $289 |

| $336 | $337 | |

| $265 | $279 | |

| $367 | $372 | |

| $207 | $216 | |

| U.S. Average | $326 | $333 |

Rates are consistent with the top 10 companies, as there is less than a $200 difference between a short and long commute.

Discover more about offerings in our “Car Insurance Terms & Definitions.”

The Best Company for Car Insurance

The best company for auto insurance depends on individual needs. Companies like USAA, State Farm, and Geico have the lowest average rates at an average of $230.41/mo, but may not be the best company for auto insurance for you.

- Before purchasing auto insurance, you must clearly define your insurance needs

- You must realize there are numerous insurance discounts available to you